false

--12-31

Q3

0000890821

0000890821

2023-01-01

2023-09-30

0000890821

2023-11-09

0000890821

2023-09-30

0000890821

2022-12-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2023-09-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2022-12-31

0000890821

us-gaap:SeriesBPreferredStockMember

2023-09-30

0000890821

us-gaap:SeriesBPreferredStockMember

2022-12-31

0000890821

2023-07-01

2023-09-30

0000890821

2022-07-01

2022-09-30

0000890821

2022-01-01

2022-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-12-31

0000890821

ENVB:MezzanineEquityMember

2022-12-31

0000890821

us-gaap:CommonStockMember

2022-12-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0000890821

us-gaap:RetainedEarningsMember

2022-12-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2023-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-03-31

0000890821

ENVB:MezzanineEquityMember

2023-03-31

0000890821

us-gaap:CommonStockMember

2023-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000890821

us-gaap:RetainedEarningsMember

2023-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0000890821

2023-03-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2023-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-06-30

0000890821

ENVB:MezzanineEquityMember

2023-06-30

0000890821

us-gaap:CommonStockMember

2023-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000890821

us-gaap:RetainedEarningsMember

2023-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0000890821

2023-06-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2021-12-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2021-12-31

0000890821

ENVB:MezzanineEquityMember

2021-12-31

0000890821

us-gaap:CommonStockMember

2021-12-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0000890821

us-gaap:RetainedEarningsMember

2021-12-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0000890821

2021-12-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2022-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-03-31

0000890821

ENVB:MezzanineEquityMember

2022-03-31

0000890821

us-gaap:CommonStockMember

2022-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0000890821

us-gaap:RetainedEarningsMember

2022-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0000890821

2022-03-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2022-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-06-30

0000890821

ENVB:MezzanineEquityMember

2022-06-30

0000890821

us-gaap:CommonStockMember

2022-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0000890821

us-gaap:RetainedEarningsMember

2022-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0000890821

2022-06-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2023-01-01

2023-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-01-01

2023-03-31

0000890821

ENVB:MezzanineEquityMember

2023-01-01

2023-03-31

0000890821

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0000890821

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0000890821

2023-01-01

2023-03-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2023-04-01

2023-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-04-01

2023-06-30

0000890821

ENVB:MezzanineEquityMember

2023-04-01

2023-06-30

0000890821

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000890821

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0000890821

2023-04-01

2023-06-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2023-07-01

2023-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-07-01

2023-09-30

0000890821

ENVB:MezzanineEquityMember

2023-07-01

2023-09-30

0000890821

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0000890821

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2023-09-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2022-01-01

2022-03-31

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-01-01

2022-03-31

0000890821

ENVB:MezzanineEquityMember

2022-01-01

2022-03-31

0000890821

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0000890821

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0000890821

2022-01-01

2022-03-31

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2022-04-01

2022-06-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-04-01

2022-06-30

0000890821

ENVB:MezzanineEquityMember

2022-04-01

2022-06-30

0000890821

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0000890821

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0000890821

2022-04-01

2022-06-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2022-07-01

2022-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-07-01

2022-09-30

0000890821

ENVB:MezzanineEquityMember

2022-07-01

2022-09-30

0000890821

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0000890821

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2022-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2023-09-30

0000890821

ENVB:MezzanineEquityMember

2023-09-30

0000890821

us-gaap:CommonStockMember

2023-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0000890821

us-gaap:RetainedEarningsMember

2023-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0000890821

ENVB:SeriesCRedeemablePreferredStockMember

2022-09-30

0000890821

ENVB:RedeemableNoncontrollingInterestMember

2022-09-30

0000890821

ENVB:MezzanineEquityMember

2022-09-30

0000890821

us-gaap:CommonStockMember

2022-09-30

0000890821

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0000890821

us-gaap:RetainedEarningsMember

2022-09-30

0000890821

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0000890821

2022-09-30

0000890821

us-gaap:SeriesAPreferredStockMember

2023-05-12

0000890821

us-gaap:SeriesAPreferredStockMember

2023-05-11

2023-05-12

0000890821

2023-05-11

2023-05-12

0000890821

ENVB:EquityDistributionAgreementMember

2023-01-01

2023-09-30

0000890821

2023-05-01

2023-05-31

0000890821

ENVB:KanubaddiSeparationAgreementMember

2023-06-15

2023-06-16

0000890821

ENVB:MrKanubaddiEmploymentAgreementMember

us-gaap:RestrictedStockUnitsRSUMember

2023-06-15

2023-06-16

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2023-06-16

0000890821

ENVB:MrKanubaddiEmploymentAgreementMember

us-gaap:RestrictedStockUnitsRSUMember

2023-06-16

0000890821

country:US

2023-09-30

0000890821

country:CA

2023-09-30

0000890821

country:AU

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

2023-01-01

2023-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2023-07-01

2023-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2022-07-01

2022-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2023-01-01

2023-09-30

0000890821

ENVB:WarrantsToPurchaseSharesOfCommonStockMember

2022-01-01

2022-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2023-07-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2022-07-01

2022-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2023-01-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsVestedAndUnIssuedMember

2022-01-01

2022-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2023-07-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2022-07-01

2022-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2023-01-01

2023-09-30

0000890821

ENVB:RestrictedStockUnitsUnvestedMember

2022-01-01

2022-09-30

0000890821

ENVB:RestrictedStockAwardsVestedAndUnIssuedMember

2023-07-01

2023-09-30

0000890821

ENVB:RestrictedStockAwardsVestedAndUnIssuedMember

2022-07-01

2022-09-30

0000890821

ENVB:RestrictedStockAwardsVestedAndUnIssuedMember

2023-01-01

2023-09-30

0000890821

ENVB:RestrictedStockAwardsVestedAndUnIssuedMember

2022-01-01

2022-09-30

0000890821

ENVB:InvstmentOptionsToPurchaseSharesOfCommonStockMember

2023-07-01

2023-09-30

0000890821

ENVB:InvstmentOptionsToPurchaseSharesOfCommonStockMember

2022-07-01

2022-09-30

0000890821

ENVB:InvstmentOptionsToPurchaseSharesOfCommonStockMember

2023-01-01

2023-09-30

0000890821

ENVB:InvstmentOptionsToPurchaseSharesOfCommonStockMember

2022-01-01

2022-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2023-07-01

2023-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2022-07-01

2022-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2023-01-01

2023-09-30

0000890821

ENVB:OptionsToPurchaseSharesOfCommonStockMember

2022-01-01

2022-09-30

0000890821

ENVB:WarrantLiabilitiesJanuaryTwentyTwentyOneWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0000890821

