Form 8-K - Current report

09 November 2024 - 9:09AM

Edgar (US Regulatory)

false

0001602409

0001602409

2024-11-04

2024-11-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 4, 2024

Date of Report (Date of earliest event reported)

FINGERMOTION, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41187 |

|

46-4600326 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

111 Somerset Road, Level 3

Singapore |

|

238164 |

| (Address of principal executive offices) |

|

(Zip Code) |

(347) 349-5339

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol (s) |

Name of each exchange on which registered |

| Common Stock |

FNGR |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

SECTION 1 – REGISTRANT’S BUSINESS AND

OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement.

On November 4, 2024, the

Company’s wholly owned subsidiary, Finger Motion Company Limited (the “Borrower”), entered into a loan agreement

(the “Loan Agreement”) with Rita Chou Phooi Har (the “Lender”) whereby the Lender agreed to advance

a short-term loan facility of SGD$250,000 (the “Loan”) to the Borrower for working capital purposes. As of November

7, 2024, the full amount of the Loan has been drawn upon by the Borrower. The Loan is due one (1) year from the date of the drawdown,

unless extended by the Lender. If the Lender agrees, the Borrower may prepay the whole or any part of the Loan by providing the Lender

not less than three (3) business days prior written notice and subject to payment of interest accrued thereon. Any prepayment of the Loan

shall be in an amount of SGD$50,000 or multiples thereof. The Loan shall bear interest at the rate of 1.67% per month, any such interest

to accrue from day to day and to be calculated based on a 365-day year, and is payable on a monthly basis on or before the last day of

each successive month. The Loan Agreement contains undertakings and covenants of the Borrower whereby the Borrower shall not, without

the prior written consent of the Lender (which consent shall not be unreasonably withheld) (i) effect any form or reconstruction or amalgamation

by way of a scheme of arrangement or otherwise nor approve, permit or suffer any substantial change of ownership or transfer of any substantial

part of its issued capital, (ii) make any loan or advance or extend credit to any person or entity or issue or enter into any guidance

or indemnity or otherwise become directly, indirectly or contingently liable for the obligations of any other person or entity except

in the ordinary course of business, (iii) sell, lease, license alienate, transfer, assign or otherwise dispose of the whole or any part

of the undertaking, property or assets whatsoever and wheresoever situate present or future of the Borrower except in the ordinary course

of business, or (iv) amend or alter any provisions in its Memorandum or Articles of Association or such other equivalent constitutional

documents to change its objects, borrowing or charging powers in such a manner so as to adversely affect the ability of the Borrower to

perform or comply with any one or more of its obligations under the Loan Agreement.

The foregoing description of the Loan Agreement does

not purport to be complete and is qualified in its entirety by reference to the terms of the Loan Agreement, which is filed as Exhibit

10.1 to this Current Report on Form 8-K, and incorporated by reference herein.

SECTION 2 – FINANCIAL INFORMATION

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth

above under Item 1.01 with respect to the Loan Agreement is incorporated by reference into this Item 2.03.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

| Item 9.01 | Financial Statements and Exhibits |

Notes:

* Portions of this exhibit have

been omitted

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FINGERMOTION, INC. |

| |

|

| DATE: November 8, 2024 |

By: /s/ Martin J. Shen |

| |

Martin J. Shen

CEO and Director |

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THIS EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL

THIS LOAN AGREEMENT is made on the 4th

day of November 2024

BETWEEN

| (1) | FINGER MOTION COMPANY LIMITED a company having its registered office at Unit 912, 9/F., Two Harbourfront, 22 Tak Fung Street,

HungHom, Kowloon, Hong Kong (hereinafter called the “Borrower”); and |

| (2) | Rita Chou Phooi Har (Passport No.: [****]), an individual having address

[****] (hereinafter called the “Lender”); |

(The Borrower and the Lender are collectively referred

to as the “Parties” and each, a “Party”.)

