false

0001602409

0001602409

2024-01-22

2024-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 22, 2024

Date of Report (Date of earliest event reported)

FINGERMOTION, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41187 |

|

46-4600326 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

111 Somerset Road,

Level 3

Singapore |

|

238164 |

| (Address of principal executive offices) |

|

(Zip Code) |

(347) 349-5339

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol (s) |

Name of each exchange on which registered |

| Common Stock |

FNGR |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 7 – REGULATION FD

| Item 7.01 |

Regulation FD Disclosure |

On

January 22, 2024, the Company issued a news release to provide a supplemental corporate update in a letter from our CEO, Martin

Shen, to our shareholders.

To Our Shareholders,

Overview

In our continuing

efforts to provide transparency regarding our financial status, I am providing more clarity as to the results of our most recent quarterly

results.

As most of

you know, the majority of our revenue is currently derived from our Telecommunication Products and Services division. This consists primarily

of our Top-Up and Recharge services, however, over the past year we have evolved this category to include more profitable endeavors. Thus,

we want to outline the three other service offerings within this category besides Top Up as we seek to increase this division’s

gross margins:

| · | Top Up and Recharge - Top Up and Recharge services offered to consumers nationwide; |

| · | Subscription Plans - New customer acquisition by offering packaged telecommunication subscription plans; |

| · | Mobile Phone - Portal sales of mobile phones to online consumers. This business can be sporadic, as sales

are driven by market demand, new model releases, and promotional activities; and |

| · | Cloud Services – This is a new endeavour for us, providing data storage, processing servers and

databases over the internet (“the cloud”) to offer more efficient access and greater flexibility to our corporate customers

while also offering economies of scale. Essentially, companies pay only for the cloud services they use, helping lower operating costs,

run infrastructure more efficiently, and scale as business needs change. Similar to Mobile Phone sales, this service is also sporadic

and largely dependent on market opportunities and client requirements, which can vary greatly from month to month. |

Each segment plays a crucial role in

our diverse portfolio, addressing varied telecommunications needs.

Effect of Revenue Recognition

Given its sporadic nature, quarterly

revenue recognition on a go-forward basis will be variable making it difficult to issue revenue and earnings guidance. Our Cloud Services,

which represented 88% or $8.1 of the $9.2 million for Q2 of fiscal 2024, is recognized on a rolling 30 – 60 day cycle. In Q3 of

fiscal 2024, nearly all of the $6.1 million in revenue was from Top Up and Recharge and very little was attributed to our Cloud services,

despite our recurring marketing campaigns in this category; we look for the sales to be captured into Q4 of fiscal 2024 that did not make

the cutoff for Q3 of fiscal 2024.

Our Top Up business was actually quite

strong considering the $1.1 million baseline in Q2 of fiscal 2024. Revenue rose to $6.1 million in Q3 of fiscal 2024, which represents

an increase of 455% quarter over quarter. Even with the challenges in our Top Up business in Q3 of fiscal 2024, we expect a return to

sustainable growth in Q4 of fiscal 2024.

Profit Margins

In Q2 of fiscal 2024, gross profit margins

were 19.8%, which was primarily attributed to the successful addition of Cloud Services. In Q3 of fiscal 2024, almost all revenue was

attributed to Top Up with a lower gross margin of 10.4%. With an expected greater mix of Cloud Services to be recognized in Q4 of fiscal

2024, we believe the gross margins should bounce back when combined with the Top Up business. These revenue fluctuations are expected

to continue so it is important for investors to look at the overall trend in revenues and gross margins which are generally on an upward

trend.

Highlighting Yearly

Revenue Growth & Profit

Thus, with quarterly revenue swings

due to these revenue recognition rules, it is paramount to look at our long-term trends versus the short-term quarterly fluctuations,

which do not necessarily show the strength of the underlying business. For the nine months ended November 30, 2023, revenue was $27.6

million which was an increase of 30% over the $21.2 million in the nine months ended November 30, 2022.

Gross profit for the nine months ended

November 30, 2023 was $3.1 million versus $1.7 million in the nine months ended November 30, 2022, another strong marker of our growth.

