false

0001710155

0001710155

2025-01-13

2025-01-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date Earliest Event reported):

January 16, 2025 (January 13, 2025)

National Vision Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-38257 |

46-4841717 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

2435 Commerce Avenue

Bldg. 2200

Duluth, Georgia 30096-4980

(Address of principal executive offices, including

zip code)

(770) 822-3600

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8−K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

EYE |

Nasdaq |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On January 16, 2025, National Vision Holdings, Inc. (“National

Vision” or the “Company”) announced in a press release preliminary results for fiscal 2024. A copy of the

press release is furnished herewith as Exhibit 99.1 and incorporated by reference herein.

The unaudited financial results disclosed therein are preliminary based

on the most current information available to management and are subject to change until completion of the Company’s financial closing

procedures for the fourth quarter and full fiscal year 2024. As a result, the Company’s actual results may change as a result of

such financial closing procedures, final adjustments, management's review of results, and other developments that may arise between now

and the time its financial results for the fourth quarter and full fiscal year 2024 are finalized, and the Company’s results could

vary from the preliminary results set forth above.

The information in this Item 2.02 of this Current Report on Form 8-K

is being furnished to the Securities and Exchange Commission (the “SEC”) and shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference into any of National Vision’s filings with

the SEC under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 16, 2025, the Company announced that Melissa Rasmussen,

the Chief Financial Officer of National Vision, will be departing the Company to pursue another opportunity. The Company has initiated

a search to fill the CFO role upon Ms. Rasmussen’s departure. The Company and Ms. Rasmussen are in negotiations concerning her transitional

role as CFO and her departure date while the search for a replacement progresses. A copy of the press release announcing Ms. Rasmussen’s

departure is furnished herewith as Exhibit 99.1 and incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

A copy of the press release referenced in Item 2.02 and Item 5.02 above

is furnished herewith and incorporated by reference herein. The information in this Current Report on Form 8-K under Item 2.02 and Item

7.01, including exhibits, is being furnished to the SEC and shall not be deemed to be “filed” for purposes of Section 18 of

the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of

National Vision’s filings with the SEC under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed by the undersigned hereunto duly authorized.

| |

|

National Vision Holdings, Inc. |

| |

|

|

| Date: January 16, 2025 |

By: |

/s/ Jared Brandman |

| |

Name: |

Jared Brandman |

| |

Title: |

Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

National Vision Announces Leadership Changes

CFO to Depart Following Transition Period

Elevates and Expands Roles of Three Key Executives

to Support Transformation Efforts

Announces Select Preliminary Fourth Quarter

and Fiscal 2024 Financial Results

Duluth, Ga. – January 16, 2025 -- National Vision

Holdings, Inc. (NASDAQ: EYE) (“National Vision” or the “Company”) today announced updates to its leadership

structure that include expanded responsibilities for three executive team members and that Melissa Rasmussen, Chief Financial Officer,

will depart following a transition period.

The Company announced that the Chief Financial Officer, Melissa Rasmussen,

will be departing the Company to pursue an opportunity in another industry. Ms. Rasmussen intends to continue in her role through the

release of the Company’s fourth quarter and full fiscal year 2024 financial results which is expected to occur on February 26, 2025.

The Company has commenced a search to identify her successor and, if necessary, intends to appoint an interim Chief Financial Officer

prior to Ms. Rasmussen’s departure.

"On behalf of our entire organization, I want to thank Melissa

for her dedication and valuable contributions during her tenure at National Vision. Melissa played an instrumental role in helping us

navigate through a rapidly evolving business landscape over the past few years, and more recently, as we have embarked on our transformation

to position National Vision for its next chapter for growth. We wish her the very best in her future endeavors," said Reade Fahs,

National Vision’s CEO.

"I am incredibly grateful for my time at National Vision and proud

of the talented and experienced finance and accounting teams I have had the privilege to lead. The company is well-positioned to continue

to execute on its strategic initiatives, and I look forward to ensuring a smooth transition for my successor," said Ms. Rasmussen.

