false

0001357971

0001357971

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

October 30, 2024

Energy Services of America Corporation

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

001-32998 |

20-4606266 |

(State or other Jurisdiction

of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

| 75

West 3rd Ave., Huntington,

West Virginia |

25701 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| Registrant’s telephone number, including area code: |

(304) 522-3868 |

|

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Ticker symbol(s) |

Name of each exchange on which registered |

| Common Stock, Par Value $0.0001 |

ESOA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

1.01 Entry into a material definitive agreement.

On October 30, 2024,

Energy Services of America Corporation’s (the “Company”) newly formed wholly owned subsidiary, Tribute Acquisition Company

(“Tribute Acquisition”), an Ohio corporation, entered into an Asset Purchase Agreement (the “Agreement”) with

Tribute Contracting & Consultants, LLC (“Tribute”), an Ohio corporation located in South Point, Ohio.

Pursuant to the Agreement,

Tribute Acquisition will acquire substantially all the assets of Tribute for $22.0 million in cash, less any assumed debt and working

capital adjustments, and $2.0 million of the Company’s common stock. The transaction will be subject to customary closing conditions

and has been approved by Tribute’s co-owners, Tom Enyart and Todd Harrah (“Sellers”). The Company and Tribute each made

customary representations, warranties, and covenants in the Agreement. Each party also agreed to indemnify each other (subject to customary

limitations) with respect to the transaction. The Company expects the transaction will close on or about December 2, 2024 (the “Closing

Date”).

Mr. Enyart will continue his employment with

the Company’s new subsidiary. As part of the Agreement, Mr. Enyart agreed to a thirty-six (36) month Executive Officer Employment

Agreement and a sixty month (60) Non-Competition Agreement.

Mr. Harrah will continue his employment with

the Company’s new subsidiary. As part of the Agreement, Mr. Harrah agreed to a sixty (60) month Executive Officer Employment

Agreement and a sixty month (60) Non-Competition Agreement.

The Sellers will receive $2.0

million of the Company’s Common Stock with 50% to be issued to Mr. Enyart and 50% to be issued to Mr. Harrah pursuant

to certain exemptions under The Securities Act of 1933. The market value of the stock consideration shall be determined by averaging the

daily closing prices of the Company’s common stock as reported on the Nasdaq Capital Market during the ten (10) consecutive

days on which shares are traded immediately prior to two business days immediately prior to the Closing Date.

The foregoing summary of the

Agreement is not complete and is qualified in its entirety by reference to the complete text of the Agreement, which is filed as Exhibit 2.1

to this Current Report on Form 8-K and incorporated by reference herein.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit 2.1 Asset Purchase Agreement dated October 30, 2024*

104 Cover Page Interactive Data File

(the cover page XBRL tags are embedded within the Inline XBRL document)

*The schedules and exhibits have been omitted pursuant to Item 601(b)(2) of

Regulation S-K. The Company agrees to furnish a copy of such schedules and exhibits, or any section thereof, to the SEC upon

request.

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

ENERGY SERVICES OF AMERICA CORPORATION |

| |

|

| DATE: November 4, 2024 |

By: |

/s/ Charles Crimmel |

| |

|

Charles Crimmel |

| |

|

Chief Financial Officer |

Exhibit 2.1

ASSET PURCHASE AGREEMENT

TRIBUTE CONTRACTING & CONSULTANTS LLC,

AN OHIO LIMITED LIABILITY COMPANY

TO

TRIBUTE ACQUISITION COMPANY

AN OHIO CORPORATION, BUYER

October 30, 2024

TABLE OF CONTENTS

| Paragraph |

Page |

| 1. |

Sale of Assets |

1 |

| 2. |

Retained Assets |

5 |

| 3. |

Purchase Price |

5 |

| 4. |

Closing Date and Place |

11 |

| 5. |

Representations and Warranties of Company |

11 |

| 6. |

Covenants of the Company |

15 |

| 7. |

Representations and Warranties of Buyer |

17 |

| 8. |

Non-Competition |

18 |

| 9. |

Conditions Precedent to Buyer's Obligations |

18 |

| 10. |

Conditions to Closing by Company |

20 |

| 11. |

Termination of Agreement |

21 |

| 12. |

Additional Documents and Acts after Closing |

24 |

| 13. |

Non-Assumption of Liability |

24 |

| 14. |

Indemnification |

26 |

| 15. |

Risk of Loss |

26 |

| 16. |

Brokerage |

27 |

| 17. |

Survival of Representations, Warranties and Agreements |

27 |

| 18. |

Benefit |

27 |

| 19. |

Modification |

28 |

| 20. |

Nonwaiver |

28 |

| 21. |

Entire Agreement |

28 |

| 22. |

Descriptive Headings |

28 |

| 23. |

Notices |

28 |

| 24. |

Counterparts |

29 |

| 25. |

Binding Nature; Assignments |

29 |

| 26. |

Governing Law and Venue |

30 |

| 27. |

Legal Fees and Expenses; Other Expenses |

30 |

| 28. |

Invalid Provisions |

30 |

| 29. |

Dispute Resolution Venue |

30 |

| |

Signatures |

31 |

SCHEDULES

| 1(a) |

Assets – Machinery and Equipment |

| |

|

| 1(b) |

Assets – Customer and Vendor List |

| |

|

| 1(c)(i) |

Assets – Accounts Receivable |

| |

|

| 1(c)(ii) |

Assets – Bank Accounts |

| |

|

| 1(d) |

Assets – Intellectual Property |

| |

|

| 1(e) |

Assets – Inventory |

| |

|

| 1(f)(i) |

Assets – Assignable Contracts |

| |

|

| 1(f)(ii) |

Assets – Assignable Subcontracts |

| |

|

| 1(f)(iii) |

Assets – Assignable Purchase Orders |

| |

|

| 1(f)(iv) |

Assets – Other Contracts |

| |

|

| 1(l) |

Assets – List of Real Property |

| |

|

| 2 |

Retained Assets |

| |

|

| 3(c) |

Allocation of Purchase Price |

| |

|

| 5(h) |

Assumed Liabilities |

EXHIBITS

| A |

Bill of Sale and Assignment |

| |

|

| B |

Employment Agreements |

| |

|

| C |

Non-Competition Agreements |

| |

|

| D |

Deed |

ASSET PURCHASE AGREEMENT

THIS AGREEMENT is made and entered into as of the

30th day of October, 2024, by and between TRIBUTE CONTRACTING & CONSULTANTS LLC, an Ohio limited liability company,

hereinafter called the "Company" and TRIBUTE ACQUISITION COMPANY, an Ohio corporation wholly owned by Energy Services of America

Corporation, hereinafter called the "Buyer".

