- Revenue reached a record $55.2 million in the first quarter,

representing an increase of 118% year-over-year.

- Network throughput reached a record 53 gigawatt-hours (“GWh”)

in the first quarter, an increase of 194% year-over-year.

- Added 250 new operational stalls during the first quarter,

including EVgo eXtend™ stalls.

- Ended the first quarter with approximately 3,780 stalls in

operation or under construction, including EVgo eXtend™

stalls.

- Added nearly 109,000 new customer accounts in the first

quarter, reaching more than 981,000 overall at quarter end.

EVgo Inc. (Nasdaq: EVGO) (“EVgo” or the “Company”) today

announced results for the first quarter ended March 31, 2024.

Management will host a conference call today at 11:00 a.m. ET /

8:00 a.m. PT to discuss EVgo’s results and other business

highlights.

Revenue reached $55.2 million in the first quarter of 2024,

compared to $25.3 million in the first quarter of 2023,

representing 118% year-over-year growth. Revenue growth was

primarily driven by year-over-year increases in charging revenues

and eXtend™ revenue.

Network throughput increased to 53 GWh in the first quarter of

2024, compared to 18 GWh in the first quarter of 2023, representing

194% year-over-year growth. The Company added nearly 109,000 new

customer accounts during the first quarter of 2024, a 63%

year-over-year increase in new accounts. The overall number of

customer accounts was more than 981,000 at quarter end, an increase

of 60% year-over-year.

“EVgo’s business continues to grow and achieve record results,

demonstrating the strength of our business model of owning and

operating a fast-charging network as more Americans drive electric

vehicles,” said Badar Khan, EVgo’s CEO. “We continue to build new

stalls across the U.S. and see throughput growth outpacing growth

of EVs in operation. EVgo’s compelling unit economics, operating

leverage, along with the tailwind of long-term EV adoption, gives

us confidence that we will achieve adjusted EBITDA breakeven in

2025 and create significant shareholder value.”

Business Highlights

- Stall Development: The Company ended the quarter with

approximately 3,240 stalls in operation, including EVgo eXtend™

stalls. EVgo added 250 new DC fast charging stalls during the

quarter, including EVgo eXtend™ stalls.

- EVgo eXtend™: EVgo ended the quarter with 130

operational EVgo eXtend™ stalls.

- Network Utilization: Utilization on the EVgo network in

the first quarter of 2024 was approximately 19%, up from

approximately 9% in the first quarter of 2023.

- Network Throughput: Average daily throughput per stall

for the EVgo network was 193 kilowatt hours per day in the first

quarter of 2024, an increase of 124% compared to 86 kilowatt hours

per day in the first quarter of 2023.

- Fleet Charging: EVgo’s public fleet charging business

continues to grow driven by rideshare traffic that increased over

3x year-over-year.

- EVgo Autocharge+: Autocharge+ was over 18% of total

charging sessions initiated in the first quarter of 2024, and the

number of Autocharge+ charging sessions in the first quarter

increased 358% compared to the first quarter of 2023.

- PlugShare: PlugShare reached approximately 5.0 million

registered users and achieved 8.3 million check-ins since

inception.

Financial & Operational Highlights

The below represent summary financial and operational figures

for the first quarter of 2024.

- Revenue of $55.2 million

- Network Throughput1 of 53 gigawatt-hours

- Customer Account Additions of nearly 109,000

accounts

- Gross Profit of $6.8 million

- Net Loss of $28.2 million

- Adjusted Gross Profit2 of $17.3 million

- Adjusted EBITDA2 of ($7.2) million

- Cash Flows Used in Operating Activities of $14.1

million

- Capital Expenditures of $21.1 million

- Capital Expenditures, Net of Capital Offsets2 of $13.6

million

_______________

1 Network throughput for EVgo network

excludes EVgo eXtend™ sites.