In addition, to support the Company’s transformation, enhance

the overall patient and customer experience and promote growth in strategic areas, the following changes have been made to the executive

leadership team:

| · | Megan Molony, Chief Merchandising and Managed Care Officer, is assuming leadership of Manufacturing and Distribution. With

this change, the Company is uniting all Managed Vision Care functions, including strategy and revenue cycle management, under one umbrella. |

| · | Mark Banner has been named President of America’s Best. In this new position, Mr. Banner’s significant

retail leadership and customer experience expertise will play a critical role in leading the transformation of the brand’s in-store

experience. In this role, Mr. Banner will also oversee Store Design and Clinical Services. |

| · | Dr. Priti Patel has been named General Manager of Eyeglass World, Fred Meyer and Military. Ms. Patel brings a breadth

of optical experience to the role, providing these brands with a fresh leadership perspective. In this capacity, Ms. Patel will be primarily

focused on strengthening the Eyeglass World brand. |

In addition, the following leader’s roles have been expanded

to align with the Company’s strategic initiatives: Joe VanDette has been named Chief Brand & Marketing Officer, Jared Brandman

has been named Chief Legal & Strategy Officer, and Bill Clark, Chief People Officer will now assume expanded responsibilities in the

areas of Transformation, Enterprise PMO, and Change Management.

Alex Wilkes, National Vision’s President, commented, “These

leaders each bring extensive industry and retail experience that we plan to leverage further with their expanded roles focused on accelerating

our transformation efforts and driving profitable growth in our core brands.”

Select Preliminary Fourth Quarter and Fiscal 2024 Financial Results

The Company today also announced select preliminary results for the

fourth quarter and full year fiscal 2024.

Preliminary Results for Fourth Quarter 2024

| · | Net revenue from continuing operations of approximately $437 million, an increase of 3.9% from the same quarter in fiscal year 2023 |

| · | Comparable store sales growth of approximately 2.6% and Adjusted Comparable Store Sales Growth1

of approximately 1.5% from the same quarter in fiscal year 2023 |

Preliminary Results for Fiscal Year 2024

| · | Net revenue from continuing operations of approximately $1,823 million, an increase of 3.8% from fiscal year 2023 |

| · | Comparable store sales growth of approximately 1.9% and Adjusted Comparable Store Sales Growth1 of approximately 1.3% compared

to fiscal year 2023 |

| · | The Company now expects Adjusted Operating Income1 from continuing operations to be slightly above the higher end of its

previously provided guidance for fiscal 2024 |

"We are pleased to have delivered fourth quarter adjusted comparable

store sales growth that enables us to provide select preliminary full year results more in line with the higher end

of our prior guidance ranges,” continued Fahs. “Our fourth quarter performance reflects initial benefits from transformation

initiatives as well as the impact from the timing of unearned revenue. We look forward to sharing more on our results and the progress

we are making on our transformation when we report fourth quarter earnings. We have a strong team with deep bench strength, and with key

leaders taking on expanded leadership roles, I am confident that we will continue to execute and deliver on our commitment to position

National Vision for long-term profitable growth."

The unaudited financial results disclosed herein are preliminary based

on the most current information available to management and are subject to change until completion of our financial closing procedures

for the fourth quarter and full fiscal year 2024. As a result, our actual results may change as a result of such financial closing procedures,

final adjustments, management's review of results, and other developments that may arise between now and the time our financial results

for the fourth quarter and full fiscal year 2024 are finalized, and our results could vary from the preliminary results set forth above.

The Company expects to release financial results for the fourth quarter

and full fiscal year 2024 on Wednesday, February 26, 2025.

