- Gevo to Host Conference Call Today at 4:30 p.m.

EST/2:30 MST -

Gevo, Inc. (NASDAQ:GEVO) today announced financial results for the

three months ended December 31, 2016. Key highlights for the fourth

quarter of 2016 and key subsequent events included:

- Gevo produced approximately 190,000 gallons of isobutanol

during the quarter at Gevo’s isobutanol production facility located

in Luverne, Minnesota (the “Agri-Energy Facility”).

- Cash and Cash Equivalents at February 28, 2017 were $22.6

million and the total principal face value of the debt outstanding

was $17.7 million3.

- On February 13, 2017, Gevo signed a letter of intent with HCS

Holding GmbH (HCS) to supply isooctane under an offtake agreement.

HCS is a manufacturer of specialty products and solutions in the

hydrocarbons sector, operating under such brands as Haltermann

Carless. In the first phase of the contemplated binding offtake

agreement, HCS is expected to purchase isooctane produced at Gevo’s

demonstration hydrocarbons plant located in Silsbee, Texas,

commencing in 2017. During the first phase, expected revenue would

be in the range of $2-3 million per year and would

continue until completion of Gevo’s future, large-scale commercial

hydrocarbon plant. In the second phase, HCS is expected to

purchase approximately 300,000 to 400,000 gallons of isooctane per

year under the contemplated binding offtake agreement for a period

of five years. Gevo expects to supply this isooctane from

its first large-scale commercial hydrocarbons facility, which is

likely to be built at the Agri-Energy Facility.

- On February 13, 2017, the holder of Gevo’s 10% Convertible

Senior Notes, due 2017 (the “2017 Notes”), agreed to extend the

maturity date of the 2017 Notes from March 15, 2017 to June 23,

2017 (the “2017 Notes Extension Transaction”). The terms of

the 2017 Notes Extension Transaction included, among other things,

the following: (i) an increase in the coupon on the 2017 Notes by

two percent (2%) to twelve percent (12%); and (ii) the requirement

that Gevo pay down $8 million of principal on the 2017 Notes as

follows: $2 million on each of March 13, 2017, April 13, 2017, May

12, 2017 and June 13, 2017, with an option for Gevo to prepay all

$8 million at any time in our sole discretion. In addition, as part

of the 2017 Notes Extension Transaction, Gevo agreed to pay the

holder fifteen percent (15%) of the net proceeds from its next

underwritten public offering, completed prior to June 23, 2017, to

be used to reduce the then-outstanding principal of the 2017

Notes.

- On February 17, 2017, in an underwritten offering Gevo sold

5,680,000 Series G units, with each Series G unit consisting of one

share of common stock, a Series K warrant to purchase one share of

common stock and a Series M warrant to purchase one share of common

stock. Gevo also sold 570,000 Series H units, with each Series H

unit consisting of a pre-funded Series L warrant to purchase one

share of common stock, a Series K warrant to purchase one share of

common stock and a Series M warrant to purchase one share of common

stock. The gross proceeds from this offering were approximately

$11.9 million, not including any future proceeds from the exercise

of the warrants.

- On February 23, 2017, Gevo paid down the principal balance on

the 2017 Notes with 15% of the net proceeds from the offering

referred to above, along with the $8.0 million in prepayments under

the supplemental indenture, for an aggregate total payment of $9.6

million, which reduced the principal balance on the 2017 Notes to

approximately $16.5 million.

- In December 2016 and January 2017, Gevo entered into private

exchange agreements with holders of its 7.5% convertible senior

notes due 2022 (the “ 2022 Notes”) to exchange an aggregate of $9.8

million of principal amount of 2022 Notes for an aggregate of

2,407,214 shares of common stock. These exchanges reduced the

outstanding principal amount of the 2022 Notes to $1.175

million.

Outlook for 2017

Gevo has established the following specific operational and

financial targets and milestones for 2017:

- Restructure Gevo’s balance sheet in a manner that addresses the

$17.7 million of debt represented by its outstanding convertible

notes and that allows Gevo to execute on its long-term strategy and

business development plan.

- Obtain binding supply contracts for a combination of

isobutanol and related hydrocarbon products equal to at least fifty

percent (50%) of the capacity of the expanded Agri-Energy Facility

that Gevo plans to construct (the “Agri-Energy Facility

Expansion”).