WHEREAS

The Borrower is a subsidiary of FingerMotion, Inc.,

a corporation incorporated under the laws of the State of Delaware (the “Company”). At the request of the Borrower,

the Lender has agreed to grant for the benefit of the Borrower a short-term loan facility of Singapore Dollars Two Hundred Fifty Thousand

Only (SGD250,000.00) on the terms and conditions herein contained.

NOW THIS AGREEMENT WITNESSES as follows:

| 1.1 | For the purposes of this Agreement, the following expressions, except where the context requires otherwise,

shall have the following meanings: |

| 1.1:1 | “Applicable Laws” includes any constitution, treaty, decree, legislation, subsidiary

legislation, common or customary law and judicial decisions, rule or regulation promulgated by the Relevant Authorities or administrative

agency(ies) for the time being in force in the Relevant Jurisdiction which is material to the execution, delivery, performance, validity

or enforceability of this Agreement and the Finance Documents ; |

| 1.1:2 | “Articles of Association” means the articles of association of the Borrower, as may

be amended, modified or supplemented from time to time; |

| 1.1:3 | “Hong Kong” means the Hong Kong Special Administrative Region of the People’s

Republic of China; |

| 1.1:4 | “Availability Period” means the period commencing from the date hereof and terminating

on 31 December 2025 or the date on which the Commitment is cancelled pursuant to this Agreement, whichever is the earlier; |

| 1.1:5 | “Business Day” means a day (other than a Saturday or Sunday) on which banks and foreign

exchange markets are open in Hong Kong and New York for the transaction of business of the nature required by this Agreement; |

| 1.1:6 | “Commitment” means the Principal Sum as the commitment of the Lender; |

| 1.1:7 | “Drawdown” means the advance made or to be made to the Borrower under the Loan pursuant

to Clause 4 hereof; |

| 1.1:8 | “Drawing Amount” has the meaning specified in [Clause 4.1]; |

| 1.1:9 | “Drawing Notice” means a notice (substantially in the form set out in Appendix

A hereto) to be signed by the person or persons authorised by a resolution of the Board of Directors of the Borrower requesting

for the Drawdown; |

| 1.1:10 | “Event of Default” means any of the events of default described in Clause 10 hereof and

shall include any event which with the giving of notice and/or the passage of time constitute any of the events of default described in

Clause 10 hereof; |

| 1.1:11 | “Finance Documents” means collectively, this Agreement

and all other documents executed or to be executed as guarantee, indemnity or Security, whether by the Borrower and/or any other party,

for the obligations of the Borrower under this Agreement; |

| 1.1:12 | “Loan” means either the short term loan facility of the Principal Sum of Singapore Dollars

Two Hundred Fifty Thousand Only (SGD250,000.00) OR (where the context so admits) such amount (whether as to principal or interest or any

other sum) as is for the time being outstanding and owing by the Borrower to the Lender under this Agreement; |

| 1.1:13 | “Maturity Date” means the date ending 6 months from the

date of the Drawdown, unless extended by the Lender; |

| 1.1:14 | “Memorandum” means the memorandum of association of the Borrower, as may be amended,

modified or supplemented from time to time; |

| 1.1:15 | “Principal Repayment Date” means 6 months from the date of each Drawdown or such other

due date as the Parties may mutually agree in writing in respect of each Drawdown; |

| 1.1:16 | “Principal Sum” means Singapore Dollars Two Hundred Fifty Thousand Only (SGD250,000.00); |

| 1.1:17 | “Relevant Authorities” includes any judicial, governmental or administrative bodies which

are authorized and empowered by any Applicable Laws to exercise control over any matter relating to the execution, delivery, performance,

validity or enforceability of this Agreement, or to adjudicate upon any dispute arising from or in connection therewith and references

to “Relevant Authority” means any one of them; |

| 1.1:18 | “Relevant Jurisdiction” means Hong Kong and any other jurisdiction within which the execution

of this Agreement and/or the performance and/or the enforcement of any terms and conditions herein and therein may take place. |