2 Adjusted Gross Profit, Adjusted EBITDA,

and Capital Expenditures, Net of Capital Offsets are non-GAAP

measures and have not been prepared in accordance with generally

accepted accounting principles in the United States of America

(“GAAP”). For a definition of these non-GAAP measures and a

reconciliation to the most directly comparable GAAP measure, please

see “Definitions of Non-GAAP Financial Measures” and

“Reconciliations of Non-GAAP Financial Measures” included elsewhere

in this release.

(unaudited, dollars in thousands)

Q1'24

Q1'23

Better (Worse)

Network Throughput (GWh)

53

18

194%

Revenue

$

55,158

$

25,300

118%

Gross profit

$

6,841

$

41

*

Gross margin

12.4

%

0.2

%

1,220 bps

Net loss

$

(28,193

)

$

(49,081

)

43%

Adjusted Gross Profit1

$

17,287

$

6,405

170%

Adjusted Gross Margin1

31.3

%

25.3

%

600 bps

Adjusted EBITDA1

$

(7,207

)

$

(20,067

)

64%

_______________

1 Adjusted Gross Profit, Adjusted Gross

Margin, and Adjusted EBITDA are non-GAAP measures and have not been

prepared in accordance with GAAP. For a definition of these

non-GAAP measures and a reconciliation to the most directly

comparable GAAP measures, please see “Definitions of Non-GAAP

Financial Measures” and “Reconciliations of Non-GAAP Financial

Measures” included elsewhere in these materials.

(unaudited, dollars in thousands)

Q1'24

Q1'23

Change

Cash flows used in operating

activities

$

(14,082

)

$

(19,343

)

27%

Capital expenditures

$

21,071

$

65,246

(68)%

Capital offsets:

OEM infrastructure payments

5,826

3,895

50%

Proceeds from capital-build funding

1,680

2,216

(24)%

Total capital offsets

7,506

6,111

23%

Capital Expenditures, Net of Capital

Offsets1

$

13,565

$

59,135

(77)%

_______________

1 Capital Expenditures, Net of Capital

Offsets are non-GAAP measures and have not been prepared in

accordance with GAAP. For a definition of these non-GAAP measures

and a reconciliation to the most directly comparable GAAP measures,

please see “Definitions of Non-GAAP Financial Measures” and

“Reconciliations of Non-GAAP Financial Measures” included elsewhere

in these materials.

3/31/2024

3/31/2023

Increase

Stalls in operation or under

construction:

EVgo Network

3,510

3,080

14%

EVgo eXtend™

270

—

*

Total stalls in operation or under

construction

3,780

3,080

23%

Stalls in operation:

EVgo Network

3,110

2,350

32%

EVgo eXtend™

130

—

*

Total stalls in operation

3,240

2,350

38%

_______________

* Percentage not meaningful.

2024 Financial Guidance

EVgo is reaffirming 2024 guidance as follows:

- Total revenue of $220 – $270 million

- Adjusted EBITDA* of ($48) – ($30) million

_______________

* A reconciliation of projected Adjusted

EBITDA (non-GAAP) to net income (loss), the most directly

comparable GAAP measure, is not provided because certain measures,

including share-based compensation expense, which is excluded from

Adjusted EBITDA, cannot be reasonably calculated or predicted at

this time without unreasonable efforts. For a definition of

Adjusted EBITDA, please see “Definitions of Non-GAAP Financial

Measures” included elsewhere in this release.

CFO Transition

EVgo also announced that Olga Shevorenkova will be stepping down

as Chief Financial Officer and departing the Company, effective on

or about May 31, 2024, for a role with a private company. Stephanie

Lee, EVP of Accounting & Finance, will serve as Interim CFO

from the time of Olga’s departure until a permanent successor joins

the Company. The Company has retained a leading executive search

firm and commenced a comprehensive search process to identify the

Company’s next CFO. Ms. Shevorenkova's departure was not the result

of any disagreement with the Company on any matter relating to the

Company's operations, policies or practices, including the

Company's accounting principles and practices and internal

controls.