- Gevo estimates that its maximum annual isobutanol production

capacity at the Agri-Energy Facility to be currently over 1 million

gallons per year. As described below, however, Gevo expects to

produce isobutanol at levels that better match market development

sales in 2017. As such, Gevo expects to produce approximately

500,000 gallons of isobutanol during 2017.

- Achieve a cash EBITDA loss of between $18.0-$20.0

million for the fiscal year ending December 31,

2017.4

Market Development Sales and Production Strategy for

2017

Gevo believes that during 2016 it demonstrated its ability to

produce isobutanol in commercial quantities on a consistent and

repeatable basis. For 2017, Gevo’s overarching goal is to

leverage its isobutanol production of 440,000 gallons in 2016 and

its projected isobutanol production of 500,000 gallons in 2017, to

more fully develop the markets for its isobutanol and related

hydrocarbon products. Ultimately, Gevo’s primary goal is to enter

into binding supply contracts for isobutanol and related

hydrocarbon products that represent the majority of the production

volumes to be produced at the expanded Agri-Energy Facility. Gevo

believes that such contracts would underpin the economics of the

Agri-Energy Facility Expansion, which should facilitate the raising

of the capital necessary to finance the Agri-Energy Facility

Expansion, potentially at a lower cost of capital than what Gevo

has historically achieved through the issuance of common stock and

warrants in underwritten public offerings.

In addition, Gevo intends to further develop the market for

isobutanol-blended gasoline in 2017. Gevo expects to benefit from

its market development efforts in the marina market in 2016, by

increasing the number of marina outlets which carry gasoline blends

containing its isobutanol. In 2017, Gevo expects to benefit, for

the first time, from active sales efforts throughout the entire

boating season, traditionally a very seasonal market. In terms of

development for the on-road market, Gevo seeks to increase the

number of geographic regions which carry its isobutanol. In 2016,

Gevo announced that gasoline blended with its isobutanol and

marketed for use in automobiles had begun to be sold in

the Houston area through Gevo’s partner, Musket. This

marked the first time that Gevo’s isobutanol has been specifically

targeted towards on-road vehicles. In 2017, Gevo expects to expand

sales into other regions of the Southwest U.S., as well as

potentially into the Midwest and Northeast of the U.S.

In terms of isobutanol production, Gevo anticipates producing

sufficient quantities to meet customer demand in 2017 while also

providing enough inventory to support additional market and

customer development efforts in the future. As a result, Gevo’s

production goals will not be to maximize production, but rather to

align such production with its isobutanol sales efforts. Gevo’s

alcohol storage capacity is limited at its Agri-Energy Facility,

and any excess isobutanol inventory which Gevo builds up will

simply tie up some portion of its cash in working capital.

Therefore, during certain periods of 2017, Gevo may cease

isobutanol production at the Agri-Energy Facility and produce

ethanol only over such periods.

Agri-Energy Facility Expansion

Gevo believes that the current configuration of the Agri-Energy

Facility, whereby Gevo co-produces isobutanol and ethanol utilizing

one fermenter for isobutanol production and three fermenters for

ethanol production, will not enable Gevo to become profitable on a

consolidated basis. Gevo believes that the best way for it to

become profitable is to undertake the Agri-Energy Facility

Expansion, whereby Gevo would convert the Agri-Energy Facility to

the sole production of isobutanol, with some percentage of such

isobutanol volumes to be further processed into hydrocarbons such

as alcohol-to-jet fuel (“ATJ”) and isooctane. The Agri-Energy

Facility represents the best site to expand our isobutanol

production because it leverages the equipment Gevo has already

installed at the site, in particular Gevo’s GIFT® technology

system.

Gevo is currently conducting engineering work to determine the

ultimate production capacity of the Agri-Energy Facility following

the Agri-Energy Facility Expansion, as well as the capital cost

associated with the project. The binding supply contracts, which

Gevo will pursue in 2017, are expected to form the basis on which

Gevo would set the specific configuration of the plant in terms of

end product mix between isobutanol, ATJ and isooctane. Once this

preliminary engineering work is completed, which Gevo expects will

be in the second half of 2017, Gevo expects to be able to

communicate publicly the estimated scale, configuration and

projected capital cost for the Agri-Energy Facility Expansion.