| 1.1:19 | “Singapore Dollars” and “SGD” means the lawful currency of Singapore. |

| 1.2 | Words denoting the singular number only shall include the plural number also and vice versa. |

| 1.3 | The clause headings in this Agreement are inserted for convenience only and shall be ignored in construing

this Agreement. |

| 1.4 | Unless otherwise specified, references to Clauses and Appendices are to be construed as references respectively

to the clauses and appendices of or to this Agreement. |

| 1.5 | All references to provisions of statutes include such provisions as modified or re-enacted from time to

time. |

| 1.6 | Unless otherwise provided herein, all references to time shall mean Hong Kong time. |

| 1.7 | Unless otherwise specified, references to this Agreement or any other document referred to herein or therein

shall be construed as references to such document as the same may be amended, varied, supplemented or novated from time to time. |

| 2.1 | The Borrower shall use the proceeds of the Loan only for the exclusive purpose as working capital for

its business. |

| 2.2 | Without prejudice to [Clause 2.1], the Lender may, but shall not be bound to enquire as to the proposed

or actual application of the proceeds of the Loan (or any portion thereof) and shall not be bound to monitor or verify that application

or be responsible for, or for the consequences of, that application. |

Subject to the terms and conditions herein

contained, the Loan shall become the Commitment and available to the Borrower ONLY:

| 3.1 | When the Lender has received (or is satisfied that it will receive the same immediately when available

and, on such terms, and conditions as it in its absolute discretion direct) in form and substance satisfactory to it each of the following: |

| 3.1:1 | Borrower, duly authorizing: |

| 3.1:1.1 | the Borrower to obtain the Loan on the terms and conditions herein contained; |

| 3.1:1.2 | the Borrower’s duly authorised representative(s) to sign this Agreement, the Drawing Notice and to give

such notices, requests, demands or other communications as may be required from time to time for the purposes of the Loan; |

| 3.2 | Upon the following conditions being satisfied: |

| 3.2:1 | all acts, conditions and things required to be done and performed and to have happened precedent to the

execution and delivery of this Agreement and to constitute the same legal valid and binding obligations of the Borrower and of the security

providers enforceable in accordance with their respective terms, shall have been done, performed and happened in due and strict compliance

with all Applicable Laws; |

| 3.2:2 | there is no breach by the Borrower of any of the covenants, undertakings or stipulations contained in

this Agreement and that all the representations and warranties contained in this Agreement shall be true and correct and no Event of Default

has occurred; and |

| 3.2:3 | in the reasonable opinion of the Lender, there is no material adverse change in the operations or the

financial standing of the Borrower. |

| 4.1 | The Borrower shall drawdown the Principal Sum in one (1) tranche during the Availability Period, such

Drawdown to be made by delivering to the Lender the Drawing Notice in accordance with this Clause 4. |

| 4.2 | Unless otherwise agreed by the Lender, the Drawing Notice shall be given by the Borrower to the Lender

at least three (3) Business Days prior to the date of the intended Drawdown. |

| 4.3 | The Drawing Notice shall specify the details of the intended Drawdown as required by the form attached

as Appendix A hereto. |

| 4.4 | The Drawing Notice shall be effective only upon actual receipt by the Lender. For the purposes of this

provision, a transmission via fax to the Lender shall suffice if the same is actually received by the Lender. |

| 4.5 | The Drawing Notice shall constitute a confirmation by the Borrower that at the relevant date thereon no

Event of Default has occurred and that the representations and warranties contained herein remain true and accurate in all material respects. |

| 4.6 | The Borrower may not cancel all or any part of the Commitment before the expiration of the Availability

Period except as expressly provided in this Agreement or with the written consent of the lender; provided that any part of the

