false

FY

0001042187

0001042187

2023-01-01

2023-12-31

0001042187

2023-06-30

0001042187

2024-03-20

0001042187

2023-12-31

0001042187

2022-12-31

0001042187

us-gaap:NonrelatedPartyMember

2023-12-31

0001042187

us-gaap:NonrelatedPartyMember

2022-12-31

0001042187

us-gaap:RelatedPartyMember

2023-12-31

0001042187

us-gaap:RelatedPartyMember

2022-12-31

0001042187

2022-01-01

2022-12-31

0001042187

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001042187

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001042187

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2022-12-31

0001042187

us-gaap:CommonStockMember

2022-12-31

0001042187

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001042187

us-gaap:RetainedEarningsMember

2022-12-31

0001042187

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001042187

us-gaap:TreasuryStockCommonMember

2022-12-31

0001042187

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001042187

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001042187

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2021-12-31

0001042187

us-gaap:CommonStockMember

2021-12-31

0001042187

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001042187

us-gaap:RetainedEarningsMember

2021-12-31

0001042187

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001042187

us-gaap:TreasuryStockCommonMember

2021-12-31

0001042187

2021-12-31

0001042187

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001042187

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001042187

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2023-01-01

2023-12-31

0001042187

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001042187

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001042187

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001042187

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-12-31

0001042187

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-12-31

0001042187

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001042187

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001042187

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2022-01-01

2022-12-31

0001042187

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001042187

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001042187

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001042187

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001042187

us-gaap:TreasuryStockCommonMember

2022-01-01

2022-12-31

0001042187

us-gaap:SeriesAPreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001042187

us-gaap:SeriesBPreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001042187

us-gaap:SeriesCPreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

us-gaap:PreferredStockMember

2023-12-31

0001042187

us-gaap:CommonStockMember

2023-12-31

0001042187

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001042187

us-gaap:RetainedEarningsMember

2023-12-31

0001042187

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001042187

us-gaap:TreasuryStockCommonMember

2023-12-31

0001042187

srt:MinimumMember

us-gaap:BuildingMember

2023-12-31

0001042187

srt:MaximumMember

us-gaap:BuildingMember

2023-12-31

0001042187

srt:MinimumMember

us-gaap:MachineryAndEquipmentMember

2023-12-31

0001042187

srt:MaximumMember

us-gaap:MachineryAndEquipmentMember

2023-12-31

0001042187

YHGJ:ProjectLifeMember

srt:MinimumMember

2023-12-31

0001042187

YHGJ:ProjectLifeMember

srt:MaximumMember

2023-12-31

0001042187

srt:MinimumMember

YHGJ:LightMachineryMember

2023-12-31

0001042187

srt:MaximumMember

YHGJ:LightMachineryMember

2023-12-31

0001042187

srt:MinimumMember

YHGJ:HeavyMachineryMember

2023-12-31

0001042187

srt:MaximumMember

YHGJ:HeavyMachineryMember

2023-12-31

0001042187

srt:MinimumMember

us-gaap:FurnitureAndFixturesMember

2023-12-31

0001042187

srt:MaximumMember

us-gaap:FurnitureAndFixturesMember

2023-12-31

0001042187

srt:MinimumMember

us-gaap:IntellectualPropertyMember

2023-12-31

0001042187

srt:MaximumMember

us-gaap:IntellectualPropertyMember

2023-12-31

0001042187

srt:MinimumMember

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001042187

srt:MaximumMember

us-gaap:LeaseholdImprovementsMember

2023-12-31

0001042187

srt:MinimumMember

YHGJ:FurnitureAndEquipmentAtCustomerLocationsMember

2023-12-31

0001042187

srt:MaximumMember

YHGJ:FurnitureAndEquipmentAtCustomerLocationsMember

2023-12-31

0001042187

2019-01-02

2023-12-31

0001042187

us-gaap:RevolvingCreditFacilityMember

YHGJ:NewCreditAgreementsMember

2021-09-30

0001042187

YHGJ:NewCreditAgreementsMember

YHGJ:TermLoanMember

2021-09-30

0001042187

us-gaap:RevolvingCreditFacilityMember

YHGJ:NewCreditAgreementsMember

2023-12-31

0001042187

2022-10-01

2022-10-31

0001042187

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

YHGJ:CustomerOneMember

2023-01-01

2023-12-31

0001042187

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

YHGJ:CustomerTwoMember

2023-01-01

2023-12-31

0001042187

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

YHGJ:CustomerOneMember

2022-01-01

2022-12-31

0001042187

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

YHGJ:CustomerTwoMember

2022-01-01

2022-12-31

0001042187

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

YHGJ:TwoCustomerMember

2023-12-31

0001042187

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

YHGJ:TwoCustomerMember

2022-12-31

0001042187

us-gaap:SubordinatedDebtMember

srt:OfficerMember

2023-12-31

0001042187

us-gaap:SubordinatedDebtMember

srt:OfficerMember

2022-12-31

0001042187

YHGJ:NotesPayableRelatedPartyMember

2023-12-31

0001042187

YHGJ:NotesPayableRelatedPartyMember

2022-12-31

0001042187

YHGJ:TermLoanMember

2023-12-31

0001042187

YHGJ:TermLoanMember

2022-12-31

0001042187

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2023-12-31

0001042187

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2022-12-31

0001042187

us-gaap:RevolvingCreditFacilityMember

YHGJ:LineFinancialAgreementMember

YHGJ:LineFinancialMember

2021-09-30

0001042187

YHGJ:TermLoanFacilityMember

YHGJ:LineFinancialAgreementMember

YHGJ:LineFinancialMember

2021-09-30

0001042187

YHGJ:LineFinancialAgreementMember

us-gaap:PrimeRateMember

2023-12-31

0001042187

YHGJ:LineFinancialAgreementMember

us-gaap:PrimeRateMember

2021-09-30

2021-09-30

0001042187

YHGJ:LineFinancialAgreementMember

2021-09-30

0001042187

YHGJ:LineFinancialAgreementMember

2021-11-01

2021-11-01

0001042187

YHGJ:LineFinancialAgreementMember

2021-09-30

2021-09-30

0001042187

YHGJ:LineFinancialAgreementMember

2022-08-31

2022-08-31

0001042187

2021-09-30

2021-09-30

0001042187

2021-09-30

0001042187

YHGJ:LineFinancialAgreementMember

us-gaap:RevolvingCreditFacilityMember

2023-01-01

2023-12-31

0001042187

YHGJ:LineFinancialAgreementMember

YHGJ:TermLoanMember

2023-01-01

2023-12-31

0001042187

YHGJ:LineFinancialAgreementMember

YHGJ:TermLoanMember

2023-12-31

0001042187

YHGJ:LineFinancialAgreementMember

2023-01-01

2023-12-31

0001042187

YHGJ:LineFinancialAgreementMember

2021-12-31

2021-12-31

0001042187

YHGJ:LineFinancialAgreementMember

srt:MaximumMember

2023-01-01

2023-12-31

0001042187

