false

0001534708

0001534708

2024-07-03

2024-07-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 3, 2024

EASTSIDE

DISTILLING, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38182 |

|

20-3937596 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (971) 888-4264

Securities

registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.0001 par value |

|

EAST |

|

The

Nasdaq Stock Market LLC |

| (Title

of Each Class) |

|

(Trading

Symbol) |

|

(Name

of Each Exchange on Which Registered) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (CFR §240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Compensatory Arrangements of Certain Officers.

Eastside

Distilling Inc. (“Eastside”) has entered into an Executive Employment Agreement with Geoffrey Gwin dated July

3, 2024. The “Effective Date” of the Agreement is as of January 1, 2024.

The

Agreement provides that Mr. Gwin will serve as Chief Executive Officer of Eastside on a full-time basis until the third anniversary of

the Effective Date. Mr. Gwin will also function as Eastside’s Chief Financial Officer and Chief Compliance Officer without additional

compensation, and will serve as Chairman of the Eastside Board of Directors with such compensation as the Board may grant.

The

Agreement provides that Eastside will pay Mr. Gwin a base salary of $300,000 per year for the first year of his term of employment. The

Compensation Committee will review Mr. Gwin’s compensation on an annual basis, and may replace the terms of compensation by agreement

with Mr. Gwin.

Either

Eastside or Mr. Gwin may terminate Mr. Gwin’s employment at will. If Eastside terminates the employment without cause or Mr. Gwin

terminates his employment with good reason, Eastside will continue to pay Mr. Gwin’s salary for the lesser of twelve months or

the remaining term of employment.

Item

9.01 Financial Statements and Exhibits

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

July 10, 2024

| |

EASTSIDE

DISTILLING, INC. |

| |

|

|

| |

By:

|

/s/

Geoffrey Gwin |

| |

|

Geoffrey

Gwin |

| |

|

Chief

Executive Officer |

Exhibit

10-a

[Note:

Certain Information has been excluded from this exhibit because it is both (1) not material and (2) the type of information that Eastside

Distilling Inc. treats as private or confidential. The location from which information has been redacted is identified in this document

by brackets.]

EXECUTIVE

EMPLOYMENT AGREEMENT

This

Executive Employment Agreement (the “Agreement”) is entered into as of July 3, 2024, by and between Eastside Distilling,

Inc., a Nevada corporation (the “Company”), and Geoffrey Gwin (“Executive”) (collectively, the

“Parties”), and is to be effective as of January 1, 2024 (the “Effective Date”). This Agreement

shall replace any prior agreement between the Company and Executive existing prior to the Effective Date.

1. Duties

and Scope of Employment.

(a) Positions

and Duties. Executive will serve as Chief Executive Officer (“CEO”) of the Company. Executive will render such

business and professional services in the performance of Executive’s duties, consistent with Executive’s position within

the Company, as will reasonably be assigned to him by the Company’s Board of Directors (the “Board”), to whom

he shall report. Unless and until the Board appoints replacements to the positions, Executive will also function as the Company’s

Chief Financial Officer and Chief Compliance Officer, as well as the Chairman of the Company’s Board, all without additional compensation

except such compensation for service as Chairman of the Board as the Board may grant.

(b) Term.

This Agreement will commence on the Effective Date and terminate on the third anniversary of the Effective Date, unless earlier terminated

in accordance with this Agreement (the “Employment Term”). However, the terms of Executive’s compensation shall

be reviewed annually by the Compensation Committee in accordance with the Charter of that Committee. The terms of Executive’s compensation

set forth herein shall be applicable only during the initial year of the Employment Term and any carryover period until replaced by agreement

of Executive and the Company’s Compensation Committee.

(c) Obligations.

Executive will devote Executive’s full business efforts and time to the Company and will use good faith efforts to discharge Executive’s

obligations under this Agreement to the best of Executive’s ability and in accordance with each of the Company’s corporate

guidance and ethics guidelines, conflict of interest policies and code of conduct as may be in effect from time to time. Notwithstanding

the foregoing, nothing in this letter shall preclude Executive from devoting reasonable periods of time to charitable and community activities,

managing personal investment or business assets and, subject to approval of the Board which will not be unreasonably withheld, serving

on boards of other companies (public or private) not in competition with the Company, provided that none of these activities interferes

with the performance of Executive’s duties hereunder or creates a conflict of interest.

