Amended Current Report Filing (8-k/a)

03 June 2021 - 6:55AM

Edgar (US Regulatory)

united

states

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K/A

(Amendment No. 3)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 9, 2021

METROMILE,

INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-39484

|

|

84-4916134

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

425 Market Street #700

|

|

|

|

San Francisco, CA

|

|

94105

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(888) 242-5204

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

MILE

|

|

The Nasdaq Capital Market

|

|

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

|

MILEW

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY NOTE

Metromile, Inc., a Delaware

corporation (the “Company”) (f/k/a INSU Acquisition Corp. II), filed a Current Report on Form 8-K on

February 11, 2021, as amended by Amendment No. 1 on Form 8-K/A filed on February 11,

2021 and Amendment No. 2 on Form 8-K/A filed on March 31, 2021 (together, the “Original Report”),

to report, among other events, the Closing and related matters under Items 1.01, 2.01, 3.02, 3.03, 4.01, 5.01, 5.03, 5.05, 5.06

and 9.01 of Form 8-K. The Company is filing this Amendment No. 3

on Form 8-K/A (this “Amendment”) in order to provide restated unaudited

pro forma condensed combined financial information of the Company for the year ended December 31, 2020,

as further described below.

As

previously reported in the Form 8-K filed by the Company on May 18, 2021 (the “Restatement 8-K”), on April 12, 2021, the

Acting Director of the Division of Corporate Finance and the Acting Chief Accountant of the U.S. Securities and Exchange Commission (the

“SEC”) issued “Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition

Companies” (the “Statement”), which indicated that when one or more of certain features is included in a warrant, the

warrant “should be classified as a liability measured at fair value, with changes in fair value each period reported in earnings.”

The Company had previously classified its private placement warrants and public warrants, which were issued in connection with the initial

public offering of INSU Acquisition Corp. II (“INSU”) in 2020, as equity.

As

reported in the Restatement 8-K, on May 16, 2021, the Audit Committee of the Board of Directors of the Company (the “Audit Committee”),

in response to the Statement, determined that the previously issued consolidated financial statements of INSU as of December 31, 2020

included in (i) the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 31,

2021 (the “2020 Form 10-K”), (ii) the Company’s Registration Statement on Form S-1, which was declared effective by

the SEC on April 2, 2021 (the “Resale S-1”) and (iii) INSU’s unaudited condensed financial statements for the nine

months ended September 30, 2020 (such periods, the “Affected Periods”), should be restated to reflect the impact of the guidance

provided in the Statement and accordingly, should no longer be relied upon.

On June 2, 2021, the Company

filed an amendment to the 2020 Form 10-K to provide restated consolidated financial statements for the year ended December 31, 2020 and

related revisions . This Amendment is being filed in order to amend and restate the unaudited pro forma condensed combined financial information

of the Company provided for the year ended December 31, 2020, provided under Item 9.01(b) in the Original Report.

This Amendment does not amend

any other item of the Original Report or purport to provide an update or a discussion of any developments at the Company or its subsidiaries

subsequent to the filing date of the Original Report. The information previously reported in or filed with the Original Report is hereby

incorporated by reference to this Amendment. Capitalized terms used but not defined

herein have the meanings given to such terms in the Original Report.

Item 9.01 Financial Statements and Exhibits.

|

|

(b)

|

Pro forma financial information

|

The unaudited pro forma condensed combined

financial information of the Company for the year ended December 31, 2020 is set forth in Exhibit 99.3 to this Amendment and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: June 2, 2021

|

METROMILE, INC.

|

|

|

|

|

|

By:

|

/s/ Dan Preston

|

|

|

Name:

|

Dan Preston

|

|

|

Title:

|

Chief Executive Officer

|

3

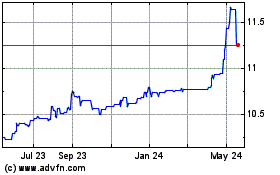

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

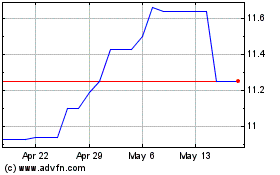

Insight Acquisition (NASDAQ:INAQ)

Historical Stock Chart

From Jan 2024 to Jan 2025