us-gaap:RevolvingCreditFacilityMember

2023-12-31

0001042187

us-gaap:RevolvingCreditFacilityMember

2022-12-31

0001042187

YHGJ:JohnHSchwanMember

2019-01-01

0001042187

YHGJ:JohnHSchwanMember

2018-12-30

2019-01-01

0001042187

YHGJ:JohnHSchwanMember

us-gaap:CommonStockMember

2018-12-30

2019-01-01

0001042187

YHGJ:JohnHSchwanMember

2023-12-31

0001042187

YHGJ:JohnHSchwanMember

2022-12-31

0001042187

YHGJ:JohnHSchwanMember

2023-10-01

2023-12-31

0001042187

YHGJ:JohnHSchwanMember

2022-10-01

2022-12-31

0001042187

YHGJ:JohnHSchwanMember

2023-01-01

2023-12-31

0001042187

YHGJ:JohnHSchwanMember

2022-01-01

2022-12-31

0001042187

YHGJ:TermLoanMember

us-gaap:SubsequentEventMember

2024-01-02

2024-01-02

0001042187

YHGJ:TermLoanMember

us-gaap:SubsequentEventMember

2024-01-16

2024-01-16

0001042187

YHGJ:AlexFengMember

2022-12-31

0001042187

2017-12-21

2017-12-22

0001042187

us-gaap:DomesticCountryMember

us-gaap:InternalRevenueServiceIRSMember

2023-12-31

0001042187

us-gaap:StateAndLocalJurisdictionMember

2023-12-31

0001042187

YHGJ:SchwanIncorporatedMember

2023-01-01

2023-12-31

0001042187

YHGJ:SchwanIncorporatedMember

2022-01-01

2022-12-31

0001042187

us-gaap:AccountingStandardsUpdate201602Member

2023-01-01

2023-12-31

0001042187

YHGJ:StockPurchaseAgreementMember

us-gaap:SeriesAPreferredStockMember

2020-01-02

2020-01-03

0001042187

YHGJ:StockPurchaseAgreementMember

us-gaap:SeriesAPreferredStockMember

2020-01-03

0001042187

us-gaap:SeriesAPreferredStockMember

YHGJ:AdditionalSharesOfferingMember

2020-01-02

2020-01-03

0001042187

us-gaap:SeriesAPreferredStockMember

us-gaap:InvestorMember

2020-01-02

2020-01-03

0001042187

us-gaap:CommonStockMember

YHGJ:LFInternationalOfferingMember

2020-01-02

2020-01-03

0001042187

us-gaap:SeriesAPreferredStockMember

2020-01-02

2020-01-03

0001042187

us-gaap:SeriesAPreferredStockMember

2020-01-03

0001042187

us-gaap:SeriesAPreferredStockMember

2022-07-01

2022-09-30

0001042187

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-09-30

0001042187

us-gaap:CommonStockMember

YHGJ:ConvertibleSeriesAPreferredStockMember

2022-09-01

0001042187

us-gaap:CommonStockMember

YHGJ:ConvertibleSeriesAPreferredStockMember

2022-09-01

2022-09-01

0001042187

us-gaap:SeriesBPreferredStockMember

2020-11-01

2020-11-30

0001042187

us-gaap:SeriesBPreferredStockMember

2020-11-30

0001042187

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001042187

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001042187

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-12-31

0001042187

us-gaap:CommonStockMember

YHGJ:ConvertibleSeriesCPreferredStockMember

2023-02-01

0001042187

us-gaap:SeriesCPreferredStockMember

2021-01-01

2021-01-31

0001042187

us-gaap:SeriesCPreferredStockMember

2021-01-31

0001042187

us-gaap:SeriesCPreferredStockMember

2022-08-30

0001042187

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001042187

us-gaap:CommonStockMember

YHGJ:ConvertibleSeriesCPreferredStockMember

2022-09-01

0001042187

us-gaap:CommonStockMember

YHGJ:ConvertibleSeriesCPreferredStockMember

2022-09-01

2022-09-01

0001042187

YHGJ:UnrelatedThirdPartyMember

us-gaap:SeriesDPreferredStockMember

2021-06-01

2021-06-30

0001042187

us-gaap:SeriesDPreferredStockMember

2021-09-29

2021-09-30

0001042187

us-gaap:SeriesDPreferredStockMember

2021-12-30

2021-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

2021-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

2021-01-01

2021-12-31

0001042187

us-gaap:SeriesDPreferredStockMember

2022-09-01

0001042187

us-gaap:CommonStockMember

YHGJ:ConvertibleSeriesDPreferredStockMember

2022-09-01

0001042187

us-gaap:CommonStockMember

YHGJ:ConvertibleSeriesDPreferredStockMember

2022-09-01

2022-09-01

0001042187

us-gaap:WarrantMember

2023-11-30

2023-11-30

0001042187

2023-11-30

0001042187

us-gaap:WarrantMember

2022-12-31

0001042187

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001042187

us-gaap:WarrantMember

2023-12-31

0001042187

YHGJ:LFInternationalPteMember

2020-01-01

2020-12-31

0001042187

YHGJ:GardenStateSecuritiesMember

2020-01-01

2020-12-31

0001042187

us-gaap:RestrictedStockMember

YHGJ:MrHylandMember

2020-01-01

2020-12-31

0001042187

us-gaap:RestrictedStockMember

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-12-31

0001042187

us-gaap:RestrictedStockMember

srt:DirectorMember

2022-01-01

2022-12-31

0001042187

us-gaap:RestrictedStockMember

srt:ChiefOperatingOfficerMember

2023-01-01

2023-12-31

0001042187

us-gaap:RestrictedStockMember

srt:ChiefOperatingOfficerMember

2023-12-31

0001042187

us-gaap:RestrictedStockMember

srt:ChiefExecutiveOfficerMember

2023-12-31

0001042187

us-gaap:RestrictedStockMember

srt:ChiefExecutiveOfficerMember

2022-12-31

0001042187

us-gaap:RestrictedStockMember

srt:ChiefOperatingOfficerMember

2022-01-01

2022-12-31

0001042187

YHGJ:StockIncentivePlan2009Member

2009-04-10

0001042187

YHGJ:StockIncentivePlan2018Member

2018-06-08

0001042187

YHGJ:StockIncentivePlan2018Member

2022-06-17

0001042187

us-gaap:PerformanceSharesMember

2023-01-01

2023-12-31

0001042187

YHGJ:SeriesAWarrantMember

2020-01-01

2020-12-31

0001042187

YHGJ:SeriesAWarrantMember

2020-12-31

0001042187

YHGJ:SeriesAWarrantMember

2021-02-01

2021-02-28

0001042187

YHGJ:SeriesAPreferredStockWarrantsMember

2023-01-01

2023-12-31

0001042187

YHGJ:SeriesAWarrantMember

2023-12-31

0001042187

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-12-31

0001042187

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001042187

us-gaap:MeasurementInputExpectedTermMember

2023-12-31

0001042187

us-gaap:MeasurementInputExpectedTermMember

2022-12-31

0001042187

us-gaap:MeasurementInputExpectedDividendRateMember

2023-12-31

0001042187

us-gaap:MeasurementInputExpectedDividendRateMember

2022-12-31

0001042187

us-gaap:WarrantMember

2023-12-31

0001042187

us-gaap:WarrantMember

2022-12-31

0001042187

us-gaap:EmployeeStockOptionMember

2021-12-31

0001042187

us-gaap:WarrantMember

2021-12-31

0001042187

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-12-31

0001042187

us-gaap:EmployeeStockOptionMember

2022-12-31

0001042187

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-12-31

0001042187

us-gaap:WarrantMember

2023-01-01

2023-12-31

0001042187

us-gaap:EmployeeStockOptionMember

2023-12-31

0001042187

YHGJ:FoilBalloonsMember

2023-01-01

2023-12-31

0001042187

YHGJ:FoilBalloonsMember

2022-01-01

2022-12-31

0001042187

YHGJ:FilmProductsMember

2023-01-01

2023-12-31

0001042187

YHGJ:FilmProductsMember

2022-01-01

2022-12-31

0001042187

YHGJ:OtherProductsMember

2023-01-01

2023-12-31

0001042187

YHGJ:OtherProductsMember

2022-01-01

2022-12-31

0001042187

us-gaap:SubsequentEventMember

2024-01-01

2024-01-31

0001042187

us-gaap:SubsequentEventMember

YHGJ:SeriesEConvertiblePreferredStockMember

2024-03-31

0001042187

us-gaap:SubsequentEventMember

YHGJ:SeriesFConvertiblePreferredStockMember

2024-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

YHGJ:Integer

YHGJ:Customers

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2023

OR

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _________to_________

Commission

File Number

000-23115

