Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 November 2024 - 11:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date

of Report: November 6, 2024

Commission File Number: 001-40553

D-MARKET Elektronik Hizmetler ve Ticaret Anonim

Şirketi

(Exact Name of registrant as specified in its charter)

D-MARKET

Electronic Services & Trading

(Translation of Registrant‘s Name into English)

Kuştepe Mahallesi Mecidiyeköy Yolu

Cadde no: 12 Kule 2 K2

Istanbul, Türkiye

(Address of principal executive

office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

D-MARKET ELECTRONIC SERVICES & TRADING |

| |

|

| November 6, 2024 |

By: |

/s/ NİLHAN GÖKÇETEKİN |

| |

Name: |

Nilhan Gökçetekin |

| |

Title: |

Chief Executive Officer |

| |

By: |

/s/ M. SEÇKİN KÖSEOĞLU |

| |

Name: |

M. Seçkin Köseoğlu |

| |

Title: |

Chief Financial Officer |

EXHIBITS

Exhibit 99.1

Hepsiburada Announces the Second Bond Issuance

of Hepsifinans

ISTANBUL, November 6, 2024 D-MARKET Electronic

Services & Trading (d/b/a “Hepsiburada”) (NASDAQ: HEPS), a leading Turkish

e-commerce platform, today announced the second bond issuance of its indirect wholly owned subsidiary, Hepsi Finansman A.Ş. (“Hepsifinans”),

at a nominal value of TRY 150 million.

Further

to our disclosure in a report on Form 6-K furnished on September 11, 2024 regarding the Capital Markets Board’s approval

of Hepsifinans’s issuance of bonds or bills with a total aggregate principal amount of up to TRY 1,050,000,000 in one or more tranches

within one year, Hepsiburada announces that Hepsifinans closed its second bond issuance to domestic qualified investors today.

The bonds have an aggregate principal amount of TRY 150 million, a six-month maturity and coupon payments due every three months. The

bonds will accrue interest at a rate of 51.50% per annum. The principal of the bonds will be repaid at maturity. Hepsifinans will use

the funds raised to sustainably grow its consumer finance business.

About Hepsiburada

Hepsiburada is a leading e-commerce technology

platform in Türkiye, connecting over 66 million members with over 264 million stock keeping units across over 30 product categories.

Hepsiburada provides goods and services through its hybrid model combining first-party direct sales (1P model) and a third-party marketplace

(3P model) with approximately 101 thousand merchants.

With its vision of leading the digitalization

of commerce, Hepsiburada acts as a reliable, innovative and purpose-led companion in consumers’ daily lives. Hepsiburada’s

e-commerce platform provides a broad ecosystem of capabilities for merchants and consumers including: last-mile delivery and fulfilment

services, advertising services, on-demand grocery delivery services, and payment solutions offered through Hepsipay, Hepsiburada’s

payment companion and BNPL solutions provider. HepsiGlobal offers a selection from international merchants through its inbound arm while

outbound operations aim to enable merchants in Türkiye to make cross-border sales.

Since its founding in 2000, Hepsiburada has been

purpose-led, leveraging its digital capabilities to develop the role of women in the Turkish economy. Hepsiburada started the ‘Technology

Empowerment for Women Entrepreneurs’ programme in 2017, which has supported approximately 55 thousand female entrepreneurs throughout

Türkiye to reach millions of customers with their products.

Investor Relations Contact

ir@hepsiburada.com

Media Contact

corporatecommunications@hepsiburada.com

Forward-Looking Statements

This press release includes forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934,

as amended and the Safe Harbor provisions of the US Private Securities Litigation Reform Act of 1995, and encompasses all statements,

other than statements of historical fact contained in this press release. These forward-looking statements can be identified by terminology

such as “may,” “could,” “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “targets,”

“likely to” and similar statements. These forward-looking statements are based on management’s current expectations.

However, it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking

statements we may make. These statements are neither promises nor guarantees but involve known and unknown risks, uncertainties and other

important factors and circumstances that may cause Hepsiburada’s actual results, performance or achievements to be materially different

from its expectations expressed or implied by the forward-looking statements, including conditions in the U.S. capital markets, negative

global economic conditions, potential negative developments resulting from epidemics or natural disasters, other negative developments

in Hepsiburada’s business or unfavorable legislative or regulatory developments. We caution you therefore against relying on these

forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements. For a discussion of additional

factors that may affect the outcome of such forward-looking statements, see our 2023 annual report filed with the SEC on Form 20-F

on April 30, 2024 (Commission File Number: 001-40553), and in particular the “Risk Factors” section, as well as the other

documents filed with or furnished to the SEC by Hepsiburada from time to time. Copies of these filings are available online from the SEC

at www.sec.gov, or on the SEC Filings section of our Investor Relations website at https://investors.hepsiburada.com. These and other

important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. These

forward looking statements should not be relied upon as representing Hepsiburada’s views as of any date subsequent to the date of

this press release. All forward-looking statements in this press release are based on information currently available to Hepsiburada,

and Hepsiburada and its authorized representatives assume no obligation to update these forward-looking statements in light of new information

or future events. Accordingly, undue reliance should not be placed upon the forward-looking statements.

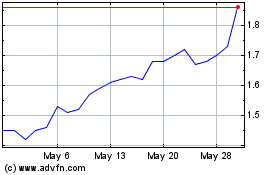

D Market Electronic Serv... (NASDAQ:HEPS)

Historical Stock Chart

From Nov 2024 to Dec 2024

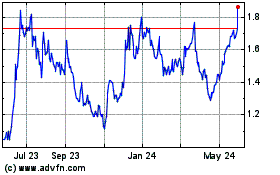

D Market Electronic Serv... (NASDAQ:HEPS)

Historical Stock Chart

From Dec 2023 to Dec 2024