This represents an increase of $1.5 million or 90% due to our introduction of the new product mix within our Telecommunications Products

& Services category.

Summary

In summary, while we faced certain challenges

and fluctuations in Q3 of fiscal 2024, we believe our diverse portfolio and adaptive strategies position us well for future growth. We

feel investors should focus on the long-term prospects of the Company, like our insurtech and big data initiatives, rather than a revenue

recognition anomaly. There is likely to be a spill over effect with regards to revenue and gross margins positioning the Company for a

record year. We remain committed to maximizing opportunities like the launch of our new lifestyle app across all segments and look forward

to continuing our positive trajectory.

Sincerely,

Martin Shen

CEO, FingerMotion Inc.

A copy of the news release is attached as Exhibit

99.1 hereto.

SECTION 9 – FINANCIAL STATEMENTS AND

EXHIBITS

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FINGERMOTION, INC. |

| |

|

| DATE: January 22, 2024 |

By: |

/s/ Martin J. Shen |

| |

|

Martin J. Shen |

| |

|

CEO |

FingerMotion Provides Supplemental Quarterly

Guidance

CEO details revenue mix, recognition of revenue,

and the transition to increasing gross margins

SINGAPORE / ACCESSWIRE

/ January 22, 2024 / FingerMotion, Inc. (NASDAQ:FNGR) (the “Company” or “FingerMotion”), a mobile

services and data company, is pleased to provide a supplemental corporate update in a letter from our CEO, Martin Shen, to our shareholders.

To Our Shareholders,

Overview

In our continuing

efforts to provide transparency regarding our financial status, I am providing more clarity as to the results of our most recent quarterly

results.

As most of

you know, the majority of our revenue is currently derived from our Telecommunication Products and Services division. This consists primarily

of our Top-Up and Recharge services, however, over the past year we have evolved this category to include more profitable endeavors. Thus,

we want to outline the three other service offerings within this category besides Top Up as we seek to increase this division’s

gross margins:

| · | Top Up and Recharge - Top Up and Recharge services

offered to consumers nationwide; |

| · | Subscription Plans - New customer acquisition

by offering packaged telecommunication subscription plans; |

| · | Mobile Phone - Portal sales of mobile phones

to online consumers. This business can be sporadic, as sales are driven by market demand, new model releases, and promotional activities;

and |

| · | Cloud Services – This is a new endeavour

for us, providing data storage, processing servers and databases over the internet (“the cloud”) to offer more efficient access

and greater flexibility to our corporate customers while also offering economies of scale. Essentially, companies pay only for the cloud

services they use, helping lower operating costs, run infrastructure more efficiently, and scale as business needs change. Similar to

Mobile Phone sales, this service is also sporadic and largely dependent on market opportunities and client requirements, which can vary

greatly from month to month. |

Each segment plays a crucial role in

our diverse portfolio, addressing varied telecommunications needs.

Effect of Revenue Recognition

Given its sporadic nature, quarterly

revenue recognition on a go-forward basis will be variable making it difficult to issue revenue and earnings guidance. Our Cloud Services,

which represented 88% or $8.1 of the $9.2 million for Q2 of fiscal 2024, is recognized on a rolling 30 – 60 day cycle. In Q3 of

fiscal 2024, nearly all of the $6.1 million in revenue was from Top Up and Recharge and very little was attributed to our Cloud services,

despite our recurring marketing campaigns in this category; we look for the sales to be captured into Q4 of fiscal 2024 that did not make

the cutoff for Q3 of fiscal 2024.

Our Top Up business was actually quite

strong considering the $1.1 million baseline in Q2 of fiscal 2024. Revenue rose to $6.1 million in Q3 of fiscal 2024, which represents

an increase of 455% quarter over quarter. Even with the challenges in our Top Up business in Q3 of fiscal 2024, we expect a return to

sustainable growth in Q4 of fiscal 2024.

Profit Margins

In Q2 of fiscal 2024, gross profit margins

were 19.8%, which was primarily attributed to the successful addition of Cloud Services. In Q3 of fiscal 2024, almost all revenue was

attributed to Top Up with a lower gross margin of 10.4%. With an expected greater mix of Cloud Services to be recognized in Q4 of fiscal

2024, we believe the gross margins should bounce back when combined with the Top Up business. These revenue fluctuations are expected

to continue so it is important for investors to look at the overall trend in revenues and gross margins which are generally on an upward

trend.