(d) Work

Location. Executive’s principal place of employment shall be both at a remote location and at the Company’s corporate

headquarters in Portland, Oregon, subject to business travel as needed to properly fulfill Executive’s employment duties and responsibilities.

The Company acknowledges and agrees that Executive’s principal place of residence may be outside of the State of Oregon. The Company

will pay rent of up to $1,100 per month for a suitable office outside of Portland, Oregon.

2. Compensation.

(a) Base

Salary. As of the Effective Date, the Company will pay Executive an annual base salary equal to the sum of $300,000 plus the Adjustment

pursuant to Section 2(b),if any (such annual salary, as is then effective, to be referred to herein as “Base Salary”).

All compensation paid to Executive will be paid periodically in accordance with the Company’s normal payroll practices and be subject

to the usual, required withholdings. Unpaid compensation will be paid in lump sum, however if cash is unavailable the Executive at his

election can elect to receive unrestricted stock in accordance with issuance limitations and priced at floor prices agreed with creditors

for all officers and directors.

[ prior location of redacted text ]

3.

Clawback. The Based Salary Adjustment and the Performance Bonuses (collectively, the “Clawback Benefits”)

shall be subject to “Clawback Rights” as follows. During the period that the Executive is employed by the Company

and for a period of three (3) years following the Employment Period, if there is a restatement by the Company of any financial results

on the basis of which any Clawback Benefits to the Executive have been determined, the Executive shall repay to the Company the amount

by which the amount of Clawback Benefits paid exceeded the amount to which Executive would have been entitled, based on the Company’s

restated financial information. The calculation of the revised Clawback Benefits amount shall be determined by the Compensation Committee

in good faith and in accordance with applicable law. All determinations by the Compensation Committee with respect to the Clawback Rights

shall be final and binding on the Company and the Executive. For purposes of this Section 3, a restatement of financial results that

requires a repayment of a portion of the Clawback Benefits shall mean a restatement resulting from material non-compliance by the Company

with any financial reporting requirement under the federal securities laws and shall not include a restatement of financial results resulting

from subsequent changes in accounting pronouncements or requirements which were not in effect on the date the financial statements were

originally prepared (“Restatements”). The parties acknowledge it is their intention that the foregoing Clawback

Rights as relates to Restatements conform in all respects to SEC Rule 10D-1 and to such regulations as may be promulgated pursuant to

the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”)

relating to recovery of “incentive-based” compensation. Accordingly, the terms and provisions of this Agreement shall be

deemed automatically amended from time to time to assure compliance with the Dodd-Frank Act and such rules and regulations as hereafter

may be adopted and in effect.

4.

Employee Benefits and Perquisites. Executive will be eligible to participate in the employee benefit plans and programs generally

available to the Company’s senior executives, subject to the terms and conditions of such plans and programs. Executive will be

entitled to other benefits and perquisites that are made available to other senior executives of the Company, each in accordance with

and subject to the eligibility and other provisions of such plans and programs. The Company reserves the right to amend, modify or terminate

any of its benefit plans or programs at any time and for any reason.

5. Expenses.

The Company will reimburse Executive for reasonable expenses incurred by Executive in the furtherance of the performance of Executive’s

duties hereunder including reimbursed office rent expense if any is paid by the Executive, in accordance with the Company’s expense

reimbursement policy as in effect from time to time.

6. Termination

of Employment. Notwithstanding anything else in this Agreement to the contract, either the Company or Executive may terminate Executive’s

employment and this Agreement at any time with or without cause. If Executive’s employment with the Company terminates for any

reason, Executive will be entitled to any (a) unpaid Base Salary accrued up to the effective date of termination; (b) pay for accrued

but unused vacation, if Company policy is to accrue vacation; (c) benefits or compensation accrued to the date of termination under the

terms of any employee benefit and compensation agreements or plans applicable to Executive; and (d) unreimbursed business expenses required

to be reimbursed to Executive.

7. Severance

and Acceleration.

(a) Termination

by the Company Without Cause or by Executive With Good Reason. If (i) Executive’s employment is terminated by the Company without

Cause (as defined below) during the Employment Term or within 12 months following a Change of Control (as defined in the Company’s

2016 Equity Incentive Plan) if a Change of Control occurs within the Employment Term or (ii) Executive terminates for Good Reason (as

defined below), then, subject to Section 8, Executive will receive, in addition to the compensation set forth in Section 6, payment of

the Executive’s Base Salary for the lesser of the remainder of the Employment Term and 12 months. The Base Salary payment will

be paid out over the payment period in accordance with the Company’s regular payroll practices, except to the extent timing of

payments are modified by the 409A provision provided in Section 9 below.

