0001558583

false

0001558583

2023-08-24

2023-08-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 24, 2023

ARCIMOTO, INC.

(Exact name of registrant as specified in its charter)

Oregon

(State or other jurisdiction of incorporation)

| 001-38213 |

|

26-1449404 |

| (Commission File Number) |

|

(IRS Employer |

|

|

Identification No.) |

2034 West 2nd Avenue, Eugene, OR 97402

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code (541) 683-6293

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common stock, no par value |

|

FUV |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On August 24, 2023, Arcimoto, Inc. issued

a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated herein in its entirety by reference.

The information contained in, or incorporated

into, this Item 2.02, including the press release attached as Exhibit 99.1, is being furnished and shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference to such filing.

Item 9.01. Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

ARCIMOTO, INC. |

| |

|

|

| Date: August 24, 2023 |

By: |

/s/ Christopher Dawson |

| |

|

Christopher Dawson |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

Arcimoto Announces Second Quarter

2023 Financial Results

EUGENE, Ore., Aug. 24, 2023 – Arcimoto, Inc.®

(NASDAQ: FUV), makers of rightsized, ultra-efficient small footprint electric vehicles for moving people and things,, today released second

quarter results ended June 30, 2023.

Arcimoto will host a stakeholder and analyst call today to

discuss the company’s results. To view the webcast use the link below:

Arcimoto, Inc. Second Quarter 2023 Call

Date: Thursday

August 24, 2023

Time: 2:00 p.m. PDT (5:00 p.m. EDT)

Webcast: https://us06web.zoom.us/webinar/register/WN_UfMTSp5qThOxpGweeDGuPw

Second Quarter 2023 Results and Milestones

| ● | Produced 94 new FUVs during the first half of 2023. |

| | | |

| ● | Delivered 65 customer vehicles in the second quarter with an average sales price of $22,744 and delivered 102 vehicles year to date. |

| | | |

| ● | Produced its 1,000th vehicle in June 2023. |

| | | |

| ● | As of June 30, there are 665 customer FUVs on the road today; 39 vehicles allocated for marketing, R&D, and internal fleet use;

and 90 vehicles in the Arcimoto rental fleet for revenue generation. |

| | | |

| ● | Tilting Motor Works completed delivery of 11 TRiO kits to customers with an average sales price of

$14,285. |

| | | |

| ● | Achieved 954 rides from demo drives and rentals combined during the second quarter. |

| | | |

| ● | Arcimoto launched the MUV (Modern Utility Vehicle), the first on-road modular utility vehicle in the company’s lineup of small

footprint electric vehicles for dedicated professional and commercial use. |

Management Commentary

“The Arcimoto team delivered a solid quarter. Sharp

execution and improving operational efficiencies generated $1.76 million of revenue, up 17% from 2022. We are continuing to see strength

in our industrial and military (government) markets with MUV and Matbock and are confident in pipeline deals coming to fruition. We also

announced today our intention to sell our U.S. manufacturing facility contingent on a lease agreement. This allows us to be tactical about

the space being used, to keep the areas we need for manufacturing and relinquish the areas unused to free up capital that is currently

locked up in the factory’s equity. The capital from the sale coupled with our recent raise of $4.2M, will be used to extend our runway

and allow us to continue working towards our goals.”

Second Quarter 2023 Financial Results

Total revenues for the second quarter of 2023 increased 17%

to $1.76 million as compared to $1.5 million in the second quarter of 2022. YTD June 30, 2023 revenue increased 45% to $3.1 million as

compared to $2.1 million in 2022.

The Company incurred a net loss of approximately $13.2 million

or ($1.71) per share, in the second quarter of 2023 compared with a net loss of $17.4 million or ($8.80) per share, for the same prior-year

period.

The Company had $53.1 million in total assets, $1.3 million

in cash and cash equivalents, and $32.7 million in total liabilities as of June 30, 2023.

About Arcimoto, Inc.

Arcimoto is a pioneer in the design and manufacture

of rightsized, ultra-efficient, incredibly fun electric vehicles for everyday mobility. Built on the revolutionary three-wheel Arcimoto

Platform, our vehicles are purpose-built for daily driving, local delivery, and emergency response, all at a fraction of the cost and

environmental impact of traditional gas-powered vehicles. Based in Eugene, Oregon, the Arcimoto team is dedicated to creating world-class

EVs that make the world a better place. For more information, please visit Arcimoto.com. Follow Arcimoto on YouTube, Facebook, Instagram,

Twitter, TikTok, and LinkedIn. Investor information about the company, including press releases, stakeholder webcast replays, and more

can be found at http://arcimoto.com/ir.

Safe Harbor / Forward-Looking Statements

Except for historical information, all of the

statements, expectations, and assumptions contained in this press release are forward-looking statements. Forward-looking statements

include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other

statements relating to our future activities or other future events or conditions. These statements are based on current

expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are

not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict and include,

without limitation, our expectations as to vehicle deliveries, the establishment of our service and delivery network and our

expected rate of production. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed

or forecasted in the forward-looking statements due to numerous factors discussed from time to time in documents which we file with

the SEC. In addition, such statements could be affected by risks and uncertainties related to, among other things: our ability to

manage the distribution channels for our products, including our ability to successfully implement our rental strategy, direct to

consumer distribution strategy and any additional distribution strategies we may deem appropriate; our ability to design,

manufacture and market vehicle models within projected timeframes given that a vehicle consists of several thousand unique items and

we can only go as fast as the slowest item; our inexperience to date in manufacturing vehicles at the high volumes that we

anticipate; our ability to maintain quality control over our vehicles and avoid material vehicle recalls; the number of reservations

and cancellations for our vehicles and our ability to deliver on those reservations; unforeseen or recurring operational problems at

our facility, or a catastrophic loss of our manufacturing facility; our dependence on our suppliers; changes in consumer demand for,

and acceptance of, our products: changes in the competitive environment, including adoption of technologies and products that

compete with our products; the overall strength and stability of general economic conditions and of the automotive industry more

specifically; changes in laws or regulations governing our business and operations; costs and risks associated with potential

litigation; and other risks described from time to time in periodic and current reports that we file with the SEC. Any

forward-looking statements speak only as of the date on which they are made, and except as may be required under applicable

securities laws, we do not undertake any obligation to update any forward-looking statements.

Investor Relations Contact:

investor@arcimoto.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

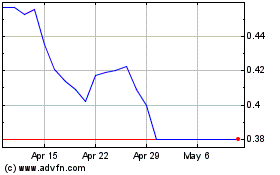

Arcimoto (NASDAQ:FUV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arcimoto (NASDAQ:FUV)

Historical Stock Chart

From Jan 2024 to Jan 2025