As filed with the Securities and Exchange Commission on September 5, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S‑3

REGISTRATION STATEMENT

Under

The Securities Act of 1933

IRIDEX Corporation

(Exact name of registrant as specified in its charter)

|

|

Delaware (State or other jurisdiction of

incorporation or organization) |

77-0210467 (I.R.S. Employer

Identification Number) |

1212 Terra Bella Avenue

Mountain View, California 94043

(650) 940-4700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David I. Bruce

Chief Executive Officer

1212 Terra Bella Avenue

Mountain View, California 94043

(650) 940-4700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Philip H. Oettinger

Jesse Schumaker

Wilson Sonsini Goodrich & Rosati,

Professional Corporation

650 Page Mill Road

Palo Alto, CA 94304

(650) 493-9300

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of the registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

|

|

|

|

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated September 5, 2024

Prospectus

IRIDEX Corporation

4,952,823 Shares

Common Stock

Offered by the Selling Stockholder

This prospectus relates to the resale or other disposition from time to time in one or more offerings of up to 4,952,823 shares of our common stock, par value $0.01, by the selling stockholder named herein or their transferees or other successors-in-interest identified in a prospectus supplement. These 4,952,823 shares of common stock consist of (i) 4,825,855 shares, which is the maximum number of shares of common stock issuable upon the conversion of a senior convertible promissory note, dated August 7, 2024 (the “Note” and the shares issuance upon conversion of the Note (the “Note Shares”)) and (ii) 126,968 shares of common stock (the “Incentive Shares”), that were issued pursuant to a Securities Purchase Agreement, dated August 4, 2024 (the “Purchase Agreement”), by and between IRIDEX Corporation and Lind Global Asset Management IX LLC (“Lind”).

We are not offering any shares of our common stock for sale under this prospectus. We are registering the offer and resale of the Note Shares and Incentive Shares, to satisfy contractual obligations owed by us to the selling stockholder pursuant to the Purchase Agreement, and documents ancillary thereto. Our registration of the shares of common stock covered by this prospectus does not mean that the selling stockholder will offer or sell any of the shares. Any shares of common stock subject to resale hereunder will have been issued by us and acquired by the selling stockholder prior to any resale of such shares pursuant to this prospectus. No underwriter or other person has been engaged to facilitate the sale of the shares in this offering. The selling stockholder will pay or assume discounts, commissions, fees of underwriters, selling brokers, dealer managers or similar expenses, if any, incurred for the sale of shares of our common stock. To the extent that the selling stockholder resells any securities, the selling stockholder may be required to provide you with this prospectus and a prospectus supplement identifying and containing specific information about the selling stockholder and the amount and terms of the securities being offered. You should read this prospectus and any applicable prospectus supplement before you invest. We will not receive any proceeds from the sale of our common stock by the selling stockholder.

The securities may be sold directly to you, through agents or through underwriters and dealers. If agents, underwriters or dealers are used to sell the securities, we will name them and describe their compensation in a prospectus supplement. The price to the public of those securities will also be set forth in a prospectus supplement.

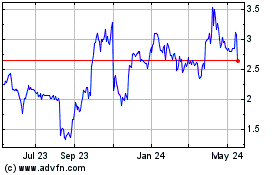

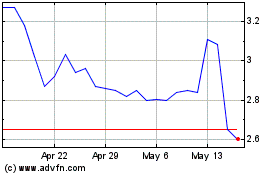

As of the date of this prospectus supplement, the aggregate market value of our outstanding common stock held by non-affiliates, or our public float, was approximately $34,195,408, which amount is based on 15,509,412 outstanding shares of common stock held by non-affiliates and a per share price of $2.15, the closing price of our common stock on July 12, 2024, which is the highest closing sale price of our common stock on The Nasdaq Capital Market within the prior 60 days. Pursuant to General Instruction I.B.6 of Form S-3, so long as our public float remains below $75,000,000, in no event will we sell securities with a value of more than one-third of our public float in any 12-month period under the registration statement of which this prospectus is a part. We have not sold any securities pursuant to General Instruction I.B.6 to Form S-3 during the 12-calendar month period that ends on and includes the date of this prospectus supplement.