WHEREAS, Company is engaged in the business of

underground pipeline construction, site utilities, sanitary sewer lines, gas and water distribution and storm drainage (the “Business);

and

WHEREAS, the parties have reached an understanding

with respect to the sale of certain of the assets and Business of Company and the purchase by the Buyer of such assets and Business.

NOW, THEREFORE, in consideration of the premises,

which are not mere recitals but are an integral part hereof, and in further consideration of the mutual covenants and promises herein

contained, and for other good and valuable consideration, the receipt and sufficiency of all of which are hereby acknowledged, the parties

hereto agree as follows:

1. Sale of Assets.The

Company agrees that, at the Closing, the Company shall sell, transfer, and deliver to the Buyer for the consideration hereinafter provided,

certain of the assets of the Company (hereinafter the “Purchased Assets”), consisting of:

(a) All

the Company’s machinery and equipment including but not limited to that machinery and equipment listed on Schedule 1(a) attached

hereto and incorporated herein by reference;

(b) lists

of customers, distributors and vendors including, without limitation, those listed on Schedule 1(b) to the Agreement under the heading

“Customer List” and “Vendor List” and copies of all files and documents relating to the customers, distributors

and vendors identified on such lists (collectively, the “Customer and Vendor List”);

(c) the

Company’s Accounts Receivable as listed on Schedule 1(c)(i) and Bank Accounts as listed on Schedule 1(c)(ii);

(d) all

of the Company's intellectual property, copyrights, patents, trademarks, trade secrets, tradenames, Company's rights in the name "Tribute

Contracting & Consultants LLC" and all variants and derivations thereof, including any "dba" names; all of Company's

rights in all telephone and fax numbers currently used by Company; all of Company's rights in all domain names and other rights with respect

to any World Wide Web site or sites maintained by or registered in the name of or owned by Company, and/or Company's rights in the content,

information and databases contained thereon; and all other intellectual property of Company and all associated goodwill, including without

limitation, all of the foregoing listed on Schedule 1(d) attached hereto and incorporated herein by reference (collectively, the

"Intellectual Property"); and

(e) all

inventory, including finished products, work in progress and raw materials to be used in production of finished goods ("Inventory")

as listed on Schedule 1(e);

(f) all

assignable contracts (including these listed on Schedule 1(f)(i)), subcontracts (including those listed on Schedule 1(f)(ii)), purchase

orders, leases, rental agreements, and vendor agreements (including those listed on Schedule 1(f)(iii)) and other arrangements, commitments

and agreements, including all costumer agreements, instillations, and maintenance agreements, computer software licenses, hardware leases

or rental agreements, and all other arrangements and understanding including those listed on Schedule 1(f)(iv) and all of Company’s

rights and interests thereunder (collectively, the “Contracts”).

(g) all

books of account, ledgers, invoices, forms, records, documents, files, vendor or supplier lists, business records (excluding corporate

minute books and stock ownership records), plans and other data which are reasonably necessary for ownership, use, maintenance or enjoyment

of the Purchased Assets or the operation of the Business including, without limitation, all blueprints and specifications, all personnel,

payroll, payroll tax and labor relations records, all environmental control records, environmental impact records, statements, studies

and related documents, handbooks, technical manuals and data, engineering specifications and work papers, all pricing and cost information,

all sales records, reports, files and records, asset history records and files, all data entry and accounting systems, all maintenance

and repair records, all correspondence, notices, citations, and all other documents in Company’s possession in connection with any

governmental authority (including, without limitation, federal, state, county or regional environmental protection, air or water quality

control and occupational health and safety) (hereinafter the “Authorities”), and all plans and designs of equipment as are

reasonably necessary to the ownership, use, maintenance or enjoyment of the Purchased Assets or the operation of the Business (collectively,

the “Records”); provided, however, that (i) the Records shall not include any item relating primarily to any Retained

Assets (as hereinafter defined in Paragraph 2), (ii) in the event Company is required to produce an original document by judicial,

arbitration or regulatory proceeding, Buyer shall deliver such original document to Company (such document to be returned to Buyer as

soon thereafter as permitted by such judicial, arbitration or regulatory proceeding), (iii) during the five (5) year period

following Closing, Company shall have a continuing right during normal business hours and upon five (5) days advance written notice

to Buyer to review and copy Records of which Company has no copy, (iv) prior to the destruction of any Records, Buyer shall use good

faith efforts to so notify Company and Company shall have the right to elect to take possession thereof, and (v) Company may retain

copies of such Records as are reasonably necessary to enable Company to fulfill its regulatory or statutory obligations after the Closing

Date;

(h) all

sales and marketing plans, projections, studies, reports and other documents and data (including, without limitation, creative materials,

advertising and other promotional matters and current and past lists of customers), and all training materials and marketing brochures;

(i) goodwill

related to the Business;

(j) all

rights and remedies on and after the Closing Date, under warranty or otherwise, against a manufacturer, vendor or other person for any

defects in any Purchased Asset;

(k) all

other personal property, assets and rights of every kind, character or description which are owned by or used by Company, plus the amount

of any note payable, account payable or any other sum payable as a result of a liability which has been assumed or is charged to Buyer,

and which are not Retained Assets;

(l) all

real estate in the name of Company, including but not limited to that certain real estate listed on Schedule 1(l); and

(m) all

causes of action, choses in action and rights of recovery with respect to any of the foregoing.

