false

0001865045

0001865045

2023-11-11

2023-11-11

0001865045

fatp:UnitsEachConsistingOfOneClassOrdinaryShareAndOneRedeemableWarrantMember

2023-11-11

2023-11-11

0001865045

fatp:ClassOrdinaryShareParValue0.0001PerShareMember

2023-11-11

2023-11-11

0001865045

fatp:RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2023-11-11

2023-11-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): November 11, 2023

Fat Projects Acquisition Corp

(Exact name of

registrant as specified in its charter)

| Cayman Islands |

|

001-40755 |

|

00-0000000N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

27 Bukit Manis Road

Singapore

|

|

099892

|

| (Address of principal executive offices) |

|

(Zip Code) |

(65) 8590-2056

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

Units,

each consisting of one Class A Ordinary Share and One Redeemable Warrant

|

|

FATPU |

|

The Nasdaq Stock Market LLC |

| Class

A Ordinary Share, par value $0.0001 per share |

|

FATP |

|

The Nasdaq Stock Market LLC |

| Redeemable

Warrants, each warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

FATPW |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory

Note

This

Current Report on Form 8-K is filed by Fat Projects Acquisition Corp, a Cayman Islands corporation (Nasdaq: FATPU, FATP, FATPW),

referred to herein as “FATP” or the “Company” to report the following events ss described

in more detail below:

|

1. |

On

Sunday, November 12, 2023, Avanseus Holdings Pte. Ltd. (“Avanseus”) informed FATP of circumstances

and developments that FATP determined constituted a material adverse effect on Avanseus and that will make Avanseus unable

to satisfy the related condition to FATP’s obligation to close the transactions in the Business Combination Agreement

between the companies. |

|

2. |

Four

of the Company’s non-management directors and its president and chief operating officer have tendered their resignations; |

|

3. |

On

Tuesday, November 14, 2023, FATP gave Avanseus notice that FATP was terminating their Business Combination Agreement,

effective immediately, because of the material adverse effect on Avanseus; and |

|

4. |

On

Wednesday, November 15, 2023, the Company did not make the payment required to extend the deadline to complete its initial

business combination; therefore, the Company is required to dissolve and liquidate in accordance with the provisions of its

Amended and Restated Memorandum and Articles of Association, as amended (the “Charter”). |

|

Item

1.02 |

Termination

of a Material Definitive Agreement. |

On

Monday, November 13, 2023, FATP notified Avanseus that FATP was terminating the Business Combination Agreement dated August 26,

2023, as amended (the “Business Combination Agreement”), by and between FATP and Avanseus and delivered a formal

notice of termination the following day. FATP terminated the Business Combination Agreement because FATP determined that a material

adverse effect on Avanseus’ financial condition and results of operations had occurred as a result of steady material deterioration

in Avanseus’ business and revenues since the execution of the Business Combination Agreement and because Avanseus’

most recent update to FATP indicated to FATP that Avanseus was unlikely to be able to materially reverse the deterioration in the

foreseeable future.

As

first disclosed in a Current Report on Form 8-K filed with the Commission on September 1, 2022, the Business Combination Agreement

had contemplated the acquisition by FATP of all of Avanseus’ outstanding ordinary shares in exchange for newly-issued FATP

Class A ordinary shares in a transaction registered with the Commission on Form S-4 making Avanseus a wholly-owned subsidiary of

FATP.

A

copy of FATP’s notice of termination to Avanseus is attached as Exhibit 10.1 and incorporated herein by reference.

On

November 17, 2023, the Company issued a press release announcing the termination of the Business Combination Agreement and

the liquidation described in Item 8.01 below. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by

reference.

|

Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers. |

On

November 11, 2023, the Company’s non-management directors Abel Martins Alexandre, Christina Wyer and Stanton Sugarman

each gave written notice to the Company of his or her resignation from the Company’s board of directors, effective immediately.

None of them stated a reason for his or her resignation. Mr. Alexandre served as the chair and Mr. Sugarman served as

a member of the audit committee of the Company’s board of directors. Ms. Wyer served as the chair of the compensation committee

of the Company’s board of directors.

Also

on November 11, 2023, Nils Michaelis gave written notice to the Company of his resignation from the positions of President,

Chief Operating Officer and Head of Mergers and Acquisitions of the Company, effective immediately. He did not state a reason for

his resignation. Mr. Michaelis is also a director of the Company but did not resign from the Company’s board of directors.