“We came a long way in 2016. On the isobutanol production

front, we brought a full production line online that enabled us to

hit our fermentation cycle times and our product quality and cost

targets. This data is critical for building out the expanded

plant and for developing appropriate pricing for sales contracts in

support of this expansion. The Silsbee hydrocarbon plant at South

Hampton Resources continues to operate well, producing market

development quantities of isooctane and ATJ. In summary, 2016

was all about making sure the isobutanol production technology

worked as it was supposed to by producing product that met

specification while meeting our lower cost targets,” said Dr.

Patrick Gruber, Gevo’s Chief Executive Officer.

Dr. Gruber continued, “2016 allowed us to better pin down the

cost side of our products and determine more clearly which markets

make sense for our isobutanol and hydrocarbon products. In

2017, our core goals relate to market development with a focus of

securing supply agreements from customers to off-take isobutanol,

ATJ and isooctane from our expanded plant in Luverne. We can

see the customer interest, and we need to translate that interest

into binding agreements to build a profitable business. We

want to know with as much certainty as possible who is going to buy

what and when, while targeting product margins to become profitable

as a company.”

Financial Highlights

Revenues for the fourth quarter of 2016 were $5.8 million

compared with $7.3 million in the same period in 2015. During the

fourth quarter of 2016, revenues derived at the Luverne plant were

$5.3 million, a decrease of approximately $1.2 million from the

same period in 2015. This was primarily a result of lower ethanol

production and distiller grain prices in the fourth quarter of 2016

versus the same period in 2015.

During the fourth quarter of 2016, hydrocarbon revenues were

$0.5 million, $0.2 million higher than the same period in 2015.

Gevo’s hydrocarbon revenues are comprised of sales of jet fuel,

isooctane and isooctene.

Gevo generated grant and other revenue of $44 thousand during

the fourth quarter of 2016, down $0.5 million as compared to the

same period in 2015, mainly as a result of Gevo’s contract with the

Northwest Advanced Renewables Alliances ending in 2016.

Cost of goods sold was $8.2 million for the three months ended

December 31, 2016, compared with $9.0 million in the same quarter

in 2015. Cost of goods sold included approximately $6.6 million

associated with the production of ethanol, isobutanol and related

products and approximately $1.6 million in depreciation

expense.

Gross loss was $2.3 million for the three months ended December

31, 2016, versus $1.7 million in the same quarter in 2015.

Research and development expense was flat during the three

months ended December 31, 2016, compared with the same quarter in

2015.

Selling, general and administrative expense decreased by $0.7

million during the three months ended December 31, 2016, compared

with the same quarter in 2015, due primarily to a decrease

of $0.8 million in salary and related expenses.

Loss from operations in the fourth quarter of 2016 was $6.5

million, compared with $6.6 million in the same quarter in

2015.

Non-GAAP cash EBITDA loss in the fourth quarter of 2016 was $4.7

million, compared with $4.2 million in the same quarter in

2015.

Interest expense in the fourth quarter of 2016 was $1.3 million,

down $0.7 million as compared to the same quarter last year.

During the three months ended December 31, 2016, there was no

change in the value of the embedded derivatives in the 2022 Notes,

as the derivatives have had no meaningful value since the third

quarter of 2014. However, Gevo did incur a non-cash gain of

$0.2 million in the quarter as a result of exchanging an aggregate

of $1.425 million principal amount of the 2022 Notes for shares of

Gevo’s common stock in December.

During the three months ended December 31, 2016, Gevo also

incurred a non-cash loss of $0.6 million during the quarter due to

the quarterly mark-to-market valuation of the 2017 Notes.

During the three months ended December 31, 2016, the estimated

fair value of the derivative warrant liability decreased by $6.0

million, resulting in a non-cash gain from a change in the fair

value of derivative warrant liability.

The net loss for the fourth quarter of 2016 was $2.3 million,

compared with $8.0 million during the same period in 2015.

The non-GAAP adjusted net loss for the fourth quarter of 2016

was $7.8 million, compared with $8.6 million during the same period

in 2015.

The cash position at December 31, 2016 was $27.9 million and the

total principal face value of the debt outstanding was $35.7

million.

Webcast and Conference Call Information

Hosting today’s conference call at 4:30 p.m. EST (2:30 p.m. MST)

will be Dr. Patrick Gruber, Chief Executive Officer, Mike Willis,

Chief Financial Officer, and Geoff Williams, General Counsel. They

will review Gevo’s financial results and provide an update on

recent corporate highlights.