Non-GAAP Financial Measures

Adjusted Comparable Store Sales Growth: We measure Adjusted

Comparable Store Sales Growth as the increase or decrease in sales recorded by the comparable store base in any reporting period, compared

to sales recorded by the comparable store base in the prior reporting period, which we calculate as follows: (i) sales are recorded on

a cash basis (i.e. when the order is placed and paid for or submitted to a managed care payor, compared to when the order is delivered),

utilizing cash basis point of sale information from stores; (ii) stores are added to the calculation during the 13th full fiscal month

following the store’s opening; (iii) closed stores are removed from the calculation for time periods that are not comparable; (iv)

sales from partial months of operation are excluded when stores do not open or close on the first day of the month; and (v) when applicable,

we adjust for the effect of the 53rd week. Quarterly, year-to-date and annual adjusted comparable store sales are aggregated using only

sales from all whole months of operation included in both the current reporting period and the prior reporting period. When a partial

month is excluded from the calculation, the corresponding month in the subsequent period is also excluded from the calculation. There

may be variations in the way in which some of our competitors and other retailers calculate comparable store sales. As a result, our adjusted

comparable store sales may not be comparable to similar data made available by other retailers.

1

This release includes certain Non-GAAP Financial Measures that are not recognized under generally accepted accounting principles (“GAAP”).

Please see “Non-GAAP Financial Measures” for more information.

Adjusted Operating Income: We define Adjusted Operating Income

from continuing operations as net income (loss), minus income (loss) from discontinued operations, net of tax, plus interest expense (income),

net and income tax provision (benefit), further adjusted to exclude stock-based compensation expense, (gain) loss on extinguishment of

debt, asset impairment, litigation settlement, secondary offering expenses, management realignment expenses, long-term incentive plan

expenses, Enterprise Resource Planning (“ERP”) and Customer Relationship Management (“CRM”) implementation expenses

and certain other expenses.

Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the

Securities Exchange Act of 1934. These statements include, but are not limited to, statements related to our current beliefs and expectations

regarding the performance of our industry, the Company’s strategic direction, market position, prospects including remote medicine

and optometrist recruiting and retention initiatives, and future results. You can identify these forward-looking statements by the use

of words such as “outlook,” “guidance,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative

version of these words or other comparable words. Caution should be taken not to place undue reliance on any forward-looking statement

as such statements speak only as of the date when made. We undertake no obligation to publicly update or review any forward-looking statement,

whether as a result of new information, future developments or otherwise, except as required by law.

Forward-looking statements are not guarantees

and are subject to various risks and uncertainties, which may cause actual results to differ materially from those implied in forward-looking

statements. Such factors include, but are not limited to, completion of our financial closing procedures for the fourth quarter and full

fiscal year 2024, the termination of our partnership with Walmart, including the transition period and other wind down activities, will

have an impact on our business, revenues, profitability and cash flows, which impact could be material; market volatility, an overall

decline in the health of the economy and other factors impacting consumer spending, including inflation, uncertainty in financial markets,

recessionary conditions, escalated interest rates, the timing and issuance of tax refunds, governmental instability, war and natural disasters,

may affect consumer purchases, which could reduce demand for our products and materially harm our sales, profitability and financial condition;

failure to recruit and retain vision care professionals for in-store roles or to provide remote care offerings could adversely affect

our business, financial condition and results of operations; the optical retail industry is highly competitive, and if we do not compete

successfully, our business may be adversely impacted; if we fail to open and operate new stores (including as a result of store conversions)

in a timely and cost-effective manner or fail to successfully enter new markets, our financial performance could be materially and adversely

affected; if the performance of our Host brands declines or we are unable to maintain or extend our operating relationships with our Host

partners, our business, profitability and cash flows may be adversely affected and we may be required to incur impairment charges; we

are a low-cost provider and our business model relies on the low-cost of inputs and factors such as wage rate increases, inflation, cost

increases, increases in the price of raw materials and energy prices could have a material adverse effect on our business, financial condition

and results of operations; we require significant capital to fund our expanding business, including updating our Enterprise Resource Planning