At the Closing the Company shall transfer

and assign the Purchased Assets pursuant to a Bill of Sale and Assignment in the form of Exhibit A and a Deed in the form of Exhibit D

attached hereto and made a part hereof. Such transfer shall be made free and clear of all liabilities, mortgages, liens, obligations,

security interests, and encumbrances except such that are expressly assumed in writing by Buyer.

2. Retained Assets. All

of the assets of Company identified on Schedule 2 to this Agreement under the heading “Retained Assets” which are expressly

excluded from this transaction. It being understood that the amount of Retained Assets will be approximately One Million Dollars ($1,000,000).

3. Purchase

Price. Subject to the terms of this Agreement, the Buyer shall purchase the Purchased Assets and,

in full consideration therefor, shall pay, subject to the adjustments provided for herein, the principal sum equal to Twenty-Four Million

Dollars ($24,000,000) (the “Purchase Price”).

A. Payment

of Purchase Price. The Purchase Price shall be paid as follows:

(1) The

amount of Twenty-Two Million Dollars ($22,000,000) less any adjustments to Purchase Price set forth in Paragraph 3(B) to be paid

by Buyer in immediately available funds at Closing; and

(2) Common

Stock of Parent with a Market Value of Two Million Dollars ($2,000,000) calculated as set forth below will be issued to the Members at

Closing in the following proportions – Todd Harrah 50% (“Harrah”) and Tommy Enyart 50% (“Enyart”) (“Parent

Common Stock”) Harrah and Enyart hereinafter referred to as the “Members.”

All shares of Parent Common Stock shall

be fully paid. The market value shall be determined by averaging the daily closing prices of Parent Common Stock as reported on Nasdaq

Capital Market during the ten (10) consecutive days on which shares of Parent Common Stock are traded on the Nasdaq Capital Market

immediately prior to the Valuation Date (“Market Value”). The Valuation Date shall be the business day two business days immediately

prior to the Closing Date.

Company and Members acknowledge and agree,

and Members will acknowledge and agree in Investment Letters to be executed by them, that the Parent Common Stock at this time will not

be registered under the Securities Act of 1933 (the “Securities Act”) or any state securities laws, and must be held at least

six (6) months after issuance unless such Parent Common Stock is subsequently registered under the Securities Act or under state

securities acts, or unless an exemption from registration is available.

Company and Members further acknowledge

and agree, except as otherwise provided herein, and Members will further acknowledge and agree in their Investment Letter, that Parent

is under no obligation, and shall assume no obligation, to cause such shares of Parent Common Stock to be registered, and that each certificate

representing shares of Parent Common Stock issued to Members shall be stamped or otherwise imprinted with, or contain a legend in substantially

the following form:

“The securities represented by this instrument have not

been registered under the Federal Securities Act of 1933, or any state securities statute and may not be sold, assigned, or transferred

unless (i) registered for resale or (ii) the issuer hereof has received the written opinion of counsel for said issuer that

after investigation of relevant facts, such counsel is of the opinion that such sale, assignment or transfer does not involve a transaction

requiring a registration of such securities under the Federal Securities Act of 1933. ”

Parent agrees that 180 days after execution

of the Investment Letter that Members may request and Parent shall forthwith without delay or condition cause the legend set forth in

the preceding paragraph to be removed from any stock certificates of Members.

Members shall further acknowledge in

their Investment Letters that Parent’s issuance of such Parent Common Stock is made in reliance upon an exemption from registration

under the Securities Act, which exemption is in part premised upon and relied upon as a result of the representations made by Members

in their Investment Letters, and Members shall review and truthfully and accurately complete and execute same and deliver same to Parent.

B. Adjustments

to Purchase Price.

(1) Accounts Receivable Purchase

Price Adjustment (decrease/increase). The Purchase Price payable to Company at Closing shall be reduced or increased (by reducing or

increasing the amount payable to Company at Closing), on a Dollar for Dollar basis, by the difference between the Accounts Receivable

to be transferred to Buyer at Closing and the sum of $6,056,878. A positive number will cause a reduction in the Purchase Price; a negative

number will cause an increase in the Purchase Price. By way of example, if the Accounts Receivable of Company at Closing is $8,000,000

then the Purchase Price would be increased by $1,943,122 ($6,056,878 - $8,000,000 = $-1,943,122). If the Accounts Receivable at Closing

is $4,000,000 then the Purchase Price would be reduced by $2,056,878 ($6,056,878 - $4,000,000 = $2,056,878)

(2) Cash Purchase Price Adjustment

(decrease/increase). The Purchase Price payable to Company at Closing shall be reduced or increased (by reducing or increasing the amount

payable to Company at Closing), on a Dollar for Dollar basis, by the difference between the Cash to be transferred to Buyer at Closing,

and the sum of $1,909,074. A negative number will case an increase in the Purchase Price; a positive number will cause a decrease in the

Purchase Price. By way of example, if the Cash of Company at Closing was $3,000,000 then the Purchase Price would be increased by $1,090,926

($1,909,074 - $3,000,000 = $-1,090,926). If the Cash at Closing is $1,000,000 then the Purchase Price would be reduced by $909,074 ($1,909,074

- $1,000,000 = $909,074).

(3) Costs and Estimated Earning

Purchase Price Adjustment (decrease/increase). The Purchase Price payable to Company at Closing shall be reduced or increased (by reducing

or increasing the amount payable to Company at Closing), on a Dollar for Dollar basis, by the difference between the Cost and Estimated

Earnings as shown on the books of Company at Closing and the sum of $837,531. A negative number will cause an increase in the Purchase

Price; a positive number will cause a decrease in the Purchase Price. By way of example, if the Costs and Estimated Earnings in Excess

of Billings on Uncompleted Contract of Company at Closing was $2,000,000 then the Purchase Price would be increased by $1,162,469 ($837,531

- $2,000,000 = $-1,162,469). If the Costs and Estimated Earnings in Excess of Billings on Uncompleted Contracts was $500,000 then the

Purchase Price would be reduced by $337,531 ($837,531 - $500,000 = $337,531).

