false

0001716947

0001716947

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 9, 2023 (November 9, 2023)

Ensysce

Biosciences, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38306 |

|

82-2755287 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

7946

Ivanhoe Avenue, Suite 201

La

Jolla, California |

|

92037 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(858)

263-4196

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

ENSC |

|

The

Nasdaq Stock Market LLC |

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

On

November 9, 2023, Ensysce Biosciences, Inc. (the “Company”) issued a press release announcing its financial results for the

fiscal quarter ended September 30, 2023. A copy of the press release is included as Exhibit 99.1 to this Current Report on Form 8-K.

The

information in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended, nor will they be deemed to be incorporated by reference in any filing

under the Securities Act of 1933, as amended, except as will be expressly set forth by specific reference in such a filing.

Forward-Looking

Statements

This

report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These statements may be made directly in this report. Some of the forward-looking

statements can be identified by the use of forward-looking words. Statements that are not historical in nature, including the words “anticipate,”

“expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,”

“targets,” “projects,” “should,” “could,” “would,” “may,” “will,”

“forecast” and other similar expressions are intended to identify forward-looking statements. All forward-looking statements

are based upon management estimates and forecasts and reflect the views, assumptions, expectations, and opinions of the Company as of

the date of this report, and may include, without limitation, changes in general economic and political conditions, all of which are

accordingly subject to change. Any such estimates, assumptions, expectations, forecasts, views or opinions set forth in this report constitute

the Company’s judgments and should be regarded as indicative, preliminary and for illustrative purposes only. The forward-looking

statements and projections contained in this report are subject to a number of factors, risks and uncertainties, some of which are not

currently known to the Company, that may cause the Company’s actual results, performance or financial condition to be materially

different from the expectations of future results, performance of financial condition. Although such forward-looking statements have

been made in good faith and are based on assumptions that the Company believes to be reasonable, there is no assurance that the expected

results will be achieved. The Company’s actual results may differ materially from the results discussed in forward-looking statements.

Additional information on factors that may cause actual results and the Company’s performance to differ materially is included

in the Company’s filings with the Securities and Exchange Commission (the “SEC”). Copies of such filings with the SEC

are available publicly on the SEC’s website at www.sec.gov or may be obtained by contacting the Company. Readers are cautioned

not to place undue reliance upon any forward-looking statements, which speak only as of the date made. These forward-looking statements

are made only as of the date hereof, and the Company does not undertake any obligations to update or revise the forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by law.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Dated:

November 9, 2023 |

Ensysce

Biosciences, Inc. |

| |

|

|

| |

By: |

/s/

Lynn Kirkpatrick |

| |

Name |

Dr.

Lynn Kirkpatrick |

| |

Title: |

President

and Chief Executive Officer |

| |

|

(Principal

Executive Officer) |

Exhibit

99.1

Ensysce

Biosciences Reports Third Quarter 2023 Financial Results

~

PF614-201 Clinical Study Results Expected by End of Year ~

SAN

DIEGO, CA, November 9, 2023 — Ensysce Biosciences, Inc. (“Ensysce” or the “Company”) (NASDAQ: ENSC),

a clinical-stage company applying transformative chemistry to improve prescription drug safety, today reported financial results for

the third quarter of 2023.

Dr.

Lynn Kirkpatrick, Chief Executive Officer of Ensysce, commented, “We continue to execute steps toward meeting our near-term objective

of entering Phase 3 evaluation of PF614 with a long-term goal of commercialization. Specifically, we’ve achieved multiple milestones

in the third quarter which began with Institutional Review Board approval of the PF614-201 clinical protocol in August followed by the

critically important completion of the Site Initiation Visit to commence our PF614-201 clinical trial, and additionally engagement of

the strategic advisory group Alacrita Consulting to enhance our partnering and licensing opportunities. Behind the scenes we are continuing

manufacturing activities of both PF614 and the combination product PF614-MPAR for overdose protection. The Company’s progress throughout

2023 has further supported our belief that PF614 and PF614-MPAR will become the ‘next generation’ of analgesics that are

equally effective in treating severe pain with a safer outcome for pain management than currently marketed opioids.

