0001035354

false

0001035354

2023-09-18

2023-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 18, 2023

Eloxx Pharmaceuticals, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-31326 |

|

84-1368850 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

480

Arsenal Way, Suite 130, Watertown, MA |

|

02451 |

| (Address of principal executive offices) |

|

(Zip Code) |

(Registrant’s telephone number,

including area code): (781) 577-5300

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name of each exchange on which

registered |

| Common Stock, $0.01 par value per share |

ELOX |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

On September 18, 2023, Eloxx Pharmaceuticals, Inc., a Delaware

corporation (the “Company”), entered into a securities purchase agreement (the “Purchase Agreement”) with a certain

institutional investor (the “Purchaser”). The Purchase Agreement provided for the sale and issuance by the Company of an aggregate

of: (i) 305,590 shares (the “Shares”) of the Company’s common stock, $0.01 par value (the “Common Stock”),

(ii) a pre-funded warrant (the “Pre-Funded Warrant”) to purchase up to 75,000 shares of Common Stock, and (iii) a

private placement warrant (the “Private Warrant”) to purchase up to 380,590 shares of Common Stock. The Shares, Pre-Funded

Warrant and Private Warrant were sold on a combined basis for consideration equating to $5.255 for one Share and a Private Warrant to

purchase one underlying share of Common Stock and $5.254 for a Pre-Funded Warrant to purchase one underlying share of Common Stock and

a Private Warrant to purchase one underlying share of Common Stock. The exercise price of the Pre-Funded Warrant is $0.001 per underlying

share. The exercise price of the Private Warrant is $5.13 per underlying share.

The Shares and the Pre-Funded Warrant (and the shares of Common

Stock issuable upon the exercise of the Pre-Funded Warrant) were offered pursuant to an effective shelf registration statement on

Form S-3 (Registration No. 333-258994) and a related prospectus supplement filed with the Securities and Exchange

Commission (the “Registered Direct Offering”) on September 20, 2023. The Private Warrant and the shares of the Company’s Common Stock issuable upon the exercise

of the Private Warrant are not being registered under the

Securities Act of 1933, as amended (the “Securities Act”), were not offered pursuant to the registration statement and were

offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder.

The Pre-Funded Warrant is immediately exercisable and may be exercised

at any time until the Pre-Funded Warrant is exercised in full, subject to the Beneficial Ownership Limitation (as described below).

The Private Warrant is immediately exercisable upon issuance and

will expire five and one-half years following the date of issuance. The Private Warrant contains standard adjustments to the exercise price including for stock

splits, stock dividends, rights offerings and pro rata distributions. The Private Warrant also includes certain rights upon

“fundamental transactions” (as described in the Private Warrant), including the right of the holders thereof to receive

from the Company or a successor entity the same type or form of consideration (and in the same proportion) that is being offered and

paid to the holders of Common Stock in such fundamental transaction in the amount of the Black Scholes value (as described in the

Private Warrant) of the unexercised portion of the Private Warrant on the date of the consummation of such fundamental

transaction.

The Pre-Funded Warrant includes cashless exercise rights at all times,

and the Private Warrant includes cashless exercise rights to the extent the shares of Common Stock underlying the Private Warrant are

not registered under the Securities Act.

Under the terms of the Pre-Funded Warrant and Private Warrant, a holder

will not be entitled to exercise any portion of any such warrant, if, upon giving effect to such exercise, the aggregate number of shares

of Common Stock beneficially owned by the holder (together with its affiliates, any other persons acting as a group together with the

holder or any of the holder’s affiliates, and any other persons whose beneficial ownership of Common Stock would or could be aggregated

with the holder’s for purposes of Section 13(d) or Section 16 of the Securities Exchange Act of 1934, as amended)

would exceed 9.99% (in the case of the Pre-Funded Warrant) and 4.99% (in the case of the Private Warrant) of the number of shares of Common

Stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms

of such warrant, which percentage may be increased at the holder’s election upon 61 days’ notice to the Company subject to

the terms of such warrants, provided that such percentage may in no event exceed 9.99% (the “Beneficial Ownership Limitation”).

