Daktronics, Inc. (NASDAQ - DAKT) today reported results for its

fiscal 2024 second quarter which ended October 28, 2023.

Q2 FY2024 financial highlights:

- Sales of $199.4 million, a 6.4 percent increase from the second

quarter of fiscal 2023

- Gross profit as a percentage of net sales of 27.2 percent as

compared to 16.9 percent in the second quarter of fiscal 2023

- Operating income of $19.4 million as compared to $1.5 million

in the second quarter of fiscal 2023

- Product order backlog was $306.9 million(1) at October 28,

2023 compared to $400.7 million at the end of the fourth quarter of

fiscal 2023 and $463.1 million in the year-earlier period.

"Our second quarter performance reflect strong

gross profit margin expansion and cash flow generation,

contributing to a record first half year of financial results. I

attribute our success to our teams strong execution across all

business areas and pricing strategies that we undertook over the

past several quarters. In addition, our backlog reduction reflects

our efforts to reduce lead times and the more stable operating

environment, allowing more consistent output," stated Reece

Kurtenbach, Daktronics' Chairman, President and Chief Executive

Officer."

Andrew Siegel Appointed New Lead

Independent Director Daktronics, Inc. also announced the

appointment of Andrew Siegel as Lead Independent Director,

succeeding Kevin McDermott who has served as Lead Director since

June 2020.

“Kevin provided outstanding leadership to the

Board as our Lead Independent Director during a challenging time,

including the pandemic business climate, post-pandemic supply-chain

crisis, and our recent successful financing," Kurtenbach said. "We

thank Kevin for his significant leadership and commitment to

Daktronics. We appreciate that his contributions will continue as

Chair of the Audit Committee.”

Andrew Siegel joined the Board in July 2022 part

of the Company’s ongoing Board refreshment process. He currently

manages Prairieland Holdco LLC, which entered into a Cooperation

Agreement with the Company at that time, and co-manages, with

Lawrence B. Benenson, TLI Bedrock, LLC, a private multi-strategy

investment firm.

Mr. Siegel commented, “As an investment firm we

were drawn to Daktronics because of its values and culture, its

leadership position in its industry, and the exciting prospects as

technology continues to enable new applications and markets for the

Company’s products, systems and services. As a member of the Board,

I am thrilled to have supported the Company’s achievements over the

past several quarters, and look forward to working diligently with

my fellow directors toward Daktronics strategic vision of

profitable growth.”

Second Quarter Income

Statement Highlights Orders for the second quarter of

fiscal 2024 were similar to the second quarter of fiscal 2023

though the order volume from our business units differed from that

of the year earlier period. Higher orders from customers in the

International and Transportation business units offset decreases in

the Spectacular and Out-of-Home markets in our Commercial business

unit.

Net sales for the second quarter of fiscal 2024

increased by 6.4 percent as compared to the second quarter of

fiscal 2023. Sales growth was driven by fulfilling orders in

backlog, especially in the High School Park and Recreation,

Commercial, and Transportation business units. The increase is

attributable to a stable operating environment, increased

manufacturing capacity and realization of price increases.

Gross profit as a percentage of net sales

increased to 27.2 percent for the second quarter of fiscal 2024 as

compared to 16.9 percent a year earlier. The gross profit

improvement is due to strategic pricing, our ability to efficiently

generate more sales volume over our cost structure and due to the

more stable operating environment.

Operating expenses increased 15.2 percent to

$34.8 million in the second quarter of fiscal 2024 as compared to

$30.2 million for the second quarter of fiscal 2023. This increase

primarily attributable to increases in employee compensation and

benefits.

Operating income percent for the second quarter

of fiscal 2024 was 9.7 percent, compared to 0.8 percent for the

second quarter of fiscal 2023 due to the combined factors discussed

above.

The increase in interest (expense) income, net

for the second quarter of fiscal 2024 compared to the same period

one year ago was primarily due to the closing in May 2023 on the

financing transactions at higher values and interest rates than

were in effect under our previous line of credit during the 2023

second quarter.

For the three months ended October 28,

2023, we recorded a $10.7 million expense for the non-cash change

in fair value of the convertible note payable which is accounted

for under the fair value option.

