0001761918false00017619182024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 12, 2024 |

Erasca, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40602 |

83-1217027 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

3115 Merryfield Row Suite 300 |

|

San Diego, California |

|

92121 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 465-6511 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

ERAS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Erasca, Inc. announced its financial results for the three months ended September 30, 2024. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

Exhibit Description

99.1 Press Release issued November 12, 2024

104 Cover Page Interactive Data File

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Erasca, Inc. |

|

|

|

|

Date: |

November 12, 2024 |

By: |

/s/ Ebun Garner |

|

|

|

General Counsel |

Erasca Reports Third Quarter 2024 Business Updates and Financial Results

Positive preliminary Phase 1b data in SEACRAFT-1 NRASm melanoma cohort bolsters conviction in ongoing SEACRAFT-2 registrational trial; Stage 1 randomized data expected in 2025

Strong execution across potentially best-in-class RAS targeting franchise; planned IND submissions on track

Robust balance sheet with cash, cash equivalents, and marketable securities of $463 million as of September 30, 2024, is expected to fund operations into H1 2027

SAN DIEGO, November 12, 2024 (GLOBE NEWSWIRE) -- Erasca, Inc. (Nasdaq: ERAS), a clinical-stage precision oncology company singularly focused on discovering, developing, and commercializing therapies for patients with RAS/MAPK pathway-driven cancers, today provided business updates and reported financial results for the fiscal quarter ended September 30, 2024.

“We made significant progress across our pipeline programs and are pleased with the pace of our execution. Positive preliminary data from SEACRAFT-1, which we reported at the 36th EORTC-NCI-AACR (ENA) Symposium last month, has refined our clinical development focus of naporafenib plus trametinib on patients with NRAS-mutant (NRASm) melanoma, and importantly, heightens our conviction in the ongoing SEACRAFT-2 registrational trial targeting a similar patient population,” said Jonathan E. Lim, M.D., Erasca’s chairman, CEO, and co-founder. “SEACRAFT-2 has the potential for approval based on the high unmet need of these patients as well as the alignment with US and European regulators on the NRASm melanoma indication. We expect randomized dose optimization data from Stage 1 of this Phase 3 trial in 2025.”

Dr. Lim added, “Our RAS targeting franchise, which includes a potential best-in-class pan-RAS molecular glue ERAS-0015 and a potential first-in-class pan-KRAS inhibitor ERAS-4001, holds significant promise to help a broad range of patients with RAS-mutant (RASm) solid tumors. Following the in-licensing of these molecules in May, we have rapidly and effectively confirmed in-house the potential best-in-class profiles of both agents and executed across multiple activities to support their planned investigational new drug (IND) application submissions, which remain on track for the first quarter of 2025 for ERAS-4001 and the first half of 2025 for ERAS-0015. We continue to be well capitalized with an anticipated cash runway into the first half of 2027 and are poised for strong execution across our pipeline.”

Research and Development (R&D) Highlights

•Presented Promising SEACRAFT-1 Phase 1 Data: In October 2024, Erasca presented Phase 1b SEACRAFT-1 data for naporafenib plus trametinib (MEKINIST®) in patients with locally advanced unresectable or metastatic solid tumor malignancies with RAS Q61X mutations at the 36th EORTC-NCI-AACR (ENA) Symposium on Molecular Targets and Cancer Therapeutics and as part of a company R&D update. Data support rationale for pursuing an NRASm melanoma indication and reinforces the potential of the ongoing Phase 3 SEACRAFT-2 registrational trial.

•Announced Progress Across RAS Targeting Franchise: In October 2024, Erasca presented a program update for pan-RAS molecular glue ERAS-0015 and pan-KRAS inhibitor ERAS-4001 as part of a company R&D update, highlighting the rapid progress across both programs including in-house

confirmation of potential best-in-class profiles for both agents and advancement of activities to support planned IND application submissions.