(4) Current Liability Purchase

Price Adjustment (decrease/increase). The Purchase Price payable to Company at Closing shall be reduced or increased (by reducing or increasing

the amount payable to Company at Closing), on a Dollar for Dollar basis, by the difference between the Current Liabilities to be assumed

by Buyer at Closing and the sum of $3,851,306. A positive number will cause an increase in the Purchase Price; a negative number will

cause a decrease in the Purchase Price. By way of example, if the total of Current Liabilities of Company at Closing was $5,000,000 then

the Purchase Price would be decreased by $1,148,694 ($3,851,306 - $5,000,000 = $-1,148,694). If the total of Current Liabilities at Closing

was $1,000,000 then the Purchase Price would be increased by $2,851,306 ($3,851,306 - $1,000,000 = $2,851,306).

(5) Long-Term Liabilities Purchase

Price Adjustment (decrease/increase). Any Long-Term Liabilities assumed by Buyer at Closing will be a reduction in the Purchase Price.

Long-Term Liabilities being defined as all those liabilities described as such on the June 30, 2024 Balance Sheets provided to Buyer

by Seller and, if not so included, all Lease payout amounts for vehicles and equipment being transferred to Buyer.

(6) After Closing Obligations.

If, after Closing, Buyer pays any obligation it reasonably believes to be the obligation of Company over and above the amount set forth

as an Assumed Liability (as defined in Paragraph 5(h), Company, Harrah and Enyart, jointly and severally, agree to repay within ten (10) business

days of a demand for payment, all amounts paid or assumed by Buyer over and above the amount set forth as an Assumed Liability, provided

that Buyer shall first give written notice to Company, Harrah and Enyart at least ten (10) days prior to payment of the obligation,

and further that Company, Harrah and Enyart shall each be allowed an opportunity to protest whether the obligation is legally owed. Should

Company, Harrah or Enyart choose to protest whether the obligation is legally owed, then Company, Harrah or Enyart, shall provide Buyer

with security for the payment of the obligation during the pendency of the protest, which security shall be in the sole but reasonable

discretion of Buyer.

C. Allocation.

(a) The

Purchase Price shall be allocated among the Purchased Assets hereby sold and purchased for all purposes, including all tax, tax reporting

and accounting purposes, as set forth on Schedule 3(c). The allocation of the Purchase Price to the Purchased Assets hereby sold and purchased

shall be binding on Buyer and Company for all tax purposes. Buyer and Company will execute Internal Revenue Service Form 8594 at

the Closing and shall attach same to their tax return covering the year in which the Closing occurs.

(b) In

the event of an adjustment in the Purchase Price, the allocation agreed to by the parties shall be adjusted in proportion to the original

values agreed upon, unless otherwise agreed to in writing by both Buyer and Company.

(c) Buyer

shall be responsible for the payment of any conveyance tax, if any, applicable to the transfer of the Real Estate. To the extent that

any tax or fee is due to any taxing authority for the right to transfer any other Purchased Asset, the cost of that fee or tax shall be

the responsibility of Buyer.

4. Closing

Date and Place. The Closing under this Agreement (the "Closing") shall take place on or before December 2, 2024, or

at any such other date as the parties may agree (the "Closing Date") and at any place as to which the parties may agree and

only if all conditions required to be satisfied by this Agreement have been met or waived within three (3) days of the Closing Date.

5. Representations

and Warranties of Company. The Company represents and warrants to Buyer as a material inducement to Buyer to enter into and perform

its obligations under this Agreement, as follows:

(a) Organization

and Standing of Company. The Company is a limited liability company duly organized, validly existing, under the laws of the State

of Ohio and is duly qualified as a foreign corporation under the laws of West Virginia and Kentucky. The Company has all requisite corporate

power and authority to own and operate its properties and to conduct its business in the manner and in the places where it is now conducted.

(b) Company's

Authority. The execution and delivery of this Agreement and other documents herein contemplated to the Buyer and the sale contemplated

hereby will have been duly authorized by the Company's Members and the Company will, at the Closing, deliver to the Buyer copies of the

resolutions of its Members granting such authority. No other action on the part of the Company will be necessary to authorize execution

and delivery of same and of the sale. The execution and delivery of this Agreement to the Buyer and the sale contemplated hereby do not

violate any federal, state or local laws or regulations. The execution and delivery of this Agreement and the consummation of the transactions

contemplated hereby will not violate any provision of, or result in the breach of or accelerate or permit the acceleration of the performance

required by the terms of, any applicable law, rule or regulation of any governmental body having jurisdiction, the Articles of Organization

of the Company, or any agreement to which the Company is a party or by which it may be bound, or of any order, judgment or decree applicable

to it, or result in the creation of any claim, lien, charge or encumbrance upon any of the property or assets of the Company or terminate

or result in the termination of any such agreement.

(c) Title

of Property. The Company has good, marketable and indefeasible title to all the Purchased Assets to be sold hereunder, free and clear

of any mortgages, security interests, liens, charges or encumbrances whatsoever, except as otherwise specifically disclosed.

(d) Intellectual

Property. Company has adequate rights in the Intellectual Property necessary to conduct the Company's Business as it is presently

operated, and Buyer will be able to continue same after the assignment of such Intellectual Property. The Company is not infringing upon

or otherwise acting adversely to any intellectual property owned by any other person or persons, and there is no written claim or action

by any such person pending, or to the knowledge of Company threatened, with respect to the Company's ownership, use or claim to any of

the Intellectual Property.