Highlighting Yearly

Revenue Growth & Profit

Thus, with quarterly revenue swings

due to these revenue recognition rules, it is paramount to look at our long-term trends versus the short-term quarterly fluctuations,

which do not necessarily show the strength of the underlying business. For the nine months ended November 30, 2023, revenue was $27.6

million which was an increase of 30% over the $21.2 million in the nine months ended November 30, 2022.

Gross profit for the nine months ended

November 30, 2023 was $3.1 million versus $1.7 million in the nine months ended November 30, 2022, another strong marker of our growth.

This represents an increase of $1.5 million or 90% due to our introduction of the new product mix within our Telecommunications Products

& Services category.

Summary

In summary, while we faced certain challenges

and fluctuations in Q3 of fiscal 2024, we believe our diverse portfolio and adaptive strategies position us well for future growth. We

feel investors should focus on the long-term prospects of the Company, like our insurtech and big data initiatives, rather than a revenue

recognition anomaly. There is likely to be a spill over effect with regards to revenue and gross margins positioning the Company for a

record year. We remain committed to maximizing opportunities like the launch of our new lifestyle app across all segments and look forward

to continuing our positive trajectory.

Sincerely,

Martin Shen

CEO, FingerMotion Inc.

About FingerMotion, Inc.

FingerMotion is an evolving technology company

with a core competency in mobile payment and recharge platform solutions in China. As the user base of its primary business continues

to grow, the Company is developing additional value-added technologies to market to its users. The vision of the Company is to rapidly

grow the user base through organic means and have this growth develop into an ecosystem of users with high engagement rates utilizing

its innovative applications. Developing a highly engaged ecosystem of users would strategically position the Company to onboard larger

customer bases. FingerMotion eventually hopes to serve over 1 billion users in the China market and eventually expand the model to other

regional markets.

For more information on FingerMotion, visit:

https://fingermotion.com/

Company Contact:

FingerMotion, Inc.

For further information e-mail: info@fingermotion.com

Phone: 718-269-3366

Investor Relations Contact:

Skyline Corporate Communications Group, LLC

Scott Powell, President

One Rockefeller Plaza, 11th Floor

New York, NY 10020

Office: (646) 893-5835

Email: info@skylineccg.com

Safe Harbor Statement

Except for the statements of historical fact

contained herein, the information presented in this news release constitutes “forward-looking statements” as such term is used

in applicable United States securities laws. These statements relate to the Company’s expectations for revenues and gross margins

in Q4 of fiscal 2024, analysis and other information that are based on forecasts or future results, estimates of amounts not yet determinable

and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”,

or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”,

“estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”,

“might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as “forward-looking

statements”. We have based these forward-looking statements on our current expectations about future events or performance, including

expected revenues. While we believe these expectations are reasonable, such forward-looking statements are inherently subject to risks

and uncertainties, many of which are beyond our control. Our actual future results may differ materially from those discussed or implied

in our forward-looking statements for various reasons. Factors that could contribute to such differences include, but are not limited

to: international, national and local general economic and market conditions; demographic changes; the ability of the Company to sustain,

manage or forecast its growth; the ability of the Company to manage its VIE contracts; the ability of the Company to maintain its relationships

and licenses in China; adverse publicity; competition and changes in the Chinese telecommunications market; fluctuations and difficulty

in forecasting operating results; business disruptions, such as technological failures and/or cybersecurity breaches; and the other factors

discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on its website (http://www.sec.gov).

There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from

those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements contained in

this news release and in any document referred to in this news release. The forward-looking statements included in this release are made

only as of the date hereof. For forward-looking statements in this news release, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities Litigation Report Act of 1995. The Company assumes no obligation to

update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. This news release

shall not constitute an offer to sell or the solicitation of any offer to our securities.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

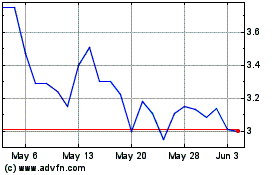

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Dec 2023 to Dec 2024