Commitment which is not drawn as of the final date of the Availability Period shall be automatically cancelled. |

| 5. | REPAYMENT AND PREPAYMENT |

| 5.1 | Unless otherwise agreed by the Lender and on such terms and conditions as may be directed by the Lender,

the Borrower shall repay the Drawing Amount thereon pursuant to this Agreement on each Principal Repayment Date in Singapore Dollars. |

| 5.2 | Only if agreed by the Lender, the Borrower may prepay the whole or any part of the Loan outstanding by

giving to the Lender not less than three (3) Business Days prior written notice and subject to payment of interest accrued thereon. Unless

otherwise agreed, any prepayment of the Loan shall be in an amount of SGD50,000 or multiples thereof. |

| 5.3 | For the avoidance of doubt, any amount repaid and/or paid pursuant to [Clause 5.1] and [Clause 5.2] shall

not be re-borrowed or redrawn, unless otherwise agreed in writing by the Lender. |

| 6.1 | The Borrower shall pay interest on the Loan at a rate equal to 1.67% per month, any such interest to accrue

from day to day and to be calculated based on a 365-day year. Interest shall be paid on a monthly pro-rata basis by way of telegraphic

transfer to the following designated bank account of the Lender on or before the last day of each successive month; |

| Bank Name |

: [****] |

| Branch code |

: [****] |

| Account Name |

: Rita Chou Phooi Har |

| Account No. |

: [****] |

| |

|

| SWIFT Code |

: [****] |

| Address |

: [****] |

| 6.2 | Subject to any prepayment of the Loan, the last interest payment shall be on the Maturity Date. |

| 7. | PAYMENT BY THE BORROWER |

| 7.1 | All payments whether as to principal, interest, fees or otherwise, to be made by the Borrower under this

Agreement shall be made without set-off, counterclaim or condition and free and clear of and without any deduction of or withholding for

or on account of any taxes, duties, levies, charges, imposts or any other deductions of whatsoever nature, now or hereafter imposed. If

at any time in accordance with any Applicable Laws, the Borrower is required to make any such deduction or withholding from any such payment,

the sum due from the Borrower in respect of such payment shall be increased to the extent necessary to ensure that after the making of

such deduction or withholding, the Lender receives a net sum equal to the sum which it would have received, had no such deduction or withholding

been required to be made. |

| 7.2 | If the Borrower pays a sum which is less than the total amount due and overdue whether in respect of principal,

fees or otherwise, the Borrower shall apply all payments in the following order of priority: |

| 7.2.1 | firstly, in reimbursement of all fees (including legal fees on a full indemnity basis) and expenses incurred

by the Lender arising from or in connection with the demanding, enforcement or attempted enforcement of payment of moneys due under this

Agreement or the protection, preservation, enforcement (or the attempt to do so) of the Lender’s rights and remedies under this

Agreement and the Applicable Laws; |

| 7.2.2 | secondly, in repayment of any interest under this Agreement: |

i) interest to be repaid end of every month

ii) monthly interest rate – 1.67% on the Loan; and

| 7.2.3 | thirdly, in repayment of the principal element of the Loan. |

| 8. | REPRESENTATIONS AND WARRANTIES |

| 8.1 | The Borrower hereby represents and warrants to the Lender which representations and warranties shall survive

the making of the Loan as follows: |

| 8.1:1 | That the Borrower is a company with limited liability incorporated in Hong Kong, and has full power, authority

and legal right to own its assets and to carry on its businesses and that the Borrower will until the Loan and all other amounts due and

payable hereunder have been fully paid by the Borrower to the Lender maintain its corporate existence as a company with limited liability

under the laws of Hong Kong, and will maintain its registered office in Hong Kong; |

| 8.1:2 | That this Agreement (where applicable) when executed will constitute legal valid and binding obligations

of the Borrower enforceable in accordance with their respective terms; |

| 8.1:3 | That all acts, conditions and things, all consents, licenses, approvals, authorisations of, exemptions

by or registration or necessary declarations with any Relevant Authorities (if any) required to be done and performed and to have happened

precedent to the execution and delivery of this Agreement to constitute the same legal, valid and binding obligations of the Borrower

and of the security providers enforceable in accordance with their respective terms, have been done, performed and happened in due compliance