ENVB:WarrantLiabilitiesJanuaryTwentyTwentyOneWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0000890821

ENVB:WarrantLiabilitiesFebruaryTwentyTwentyOneWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0000890821

ENVB:WarrantLiabilitiesFebruaryTwentyTwentyOneWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0000890821

ENVB:WarrantLiabilitiesFebruaryTwentyTwentyTwoWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0000890821

ENVB:WarrantLiabilitiesFebruaryTwentyTwentyTwoWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2023-09-30

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:DerivativeLiabilityMayTwoThousandTwentyTwoMember

2023-09-30

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:DerivativeLiabilityMayTwoThousandTwentyTwoMember

2022-12-31

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-09-30

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2022-12-31

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:RDInvestmentOptionsMember

2023-09-30

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:RDInvestmentOptionsMember

2022-12-31

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:PIPEInvestmentOptionsMember

2023-09-30

0000890821

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

ENVB:PIPEInvestmentOptionsMember

2022-12-31

0000890821

us-gaap:WarrantMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000890821

us-gaap:WarrantMember

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-09-30

0000890821

us-gaap:WarrantMember

us-gaap:FairValueInputsLevel3Member

2023-09-30

0000890821

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000890821

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-09-30

0000890821

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel3Member

2023-09-30

0000890821

us-gaap:OptionMember

us-gaap:FairValueInputsLevel3Member

2022-12-31

0000890821

us-gaap:OptionMember

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-09-30

0000890821

us-gaap:OptionMember

us-gaap:FairValueInputsLevel3Member

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:JanuaryTwentyTwentyOneWarrantsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyOneWarrantsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoWarrantsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoPostModificationWarrantsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:JanuaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoPostModificationWarrantsMember

us-gaap:MeasurementInputSharePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:JanuaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputExercisePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputExercisePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoWarrantsMember

us-gaap:MeasurementInputExercisePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoPostModificationWarrantsMember

us-gaap:MeasurementInputExercisePriceMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:JanuaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoPostModificationWarrantsMember

us-gaap:MeasurementInputExpectedDividendRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:JanuaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputOptionVolatilityMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputOptionVolatilityMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoWarrantsMember

us-gaap:MeasurementInputOptionVolatilityMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoPostModificationWarrantsMember

us-gaap:MeasurementInputOptionVolatilityMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:JanuaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyOneWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:FebruaryTwentyTwentyTwoPostModificationWarrantsMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-01-01

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:RDOfferingInvestmentOptionsMember

2023-01-01

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:PIPEOfferingInvestmentOptionsMember

2023-01-01

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputSharePriceMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputSharePriceMember

ENVB:RDOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputSharePriceMember

ENVB:PIPEOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputExpectedDividendRateMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputExpectedDividendRateMember

ENVB:RDOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputExpectedDividendRateMember

ENVB:PIPEOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputOptionVolatilityMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputOptionVolatilityMember

ENVB:RDOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputOptionVolatilityMember

ENVB:PIPEOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

ENVB:RDOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

ENVB:PIPEOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:RDOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:PIPEOfferingInvestmentOptionsMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:MayTwentyTwentyTwoDerivativeLiabilityMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

us-gaap:MeasurementInputExpectedDividendRateMember

ENVB:MayTwentyTwentyTwoDerivativeLiabilityMember

2023-09-30

0000890821

ENVB:SubsequentMeasurementMember

ENVB:MeasurementInputExpectedMarketRateMember

ENVB:HCWainwrightAndCoLLCInvestmentOptionsMember

2023-09-30

0000890821

ENVB:LabEquipmentMember

2023-09-30

0000890821

ENVB:LabEquipmentMember

2022-12-31

0000890821

ENVB:ComputerEquipmentAndLeaseholdImprovementsMember

2023-09-30

0000890821

ENVB:ComputerEquipmentAndLeaseholdImprovementsMember

2022-12-31

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2023-09-01

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2023-09-01

2023-09-01

0000890821

ENVB:DistributionAgreementMember

ENVB:CanaccordGenuityLLCMember

2023-09-30

0000890821

us-gaap:IPOMember

2022-02-13

2022-02-15

0000890821

us-gaap:IPOMember

2022-02-15

0000890821

ENVB:UnderwritersMember

2022-02-13

2022-02-15

0000890821

ENVB:UnderwritersMember

2022-02-15

0000890821

ENVB:RegisteredDirectSecuritiesPurchaseAgreementMember

2022-07-21

2022-07-22

0000890821

ENVB:RegisteredDirectSecuritiesPurchaseAgreementMember

2022-07-22

0000890821

ENVB:PIPESecuritiesPurchaseAgreementMember

2022-07-21

2022-07-22

0000890821

ENVB:PIPESecuritiesPurchaseAgreementMember

2022-07-22

0000890821

ENVB:RDOfferingAndPIPEInvestmentOptionsMember

2022-07-25

2022-07-26

0000890821

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0000890821

us-gaap:CommonStockMember

2022-01-01

2022-09-30

0000890821

2022-05-02

2022-05-03

0000890821

us-gaap:EmployeeStockOptionMember

2023-07-01

2023-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2022-07-01

2022-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-09-30

0000890821

us-gaap:EmployeeStockOptionMember

2023-09-30

0000890821

us-gaap:RestrictedStockMember

2023-07-01

2023-09-30

0000890821

us-gaap:RestrictedStockMember

2022-07-01

2022-09-30

0000890821

us-gaap:RestrictedStockMember

2023-01-01

2023-09-30

0000890821

us-gaap:RestrictedStockMember

2022-01-01

2022-09-30

0000890821

us-gaap:RestrictedStockMember

2023-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2023-07-01

2023-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2022-07-01

2022-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2023-01-01

2023-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2022-01-01

2022-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2023-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:CommonStockMember

