Dyadic International, Inc. (“Dyadic”, “we”, “us”, “our”, or the

“Company”) (NASDAQ: DYAI), a global biotechnology company focused

on building innovative microbial platforms to develop and produce

biopharmaceuticals and alternative proteins for human and animal

health, today announced its financial results for the second

quarter of 2023, and highlighted recent company developments.

“As announced last month, we are excited to

report the interim analysis of Day 29 data from our first in human

Phase 1 clinical trial, in which no major vaccine related safety

issues were observed. DYAI-100, the vaccine candidate produced from

our proprietary and patented C1-cell protein production platform

has been shown to produce an immune response at both the low and

high dosing levels,” said Mark Emalfarb, President and Chief

Executive Officer of Dyadic. “We believe this important milestone

is a pivotal point in the evolution from our commercial success in

industrial biotech to broadening our capability as a life-science

biotechnology company. As demonstrated by our recently announced

fully funded collaboration with a top five pharmaceutical company

in a large infectious disease segment, we believe that our Phase 1

data will provide the biopharmaceutical industry, academia, and

governmental agencies with the confidence that our C1-cell

microbial protein production platform offers the safety, speed,

cost, and quality needed to gain market share in the competitive

industry,” concluded Mr. Emalfarb.

Joe Hazelton, Chief Business Officer of Dyadic,

also commented, “In addition to the expansion of our pharmaceutical

licensing programs, Dyadic is working toward the development of

near-term commercialization opportunities such as our non-animal

derived serum albumin projects, where we recently reported positive

results from third party analytical testing of the company’s

animal-free recombinant bovine serum albumin. We believe

demonstrating that Dyadic’s recombinant albumin is comparable to

currently marketed products has brought us a step closer to

commercialization opportunities in the rapidly expanding global

serum albumin market as well as helping us to initiate several

other projects for non-pharmaceutical enzyme and protein

applications. We believe the successful expression of a stable

casein protein in our Dapibus™ expression system further

demonstrates the broad applicability of our technology in large and

growing segments such as non-animal dairy proteins.” Mr. Hazelton

continued, “We are expanding both our C1 licensing and DapibusTM

programs for strain engineering and production services with a

focus on customers interested in creating high performance

microbial strains for their vaccine antigens, monoclonal

antibodies, other therapeutic proteins, as well as enzymes and

proteins for food, nutrition, and wellness.”

Recent Company Progress

DYAI-100 SARS-CoV-2 RBD (Receptor Binding Domain)

Booster Vaccine Candidate

- No major vaccine-related safety

concerns based on the interim analysis of the Day 29 data for both

low and high dose groups reviewed by the Data Safety Monitoring

Board (DSMB).

- To date, no serious adverse events

or local and systemic side effects have been observed.

- Booster vaccine

produced immune response at both dose levels.

- The Last Patient

Last Visit (LPLV) is scheduled for August 25, 2023, and the full

clinical study report (CSR) is expected in Q4 2023.

Vaccine Collaborations

- Essential Drugs Company

Limited (EDCL) in Bangladesh – On June 21, 2023, the

Company announced that it entered a Memorandum of Understanding

with EDCL, the state-owned pharmaceutical company under the

Ministry of Health and Family Welfare of Bangladesh, to facilitate

biopharmaceutical research, pre-clinical development, cGMP

production, and clinical development for the prevention and control

of diseases and improvement of public health programs in

Bangladesh.

- Top

5 Pharma – In April 2023, the

Company entered a new fully funded research collaboration, with a

top 5 pharmaceutical company, to express a vaccine antigen from C1

for human health in a large infectious disease segment. The

agreement also grants an option for a future commercialization

license in the designated field.

- Rubic

One Health

(“Rubic”) – On April 12, 2023, the Company

expanded its initial 2021 license agreement with Rubic to include

vaccines and therapeutic proteins beyond COVID-19 vaccines, for

both human animal health markets. The expanded license agreement

will help Rubic prepare for the development and manufacture of

affordable vaccines and drugs for the African continent.

- Virovax

Bio (“Virovax”) – Currently, four new animal studies are

ongoing with C1 produced ferritin nanoparticle antigens combined

with Virovax’s adjuvants for influenza (H5N1/Bird Flu), West Nile

and Powassan, to protect against encephalitis and meningitis.