To participate in the conference call, please dial 1 (888)

771-4371 (inside the U.S.) or 1 (847) 585-4405 (outside the U.S.)

and reference the access code 44557047. A replay of the call and

webcast will be available two hours after the conference call ends

on March 29, 2017. To access the replay, please dial 1-888-843-7419

(inside the US) or 1-630-652-3042 (outside the US) and

reference the access code 44557047. The archived webcast will be

available in the Investor Relations section of Gevo's website at

www.gevo.com.

About Gevo

Gevo is a leading renewable technology, chemical products, and

next generation biofuels company. Gevo has developed proprietary

technology that uses a combination of synthetic biology, metabolic

engineering, chemistry and chemical engineering to focus primarily

on the production of isobutanol, as well as related products from

renewable feedstocks. Gevo’s strategy is to commercialize biobased

alternatives to petroleum-based products to allow for the

optimization of fermentation facilities’ assets, with the ultimate

goal of maximizing cash flows from the operation of those assets.

Gevo produces isobutanol, ethanol and high-value animal feed at its

fermentation plant in Luverne, Minnesota. Gevo has also developed

technology to produce hydrocarbon products from renewable alcohols.

Gevo currently operates a biorefinery in Silsbee, Texas, in

collaboration with South Hampton Resources Inc., to produce

renewable jet fuel, octane, and ingredients for plastics like

polyester. Gevo has a marquee list of partners including The

Coca-Cola Company, Toray Industries Inc. and Total SA, among

others. Gevo is committed to a sustainable bio-based economy that

meets society’s needs for plentiful food and clean air and

water.

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to a variety of matters, including, without

limitation, statements related to the ability of Gevo to develop

markets for its products, Gevo’s ability to enter into binding

offtake, sales or supply agreements for its products, Gevo’s

ability to produce isobutanol or related hydrocarbon products at

its Luverne, Minnesota production facility, Gevo’s ability to

finance the Agri-Energy Facility Expansion, Gevo’s ability to

achieve its 2017 operational and financial targets and milestones,

Gevo’s ability to secure new customer relationships across core

markets, and other statements that are not purely statements of

historical fact. These forward-looking statements are made on

the basis of the current beliefs, expectations and assumptions of

the management of Gevo and are subject to significant risks and

uncertainty. Investors are cautioned not to place undue reliance on

any such forward-looking statements. All such forward-looking

statements speak only as of the date they are made, and Gevo

undertakes no obligation to update or revise these statements,

whether as a result of new information, future events or otherwise.

Although Gevo believes that the expectations reflected in these

forward-looking statements are reasonable, these statements involve

many risks and uncertainties that may cause actual results to

differ materially from what may be expressed or implied in these

forward-looking statements. For a further discussion of risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Gevo in general, see the risk

disclosures in the Annual Report on Form 10-K of Gevo for the year

ended December 31, 2016, and in subsequent reports on Forms 10-Q

and 8-K and other filings made with the U.S. Securities and

Exchange Commission by Gevo.

Non-GAAP Financial Information

This press release contains financial measures that do not

comply with U.S. generally accepted accounting principles (GAAP),

including non-GAAP cash EBITDA loss and non-GAAP adjusted net loss

per share. On a non-GAAP basis, non-GAAP cash EBITDA excludes

non-cash items such as depreciation and stock-based compensation.

On a non-GAAP basis, non-GAAP adjusted net loss per share excludes

non-cash gains and/or losses recognized in the quarter due to the

changes in the fair value of certain of Gevo’s financial

instruments, such as warrants, convertible debt and embedded

derivatives. Management believes these measures are useful to

supplements to its GAAP financial statements with this non-GAAP

information because management uses such information internally for

its operating, budgeting and financial planning purposes. These

non-GAAP financial measures also facilitate management's internal

comparisons to Gevo’s historical performance as well as comparisons

to the operating results of other companies. In addition, Gevo

believes these non-GAAP financial measures are useful to investors

because they allow for greater transparency into the indicators

used by management as a basis for its financial and operational

decision making. Non-GAAP information is not prepared under a

comprehensive set of accounting rules and therefore, should only be

read in conjunction with financial information reported under U.S.