The effective tax rate of 64.8 percent resulted

in $4.0 million of income tax expense for the second quarter of

fiscal 2024. Income before tax includes the impacts of the change

in the convertible note fair value; however, these changes are not

deductible resulting in the high effective tax rate. The $14.0

million tax expense for the second quarter of fiscal 2023 was

primarily a result of a $13.0 million valuation allowance recorded

against our net deferred tax assets. Absent any major tax changes,

we expect our full year effective tax rate to be in the

mid-twenties before the impacts of fair value accounting for the

convertible note.

Balance Sheet and Cash Flow At

the end of the fiscal 2024 second quarter, our working capital

ratio was 2.0 to 1. Inventory levels dropped slightly since the end

of the fiscal year ended April 29, 2023. Our focus remains on

managing working capital through expected growth of the company.

Cash, restricted cash and marketable securities totaled $73.5

million, and $56.6 million of long-term debt was outstanding. The

long-term debt includes the face value of the debt of $39.6

million, $17.9 million adjustment to fair value, and $0.9 million

of debt issuance costs, net. Restricted cash consists of cash and

cash equivalents held in bank deposit accounts to secure issuances

of foreign bank guarantees and letters of credit outstanding under

a previous credit agreement. There were no draw-downs on our line

of credit during the first six months of fiscal 2024. In the first

six months of fiscal 2024, we generated $44.3 million from

operations and used $9.2 million for purchases of property and

equipment.

Fiscal Year

2024 and Beyond Priorities and

Strategies Kurtenbach added, “As we look ahead, we expect

growth in the global use of sophisticated audio-visual

communication systems in both traditional and in new applications.

Our attention remains focused on our multi-year journey to capture

the market's expected growth and broaden our leading market

position by offering best in class technology, capabilities and

services to both our traditional customer base as well as new and

adjacent markets."

Looking forward, our focus is to:

- Grow our business profitably while generating cash through

working capital management, strategic pricing adjustments, product

mix enhancements and careful expense management

- Improve operational efficiency to lower costs, reduce lead

times and improve the customer experience

- Develop additional markets for new customers and channels while

continuing to grow in the markets where the company been a leader

to date

- Implement robust integrated business planning systems to

generate data-based insights for improved decision making

- Investing in high-return projects and technologies, including

digital technologies for both internal and customer facing

uses

- Monitor and then adjust as necessary to the ever-evolving

geopolitical and global economic environment to maintain

profitability and cash generation

Webcast Information The company

will host a conference call and webcast to discuss its financial

results today at 10:00 am (Central Time). This call will be

broadcast live at http://investor.daktronics.com and be available

for replay shortly after the event.

About Daktronics Daktronics has

strong leadership positions in, and is the world's largest supplier

of, large-screen video displays, electronic scoreboards, LED text

and graphics displays, and related control systems. The company

excels in the control of display systems, including those that

require integration of multiple complex displays showing real-time

information, graphics, animation, and video. Daktronics designs,

manufactures, markets and services display systems for customers

around the world in four domestic business units: Live Events,

Commercial, High School Park and Recreation, and Transportation,

and one International business unit. For more information, visit

the company's website at: www.daktronics.com, email the company at

investor@daktronics.com, call (605) 692-0200 or toll-free (800)

843-5843 in the United States, or write to the company at 201

Daktronics Dr., P.O. Box 5128, Brookings, S.D. 57006-5128.

Safe Harbor Statement

Cautionary Notice: In addition to statements of historical fact,

this news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and

is intended to enjoy the protection of that Act. These

forward-looking statements reflect the Company's expectations or

beliefs concerning future events. The Company cautions that these

and similar statements involve risk and uncertainties which could

cause actual results to differ materially from our expectations,

including, but not limited to, changes in economic and market

conditions, management of growth, timing and magnitude of future

contracts and orders, fluctuations in margins, the introduction of

new products and technology, the impact of adverse weather

conditions, increased regulation and other risks described in the

company's SEC filings, including its Annual Report on Form 10-K for

its 2023 fiscal year. Forward-looking statements are made in the

context of information available as of the date stated. The Company

undertakes no obligation to update or revise such statements to

reflect new circumstances or unanticipated events as they

occur.

(1)Orders and backlog are not measures defined

by accounting principles generally accepted in the United States of

America ("GAAP"), and our methodology for determining orders and

backlog may vary from the methodology used by other companies in

determining their orders and backlog amounts. For more information

related to backlog, see Part I, Item 1. Business of our Annual

Report on Form 10-K for the fiscal year ended April 29, 2023. this

release does not include a reconciliation of orders or backlog, as

it would be impractical to do so without unreasonable effort.