Key Upcoming Milestones

•SEACRAFT-2: Randomized pivotal Phase 3 trial for naporafenib plus trametinib in patients with NRASm melanoma

oPhase 3 Stage 1 randomized dose optimization data expected to be reported in 2025

•AURORAS-1: Phase 1 trial for ERAS-0015 (pan-RAS molecular glue) in patients with RASm solid tumors

oIND filing expected in H1 2025

oInitial Phase 1 monotherapy data in relevant tumor types expected to be reported in 2026

•BOREALIS-1: Phase 1 trial for ERAS-4001 (pan-KRAS inhibitor) in patients with KRASm solid tumors

oIND filing expected in Q1 2025

oInitial Phase 1 monotherapy data in relevant tumor types expected to be reported in 2026

Third Quarter 2024 Financial Results

Cash Position: Cash, cash equivalents, and marketable securities were $463.3 million as of September 30, 2024, compared to $322.0 million as of December 31, 2023. Erasca expects its current cash, cash equivalents, and marketable securities balance of $463.3 million to fund operations into the first half of 2027.

Research and Development (R&D) Expenses: R&D expenses were $27.6 million for the quarter ended September 30, 2024, compared to $25.2 million for the quarter ended September 30, 2023. The increase was primarily driven by increases in expenses incurred in connection with clinical trials, preclinical studies, and discovery activities, partially offset by decreases in personnel costs, including stock-based compensation expense, and outsourced services and consulting fees.

General and Administrative (G&A) Expenses: G&A expenses were $9.6 million for the quarter ended September 30, 2024, compared to $9.4 million for the quarter ended September 30, 2023.

Net Loss: Net loss was $31.2 million, or $(0.11) per basic and diluted share, for the quarter ended September 30, 2024, compared to $30.4 million, or $(0.20) per basic and diluted share, for the quarter ended September 30, 2023.

About Erasca

At Erasca, our name is our mission: To erase cancer. We are a clinical-stage precision oncology company singularly focused on discovering, developing, and commercializing therapies for patients with RAS/MAPK pathway-driven cancers. Our company was co-founded by leading pioneers in precision oncology and RAS targeting to create novel therapies and combination regimens designed to comprehensively shut down the RAS/MAPK pathway for the treatment of patients with cancer. We have assembled one of the deepest RAS/MAPK pathway-focused pipelines in the industry. We believe our team’s capabilities and experience, further guided by our scientific advisory board which includes the world’s leading experts in the RAS/MAPK pathway, uniquely position us to achieve our bold mission of

erasing cancer.

Cautionary Note Regarding Forward-Looking Statements

Erasca cautions you that statements contained in this press release regarding matters that are not historical facts are forward-looking statements. The forward-looking statements are based on our current beliefs and expectations and include, but are not limited to: our expectations regarding the potential therapeutic benefits of our product candidates, including naporafenib, ERAS-0015, and ERAS-4001; the planned advancement of our development pipeline, including the anticipated timing of data readouts for the SEACRAFT-2, AURORAS-1, and BOREALIS-1 trials; our alignment with regulatory authorities on the regulatory pathway for naporafenib; the anticipated timing of the IND filings for the AURORAS-1 and BOREALIS-1 trials; our ability to successfully prioritize our pipeline portfolio to focus on existing programs that we believe have the highest probability of success; and the sufficiency of our cash, cash equivalents, and marketable securities to fund operations into the first half of 2027. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in our business, including, without limitation: our approach to the discovery and development of product candidates based on our singular focus on shutting down the RAS/MAPK pathway, a novel and unproven approach; results from preclinical studies or early clinical trials not necessarily being predictive of future results; preliminary results of clinical trials are not necessarily indicative of final results and one or more of the clinical outcomes may materially change as patient enrollment continues, following more comprehensive reviews of the data and more patient data become available; our planned SEACRAFT trials may not support the registration of naporafenib; our assumptions about ERAS-0015’s or ERAS-4001’s development potential are based in large part on the preclinical data generated by the licensors and we may observe materially and adversely different results as we conduct our planned studies and trials; we only have one product candidate in clinical development and all of our other development efforts are in the preclinical or development stage; our assumptions around which programs may have a higher probability of success may not be accurate, and we may expend our limited resources to pursue a particular product candidate and/or indication and fail to capitalize on product candidates or indications with greater development or commercial potential; potential delays in the commencement, enrollment, data readout, and completion of clinical trials and preclinical studies; our dependence on third parties in connection with manufacturing, research, and preclinical and clinical testing; unexpected adverse side effects or inadequate efficacy of our product candidates that may limit their development, regulatory approval, and/or commercialization, or may result in recalls or product liability claims; unfavorable results from preclinical studies or clinical trials; the inability to realize any benefits from our current licenses, acquisitions, and collaborations, and any future licenses, acquisitions, or collaborations, and our ability to fulfill our obligations under such arrangements; regulatory developments in the United States and foreign countries; later developments with the FDA or EU health authorities may be inconsistent with the feedback received to date regarding our development plans and trial designs; our ability to obtain and maintain intellectual property protection for our product candidates and maintain our rights under intellectual property licenses; we may use our capital resources sooner than we expect; and other risks described in our prior filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2023, and any subsequent filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to update such statements to reflect events that occur or circumstances that

exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Erasca, Inc.

Selected Condensed Consolidated Balance Sheet Data

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Balance Sheet Data: |

|

|

|

|

|

|

Cash, cash equivalents, and marketable securities |

|

$ |

463,303 |

|

|

$ |

321,992 |

|

Working capital |

|

|

300,149 |

|

|

|

294,520 |

|

Total assets |

|

|

528,896 |

|

|

|

395,297 |

|

Accumulated deficit |

|

|

(735,431 |

) |

|

|

(606,013 |

) |

Total stockholders’ equity |

|

|

450,042 |

|

|

|

316,686 |

|

Erasca, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

|

Nine months ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

$ |

27,631 |

|

|

$ |

25,213 |

|

|

$ |

89,237 |

|

|

$ |

79,016 |

|

In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

22,500 |

|

|

|

— |

|

General and administrative |

|

|

9,611 |

|

|

|

9,445 |

|

|

|

32,138 |

|

|

|

28,637 |

|

Total operating expenses |

|

|

37,242 |

|

|

|

34,658 |

|

|

|

143,875 |

|

|

|

107,653 |

|

Loss from operations |

|

|

(37,242 |

) |

|

|

(34,658 |

) |

|

|

(143,875 |

) |

|

|

(107,653 |

) |

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

5,869 |

|

|

|

4,346 |

|

|

|

14,810 |

|

|

|

12,474 |

|

Other income (expense), net |

|

|

173 |

|

|

|

(49 |

) |

|

|

(353 |

) |

|

|

(162 |

) |

Total other income (expense), net |

|

|

6,042 |

|

|

|

4,297 |

|

|

|

14,457 |

|

|

|

12,312 |

|

Net loss |

|

$ |

(31,200 |

) |

|

$ |

(30,361 |

) |

|

$ |

(129,418 |

) |

|

$ |

(95,341 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.60 |

) |

|

$ |

(0.64 |

) |

Weighted-average shares of common stock used in computing net loss per share, basic and diluted |

|

|

282,384,964 |

|

|

|

150,450,201 |

|

|

|

217,355,959 |

|

|

|

150,000,613 |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on marketable securities, net |

|

|

2,021 |

|

|

|

218 |

|

|

|

1,748 |

|

|

|

466 |

|

Comprehensive loss |

|

$ |

(29,179 |

) |

|

$ |

(30,143 |

) |

|

$ |

(127,670 |

) |

|

$ |

(94,875 |

) |

MEKINIST® is a registered trademark owned by or licensed to Novartis AG, its subsidiaries, or affiliates.

Contact:

Joyce Allaire

LifeSci Advisors, LLC

jallaire@lifesciadvisors.com

Source: Erasca, Inc.

v3.24.3

Document And Entity Information

|

Nov. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity Registrant Name |

Erasca, Inc.

|

| Entity Central Index Key |

0001761918

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40602

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

83-1217027

|

| Entity Address, Address Line One |

3115 Merryfield Row

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

(858)

|

| Local Phone Number |

465-6511

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

ERAS

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

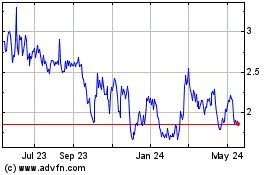

Erasca (NASDAQ:ERAS)

Historical Stock Chart

From Oct 2024 to Nov 2024

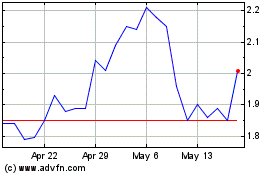

Erasca (NASDAQ:ERAS)

Historical Stock Chart

From Nov 2023 to Nov 2024