Looking

forward, we are on track for the important readout from the PF614-201 ‘time of onset’ study prior to year-end. The data will

support the design of our Phase 3 protocols and add to the favorable results from the three clinical studies completed over the last

year. All data generated to date have contributed to the regulatory submission for our End of Phase 2 discussions with the FDA scheduled

for January 30, 2024, in advance of initiating Phase 3 studies in 2024. Lastly, we successfully completed a private placement funding

round made possible by the support of our long-term investors signaling continued confidence in Ensysce’s PF614 pain management

treatment and our mission to improve drug safety,” concluded Dr. Kirkpatrick.

TAAPTM

(Opioid Abuse Deterrent Program) Updates

Our

lead product, PF614, is a Trypsin-Activated Abuse Protection (TAAPTM) extended-release oxycodone and a potential ‘next

generation’ analgesic for severe pain. The Company’s TAAPTM technology is designed to control release, be highly

resistant to tampering and reduce abuse through a unique chemical modification. PF614’s TAAPTM modification makes it

inactive until it is swallowed, following which it is activated or ‘turned on’ to release oxycodone by the body’s own

trypsin, an enzyme in the small intestine. Ensysce completed three clinical trials over the last year and is working to complete enrollment

for its latest clinical trial to evaluate the time of onset of pain relief with PF614. Ensysce believes it has a body of evidence showing

that PF614 works as designed, is bioequivalent to OxyContin and has a good safety profile. Our most recent studies demonstrate that PF614

is less liked by recreational drug users when taken orally as compared to regular oxycodone, creating what we believe is a safer analgesic.

Most

recently, on September 26, 2023, the Company completed the Site Initiation Visit for the PF614-201 study, ‘A Randomized, Double-Blind,

Placebo-Controlled Crossover Study of PF614 on Analgesic Response in the Cold Pressor Test in Healthy Male Subjects’ to evaluate

time of onset for PF614. The study is being conducted by Dr. George Atiee at Dr. Vince Clinical Research (DVCR) in Overland, KS. The

Company expects results from this study in December 2023.

On

September 14, 2023, the Company announced that two scale up manufactures had been completed for PF614 in 2023. The success of the scaled

manufacturing work positions the Company to begin its strategy of commercial readiness consistent with timeline expectations as it enters

the next phase of development, including planning its phase 3 studies.

MPAR®

(Opioid Abuse Deterrent and Overdose Protection Program) Updates

PF614-MPAR

is a combination product to treat severe pain, designed with overdose protection. MPAR® (Multi-Pill Abuse Resistance) reduces or

‘turns off’ the release of the opioid to prevent an overdose, providing an additional layer of protection to Ensysce’s

TAAP™ medications. We believe that MPAR® is the first technology that may reduce prescription drug overdoses stemming from

oral abuse, which can save lives. The clinical data generated over the past year supported the approach that the MPAR® combination

technology reduces release and absorption of oxycodone from PF614, when consumed in overdose. A regulatory submission is planned to discuss

our MPAR development program with the FDA.

On

September 7, 2023, the Company hosted a symposium at PAINWeek 2023 to formally present the recent clinical data for PF614 and PF614-MPAR

to a global community of leading pain medical professionals. Ensysce’s objectives included conveying an understanding of the current

landscape for severe pain treatment and drug use and abuse in America. This overview dovetailed with the Company’s thesis of the

unmet medical and societal need for the safety and effectiveness of PF614 and PF614-MPAR, the Company’s two leading next-generation

agents which are designed to reduce opioid abuse and prevent overdose deaths.

The

results from our clinical trials are evidence that Ensysce’s PF614 and PF614-MPAR analgesics reflect an inflection point in the

management of severe pain as a safe and equally effective alternative to prescription opioids that have become less accessible due to

the direct correlation to abuse and overdose.

Third

Quarter 2023 Financial Results

| ● | Cash

– Cash and cash equivalents were $1.5 million as of September 30, 2023, as compared

to $3.8 million as of June 30, 2023. Subsequent to quarter end, on October 23, 2023, the

Company entered into a securities purchase agreement with investors in the form of senior

secured convertible notes with a dedicated syndicate of investors for an aggregate investment

of $1.7 million to occur in two closings. The initial closing occurred on October 25, 2023,

providing $0.6 million prior to fees and offering expenses. The second closing is anticipated

prior to year-end. |

| ● | Federal

Grants - Funding under federal grants totaled to $0.4 million for the third quarter of

