false

0000036377

0000036377

2024-12-09

2024-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 9, 2024

FIRST

HAWAIIAN, INC.

(Exact Name of Registrant as Specified in Its

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| 001-14585 |

|

99-0156159 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

| 999

Bishop St., 29th Floor |

|

|

| Honolulu,

Hawaii |

|

96813 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(808)

525-7000

(Registrant’s Telephone

Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

| Common

Stock, par value $0.01 per share |

|

FHB |

|

NASDAQ

Global Select Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On December 9, 2024, First Hawaiian, Inc. (the

“Company”) announced the completion of a restructuring related to its available-for-sale investment securities portfolio. A

copy of the Company’s press release announcing this event is being furnished as Exhibit 99.1 to this Current Report on Form 8-K

Pursuant to Regulation FD, the press release is

furnished as Exhibit 99.1. The information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

under that Section, and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of

1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FIRST HAWAIIAN, INC. |

| |

|

|

| Date: December 9, 2024 |

By: |

/s/Robert S. Harrison |

| |

|

Robert S. Harrison |

| |

|

Chairman of the Board, President and Chief Executive Officer |

Exhibit 99.1

For Immediate Release

First Hawaiian, Inc. Completes Investment

Portfolio Restructuring

HONOLULU, Hawaii December 9, 2024--(Globe Newswire)--First Hawaiian, Inc.

(NASDAQ:FHB), (“First Hawaiian” or the “Company”) today announced the completion of a restructuring related to

its available-for-sale investment securities portfolio.

The Company executed the sale of $293 million of its lower-yielding

available-for-sale debt securities for an estimated after-tax loss of $19.7 million. Proceeds from the sale were reinvested in $293 million

of debt securities currently yielding 309 basis points more than the securities that were sold. The transaction is projected to increase

net interest income by approximately $8.6 million and net interest margin by approximately 4 basis points in 2025. The transaction is

projected to increase net interest income by approximately $0.5 million and net interest margin by approximately 1 basis point in the

fourth quarter of 2024.

The securities sold had a weighted average yield of 1.92% and a weighted

average duration of 3.2 years. The proceeds were reinvested into securities with a weighted average yield of 5.01%, with a weighted average

duration of 4.1 years. The Company recognized a one-time pre-tax loss of $26.2 million as a result of the transaction, which will be recognized

in the quarter ending December 31, 2024. The breakeven on this transaction is estimated to be 3 years.

This restructuring had no impact on tangible equity, and the Company

remains "well capitalized" under applicable regulatory guidelines.

First Hawaiian, Inc.

First Hawaiian, Inc. (NASDAQ:FHB)

is a bank holding company headquartered in Honolulu, Hawaii. Its principal subsidiary, First Hawaiian Bank, founded in 1858 under

the name Bishop & Company, is Hawaii’s oldest and largest financial institution with branch locations throughout Hawaii,

Guam and Saipan. The company offers a comprehensive suite of banking services to consumer and commercial customers including deposit

products, loans, wealth management, insurance, trust, retirement planning, credit card and merchant processing services. Customers may

also access their accounts through ATMs, online and mobile banking channels. For more information about First Hawaiian, Inc., visit

the Company’s website, www.fhb.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among

other things, future events and our financial performance. These statements are often, but not always, made through the use of words or

phrases such as “may”, “might”, “should”, “could”, “predict”, “potential”,

“believe”, “expect”, “continue”, “will”, “anticipate”, “seek”,

“estimate”, “intend”, “plan”, “projection”, “would”, “annualized”

and “outlook”, or the negative version of those words or other comparable words or phrases of a future or forward-looking

nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about

our industry, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain

and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance

and are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Although we believe that the expectations

reflected in these forward-looking statements are reasonable as of the date made, there can be no assurance that actual results will not

prove to be materially different from the results expressed or implied by the forward-looking statements. A number of important factors

could cause actual results or performance to differ materially from the forward-looking statements, including (without limitation) the

risks and uncertainties associated with the domestic and global economic environment and capital market conditions and other risk factors.

For a discussion of some of these risks and important factors that could affect our future results and financial condition, see our U.S.

Securities and Exchange Commission (“SEC”) filings, including, but not limited to, our Annual Report on Form 10-K for

the year ended December 31, 2023 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30,

2024, and September 30, 2024.

Investor Relations Contact:

Kevin Haseyama, CFA

(808) 525-6268

khaseyama@fhb.com |

Media Contact:

Lindsay Chambers

(808) 525-6254

lchambers@fhb.com |

v3.24.3

Cover

|

Dec. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 09, 2024

|

| Entity File Number |

001-14585

|

| Entity Registrant Name |

FIRST

HAWAIIAN, INC.

|

| Entity Central Index Key |

0000036377

|

| Entity Tax Identification Number |

99-0156159

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

999

Bishop St.

|

| Entity Address, Address Line Two |

29th Floor

|

| Entity Address, City or Town |

Honolulu

|

| Entity Address, State or Province |

HI

|

| Entity Address, Postal Zip Code |

96813

|

| City Area Code |

808

|

| Local Phone Number |

525-7000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01 per share

|

| Trading Symbol |

FHB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

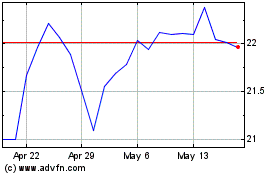

First Hawaiian (NASDAQ:FHB)

Historical Stock Chart

From Jan 2025 to Feb 2025

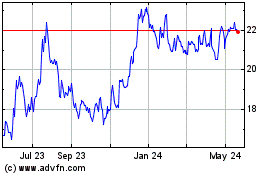

First Hawaiian (NASDAQ:FHB)

Historical Stock Chart

From Feb 2024 to Feb 2025