with all Applicable Laws; |

| 8.1:4 | That no steps have been taken or are being taken to appoint a receiver and/or manager, liquidator or similar

appointee to take over or to wind up the Borrower, or to place the Borrower under the management of a judicial manager; |

| 8.1:5 | That no Event of Default has occurred and is continuing unremedied; and |

| 8.1:6 | That neither the Borrower nor any of its assets or revenues is entitled to any immunity or privilege (sovereign

or otherwise) from any set-off, judgment, execution, attachment or other legal process. |

| 8.2 | Each of the representations and warranties contained in Clause 8.1 shall survive and continue to have

full force and effect after the execution of this Agreement. The Borrower hereby represents and warrants to the Lender that the above

representations and warranties will be true and correct and fully observed until the Loan and all other amounts due and payable hereunder

is fully paid. |

| 9. | COVENANTS AND UNDERTAKINGS |

| 9.1 | The Borrower undertakes and covenants with the Lender as follows: |

| 9.1:1 | The Borrower shall not, without the prior written consent of the Lender (which consent shall not be unreasonably

withheld): |

| 9.1:1.1 | effect any form of reconstruction or amalgamation by way of a scheme of arrangement or otherwise nor approve,

permit or suffer any substantial change of ownership or transfer of any substantial part of its issued capital; |

| 9.1:1.2 | make any loan or advance or extend credit to any person or entity or issue or enter into any guarantee

or indemnity or otherwise become directly, indirectly or contingently liable for the obligations of any other person or entity except

in the ordinary course of business; |

| 9.1:1.3 | sell, lease, license, alienate, transfer, assign or otherwise dispose of the whole or any part of the

undertaking, property or assets whatsoever and wheresoever situate present or future of the Borrower except in the ordinary course of

business; or |

| 9.1:1.4 | amend or alter any provisions in its Memorandum or Articles of Association or such other equivalent constitutional

documents to change its objects, borrowing or charging powers in such a manner so as to adversely affect the ability of the Borrower to

perform or comply with any one or more of its obligations under this Agreement. |

| 10.1 | Each of the following occurrences shall constitute an Event of Default: |

| 10.1:1 | The Borrower fails to pay any sum whether as to principal, interest, fees or any other sum due and payable

hereunder on the Maturity Date or any due date or dates hereunder; or |

| 10.1:2 | The Borrower commits or threatens to commit any breach or fails or threatens not to observe any of the

obligations accepted or undertakings given by its execution and delivery of this Agreement (other than a failure to pay any sum due hereunder)

and such breach or omission is not remedied within seven (7) days after notice of the breach has been given to it; or |

| 10.1:3 | Any representation or warranty made or deemed to be made by the Borrower in this Agreement or the Finance

Documents or any notice, certificate, instrument or statement contemplated by or made or delivered pursuant to this Agreement or the Finance

Documents, as the case may be, is incorrect or untrue or ceases to be correct or true in any material respect; or |

| 10.1:4 | Anything is done, suffered or omitted to be done by the Borrower which in the reasonable opinion of the

Lender may imperil the due repayment of any monies for the time being owing by the Borrower to the Lender under this Agreement or the

Finance Documents; or |

| 10.1:5 | If the Borrower shall make an assignment for the benefit of its creditors or enter into an arrangement

for composition for the benefit of its creditors; or |

| 10.1:6 | An effective resolution is passed, a petition is presented or analogous proceedings are commenced or a

formal order is made by any Relevant Authority, for the winding-up, insolvency, administration, judicial management, dissolution or bankruptcy

of the Borrower, or for the appointment of a receiver and/or manager, liquidator, administrator, trustee, judicial manager or any other

person pursuant to the provision of any agreement or under any Applicable Laws to take over the whole or any part of the undertaking,

property or assets of the Borrower; or |

| 10.1:7 | An encumbrancer takes possession of or a receiver is appointed over or a distress or execution is levied

upon or against the whole or any substantial part of the undertaking, property or assets of the Borrower and is not discharged within

seven (7) days of the taking of possession or appointment of receiver or levy of execution or distress; or |

| 10.1:8 | If there shall occur a change in the business assets, financial position of the Borrower which in the

reasonable opinion of the Lender materially affects the ability of the Borrower to perform any of its obligations under this Agreement

or the Finance Documents; or |

| 10.1:9 | If there shall occur a change in the operations and/or management of the Borrower which in the reasonable

opinion of the Lender materially affects the ability of the Borrower to perform any of its obligations under this Agreement or the Finance