GAAP when understanding Gevo’s operating performance. A

reconciliation between GAAP and non-GAAP financial information is

provided in the financial statement tables below.

Reverse Stock Split

On December 21, 2016, our Board of Directors approved a reverse

split of our common stock, par value $0.01, at a ratio of

one-for-twenty. This reverse stock split became

effective on January 5, 2017 and, unless otherwise indicated, all

share amounts, per share data, share prices, exercise prices and

conversion rates set forth in this press release and the

accompanying consolidated financial statements have, where

applicable, been adjusted to reflect this reverse stock split.

1 Adjusted Net Loss Per Share is calculated by adding back

non-cash gains and/or losses recognized in the quarter due to the

changes in the fair value of certain of our financial instruments,

such as warrants, convertible debt and embedded derivatives; a

reconciliation of Adjusted Net Loss Per Share to GAAP net loss per

share is provided in the financial statement tables following this

release.

2 Cash EBITDA loss is calculated by adding back

depreciation and non-cash stock compensation to GAAP loss from

operations; a reconciliation of cash EBITDA Loss to GAAP loss from

operations is provided in the financial statement tables following

this release.

3 Cash and Cash Equivalents is unaudited and preliminary,

and does not present all information necessary for an understanding

of our financial condition as of February 28, 2017.

4 A reconciliation of projected cash EBITDA Loss to

projected GAAP loss from operations for the year ending December

31, 2017 is provided in the financial statement tables following

this release.

Gevo, Inc. Condensed Consolidated

Statements of Operations Information(Unaudited, in

thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Year Ended December 31, |

|

December 31, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Revenue and

cost of goods sold |

|

|

|

|

|

|

|

|

|

|

| Ethanol

sales and related products, net |

|

$ |

24,613 |

|

|

$ |

27,125 |

|

|

$ |

5,325 |

|

|

$ |

6,521 |

|

|

Hydrocarbon revenue |

|

|

1,929 |

|

|

|

1,694 |

|

|

|

467 |

|

|

|

245 |

|

| Grant and

other revenue |

|

|

671 |

|

|

|

1,318 |

|

|

|

44 |

|

|

|

531 |

|

|

Total revenues |

|

|

27,213 |

|

|

|

30,137 |

|

|

|

5,836 |

|

|

|

7,297 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

goods sold |

|

|

37,017 |

|

|

|

38,762 |

|

|

|

8,156 |

|

|

|

9,001 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

loss |

|

|

(9,804 |

) |

|

|

(8,625 |

) |

|

|

(2,320 |

) |

|

|

(1,704 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research

and development expense |

|

|

5,216 |

|

|

|

6,610 |

|

|

|

1,546 |

|

|

|

1,596 |

|

| Selling,

general and administrative expense |

|

|

8,965 |

|

|

|

16,692 |

|

|

|

2,627 |

|

|

|

3,286 |

|

|

Total operating expenses |

|

|

14,181 |

|

|

|

23,302 |

|

|

|

4,173 |

|

|

|

4,882 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(23,985 |

) |

|

|

(31,927 |

) |

|

|

(6,493 |

) |

|

|

(6,586 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

(7,837 |

) |

|

|

(8,243 |

) |

|

|

(1,342 |

) |

|

|

(2,057 |

) |

| Gain

(loss) on extinguishment of debt |

|

|

(763 |

) |

|

|

232 |

|

|

|

157 |

|

|

|

(53 |

) |

| Gain on

extinguishment of warrant liability |

|

|

(918 |

) |

|

|

1,775 |

|

|

|

- |

|

|

|

- |

|

| Gain

(loss) from change in fair value of derivative warrant

liability |

|

|

1,783 |

|

|

|

577 |

|

|

|

5,954 |

|

|

|

2,938 |

|

| Gain from

change in fair value of 2017 Notes |

|

|

(4,204 |

) |

|

|

3,895 |

|

|

|

(574 |

) |

|

|

313 |

|

|

Loss on issuance of equity |

|

|

(1,519 |

) |

|

|

(2,523 |

) |

|

|

- |

|

|

|

(2,523 |

) |

| Other

income |

|

|

215 |

|

|

|

20 |

|

|

|

9 |

|

|

|

6 |

|

| Total

other expense |

|

|

(13,243 |

) |

|

|

(4,267 |

) |

|

|

4,204 |

|

|

|

(1,376 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(37,228 |

) |

|

$ |

(36,194 |

) |

|

$ |

(2,289 |

) |

|

$ |

(7,962 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share -

basic and diluted |

|

$ |

(9.68 |

) |

|

$ |

(51.61 |

) |

|

$ |

(0.33 |

) |

|

$ |

(8.87 |

) |

| Weighted-average number

of common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

outstanding - basic and diluted |

|

|

3,847,421 |

|

|

|

701,252 |

|

|

|

6,840,316 |

|

|

|

897,723 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gevo, Inc. Condensed Consolidated