2023-01-01

2023-09-30

0000890821

us-gaap:RestrictedStockUnitsRSUMember

2022-12-31

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2023-07-01

2023-09-30

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2022-07-01

2022-09-30

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-09-30

0000890821

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2023-07-01

2023-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2022-07-01

2022-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2023-01-01

2023-09-30

0000890821

us-gaap:ResearchAndDevelopmentExpenseMember

2022-01-01

2022-09-30

0000890821

us-gaap:WarrantMember

2023-01-01

2023-09-30

0000890821

us-gaap:WarrantMember

2022-01-01

2022-12-31

0000890821

us-gaap:WarrantMember

2022-12-31

0000890821

us-gaap:WarrantMember

2023-09-30

0000890821

ENVB:InvestmentOptionsMember

2023-01-01

2023-09-30

0000890821

ENVB:InvestmentOptionsMember

2022-01-01

2022-12-31

0000890821

ENVB:InvestmentOptionsMember

2023-09-30

0000890821

ENVB:AkosSecuritiesPurchaseAgreementMember

ENVB:SeriesAConvertiblePreferredStockMember

2022-05-04

2022-05-05

0000890821

ENVB:AkosSecuritiesPurchaseAgreementMember

ENVB:SeriesAConvertiblePreferredStockMember

2022-05-05

0000890821

ENVB:AkosSecuritiesPurchaseAgreementMember

2022-05-05

0000890821

ENVB:AkosSecuritiesPurchaseAgreementMember

srt:MaximumMember

2022-05-04

2022-05-05

0000890821

ENVB:AkosSecuritiesPurchaseAgreementMember

us-gaap:SeriesAPreferredStockMember

2022-05-04

2022-05-05

0000890821

ENVB:AkosSecuritiesPurchaseAgreementMember

2022-05-04

2022-05-05

0000890821

ENVB:AkosSecuritiesPurchaseAgreementMember

2023-01-01

2023-09-30

0000890821

ENVB:SecuritiesPurchaseAgreementMember

us-gaap:SeriesAPreferredStockMember

ENVB:AkosMember

2022-05-05

0000890821

ENVB:SecuritiesPurchaseAgreementMember

us-gaap:SeriesAPreferredStockMember

ENVB:AkosMember

2022-05-04

2022-05-05

0000890821

ENVB:SecuritiesPurchaseAgreementMember

2022-05-05

0000890821

us-gaap:SeriesAPreferredStockMember

2023-05-31

0000890821

us-gaap:SeriesAPreferredStockMember

2023-05-01

2023-05-31

0000890821

ENVB:AvanceClinicalMember

2023-03-23

0000890821

ENVB:AvanceClinicalMember

2023-09-30

0000890821

ENVB:AvanceClinicalMember

2023-07-01

2023-09-30

0000890821

ENVB:AvanceClinicalMember

2023-01-01

2023-09-30

0000890821

ENVB:VogalNathanPurchaseAgreementMember

ENVB:OneTimeMilestoneMember

2017-12-25

2017-12-26

0000890821

ENVB:VogalNathanPurchaseAgreementMember

ENVB:AdditionalMilestoneMember

2017-12-25

2017-12-26

0000890821

ENVB:OtherConsultingAndVendorAgreementsMember

2023-09-30

0000890821

ENVB:RegistrationRightsAgreementMember

us-gaap:SubsequentEventMember

ENVB:LincolnParkCapitalFundLLCMember

2023-11-03

2023-11-03

0000890821

ENVB:RegistrationRightsAgreementMember

us-gaap:SubsequentEventMember

2023-11-03

0000890821

ENVB:RegistrationRightsAgreementMember

us-gaap:SubsequentEventMember

2023-11-03

2023-11-03

0000890821

ENVB:TwoThousandTwentyLongTermIncentivePlanMember

us-gaap:SubsequentEventMember

2023-11-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:AUD

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

☒

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the quarterly period ended: September 30, 2023

OR

☐

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the transition period from ___ to ___

Commission

File Number 001-38286

ENVERIC

BIOSCIENCES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

95-4484725 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(IRS

Employer

Identification

No.) |

4851

Tamiami Trail N, Suite 200

Naples,

FL |

|

34103 |

| (Address

of principal executive offices) |

|

(Zip

code) |

| (239)

302-1707 |

| (Registrant’s

telephone number, including area code) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

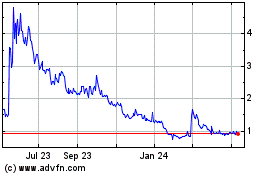

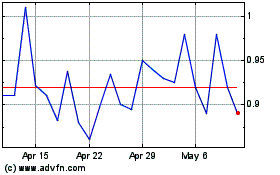

| Common

Stock, $0.01 par value per share |

|

ENVB |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was

required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of November 9, 2023, there were 2,321,315 shares outstanding of Registrant’s Common Stock (par value $0.01 per share).

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

FORM

10-Q

TABLE

OF CONTENTS

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

September 30, 2023 | | |

December 31, 2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 4,266,568 | | |

$ | 17,723,884 | |

| Prepaid expenses and other current assets | |

| 1,560,354 | | |

| 708,053 | |

| Total current assets | |

| 5,826,922 | | |

| 18,431,937 | |

| | |

| | | |

| | |

| Other assets: | |

| | | |

| | |

| Property and equipment, net | |

| 539,152 | | |

| 677,485 | |

| Right-of-use operating lease asset | |

| — | | |

| 63,817 | |

| Intangible assets, net | |

| 253,120 | | |

| 379,686 | |

| Total other assets | |

| 792,272 | | |

| 1,120,988 | |

| Total assets | |

$ | 6,619,194 | | |

$ | 19,552,925 | |

| | |

| | | |

| | |

| LIABILITIES, MEZZANINE EQUITY, AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 1,098,233 | | |