On

November 14, 2023, the Company’s non-management director Samir Addamine gave written notice to the Company of his resignation

from the Company’s board of directors, effective immediately. He did not state a reason for his resignation. Mr. Addamine

served as a member of the audit committee of the Company’s board of directors.

The

remaining directors of the Company are Tristan Lo, the Company’s Co-Chief Executive Officer, David Andrada, the Company’s

Co-Chief Executive Officer and Chief Financial Officer, and Alex Bono, a non-management director.

The

Company’s Charter requires the Company to complete its initial business combination by November 15, 2023 unless the

Company obtains up to two remaining 1-month extensions of that deadline to January 15, 2024 by depositing on or prior to the

then-current deadline $24,279.65 into the Company’s trust account with Continental Stock Transfer and Trust Company (the

“Trust Account”) for each 1-month extension. The Company did not make the required deposit by November 15,

2023 for the extension of the deadline to December 15, 2023; therefore, the Company’s Charter required the Company to,

and the Company will:

| (i) |

|

cease

all operations as of November 15, 2023 except for the purpose of winding up the Company’s business; |

| (ii) |

|

as

promptly as reasonably possible but not more than ten business days thereafter, subject to lawfully available funds therefor,

redeem the Company’s publicly held Class A ordinary shares (the “Public Shares”), at a per-share

price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on

the Trust Account and not previously released to the Company to pay taxes, if any, (less up to US$100,000 of interest to

pay dissolution expenses), divided by the number of Public Shares then in issue, which redemption will completely extinguish

Public Shareholders’ rights as Shareholders (including the right to receive further liquidation distributions, if any);

and |

| (iii) |

|

as

promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining shareholders

and directors, liquidate and dissolve; |

subject

in the case of items (ii) and (iii) above, to the Company’s obligations under Cayman Islands law to provide for claims of

creditors and in all cases subject to the other requirements of applicable law.

The per-share redemption price for the

Public Shares will be approximately $10.96 (the “Redemption Amount”). The balance of the Trust Account as of November 15,

2023 was approximately $5.4 million. In accordance with the terms of the related trust agreement, the Company expects to retain $100,000

of the interest and dividend income from the Trust Account to pay dissolution expenses.

As

of the close of business on November 15, 2023, the Public Shares will be deemed cancelled and will represent only the right

to receive the Redemption Amount.

The

Redemption Amount will be payable to the holders of the Public Shares upon presentation of their respective share or unit certificates

or other delivery of their shares or units to the Company’s transfer agent, Continental Stock Transfer & Trust Company.

Beneficial owners of Public Shares held in “street name,” however, will not need to take any action in order to receive

the Redemption Amount.

There

will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will expire worthless.

Our

initial shareholders, including the Company’s Sponsor, have agreed to waive their redemption rights with respect to the Company’s

Class B ordinary shares. After November 15, 2023, the Company shall cease all operations except for those required to wind

up its business.

The

Company expects that the Nasdaq Stock Market will file a Form 25 with the U.S. Securities and Exchange Commission (the “Commission”)

to delist its securities. The Company thereafter expects to file a Form 15 with the Commission to terminate the registration of

its securities under the Securities Exchange Act of 1934, as amended.

On

November 17, 2023, the Company issued a press release announcing its termination of the Business Combination Agreement and

the liquidation described in this Item 8.01. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by

reference.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

FAT

PROJECTS ACQUISITION CORP

|

| |

|

| |

By: |

/s/ Tristan Lo |

| |

Name: |

Tristan

Lo |

| |

Title: |

Co-Chief Executive Officer |

Date:

November 17, 2023

Exhibit 10.1

Fat Projects Acquisition Corp

27 Bukit Manis Road

Singapore 099892

November 14, 2023

By electronic mail:

Avanseus Holdings Pte. Ltd.

230 Victoria Street, #15-01/08

Bugis Junction

Singapore 188024

MeiLan Ng

|

Email: |

bhargab.mitra@avanseus.com |

Meilan.ng@avanseus.com

|

RE: |

Termination of Business Combination Agreement dated August 26, 2022, as amended (the “BCA”), by and between Fat Projects Acquisition Corp (“FATP”) and Avanseus Holdings Pte. Ltd. (“Avanseus”) |

Dear Bhargab and MeiLan:

We hereby inform you on behalf of FATP, that FATP is hereby terminating the BCA, effective immediately, in accordance with the provisions of Section 12.1(e)(i) thereof. Capitalized terms not otherwise defined in this notice have the meanings ascribed to them in the BCA, and section references in this notice are references to sections of the BCA.