(e) Compliance

with Laws. To the best knowledge of Company, the Company has complied in all material respects with all applicable laws, rules, regulations,

ordinances, and franchises with respect to its operations, and neither the ownership nor use of the Company's Purchased Assets nor the

conduct of its business conflicts with the rights of any other person, firm or corporation.

(f) No

Litigation. There is no claim, legal action, suit, arbitration, governmental investigation or other legal, administrative or tax proceeding

for which Company has received written notice, nor any order, decree or judgment, in progress, pending, or, to the best knowledge of Company,

threatened against or relating to the Company which involves or affects the Purchased Assets or Business or the transactions contemplated

by this Agreement.

(g) Employees.

Company will retain all liability, if any, for any benefits of its employees attributable to their employment by Company prior to Closing

and any termination of such employment by Company, including specifically severance, hospitalization, or retirement benefits, if any,

and liability for any other claim by an employee or former employee of Company attributable to his employment or termination of employment

by Company.

(h) List

of Secured Creditors, Taxes, and Obligations. The Company shall deliver to Buyer a true and complete list of the Company's obligations,

including but not limited to obligations owed to secured creditors, taxing authorities, and other creditors, whether secured or unsecured,

as of 12:01 a.m. October 20, 2024, together with copies of all documents evidencing or relating to such obligations. Buyer and

Company acknowledge and agree that Buyer shall only be responsible for those obligations identified in Schedule 5(h) (the “Assumed

Liabilities”). Company shall have paid or arranged for the satisfaction of the balance owed to its creditors on or before the Closing

Date, other than those liabilities identified as “Assumed Liabilities.”

(i) Inventory.

All items included in Inventory consist of a quality and quantity usable and, with respect to finished goods, saleable, in the ordinary

course of business of Company. All of the Inventory has been and shall be valued at the Company's cost.

(j) Accounts

Receivable. The accounts receivable listed on Schedule 1(c)(j) and the accounts receivable arising after the date of preparation

of Schedule 1(c)(j); (a) have arisen from bona fide transactions entered into by the Company involving the rendering services in

the ordinary course of business consistent with past practice; (b) constitute only valid, undisputed claims of the Company not subject

to any material claims of set-off or other defenses or counterclaims accrued in the ordinary course of business consistent with past practice.

Material meaning no more than 5% of the accounts receivable are deemed uncollectable in the good faith judgment of Buyer.

6. Covenants

of the Company.

The Company covenants and agrees with the Buyer

that it will perform the following between the date of this Agreement and the Closing Date:

(a) Access.

The Company shall give Buyer and its lenders, counsel, accountants, and other representatives full access during normal business hours

to all of the properties, books, contracts and records of the Company, and the Company will furnish Buyer with all such documents, copies

of documents (certified if required) and information concerning the affairs of the Company as Buyer may from time to time reasonably request.

Buyer and its representatives will conduct their investigation so as not to disrupt the operations of Company.

(b) Conduct

of Business Pending Closing. The Company covenants that pending the Closing:

(i) The

Company shall maintain, keep and preserve the Purchased Assets and properties in good condition and repair, normal wear and tear excepted,

and maintain insurance thereon in accordance with present practices.

(ii) The

Company will not sell or dispose of any of its Purchased Assets subject to this Agreement except for sales of Inventory in the ordinary

course of business, or permit the creation of any mortgage, pledge, lien or other encumbrances, security interest, or imperfection of

title thereon or with respect thereto, without prior written consent of Buyer. Without limiting the foregoing, the Company shall not transfer

any Purchased Assets to or incur any liability to any corporation, partnership, company, joint venture or any individual related to (whether

by virtue of common ownership or agreement) or controlled by the Company or any of its Members, and any such transfer or incurrence of

liability shall be deemed not to be in the ordinary course of Company's Business.

(iii) Except

as otherwise requested by the Buyer and without making any commitment on its behalf, the Company will use its best efforts to preserve

for the Buyer the goodwill of the suppliers, customers, and others having business relations with the Company.

(iv) Except

as otherwise specifically provided in this Agreement, possession and control of the Purchased Assets covered by this Agreement shall remain

with Company until the Closing.

(c) Post-Closing Covenants. The following covenants and obligations of the Parties shall apply immediately upon Closing:

(1) For

a period of Five years, Todd Harrah will, for an initial salary of $200,000 per annum, make himself available to Buyer on a full time

basis to (i) consult with, (ii) provide technical support related to the Business, (iii) assist with transitional matters,

(iv) make himself available for maintaining customer relations and (v) assist in contract renewal and renegotiations all as

set forth in an Employment Agreement to be entered into between Buyer and Todd Harrah, the additional terms and conditions of said employment

being substantially in the form as that Employment Agreement attached hereto as Exhibit B-1.

(2) For

a period of Three years Tommy Enyart will, for an initial salary of $200,000 per annum, make himself available to Buyer on a full time

basis to (i) consult with, (ii) provide technical support related to the Business, (iii) assist with transitional matters,

(iv) make himself available for maintaining customer relations and (v) assist in contract renewal and renegotiations all as

set forth in an Employment Agreement to be entered into between Buyer and Tommy Enyart, the additional terms and conditions of said employment

being substantially in the form as that Employment Agreement attached hereto as Exhibit B-2.

7. Representations

and Warranties of Buyer. Buyer represents and warrants to Company as follows:

(a) Buyer

is duly organized and validly existing under the laws of Ohio, and has the full corporate power and authority to enter into this Agreement

and to carry out the transactions contemplated thereby.

(b) Neither

the execution, delivery nor performance of this Agreement by Buyer will, with or without the giving of notice of the passage of time,

or both, conflict with, result in a default or loss or rights under, or result in the creation of any lien, charge or encumbrance pursuant

to any provision of its Articles of Incorporation or bylaws, or any mortgage, deed of trust, lease, license, agreement, understanding,

law, order, or judgment, franchise, ordinance or decree to which Buyer is a party or by which it is bound. Buyer has the full power and

authority to enter into this Agreement and to carry out the transactions contemplated hereby and this Agreement and Buyer's performance

hereunder have been duly and validly authorized by all necessary corporate actions on the part of the Buyer and constitutes the valid

and binding obligation of the Buyer enforceable in accordance with its terms.