$ | 463,275 | |

| Accrued liabilities | |

| 1,533,829 | | |

| 1,705,655 | |

| Current portion of right-of-use operating lease obligation | |

| — | | |

| 63,820 | |

| Investment option liability | |

| 1,250,929 | | |

| 851,008 | |

| Warrant liability | |

| 300,557 | | |

| 185,215 | |

| Derivative liability | |

| — | | |

| 727,000 | |

| Total current liabilities | |

$ | 4,183,548 | | |

$ | 3,995,973 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 9) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | |

| Series C redeemable preferred stock, $0.01 par value, 100,000 shares authorized, and 0 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| — | | |

| — | |

| Redeemable non-controlling interest | |

| — | | |

| 885,028 | |

| Total mezzanine equity | |

| — | | |

| 885,028 | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Preferred stock, $0.01 par value, 20,000,000 shares authorized; Series B preferred stock, $0.01 par value, 3,600,000 shares authorized, 0 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | |

| — | | |

| — | |

| Common stock, $0.01 par value, 100,000,000 shares authorized, 2,181,912 and 2,078,271 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | |

| 21,818 | | |

| 20,782 | |

| Additional paid-in capital | |

| 96,013,029 | | |

| 94,395,662 | |

| Accumulated deficit | |

| (93,063,582 | ) | |

| (79,207,786 | ) |

| Accumulated other comprehensive loss | |

| (535,619 | ) | |

| (536,734 | ) |

| Total shareholders’ equity | |

| 2,435,646 | | |

| 14,671,924 | |

| Total liabilities, mezzanine equity, and shareholders’ equity | |

$ | 6,619,194 | | |

$ | 19,552,925 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

For the Three Months Ended September 30, | | |

For the Nine Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

$ | 2,010,349 | | |

$ | 3,514,547 | | |

$ | 7,921,340 | | |

$ | 8,783,619 | |

| Research and development | |

| 1,351,750 | | |

| 2,055,656 | | |

| 5,883,440 | | |

| 6,134,421 | |

| Depreciation and amortization | |

| 86,296 | | |

| 86,646 | | |

| 259,300 | | |

| 241,413 | |

| Total operating expenses | |

| 3,448,395 | | |

| 5,656,849 | | |

| 14,064,080 | | |

| 15,159,453 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (3,448,395 | ) | |

| (5,656,849 | ) | |

| (14,064,080 | ) | |

| (15,159,453 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of warrant liabilities | |

| 67,822 | | |

| 1,599,623 | | |

| (115,342 | ) | |

| 3,845,514 | |

| Change in fair value of investment option liability | |

| 562,715 | | |

| 1,809,622 | | |

| (399,921 | ) | |

| 1,809,622 | |

| Change in fair value of derivative liability | |

| — | | |

| (231,000 | ) | |

| 727,000 | | |

| (284,000 | ) |

| Interest income (expense) | |

| 2,237 | | |

| (308 | ) | |

| 3,142 | | |

| (5,114 | ) |

| Total other income | |

| 632,774 | | |

| 3,177,937 | | |

| 214,879 | | |

| 5,366,022 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expense | |

| (6,595 | ) | |

| — | | |

| (6,595 | ) | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (2,822,216 | ) | |

| (2,478,912 | ) | |

| (13,855,796 | ) | |

| (9,793,431 | ) |

| Less preferred dividends attributable to non-controlling interest | |

| — | | |

| 12,603 | | |

| 19,041 | | |

| 20,411 | |

| Less deemed dividends attributable to accretion of embedded derivative at redemption value | |

| — | | |

| 110,991 | | |

| 147,988 | | |

| 184,985 | |

| Net loss attributable to shareholders | |

| (2,822,216 | ) | |

| (2,602,506 | ) | |

| (14,022,825 | ) | |

| (9,998,827 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation | |

| 10,433 | | |

| (417,390 | ) | |

| 1,115 | | |

| (609,695 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

$ | (2,811,783 | ) | |

$ | (3,019,896 | ) | |

$ | (14,021,710 | ) | |

$ | (10,608,522 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share - basic and diluted | |

$ | (1.30 | ) | |

$ | (1.46 | ) | |

$ | (6.62 | ) | |

$ | (8.11 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding, basic and diluted | |

| 2,164,656 | | |

| 1,787,235 | | |

| 2,117,153 | | |

| 1,232,936 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY

FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

| | - |

Shares | | |

Amount | | |

Equity | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Equity | |

| | |

Redeemable

Non-controlling Interest | | |

Total Mezzanine | | |

Common

Stock | | |

Additional Paid-In | | |

Accumulated | | |

Accumulated Other Comprehensive | | |

Total

Shareholders’ | |

| | |

Shares | | |

Amount | | |

Equity | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Equity | |

| Balance at January 1, 2023 | - |

| 1,000 | | |

$ | 885,028 | | |

$ | 885,028 | | |

| 2,078,271 | | |

$ | 20,782 | | |

$ | 94,395,662 | | |

$ | (79,207,786 | ) | |

$ | (536,734 | ) | |

$ | 14,671,924 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 532,835 | | |

| — | | |

| — | | |

| 532,835 | |

| Preferred dividends attributable to redeemable non-controlling

interest | |

| — | | |

| 12,329 | | |

| 12,329 | | |

| — | | |

| — | | |

| (12,329 | ) | |

| — | | |

| — | | |

| (12,329 | ) |

| Accretion of embedded derivative to redemption value | |

| — | | |

| 110,991 | | |

| 110,991 | | |

| — | | |

| — | | |

| (110,991 | ) | |

| — | | |

| — | | |

| (110,991 | ) |

| Foreign exchange translation gain | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,968 | | |

| 1,968 | |

| Net loss | - |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4,677,527 | ) | |

| — | | |

| (4,677,527 | ) |

| Balance at March 31, 2023 | - |

| 1,000 | | |

$ | 1,008,348 | | |

$ | 1,008,348 | | |

| 2,078,271 | | |

$ | 20,782 | | |

$ | 94,805,177 | | |

$ | (83,885,313 | ) | |

$ | (534,766 | ) | |

$ | 10,405,880 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 879,738 | | |