2023 compared to $0.3 million in the comparable year ago quarter. The increase is due to

the timing of research activities eligible for funding, particularly relative to the MPAR®

program. |

| ● | Research

& Development Expenses – R&D expenses decreased to $1.9 million for the

third quarter of 2023 compared to $4.8 million for the same period in 2022. The decrease

was primarily the result of changes in timing of external research and development costs

related to clinical and pre-clinical programs for PF614 and PF614-MPAR. |

| ● | General

& Administrative Expenses – G&A expenses decreased to $1.2 million for

the third quarter of 2023 compared to $1.7 million for the same period of 2022. The decrease

was primarily a result of reduced stock-based compensation, employee bonus accrual and consulting

fees. |

| ● | Other

Income (Expense) – Total other income (expense), net was income of $16,508 for

the third quarter of 2023 compared to expense of $3.7 million for the same period of 2022.

The change in other income is primarily due to non-cash fair value adjustments for convertible

notes and warrants. |

| ● | Net

Loss – Net loss attributable to common stockholders for the third quarter of 2023

was $2.7 million compared to $9.9 million for the third quarter of 2022. As a clinical stage

biotech company, our continued research and development efforts toward regulatory approvals

for our product candidates are expected to result in losses for the foreseeable future. |

Ensysce

Biosciences, Inc.

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

Three

Months Ended September

30, | | |

Nine

Months Ended September

30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Federal

grants | |

$ | 435,380 | | |

$ | 279,351 | | |

$ | 1,715,488 | | |

$ | 1,089,920 | |

| Operating

expenses: | |

| | | |

| | | |

| | | |

| | |

| Research

and development | |

| 1,914,970 | | |

| 4,756,096 | | |

| 5,354,713 | | |

| 13,393,948 | |

| General

and administrative | |

| 1,227,724 | | |

| 1,686,580 | | |

| 3,923,277 | | |

| 5,717,281 | |

| Total

operating expenses | |

| 3,142,694 | | |

| 6,442,676 | | |

| 9,277,990 | | |

| 19,111,229 | |

| Loss

from operations | |

| (2,707,314 | ) | |

| (6,163,325 | ) | |

| (7,562,502 | ) | |

| (18,021,309 | ) |

| Total

other income (expense), net | |

| 16,508 | | |

| (3,692,240 | ) | |

| 440,588 | | |

| (708,300 | ) |

| Net

loss | |

$ | (2,690,806 | ) | |

$ | (9,855,565 | ) | |

$ | (7,121,914 | ) | |

$ | (18,729,609 | ) |

| Adjustments

to net loss | |

| 1,235 | | |

| (42,047 | ) | |

| 198 | | |

| (833,979 | ) |

| Net

loss attributable to common stockholders | |

$ | (2,689,571 | ) | |

$ | (9,897,612 | ) | |

$ | (7,121,716 | ) | |

$ | (19,563,588 | ) |

| Net

loss per share attributable to common stockholders, basic and diluted | |

$ | (0.87 | ) | |

$ | (61.58 | ) | |

$ | (3.32 | ) | |

$ | (140.90 | ) |

Ensysce

Biosciences, Inc.

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

| | |

Nine

Months Ended September 30, | |

| | |

2023 | | |

2022 | |

| Net

cash used in operating activities | |

$ | (8,978,107 | ) | |

$ | (14,591,819 | ) |

| Net

cash provided by investing activities | |

| - | | |

| 4,500 | |

| Net

cash provided by financing activities | |

| 7,294,786 | | |

| 6,825,664 | |

| Change

in cash and cash equivalents | |

| (1,683,321 | ) | |

| (7,761,655 | ) |

| Cash

and cash equivalents at beginning of period | |

| 3,147,702 | | |

| 12,264,736 | |

| Cash

and cash equivalents at end of period | |

$ | 1,464,381 | | |

$ | 4,503,081 | |

Ensysce

Biosciences, Inc.

Condensed

Consolidated Balance Sheets

(Unaudited)

| | |

September

30, | | |

December

31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current

assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 1,464,381 | | |

$ | 3,147,702 | |

| Prepaid

expenses and other current assets | |

| 1,293,422 | | |

| 2,151,467 | |

| Total

current assets | |

| 2,757,803 | | |

| 5,299,169 | |

| Other

assets | |

| 460,883 | | |

| 585,883 | |

| Total

assets | |

$ | 3,218,686 | | |

$ | 5,885,052 | |

| | |

| | | |

| | |

| Liabilities

and stockholders’ equity (deficit) | |

| | | |

| | |

| Current

liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 916,416 | | |

$ | 2,943,791 | |

| Accrued

expenses and other liabilities | |

| 763,190 | | |

| 2,253,809 | |

| Notes

payable and accrued interest | |

| 350,932 | | |

| 4,266,610 | |

| Total

current liabilities | |

| 2,030,538 | | |

| 9,464,210 | |

| Long-term

liabilities | |

| 30,473 | | |

| 450,494 | |

| Total

liabilities | |

| 2,061,011 | | |

| 9,914,704 | |

| Stockholders’