Since the date the original BCA was signed, Avanseus has failed to generate sufficient revenues to grow its business operations or even maintain them at the level contemplated when the BCA was signed. We understand that Avanseus will not produce any material revenues at all in the entire 2023 calendar year and cannot guaranty it will obtain any of the new contracts it is currently negotiating in its business development pipeline. Further, you have advised us that Avanseus is simply not ready to be a public company and that its solvency is rapidly deteriorating.

These circumstances and others constitute a Company Material Adverse Effect that will make Avanseus unable to satisfy the condition to FATP’s obligation to consummate the Transactions in Section 11.2(a)(ii) that the Company Fundamental Representation in Section 5.24 that there has been no Company Material Adverse Effect since the date of Avanseus’ Audited Financial Statements (as of and for the years ended December 31, 2021 and December 31, 2020) will remain true and correct in all material respects as of the Closing Date. FATP reserves the right to terminate the BCA on additional grounds as well.

Personally, we regret that it has become necessary for FATP to terminate the BCA. We admire you and your business and have very much enjoyed working with you, and we wish Avanseus and you all the very best in the future.

Sincerely,

FAT PROJECTS ACQUISITION CORP

| By: |

/s/ Tristan Lo |

|

| |

Tristan Lo |

|

| |

Co-Chief Executive Officer |

|

| By: |

/s/ David Andrada |

|

| |

David Andrada |

|

| |

Co-Chief Executive Officer |

|

| CC: | Rachel Eng (rachel.eng@mail.engandcollc.com) |

Andrew Heng (andrew.heng@mail.engandcollc.com)

Joseph Lucosky (jlucosky@lucbro.com)

Scott Rapfogel (srapfogel@lucbro.com)

Chris Haunschild (chaunschild@lucbro.com)

Andrew M. Tucker (andy.tucker@nelsonmullins.com)

Eric K. Graben (eric.graben@nelsonmullins.com)

Exhibit 99.1

Fat Projects Acquisition Corp Announces

Termination of Business Combination Agreement with Avanseus and Subsequent Liquidation

Singapore – November 17, 2023 — Fat Projects Acquisition Corp (NASDAQ: FATPU, FATP, FATPW) (“FATP” or the “Company”), a special purpose acquisition company, announced that it has terminated its Business Combination Agreement with Avanseus Holdings Pte. Ltd. (“Avanseus”) and that it did not extend the deadline to complete its initial business combination to November 15, 2023 therefore it will dissolve and liquidate. Four of its non-management directors and its president and chief operating officer have resigned.

Termination of Business Combination Agreement with Avanseus

On Monday, November 13, 2023, FATP notified Avanseus that FATP was terminating the Business Combination Agreement dated August 26, 2023, as amended (the “Business Combination Agreement”), by and between FATP and Avanseus and delivered a formal notice of termination the following day. FATP terminated the Business Combination Agreement because FATP determined that a material adverse effect on Avanseus’ financial condition and results of operations had occurred as a result of steady material deterioration in Avanseus’ business and revenues since the execution of the Business Combination Agreement and because Avanseus’ most recent update to FATP indicated to FATP that Avanseus was unlikely to be able to materially reverse the deterioration in the foreseeable future. The Business Combination Agreement had contemplated the acquisition by FATP of all of Avanseus’ outstanding ordinary shares in exchange for newly-issued FATP Class A ordinary shares in a transaction registered with the U.S. Securities and Exchange Commission on Form S-4 making Avanseus a wholly-owned subsidiary of FATP.

Dissolution and Liquidation of the Company

The Company’s Charter requires the Company to complete its initial business combination by November 15, 2023 unless the Company obtains up to two remaining 1-month extensions of that deadline to January 15, 2024 by depositing on or prior to the then-current deadline $24,279.65 into the Company’s trust account with Continental Stock Transfer and Trust Company (the “Trust Account”) for each 1-month extension. The Company did not make the required deposit by November 15, 2023 for the extension of the deadline to December 15, 2023; therefore, the Company’s Charter required the Company to, and the Company will:

| (i) |

|

cease all operations as of November 15, 2023 except for the purpose of winding up the Company’s business; |

| (ii) |

|

as promptly as reasonably possible but not more than ten business days thereafter, subject to lawfully available funds therefor, redeem the Company’s publicly held Class A ordinary shares (the “Public Shares”), at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the Trust Account, including interest earned on the Trust Account and not previously released to the Company to pay taxes, if any, (less up to US$100,000 of interest to pay dissolution expenses), divided by the number of Public Shares then in issue, which redemption will completely extinguish Public Shareholders’ rights as Shareholders (including the right to receive further liquidation distributions, if any); and |

| (iii) |

|

as promptly as reasonably possible following such redemption, subject to the approval of the Company’s remaining shareholders and directors, liquidate and dissolve; |

subject in the case of items (ii) and (iii) above, to the Company’s obligations under Cayman Islands law to provide for claims of creditors and in all cases subject to the other requirements of applicable law.