- Uvax Bio

(“Uvax”) – In June 2023, the Company has renewed and

expanded its research collaboration with Uvax, a spin-off vaccine

company from Scripps Research. Uvax is developing prophylactic

vaccines for the most challenging infectious diseases, and our

research collaboration is expected to help Uvax overcome gene

expression challenges using the Company’s C1-cell protein

production platform.

Antibody Collaborations

- NIIMBL – During

the NIIMBL annual meeting in June 2023, the Company presented data

and research results generated from the NIIMBL Grant received

by the Company under the previously announced White House’s

American Rescue Plan, which ended successfully.

- EU 87G7

COVID-19 Antibody

Collaboration – In June 2023, a

manuscript was submitted to a peer-reviewed scientific journal

titled “Filamentous Fungus-Produced Human Monoclonal Antibody

Provides SARS-CoV-2 Protection in Hamster and Non-Human Primate

Models” in collaboration with Dr. Albert Osterhaus and several

other authors. The manuscript describes the safety and efficacy

results with a C1-cell produced monoclonal antibody obtained from

studies in hamsters and non-human primates.

-

Fondazione Biotecnopolo di Siena (“FBS”) – On May

24, 2023, the Company entered a Memorandum of Understanding with

the FBS, which performs the functions of an anti-pandemic

hub with a particular focus on the development and production

of vaccines and monoclonal antibodies for the

treatment of emerging epidemic-pandemic

pathologies. We expect FBS to conduct research and

development, clinical study, regulatory approval, manufacture and

commercialization of vaccines and therapeutic proteins using the

Company’s C1 protein production platform.

Animal Health

- New

Animal Health Partner – In June 2023, the Company entered

a fully funded collaboration with a new animal health company to

develop an antigen for livestock animals.

-

Rubic One Health

(“Rubic”) – On April 12, 2023, the Company

expanded its initial 2021 license agreement with Rubic to include

vaccines and therapeutic proteins beyond COVID-19 vaccines for both

human animal health markets. The expanded license agreement is

expected to help Rubic prepare for the development and manufacture

of affordable vaccines and drugs for the African continent.

- Phibro

Animal Health/Abic Biological Laboratories – In the first

quarter of 2023, the Company extended its research collaboration

with Abic Biological Laboratories Ltd. (“Abic”), an affiliate of

Phibro Animal Health Corporation (“Phibro”) to apply newly

developed techniques and methods to further increase the expression

level of a recombinant livestock antigen using C1. The Company and

Abic have expanded the collaboration to include the development of

additional antigens for use in livestock animal health

applications.

Alternative Proteins and Dapibus™ Platform

- Commercial

Product Portfolio Pipeline – On

August 7, 2023, the Company announced that it has successfully

developed stable cell lines to produce recombinant serum albumin

products. The Company initiated animal-free recombinant serum

albumin projects in late 2022 for use in potential therapeutic,

product development, research, and/or diagnostic human and animal

pharmaceutical applications. We have started sampling potential

customers who have expressed interest in Dyadic’s C1 serum albumin

products. Initial independent analytical assessment of the

Company’s recombinant bovine serum albumin demonstrated that it is

structurally equivalent to the commercially available animal

derived product. In non-pharmaceutical applications, the Company

initiated the development of non-animal derived recombinant dairy

proteins and enzymes for use in food and nutrition to support its

Dapibus™ platform.

- Fermbox

Bio (“Fermbox”) – On May 7, 2023,

the Company entered a fully funded co-development and marketing

agreement with Fermbox to help accelerate our ability to exploit

the Dapibus™ platform and expand Dyadic’s product offerings for

non-pharmaceutical alternative proteins applications, such as food,

nutrition, wellness and other bioproducts.

Other Events

-

BARDA and FDA

Workshop – On April 27, 2023, the Company

presented at Recombinant Protein-Based COVID-19 Vaccines Workshop,

a virtual event hosted by the Biomedical Advanced Research and

Development Authority (BARDA) and FDA. The goals of the workshop

were to provide: 1) a forum for product sponsors to discuss

progress and technical challenges in the manufacturing when

changing strain composition to currently circulating variants of

SARS-CoV-2; and 2) an open forum for collaborative discussions to

facilitate advancement of recombinant protein-based COVID-19

vaccines.