| — | | |

| — | | |

| 879,738 | |

| Preferred dividends attributable to redeemable non-controlling interest | |

| — | | |

| 6,712 | | |

| 6,712 | | |

| — | | |

| — | | |

| (6,712 | ) | |

| — | | |

| — | | |

| (6,712 | ) |

| Accretion of embedded derivative to redemption value | |

| — | | |

| 36,997 | | |

| 36,997 | | |

| — | | |

| — | | |

| (36,997 | ) | |

| — | | |

| — | | |

| (36,997 | ) |

| Redemption of Series A preferred stock | |

| (1,000 | ) | |

| (1,052,057 | ) | |

| (1,052,057 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of common shares in exchange for RSU conversions

from the reduction in force | |

| — | | |

| — | | |

| — | | |

| 63,511 | | |

| 635 | | |

| (635 | ) | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (11,286 | ) | |

| (11,286 | ) |

| Net loss | - |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (6,356,053 | ) | |

| — | | |

| (6,356,053 | ) |

| Balance at June 30, 2023 | - |

| — | | |

$ | — | | |

$ | — | | |

| 2,141,782 | | |

$ | 21,417 | | |

$ | 95,640,571 | | |

$ | (90,241,366 | ) | |

$ | (546,052 | ) | |

$ | 4,874,570 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 372,859 | | |

| — | | |

| — | | |

| 372,859 | |

| Issuance of common shares in exchange for RSU conversions | |

| — | | |

| — | | |

| — | | |

| 40,130 | | |

| 401 | | |

| (401 | ) | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 10,433 | | |

| 10,433 | |

| Net loss | - |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,822,216 | ) | |

| — | | |

| (2,822,216 | ) |

| Balance at September 30, 2023 | - |

| — | | |

$ | — | | |

$ | — | | |

| 2,181,912 | | |

$ | 21,818 | | |

$ | 96,013,029 | | |

$ | (93,063,582 | ) | |

$ | (535,619 | ) | |

$ | 2,435,646 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY

FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Equity | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Income

(Loss) | | |

Equity | |

| | |

Series

C Preferred Stock | | |

Redeemable

Non-controlling Interest | | |

Total Mezzanine | | |

Common

Stock | | |

Additional Paid-In | | |

Accumulated | | |

Accumulated

Other Comprehensive | | |

Total Shareholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Equity | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Income (Loss) | | |

Equity | |

| Balance at January 1, 2022 | |

| — | | |

$ | — | | |

| — | | |

$ | — | | |

| — | | |

| 651,921 | | |

$ | 6,519 | | |

$ | 83,066,656 | | |

$ | (60,736,453 | ) | |

$ | (30,802 | ) | |

$ | 22,305,920 | |

| February 2022 registered direct offering | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 400,000 | | |

| 4,000 | | |

| 5,798,464 | | |

| — | | |

| — | | |

| 5,802,464 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 768,619 | | |

| — | | |

| — | | |

| 768,619 | |

| Conversion of RSUs into common shares | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 899 | | |

| 9 | | |

| (9 | ) | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation gain | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 88,709 | | |

| 88,709 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (4,524,014 | ) | |

| — | | |

| (4,524,014 | ) |

| Balance at March 31, 2022 | |

| — | | |

$ | — | | |

| — | | |

$ | — | | |

$ | — | | |

| 1,052,820 | | |

$ | 10,528 | | |

$ | 89,633,730 | | |

$ | (65,260,467 | ) | |

$ | 57,907 | | |

$ | 24,441,698 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 677,543 | | |

| — | | |

| — | | |

| 677,543 | |

| Redeemable non-controlling interest, net of $402,000 embedded derivative and net of issuance costs of $41,962 | |

| — | | |

| — | | |

| 1,000 | | |

| 556,038 | | |

| 556,038 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Issuance of redeemable non-controlling Series C preferred stock | |

| 52,685 | | |

| 527 | | |

| — | | |

| — | | |

| 527 | | |

| — | | |

| — | | |

| (527 | ) | |

| — | | |

| — | | |

| (527 | ) |

| Preferred dividends attributable to redeemable non-controlling

interest | |

| — | | |

| — | | |

| — | | |

| 7,808 | | |

| 7,808 | | |

| — | | |

| — | | |

| (7,808 | ) | |

| — | | |

| — | | |

| (7,808 | ) |

| Accretion of embedded derivative to redemption value | |

| — | | |

| — | | |

| — | | |

| 73,994 | | |

| 73,994 | | |

| — | | |

| — | | |

| (73,994 | ) | |

| — | | |

| — | | |

| (73,994 | ) |

| Conversion of RSAs into common shares | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,223 | | |

| 12 | | |

| (12 | ) | |

| — | | |

| — | | |

| — | |

| Foreign exchange translation gain | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (281,014 | ) | |

| (281,014 | ) |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,790,505 | ) | |

| — | | |

| (2,790,505 | ) |

| Balance at June 30, 2022 | |

| 52,685 | | |

$ | 527 | | |

| 1,000 | | |

$ | 637,840 | | |

$ | 638,367 | | |

| 1,054,043 | | |

$ | 10,540 | | |

$ | 90,228,932 | | |

$ | (68,050,972 | ) | |

$ | (223,107 | ) | |

$ | 21,965,393 | |

| Balance | |

| 52,685 | | |

$ | 527 | | |

| 1,000 | | |

$ | 637,840 | | |

$ | 638,367 | | |

| 1,054,043 | | |

$ | 10,540 | | |

$ | 90,228,932 | | |

$ | (68,050,972 | ) | |

$ | (223,107 | ) | |

$ | 21,965,393 | |

| Stock-based compensation | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 645,137 | | |

| — | | |

| — | | |

| 645,137 | |

| July 2022 registered direct offering, PIPE offering, modification of warrants and exercise of pre-funded warrants, net of offering costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,000,000 | | |

| 10,000 | | |

| 3,239,125 | | |

| — | | |

| — | | |

| 3,249,125 | |

| Issuance of rounded shares as a result of the reverse stock split | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 24,228 | | |