8. Non-Competition. Concurrently

with the execution and delivery of this Agreement the Company and the Buyer shall and each Member shall enter into a Non-Competition Agreement,

in substantially the form attached hereto as Exhibit C-1 and C-2.

9. Conditions

Precedent to Buyer's Obligations. All obligations of Buyer under this Agreement are subject, at the option of Buyer, to the satisfaction

and fulfillment of each of the following conditions at or prior to Closing. Buyer may waive any or all of these conditions in whole or

in part without prior notice; provided, however, that no such waiver of a condition shall constitute a waiver by Buyer of

any of their other rights or remedies at law or in equity, if the Company shall be in default of any of its representations, warranties

or covenants under this Agreement. The Company agrees to use its best efforts to fulfill each such condition:

(a) The

representations and warranties of the Company contained herein and in any document or certificate delivered pursuant to this Agreement

shall be true and correct as of the date of this Agreement, and shall be true and correct on and as of the Closing Date with the same

force and effect as though made on and as of the Closing Date.

(b) The

Company shall have performed all of its obligations and agreements and complied with all covenants and conditions contained in this Agreement

to be performed or complied with on or before the Closing Date.

(c) The

Company shall have obtained all necessary consents or approvals, of other persons or parties, to the assignment of all contracts to be

assigned to Buyer pursuant hereto.

(d) Company

shall deliver to Buyer bills of sale, endorsements, certificates of title, assignments and other good and sufficient instruments of conveyance,

transfer and assignment as shall be effective to vest in Buyer good and marketable title in and to the Purchased Assets transferred pursuant

to this Agreement, free and clear of all security interests, liens, charges and encumbrances of any nature whatsoever.

(e) Between

the date of this Agreement and the date of Closing, there shall have been no material adverse change in the assets, operations or Business

of the Company.

(f) The

Non-Competition Agreements described in Paragraph 8 and the Employment Agreements described in Paragraph 6, duly and properly executed,

shall be delivered to Buyer.

(g) Company and Buyer shall

deliver to each other copies of resolutions authorizing and approving the execution and consummation of the transactions contemplated

hereby.

(h) There shall not be any pending or threatened arbitration, litigation or administrative proceeding

against or affecting any Member, the Company, Buyer director, officer, agent, employee or affiliate of any of the foregoing or to which

any properties or rights of the Company or Buyer is subject, which (a) is likely to have a material adverse effect on the Purchased

Assets or Business to be sold hereunder to the Buyer or (b) would prohibit or set aside the transactions contemplated by this Agreement.

(i) The

approval of and consent to the transactions contemplated hereby shall have been given prior to the Closing Date by the regulatory agencies,

federal and state, whose approval or consent is required, and all notice periods, waiting periods, delay periods and all periods for review,

objection or appeal of or to any of the consents, approvals, or permissions required by law with respect to the consummation of this Agreement

shall have expired. Such approvals shall not be conditioned or restricted in a manner which, in the judgment of Buyer, materially adversely

affects the economic assumptions of the transactions contemplated hereby so as to render inadvisable consummation of the Agreement.

(j) The

approvals, consents and permissions referred to generally herein shall not have required the divestiture or cessation of any significant

part of the present operations conducted by Buyer or the Company, and shall not have imposed any other condition, which divestiture, cessation

or condition Buyer reasonably deem to be materially disadvantageous or burdensome.

10. Conditions

to Closing by Company. The obligations of Company under this Agreement are, at the option of Company, subject to the satisfaction,

at or prior to the Closing Date, of each of the conditions set forth below in this Paragraph 10. Company may waive any or all of these

conditions in whole or in part without prior notice; provided, however, that no such waiver of a condition shall constitute

a waiver by Company of any of its other rights or remedies at law or in equity if Buyer shall be in default of any of its representations,

warranties or covenants under this Agreement.

(a) All

proceedings taken in connection with the transactions contemplated hereby, and all instruments and documents incident thereto shall be

reasonably satisfactory in form and substance to counsel for Company.

(b) The

representations and warranties of Buyer made in this Agreement and in any document or certificate delivered pursuant to this Agreement

shall be true and correct as of the date of this Agreement and shall be true and correct on and as of the Closing Date with the same effect

as though such representations and warranties had been made on and as of the Closing Date.

(c) Buyer

shall have fully performed and complied with all covenants and agreements to be performed and complied with by Buyer on or before the

Closing Date.

(d) There

shall not be any pending or threatened arbitration, litigation or administrative proceeding against or affecting the Company, Buyer or

any member, director, officer, agent, employee or affiliate of any of the foregoing or to which any properties or rights of the Company

or Buyer is subject, which (i) is likely to have a material adverse effect on the Business or any Purchased Assets to be sold hereunder

or the Buyer or (ii) would prohibit or set aside the transactions contemplated by this Agreement.

11. Termination

of Agreement.

(a) Grounds

for Termination. This Agreement and the transactions contemplated hereby may be terminated at any time prior to the Closing Date:

(i) By

mutual consent in writing of all parties hereto; or

(ii) By

Buyer if there has been a material misrepresentation or breach of warranty in the representations and warranties of Company set forth

herein not materially cured by Company within thirty (30) days after written notice of same from Buyer, or by Company if there has been

a material misrepresentation or breach of warranty in the representations and warranties of Buyer set forth herein not materially cured

by Buyer within thirty (30) days after written notice of same from Company; or

(iii) By

either Company or Buyer upon written notice to the other if any regulatory agency whose approval of the transactions contemplated by this

Agreement is required denies such application for approval by final order or ruling (which order or ruling shall not be considered final

until expiration or waiver of all periods for review or appeal); or

(iv) By

either Company or Buyer upon written notice to the other if any condition precedent to such party’s performance hereunder is not

satisfied or waived; or

(v) By

either Company or Buyer if the transactions contemplated by the Agreement shall violate any non-appealable final order, decree or judgment

of any court or governmental body having competent jurisdiction; or

(vi) By

either Company or Buyer upon the bankruptcy or assignment for the benefit of creditors of either the Company or the Buyer, or

(vii) By

the Company or the Buyer in the event that Closing shall not have occurred by December 31, 2024, if the failure to consummate the

transaction contemplated hereby on or before such date is not caused by any willful breach of this Agreement by the party electing to

terminate pursuant to this Paragraph 11(a)(vii).