(b) Definition

of Cause. For purposes of this Agreement, “Cause” will mean:

(i)

Executive’s failure to perform the duties and responsibilities of Executive’s position after there has been delivered to

Executive a written demand for performance from the Board which describes the basis for the Board’s belief that Executive has failed

to perform Executive’s duties and provides Executive with thirty (30) days to take corrective action;

(ii)

Any act of personal dishonesty taken by Executive in connection with Executive’s responsibilities as an employee of the Company

with the intention or reasonable expectation that such action will result in the personal enrichment of Executive;

(iii)

Executive’s conviction of, or plea of nolo contendere to, a felony;

(iv)

Executive’s commission of any tortious act, unlawful act, malfeasance or violation of Company policies (such as workplace harassment

or insider trading policy) which causes or reasonably could cause (for example, if it became publicly known), in the sole and good faith

judgment of the Board, material harm to the Company’s public standing, operational condition or reputation;

(v)

Any material breach by Executive of the Company’s standard form of Confidentiality and Proprietary Rights Agreement, in substantially

the form attached hereto as Exhibit A (such agreement, the “Confidentiality Agreement”) or any other

improper disclosure by Executive of the Company’s confidential or proprietary information;

(vi)

A breach of any fiduciary duty owed to the Company by Executive;

(vii)

The existence of “Cause” under the Company’s 2016 Equity Incentive Plan; or

(viii)

Executive (A) obstructing or impeding; (B) endeavoring to influence, obstruct or impede; or (C) failing to materially cooperate with,

any investigation authorized by the Board or any governmental or self-regulatory entity (an “Investigation”). However,

Executive’s failure to waive attorney-client privilege relating to communications with Executive’s own attorney in connection

with an Investigation will not constitute “Cause.”

(c) Definition

of Good Reason. For purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following

events without Executive’s consent: (A) the assignment to the Executive of duties that are significantly different from, and/or

that result in a substantial diminution of, the duties that he assumed on the Effective Date (including reporting to anyone other than

solely and directly to the Board); (B) the assignment to the Executive of a title that is different from and subordinate to the title

Chief Executive Officer of the Company; provided, however, for the absence of doubt following a Change of Control, should the Executive

be required to serve in a diminished capacity in a division or unit of another entity (including the acquiring entity), such event shall

constitute Good Reason regardless of the title of the Executive in such acquiring company, division or unit; or (C) material breach by

the Company of this Agreement.

In

order for the termination of Executive’s employment with the Company to be for Good Reason, Executive must not terminate employment

without first providing written notice to the Company of the acts or omissions constituting the grounds for “Good Reason”

within 30 days of the initial existence of the grounds for “Good Reason” and a cure period of 30 days following the date

of written notice (the “Cure Period”), the grounds must not have been cured during that time, and Executive must terminate

Executive’s employment within 30 days following the Cure Period.

(d) Voluntary

Termination or Termination for Cause. If Executive’s employment is terminated voluntarily or due to death or disability or

is terminated for Cause by the Company, then except as set forth in Section 6, all payments of compensation by the Company to Executive

hereunder will terminate immediately.

8. Conditions

to Receipt of Severance and Acceleration.

(a) Separation

Agreement and Release of Claims. The receipt of any severance or other benefits pursuant to Section 7 will be subject to Executive

signing and not revoking a separation agreement and release of claims in form and substance reasonably acceptable to the Company in its

discretion that becomes effective no later than sixty (60) days following Executive’s employment termination date (such date, the

“Release Deadline”). If the release does not become effective by the Release Deadline, Executive will forfeit any

rights to severance under this Agreement. In no event will severance payments be paid or provided until the Release Deadline. Any payments

delayed from the date Executive terminates employment through the Release Deadline will be payable in a lump sum without interest on

the Release Deadline and all other amounts will be payable in accordance with the payment schedule applicable to each payment or benefit.

In the event the termination occurs at a time during the calendar year where the release could become effective in the calendar year

following the calendar year in which Executive’s termination occurs, then any severance payments under this letter that would be

considered Deferred Compensation Separation Benefits (as defined below) will be paid on the first payroll date to occur during the calendar

year following the calendar year in which such termination occurs, or, if later, (i) the Release Deadline, (ii) such time as required

by the payment schedule provided above that is applicable to each payment or benefit, or (iii) the Delayed Initial Payment Date (as defined

below).