In connection with the offering, the Company entered into an engagement

letter (the “Engagement Letter”) with H.C. Wainwright & Co., LLC (“Wainwright”), pursuant to which Wainwright

agreed to serve as the exclusive placement agent for the issuance and sale of securities of the Company pursuant to the Purchase Agreement.

As compensation for such placement agent services, the Company has agreed to pay Wainwright an aggregate cash fee equal to 7.5% of the

gross proceeds received by the Company from the offering, a non-accountable expense of $50,000 and a clearing fee of $15,950. The Company

has also agreed to issue to Wainwright, or its designees, warrants to purchase up to 22,835 shares of Common Stock (the “Wainwright

Warrants”), representing 6.0% of the shares and Pre-Funded Warrant issued in the offering. The Wainwright Warrants have a term

of five years from the commencement of sales in the offering, and have an exercise price of $6.5688 per share, representing 125% of the

purchase price in the offering. In addition, Wainwright is entitled to certain tail rights for a period of 12 months following the expiration

of the Engagement Letter and a right of first refusal for certain transactions for a period of 12 months from the date of the closing

of the offering.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The information contained above in Item 1.01 relating to the

Private Warrant and the Wainwright Warrants and the shares of Common Stock issuable thereunder is incorporated by reference into

this Item 3.02 in its entirety. The sales of the Private Warrant, the Wainwright Warrants and the shares of Common Stock issuable

upon exercise of the Private Warrant and Wainwright Warrants have not been registered under the Securities Act or any state

securities laws and the Private Warrant, the Wainwright Warrants and the shares of Common Stock issuable upon exercise of the

Private Warrant and the Wainwright Warrants may not be offered or sold in the United States absent registration with the Securities

and Exchange Commission or an applicable exemption from the registration requirements. The sale of such securities does not involve

a public offering and is made without general solicitation or general advertising.

Forward-Looking Statements

This Current Report on Form 8-K (the “Form 8-K”) contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements

of historical facts contained in this Form 8-K, including without limitation, statements regarding the consummation of the offering, the

terms of the offering, the satisfaction of customary closing conditions with respect to the offering and the anticipated amount of net

proceeds from the offering are forward-looking statements. Forward-looking statements can be identified by the words “aim,”

“may,” “will,” “would,” “should,” “expect,” “explore,” “plan,”

“anticipate,” “could,” “intend,” “target,” “project,” “contemplate,”

“believe,” “estimate,” “predict,” “potential,” “seeks,” or “continue”

or the negative of these terms similar expressions, although not all forward-looking statements contain these words. Forward-looking statements

are based on management’s current plans, estimates, assumptions and projections based on information currently available to us. Forward-looking

statements are subject to known and unknown risks, uncertainties and assumptions, and actual results or outcomes may differ materially

from those expressed or implied in the forward-looking statements due to various important factors, including, but not limited to: the

amount of and use of net proceeds from the offering may differ from the Company’s current expectations; the Company’s ability to obtain

the capital necessary to fund the Company’s operations; the Company’s ability to obtain financial in the future through product licensing,

public or private equity or debt financing or otherwise; the Company’s ability to meet the continued listing requirements of the Nasdaq

Capital Market; general business conditions, regulatory environment, competition and market for the Company’s products; and business ability

and judgment of personnel, and the availability of qualified personnel and other important factors discussed under the caption “Risk

Factors” in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, as any such factors may be

updated from time to time in the Company’s other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the “Financials

& Filings” page of the Company’s website at https://investors.eloxxpharma.com/financials-filings.