YUNHONG

GREEN CTI LTD.

(Exact

name of registrant as specified in its charter)

| Illinois |

|

36-2848943 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| |

|

|

| 22160

N. Pepper Road |

|

|

| Lake

Barrington, Illinois |

|

60010 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (847) 382-1000

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Ticker

symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, no par value per share |

|

YHGJ |

|

The

NASDAQ Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

Non-accelerated

filer ☒ |

Smaller

Reporting Company ☒ |

Emerging

Growth Company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has fi led a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting fi rm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Based

upon the closing price of $1.97 per share of the Registrant’s Common Stock as reported on NASDAQ Capital Market tier of The NASDAQ

Stock Market on June 30, 2023, the aggregate market value of the voting common stock held by non-affiliates of the Registrant was then

approximately $14,768,000. (The determination of stock ownership by non-affiliates was made solely for the purpose of responding to the

requirements of the Form and the Registrant is not bound by this determination for any other purpose.)

The

number of shares outstanding of the Registrant’s Common Stock as of March 20, 2024 was 20,771,937 (excluding treasury shares).

DOCUMENTS

INCORPORATED BY REFERENCE

The

Registrant’s definitive Proxy Statement for the Annual Meeting of Shareholders (the “2024 Proxy Statement”) is incorporated

by reference in Part III of this Form 10-K to the extent stated herein. The 2024 Proxy Statement, or an amendment to this Form 10-K,

will be filed with the SEC within 120 days after December 31, 2023. Except with respect to information specifically incorporated by reference

in this Form 10-K, the Proxy Statement is not deemed to be filed as a part hereof.

TABLE

OF CONTENTS

INDEX

FORWARD

LOOKING STATEMENTS

FORWARD-LOOKING

STATEMENTS

This

Annual Report on Form 10-K includes both historical and “forward-looking statements” within the meaning of Section 21E of

the Securities Exchange Act of 1934, as amended. We have based these forward-looking statements on our current expectations and projections

about future results. Words such as “may,” “should,” “could,” “would,” “expect,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“continue,” or similar words are intended to identify forward-looking statements, although not all forward-looking statements

contain these words. Although we believe that our opinions and expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements, and our actual results may differ substantially

from the views and expectations set forth in this Annual Report on Form 10-K. We disclaim any intent or obligation to update any forward-looking

statements after the date of this Annual Report on Form 10-K to conform such statements to actual results or to changes in our opinions

or expectations. These forward-looking statements are affected by factors, risks, uncertainties and assumptions that we make, including,

without limitation, our participation in highly competitive markets, potential changes in the cost or availability of raw materials,

our dependence on a limited number of suppliers, the possible inability to obtain an adequate supply of raw materials, our reliance on

a limited number of key customers, the loss of one or more of our key customers, changing consumer demands, developments or changes in

technology, risks of international operations and political environments, dependence on our intellectual property, compliance with federal,

state or local regulations, the resolution of litigation or other legal proceedings to which we may become involved, restrictions included

in the Company’s credit facility, the availability of funds under the Company’s credit facility, damage to or destruction

of one or both of the Company’s principal plants, our ability to service our indebtedness, our ability to invest in needed plant

or equipment.

PART

I

Item

No. 1 –Business

Business

Overview

We

develop, produce, distribute and sell a number of consumer products throughout the United States and in several other countries, and

we produce film products for commercial and industrial uses in the United States. Many of our products utilize flexible films and, for

a number of years, we have been a leading developer of innovative products which employ flexible films including novelty balloons, pouches

and films for commercial packaging applications.

Our

principal lines of products include:

Novelty

Products consisting principally of foil and latex balloons and related gift items; and

Flexible

Films for food and other commercial and packaging applications.

In

addition to these principal product lines, for the past several years, we have engaged in the assembly and sale of balloon-inspired gift

items (small gift bouquets of arranged candy items often including ribbons and/or a small foil balloon).

During

2023 we expanded to include samples of compostable material intended to replace single-use plastic and other materials. Adding these

materials to our Company inspired us to ask our shareholders to include “Green” in our name and to reflect our name in new

trading symbol “YHGJ”. Our shareholders approved of these actions during August 2023.

We

leverage our technology to design and develop proprietary products which we develop, market and sell for our customers. We have been

engaged in the business of developing flexible film products for over 40 years and have acquired significant technology and know-how

in that time. We currently hold several patents related to flexible film products, including specific films, zipper closures, valves

and other features of these products.

We

print, process and convert flexible film into finished products and we produce balloons and novelty items. Our principal production processes

include:

| |

● |

Coating

and laminating rolls of flexible film. Generally, we adhere polyethylene film to another film such as nylon or polyester; |

| |

● |

Printing

film and latex balloons. We print on plastic films, with a variety of graphics, for use as packaging film or for balloons; |

| |

● |

Converting

printed film to balloons; |

| |

● |

Converting

film to flexible containers; |

| |

● |

Producing

or reselling latex balloons and other latex novelty items; and |

| |

● |

Assembling

and inflating of novelty products and balloons and Candy Blossoms. |

In

1978, we began manufacturing metalized balloons (often referred to as “foil” balloons), which are balloons made of a base

material (usually nylon or polyester) often having vacuum deposited aluminum and polyethylene coatings. These balloons remain buoyant

when filled with helium for much longer periods than latex balloons and permit the printing of graphic designs on the surface. In 1985,

we began marketing latex balloons and, in 1988, we began manufacturing latex balloons. In 1999, we acquired an extrusion coating and

laminating machine and began production of coated and laminated films, which we have produced since that time.