Documents; or |

| 10.1:10 | This Agreement and/or any the Finance Document is not, or is claimed not to be, in full force and effect. |

| 10.2 | Notwithstanding any other provision of this Agreement and without prejudice to any other rights and remedies

to which the Lender may be entitled under the Applicable Laws, if any Event of Default shall occur for any reason whatsoever (and whether

such occurrence shall be voluntary or involuntary or come about or be effected by operation of law or otherwise), the Lender may by written

notice to the Borrower declare that (a) the Commitment (or any part thereof) be cancelled and/or (b) the Loan and all other sums of money

due or to become due and payable by the Borrower to the Lender under this Agreement shall immediately become payable to the Lender who

shall be entitled forthwith and without further notice to the Borrower to enforce payment. |

| 10.3 | The Lender shall not be answerable for any involuntary loss incurred by the Borrower resulting from the

exercise or execution of the powers which may be vested in the Lender by virtue of this Agreement or by any Applicable Laws. Without prejudice

to the other provisions of this Agreement, the Borrower shall indemnify and keep indemnified the Lender in full and hold the Lender harmless

from and against any losses, costs, charges or expenses whatsoever, legal or otherwise, which the Lender may sustain, suffer or incur

as a consequence of or in connection with any Event of Default and/or the cancellation of the Commitment (or any part thereof) and/or

the declaration of the Loan (and all other sums of money due or to become due and payable by the Borrower to the Lender under this Agreement)

to be immediately payable as aforesaid. |

| 11.1 | The Lender may from time to time and at any time waive either unconditionally or on such terms and conditions

as it may deem fit any breach by the Borrower of any of the covenants, undertakings, stipulations, terms and conditions herein contained

and in any modification thereof but without prejudice to its powers, rights and remedies for enforcement thereof. Provided always and

it is hereby expressly agreed and declared that any waiver by or neglect or forbearance of the Lender to require and enforce the payment

of any moneys owing hereunder at any time which may be given to the Borrower shall not in any way prejudice or affect the right of the

Lender afterwards at any time to act strictly in accordance with the provisions thereof. The rights and remedies herein provided are cumulative

and are not exclusive of any rights or remedies provided by law. |

| 11.2 | The liability of the Borrower hereunder shall not be impaired or discharged by reason of any time or other

indulgence being granted by or with the consent of the Lender to any person who or which may be in any way liable to pay any of the moneys

owing by the Borrower hereunder or by reason of any arrangement being entered into or composition accepted by the Lender modifying by

operation of law or otherwise the rights and remedies of the Lender under the provisions of this Agreement and the Applicable Laws. |

| 12.1 | This Agreement shall be binding upon and inure to the benefit of the Borrower and the Lender and their

respective successor(s). All covenants, undertakings, stipulations, agreements, terms, conditions, representations and warranties given,

made or entered into by the Borrower under this Agreement, shall survive the making of any assignments or the result of any succession

in title in connection therewith. |

| 12.2 | The Lender may assign or transfer all or any of its rights, benefits, duties and obligations hereunder

at any time. The Borrower shall have no right to assign or transfer any of its rights hereunder and it shall remain fully liable for all

of its undertakings and obligations hereunder and for the due and punctual observance and performance thereof. |

| 12.3 | The Borrower hereby acknowledges and consents to the fact that the Lender shall be entitled at any time

and from time to time to disclose to prospective assignees or transferees any information within its knowledge relating to the Borrower,

whether such information has been acquired by the Lender pursuant to or in connection with this Agreement or otherwise. |