The per-share redemption price for the Public

Shares will be approximately $10.96 (the “Redemption Amount”). The balance of the Trust Account as of November 15,

2023 was approximately $5.4 million . In accordance with the terms of the related trust agreement, the Company expects to retain $100,000

of the interest and dividend income from the Trust Account to pay dissolution expenses.

As of the close of business on November 15, 2023, the Public Shares will be deemed cancelled and will represent only the right to receive the Redemption Amount.

The Redemption Amount will be payable to the holders of the Public Shares upon presentation of their respective share or unit certificates or other delivery of their shares or units to the Company’s transfer agent, Continental Stock Transfer & Trust Company. Beneficial owners of Public Shares held in “street name,” however, will not need to take any action in order to receive the Redemption Amount.

There will be no redemption rights or liquidating distributions with respect to the Company’s warrants, which will expire worthless.

Our initial shareholders, including the Company’s Sponsor, have agreed to waive their redemption rights with respect to the Company’s Class B ordinary shares. After November 15, 2023, the Company shall cease all operations except for those required to wind up its business.

The Company expects that the Nasdaq Stock Market will file a Form 25 with the U.S. Securities and Exchange Commission (the “Commission”) to delist its securities. The Company thereafter expects to file a Form 15 with the Commission to terminate the registration of its securities under the Securities Exchange Act of 1934, as amended.

Resignations of Directors and President

The Company’s non-management directors Abel Martins Alexandre, Christina Wyer, Samir Addamine and Stanton Sugarman each gave written notice to the Company of his or her resignation from the Company’s board of directors, effective immediately. None of them stated a reason for his or her resignation. Mr. Alexandre served as the chair and Mr. Sugarman and Mr. Addamine served as members of the audit committee of the Company’s board of directors. Ms. Wyer served as the chair of the compensation committee of the Company’s board of directors.

Nils Michaelis also gave written notice to the Company of his resignation from the positions of President, Chief Operating Officer and Head of Mergers and Acquisitions of the Company, effective immediately. He did not state a reason for his resignation.

The remaining directors of the Company are Tristan Lo, the Company’s Co-Chief Executive Officer, David Andrada, the Company’s Co-Chief Executive Officer and Chief Financial Officer, and Alex Bono, a non-management director.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this press release, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Such forward-looking statements are based on current information and expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. You should not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of, and elsewhere in, the Company’s registration statement on Form S-1 (Registration No. 333-257126), as amended, initially filed with the Commission on June 16, 2021, relating to its initial public offering, the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 13, 2023, the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2023, which was filed with the SEC on August 21, 2023., and other documents filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

investor@fatprojects.com

v3.23.3

Cover

|

Nov. 11, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 11, 2023

|

| Entity File Number |

001-40755

|

| Entity Registrant Name |

Fat Projects Acquisition Corp

|

| Entity Central Index Key |

0001865045

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

27 Bukit Manis Road

|

| Entity Address, City or Town |

Singapore

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

099892

|

| City Area Code |

(65)

|

| Local Phone Number |

8590-2056

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share and One Redeemable Warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one Class A Ordinary Share and One Redeemable Warrant

|

| Trading Symbol |

FATPU

|

| Security Exchange Name |

NASDAQ

|

| Class A Ordinary Share, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A Ordinary Share, par value $0.0001 per share

|

| Trading Symbol |

FATP

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable

Warrants, each warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50

|

| Trading Symbol |

FATPW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fatp_UnitsEachConsistingOfOneClassOrdinaryShareAndOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fatp_ClassOrdinaryShareParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fatp_RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

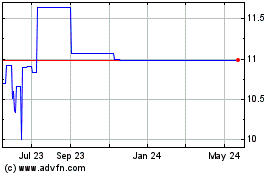

Fat Projects Acquisition (NASDAQ:FATPU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fat Projects Acquisition (NASDAQ:FATPU)

Historical Stock Chart

From Apr 2023 to Apr 2024