Balance Sheet Information(Unaudited, in

thousands)

| |

|

|

|

| |

|

December

31, |

|

| |

|

2016 |

|

2015 |

|

|

Assets |

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

27,888 |

|

$ |

17,031 |

|

| Accounts

receivable |

|

|

1,122 |

|

|

1,391 |

|

|

Inventories |

|

|

3,458 |

|

|

3,487 |

|

| Prepaid

expenses and other current assets |

|

|

850 |

|

|

731 |

|

| Total

current assets |

|

|

33,318 |

|

|

22,640 |

|

| |

|

|

|

|

| Property, plant and

equipment, net |

|

|

75,592 |

|

|

76,777 |

|

| Deposits and other

assets |

|

|

3,414 |

|

|

3,414 |

|

| Total

assets |

|

$ |

112,324 |

|

$ |

102,831 |

|

| |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable, accrued liabilities and other current liabilities |

|

$ |

6,193 |

|

$ |

7,476 |

|

| Current

Portion of 2017 Notes recorded at fair value |

|

|

25,769 |

|

|

- |

|

|

Derivative warrant liability |

|

|

2,698 |

|

|

10,493 |

|

| Current

portion of secured debt, net |

|

|

- |

|

|

330 |

|

| Total

current liabilities |

|

|

34,660 |

|

|

18,299 |

|

| Long-term portion

secured debt, net |

|

|

- |

|

|

153 |

|

| 2017 notes recorded at

fair value |

|

|

- |

|

|

21,565 |

|

| 2022

notes, net |

|

|

8,221 |

|

|

14,341 |

|

| Other long-term

liabilities |

|

|

179 |

|

|

147 |

|

| Total

liabilities |

|

|

43,060 |

|

|

54,505 |

|

| |

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

69,264 |

|

|

48,326 |

|

| Total

liabilities and stockholders' equity |

|

$ |

112,324 |

|

$ |

102,831 |

|

| |

|

|

|

|

|

|

|

Gevo, Inc. Condensed Consolidated Cash

Flow Information(Unaudited, in

thousands)

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Three Months Ended |

| |

|

Year Ended December 31, |

|

December 31, |

| |

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Operating

Activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(37,228 |

) |

|

$ |

(36,194 |

) |

|

$ |

(2,290 |

) |

|

$ |

(7,962 |

) |

| Adjustments to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| (Gain)