(b) Effect

of Termination. In the event of the termination and abandonment of this Agreement pursuant to Paragraph 11 of this Agreement, this

Agreement shall become void and have no effect, and none of the Company, the Buyer, the Members, or any of the officers or directors of

any of them shall have any liability of any nature whatsoever under this Agreement, except that the provisions of this Paragraph 11(b),

Paragraph 11(c) and Paragraph 14 of this Agreement shall survive any such termination and abandonment.

(c) Return

of Information. In the event of the termination of this Agreement for any reason, each party shall deliver to the other party, and

shall require each of its officers, agents, employees and independent advisers (including legal, financial and accounting advisers) to

deliver to the other party all documents, work papers, and other material obtained from such other party relating to the transactions

contemplated hereby, whether obtained before or after the execution hereof. Each party agrees that notwithstanding any other provision

contained in this Agreement, the undertakings and covenants regarding confidentiality shall survive termination of this Agreement.

12. Additional

Documents and Acts after Closing. From time to time, at the Buyer's or Company's request, whether at or after Closing, and without

further consideration, the Company or Buyer, as the case may be, will at their own expense execute and deliver such further instruments

of conveyance and transfer and take such other action as may be reasonably requested to more effectively convey and transfer to the Buyer

any of the property to be sold hereunder, and will assist the Buyer in the collection or reduction to possession of such property.

13. Non-Assumption

of Liability. It is understood and agreed that the Buyer is not assuming in any way whatsoever any

liability of Company of any kind whatsoever except those liabilities expressly assumed in Schedule 5 – Assumed Liabilities.

14. Indemnification.

(a) Company.

Without limiting any other right of indemnification or any other cause of action, Company and each Member shall defend, indemnify and

hold Buyer harmless from and against any and all losses, liabilities, damages, costs, claims, judgments and expenses (including attorney's

fees) whatsoever arising out of or resulting from:

(i) Any

breach of warranty or misrepresentation by Company contained herein, or the nonperformance of any covenant or obligation to be performed

by Company or from any misrepresentation, omission or inaccuracy in any schedule, exhibit, certificate, instrument or paper delivered

or to be delivered by Company hereunder in connection with the transactions herein contemplated;

(ii) Any

liability or matter not disclosed in writing to Buyer prior to Closing arising out of the conduct of Company's Business prior to the Closing

Date, including but not limited to, any product or service warranty claims arising after the Closing Date for services rendered or products

sold before the Closing Date (other than liabilities accruing after the Closing Date with respect to agreements or obligations specifically

assumed by Buyer) as well as any claim by any creditor of Company;

(iii) Any

claim which may be asserted against Buyer or any of the Purchased Assets being sold hereunder, by any of Company's employees, independent

contractors or agents with respect to liabilities incurred by or on Company's behalf prior to their termination by Company;

(iv) Any

attempt (whether or not successful) by any person to cause or require Buyer to pay or discharge any debt, obligation or liability relating

to the Company other than any liability specifically assumed by Buyer hereunder; and

(v) Any

liability arising out of or in connection with Company's termination of its employees.

(b) Buyer's

Indemnity. Without limiting any other right of indemnification or any other cause of action, Buyer shall indemnify and hold Company

and each Member forever harmless from and against any and all losses, liability, damages, costs, claims, judgments and expenses (including

attorney's fees) whatsoever arising out of or resulting from:

(i) Any

breach of warranty or misrepresentation by Buyer contained herein, or the non-performance of any covenant or obligation to be performed

by Buyer or from any misrepresentation, omission or inaccuracy in any schedule, exhibit, certificate, instrument or paper delivered or

to be delivered by Buyer hereunder in connection with the transactions herein contemplated; or

(ii) the

conduct of Business utilizing the Purchased Assets from and after the Closing Date.

(c) Indemnification

Limitations. Notwithstanding any other provision in this Agreement:

(i) The

Indemnifying Party hereunder shall have the right to control the defense of any claim or proceeding by any third party as to which it

shall have acknowledged its obligation to indemnify the other party, and the Indemnified Party hereunder shall not settle or compromise

any such claim or proceeding without the written consent of the Indemnifying Party, which consent shall not unreasonably be withheld or

delayed. The Indemnified Party may in any event participate in any such defense, with its own counsel and at its own expense; and

(ii) Nothing

herein shall be construed as granting a right of indemnification in any party hereto in respect of any (A) losses any party may have

arising out of the allocation of the purchase price or (B) in respect of any consequential damages.

15. Risk of

Loss. Company shall assume all risk of loss to the Purchased Assets covered by this Agreement until

the Closing Date and the transfer of Purchased Assets contemplated hereunder except either the Buyer or the Company shall have the option

to determine whether to cancel this Agreement or adjust the sales price in the event of losses in excess of $10,000.00. Buyer has the

risk of loss after the Closing Date.

16. Brokerage.

The Company and Members represent and warrant to the Buyer, and Buyer represents to Company and each Member that all negotiations on its

part relative to this Agreement have been carried on by the parties hereto directly without the intervention of any other person on its

behalf; that neither the Company nor Buyer has incurred any liability for finder's, agents or brokerage fees, commissions or compensation

in connection with this Agreement or the transactions contemplated hereby, and the Company or Buyer shall indemnify the other, as the

case may be, and hold the other harmless against and in respect of any claim for such relative to this Agreement, or to the transactions

contemplated hereby, and also in respect of all expenses of any character incurred by them in connection with this Agreement or such transactions.