For more information contact:

INVESTOR RELATIONS: Sheila M. Anderson, Chief Financial Officer Tel

(605) 692-0200 Investor@daktronics.com

| |

| Daktronics,

Inc. and Subsidiaries Consolidated Statements of

Operations (in thousands, except per share amounts)

(unaudited) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

October 28, 2023 |

|

October 29, 2022 |

|

October 28, 2023 |

|

October 29, 2022 |

|

Net sales |

$ |

199,369 |

|

|

$ |

187,439 |

|

|

$ |

431,900 |

|

|

$ |

359,359 |

|

| Cost of

sales |

|

145,170 |

|

|

|

155,735 |

|

|

|

306,554 |

|

|

|

301,861 |

|

|

Gross profit |

|

54,199 |

|

|

|

31,704 |

|

|

|

125,346 |

|

|

|

57,498 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Selling |

|

14,653 |

|

|

|

14,525 |

|

|

|

27,582 |

|

|

|

28,958 |

|

|

General and administrative |

|

10,889 |

|

|

|

8,687 |

|

|

|

20,488 |

|

|

|

18,128 |

|

|

Product design and development |

|

9,221 |

|

|

|

6,966 |

|

|

|

17,624 |

|

|

|

14,405 |

|

| |

|

34,763 |

|

|

|

30,178 |

|

|

|

65,694 |

|

|

|

61,491 |

|

|

Operating income (loss) |

|

19,436 |

|

|

|

1,526 |

|

|

|

59,652 |

|

|

|

(3,993 |

) |

| |

|

|

|

|

|

|

|

| Nonoperating

(expense) income: |

|

|

|

|

|

|

|

|

Interest (expense) income, net |

|

(1,326 |

) |

|

|

(263 |

) |

|

|

(2,207 |

) |

|

|

(323 |

) |

|

Change in fair value of convertible note |

|

(10,650 |

) |

|

|

— |

|

|

|

(17,910 |

) |

|

|

— |

|

|

Other expense and debt issuance costs write-off, net |

|

(1,303 |

) |

|

|

(208 |

) |

|

|

(5,282 |

) |

|

|

(955 |

) |

| |

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

6,157 |

|

|

|

1,055 |

|

|

|

34,253 |

|

|

|

(5,271 |

) |

|

Income tax expense |

|

3,992 |

|

|

|

14,039 |

|

|

|

12,892 |

|

|

|

13,039 |

|

|

Net income (loss) |

$ |

2,165 |

|

|

$ |

(12,984 |

) |

|

$ |

21,361 |

|

|

$ |

(18,310 |

) |

| |

|

|

|

|

|

|

|

| Weighted

average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

46,030 |

|

|

|

45,317 |

|

|

|

45,838 |

|

|

|

45,258 |

|

|

Diluted |

|

46,705 |

|

|

|

45,317 |

|

|

|

46,454 |

|

|

|

45,258 |

|

| |

|

|

|

|

|

|

|

| Earnings

(loss) per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.05 |

|

|

$ |

(0.29 |

) |

|

$ |

0.47 |

|

|

$ |

(0.40 |

) |

|

Diluted |

$ |

0.05 |

|

|

$ |

(0.29 |

) |

|

$ |

0.46 |

|

|

$ |

(0.40 |

) |

|

|

|

Daktronics, Inc. and Subsidiaries

Consolidated Balance Sheets (in thousands)

