EUROPE MARKETS: Spain Leads European Stocks Lower After Elections; Weak Oil Prices Also Weigh

29 April 2019 - 9:09PM

Dow Jones News

By Dave Morris

Far-right party Vox emerges with wins in Spanish election

Spanish stocks fell Monday after no political party emerged with

a majority in Sunday elections, while weak oil prices weighed on

shares across the rest of the European continent.

How did markets perform?

The Spain IBEX 35 led losses for regional indexes, falling 0.9%.

On Friday, it had closed up 0.1%.

The Stoxx Europe 300 gave up modest gains to slip 0.3%, after a

gain of 0.2% Friday. The euro was changing hands at $1.1162 from

$1.1149 late Friday in New York.

In the U.K., the FTSE 100 was flat following Friday's decline of

nearly 0.1%. The pound rose again 0.2% to $1.2941 after climbing

0.2% Friday.

France's CAC 40 fell 0.4%. At Friday's close, it had risen 0.2%.

Germany's DAX (DAX) slipped 0.3% on the heels of its 0.3% jump

Friday.

In Italy, the FTSE MIB fell 0.4%, following Friday's 0.1%

increase.

What's moving the markets?

Spain's ruling Socialist party took the largest share

(http://www.marketwatch.com/story/far-right-party-poised-for-big-gains-in-spanish-parliamentary-elections-2019-04-28)of

votes in elections Sunday, but that did not constitute enough to

form a government without entering into a coalition. They are

expected to join a group of smaller parties led by Podemos, a party

firmly on the left of Spain's political spectrum. However Reuters

reported

(https://uk.reuters.com/article/uk-spain-election-podemos/spains-far-left-podemos-says-open-to-coalition-government-with-socialists-idUKKCN1S40SS)

that the Podemos leader cautioned supporters that forming a

coalition "will take much time and I would ask for your

patience."

In addition, the election saw the emergence of the far-right Vox

party, which captured 10% of the vote for 10 seats in parliament.

It was the first significant victory for a far-right party since

the country's dictatorship ended in the 1970s.

"We expect a prolonged standstill, at least until the May

regional and European elections. But we continue to think that

political instability will have only a modest effect on the

performance of the Spanish economy," said analysts at Oxford

Economics, in a note to clients.

Oil prices stepped lower again on Monday, extending a selloff

from late last week after U.S. President Donald Trump said he had

personally intervened to pressure the Organization of the Petroleum

Exporting Countries to lower prices of the commodity. Those losses

extended to the heavily-weighed oil sector.

U.S.-China trade talks continue in Beijing this week, and then

back to Washington D.C. on May 8. The reassuring tone from the U.S.

Treasury was countered with a degree of sabre rattling from an

anonymous source who told Bloomberg that President Donald Trump

would walk away

(https://www.bloomberg.com/news/articles/2019-04-29/u-s-china-talks-to-resume-as-world-awaits-trump-xi-meeting-date)

from the negotiating table if he was not satisfied.

China kicked off a busy week of economic developments Saturday

with news that recovery in key sectors had sparked a 13.9% year

over year increase in industrial profits in March. The rebound,

reported by the National Bureau of Statistics, was significant

coming after a slump in that figure in January and February.

This week's economic reports will include both a U.S. Federal

Reserve meeting on Wednesday and the Bank of England on

Thursday.

Which stocks are active?

Tracking those oil prices lower, France's Total SA (FP.FR) fell

1.1%, while BP PLC (BP.LN) (BP.LN) fell 0.5% and Italy's Enel SpA

(ENEL.MI) slipped 0.8%.

Shares of Dutch technology firm Koninklijke Philips NV (PHIA.AE)

climbed 2.1% after it reported strong first quarter earnings

(http://www.marketwatch.com/story/philips-net-income-rose-31-2019-04-29)

based on both cost-cutting and sales increases. Net income in the

quarter rose 31% and the group reaffirmed its guidance through

2020.

British Airways parent International Consolidated Airlines Group

(IAG.LN) was 2.6% higher after an upgrade by UBS from neutral to

buy, with a price target of 705 pence. The company will report

earnings May 10.

Deutsche Bank AG (DBK.XE) fell 1.1% after Credit Suisse

downgraded the financial group to underperform from neutral.

Analysts took a tough line on what they called "no plan B"

following lackluster earnings and the collapse of the Commerzbank

AG merger discussions.

"Despite DBK's weak profitability, it declined (for now) to

offer any strategic update to improve returns. We think it will

continue to lose market share in trading as it needs to continue to

cut expenses amid elevated funding costs and improve its leverage

ratio," the analyst said.

(END) Dow Jones Newswires

April 29, 2019 06:54 ET (10:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

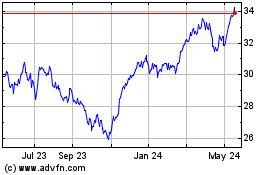

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

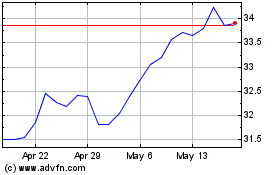

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024