For

more than 20 years, we have been engaged in the coating, laminating and printing of flexible films for our novelty and container products

and for the production of laminated and printed films we supply to others.

We

market and sell our foil and latex balloons and related novelty items throughout the United States, Canada and Mexico and in a number

of other countries. We supply directly to retail stores and chains and through distributors, who in turn sell to retail stores and chains.

Our balloon and novelty products are sold to consumers through a wide variety of retail outlets including general merchandise, discount

and drugstore chains, grocery chains, card and gift shops and party goods stores, as well as through florists and balloon decorators.

Most

of our foil balloons contain printed characters, designs and social expression messages, such as “Happy Birthday,” “Get

Well” and similar items. We may obtain licenses from time to time for well-known characters and print those characters and messages

on our balloons.

We

provide customized laminated films and printed films to customers who utilize the film to produce bags or pouches for the packaging of

food, liquids and other items. In 2014, we began assembling and producing balloon-inspired gifts - containers including candy items and,

often, air-inflated balloons.

In

2023, our revenues from our product lines, as a percent of total revenues were:

| ● |

Novelty

Products |

66%

of revenues |

| ● |

Flexible

Film Products |

5%

of revenues |

| ● |

Balloon-inspired

gifts and Other Products |

29%

of revenues |

We

are an Illinois corporation with our principal offices and plant at 22160 N. Pepper Road, Lake Barrington, Illinois.

Business

Strategies and Developments

Our

business strategies, and recent developments related to our business, include:

| |

● |

Management.

During 2020 Ms. Jana Schwan became our Chief Operating Officer after having served as Vice President of Operations and a number of

other roles of increasing responsibility during her 20 years with the Company. During 2021, Mr. Cesario rejoined the Company’s

Board of Directors. During January 2022, Mr. Cesario rejoined the Company as Chief Executive Officer and Acting Chief Financial Officer,

with Mr. Yubao Li retaining the role of Chairman of the Board of Directors. |

| |

● |

Financing.

We entered into a credit facility during September 2021 that was extended during 2023 expiring September 2025. We have been in compliance

with this credit facility since inception. |

| |

● |

Strategy.

Our management determined to focus on achieving growth and profitability within the current scope of our core product lines –

foil balloons and related products – from our United States based business. In addition, we seek to leverage advancements in

compostable materials from a group of companies based in China that are directly or indirectly controlled by our

Chairman and director, Mr. Yubao Li (collectively, and including LF International plc, these other companies are referred to herein as

the “Yunhong Companies” or “Yunhong Group”). We believe the combination of traditional product optimization with risk-managed

investment in new materials is the right combination for our company. |

| |

● |

Focus

on our Core Assets and Expertise. We have been engaged in the development, production and sale of film and container products

for 40 years and have developed assets, technology and expertise which, we believe, enable us to develop, manufacture, purchase,

market and sell innovative products of high quality within our areas of knowledge and expertise. We have focused our efforts on these

core assets and areas of expertise – film novelty products, specialty film products, laminated films and printed films –

to develop new products, to market and sell our products and to build our revenues. |

| |

● |

Develop

New Products, Product Improvements and Technologies. We engage in research, design, innovation and development for the purpose

of developing and improving products, materials, methods and technologies within our core product categories. We work to develop

and identify new products, to improve existing products and to develop new technologies within our core product areas in order to

enhance our competitive position and increase our sales. We seek to leverage our technology to develop innovative and proprietary

products. In our novelty product lines, our development work includes new designs, new character licenses, new product developments,

new materials and improved production methods. We work with customers to develop custom film products which serve the unique needs

or requirements of the customer. We seek to leverage the advancements of other Yunhong Companies. |

| |

● |

Develop

New Channels of Distribution and New Sales Relationships. We seek to organically develop new channels of distribution and new

sales relationships, both for existing and new products. Over the past several years, we have developed new distributors and customers

for our products in the United States and in Europe, Mexico, Latin America and Australia. We also look to leverage resources within

the Yunhong China Group for a wide range of topics, from sales to sourcing. |

| |

● |

Product

and Line Extensions. We intend to pursue new product lines and product line extensions, through internal developments. |

Products

Foil

Balloons. We have designed, produced and sold foil balloons since 1979 and, we believe, are one of the larger manufacturers of foil

balloons in the United States. Currently, we produce several hundred foil balloon designs, in different shapes and sizes.

In

addition to size and shape, a principal element of our foil balloon products is the printed design or message contained on the balloon.

These designs may include figures and licensed characters, but typically are of our own design. We recognize that consumer trends and

preferences, and competing products, are constantly changing. In order to compete effectively in this product line we must constantly

innovate and develop new designs, shapes and products.

Latex

Balloons. Our former subsidiary in Guadalajara, Mexico, Flexo Universal, S. de R.L. de C.V. (“Flexo Universal”) manufactures

latex balloons in a wide variety of sizes and colors. Flexo Universal was sold during October 2021. The Company currently sources latex

products from a foreign supplier and resells those products to customers that seek both foil and latex solutions.

Packaging

Films and Custom Film Products. A large and increasing number of both consumer and commercial products are packaged in pouches or

containers utilizing flexible films. Often such containers include printed labels and designs. We produce and sell films that may be

utilized for the packaging of a wide variety of products and liquids. We laminate, extrusion coat and adhesive coat flexible films for

these purposes and we provide flexographic printing for the films we produce. We can produce a variety of customized film products, and

printing services, to meet the specific packaging needs of a wide variety of customers.

Other

Products. In 2014, we began assembly and sale of our balloon-inspired gifts product line (typically a presentation of candy with

a balloon in a decorative arrangement for gifting). We have since supplemented this product line with related products.

Markets

Foil

Balloons

The

foil balloon came into existence in the late 1970s. During the 1980s, the market for foil balloons grew rapidly. Initially, the product

was sold principally to individual vendors, small retail outlets and at fairs, amusement parks, shopping centers and other outdoor facilities

and functions. Foil balloons remain buoyant when filled with helium for extended periods of time and they permit the printing and display

of graphics and messages. As a result, the product has significant appeal as a novelty and message item. Foil balloons became part of

the “social expression” industry, carrying graphics designs, characters and messages like greeting cards. In the mid-1980s,

we and other participants in the market began licensing character and cartoon images for printing on the balloons and directed marketing

of the balloons to retail outlets including grocery, general merchandise, discount and drug store chains, card and gift shops, party

goods stores as well as florists and balloon decorators. These outlets now represent the principal means for the sale of foil balloons

throughout the United States and in a number of other countries, although individual vendors remain a means of distribution in certain

areas.