(unaudited) |

|

|

|

|

October 28, 2023 |

|

April 29, 2023 |

|

ASSETS |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

64,740 |

|

$ |

23,982 |

|

Restricted cash |

|

8,246 |

|

|

708 |

|

Marketable securities |

|

546 |

|

|

534 |

|

Accounts receivable, net |

|

115,052 |

|

|

109,979 |

|

Inventories |

|

141,646 |

|

|

149,448 |

|

Contract assets |

|

45,210 |

|

|

46,789 |

|

Current maturities of long-term receivables |

|

766 |

|

|

1,215 |

|

Prepaid expenses and other current assets |

|

10,137 |

|

|

9,676 |

|

Income tax receivables |

|

— |

|

|

326 |

|

Total current assets |

|

386,343 |

|

|

342,657 |

|

|

|

|

|

|

Property and equipment, net |

|

72,619 |

|

|

72,147 |

|

Long-term receivables, less current maturities |

|

151 |

|

|

264 |

|

Goodwill |

|

3,198 |

|

|

3,239 |

|

Intangibles, net |

|

970 |

|

|

1,136 |

|

Debt issuance costs, net |

|

3,150 |

|

|

3,866 |

|

Investment in affiliates and other assets |

|

27,705 |

|

|

27,928 |

|

Deferred income taxes |

|

16,812 |

|

|

16,867 |

|

TOTAL ASSETS |

$ |

510,948 |

|

$ |

468,104 |

|

|

|

Daktronics, Inc. and

SubsidiariesConsolidated Balance Sheets

(continued)(in thousands)(unaudited) |

|

|

October 28, 2023 |

|

April 29, 2023 |

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Current portion of long-term debt |

$ |

1,500 |

|

|

$ |

— |

|

|

Accounts payable |

|

53,645 |

|

|

|

67,522 |

|

|

Contract liabilities |

|

78,293 |

|

|

|

91,549 |

|

|

Accrued expenses |

|

39,773 |

|

|

|

36,005 |

|

|

Warranty obligations |

|

13,378 |

|

|

|

12,228 |

|

|

Income taxes payable |

|

3,347 |

|

|

|

2,859 |

|

|

Total current liabilities |

|

189,936 |

|

|

|

210,163 |

|

|

|

|

|

|

|

Long-term warranty obligations |

|

21,435 |

|

|

|

20,313 |

|

|

Long-term contract liabilities |

|

15,390 |

|

|

|

13,096 |

|

|

Other long-term obligations |

|

5,686 |

|

|

|

5,709 |

|

|

Long-term debt, net |

|

55,087 |

|

|

|

17,750 |

|

|

Deferred income taxes |

|

193 |

|

|

|

195 |

|

|

Total long-term liabilities |

|

97,791 |

|

|

|

57,063 |

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY: |

|

|

|

|

Preferred Shares, no par value, authorized 50,000 shares; no shares

issued and outstanding |

|

— |

|

|

|

— |

|

|

Common Stock, no par value, authorized 115,000,000 shares;

