UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-39833

EZGO Technologies

Ltd.

(Translation of registrant’s name into English)

Building #A, Floor 2, Changzhou Institute of Dalian

University of Technology,

Science and Education Town,

Wujin District, Changzhou City

Jiangsu, China 213164

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On October 18, 2023, EZGO

Technologies Ltd. (the “Company”) received a letter from the Listings Qualifications Department of The Nasdaq Capital Market

(“Nasdaq”) notifying the Company that the minimum closing bid price per share for its ordinary shares, par value US$0.001

per share (“Ordinary Shares”) was below $1.00 for a period of 30 consecutive business days and that the Company did not meet

the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2). The Nasdaq notification letter does not result in the immediate

delisting of the Company’s Ordinary Shares, and the shares will continue to trade uninterrupted under the symbol “EZGO.”

Pursuant to Nasdaq Listing

Rule 5810(c)(3)(A), the Company has a compliance period of one hundred eighty (180) calendar days, or until April 15, 2024 (the “Compliance

Period”), to regain compliance with Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the

closing bid price per share of the Company 's Ordinary Shares is at least $1.00 for a minimum of ten (10) consecutive business days, Nasdaq

will provide the Company a written confirmation of compliance and the matter will be closed.

In the event the Company

does not regain compliance by April 15, 2024, the Company may be eligible for an additional 180 calendar day grace period. To qualify,

the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial

listing standards for the Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice

of its intention to cure the deficiency during the second compliance period, including by effecting a reverse stock split, if necessary.

If the Company chooses to implement a reverse stock split, it must complete the split no later than ten (10) business days prior to April

15, 2024, or the expiration of the second compliance period if granted.

On October 19, 2023,

the Company issued a press release entitled “EZGO Announces Receipt of Nasdaq Notification Regarding Minimum Bid Price Deficiency.”

A copy of the please release is filed as Exhibit 99.1 to this Current Report on Form 6-K and is incorporated herein by reference.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

EZGO Technologies Ltd. |

| |

|

| |

By: |

/s/ Jianhui Ye |

| |

Name: |

Jianhui Ye |

| |

Title: |

Chief Executive Officer |

Date: October 19, 2023

Exhibit 99.1

EZGO Announces

Receipt of Nasdaq Notification Regarding Minimum Bid Price Deficiency

CHANGZHOU,

China, October 19, 2023 /PRNewswire/ -- EZGO Technologies Ltd. (Nasdaq: EZGO) ("EZGO" or the "Company"), a leading

short-distance transportation solutions provider in China, today announced that the Company had received a notification letter (the

“Notification Letter”) dated October 18, 2023 from the Listing Qualifications Department

of The Nasdaq Stock Market LLC ("Nasdaq"), notifying the Company that it is currently not in compliance with the minimum bid

price requirement set forth under Nasdaq Listing Rule 5550(a)(2). It resulted from the fact that the closing bid price of the Company's

ordinary shares, par value US$0.001 per share (“Ordinary Shares”) was below $1.00 per share for a period of 30 consecutive

business days from September 6, 2023 to October 17, 2023.

This

press release is issued pursuant to Nasdaq Listing Rule 5810(b), which requires prompt disclosure of receipt of a deficiency notification.

The Notification Letter has no immediate effect on the listing of the Company's Ordinary

Shares, which will continue to trade uninterrupted on Nasdaq under the ticker "EZGO".

Pursuant to Nasdaq Listing

Rule 5810(c)(3)(A), the Company has a compliance period of 180 calendar days, or until April 15, 2024 (the "Compliance Period"),

to regain compliance with Nasdaq's minimum bid price requirement. If at any time during the Compliance Period, the closing bid price per

share of the Company's Ordinary Shares is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide the Company

a written confirmation of compliance and the matter will be closed.

In the event the Company

does not regain compliance with the minimum bid price requirement by April 15, 2024, the Company may be eligible for an additional 180

calendar day grace period to regain compliance. To qualify, the Company will be required to meet the continued listing requirement for

market value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of the

bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period,

including by effecting a reverse stock split, if necessary. If the Company chooses to implement a reverse stock split, it must complete

the split no later than 10 business days prior to April 15, 2024 or the expiration of the second compliance period if granted.

The Company's operations

are not affected by the receipt of the Notification Letter. The Company intends to monitor the closing bid price of its Ordinary Shares

and may, if appropriate, consider implementing available options, including, but not limited to, implementing a reverse share split of

its outstanding Ordinary Shares, to regain compliance with the minimum bid price requirement under the Nasdaq Listing Rules.

About EZGO Technologies

Ltd.

Leveraging

an Internet of Things (IoT) product and service platform and three e-bicycle brands, “EZGO”, “Dilang” and “Cenbird”,

EZGO has established a business model centered on the manufacturing and sale of two- and three-wheeled electric vehicles, lithium batteries,

complemented by the e-bicycle charging pile business. For additional information, please visit EZGO’s website at www.ezgotech.com.cn.

Investors can visit the “Investor Relations” section of EZGO’s website at www.ezgotech.com.cn/Investor.

Safe Harbor Statement

This press release

contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include

statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements

that are other than statements of historical facts. When the Company uses words such as “may,” “will,” “intend,”

“should,” “believe,” “expect,” “anticipate,” “project,” “estimate,”

or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements

are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from

the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks

including, but not limited to, the following: the Company’s goals and strategies; the Company’s future business development;

product and service demand and acceptance; changes in technology; economic conditions; the growth of the short-distance transportation

solutions market in China and the other international markets the Company plans to serve; reputation and brand; the impact of competition

and pricing; government regulations; fluctuations in general economic and business conditions in China and the international markets the

Company plans to serve and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the

Company with the Securities and Exchange Commission (“SEC”), including the Company’s most recently filed Annual Report

on Form 20-F and its subsequent filings. For these reasons, among others, investors are cautioned not to place undue reliance upon any

forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which

are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements

to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

Ascent Investor Relations LLC

Tina Xiao

Email: investors@ascent-ir.com

Phone: +1-646-932-7242

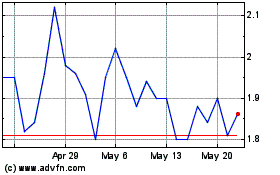

EZGO Technologies (NASDAQ:EZGO)

Historical Stock Chart

From Apr 2024 to May 2024

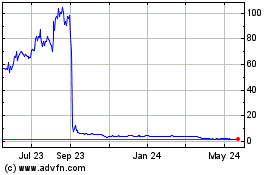

EZGO Technologies (NASDAQ:EZGO)

Historical Stock Chart

From May 2023 to May 2024