(“ERP”) and Customer Relationship Management (“CRM”), and other technological, systems and capabilities; our ability

to successfully implement transformation initiatives (including store fleet optimization); our growth strategy could strain our existing

resources and cause the performance of our existing stores to suffer; our success depends upon our marketing, advertising and promotional

efforts and if we are unable to implement them successfully or efficiently, or if our competitors are more effective than we are, we may

experience a material adverse effect on our business, financial condition and results of operations; we are subject to risks associated

with leasing substantial amounts of space, including future increases in occupancy costs; certain technological advances, greater availability

of, or increased consumer preferences for, vision correction alternatives to prescription eyeglasses or contact lenses, or future drug

development for the correction of vision-related problems may reduce the demand for our products and adversely impact our business and

profitability; if we fail to retain our existing senior management team or attract qualified new personnel such failure could have a material

adverse effect on our business, financial condition and results of operations; our profitability and cash flows may be negatively affected

if we are not successful in managing our inventory balances and inventory shrinkage; our operating results and inventory levels fluctuate

on a seasonal basis; our e-commerce and omni-channel business faces distinct risks, and our failure to successfully manage those risks

could have a negative impact on our profitability; we depend on our distribution centers and/or optical laboratories; we may incur losses

arising from our investments in technological innovators in the optical retail industry, including artificial intelligence, which would

negatively affect our financial results; environmental, social and governance (“ESG”) issues, including those related to climate

change, could have a material adverse effect on our business, financial condition and results of operations; changing climate and weather

patterns leading to severe weather and disasters may cause significant business interruptions and expenditures; future operational success

depends on our ability to develop, maintain and extend relationships with managed vision care companies, vision insurance providers and

other third-party payors; we face risks associated with vendors from whom our products are sourced and are dependent on a limited number

of suppliers; we rely heavily on our information technology systems, as well as those of our vendors, for our business to effectively

operate and to safeguard confidential information; any significant failure, inadequacy, interruption or security breach could adversely

affect our business, financial condition and operations; we rely on third-party coverage and reimbursement, including government programs,

for an increasing portion of our revenues, the future reduction of which could adversely affect our results of operations; we are subject

to extensive state, local and federal vision care and healthcare laws and regulations and failure to adhere to such laws and regulations

would adversely affect our business; we are subject to managed vision care laws and regulations; we are subject to rapidly changing and

increasingly stringent laws, regulations, contractual obligations, and industry standards relating to privacy, data security and data

protection which could subject us to liabilities that adversely affect our business, operations and financial performance; we could be

adversely affected by product liability, product recall or personal injury issues; failure to comply with laws, regulations and enforcement

activities or changes in statutory, regulatory, accounting and other legal requirements could potentially impact our operating and financial

results; adverse judgments or settlements resulting from legal proceedings relating to our business operations could materially adversely

affect our business, financial condition and results of operations; we may not be able to adequately protect our intellectual property,

which could harm the value of our brand and adversely affect our business; we have a significant amount of indebtedness which could adversely

affect our business and financial position, including limiting our business flexibility and preventing us from meeting our debt obligations;

a change in interest rates may adversely affect our business; our credit agreement contains restrictions that limit our flexibility in

operating our business; conversion of the 2025 Notes could dilute the ownership interest of existing stockholders or may otherwise depress

the price of our common stock; and risks related to owning our common stock, including our ability to comply with requirements to design

and implement and maintain effective internal controls. Additional information about these and other factors that could cause National

Vision’s results to differ materially from those described in the forward-looking statements can be found in filings by National

Vision with the Securities and Exchange Commission (“SEC”), including our latest Annual Report on Form 10-K and subsequent

Quarterly Reports on Form 10-Q, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed

as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings

with the SEC.

Non-GAAP Financial Measures

National Vision uses certain non-GAAP financial

measures, including Adjusted EBITDA, which are designed to supplement, and not substitute, financial information presented in accordance

with generally accepted accounting principles in the United States of America (“GAAP”) because management believes such measures

are useful to investors. Additional information about these measures and a reconciliation to the nearest GAAP financial measures is detailed

in National Vision’s press release regarding financial results for the third quarter of 2024, which is available at www.nationalvision.com/investors.

About National Vision Holdings, Inc.