Foil

balloons are now sold in virtually every region of the world. The United States remains the largest market for these products.

Foil

balloons are sold in the United States and foreign countries directly by producers to retail outlets and through distributors and wholesalers.

Often the sale of foil balloons by the wholesalers/distributors is accompanied by related products including latex balloons, floral supplies,

candy containers, mugs, plush toys, baskets and a variety of party goods.

Latex

Balloons

For

a number of years, latex balloons and related novelty/toy latex items have been marketed and sold throughout the United States and in

many other countries. Latex balloons are sold as novelty/toy items for decorative purposes, as part of floral designs and as party goods

and favors. In addition to standard size and shape balloons, inflatable latex items include punch balls, water bombs, balloons to be

twisted into shapes, and other specialty designs. Often, latex balloons include printed messages or designs.

Latex

balloons are sold principally in retail outlets, including party goods stores, general merchandise stores, discount chains, gift stores

and drugstore chains. Latex balloons are also purchased by balloon decorators and floral outlets for use in decorative or floral designs.

Printed latex balloons are sold both in retail outlets and for balloon decoration purposes including floral designs.

Latex

balloons are sold both through distributors and directly to retail outlets by the producers.

Printed

and Specialty Films

The

industry and market for printed and specialty films are fragmented and include many participants. There are hundreds of manufacturers

of printed and specialty film products in the United States and in other markets. In many cases, companies who provide food and other

products in film packages also produce or process the films used for their packages. The market for the Company’s film products

consists principally of companies who utilize the films for the packaging of their products, including food products and other items,

usually by converting the film to a flexible container.

Marketing,

Sales and Distribution

Balloon

Products

We

work in collaboration with our customers on designs, promotions, and other elements of marketing and selling. Our customers are typically

retailers who sell our products to individual consumers. These relationships generally can be terminated unilaterally by either us or

our customers. We must maintain good relationships with our customers if this sales model is to be successful.

We

market and sell our foil balloon, latex balloon and related novelty products throughout the United States and in a number of other countries.

We maintain marketing, sales and support staff and a customer service department in the United States. We sell directly to foreign customers

from the United States.

We

sell and distribute our balloon products (i) through our sales staff and customer service personnel in the United States, (ii) through

a network of distributors and wholesalers, (iii) through several groups of independent sales representatives, and (iv) to retail chains.

Our balloon products are generally sold through retail outlets including grocery, general merchandise and drug store chains, card and

gift shops, party goods stores as well as florists and balloon decorators.

We

sometimes engage in advertising and promotional activities to promote the sale of our balloon products. We produce catalogs of our balloon

products, and also prepare various flyers and brochures for special or seasonal products, which we disseminate to customers, potential

customers and others. We maintain websites which show images of our products.

Printed

and Specialty Films

We

market and sell printed and laminated films directly and through independent sales representatives throughout the United States. We sell

laminated and printed films to companies that utilize these films to produce packaging for a variety of products, including food products,

in both solid and liquid form, such as cola syrup, coffee, juices and other items. We seek to identify and maintain customer relationships

in which we provide added value in the form of technology or systems.

Other

Products

Other

products are sold by our internal sales force directly to customers and also by independent sales representatives. These products are

generally sold directly to retail outlets or other intermediaries to the ultimate consumer (for example, to a florist).

Production

and Operations

We

conduct our operations at our facilities including: (i) our 68,000 square feet facility in Lake Barrington, Illinois, incorporating our

headquarters office, production and warehouse space, and (ii) our 69,000 square foot facility in Elgin, Illinois consisting of warehouse,

packaging and office space.

Our

production operations include (i) lamination and extrusion coating of films, (ii) slitting of film rolls, (iii) printing on film and

on latex balloons, (iv) converting film to completed products including balloons, flexible containers and pouches, (v) distributing latex

balloon products, (vi) inflating of air-filled balloons, and (vii) assembling Candy blossoms. We perform all of the lamination, extrusion

coating and slitting activities in our Lake Barrington, Illinois plant. We complete air-filling and assembly of balloons and balloon-inspired

gifts in our Elgin, Illinois facility.

We

warehouse raw materials in Lake Barrington, Illinois and we warehouse finished goods at our facilities in Lake Barrington, Illinois and

Elgin, Illinois. We maintain customer service and fulfillment operations at each of our locations. We conduct sales operations for the

United States and for all other markets at the Lake Barrington, Illinois facility.

We

maintain a graphic arts and development department at our Lake Barrington, Illinois facility which designs our balloon products and graphics.

Our creative department operates a networked, computerized graphic arts system for the production of these designs and of printed materials

including catalogues, advertisements and other promotional materials. As many of our products are custom designed or created to fulfill

promotional schedules, we sometimes have excess inventory that must be sold at a discount or disposed of. Any such disposition will typically

negatively impact our profit margin.

We

conduct administrative and accounting functions at our headquarters in Lake Barrington, Illinois.

Raw

Materials

The

principal raw materials we use in manufacturing our products are (i) petroleum or natural gas-based films, (ii) petroleum or natural

gas-based resin, (iii) printing inks, and (iv) bulk candy. The cost of raw materials represents a significant portion of the total cost

of our products, with the result that fluctuations in the cost of raw materials have a material effect on our profitability. During the

past several years, we have experienced significant fluctuations in the cost of these raw materials. We do not have any long-term agreements

for the supply of raw materials and may experience wide fluctuations in the cost of raw materials in the future. Further, although we

have been able to obtain adequate supplies of raw materials in the past, there can be no assurance that we will be able to obtain adequate

supplies of one or more of our raw materials in the future.

Many

of the foil balloons we produce and sell are intended to be filled with helium in order to be buoyant. Over the past several years, the

price of helium has fluctuated substantially and the availability of helium has, on occasion, been limited. During 2018 and 2019, the

availability of helium declined and the cost of helium increased. The supply of helium improved significantly until 2022, when another

set of supply disruptions caused significant price escalation of helium. The price of helium has gradually decreased during the second

half of 2022 and through 2023, but remains higher than prior to February 2022. Any future occurrence of limited availability and/or an

increase in the cost of helium could adversely affect our sales of foil balloons.

Competition

The

balloon and novelty industry is highly competitive, with numerous competitors. We believe the principal manufacturers of foil balloons

whose products are sold in the United States include Anagram International, Inc., Pioneer Balloon Company, Convertidora International

S.A. de C.V., and Betallic, LLC. Several companies market and sell foil balloons designed by them and manufactured by others for them.

In addition, there are several additional foil balloon manufacturers in Europe and China who participate in our markets.

We

compete for the sale of latex balloons in the United States, Canada, Mexico, Latin America, the United Kingdom, Australia and Europe.

There are a number of other companies situated in the United States, Mexico, Asia, South America and Europe who manufacture latex balloons

and with whom we compete in the markets in which we participate. The markets are highly competitive with respect to price, quality and

terms.