All forward-looking statements speak only as of the date of this Form

8-K and, except as required by applicable law, the Company has no obligation to update or revise any forward-looking statements contained

herein, whether as a result of any new information, future events, changed circumstances or otherwise.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: September 20, 2023 |

ELOXX PHARMACEUTICALS, INC. |

| |

|

| |

|

| |

By: |

/s/ Sumit Aggarwal |

| |

Name: |

Sumit Aggarwal |

| |

Title: |

President and Chief Executive Officer |

Exhibit 5.1

| |

200 Clarendon Street |

| |

Boston, Massachusetts 02116 |

| |

Tel: +1.617.948.6000 Fax: +1.617.948.6001 |

| |

www.lw.com |

| |

|

| |

FIRM / AFFILIATE OFFICES |

|

Austin |

Milan |

| Beijing |

Munich |

| Boston |

New York |

| Brussels |

Orange County |

| Century City |

Paris |

| September 20, 2023 |

Chicago |

Riyadh |

| |

Dubai |

San Diego |

| |

Düsseldorf |

San Francisco |

| |

Frankfurt |

Seoul |

| |

Hamburg |

Shanghai |

| |

Hong Kong |

Silicon Valley |

| |

Houston |

Singapore |

|

London |

Tel Aviv |

|

Los Angeles |

Tokyo |

|

Madrid |

Washington, D.C. |

Eloxx Pharmaceuticals, Inc.

480 Arsenal Way, Suite 130

Watertown, MA 02451

| Re: | Registration Statement on Form S-3 (No. 333-258994); 305,590 shares of common stock, $0.01 par value per share and pre-funded

warrants to purchase up to 75,000 shares of common stock, $0.01 par value per share |

To the addressees set forth above:

We have acted as special counsel to Eloxx

Pharmaceuticals, Inc., a Delaware corporation (the “Company”), in connection with the issuance of (i) 305,590 shares (the “Shares”) of common stock, par value $0.01 per share, of the

Company (the “Common Stock”), and (ii) pre-funded warrants to purchase up to 75,000 shares of Common

Stock (the “Warrants”). The Shares and the Warrants are included in a registration statement on

Form S-3 under the Securities Act of 1933, as amended (the “Act”), filed with the Securities and

Exchange Commission (the “Commission”) on August 20, 2021 (Registration No. 333-258994) (the

“Registration Statement”), a base prospectus dated August 30, 2021 (the “Base

Prospectus”) and a prospectus supplement dated September 18, 2023 filed with the Commission pursuant to

Rule 424(b) under the Act (together with the Base Prospectus, the “Prospectus”). The Shares and

the Warrants are being sold pursuant to a securities purchase agreement dated as of September 18, 2023 by and between the

Company and the purchaser named therein (the “Purchase Agreement”). This opinion is being furnished in

connection with the requirements of Item 601(b)(5) of Regulation S-K under the Act, and no opinion is expressed herein as to

any matter pertaining to the contents of the Registration Statement or related Prospectus, other than as expressly stated herein

with respect to the issue of the Shares, the Warrants and Warrant Shares (as defined below).

September 20, 2023

Page 2

As such counsel, we have examined such matters

of fact and questions of law as we have considered appropriate for purposes of this letter. With your consent, we have relied upon certificates

and other assurances of officers of the Company and others as to factual matters without having independently verified such factual matters.

We are opining herein as to the General Corporation Law of the State of Delaware (the “DGCL”), and we express

no opinion with respect to any other laws.

Subject to the foregoing and the other matters

set forth herein, it is our opinion that, as of the date hereof:

1. When the Shares shall have been duly registered

on the books of the transfer agent and registrar therefor in the name or on behalf of the purchaser, and have been issued by the Company

against payment therefor (not less than par value) in the circumstances contemplated by the Purchase Agreement, the issue and sale of

the Shares will have been duly authorized by all necessary corporate action of the Company, and the Shares will be validly issued, fully

paid and nonassessable. In rendering the foregoing opinion, we have assumed that the Company will comply with all applicable notice requirements

regarding uncertificated shares provided in the DGCL.

2. When the Warrants have been issued by the Company

against payment therefor in the circumstances contemplated by the Purchase Agreement, the issue and sale of the Warrants will have been

duly authorized by all necessary corporate action of the Company, and the Warrants will be legally valid and binding obligations of the

Company, enforceable against the Company in accordance with their terms.