| 242 | | |

| (242 | ) | |

| — | | |

| — | | |

| — | |

| Preferred dividends attributable to redeemable non-controlling interest | |

| — | | |

| — | | |

| — | | |

| 12,603 | | |

| 12,603 | | |

| — | | |

| — | | |

| (12,603 | ) | |

| — | | |

| — | | |

| (12,603 | ) |

| Accretion of embedded derivatives to redemption value | |

| — | | |

| — | | |

| — | | |

| 110,991 | | |

| 110,991 | | |

| — | | |

| — | | |

| (110,991 | ) | |

| — | | |

| — | | |

| (110,991 | ) |

| Redemption of Series C preferred stock | |

| (52,685 | ) | |

| (527 | ) | |

| — | | |

| — | | |

| (527 | ) | |

| — | | |

| — | | |

| 527 | | |

| — | | |

| — | | |

| 527 | |

| Foreign exchange translation loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (417,390 | ) | |

| (417,390 | ) |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,478,912 | ) | |

| — | | |

| (2,478,912 | ) |

| Balance at September 30, 2022 | |

| — | | |

$ | — | | |

| 1,000 | | |

$ | 761,434 | | |

$ | 761,434 | | |

| 2,078,271 | | |

$ | 20,782 | | |

$ | 93,989,885 | | |

$ | (70,529,884 | ) | |

$ | (640,497 | ) | |

$ | 22,840,286 | |

| Balance | |

| — | | |

$ | — | | |

| 1,000 | | |

$ | 761,434 | | |

$ | 761,434 | | |

| 2,078,271 | | |

$ | 20,782 | | |

$ | 93,989,885 | | |

$ | (70,529,884 | ) | |

$ | (640,497 | ) | |

$ | 22,840,286 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

2023 | | |

2022 | |

| | |

For the Nine Months Ended | |

| | |

2023 | | |

2022 | |

| Cash Flows From Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (13,855,796 | ) | |

$ | (9,793,431 | ) |

| Adjustments to reconcile net loss to cash used in operating activities | |

| | | |

| | |

| Change in fair value of warrant liability | |

| 115,342 | | |

| (3,845,514 | ) |

| Change in fair value of investment option liability | |

| 399,921 | | |

| (1,809,622 | ) |

| Change in fair value of derivative liability | |

| (727,000 | ) | |

| 284,000 | |

| Stock-based compensation | |

| 1,785,432 | | |

| 2,091,299 | |

| Amortization of right-of-use asset | |

| 64,246 | | |

| 103,365 | |

| Amortization of intangible assets | |

| 126,566 | | |

| 126,563 | |

| Depreciation expense | |

| 132,734 | | |

| 114,850 | |

| Gain on disposal of property and equipment | |

| (4,219 | ) | |

| — | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| (746,033 | ) | |

| (758,419 | ) |

| Accounts payable and accrued liabilities | |

| 429,688 | | |

| (106,675 | ) |

| Right-of-use operating lease liability | |

| (64,244 | ) | |

| (91,022 | ) |

| Net cash used in operating activities | |

| (12,343,363 | ) | |

| (13,684,606 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (5,195 | ) | |

| (577,972 | ) |

| Proceeds from disposal of property and equipment | |

| 16,900 | | |

| — | |

| Net cash provided by (used in) investing activities | |

| 11,705 | | |

| (577,972 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities: | |

| | | |

| | |

| Payment for the deferred offering costs from the equity distribution agreement | |

| (105,000 | ) | |

| — | |

| Proceeds from sale of common stock, warrants, and investment options, net of offering costs | |

| — | | |

| 17,222,100 | |

| Redemption of Series A Preferred Stock (see Note 8) | |

| (1,052,057 | ) | |

| — | |

| Proceeds from the sale of redeemable non-controlling interest, net of offering | |

| — | | |

| 958,038 | |

| Net cash (used in) provided by financing activities | |

| (1,157,057 | ) | |

| 18,180,138 | |

| | |

| | | |

| | |

| Effect of foreign exchange rate on cash | |

| 31,399 | | |

| (72,554 | ) |

| | |

| | | |

| | |

| Net (decrease) increase in cash | |

| (13,457,316 | ) | |

| 3,845,006 | |

| Cash at beginning of period | |

| 17,723,884 | | |

| 17,355,999 | |

| Cash at end of period | |

$ | 4,266,568 | | |

$ | 21,201,005 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash and non-cash transactions: | |

| | | |

| | |

| Cash paid for interest | |

$ | — | | |

$ | 5,114 | |

| Income taxes paid | |

$ | 6,595 | | |

$ | — | |

| Warrants issued in conjunction with common stock issuance | |

$ | — | | |

$ | 3,595,420 | |

| Issuance of embedded derivative | |

$ | — | | |

$ | 402,000 | |

| Issuance of redeemable non-controlling Series C preferred stock | |

$ | — | | |

$ | — | |

| Offering costs accrued not paid | |

$ | 20,800 | | |

$ | — | |

| Preferred dividends attributable to redeemable non-controlling interest | |

$ | 19,041 | | |

$ | 20,411 | |

| Accretion of embedded derivative to redemption value | |

$ | 147,988 | | |

$ | 184,985 | |

| Investment options issued in conjunction with common stock issuance | |

$ | — | | |

$ | 4,323,734 | |

| Modification of warrants as part of share capital raise | |

$ | — | | |

$ | 251,357 | |

See

the accompanying notes to the unaudited condensed consolidated financial statements.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1. BUSINESS AND LIQUIDITY AND OTHER UNCERTAINTIES

Nature

of Operations

Enveric

Biosciences, Inc. (“Enveric” or the “Company”) is a biotechnology company developing novel neuroplastogenic small-molecule

therapeutics for the treatment of depression, anxiety, and addiction disorders. The head office of the Company is located in Naples,

Florida. The Company has the following wholly-owned subsidiaries: Jay Pharma Inc. (“Jay Pharma”), 1306432 B.C. Ltd. (“HoldCo”),

MagicMed Industries, Inc. (“MagicMed”), Enveric Canada Inc., and Enveric Therapeutics, Pty. Ltd. (“Enveric Therapeutics”).