As separate and independent

obligations, the Borrower shall pay forthwith on demand to the Lender:

| 13.1 | All legal fees (on a full indemnity basis) and other costs and disbursements whatsoever including but

not limited to stamp or other duties incurred in connection with demanding and enforcing the payment of moneys due hereunder or otherwise

howsoever in enforcing this Agreement or any of the covenants, undertakings, stipulations, terms, conditions or provisions of this Agreement

or any other documents required under the provisions of this Agreement or incurred in connection with any delay or omission on the part

of the Borrower to pay any stamp or other duties in connection with this Agreement or any document ancillary hereto or incurred in the

course of granting of any waiver, consent or variation of this Agreement or any document ancillary thereto. |

| 14.1 | All notices, requests, demands or other communications under or in connection with this Agreement shall

be given or made in writing and delivered by post or transmitted by electronic mail or facsimile to the relevant addresses and numbers

specified below: |

| 14.1:1 |

to the Borrower |

: |

Finger Motion Company Limited |

| |

|

|

Unit 912, 9/F., Two Harbourfront, |

| |

|

|

22 Tak Fung Street, HungHom, |

| |

|

|

Kowloon, Hong Kong |

| |

|

|

Attention: Mr. Martin Shen |

| |

|

|

|

| 14.1:2 |

to the Lender |

: |

Rita Chou Phooi Har |

| |

|

|

[****] |

| |

|

|

[****] |

| |

|

|

Attention: Rita Chou |

| 14.2 | Any notice, request or other communication addressed to any Party hereto, whether dispatched by hand or

transmitted by electronic mail or facsimile, shall be effective only upon actual receipt by the addressee. |

If under any Applicable

Law, any payment to the Lender under or in connection with this Agreement (whether pursuant to any judgment, court order or otherwise)

is made or falls to be satisfied in a currency (the “Other Currency”), other than that in which the relevant payment

is due (the “Required Currency”), then, to the extent that the payment (when converted into the Required Currency at

the rate of exchange as conclusively determined by the Lender on the date of payment, or if it is not practicable for the Lender to purchase

the Required Currency with the Other Currency on the date of payment, at the rate of exchange as soon afterwards as it is practicable

for them to do so) falls short of the amount due under the relevant provisions of this Agreement, the Borrower shall, as a separate and

independent obligation, indemnify and hold harmless the Lender against the amount of such shortfall and the Lender shall have a further

separate cause of action against the Borrower to recover the amount of such shortfall. For the purpose of this Clause, “rate of

exchange” means the rate at which the Lender is able on the date of payment or such other date to purchase the Required Currency

with the Other Currency and shall take into account any premium and other costs of exchange.

| 16.1 | This Agreement shall be governed by and interpreted and construed in accordance with the laws of Hong

Kong. |

| 16.2 | Any dispute, controversy or claim arising out of or in connection with this Agreement and the documents

contemplated hereunder, including any question regarding its existence, validity or termination, shall be referred to and finally resolved

by arbitration in Hong Kong. The language of the arbitration shall be English. |

| 16.3 | In the event that recourse to the courts shall be necessary for the purpose of determining any question

of law required to be determined for arbitration, the Parties hereto hereby submit to the non-exclusive jurisdiction of the Courts of

Hong Kong. |

If any Clause or sub-Clause

or part of a Clause or sub-Clause in this Agreement is held or found to be void, invalid or otherwise unenforceable, it shall be deemed

to be severed from this Agreement but the remainder of this Agreement shall remain in full force and effect.

| 18. | ENTIRETY AND MODIFICATION |

| 18.1 | This Agreement embodies all the terms and conditions agreed upon between the Parties hereto as to the

subject matter of this Agreement and supersedes and cancels in all respects all previous agreements and undertakings, if any, between

the Parties hereto with respect to the subject matter hereof, whether such be written or oral. |

| 18.2 | No modification nor any further representation, promise or agreement in connection with the subject matter

of this Agreement is binding upon any Party unless made in writing and signed by the Parties or the respective authorized representatives

of the Parties hereto. |

This Agreement may be

executed in any number of counterparts by any Party or Parties on separate counterparts, each of which when executed and delivered shall

have the same effect as if the signatures and seals on the counterparts were on a single copy of this Agreement. Such counterpart executed

by one Party may be received by facsimile or electronic mail (and shall be valid and effectual as if executed as an original), followed

by the original delivered to the other Party.