The

market for films, packaging, and custom products is fragmented, and competition in this area is difficult to gauge. However, there are

numerous participants in this market and the Company can expect to experience intense quality and price competition.

Many

of the companies in these markets offer products and services that are the same or similar to those offered by us and our ability to

compete depends on many factors within and outside our control. There are a number of well-established competitors in each of our product

lines, several of which possess substantially greater financial, marketing and technical resources and have established extensive, direct

and indirect channels of distribution for their products and services. As a result, such competitors may be able to respond more quickly

to new developments and changes in customer requirements, or devote greater resources to the development, promotion and sale of their

products and services than we can. Competitive pressures include, among other things, price competition, new designs and product development

and copyright licensing.

Patents,

Trademarks and Copyrights

We

have developed or acquired a number of intellectual property rights which we believe are significant to our business. As of December

31, 2023, we held 1 issued patent in the United States scheduled to expire in 2024. While intellectual property rights are helpful, we

believe that their degree of protection is uncertain. Competitors may violate our intellectual property rights, forcing us to decide

whether to challenge them. Such rights may or may not withstand challenge. Conversely, entities may charge us with violating their intellectual

property rights. Failure to protect our rights, or conflict with the rights of one or more other entities, may negatively impact our

financial and competitive position.

Proprietary

Designs and Copyright Licenses. We design the shapes and graphic designs of most of our foil balloon products.

Trademarks.

We own nine registered trademarks in the United States relating to our balloon products, including trademark applications. Some of

these trademarks are registered in foreign countries, principally in the European Union.

Patent

Rights. We own, or have license rights under, or have applied for, patents related to our balloon products, certain film products

and certain flexible container products.

Research

and Development

We

maintain a product development and research group for the development or identification of new products, product designs, product components

and sources of supply. Research and development includes (i) creative product development and design, (ii) creative marketing, and (iii)

engineering development. During each of the fiscal years ended December 31, 2023 and 2022, we estimate that the total amount spent on

research and development activities was approximately $200,000 and $200,000, respectively.

Employees

As

of December 31, 2023, the Company had 57 full-time employees in the United States, of whom 14 are executive or supervisory, 2 are in

sales, 29 are in manufacturing or warehouse functions and 12 are clerical. The Company is not a party to any collective bargaining agreement

in the United States, has not experienced any work stoppages, and believes that its relationship with its employees is satisfactory.

Beginning

November 2018, the Company experienced severe difficulty in securing adequate seasonal workers in its US operations, forcing it to pay

substantially higher costs in the form of overtime and a holiday premium. The Company expects its local labor market in the US (near

Chicago) to continue to become more costly over time, which, if not changed, would negatively impact its future profitability. The Company

has introduced additional automation features in its production lines during 2022 and 2023 and expects to continue to implement automation

tools during 2024 and beyond.

Regulatory

Matters

Our

manufacturing operations in the United States are subject to the U.S. Occupational Safety and Health Act (“OSHA”). We believe

we are in material compliance with OSHA. The Company generates liquid, gaseous and solid waste materials in its operations in Lake Barrington,

Illinois and the generation, emission or disposal of such waste materials are, or may be, subject to various federal, state and local

laws and regulations regarding the generation, emission or disposal of waste materials. We believe we are in material compliance with

applicable environmental rules and regulations. Several states have enacted laws limiting or restricting the release of helium filled

foil balloons. We do not believe such legislation will have any material effect on our operations.

An

increasing number of regulations and actions relate to the integrity and security of individually identifiable data. Additionally, we

require the effective use of data in running our business. While we are not aware of losses in the past, access of such data by unauthorized

persons may expose us to costs, fines, penalties, and loss of customer confidence.

International

Operations

We

have no international operations.

Available

Information

We

maintain our corporate website at www.ctiindustries.com and we make available, free of charge, through this website our annual report

on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports that we file with, or furnish

to, the Securities and Exchange Commission (“SEC”), as soon as reasonably practicable after we electronically file that material

with, or furnish it to, the SEC. You may also read and copy material filed by us with the SEC at the SEC’s Public Reference Room

at 100 F Street, N.E., Washington, D.C. 20549, and you may obtain information on the operation of the Public Reference Room by calling

the SEC in the U.S. at 1-800-SEC-0330. In addition, the SEC maintains an Internet website, www.sec.gov, which contains reports, proxy

and information statements and other information that we file electronically with the SEC. Our website also includes corporate governance

information, including our Code of Ethics, Clawback Policy and our Board Committee Charters. The information contained on our website

does not constitute a part of this report.

Item

No. 1A – Risk Factors

Our

business and results of operations have been and may continue to be negatively impacted by the spread of COVID-19.

We

sell our products throughout the United States and in many foreign countries and may be impacted by public health crises beyond our control.

This could disrupt our operations and negatively impact consumer spending and confidence levels, and supply availability and costs, all

of which can affect our financial results, condition, and outlook. Our customers, suppliers and distributors may experience similar disruption.

Importantly, the global pandemic resulting from COVID-19 has disrupted global health, economic and market conditions.

Throughout

2021 and into 2022 the landscape improved from 2020, but the issue continues to drive elements of disruption in the ability to travel,

attract and retain workers, manage production configurations and protocols, the supply chain and customer base. While we cannot predict

the duration or scope of the COVID-19 pandemic, the resurgence of infections in one or more markets, or the impact of vaccines across

the globe, the COVID-19 pandemic has negatively impacted our business and is expected to continue to impact our financial results, condition

and outlook in a way that may be material.

COVID-19

has also delayed certain strategic transactions the Company intended to close during 2020, most notably its attempted sale of its former

subsidiary Flexo Universal which was ultimately realized during October 2021 and the potential relocation of certain activities to the

Laredo, Texas area, which is no longer a consideration of the Company.

Our

business and results of operations have been and may continue to be negatively impacted by supply chain disruptions and inflationary

pressure.

Beginning

in 2021 we saw material shortages, supply chain interruption, and reduced ability to transport goods throughout the United States and

on a global scale. These pressures forced us to take steps to ensure the availability of products, including buying materials at higher

prices and more aggressively managing lead times. Despite these efforts, our ability to fulfill customer demands was challenged. We also

were forced to pass cost increases on to customers in the form of price increases, which threatened our ability to maintain sales volume.

While we believe we were largely successful in passing along these increased costs, such pressures may negatively impact our financial

results and book of business going forward.

The

price and availability of helium may negatively impact our largest product line.

Beginning

in February 2022 we saw a dramatic increase in the price of helium. We understand Russia to be a net exporter of helium prior to February

2022, and at that time one of the largest manufacturing facilities in the United States was damaged by fire. Our largest product line

consists of balloons that are filled with helium by customers. When the cost of helium increases, our customers become more likely to

temporarily not carry helium, or to increase prices to customers that may have a negative impact on ultimate demand. From May 2022 through

the end of 2023, we believe our revenue was negatively impacted by several million dollars due to the price of helium. The price of helium

gradually reduced during 2022 and 2023. Helium remains slightly elevated, though not at the level experienced during 2022. The longer

the price of helium exceeds a normal range, the more negatively our business will be impacted.