46,022,885 and 45,488,595 shares issued at October 28, 2023 and

April 29, 2023, respectively |

|

64,643 |

|

|

|

63,023 |

|

|

Additional paid-in capital |

|

51,047 |

|

|

|

50,259 |

|

|

Retained earnings |

|

124,771 |

|

|

|

103,410 |

|

|

Treasury Stock, at cost, 1,907,445 shares at October 28, 2023 and

April 29, 2023, respectively |

|

(10,285 |

) |

|

|

(10,285 |

) |

|

Accumulated other comprehensive loss |

|

(6,955 |

) |

|

|

(5,529 |

) |

|

TOTAL SHAREHOLDERS' EQUITY |

|

223,221 |

|

|

|

200,878 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

510,948 |

|

|

$ |

468,104 |

|

|

|

|

Daktronics, Inc. and

SubsidiariesConsolidated Statements of Cash

Flows(in thousands)(unaudited) |

|

|

Six Months Ended |

|

|

October 28, 2023 |

|

October 29, 2022 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

Net income (loss) |

$ |

21,361 |

|

|

$ |

(18,310 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

Depreciation and amortization |

|

9,494 |

|

|

|

8,225 |

|

|

Loss (gain) on sale of property, equipment and other assets |

|

101 |

|

|

|

(412 |

) |

|

Share-based compensation |

|

1,091 |

|

|

|

985 |

|

|

Equity in loss of affiliates |

|

1,461 |

|

|

|

1,701 |

|

|

Provision for doubtful accounts, net |

|

240 |

|

|

|

573 |

|

|

Deferred income taxes, net |

|

20 |

|

|

|

13,037 |

|

|

Non-cash impairment charges |

|

654 |

|

|

|

— |

|

|

Change in fair value of convertible note |

|

17,910 |

|

|

|

— |

|

|

Debt issuance costs write-off |

|

3,353 |

|

|

|

— |

|

|

Change in operating assets and liabilities |

|

(11,374 |

) |

|

|

(27,737 |

) |

|

Net cash provided by (used in) operating

activities |

|

44,311 |

|

|

|

(21,938 |

) |

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

Purchases of property and equipment |

|

(9,226 |

) |

|

|

(16,237 |

) |

|

Proceeds from sales of property, equipment and other assets |

|

52 |

|

|

|

432 |

|

|

Proceeds from sales or maturities of marketable securities |

|

— |

|

|

|

3,495 |

|

|

Purchases of equity and loans to equity investees |

|

(2,899 |

) |

|

|

(2,882 |

) |

|

Net cash used in investing activities |

|

(12,073 |

) |

|

|

(15,192 |

) |

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

Borrowings on notes payable |

|

40,000 |

|

|

|

190,608 |

|

|

Payments on notes payable |

|

(18,125 |

) |

|

|

(164,190 |

) |

|

Principal payments on long-term obligations |

|

(204 |

) |

|

|

— |

|

|

Debt issuance costs |

|

(6,454 |

) |

|

|

— |

|

|

Proceeds from exercise of stock options |

|

1,005 |

|

|

|

— |

|

|

Tax payments related to RSU issuances |

|

(303 |

) |

|

|

(140 |

) |

|

Net cash provided by financing activities |

|

15,919 |

|

|

|

26,278 |

|

|

|

|

|

|

|

EFFECT OF EXCHANGE RATE CHANGES ON CASH |

|

139 |

|

|

|

(13 |

) |

|

NET INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS AND RESTRICTED

CASH |

|

48,296 |

|

|

|

(10,865 |

) |

|

|

|

|

|

|

CASH, CASH EQUIVALENTS AND RESTRICTED CASH: |

|

|

|

|

Beginning of period |

|

24,690 |

|

|

|

18,008 |

|

|

End of period |

$ |

72,986 |

|

|

$ |

7,143 |

|

|

|

|

Daktronics, Inc. and Subsidiaries Net

Sales and Orders by Business Unit (in thousands)