“On behalf of the Board and management team, I would like to

thank and recognize Olga for her many contributions to EVgo over

the past six years,” said Badar Khan, CEO of EVgo. “Olga joined

EVgo at a time when it was a private company in a nascent sector,

and helped EVgo navigate a path to become a scaled electric vehicle

charging network provider that is an industry leader. Her

commitment to our mission is evident, and we wish Olga all the best

in her future pursuits. We have a well-defined transition plan in

place and are thankful for the deep and talented finance team she

has built.”

Conference Call Information

A live audio webcast and conference call for EVgo’s first

quarter earnings release will be held today at 11 a.m. ET / 8 a.m.

PT. The webcast will be available at investors.evgo.com, and the

dial-in information for those wishing to access via phone is:

Toll Free: (888) 340-5044 (for U.S. callers)

Toll/International: (646) 960-0363 (for callers outside the

U.S.) Conference ID: 6304708

This press release, along with other investor materials that

will be used or referred to during the webcast and conference call,

including a slide presentation and reconciliations of certain

non-GAAP measures to their nearest GAAP measures, will also be

available on that site.

About EVgo

EVgo (Nasdaq: EVGO) is a leader in electric vehicle charging

solutions, building and operating the infrastructure and tools

needed to expedite the mass adoption of electric vehicles for

individual drivers, rideshare and commercial fleets, and

businesses. EVgo is one of the nation’s largest public fast

charging networks, featuring over 1,000 fast charging locations

across more than 35 states, including stations built through EVgo

eXtend™, its white label service offering. EVgo is accelerating

transportation electrification through partnerships with

automakers, fleet and rideshare operators, retail hosts such as

grocery stores, shopping centers, and gas stations, policy leaders,

and other organizations. With a rapidly growing network and unique

service offerings for drivers and partners including EVgo Optima™,

EVgo Inside™, EVgo Rewards™, and Autocharge+, EVgo enables a

world-class charging experience where drivers live, work, travel

and play.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “anticipate,” “believe,” “seek,” “target,” “assume” or

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements are based on management’s current

expectations or beliefs and are subject to numerous assumptions,

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

You are cautioned, therefore, against relying on any of these

forward-looking statements. These forward-looking statements

include, but are not limited to, express or implied statements

regarding EVgo’s future financial and operating performance,

revenues, market size and opportunity, capital expenditures and

offsets; EVgo’s “confidence that [it] will achieve adjusted EBITDA

breakeven in 2025 and create significant shareholder value;” EVgo’s

expectation of market position and progress on its network

buildout, customer experience, technological capabilities and cost

efficiencies; growth in the Company’s throughput versus the growth

in electric vehicles (“EVs”) in operation; growth in the Company’s

fleet business; the Company’s collaboration with partners enabling

effective deployment of chargers, including under its contract with

the Pilot Company and GM; and anticipated awards of funding in

connection with the NEVI program and associated state programs.

These statements are based on various assumptions, whether or not

identified in this press release, and on the current expectations

of EVgo’s management and are not predictions of actual performance.

There are a significant number of factors that could cause actual

results to differ materially from the statements made in this press

release, including changes or developments in the broader general

market; EVgo’s dependence on the widespread adoption of EVs and

growth of the EV and EV charging markets; competition from existing

and new competitors; EVgo’s ability to expand into new service

markets, grow its customer base and manage its operations; the

risks associated with cyclical demand for EVgo’s services and

vulnerability to industry downturns and regional or national

downturns; fluctuations in EVgo’s revenue and operating results;

unfavorable conditions or disruptions in the capital and credit

markets and EVgo’s ability to obtain additional financing on

commercially reasonable terms; EVgo’s ability to generate cash,

service indebtedness and incur additional indebtedness; any

current, pending or future legislation, regulations or policies

that could impact EVgo’s business, results of operations and

financial condition, including regulations impacting the EV

charging market and government programs designed to drive broader

adoption of EVs and any reduction, modification or elimination of

such programs; EVgo’s ability to adapt its assets and

infrastructure to changes in industry and regulatory standards and

market demands related to EV charging; impediments to EVgo’s

expansion plans, including permitting and utility-related delays;