from the change in fair value of derivative warrant liability |

|

|

(1,783 |

) |

|

|

(577 |

) |

|

|

(5,953 |

) |

|

|

(2,938 |

) |

|

Loss/(Gain) from the change in fair value of 2017 Notes |

|

|

4,204 |

|

|

|

(3,895 |

) |

|

|

575 |

|

|

|

(313 |

) |

|

Loss/(Gain) on exchange or conversion of debt |

|

|

763 |

|

|

|

(232 |

) |

|

|

(157 |

) |

|

|

53 |

|

|

Loss/(Gain) on extinguishment of warrant liability |

|

|

918 |

|

|

|

(1,775 |

) |

|

|

- |

|

|

|

- |

|

| Loss on

issuance of equity |

|

|

1,519 |

|

|

|

2,523 |

|

|

|

- |

|

|

|

2,523 |

|

|

Stock-based compensation |

|

|

886 |

|

|

|

2,647 |

|

|

|

77 |

|

|

|

694 |

|

|

Depreciation and amortization |

|

|

6,747 |

|

|

|

6,573 |

|

|

|

1,709 |

|

|

|

1,676 |

|

| Non-cash

interest expense |

|

|

3,977 |

|

|

|

3,772 |

|

|

|

637 |

|

|

|

1,032 |

|

| Other

non-cash expenses |

|

|

(1 |

) |

|

|

(7 |

) |

|

|

(3 |

) |

|

|

(7 |

) |

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

|

269 |

|

|

|

970 |

|

|

|

(43 |

) |

|

|

(257 |

) |

|

Inventories |

|

|

29 |

|

|

|

805 |

|

|

|

(255 |

) |

|

|

(784 |

) |

| Prepaid

expenses and other current assets |

|

|

(119 |

) |

|

|

1 |

|

|

|

(6 |

) |

|

|

(113 |

) |

| Accounts

payable, accrued expenses, and long-term liabilities |

|

|

(697 |

) |

|

|

(2,771 |

) |

|

|

1,398 |

|

|

|

(752 |

) |

| Net cash

used in operating activities |

|

$ |

(20,516 |

) |

|

$ |

(28,160 |

) |

|

$ |

(4,311 |

) |

|

$ |

(7,148 |

) |

|

|

|

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

|

(5,938 |

) |

|

|

(1,464 |

) |

|

|

(418 |

) |

|

|

(1,193 |

) |

|

Restricted certificate of deposit |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Proceeds

from sales tax refund for property, plant and equipment |

|

|

- |

|

|

|

144 |

|

|

|

- |

|

|

|

- |

|

| Net cash

used in investing activities |

|

|

(5,938 |

) |

|

|

(1,320 |

) |

|

|

(418 |

) |

|

|

(1,193 |

) |

|

|

|

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

|

| Payments

on secured debt |

|

|

(504 |

) |

|

|

(318 |

) |

|

|

- |

|

|

|

(82 |

) |

| Debt and

equity offering costs |

|

|

(3,144 |

) |

|

|

(3,519 |

) |

|

|

151 |

|

|

|

(734 |

) |

| Proceeds

from issuance of common stock upon exercise of stock options

and employee stock purchase plan |

|

|

- |

|

|

|

3 |

|

|

|

- |

|

|

|

| Proceeds

from issuance of common stock and common stock warrants |

|

|

28,661 |

|

|

|

33,820 |

|

|

|

- |

|

|

|

9,970 |

|

| Proceeds

from issuance of convertible debt, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

| Proceeds

from the exercise of warrants |

|

|

12,298 |

|

|

|

10,166 |

|

|

|

1,403 |

|

|

|

15 |

|

| Net cash

provided by financing activities |

|

|

37,311 |

|

|

|

40,152 |

|

|

|

1,554 |

|

|

|

9,169 |

|

| |

|

|

|

|

|

|

|

|

| Net increase (decrease)

in cash and cash equivalents |

|

|

10,857 |

|

|

|

10,672 |

|

|

|

(3,175 |

) |

|

|

828 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

|

|

|

|

| Beginning

of year |

|

|

17,031 |

|

|

|

6,359 |

|

|

|

31,063 |

|

|

|

16,203 |

|

| Ending of

year |

|

|

27,888 |

|

|

|

17,031 |

|

|

|

27,888 |

|

|

|

17,031 |

|

Gevo, Inc. Reconciliation of GAAP to

Non-GAAP Financial Information(Unaudited, in

thousands)