(b) Other

Requirements. Executive’s receipt and retention of severance payments will be subject to Executive executing and continuing

to comply with the terms of the Confidentiality Agreement.

9. Section

409A.

(a)

Notwithstanding anything to the contrary in this Agreement, no severance pay or benefits payable upon separation that are payable to

Executive pursuant to this Agreement, when considered together with any other severance payments or separation benefits that are considered

deferred compensation (together, the “Deferred Compensation Separation Benefits”) under Section 409A of the Internal

Revenue Code (the “Code”) and the final regulations and official guidance thereunder (“Section 409A”),

will be payable until Executive has a “separation from service” within the meaning of Section 409A.

(b)

Notwithstanding anything to the contrary in this Agreement, if Executive is a “specified employee” within the meaning of

Section 409A, any Deferred Compensation Separation Benefits that are payable within the first six (6) months following Executive’s

separation from service, will become payable on the first payroll date that occurs on or after the date six (6) months and one (1) day

following the date of Executive’s separation from service (the “Delayed Initial Payment Date”). All subsequent

Deferred Compensation Separation Benefits, if any, will be payable in accordance with the payment schedule applicable to each payment

or benefit. Notwithstanding anything herein to the contrary, if Executive dies following Executive’s termination of employment

but prior to the six (6) month anniversary of Executive’s termination of employment, then any payments delayed in accordance with

this paragraph will be payable in a lump sum as soon as administratively practicable after the date of Executive’s death and all

other Deferred Compensation Separation Benefits will be payable in accordance with the payment schedule applicable to each payment or

benefit. Each payment and benefit payable under this Agreement is intended to constitute separate payments for purposes of Section 1.409A-2(b)(2)

of the Treasury Regulations.

(c)

Any amount paid under the Agreement that satisfies the requirements of the “short-term deferral” rule set forth in Section

1.409A-1(b)(4) of the Treasury Regulations will not constitute Deferred Compensation Separation Benefits for purposes of this Agreement.

Any amount paid under the Agreement that qualifies as a payment made as a result of an involuntary separation from service pursuant to

Section 1.409A-1(b)(9)(iii) of the Treasury Regulations that does not exceed the Section 409A Limit will not constitute Deferred Compensation

Separation Benefits for purposes of this Agreement. For this purpose, “Section 409A Limit” means the lesser of two (2) times:

(i) Executive’s annualized compensation based upon the annual rate of pay paid to Executive during Executive’s taxable year

preceding Executive’s taxable year of Executive’s termination of employment as determined under Treasury Regulation 1.409A-1(b)(9)(iii)(A)(1)

and any Internal Revenue Service guidance issued with respect thereto; or (ii) the maximum amount that may be taken into account under

a qualified plan pursuant to Section 401(a)(17) of the Code for the year in which Executive’s employment is terminated.

(d)

The foregoing provisions are intended to comply with the requirements of Section 409A so that none of the severance payments and benefits

to be provided hereunder will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be interpreted

to so comply. Executive and the Company agree to work together in good faith to consider amendments to this Agreement and to take such

reasonable actions which are necessary, appropriate or desirable to avoid imposition of any additional tax or income recognition prior

to actual payment to Executive under Section 409A.

10. Representations.

By executing this Agreement, Executive represents that Executive is able to accept this role and carry out the work that it would involve.

11. Confidential

Information. Executive reaffirms that any confidentiality agreement executed by Executive in favor of the Company remains in full

force and effect in accordance with its terms.

12. Assignment.

This Agreement will be binding upon and inure to the benefit of (a) the heirs, executors and legal representatives of Executive upon

Executive’s death, and (b) any successor of the Company. Any such successor of the Company will be deemed substituted for the Company

under the terms of this Agreement for all purposes. For this purpose, “successor” means any person, firm, corporation, or

other business entity which at any time, whether by purchase, merger, or otherwise, directly or indirectly acquires all or substantially

all of the assets or business of the Company. None of the rights of Executive to receive any form of compensation payable pursuant to

this Agreement may be assigned or transferred except by will or the laws of descent and distribution. Any other attempted assignment,

transfer, conveyance, or other disposition of Executive’s right to compensation or other benefits will be null and void.