The

efficient trading of our common stock on an appropriate platform.

Twice

during 2022 we were informed by Nasdaq that the bid price of our common stock had been below $1 for an extended period of time and that

we risked being delisted if that problem was not satisfactorily resolved. As of January 19, 2023, we received confirmation from the Nasdaq

that we had regained compliance with the minimum bid requirement for continued listing.

Item

No. 1B – Unresolved Staff Comments

As

of the filing of this Annual report on Form 10-K, we had no unresolved comments from the staff of the Securities and Exchange Commission.

Item

No. 1C -– Cybersecurity

Our

business is subject to risk from cybersecurity threats and incidents, including attempts to gain unauthorized access to our systems and

networks, or those of our managers, venture partners and third-party vendors and service providers, to disrupt operations, corrupt data

or steal confidential or personal information and other cybersecurity breaches. We consider cybersecurity risk a threat to our assets

and thus have put processes in place designed to mitigate the risk and impact of any such cybersecurity threat or incident.

Risk

Management and Strategy

As

part of our cybersecurity risk management process, we:

●

Research and consider recommendations and “best practices” in the field, including procedures with respect to evaluation

and monitoring of cybersecurity threats and incidents;

●

Consider whether and when to engage third-party security firms to monitor and respond to cybersecurity threats and incidents,

including those associated with our use of third-party vendors and service providers, and conduct periodic penetration tests with

the aim of identifying and remediating vulnerabilities.

● Periodically

evaluate and assess cybersecurity risks, including those associated with our use of key third-party business partners, vendors and

service providers. We do not control the cybersecurity plans and systems put in place by such third parties and we may have limited

contractual protections with such third parties, such as indemnification obligations to us, which could cause us to be negatively

impacted as a result;

●

Provide employees with the training, tools and resources designed to protect the Company from cybersecurity threats and incidents

and to identify and report such threats and incidents. Our employees receive training and reminders on cybersecurity protocols

throughout the year; and

●

Seek to minimize the amount of personal information collected to support business needs and use storage and transfer protocols

leveraging encryption of critical information, including confidential or personal information.

Our

processes for assessing, identifying, and managing material risks from cybersecurity threats and incidents are integrated into our process,

which includes direct participation with personnel from our senior leadership team. Existing risks are evaluated for changes, and mitigation strategies

are discussed as needed. New risks are discussed and evaluated for consideration as a top risk. Results are discussed with our Board

of Directors on an as needed basis.

The

Company has not identified any cybersecurity threats or incidents that have materially affected or are reasonably likely to materially

affect the Company, including with respect to our business strategy, results of operations, or financial condition. While we have implemented

measures designed to help mitigate the risk from cybersecurity threats and incidents, we cannot guarantee that we or our tenants, managers

or business partners will be successful in preventing a cybersecurity incident, which could result in a data center outage, disrupt our

systems and operations or the systems and operations of our tenants, managers or business partners, compromise the confidential or personal

information of our employees or partners, which could damage our business relationships and reputation. Although we have implemented

various measures designed to manage risks relating to these types of events, these measures and the systems supporting them could prove

to be inadequate and, if compromised, could become inoperable for extended periods of time, cease to function properly or fail to adequately

secure confidential or personal information. See “Risk Factors—Our Legal, Compliance and Regulatory Risks—The occurrence

of cybersecurity incidents could disrupt our operations or the operations of the third parties with whom we do business, invest in or

lend to, result in the loss of confidential or personal information or damage our or their business relationships and reputation. included

in Part I, Item 1A of this Annual Report.

Governance

Our

Board of Directors, directly and through its committees, routinely discusses significant enterprise risks with management and reviews

the procedures we have in place designed to manage those risks. At Board and committee meetings, directors engage in analyses and dialogue

which can include any aspect of business risk. In addition to the overall risk oversight function administered directly by our Board,

the Audit and Compliance Committee of our Board also exercises oversight over managing the Company’s cybersecurity risks.

Management

has primary responsibility for identifying, assessing and managing our exposure to cybersecurity threats and incidents, subject to oversight

by our Board of Directors of the processes we establish to assess, monitor and mitigate that exposure.

If

a potentially material cybersecurity threat or incident is identified or discovered, the Company’s Management Team will notify

relevant business executives, the Board of Directors, Legal Counsel, and other relevant entities. Our Chief Executive Officer, or that

person’s designated representative, will work with the appropriate leaders and employees in any impacted business groups, as well

as appropriate personnel in our finance, legal and potentially impacted departments, to assess the risks to the Company and potential

impact while determining appropriate remediation steps.

If

management determines that a cybersecurity threat or incident could be material to the Company, our management will notify the Audit

Committee, and to our full Board of Directors.

Item

No. 2 – Properties

We

executed a sale and leaseback transaction during 2021 on our principal plant and offices located in Lake Barrington, Illinois, approximately

45 miles northwest of Chicago, Illinois. The facility includes approximately 68,000 square feet of office, manufacturing and warehouse

space. The lease is for ten years, and annual rent increases from $500,000 the first year to $652,000 during the final year.

During

2021 we entered into a sublease agreement, which was extended during 2022, now expiring on December 31, 2025 to rent approximately 69,000

square feet of warehouse and assembly space in Elgin, Illinois. The annual lease cost for this facility will rise to $445,000 during

the final year of the lease.

We

believe that our properties have been adequately maintained, are in generally good condition and are suitable for our business as presently

conducted. We believe our existing facilities provide sufficient production capacity for our present needs and for our presently anticipated

needs in the foreseeable future. We also believe that, with respect to leased properties, upon the expiration of our current leases,

we will be able to either secure renewal terms or to enter into leases for alternative locations at market terms.

Item

No. 3 – Legal Proceedings

The

Company may be party to certain lawsuits or claims arising in the normal course of business. The ultimate outcome of these matters is

unknown but, in the opinion of management, we do not believe any of these proceedings will have, individually or in the aggregate, a

material adverse effect upon our financial condition, cash flows or future results of operation.

Item

No. 4. – Mine Safety Disclosures

Not

Applicable.

PART

II

Item

No. 5 – Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market

Information

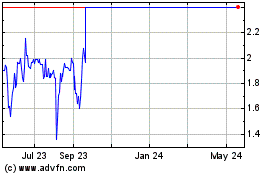

The

Company’s common stock was admitted to trading on the NASDAQ SmallCap Market (now the NASDAQ Capital Market) under the symbol “CTIB”

on November 5, 1997. During September 2023 we changed our symbol to “YHGJ” when we renamed our company “Yunhong Green

CTI Ltd.” These changes did not otherwise impact our shareholders or other attributes.

As

of December 31, 2023 there were approximately 400 holders of record of the Company’s Common Stock. The Company’s total number

of beneficial owners of common stock of the Company was approximately 30.