equity (deficit) | |

| 1,157,675 | | |

| (4,029,652 | ) |

| Total

liabilities and stockholders’ equity (deficit) | |

$ | 3,218,686 | | |

$ | 5,885,052 | |

About

Ensysce Biosciences

Ensysce

Biosciences is a clinical-stage company using its proprietary technology platforms to develop safer prescription drugs. Leveraging its

Trypsin-Activated Abuse Protection (TAAPTM) and Multi-Pill Abuse Resistance (MPAR®) platforms, the Company is developing

unique, tamper-proof treatment options for pain that minimize the risk of both drug abuse and overdose. Ensysce’s products are

anticipated to provide safer options to treat patients suffering from severe pain and assist in preventing deaths caused by medication

abuse. The platforms are covered by an extensive worldwide intellectual property portfolio for a wide array of prescription drug compositions.

For more information, please visit www.ensysce.com.

Forward-Looking

Statements

Statements

contained in this press release that are not purely historical may be deemed to be forward-looking statements for the purposes of the

safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. Without limiting

the foregoing, the use of words such as “may,” “intends,” “can,” “might,” “will,”

“expect,” “plan,” “possible,” “believe” and other similar expressions are intended to

identify forward-looking statements. The product candidates discussed are in clinic and not approved and there can be no assurance that

the clinical programs will be successful in demonstrating safety and/or efficacy, that Ensysce will not encounter problems or delays

in clinical development, or that any product candidate will ever receive regulatory approval or be successfully commercialized. All forward-looking

statements are based on estimates and assumptions by Ensysce’s management that, although Ensysce believes to be reasonable, are

inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially

from those that Ensysce expected. In addition, Ensysce’s business is subject to additional risks and uncertainties, including among

others, the initiation and conduct of preclinical studies and clinical trials; the timing and availability of data from preclinical studies

and clinical trials; expectations for regulatory submissions and approvals; potential safety concerns related to, or efficacy of, Ensysce’s

product candidates; the availability or commercial potential of product candidates; the ability of Ensysce to fund its continued operations,

including its planned clinical trials; the dilutive effect of stock issuances from our fundraising; and Ensysce’s and its partners’

ability to perform under their license, collaboration and manufacturing arrangements. These statements are also subject to a number of

material risks and uncertainties that are described in Ensysce’s most recent quarterly report on Form 10-Q and current reports

on Form 8-K, which are available, free of charge, at the SEC’s website at www.sec.gov. Any forward-looking statement speaks only

as of the date on which it was made. Ensysce undertakes no obligation to publicly update or revise any forward-looking statement, whether

as a result of new information, future events or otherwise, except as required under applicable law.

Ensysce

Biosciences Company Contact:

Lynn

Kirkpatrick, Ph.D.

Chief

Executive Officer

(858)

263-4196

Ensysce

Biosciences Investor Relations Contact:

Shannon

Devine

MZ

North America

Main:

203-741-8811

ENSC@mzgroup.us

Source:

Ensysce Biosciences Inc.

v3.23.3

Cover

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity File Number |

001-38306

|

| Entity Registrant Name |

Ensysce

Biosciences, Inc.

|

| Entity Central Index Key |

0001716947

|

| Entity Tax Identification Number |

82-2755287

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7946

Ivanhoe Avenue

|

| Entity Address, Address Line Two |

Suite 201

|

| Entity Address, City or Town |

La

Jolla

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92037

|

| City Area Code |

(858)

|

| Local Phone Number |

263-4196

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

ENSC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

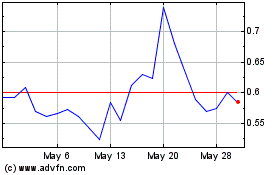

Ensysce Biosciences (NASDAQ:ENSC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ensysce Biosciences (NASDAQ:ENSC)

Historical Stock Chart

From Nov 2023 to Nov 2024