Leveraging

its unique discovery and development platform, The Psybrary™, Enveric has created a robust Intellectual Property portfolio of New

Chemical Entities for specific mental health indications. Enveric’s lead program, the EVM201 Series, comprises next generation

synthetic prodrugs of the active metabolite, psilocin. Enveric is developing the first product from the EVM201 Series – EB-373

– for the treatment of psychiatric disorders. Enveric is also advancing its second program, the EVM301 Series, expected to offer

a first-in-class, new approach to the treatment of difficult-to-address mental health disorders, mediated by the promotion of neuroplasticity

without also inducing hallucinations in the patient.

Following

the Company’s amalgamation with MagicMed completed in September 2021 (the “Amalgamation”), the Company has continued

to pursue the development of MagicMed’s proprietary Psychedelic Derivatives library, the Psybrary™ which the Company believes

will help to identify and develop the right drug candidates needed to address mental health challenges, including cancer-related distress.

The Company synthesizes novel versions of classic psychedelics, such as psilocybin, DMT, mescaline and MDMA, using a mixture of chemistry

and synthetic biology, resulting in the expansion of the Psybrary™, which includes 15 patent families with over a million potential

variations and hundreds of synthesized molecules. Within the Psybrary™ the Company has three different types of molecules, Generation

1 (classic psychedelics), Generation 2 (pro-drugs), and Generation 3 (new chemical entities). The Company is working to add novel psychedelic

molecular compounds and derivatives (“Psychedelic Derivatives”) on a regular basis through its work at the Company’s

labs in Calgary, Alberta, Canada, where the Company has a team of PhD scientists with expertise in synthetic biology and chemistry. To

date the Company has created over 500 molecules that are housed in the Psybrary™.

The

Company screens newly synthesized molecules in the Psybrary™ through PsyAI™, a proprietary artificial intelligence (“AI”)

tool. Leveraging AI systems is expected to reduce the time and cost of pre-clinical, clinical, and commercial development. The Company

believes it streamlines pharmaceutical design by predicting ideal binding structures of molecules, manufacturing capabilities, and pharmacological

effects to help determine ideal drug candidates, tailored to each indication. Each of these molecules that the Company believes are patentable

can then be further screened to see how changes to its makeup alter its effects in order to synthesize additional new molecules. New

compounds of sufficient purity are undergoing pharmacological screening, including non-clinical (receptors/cell lines), preclinical (animal),

and ultimately clinical (human) evaluations. The Company intends to utilize the Psybrary™ and the AI tool to categorize and characterize

the Psybrary™ substituents to focus on bringing more psychedelics-inspired molecules from discovery to the clinical phase.

Akos

Spin-Off

On

May 11, 2022, the Company announced plans to transfer and spin-off its cannabinoid clinical development pipeline assets to Akos Biosciences,

Inc. (formerly known as Acanna Therapeutics, Inc.), a majority-owned subsidiary of the Company (hereafter referred to as “Akos”),

which was incorporated on April 13, 2022, by way of dividend to Enveric shareholders (the “Spin-Off”). As of May 12, 2023,

the holders of the Company’s Akos Series A Preferred Stock, par value $0.01 per share (“Akos Series A Preferred Stock”)

have exercised this right to force redemption of all of the Akos Series A Preferred Stock for $1,000 per share, plus accrued but unpaid

dividends of $52,057 for a total of $1,052,057. The Company made full payment on May 19, 2023. See Note 8.

Australian

Subsidiary

On

March 21, 2023, the Company established Enveric Therapeutics, an Australia-based subsidiary, to support the Company’s plans to

advance its lead program, the EVM201 Series, comprised of the next generation synthetic prodrugs of the active metabolite, psilocin (“EVM201

Series”), towards the clinic. Enveric Therapeutics will oversee the Company’s preclinical, clinical, and regulatory activities

in Australia, including ongoing interactions with the local Human Research Ethics Committees (HREC) and the Therapeutic Goods Administration

(TGA), Australia’s regulatory authority.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Going

Concern, Liquidity and Other Uncertainties

The

Company has incurred a loss since inception resulting in an accumulated deficit of $93,063,582 as of September 30, 2023, and further

losses are anticipated in the development of its business. Further, the Company had operating cash outflows of $12,343,363 for the nine

months ended September 30, 2023. For the nine months ended September 30, 2023, the Company had a loss from operations of $14,064,080.

Since its inception, being a research and development company, the Company has not yet generated revenue and the Company has incurred

continuing losses from its operations. The Company’s operations have been funded principally through the issuance of debt and equity.

These factors raise substantial doubt about the Company’s ability to continue as a going concern for a period of one year from

the issuance of these financial statements.

In

assessing the Company’s ability to continue as a going concern, the Company monitors and analyzes its cash and its ability to generate

sufficient cash flow in the future to support its operating and capital expenditure commitments. At September 30, 2023, the Company had

cash of $4,266,568 and working capital of $1,643,374. The Company’s current cash on hand is insufficient to satisfy its operating

cash needs for the 12 months following the filing of this Quarterly Report on Form 10-Q. These conditions raise substantial doubt regarding

the Company’s ability to continue as a going concern for a period of one year after the date the financial statements are issued.

Management’s plan to alleviate the conditions that raise substantial doubt include reducing the Company’s rate of spend,

managing its cash flow, advancing its programs, and raising additional working capital through public or private equity or debt financings

or other sources, which has included the Equity Distribution Agreement with Canaccord for proceeds of up to $2.4 million (see Note 7) and the Purchase Agreement with Lincoln Park (see Note 10), subject to registration, and may include collaborations

with additional third parties, as well as disciplined cash spending, to increase the Company’s cash runway. Adequate additional

financing may not be available to the Company on acceptable terms, or at all. Should the Company be unable to raise sufficient additional

capital, the Company may be required to undertake cost-cutting measures including delaying or discontinuing certain operating activities.

The

Company’s material cash requirements consist of working capital to fund capital expenditures incurred at their research facility

in Calgary and their operations, which consist primarily of, without limitation, employee related expenses, product development activities

conducted by third parties, research materials and lab supplies, facility related expenses including rent and maintenance, costs associated

with preclinical studies, patent related costs, costs of regulatory and public company compliance, insurance costs, audit costs, consultants

and legal fees. Additionally, the Company currently utilizes third-party contract research organizations (“CROs”) to assist

with clinical development activities. If the Company obtains regulatory approval for any of their product candidates, they expect to

incur significant expenses to engage third-party contract manufacturing organizations (“CMOs”) to carry out their clinical

manufacturing activities as it does not yet have a commercialization infrastructure, and incur significant expenses related to developing

its internal commercialization capability to support product sales, marketing and distribution. The Company’s current working capital

resources are insufficient to fund these material cash requirements for the next twelve months.