(unaudited) |

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

(in thousands) |

October 28, 2023 |

|

October 29, 2022 |

|

Dollar Change |

|

Percent Change |

|

October 28, 2023 |

|

October 29, 2022 |

|

Dollar Change |

|

Percent Change |

|

Net Sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial |

$ |

42,453 |

|

$ |

37,047 |

|

$ |

5,406 |

|

|

14.6 |

|

% |

|

$ |

89,336 |

|

$ |

77,165 |

|

$ |

12,171 |

|

|

15.8 |

|

% |

|

Live Events |

|

68,210 |

|

|

69,239 |

|

|

(1,029 |

) |

|

(1.5 |

) |

|

|

|

160,209 |

|

|

125,622 |

|

|

34,587 |

|

|

27.5 |

|

|

|

High School Park and Recreation |

|

48,942 |

|

|

42,006 |

|

|

6,936 |

|

|

16.5 |

|

|

|

|

105,176 |

|

|

77,815 |

|

|

27,361 |

|

|

35.2 |

|

|

|

Transportation |

|

20,243 |

|

|

16,679 |

|

|

3,564 |

|

|

21.4 |

|

|

|

|

41,612 |

|

|

36,219 |

|

|

5,393 |

|

|

14.9 |

|

|

|

International |

|

19,521 |

|

|

22,468 |

|

|

(2,947 |

) |

|

(13.1 |

) |

|

|

|

35,567 |

|

|

42,538 |

|

|

(6,971 |

) |

|

(16.4 |

) |

|

|

|

$ |

199,369 |

|

$ |

187,439 |

|

$ |

11,930 |

|

|

6.4 |

|

% |

|

$ |

431,900 |

|

$ |

359,359 |

|

$ |

72,541 |

|

|

20.2 |

|

% |

|

Orders: (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial |

$ |

34,209 |

|

$ |

42,711 |

|

$ |

(8,502 |

) |

|

(19.9 |

) |

% |

|

$ |

66,643 |

|

$ |

90,389 |

|

$ |

(23,746 |

) |

|

(26.3 |

) |

% |

|

Live Events |

|

79,016 |

|

|

80,999 |

|

|

(1,983 |

) |

|

(2.4 |

) |

|

|

|

131,219 |

|

|

132,752 |

|

|

(1,533 |

) |

|

(1.2 |

) |

|

|

High School Park and Recreation |

|

32,800 |

|

|

31,898 |

|

|

902 |

|

|

2.8 |

|

|

|

|

68,539 |

|

|

69,477 |

|

|

(938 |

) |

|

(1.4 |

) |

|

|

Transportation |

|

21,500 |

|

|

16,583 |

|

|

4,917 |

|

|

29.7 |

|

|

|

|

40,485 |

|

|

32,287 |

|

|

8,198 |

|

|

25.4 |

|

|

|

International |

|

16,168 |

|

|

10,616 |

|

|

5,552 |

|

|

52.3 |

|

|

|

|

35,437 |

|

|

28,125 |

|

|

7,312 |

|

|

26.0 |

|

|

|

|

$ |

183,693 |

|

$ |

182,807 |

|

$ |

886 |

|

|

0.5 |

|

% |

|

$ |

342,323 |

|

$ |

353,030 |

|

$ |

(10,707 |

) |

|

(3.0) |

|

% |

|

|

|

Reconciliation of Free Cash Flow* (in thousands)

(unaudited) |

|

|

Six Months Ended |

|

|

October 28, 2023 |

|

October 29, 2022 |

|

Net cash provided by (used in) operating activities |

$ |

44,311 |

|

|

$ |

(21,938 |

) |

|

Purchases of property and equipment |

|

(9,226 |

) |

|

|

(16,237 |

) |

|

Proceeds from sales of property and equipment |

|

52 |

|

|

|

432 |

|

|

Free cash flow |

$ |

35,137 |

|

|

$ |

(37,743 |

) |

|

|

|

* In evaluating its business, Daktronics considers and uses

free cash flow as a key measure of its operating performance. The

term free cash flow is not defined under accounting principles

generally accepted in the United States of America ("GAAP") and is

not a measure of operating income, cash flows from operating

activities or other GAAP figures and should not be considered

alternatives to those computations. Free cash flow is intended to

provide information that may be useful for investors when assessing

period to period results. |

|

|

|

Reconciliation of Adjusted Net Income (loss)* (in

thousands) (unaudited) |

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

October 28, 2023 |

|

October 29, 2022 |

|

October 28, 2023 |

|

October 29, 2022 |

|

Net income (loss) |

$ |

2,165 |

|

$ |

(12,984 |

) |

|

$ |

21,361 |

|

$ |

(18,310 |

) |

|

Change in fair value of convertible note |

|

10,650 |

|

|

— |

|

|

|

17,910 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt issuance costs expensed due to fair value of convertible note,

net of taxes |

|

— |

|

|

— |

|

|

|

2,092 |

|

|

— |

|

|

Adjusted net income (loss) |

$ |

12,815 |

|

$ |

(12,984 |

) |

|

$ |

41,363 |

|

$ |

(18,310 |

) |

|

|

|

* Adjusted net income. We disclose adjusted net income as a

non-GAAP financial measurement in order to report our results

exclusive of items that are non-recurring or not core to our

operating business. We believe presenting this non-GAAP financial

measurements provides investors with a consistent way to analyze

our performance. |

|

|

|

Reconciliation of Long-term Debt (in thousands)

(unaudited) |

|

|

|

Long-term debt consists of the following: |

|

|

|

|

October 28, 2023 |

|

April 29, 2023 |

|

Prior line of credit |

$ |

— |

|

|

$ |

17,750 |

|

|

Mortgage |

|

14,625 |

|

|

|

— |

|

|

Convertible note |

|

25,000 |

|

|

|

— |

|

|

Long-term debt, gross |

|

39,625 |

|

|

|

17,750 |

|

|

Debt issuance costs, net |

|

(948 |

) |

|

|

— |

|

|

Change in fair value of convertible note |

|

17,910 |

|

|

|

— |

|

|

Current portion |

|

(1,500 |

) |

|

|

— |

|

|

Long-term debt, net |

$ |

55,087 |

|

|

$ |

17,750 |

|

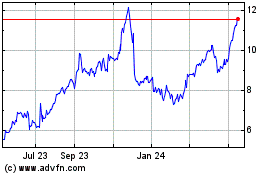

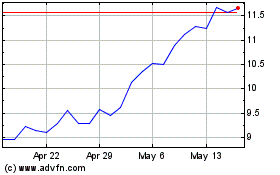

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Daktronics (NASDAQ:DAKT)

Historical Stock Chart

From Apr 2023 to Apr 2024