| |

|

|

|

|

| |

|

Year Ended |

|

Three Months

Ended |

| |

|

December 31, |

|

December 31, |

| |

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Gevo Development, LLC /

Agri-Energy, LLC |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

$ |

(12,940 |

) |

|

$ |

(12,204 |

) |

|

$ |

(3,044 |

) |

|

$ |

(2,636 |

) |

|

Depreciation and amortization |

|

|

6,009 |

|

|

|

5,717 |

|

|

|

1,557 |

|

|

|

1,429 |

|

| Non-cash

stock-based compensation |

|

|

11 |

|

|

|

43 |

|

|

|

- |

|

|

|

14 |

|

| Non-GAAP cash EBITDA

loss |

|

$ |

(6,920 |

) |

|

$ |

(6,444 |

) |

|

$ |

(1,487 |

) |

|

$ |

(1,193 |

) |

| |

|

|

|

|

|

|

|

|

| Gevo, Inc. |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

$ |

(11,045 |

) |

|

$ |

(19,723 |

) |

|

$ |

(3,449 |

) |

|

$ |

(3,950 |

) |

|

Depreciation and amortization |

|

|

738 |

|

|

|

856 |

|

|

|

152 |

|

|

|

247 |

|

| Non-cash

stock-based compensation |

|

|

875 |

|

|

|

2,604 |

|

|

|

77 |

|

|

|

680 |

|

| Non-GAAP cash EBITDA

loss |

|

$ |

(9,432 |

) |

|

$ |

(16,263 |

) |

|

$ |

(3,220 |

) |

|

$ |

(3,023 |

) |

| |

|

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

$ |

(23,985 |

) |

|

$ |

(31,927 |

) |

|

$ |

(6,493 |

) |

|

$ |

(6,586 |

) |

|

Depreciation and amortization |

|

|

6,747 |

|

|

|

6,573 |

|

|

|

1,709 |

|

|

|

1,676 |

|

| Non-cash

stock-based compensation |

|

|

886 |

|

|

|

2,647 |

|

|

|

77 |

|

|

|

694 |

|

| Non-GAAP cash EBITDA

loss |

|

$ |

(16,352 |

) |

|

$ |

(22,707 |

) |

|

$ |

(4,707 |

) |

|

$ |

(4,216 |

) |

| |

|

|

|

|

|

|

|

|

| Non-GAAP

Adjusted Net Loss: |

|

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(37,228 |

) |

|

$ |

(36,194 |

) |

|

$ |

(2,289 |

) |

|

$ |

(7,962 |

) |

| (Loss)/Gain on exchange

or conversion of debt |

|

|

(763 |

) |

|

|

232 |

|

|

|

157 |

|

|

|

(53 |

) |

| (Loss)/Gain on

extinguishment of warrant liability |

|

|

(918 |

) |

|

|

1,775 |

|

|

|

- |

|

|

|

- |

|

| (Loss)/Gain from change

in fair value of the 2017 Notes |

|

|

(4,204 |

) |

|

|

3,895 |

|

|

|

(574 |

) |

|

|

313 |

|

| (Loss)/Gain from change

in fair value of derivative warrant liability |

|

|

1,783 |

|

|

|

577 |

|

|

|

5,954 |

|

|

|

2,938 |

|

| Loss on issuance of

equity |

|

|

(1,519 |

) |

|

|

(2,523 |

) |

|

|

- |

|

|

|

(2,523 |

) |

| Non-GAAP Net Loss |

|

$ |

(31,607 |

) |

|

$ |

(40,150 |

) |

|

$ |

(7,826 |

) |

|

$ |

(8,637 |

) |

| Weighted-average number

of common shares outstanding - basic and diluted |

|

|

3,847,421 |

|

|

|

701,252 |

|

|

|

6,840,316 |

|

|

|

897,723 |

|

| Non-GAAP Adjusted Net

loss per share - basic and diluted |

|

$ |

(8.22 |

) |

|

$ |

(57.25 |

) |

|

$ |

(1.14 |

) |

|

$ |

(9.62 |

) |

| |

|

|

|

|

|

|

|

|

Gevo, Inc. Reconciliation of GAAP to

Non-GAAP Financial Information(Unaudited, in

thousands)

| |

|

|

| |

|

Year Ended |

| |

|

December 31, 2017 |

|

Projected Non-GAAP Cash EBITDA Loss |

|

Estimated Range |

| |

|

|

| Gevo Consolidated |

|

|

| Loss from

operations |

|

$

(24,000) - (28,000) |

|

Depreciation and amortization |

|

5,500

- 7,000 |

| Non-cash

stock-based compensation |

|

500 - 1,000 |

| Non-GAAP cash EBITDA

loss |

|

$ (18,000) - (20,000) |

| |

|

|

Media Contact

David Rodewald

The David James Agency, LLC

+1 805-494-9508

gevo@davidjamesagency.com

Investor Contact

Shawn M. Severson

EnergyTech Investor, LLC

+1 415-233-7094

gevo@energytechinvestor.com

@ShawnEnergyTech

www.energytechinvestor.com

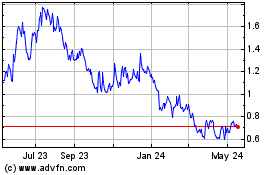

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jun 2024 to Jul 2024

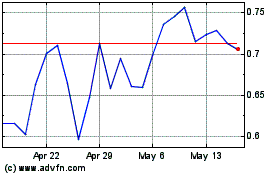

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jul 2023 to Jul 2024