EVgo’s ability to integrate any businesses it acquires; EVgo’s

ability to recruit and retain experienced personnel; risks related

to legal proceedings or claims, including liability claims; EVgo’s

dependence on third parties, including hardware and software

vendors and service providers, utilities and permit-granting

entities; supply chain disruptions, inflation and other increases

in expenses; safety and environmental requirements or regulations

that may subject EVgo to unanticipated liabilities or costs; EVgo’s

ability to enter into and maintain valuable partnerships with

commercial or public-entity property owners, landlords and/or

tenants (collectively “Site Hosts”), original equipment

manufacturers (“OEMs”), fleet operators and suppliers; EVgo’s

ability to maintain, protect and enhance EVgo’s intellectual

property; and general economic or political conditions, including

the conflicts in Ukraine, Israel and the broader Middle East

region, and elevated rates of inflation and associated changes in

monetary policy. Additional risks and uncertainties that could

affect the Company’s financial results are included under the

captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations of EVgo” in EVgo’s

most recent Annual Report on Form 10-K, filed with the Securities

and Exchange Commission (the “SEC”), as well as its other SEC

filings, copies of which are available on EVgo’s website at

investors.evgo.com, and on the SEC’s website at www.sec.gov. All

forward-looking statements in this press release are based on

information available to EVgo as of the date hereof, and EVgo does

not assume any obligation to update the forward-looking statements

provided to reflect events that occur or circumstances that exist

after the date on which they were made, except as required by

applicable law.

EVgo

Inc. and Subsidiaries

Condensed Consolidated Balance

Sheets

March 31,

December 31,

2024

2023

(in thousands)

(unaudited)

Assets

Current assets

Cash, cash equivalents and restricted

cash

$

175,526

$

209,146

Accounts receivable, net of allowance of

$1,327 and $1,116 as of March 31, 2024 and December 31, 2023,

respectively

35,262

34,882

Accounts receivable, capital-build

12,096

9,297

Prepaid expenses and other current

assets1

16,143

14,081

Total current assets

239,027

267,406

Property, equipment and software, net

393,693

389,227

Operating lease right-of-use assets

75,232

67,724

Other assets

2,149

2,208

Intangible assets, net

46,392

48,997

Goodwill

31,052

31,052

Total assets

$

787,545

$

806,614

Liabilities, redeemable noncontrolling

interest and stockholders’ equity (deficit)

Current liabilities

Accounts payable

$

10,087

$

10,133

Accrued liabilities

34,971

40,549

Operating lease liabilities, current

6,515

6,018

Deferred revenue, current2

29,898

32,349

Other current liabilities

154

298

Total current liabilities

81,625

89,347

Operating lease liabilities,

noncurrent

69,039

61,987

Earnout liability, at fair value

446

654

Asset retirement obligations

18,968

18,232

Capital-build liability

38,103

35,787

Deferred revenue, noncurrent

58,808

55,091

Warrant liabilities, at fair value

3,423

5,141

Total liabilities

270,412

266,239

Commitments and contingencies

Redeemable noncontrolling interest

491,458

700,964

Stockholders' equity (deficit)

25,675

(160,589

)

Total liabilities, redeemable

noncontrolling interest and stockholders’ equity (deficit)

$

787,545

$

806,614

_______________

1 In the third quarter of 2023, prepaid

expenses and other current assets were combined into a single line

item. Previously reported amounts have been updated to conform to

the current period presentation.

2 In the first quarter of 2024, deferred

revenue, current, and customer deposits were combined into a single

line item. Previously reported amounts have been updated to conform

to the current period presentation.