3. When the shares of Common Stock initially issuable

upon exercise of the Warrants (the “Warrant Shares”) shall have been duly registered on the books of the transfer

agent and registrar therefor in the name or on behalf of the Warrant holders, and have been issued by the Company against payment therefor

(not less than par value) in the circumstances contemplated by the Warrants, the issue of the Warrant Shares will have been duly authorized

by all necessary corporate action of the Company, and the Warrant Shares will be validly issued, fully paid and nonassessable. In rendering

the foregoing opinion, we have assumed that (i) the Company will comply with all applicable notice requirements regarding uncertificated

shares provided in the DGCL and (ii) upon the issue of any of the Warrant Shares, the total number of shares of Common Stock issued

and outstanding will not exceed the total number of shares of Common Stock that the Company is then authorized to issue under its Amended

and Restated Certificate of Incorporation, as amended, and by the board of directors of the Company in connection with the offering contemplated

by the Registration Statement.

With your consent, we have assumed that the status

of the Warrants as legally valid and binding obligations of the Company is not affected by any (i) breaches of, or defaults under,

agreements or instruments, (ii) violations of statutes, rules, regulations or court or governmental orders, or (iii) failures

to obtain required consents, approvals or authorizations from, or make required registrations, declarations or filings with, governmental

authorities.

September 20, 2023

Page 3

Our opinions are subject to: (i) the effect

of bankruptcy, insolvency, reorganization, preference, fraudulent transfer, moratorium or other similar laws relating to or affecting

the rights and remedies of creditors; (ii) (a) the effect of general principles of equity, whether considered in a proceeding

in equity or at law (including the possible unavailability of specific performance or injunctive relief), (b) concepts of materiality,

reasonableness, good faith and fair dealing, and (c) the discretion of the court before which a proceeding is brought; and (iii) the

invalidity under certain circumstances under law or court decisions of provisions providing for the indemnification of or contribution

to a party with respect to a liability where such indemnification or contribution is contrary to public policy. We express no opinion

as to (a) any provision for liquidated damages, default interest, late charges, monetary penalties, make-whole premiums or other

economic remedies to the extent such provisions are deemed to constitute a penalty; (b) consents to, or restrictions upon, governing

law, jurisdiction, venue, arbitration, remedies, or judicial relief; (c) any provision requiring the payment of attorneys’

fees, where such payment is contrary to law or public policy; (d) other applicable exceptions; and (e) the severability, if

invalid, of provisions to the foregoing effect.

This opinion is for your benefit in connection

with the Registration Statement and may be relied upon by you and by persons entitled to rely upon it pursuant to the applicable provisions

of the Act. We consent to your filing this opinion as an exhibit to the Company’s Form 8-K dated September 20, 2023 and

to the reference to our firm in the Prospectus under the heading “Legal Matters.” In giving such consent, we do not thereby

admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations

of the Commission thereunder.

| | Sincerely, |

| | | |

| | | /s/ Latham & Watkins LLP |

v3.23.3

Cover

|

Sep. 18, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 18, 2023

|

| Entity File Number |

001-31326

|

| Entity Registrant Name |

Eloxx Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001035354

|

| Entity Tax Identification Number |

84-1368850

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

480

Arsenal Way, Suite 130

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02451

|

| City Area Code |

781

|

| Local Phone Number |

577-5300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

ELOX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

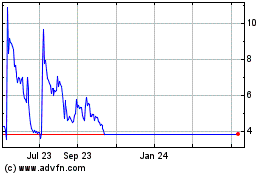

Eloxx Pharmaceuticals (NASDAQ:ELOX)

Historical Stock Chart

From Nov 2024 to Dec 2024

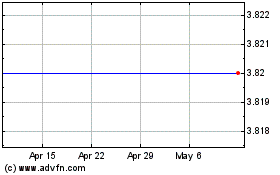

Eloxx Pharmaceuticals (NASDAQ:ELOX)

Historical Stock Chart

From Dec 2023 to Dec 2024