AS WITNESS the hands of duly authorised representatives

of the Borrower and the Lender respectively, the day and year first above written.

BORROWER

| SIGNED by |

Lee Yew Hon |

|

) |

|

|

| |

Name of Borrower’s Representative |

|

) |

/s/ Lee Yew Hon |

|

| for and on behalf of |

|

) |

|

|

| FINGER MOTION COMPANY LIMITED |

|

) |

|

|

| in the presence of: |

|

) |

|

|

LENDER

| SIGNED by |

Rita Chou Phooi Har |

|

) |

|

|

| |

Name of Lender |

|

) |

/s/ Rita Chou Phooi Har |

|

| |

|

|

) |

|

|

| |

|

|

) |

|

|

| in the presence of: |

|

) |

|

|

APPENDIX A

| To: |

Rita Chou Phooi Har |

|

| |

[****] |

|

| |

[****] |

|

| |

|

|

Date: 4 November 2024

Dear Sir(s),

DRAWING NOTICE

| 1. | We refer to the loan agreement dated 4 November 2024 made between us as borrower and you as the

Lender (the “Agreement”). Expressions defined in the Agreement shall have the same meanings when used in this Drawing

Notice. |

| 2. | Pursuant to Clause 4 of the Agreement, we hereby give you notice of our intention to affect the Drawdown,

the details of which are set out below: |

| 2.1 |

Date of intended Drawdown |

: |

6 November 2024 |

| |

|

|

|

| 2.2 |

Amount of the intended Drawdown |

: |

SGD250,000.00 (SINGAPORE DOLLARS TWO HUNDRED

FIFTY THOUSAND ONLY) |

| |

|

|

|

| 2.3 |

Payment instructions |

: |

Please remit the full amount as required under

this Drawing Notice to the following bank account :- |

| Account Name |

: |

FINGER MOTION COMPANY LIMITED |

| Account No. (SGD) |

: |

[****] |

| Bank |

: |

[****] |

| Bank Country |

: |

[****] |

| Bank Address |

: |

[****] |

| |

|

[****] |

| |

|

[****] |

| Swift Address |

: |

[****] |

| Beneficiary Address |

: |

Unit 912, 9/F., Two Harbourfront, |

| |

|

22 Tak Fung Street, Hunghom, Kowloon, |

| |

|

Hong Kong |

| 3.1 | that each of the representations and warranties contained in Clause 8 of the Agreement is true and accurate

in every respect; |

| 3.2 | that each of the covenants and undertakings contained in Clause 9 of the Agreement has been complied with

in every respect; and |

| 3.3 | that no Event of Default (as defined in Clause 10) has occurred and remains unremedied. |

| 4. | We represent, warrant and undertake that our above confirmation will continue to be true and accurate

in all respects until the Loan and all other sums due and payable under the Agreement are fully paid and the other obligations (whether

express or implied) under the Agreement are fulfilled by us. |

Yours faithfully,

for and on behalf of

FINGER MOTION COMPANY LIMITED

| /s/ Lee Yew Hon |

|

| Name: Lee Yew Hong |

|

| Designation: CFO |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

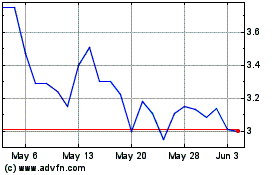

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Jan 2025 to Feb 2025

FingerMotion (NASDAQ:FNGR)

Historical Stock Chart

From Feb 2024 to Feb 2025