EVgo

Inc. and Subsidiaries

Condensed Consolidated

Statements of Operations

(unaudited)

Three Months Ended

March 31,

(in thousands, except per share data)

2024

2023

Change %

Revenue

Charging, retail

$

18,326

$

6,615

177%

Charging, commercial

5,839

1,715

240%

Charging, OEM

2,732

552

395%

Regulatory credit sales

2,034

1,215

67%

Network, OEM

3,423

2,699

27%

Total charging network

32,354

12,796

153%

eXtend

19,151

10,292

86%

Ancillary

3,653

2,212

65%

Total revenue

55,158

25,300

118%

Cost of sales

Charging network1

19,510

9,979

96%

Other1

18,448

8,938

106%

Depreciation, net of capital-build

amortization

10,359

6,342

63%

Total cost of sales

48,317

25,259

91%

Gross profit

6,841

41

*

Operating expenses

General and administrative

34,226

37,889

(10)%

Depreciation, amortization and

accretion

4,985

4,784

4%

Total operating expenses

39,211

42,673

(8)%

Operating loss

(32,370

)

(42,632

)

24%

Interest income

2,273

1,998

14%

Other (expense) income, net

(9

)

1

*

Change in fair value of earnout

liability

208

(2,063

)

110%

Change in fair value of warrant

liabilities

1,718

(6,380

)

127%

Total other income (expense), net

4,190

(6,444

)

165%

Loss before income tax expense

(28,180

)

(49,076

)

43%

Income tax expense

(13

)

(5

)

(160)%

Net loss

(28,193

)

(49,081

)

43%

Less: net loss attributable to redeemable

noncontrolling interest

(18,360

)

(36,005

)

49%

Net loss attributable to Class A common

stockholders

$

(9,833

)

$

(13,076

)

25%

Net loss per share to Class A common

stockholders, basic and diluted

$

(0.09

)

$

(0.18

)

Weighted average common stock outstanding,

basic and diluted

104,676

70,994

_______________

* Not meaningful

1 In the fourth quarter of 2023, the

Company changed the presentation of cost of sales to disaggregate

such costs between “charging network” and “other.” Previously

reported amounts have been updated to conform to the current

presentation.

EVgo

Inc. and Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(unaudited)

Three Months Ended

March 31,

(in thousands)

2024

2023

Cash flows from operating

activities

Net loss

$

(28,193

)

$

(49,081

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation, amortization and

accretion

15,344

11,126

Net loss on disposal of property and

equipment, net of insurance recoveries, and impairment expense1

2,740

3,460

Share-based compensation

4,701

6,427

Change in fair value of earnout

liability

(208

)

2,063

Change in fair value of warrant

liabilities

(1,718

)

6,380

Other

5

—

Changes in operating assets and

liabilities

Accounts receivable, net

(379

)

(18,188

)

Prepaid expenses, other current assets and

other assets

(1,763

)

(4,415

)

Operating lease assets and liabilities,

net

40

365

Accounts payable

(137

)

6,493

Accrued liabilities

(5,595

)

(799

)

Deferred revenue2

1,266

16,747

Other current and noncurrent

liabilities

(185

)

79

Net cash used in operating activities

(14,082

)

(19,343

)

Cash flows from investing

activities

Capital expenditures

(21,071

)

(65,246

)

Proceeds from insurance for property

losses

48

—

Net cash used in investing activities

(21,023

)

(65,246

)

Cash flows from financing

activities

Proceeds from capital-build funding

1,680

2,216

Payments of deferred debt issuance

costs

(195

)

—

Payments of deferred equity issuance

costs

—

(308

)

Net cash provided by financing

activities

1,485

1,908

Net decrease in cash, cash equivalents and

restricted cash

(33,620

)

(82,681

)

Cash, cash equivalents and restricted

cash, beginning of period

209,146

246,493

Cash, cash equivalents and restricted

cash, end of period

$

175,526

$

163,812

_______________

1 During the year ended December 31, 2023,

the Company reclassified insurance proceeds from property losses

from “other” to “loss on disposal of property and equipment, net of

insurance recoveries, and impairment expense.” Previously reported

amounts have been updated to conform to the current period

presentation.

2 In the first quarter of 2024, deferred

revenue, current, and customer deposits were combined into a single

line item. Previously reported amounts have been updated to conform

to the current period presentation.