13. Notices.

All notices, requests, demands and other communications called for hereunder will be in writing and will be deemed given (a) on the date

of delivery if delivered personally or by electronic mail; (b) one (1) day after being sent overnight by a well-established commercial

overnight service, or (c) four (4) days after being mailed by registered or certified mail, return receipt requested, prepaid and addressed

to the Parties or their successors at the following addresses, or at such other addresses as the Parties may later designate in writing:

If

to the Company:

Eastside

Distilling, Inc.

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

Attn:

Board of Directors

If

to Executive, at the address set forth on the signature page hereto.

14. Severability.

If any provision hereof becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable, or void, this Agreement

will continue in full force and effect without said provision.

15. Arbitration.

The Parties agree that any dispute or controversy arising out of, relating to, or concerning the interpretation, construction, performance,

or breach of this Agreement will be settled by arbitration to be held in Multnomah County, Oregon, in accordance with the Comprehensive

Arbitration Rules and Procedures and International Arbitration Rules (or similar commercial arbitration rules) of JAMS, Inc.

16. Waiver

of Breach. The waiver of a breach of any term or provision of this Agreement, which must be in writing, will not operate as or be

construed to be a waiver of any other previous or subsequent breach of this Agreement.

17. Headings.

All captions and Section headings used in this Agreement are for convenient reference only and do not form a part of this Agreement.

18. Governing

Law. This Agreement and any disputes or claims arising hereunder will be construed in accordance with, governed by and enforced under

the laws of the State of Oregon without regard for any rules of conflicts of law.

19. Acknowledgment.

Executive acknowledges that he has had the opportunity to discuss this matter with and obtain advice from Executive’s private attorney,

has had sufficient time to, and has carefully read and fully understands all the provisions of this Agreement, and is knowingly and voluntarily

entering into this Agreement.

20. Counterparts.

This Agreement may be executed in counterparts, and each counterpart will have the same force and effect as an original and will constitute

an effective, binding agreement on the part of each of the undersigned.

IN

WITNESS WHEREOF, each of the parties has executed this Agreement, in the case of the Company by a duly authorized officer, effective

as of the Effective Date.

| |

COMPANY: |

| |

|

| |

EASTSIDE

DISTILLING, INC. |

| |

|

| |

/s/

Stephanie Kilkenny |

| |

Stephanie

Kilkenny, Corporate Secretary |

| |

|

| |

EXECUTIVE: |

| |

|

| |

/s/

Geoffrey Gwin |

| |

Geoffrey

Gwin |

| |

|

| |

Address:

|

| |

|

| |

|

EXHIBIT

A

This NONDISCLOSURE

AGREEMENT is made as of the date set forth above between:

Eastside

Distilling, Inc. (the “Company”) and Geoffrey Gwin (“Employee”).

1. Purpose.

The Company and the Employee are about to begin or have begun an employment relationship in connection with which each party may disclose

Confidential Information to the other.

2. Definition

of Confidential Information. “Confidential Information” means any information, technical data, or know-how, including,

but not limited to, that which relates to research, acquisitions, product plans, products, services, customers, consultants, markets,

processes, designs, drawings, marketing or finances of the Company. The term “Confidential Information” includes trade secrets

and to any and all information of any nature or kind whatsoever which relates to all proprietary and financial information relating to

the Company’s business; to any and all information concerning the Company’s customers; and to the content of any and all

working papers, discussion papers, business plans, documents and products of any nature or kind which the Company has created, amended

or enhanced. Confidential Information does not include information, technical data or know-how which (a) is in the possession of the

Employee at the time of disclosure to him as shown by the Employee’s files and records immediately prior to the time of disclosure;

(b) the Employee can prove, from contemporaneous written evidence, has been independently developed by him without access to, either

directly or indirectly, the Company’s Confidential Information; (c) prior to or after the time of disclosure becomes part of the

public knowledge or literature other than as a result of any improper inaction or action of the Employee; (d) is approved in writing

by the Company for release; or (e) is required to be disclosed by applicable law or proper legal, governmental or other competent authority

(provided that the Company shall be notified sufficiently in advance of such requirement so that it may seek a protective order (or equivalent)

with respect to such disclosure, with which the Employee shall fully comply).