National Vision Holdings, Inc. (NASDAQ: EYE)

is one of the largest optical retail companies in the United States with over 1,200 stores in 38 states and Puerto Rico.

With a mission of helping people by making quality eye care and eyewear more affordable and accessible, the company operates four retail

brands: America’s Best, Eyeglass World, and Vista Opticals inside select Fred Meyer stores and on select military bases, and

an e-commerce website DiscountContacts.com, offering a variety of products and services for customers’ eye care needs. For

more information, please visit www.nationalvision.com.

Investor contact:

investor.relations@nationalvision.com

National Vision Holdings, Inc.

Tamara Gonzalez

ICR, Inc.

Caitlin Churchill

Media contact:

media@nationalvision.com

National Vision Holdings, Inc.

Racheal Peters

Reconciliation of Adjusted Comparable Store Sales Growth to Total

Comparable Store Sales Growth

| | |

Comparable store sales growth (a) | |

| | |

Three Months Ended December 28, 2024 | | |

Three Months Ended December 30, 2023 | | |

Fiscal Year 2024 | | |

Fiscal Year 2023 | |

| Owned & Host segment | |

| | |

| | |

| | |

| |

| America’s Best | |

| 2.0 | % | |

| 7.2 | % | |

| 1.8 | % | |

| 4.0 | % |

| Eyeglass World | |

| (1.7 | )% | |

| 1.2 | % | |

| (2.2 | )% | |

| (1.0 | )% |

| Military | |

| 0.2 | % | |

| 5.1 | % | |

| (0.5 | )% | |

| 3.0 | % |

| Fred Meyer | |

| (2.1 | )% | |

| (0.2 | )% | |

| (4.5 | )% | |

| (4.6 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Total comparable store sales growth | |

| 2.6 | % | |

| 6.6 | % | |

| 1.9 | % | |

| 3.4 | % |

| Adjusted Comparable Store Sales Growth from continuing operations (b) | |

| 1.5 | % | |

| 6.3 | % | |

| 1.3 | % | |

| 3.3 | % |

| a) | Total comparable store sales from continuing operations is calculated based on consolidated net revenue

from continuing operations excluding the impact of (i) Corporate/Other segment net revenue, (ii) sales from stores opened less than 13

months, (iii) stores closed in the periods presented, (iv) sales from partial months of operation when stores do not open or close on

the first day of the month, and (v) if applicable, the impact of a 53rd week in a fiscal year. Brand-level comparable store sales growth

is calculated based on cash basis revenues consistent with what the CODM reviews, and consistent with reportable segment revenues presented

in Note 16. “Segment Reporting” in our consolidated financial statements. |

| b) | (b) Adjusted Comparable Store Sales Growth from continuing operations includes the effect of deferred

and unearned revenue as if such revenues were earned at the point of sale, resulting in the following changes from total comparable store

sales growth based on consolidated net revenue from continuing operations; with respect to the Company’s 2025 Outlook, Adjusted

Comparable Store Sales Growth includes an estimated 0.5% decrease for the effect of deferred and unearned revenue as if such revenues

were earned at the point of sale. |

v3.24.4

Cover

|

Jan. 13, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 13, 2025

|

| Entity File Number |

001-38257

|

| Entity Registrant Name |

National Vision Holdings, Inc.

|

| Entity Central Index Key |

0001710155

|

| Entity Tax Identification Number |

46-4841717

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2435 Commerce Avenue

|

| Entity Address, Address Line Two |

Bldg. 2200

|

| Entity Address, City or Town |

Duluth

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30096-4980

|

| City Area Code |

770

|

| Local Phone Number |

822-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

EYE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

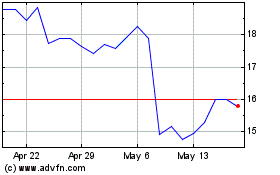

National Vision (NASDAQ:EYE)

Historical Stock Chart

From Mar 2025 to Apr 2025

National Vision (NASDAQ:EYE)

Historical Stock Chart

From Apr 2024 to Apr 2025