As

a result of these factors, management has concluded that there is substantial doubt about the Company’s ability to continue as

a going concern for a period of one year after the date of the financial statements are issued. The Company’s unaudited condensed

consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Reduction

in Force/Restructuring

In

May 2023, the Company entered into a cost reduction plan, including a reduction in force of approximately 35% of its full-time employees

to streamline its operations and conserve cash resources. Additionally, contracts with seven consultants that were focused on the Akos

cannabinoid spin-out were terminated. The Company recognized severance charges of approximately $453,059 through September 30, 2023.

The plan included a focus on progressing the Company’s existing non-cannabinoid pipeline while reducing the rate of spend and managing

cash flow. In June 2023, the Company completed the reduction in force, with such severance expenses recorded in general and administrative

accounts.

On

June 16, 2023, the Company entered into a separation agreement with Avani Kanubaddi, the Company’s President and Chief Operating

Officer (the “Kanubaddi Separation Agreement”). In accordance with the Kanubaddi Separation Agreement, Mr. Kanubaddi’s

outstanding restricted stock units (“RSUs”) will retain their vesting conditions. Mr. Kanubaddi’s 2023 salary and benefits

of $550,974 were accrued and will be paid out in twelve equal monthly installments beginning in July 2023. Upon termination, any unvested

time-based RSUs became fully vested. The Company accelerated expense recognized related to these shares that vested was $231,273. Of

the 11,278 market performance-based RSUs previously granted, 3,759 will continue to be subject to the original terms and conditions of

Mr. Kanubaddi’s employment agreement and the remainder were forfeited.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SCHEDULE

OF RESTRUCTURING COSTS PAYABLE

| | |

Accrued Restructuring Costs | |

| January 1, 2023 Beginning balance | |

$ | — | |

| Restructuring costs incurred | |

| 1,004,033 | |

| Restructuring costs paid | |

| (396,431 | ) |

| September 30, 2023 ending balance | |

$ | 607,602 | |

Inflation

Risks

The

Company considers the current inflationary trend existing in the North American economic environment reasonably likely to have a material

unfavorable impact on results of continuing operations. Higher rates of price inflation, as compared to recent prior levels of price

inflation, have caused a general increase in the cost of labor and materials. In addition, there is an increased risk of the Company

experiencing labor shortages due to a potential inability to attract and retain human resources due to increased labor costs resulting

from the current inflationary environment.

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation and Principal of Consolidation

The

accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally

accepted in the United States (“U.S. GAAP”) for interim financial information and Article 8 of Regulation S-X. Accordingly,

they do not include all the information and footnotes required by U.S. GAAP for complete financial statements. Management’s opinion

is that all adjustments (consisting of normal accruals) considered necessary for a fair presentation have been included. Operating results

for the three and nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year

ending December 31, 2023. These unaudited condensed consolidated financial statements should be read in conjunction with the consolidated

financial statements for the year ended December 31, 2022, and related notes thereto included in the Company’s Annual Report on

Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on March 31, 2023 and subsequently amended on Form

10-K/A Amendment No. 1 filed with the SEC on June 9, 2023 (as amended, the “Annual Report”).

The

Company’s significant accounting policies and recent accounting standards are summarized in Note 2 of the Company’s consolidated

financial statements for the year ended December 31, 2022. There were no significant changes to these accounting policies during the

three and nine months ended September 30, 2023.

Use

of Estimates

The

preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates

and assumptions that affect the reported amount of assets and liabilities at the date of the financial statements and expenses during

the periods reported. By their nature, these estimates are subject to measurement uncertainty and the effects on the financial statements

of changes in such estimates in future periods could be significant. Significant areas requiring management’s estimates and assumptions

include determining the fair value of transactions involving common stock and the valuation of stock-based compensation, accruals associated

with third party providers supporting research and development efforts, and estimated fair values of long lived assets used to record

impairment charges related to intangible assets. Actual results could differ from those estimates.

Foreign

Currency Translation

From

inception through September 30, 2023, the reporting currency of the Company was the United States dollar while the functional currency

of certain of the Company’s subsidiaries was the Canadian dollar and Australian dollar. For the reporting periods ended September

30, 2023 and 2022, the Company engaged in a number of transactions denominated in Canadian dollars and Australian dollars. As a result,

the Company is subject to exposure from changes in the exchange rates of the Canadian dollar and Australian dollar against the United

States dollar.

The

Company translates the assets and liabilities of its Canadian subsidiaries and Australian subsidiary into the United States dollar at

the exchange rate in effect on the balance sheet date. Revenues and expenses are translated at the average exchange rate in effect during

each monthly period. Unrealized translation gains and losses are recorded as foreign currency translation gain (loss), which is included

in the condensed consolidated statements of shareholders’ equity as a component of accumulated other comprehensive loss.

ENVERIC

BIOSCIENCES, INC. AND SUBSIDIARIES

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The

Company has not entered into any financial derivative instruments that expose it to material market risk, including any instruments designed

to hedge the impact of foreign currency exposures. The Company may, however, hedge such exposure to foreign currency exchange fluctuations

in the future.

Adjustments

that arise from exchange rate changes on transactions denominated in a currency other than the local currency are included in other comprehensive

loss in the condensed consolidated statements of operations and comprehensive loss as incurred.

Concentration

of Credit Risk

Financial

instruments that potentially subject the Company to concentrations of credit risk consist of cash accounts in a financial institution,

which at times, may exceed the federal depository insurance coverage of $250,000 in the United States and Australia and $100,000 in Canada.

The Company has not experienced losses on these accounts, and management believes the Company is not exposed to significant risks on

such accounts. As of September 30, 2023, the Company had greater than $250,000 at United States financial institutions, less than $250,000

at Australian financial institutions, and greater than $100,000 at Canadian financial institutions.

Deferred

Offering Costs

The