The

Company did not pay any cash dividends on its Common Stock during 2023 or 2022 and has no plans to pay dividends in the foreseeable future.

Under the terms of the Company’s current loan agreements, the amount of dividends the Company may pay is limited by the terms of

the financial covenants. During 2022 the Company received three deficiency notices from NASDAQ – one for the failure to hold an

annual meeting of shareholders during 2021, and the other two for failure to maintain the required $1 bid price during a 30 day period

in 2022. The Company held an annual meeting on June 17, 2022, which resolved the first deficiency. The Company’s common stock achieved

the required bid price during 2022, resolving the first bid price deficiency, but subsequently fell below the required bid price and

remained there for six months. NASDAQ provided the Company a notice of delisting in November 2022, which the Company appealed. A hearing

was held on January 5, 2023 on this matter. Subsequently, on January 19, 2023, NASDAQ confirmed that the Company had regained compliance

with the continued listing standard related to minimum bid price.

On

March 14, 2024, our common stock closed at $1.62 per share.

Equity

Compensation Plan Information

There

were no stock option incentive plans outstanding as of December 31, 2023. Effective January 2022, the Company issued an inducement grant

to its newly hired Chief Executive Officer for 250,000 shares of restricted stock. 25,000 of those shares vested during January 2022,

while the remaining shares were subject to achievement of certain performance conditions. 56,250 of these remaining shares vested during

2022 when the Company refinanced the terms of its credit facility. Additionally, the restrictions on 56,250 shares of the award lapsed

and the award vested during 2023 when the Company’s operating cash flow, calculated cumulatively from the date of employment, equaled

or exceeded $1.5 million. The Company also provided a grant of shares of restricted stock to its Chief Operating Officer, with 20,000

shares vesting over 12 months and the remaining 80,000 shares vesting based on performance criteria being met. Of these remaining shares,

20,000 subsequently vested when the Company refinanced the terms of its credit facility and another 20,000 shares vested upon the achievement

of operating cash flow described above.

During

2023, the Company’s Board of Directors enacted an Executive Compensation Recovery Policy, commonly referred to as a “Clawback”

policy. This policy enhances the Company’s ability to recover incentive compensation in the event of a restatement or similar adjustment

impacting the achievement of such incentive compensation.

Item

No. 6 – Selected Financial Data

We

are a smaller reporting company, as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended, and are not required to

provide the information required under this item.

Item

No. 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

The

Company produces film products for novelty, packaging container and custom film product applications. These products include foil balloons,

latex balloons (sourced from an external party) and related products, films for packaging applications, and custom film products. We

produce all of our film products for packaging and container applications at our facilities in Lake Barrington, Illinois. Substantially

all of our film products for packaging applications and flexible containers for packaging and storage are sold to customers in the United

States. We market and sell our novelty items – principally foil balloons and latex balloons – in the United States and a

number of additional countries. In addition, the Company assembles and sells balloon-inspired gifts (including containers of arranged

candy items) in the United States.

We

changed our capital structure, beginning January 2020. This includes:

Series

A Preferred Stock

On

January 3, 2020, the Company entered into a stock purchase agreement (as amended on February 24, 2020 and April 13, 2020 (the “LF

Purchase Agreement”)), pursuant to which the Company agreed to issue and sell, and LF International Pte. Ltd., a Singapore private

limited company (“LF International”), which is controlled by Company director, Chairman, President and Chief Executive Officer,

Mr. Yubao Li, agreed to purchase, up to 500,000 shares of the Company’s newly created shares of Series A Preferred Stock (“Series

A Preferred”), with each share of Series A Preferred initially convertible into ten shares of the Company’s common stock,

at a purchase price of $10.00 per share, for aggregate gross proceeds of $5,000,000 (the “LF International Offering”). As

permitted by the Purchase Agreement, the Company may, in its discretion issue up to an additional 200,000 shares of Series A Preferred

for a purchase price of $10.00 per share (the “Additional Shares Offering,” and collectively with the LF International Offering,

the “Offering”). Approximately $1 million of Series A Preferred has been sold, including to an investor which converted an

account receivable of $478,000 owed to the investor by the Company in exchange for 48,200 shares of Series A Preferred. The Company completed

several closings with LF International from January 2020 through June 2020. The majority of the funds received reduced our bank debt.

We issued a total of 400,000 shares of common stock to LF International and, pursuant to the LF Purchase Agreement, changed our name

from CTI Industries Corporation to Yunhong CTI Ltd. LF International had the right to name three directors to serve on our Board. They

were Mr. Yubao Li, Ms. Wan Zhang and Ms. Yaping Zhang. Ms. Wan Zhang and Ms. Yaping Zhang retired from the Board in January 2022.

The

issuance of the Series A Preferred generated a beneficial conversion feature (BCF), which arises when a debt or equity security is issued

with an embedded conversion option that is beneficial to the investor or in the money at inception because the conversion option has

an effective strike price that is less than the market price of the underlying stock at the commitment date. The fair value of the common

stock into which the Series A Preferred was convertible exceeded the allocated purchase price fair value of the Series A Preferred Stock

at the closing dates by approximately $2.5 million as of the closing dates. We recognized this BCF by allocating the intrinsic value

of the conversion option, to additional paid-in capital, resulting in a discount on the Series A Preferred. As the Series A Preferred

is immediately convertible, the Company accreted the discount on the date of issuance. The accretion was recognized as dividend equivalents.

Holders of the Series A Preferred were entitled to receive quarterly dividends at the annual rate of 8% of the stated value ($10 per

share). Such dividends may be paid in cash or in shares of common stock at the Company’s discretion. In the three months ended

September 30, 2023 and 2022 the Company accrued none and $67,000 of these dividends in each period, respectively, as the investor converted

Series A Convertible Preferred Stock into common stock on September 1, 2022. This conversation resulted in the issuance of 5 million

shares of common stock plus an additional approximately 1.3 million shares of common stock representing the accrued dividends.

Series

B Preferred Stock

In

November 2020, we issued 170,000 shares of Series B Preferred for an aggregate purchase price of $1,500,000. The Series B Preferred have

an initial stated value of $10.00 per share and liquidation preference over common stock. The Series B Preferred is convertible into

shares of our common stock equal to the number of shares determined by dividing the sum of the stated value and any accrued and unpaid

dividends by the conversion price of $1.00. The Series B Preferred accrues dividends at a rate of 8 percent per annum, payable at our

election either in cash or shares of the Company’s common stock. Initially, the Series B Preferred, in whole or part, was redeemable

at the option of the holder (but not mandatorily redeemable) at any time on or after November 30, 2021 for the stated value, plus any

accrued and unpaid dividends and thus was classified as mezzanine equity and initially recognized at fair value of $1.5 million (the

proceeds on the date of issuance). The carrying value as of September 30, 2023 and December 31, 2022 amounted to none and $1,851,000,

respectively. On February 1, 2023, the investor converted Series B Preferred into approximately 1.9 million shares of common stock, including

accrued dividends.

Series

C Preferred Stock

In