17. Survival

of Representations, Warranties and Agreements. All statements contained in any certificate or other instrument delivered by or on

behalf of the Company pursuant hereto, or in connection with the transactions contemplated hereby, shall be deemed representations and

warranties by the Company hereunder. All representations, warranties, agreements and indemnities made by the Company and Buyer in this

Agreement, or pursuant hereto, shall survive the Closing Date and any investigation at any time made by or on behalf of the Buyer or Company

for a period of three (3) years after the Closing Date.

18. Benefit.

This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

19. Modification.This

Agreement cannot be modified, changed, discharged, or terminated, except by a writing signed by the parties hereto.

20. Nonwaiver.

No waiver of any breach or default hereunder shall be considered valid unless in writing and signed by the party giving such waiver, and

no such waiver shall be deemed a waiver of any subsequent breach of default of the same or similar nature.

21. Entire

Agreement. This Agreement and the agreements specifically referred to herein constitute the entire agreement among the parties hereto

and supersede all prior agreements and understandings, oral and written, among the parties hereto or their assignors with respect to the

subject matter hereof.

22. Descriptive

Headings. Descriptive headings used in this Agreement are for convenience only and shall not control or affect the meaning or construction

of any provision of this Agreement.

23. Notices.

All notices or other communications which are required or permitted hereunder shall be in writing and shall be sufficient if delivered

or mailed by registered or certified mail, postage prepaid, sent by telex or telegram, or delivered by hand, and shall be effective upon

delivery to the following addresses or such other address as the appropriate party may advise each other party hereto.

| If to the Company: | Tribute

Contracting & Consultants LLC |

| | | 2125 County Road 1 |

| | | South Point, OH 45680 |

| | | |

| | Attention: | Todd

Harrah |

| Copy to: | Edwards,

Klein, Anderson & Shope PLLC |

| | | 1426

6th Avenue |

| | | Huntington,

WV 25701 |

| | | |

| | Attention: | Curtis

B. Anderson |

| | | canderson@edwardsklein.com |

| | | |

| | If to the Buyer: | Tribute

Acquisition Company |

| | | 75

3rd Avenue |

| | | Huntington,

WV 25701 |

| | | |

| | Attention: | Charles

Crimmel |

| | | |

| | Copy to: | Dinsmore &

Shohl, LLP |

| | | 611 Third Avenue |

| | | Huntington, West Virginia 25701 |

| | | |

| | Attention: | Daniel

J. Konrad, Esquire |

| | | daniel.konrad@dinsmore.com |

24. Counterparts.

This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same Agreement.

25. Binding

Nature; Assignments. This Agreement is binding upon, and inures to the benefit of, the parties hereto and their respective heirs,

successors and assigns. This Agreement may not be assigned by any party hereto without the prior written consent of the other parties

to be bound thereby, except that Buyer may assign this Agreement to any affiliate of Buyer. Except as otherwise expressly stated in this

Agreement, nothing contained herein shall be construed to confer any right or cause of action on any person other than the parties hereto,

and their respective successors and permitted assigns.

26. Governing

Law and Venue. This Agreement shall be governed by, and construed in accordance with, the laws of West Virginia.

27. Legal

Fees and Expenses; Other Expenses. Each of the parties hereto will pay its own fees and expenses incurred in connection with review

of this Agreement and related documents and the consummation of the transactions therein contemplated, including, without limitation,

all legal fees.

28. Invalid

Provisions. The invalidity or unenforceability of any particular provision of this Agreement shall not affect the other provisions

hereof, and this Agreement shall be construed in all respects as if such invalid or unenforceable provision were omitted.

29. Dispute

Resolution and Venue. If a dispute arises out of or relates to this Agreement or its breach, the Parties shall endeavor to settle

the dispute through direct discussion. Within ten (10) business days, the Parties’ representatives, who shall possess the necessary

authority to resolve such matter and who shall record the date of first discussions, shall conduct direct discussions and make a good

faith effort to resolve such dispute. Disputes between the Parties not resolved by direct discussion shall be submitted to mediation.

The Parties shall select the mediator within fifteen (15) days of the written request for mediation. Engaging in mediation is a condition

precedent to any form of binding dispute resolution or litigation. The Parties shall split the cost of the mediator. If the Parties cannot

agree on a mediator, they shall request a judge in the venue jurisdiction to name one. Any and all actions of law, suits in equity, or

other judicial proceedings for any breach of enforcement of this Agreement, or of any provision hereof, shall be instituted and maintained

only in a court of competent jurisdiction located in Cabell County, West Virginia, the County and State where this Agreement has been

made and entered into, or in the U.S. District Court for the Southern District of West Virginia, and each party hereby waives any right

to any change of venue.

IN WITNESS WHEREOF, the parties have executed this

Agreement, on this 30th day of October, 2024.

| |

TRIBUTE CONTRACTING & CONSULTANTS LLC, |

| |

an Ohio limited liability company |

| |

|

|

| |

By |

/s/Todd

Harrah |

| |

Its: |

Manager/Member |

| |

|

|

| |

TRIBUTE ACQUISITION COMPANY, |

| |

an Ohio corporation |

| |

|

|

| |

By |

/s/Douglas

Reynolds |

| |

Its: |

President |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

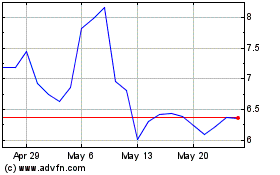

Energy Services of America (NASDAQ:ESOA)

Historical Stock Chart

From Mar 2025 to Apr 2025

Energy Services of America (NASDAQ:ESOA)

Historical Stock Chart

From Apr 2024 to Apr 2025