-

Patent Update – On April 18,

2023, the Company announced the receipt of a notice of allowance

from the U.S. Patent and Trademark Office for patent application

16/640,483, titled “Production of Flu Vaccine in Myceliophthora

thermophila”, which will cover claims for the development and

manufacture of seasonal and pandemic influenza vaccines from the

Company’s C1 protein production platform. The Company has developed

several influenza antigens and in collaboration with scientists in

the EU and USA various animal studies have been completed, with

both hemagglutinin (HA) and neuraminidase (NA) antigens expressed

from the Company’s C1 protein production platform. Additional

pandemic influenza (H5N1/bird flu) animal trials are currently in

process.

Financial Highlights

Cash Position:

As of June 30, 2023, cash, cash equivalents, and the carrying value

of investment grade securities, including accrued interest, were

approximately $10.2 million compared to $12.7 million as of

December 31, 2022.

Revenue: Research and

development revenue and license revenue for the quarter ended June

30, 2023, increased to approximately $837,000 compared to $659,000

for the same period a year ago. Research and development revenue

and license revenue for the six months ended June 30, 2023,

increased to approximately $1,815,000 compared to $1,307,000 for

the same period a year ago. The increase is primarily attributed to

higher individual contract amounts on certain research funding

compared to the same period a year ago.

Cost of

Revenue: Cost of research and development revenue

for the quarter ended June 30, 2023, increased to approximately

$793,000 compared to $411,000 for the same period a year ago. Cost

of research and development revenue for the six months ended June

30, 2023, increased to approximately $1,520,000 compared

to $815,000 for the same period a year ago.

R&D

Expenses: Research and development expenses for

the quarter ended June 30, 2023, decreased by 49.9% to

approximately $918,000 compared to $1,831,000 for the same period a

year ago. Research and development expenses for the six months

ended June 30, 2023, decreased by 45.6% to approximately $1,728,000

compared to $3,174,000 for the same period a year ago.

The decrease in research and development

expenses for the quarter and six months ended June 30, 2023 versus

the same periods in 2022 was due to the winding down of activities

of contract research organization and consultants to manage and

support the pre-clinical and clinical development as well as a

decrease in cGMP manufacturing costs as the Company completed the

dosing of Phase 1 clinical trial of its DYAI-100 RBD COVID-19

booster vaccine candidate in February 2023.

G&A

Expenses: General and administrative expenses for

the quarter ended June 30, 2023, decreased by 18.1% to

approximately $1,403,000 compared to $1,714,000 for the same period

a year ago. The decrease in G&A expenses for the quarter ended

June 30, 2023 compared to the same period in 2022 includes

decreases in legal expenses of $103,000, incentives of

approximately $81,000, business development and investor relations

expenses of $75,000, insurance expenses of $37,000, and other

decreases of $15,000. General and administrative expenses for the

six months ended June 30, 2023, decreased by 14.5% to approximately

$2,883,000 compared to $3,370,000 for the same period a year ago.

The decrease in G&A expenses for the six months ended June 30,

2023 compared to the same period in 2022 includes decreases in

incentives of approximately $215,000, business development and

investor relations expenses of $137,000, insurance expenses of

$72,000, legal expenses of $48,000 and other decreases of

$15,000.

Other Income: Other income for

the three and six months ended June 30, 2023, was primarily from

the sale of the equity interest in Alphazyme, LLC.

Net Loss: Net

loss for the quarter ended June 30, 2023, was approximately

$2,153,000 or $(0.07) per share compared to $3,288,000 or $(0.12)

per share for the same period a year ago. Net loss for the six

months ended June 30, 2023, was approximately $3,109,000 or $(0.11)

per share compared to $5,780,000 or $(0.20) per share for the same

period a year ago.

Conference Call

Information

Date: Wednesday, August 9, 2023

Time: 5:00 p.m. Eastern Time

Dial-in numbers: Toll Free: 1-877-407-0784

International: 1-201-689-8560

Conference ID: 13735362

Webcast

Link: https://viavid.webcasts.com/starthere.jsp?ei=1593531&tp_key=0b0ed46180

An archive of the webcast will be available within 24 hours

after completion of the live event and will be accessible on the

Investor Relations section of the Company’s website at

www.dyadic.com. To access the replay of the webcast, please follow

the webcast link above.