Use of Non-GAAP Financial Measures

To supplement EVgo’s financial information, which is prepared

and presented in accordance with GAAP, EVgo uses certain non-GAAP

financial measures. The presentation of non-GAAP financial measures

is not intended to be considered in isolation or as a substitute

for, or superior to, the financial information prepared and

presented in accordance with GAAP. EVgo uses these non-GAAP

financial measures for financial and operational decision-making

and as a means to evaluate period-to-period comparisons. EVgo

believes that these non-GAAP financial measures provide meaningful

supplemental information regarding the Company’s performance by

excluding certain items that may not be indicative of EVgo’s

recurring core business operating results.

EVgo believes that both management and investors benefit from

referring to these non-GAAP financial measures in assessing EVgo’s

performance. These non-GAAP financial measures also facilitate

management’s internal comparisons to the Company’s historical

performance. EVgo believes these non-GAAP financial measures are

useful to investors both because (1) they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making and (2) they are used by

EVgo’s institutional investors and the analyst community to help

them analyze the health of EVgo’s business.

For more information on these non-GAAP financial measures,

including reconciliations to the most comparable GAAP measures,

please see the sections titled “Definitions of Non-GAAP Financial

Measures” and “Reconciliations of Non-GAAP Financial Measures.”

Definitions of Non-GAAP Financial Measures

This release includes the following non-GAAP financial measures,

in each case as defined below: “Adjusted Cost of Sales,” “Adjusted

Cost of Sales as a Percentage of Revenue,” “Adjusted Gross Profit

(Loss),” “Adjusted Gross Margin,” “Adjusted General and

Administrative Expenses,” “Adjusted General and Administrative

Expenses as a Percentage of Revenue,” “EBITDA,” “EBITDA Margin,”

“Adjusted EBITDA,” “Adjusted EBITDA Margin,” and “Capital

Expenditures, Net of Capital Offsets.” With respect to Capital

Expenditures, Net of Capital Offsets, pursuant to the terms of

certain OEM contracts, EVgo is paid well in advance of when revenue

can be recognized, and usually, the payment is tied to the number

of stalls that commence operations under the applicable contractual

arrangement while the related revenue is deferred at the time of

payment and is recognized as revenue over time as EVgo provides

charging and other services to the OEM and the OEM’s customers.

EVgo management therefore uses these measures internally to

establish forecasts, budgets, and operational goals to manage and

monitor its business, including the cash used for, and the return

on, its investment in its charging infrastructure. EVgo believes

that these measures are useful to investors in evaluating EVgo’s

performance and help to depict a meaningful representation of the

performance of the underlying business, enabling EVgo to evaluate

and plan more effectively for the future.

Adjusted Cost of Sales, Adjusted Cost of Sales as a Percentage

of Revenue, Adjusted Gross Profit (Loss), Adjusted Gross Margin,

Adjusted General and Administrative Expenses, Adjusted General and

Administrative Expenses as a Percentage of Revenue, EBITDA, EBITDA

Margin, Adjusted EBITDA, Adjusted EBITDA Margin and Capital

Expenditures, Net of Capital Offsets are not prepared in accordance

with GAAP and may be different from non-GAAP financial measures

used by other companies. These measures should not be considered as

measures of financial performance under GAAP and the items excluded

from or included in these metrics are significant components in

understanding and assessing EVgo’s financial performance. These

metrics should not be considered as alternatives to net income

(loss) or any other performance measures derived in accordance with

GAAP.

