UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K/A

AMENDMENT NO. 1 TO

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): November 11, 2023

Fat

Projects Acquisition Corp

(Exact name of

registrant as specified in its charter)

| Cayman Islands |

|

001-40755 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

27 Bukit Manis Road

Singapore

|

|

099892

|

| (Address of principal executive offices) |

|

(Zip Code) |

(65) 8590-2056

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

Units,

each consisting of one Class A Ordinary Share and One Redeemable Warrant

|

|

FATPU |

|

The

Nasdaq Stock Market LLC |

| Class

A Ordinary Share, par value $0.0001 per share |

|

FATP |

|

The

Nasdaq Stock Market LLC |

| Redeemable

Warrants, each warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

FATPW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

Note

This Amendment No. 1 to Current Report on

Form 8-K is filed by Fat Projects Acquisition Corp, a Cayman Islands corporation (Nasdaq: FATPU, FATP, FATPW), referred to herein as

“FATP” or the “Company” to correct information in Item 8.01 of the original Current Report on

Form 8-K (the “Original Report”). The Original Report incorrectly stated that “As of the close of business on

November 15, 2023, the Public Shares will be deemed cancelled and will represent only the right to receive the Redemption

Amount.” The Company’s publicly held Class A ordinary shares (the “Public Shares”) have not been

cancelled, however the Nasdaq Stock Market has placed a trading halt on the Public shares. The trading halt will remain in place

until the Company sets a redemption date for the Public Shares, at which point trading of the Public Shares will resume until the

redemption date occurs. The corrected Item 8.01 is set forth in full below.

On November 22, 2023, the Company issued a press

release announcing the correction. A copy of the press release is attached as Exhibit 99.2 and incorporated herein by reference.

The

Company’s Charter requires the Company to complete its initial business combination by November 15, 2023 unless the

Company obtains up to two remaining 1-month extensions of that deadline to January 15, 2024 by depositing on or prior to the

then-current deadline $24,279.65 into the Company’s trust account with Continental Stock Transfer and Trust Company (the

“Trust Account”) for each 1-month extension. The Company did not make the required deposit by November 15,

2023 for the extension of the deadline to December 15, 2023; therefore, the Company’s Charter required the Company to,

and the Company will:

| (i) | cease

all operations as of November 15, 2023 except for the purpose of winding up the Company’s business; |

| (ii) | as

promptly as reasonably possible but not more than ten business days thereafter, subject to lawfully available funds therefor, redeem

the Company’s publicly held Class A ordinary shares (the “Public Shares”), at a per-share price, payable in

cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on the Trust Account and not previously

released to the Company to pay taxes, if any, (less up to US$100,000 of interest to pay dissolution expenses), divided by the number

of Public Shares then in issue, which redemption will completely extinguish Public Shareholders’ rights as Shareholders (including

the right to receive further liquidation distributions, if any); and |

| (iii) | as

promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining shareholders and

directors, liquidate and dissolve; |

subject

in the case of items (ii) and (iii) above, to the Company’s obligations under Cayman Islands law to provide for claims of

creditors and in all cases subject to the other requirements of applicable law.

The per-share redemption price for the

Public Shares will be approximately $10.96 (the “Redemption Amount”). The balance of the Trust Account as of November 15,

2023 was approximately $5.4 million. In accordance with the terms of the related trust agreement, the Company expects to retain $100,000

of the interest and dividend income from the Trust Account to pay dissolution expenses.

The Public Shares will continue to trade until

the Company sets a redemption date for the Public Shares and the redemption date occurs.

The

Redemption Amount will be payable to the holders of the Public Shares upon presentation of their respective share or unit certificates

or other delivery of their shares or units to the Company’s transfer agent, Continental Stock Transfer & Trust Company.

Beneficial owners of Public Shares held in “street name,” however, will not need to take any action in order to receive

the Redemption Amount.

There

will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will expire worthless.

Our

initial shareholders, including the Company’s Sponsor, have agreed to waive their redemption rights with respect to the Company’s

Class B ordinary shares. After November 15, 2023, the Company shall cease all operations except for those required to wind

up its business.

The

Company expects that the Nasdaq Stock Market will file a Form 25 with the U.S. Securities and Exchange Commission (the “Commission”)

to delist its securities. The Company thereafter expects to file a Form 15 with the Commission to terminate the registration of

its securities under the Securities Exchange Act of 1934, as amended.

On

November 17, 2023, the Company issued a press release announcing its termination of the Business Combination Agreement and

the liquidation described in this Item 8.01. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by

reference.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

FAT

PROJECTS ACQUISITION CORP

|

| |

|

| |

By: |

/s/ Tristan Lo |

| |

Name: |

Tristan

Lo |

| |

Title: |

Co-Chief Executive Officer |

Date:

November 22, 2023

Exhibit 99.2

CORRECTION - Fat Projects Acquisition Corp

Announces Temporary Trading Halt to

Publicly Held Class A

Ordinary Shares

Singapore – November 22, 2023 — Fat Projects Acquisition Corp (NASDAQ: FATPU, FATP, FATPW) (“FATP” or the “Company”), a special purpose acquisition company, announced that its press release dated November 17, 2023 incorrectly stated that “As of the close of business on November 15, 2023, the Public Shares will be deemed cancelled and will represent only the right

to receive the Redemption Amount.” The Company’s publicly held Class A ordinary shares (the “Public Shares”) have not been cancelled, however the Nasdaq Stock Market has placed a trading halt on the Public

shares. The trading halt will remain in place until the Company sets a redemption date for the Public Shares, at which point trading of

the Public Shares will resume until the redemption date occurs.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this press release,

the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar expressions are

intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words. Such forward-looking statements are based

on current information and expectations, forecasts and assumptions, and involve a

number of judgments, risks and uncertainties. Accordingly, forward-looking statements

should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation

to update forward-looking statements to reflect events or circumstances after the

date they were made, whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws. You should not place undue

reliance on these forward-looking statements. As a result of a number of known and

unknown risks and uncertainties, actual results or performance may be materially different

from those expressed or implied by these forward-looking statements. You should carefully consider the risks and uncertainties described in the “Risk Factors”

section of, and elsewhere in, the Company’s registration statement on Form S-1 (Registration No. 333-257126), as amended, initially filed with the Commission on June 16, 2021, relating to its initial public offering, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 13, 2023, the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2023, which was filed with the SEC on August 21, 2023, and other documents filed by the Company from time to time with the SEC. These filings

identify and address other important risks and uncertainties that could cause actual

events and results to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date they are made. Readers

are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result

of new information, future events, or otherwise.

Contact:

investor@fatprojects.com

Fat Projects Acquisition (NASDAQ:FATPU)

Historical Stock Chart

From Mar 2024 to May 2024

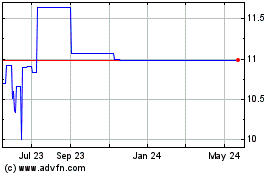

Fat Projects Acquisition (NASDAQ:FATPU)

Historical Stock Chart

From May 2023 to May 2024