About Dyadic International,

Inc.

Dyadic International, Inc. is a global biotechnology company

focused on building innovative microbial platforms to address the

growing demand for global protein bioproduction and unmet clinical

needs for effective, affordable, and accessible biopharmaceutical

products and alternative proteins for human and animal health.

Dyadic’s gene expression and protein production

platforms are based on the highly productive and scalable fungus

Thermothelomyces heterothallica (formerly Myceliophthora

thermophila). Our lead technology, C1-cell protein production

platform, is based on an industrially proven microorganism (named

C1), which is currently used to speed development, lower production

costs, and improve performance of biologic vaccines and drugs at

flexible commercial scales for the human and animal health markets.

Dyadic has also developed the DapibusTM filamentous fungal based

microbial protein production platform to enable the rapid

development and large-scale manufacture of low-cost proteins,

metabolites, and other biologic products for use in

non-pharmaceutical applications, such as food, nutrition, and

wellness.

With a passion to enable our partners and

collaborators to develop effective preventative and therapeutic

treatments in both developed and emerging countries, Dyadic is

building an active pipeline by advancing its proprietary microbial

platform technologies, including our lead asset DYAI-100 COVID-19

vaccine candidate, as well as other biologic vaccines, antibodies,

and other biological products.

To learn more about Dyadic and our commitment to

helping bring vaccines and other biologic products to market

faster, in greater volumes and at lower cost, please visit

http://www.dyadic.com.

Safe Harbor

Regarding Forward-Looking

Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

including those regarding Dyadic International’s expectations,

intentions, strategies, and beliefs pertaining to future events or

future financial performance, such as the success of our clinical

trial and interest in our protein production platforms, our

research projects and third-party collaborations, as well as the

availability of necessary funding. Actual events or results may

differ materially from those in the forward-looking statements

because of various important factors, including those described in

the Company’s most recent filings with the SEC. Dyadic assumes no

obligation to update publicly any such forward-looking statements,

whether because of new information, future events or otherwise. For

a more complete description of the risks that could cause our

actual results to differ from our current expectations, please see

the section entitled "Risk Factors” in Dyadic’s annual reports on

Form 10-K and quarterly reports on Form 10-Q filed with the SEC, as

such factors may be updated from time to time in Dyadic’s periodic

filings with the SEC, which are accessible on the SEC’s website and

at www.dyadic.com.

Contact:

Dyadic International, Inc.Ping W. RawsonChief

Financial OfficerPhone: 561-743-8333Email: ir@dyadic.com

|

|

|

DYADIC INTERNATIONAL, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

Six Months Ended

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

Research and development revenue |

$ |

793,042 |

|

$ |

614,435 |

|

$ |

1,726,976 |

|

$ |

1,148,156 |

|

|

License revenue |

|

44,117 |

|

|

44,118 |

|

|

88,235 |

|

|

158,824 |

|

|

Total revenue |

|

837,159 |

|

|

658,553 |

|

|

1,815,211 |

|

|

1,306,980 |

|

|

|

|

|

|

|

|

Costs and

expenses: |

|

|

|

|

|

Costs of research and development revenue |

|

792,944 |

|

|

411,109 |

|

|

1,519,862 |

|

|

815,855 |

|

|

Research and development |

|

917,552 |

|

|

1,830,798 |

|

|

1,728,118 |

|

|

3,173,660 |

|

|

General and administrative |

|

1,402,569 |

|

|

1,714,029 |

|

|

2,882,609 |

|

|

3,369,729 |

|

|

Foreign currency exchange loss |

|

14,521 |

|

|

20,621 |

|

|

25,543 |

|

|

10,373 |

|

|

Total costs and

expenses |

|

3,127,586 |

|

|

3,976,557 |

|

|

6,156,132 |

|

|

7,369,617 |

|

|

|

|

|

|

|

|

Loss from operations |

|

(2,290,427 |

) |

|

(3,318,004 |

) |

|

(4,340,921 |

) |

|

(6,062,637 |

) |

|

|

|

|

|

|

|

Other income: |

|

|

|

|

|

Interest income |

|

109,194 |

|

|

30,009 |

|

|

213,925 |

|

|

32,977 |

|

|

Other income |

|

28,273 |

|

|

— |

|

|

1,017,592 |

|

|

250,000 |

|

|

Total other income |

|

137,467 |

|

|

30,009 |

|

|

1,231,517 |

|

|

282,977 |

|

|

|

|

|

|

|

|

Net loss |

$ |

(2,152,960 |

) |

$ |

(3,287,995 |

) |

$ |

(3,109,404 |

) |

$ |

(5,779,660 |

) |

|

|

|

|

|

|

| Basic

and diluted net loss per common share |

$ |

(0.07 |

) |

$ |

(0.12 |

) |

$ |

(0.11 |

) |

$ |

(0.20 |

) |

|

|

|

|

|

|

| Basic

and diluted weighted-average common shares outstanding |

|

28,811,061 |

|

|

28,264,157 |

|

|

28,786,402 |

|

|

28,257,776 |

|

See Notes to Consolidated Financial Statements in

Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on August 9, 2023.

|

|

|

DYADIC INTERNATIONAL, INC. AND SUBSIDIARIES |

|

CONSOLIDATED BALANCE SHEETS |

|

|

| |

June 30,

2023 |

|

December 31,

2022 |

| |

(Unaudited) |

|

(Audited) |

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

5,841,591 |

|

|

$ |

5,794,272 |

|

|

Short-term investment securities |

|

4,287,325 |

|

|

|

6,847,270 |

|

|

Interest receivable |

|

36,053 |

|

|

|

58,285 |

|

|

Accounts receivable |

|

767,597 |

|

|

|

330,001 |

|

|

Prepaid expenses and other current assets |

|

136,152 |

|

|

|

392,236 |

|

| Total current assets |

|

11,068,718 |

|

|

|

13,422,064 |

|

| |

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

Investment in Alphazyme |

|

— |

|

|

|

284,709 |

|

|

Other assets |

|

5,822 |

|

|

|

6,045 |

|

| Total

assets |

$ |

11,074,540 |

|

|

$ |

13,712,818 |

|

| |

|

|

|

|

|

| Liabilities

and stockholders’

equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

905,876 |

|

|

$ |

1,276,313 |

|

|

Accrued expenses |

|

909,482 |

|

|

|

955,081 |

|

|

Deferred research and development obligations |

|

9,000 |

|

|

|

40,743 |

|

|

Deferred license revenue, current portion |

|

176,471 |

|

|

|

176,471 |

|

| Total current liabilities |

|

2,000,829 |

|

|

|

2,448,608 |

|

| |

|

|

|

|

|

|

|

Deferred license revenue, net of current portion |

|

88,235 |

|

|

|

176,471 |

|

| Total liabilities |

|

2,089,064 |

|

|

|

2,625,079 |

|

| |

|

|

|

|

|

|

| Commitments and contingencies

(Note 4) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, $.0001 par value: |

|

|

|

|

|

|

|

Authorized shares - 5,000,000; none issued and outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $.001 par value: |

|

|

|

|

|

|

|

Authorized shares - 100,000,000; issued shares - 41,064,563 and

40,816,602, outstanding shares - 28,811,061 and28,563,100 as of

June 30, 2023, and December 31, 2022, respectively |

|

41,065 |

|

|

|

40,817 |

|

|

Additional paid-in capital |

|

104,465,590 |

|

|

|

103,458,697 |

|

|

Treasury stock, shares held at cost - 12,253,502 |

|

(18,929,915 |

) |

|

|

(18,929,915 |

) |

|

Accumulated deficit |

|

(76,591,264 |

) |

|

|

(73,481,860 |

) |

| Total

stockholders’ equity |

|

8,985,476 |

|

|

|

11,087,739 |

|

|

Total liabilities

and stockholders’

equity |

$ |

11,074,540 |

|

|

$ |

13,712,818 |

|

See Notes to Consolidated Financial Statements in

Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on August 9, 2023.

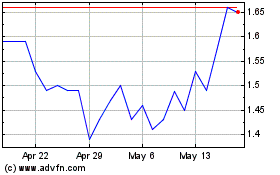

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From Apr 2024 to May 2024

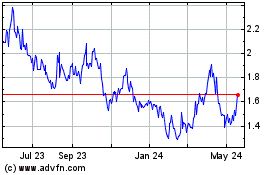

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From May 2023 to May 2024