EVgo defines Adjusted Cost of Sales as cost of sales before (i)

depreciation, net of capital-build amortization, and (ii)

share-based compensation. EVgo defines Adjusted Cost of Sales as a

Percentage of Revenue as Adjusted Cost of Sales as a percentage of

revenue. EVgo defines Adjusted Gross Profit (Loss) as revenue less

Adjusted Cost of Sales. EVgo defines Adjusted Gross Margin as

Adjusted Gross Profit (Loss) as a percentage of revenue. EVgo

defines Adjusted General and Administrative Expenses as general and

administrative expenses before (i) share-based compensation, (ii)

loss on disposal of property and equipment, net of insurance

recoveries, and impairment expense, (iii) bad debt expense

(recoveries), and (iv) certain other items that management believes

are not indicative of EVgo’s ongoing performance. EVgo defines

Adjusted General and Administrative Expenses as a Percentage of

Revenue as Adjusted General and Administrative Expenses as a

percentage of revenue. EVgo defines EBITDA as net income (loss)

before (i) depreciation, net of capital-build amortization, (ii)

amortization, (iii) accretion, (iv) interest income, (v) interest

expense, and (vi) income tax expense (benefit). EVgo defines EBITDA

Margin as EBITDA as a percentage of revenue. EVgo defines Adjusted

EBITDA as EBITDA plus (i) share-based compensation, (ii) loss on

disposal of property and equipment, net of insurance recoveries,

and impairment expense, (iii) loss (gain) on investments, (iv) bad

debt expense (recoveries), (v) change in fair value of earnout

liability, (vi) change in fair value of warrant liabilities, and

(vii) certain other items that management believes are not

indicative of EVgo’s ongoing performance. EVgo defines Adjusted

EBITDA Margin as Adjusted EBITDA as a percentage of revenue. EVgo

defines Capital Expenditures, Net of Capital Offsets as capital

expenditures adjusted for the following capital offsets: (i) all

payments under OEM infrastructure agreements excluding any amounts

directly attributable to OEM customer charging credit programs and

pass-through of non-capital expense reimbursements, and (ii)

proceeds from capital-build funding. The tables below present

quantitative reconciliations of these measures to their most

directly comparable GAAP measures as described in this

paragraph.

Reconciliations of Non-GAAP Financial Measures

The following unaudited table presents a reconciliation of

EBITDA, EBITDA Margin, Adjusted EBITDA, and Adjusted EBITDA Margin

to the most directly comparable GAAP measure:

(unaudited, dollars in thousands)

Q1'24

Q1'23

Change

GAAP revenue

$

55,158

$

25,300

118%

GAAP net loss

$

(28,193

)

$

(49,081

)

43%

GAAP net loss margin

(51.1

%)

(194.0

%)

* bps

Adjustments:

Depreciation, net of capital-build

amortization

10,476

6,468

62%

Amortization

4,463

4,119

8%

Accretion

405

539

(25)%

Interest income

(2,273

)

(1,998

)

(14)%

Income tax expense

13

5

160%

EBITDA

$

(15,109

)

$

(39,948

)

62%

EBITDA margin

(27.4

%)

(157.9

%)

* bps

Adjustments:

Share-based compensation

$

4,701

$

6,427

(27)%

Loss on disposal of property and

equipment, net of insurance recoveries, and impairment expense1

2,740

3,460

(21)%

Loss (gain) on investments

5

(1

)

600%

Bad debt expense

230

97

137%

Change in fair value of earnout

liability

(208

)

2,063

(110)%

Change in fair value of warrant

liabilities

(1,718

)

6,380

(127)%

Other1,2

2,152

1,455

48%

Total adjustments

7,902

19,881

(60)%

Adjusted EBITDA

$

(7,207

)

$

(20,067

)

64%

Adjusted EBITDA Margin

(13.1

%)

(79.3

%)

6,620 bps

_______________

* Percentage greater than 999%, bps

greater than 9,999 or not meaningful.

1 In the second quarter of 2023, the

Company reclassified insurance proceeds from property losses from

"other" to "loss on disposal of property and equipment, net of

insurance recoveries, and impairment expenses." Previously reported

amounts have been updated to conform to the current period

presentation.

2 For the three months ended March 31,

2024, comprised primarily of costs related to the organizational

realignment announced by the Company on January 17, 2024. For the

three months ended March 31, 2023, comprised primarily of costs

related to the previous reorganization of Company resources

announced by the Company on February 23, 2023 and the petition

filed by EVgo in the Delaware Court of Chancery in February 2023

seeking validation of EVgo's charter and share structure (the "205

Petition").