3. Nondisclosure

of Confidential Information. Employee (a) recognizes that the business and financial records, customer and client lists, proprietary

knowledge or data, intellectual property, trade secrets and confidential methods of operations of the Company, its subsidiaries and its

Affiliates and their respective successors, assigns and nominees, as they may exist from time to time and which relate to the then conducted

or planned business of the Company, its subsidiaries and its Affiliates or of entities with which the Company was or is expected to be

affiliated during such periods, are valuable, special and unique assets of the Company, access to and knowledge of which are essential

to Employee’s performance with the Company; and (b) shall not, during or after the Term, disclose any of such records, lists, knowledge,

data, property, secrets, methods or information to any Person for any reason or purpose whatsoever (except for disclosures (x) compelled

by law; provided that Employee promptly notifies the Company of any request for such information before disclosing the

same, if practical, and (y) made as necessary in connection with the performance of his duties with the Company) or make use of any such

property for his own purposes or for the benefit of any Person except the Company. Employee acknowledges that a breach of this Section

3 may cause irreparable injury to the Company for which monetary damages are inadequate, difficult to compute, or both. Accordingly,

Employee agrees that the provisions of this Section 3 may be enforced by specific performance or other injunctive relief.

4. Non-solicitation.

Employee acknowledges that the Company, its subsidiaries and its Affiliates have expended and shall continue to expend substantial amounts

of time, money and effort to develop business strategies, employee, client and customer relationships and goodwill to build an effective

organization. Employee acknowledges that Employee is and shall become familiar with the confidential information of the Company, its

subsidiaries and its Affiliates, including trade secrets, and that Employee’s services are of special, unique and extraordinary

value to the Company. Employee acknowledges that the opportunities of employment and compensation offered by the Company are adequate

consideration for the covenants contained in this Section 4. Employee acknowledges that the Company and each of its subsidiaries

and Affiliates and their respective successors, assigns and nominees, has a legitimate business interest and right in protecting its

confidential information, business, strategies, employee, client and customer relationships and goodwill, and that each of the Company,

its subsidiaries and Affiliates and their respective successors, assigns and nominees would be seriously damaged by the disclosure of

confidential information and the loss or deterioration of its business strategies, employee and customer relationships and goodwill.

5. Return

of Materials. All materials or documents containing or embodying Confidential Information shall remain the property of the Company,

and any such materials or documents will be promptly returned to the Company by the Employee, accompanied by all copies of such documentation,

within 10 days after (a) the employment relationship has been terminated, or (b) the delivery of written request on the part of the Company.

6. Term.

This Agreement shall apply to disclosures of Confidential Information made on or before the signing of this Agreement (including, for

the avoidance of doubt, disclosures of Confidential Information made before the date of this Agreement). This Agreement shall remain

in effect during Employee’s employment term and shall survive two years from the date Employee ceases to be an employee of the

Company.

7. Governing

Law. This Agreement shall be governed by and shall be construed in accordance with the laws of the State of Oregon, without giving

effect to the conflicts of laws principles thereof, to the exclusion of the law of any other jurisdiction.

8. Remedies.

Employee agrees that his obligations provided in this Agreement are necessary and reasonable in order to protect the Company and its

business, and each Party expressly agrees that monetary damages would be inadequate to compensate the Company for any breach by the Employee

of his covenants and agreements set forth in this Agreement. Accordingly, Employee agrees and acknowledges that any such violation or

threatened violation will cause irreparable injury to the Company and that, in addition to any other remedies that may be available,

in law, in equity or otherwise, the Company shall be entitled to obtain both mandatory and prohibitory injunctive relief against the

threatened breach of this Agreement or the continuation of any such breach by the Employee, without the necessity of proving actual damages.

*

* * * *

v3.24.2

Cover

|

Jul. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 03, 2024

|

| Entity File Number |

001-38182

|

| Entity Registrant Name |

EASTSIDE

DISTILLING, INC.

|

| Entity Central Index Key |

0001534708

|

| Entity Tax Identification Number |

20-3937596

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2321

NE Argyle Street

|

| Entity Address, Address Line Two |

Unit D

|

| Entity Address, City or Town |

Portland

|

| Entity Address, State or Province |

OR

|

| Entity Address, Postal Zip Code |

97211

|

| City Area Code |

(971)

|

| Local Phone Number |

888-4264

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

EAST

|

| Security Exchange Name |

NASDAQ

|

| Title of 12(g) Security |

Common

Stock, $0.0001 par value

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

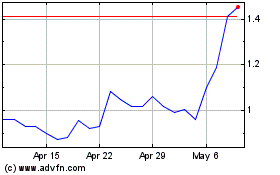

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Dec 2024 to Jan 2025

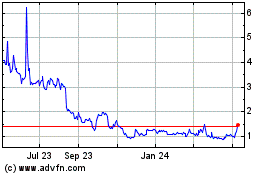

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Jan 2024 to Jan 2025