The following unaudited table presents a reconciliation of

Adjusted Cost of Sales, Adjusted Cost of Sales as a Percentage of

Revenue, Adjusted Gross Profit and Adjusted Gross Margin to the

most directly comparable GAAP measures:

(unaudited, dollars in thousands)

Q1'24

Q1'23

Change

GAAP revenue

$

55,158

$

25,300

118%

GAAP cost of sales

48,317

25,259

91%

GAAP gross profit

$

6,841

$

41

* %

GAAP cost of sales as a percentage of

revenue

87.6

%

99.8

%

(1,220) bps

GAAP gross margin

12.4

%

0.2

%

1,220 bps

Adjustments:

Depreciation, net of capital-build

amortization

$

10,359

$

6,342

63%

Share-based compensation

87

22

295%

Total adjustments

10,446

6,364

64%

Adjusted Cost of Sales

$

37,871

$

18,895

100%

Adjusted Cost of Sales as a Percentage of

Revenue

68.7

%

74.7

%

(600) bps

Adjusted Gross Profit

$

17,287

$

6,405

170%

Adjusted Gross Margin

31.3

%

25.3

%

600 bps

The following unaudited table presents a reconciliation of

Adjusted General and Administrative Expenses and Adjusted General

and Administrative Expenses as a Percentage of Revenue to the most

directly comparable GAAP measures:

(unaudited, dollars in thousands)

Q1'24

Q1'23

Change

GAAP revenue

$

55,158

$

25,300

118%

GAAP general and administrative

expenses

$

34,226

$

37,889

(10)%

GAAP general and administrative expenses

as a percentage of revenue

62.1

%

149.8

%

(8,770) bps

Adjustments:

Share-based compensation

4,614

6,405

(28)%

Loss on disposal of property and

equipment, net of insurance recoveries, and impairment expense1

2,740

3,460

(21)%

Bad debt expense

230

97

137%

Other1,2

2,152

1,455

48%

Total adjustments

9,736

11,417

(15)%

Adjusted General and Administrative

Expenses

$

24,490

$

26,472

(7)%

Adjusted General and Administrative

Expenses as a Percentage of Revenue

44.4

%

104.6

%

(6,020) bps

_______________

* Percentage greater than 999% or bps

greater than 9,999

1 In the second quarter of 2023, the

Company reclassified insurance proceeds from property losses from

"other" to "loss on disposal of property and equipment, net of

insurance recoveries, and impairment expenses." Previously reported

amounts have been updated to conform to the current period

presentation.

2 For the three months ended March 31,

2024, comprised primarily of costs related to the organizational

realignment announced by the Company on January 17, 2024. For the

three months ended March 31, 2023, comprised primarily of costs

related to the previous reorganization of Company resources

announced by the Company on February 23, 2023 and the 205

Petition.

The following unaudited table presents a reconciliation of

Capital Expenditures, Net of Capital Offsets, to the most directly

comparable GAAP measure:

(unaudited, dollars in thousands)

Q1'24

Q1'23

Change

Capital expenditures

$

21,071

$

65,246

(68)%

Capital offsets:

OEM infrastructure payments

5,826

3,895

50%

Proceeds from capital-build funding

1,680

2,216

(24)%

Total capital offsets

7,506

6,111

23%

Capital Expenditures, Net of Capital

Offsets

$

13,565

$

59,135

(77)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507503910/en/

For investors:

investors@evgo.com

For Media:

press@evgo.com

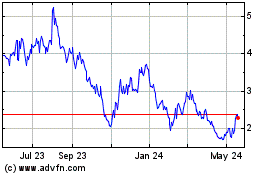

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

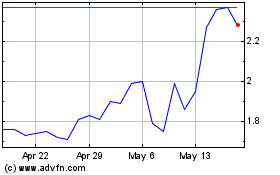

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Dec 2023 to Dec 2024