Our common stock is listed on the Nasdaq Capital Market under the symbol “IRIX.” On September 4, 2024, the last reported sale price of our Common Stock on the Nasdaq Capital Market was $2.01 per share.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. Each prospectus supplement will indicate whether the securities offered thereby will be listed on any securities exchange. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Investing in our securities involves risks. Please carefully read the information under the headings “Risk Factors” beginning on page 3 of this prospectus and “Item 1A – Risk Factors” of our most recent report on Form 10-K or 10-Q that is incorporated by reference in this prospectus before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 5, 2024.

TABLE OF CONTENTS

About this Prospectus

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf” registration process. Under this shelf registration process, the selling stockholder may from time to time offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities that may be offered. Each time the selling stockholder sells securities, we will provide one or more prospectus supplements that will contain specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus. Before you invest in our securities, you should read both this prospectus and any applicable prospectus supplement together with the additional information described in the sections titled “Where You Can Find More Information” and “Incorporation by Reference.”

We have not authorized anyone to provide you with information that is different from that contained, or incorporated by reference, in this prospectus, any applicable prospectus supplement or in any related free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus and any applicable prospectus supplement or any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in the applicable prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

Prospectus Summary

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. It does not contain all of the information that may be important to you and your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the matters set forth in the section titled “Risk Factors” and the financial statements and related notes and other information that we incorporate by reference herein, including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Unless the context indicates otherwise, references in this prospectus to “IRIDEX,” “Company,” “we,” “our” and “us” refer, collectively, to IRIDEX Corporation, a Delaware corporation, and its subsidiaries taken as a whole.

Company Overview

IRIDEX is an ophthalmic medical technology company focused on the development and commercialization of breakthrough products and procedures used to treat sight-threatening eye conditions, including glaucoma and retinal diseases.

Our propriety MicroPulse® Technology and Endpoint Management™ Technology are used for the treatment of glaucoma and retina disorders. Both technologies are offered as optional treatment modes in select laser consoles in addition to the standard continuous-wave (“CW”) treatment mode. They allow low-energy, subvisible, tissue-sparing laser therapy by different means: MicroPulse technology uses short, microsecond-long laser pulses that allow tissue to cool between pulses giving physicians finer control of thermal elevation to minimize tissue damage. Endpoint Management technology uses a delivery algorithm to titrate the laser energy. CW laser photocoagulation can stabilize vision over the long term but can also result in varying degrees of vision loss. Both MicroPulse and Endpoint Management technologies have demonstrated clinical efficacy with a safer profile compared to standard high-energy CW laser for the treatment of both retinal diseases and glaucoma.

Our products consist of laser consoles, delivery devices and consumable probes.

Our laser consoles consist of the following product lines:

•Glaucoma – Our primary glaucoma console line is the Cyclo G6® laser system with MicroPulse technology. In addition, our medical retina consoles have features supporting glaucoma laser treatments.

•Medical Retina – Our medical-retina product line includes our portable IQ 532® and IQ 577® laser systems with MicroPulse technology; and the Pattern Scanning Laser (“PASCAL”) System, an integrated workstation with Endpoint Management technology and MicroPulse technology. These systems are ideal for multispecialty practices because these lasers also can be used to treat glaucoma, i.e., single-spot laser trabeculoplasty using MicroPulse technology, iridotomy, and iridectomy using the IQ lasers; and pattern scanning laser trabeculoplasty (“PSLT”) using the PASCAL laser system.

•Surgical Retina – Our surgical-retina product line includes our OcuLight® TX and OcuLight® SLx (with MicroPulse technology) laser photocoagulation systems. These systems are often used in vitrectomy procedures, which are used to treat proliferative diabetic retinopathy, macular holes, retinal tears and detachments.

Our business generates recurring revenues through sales of consumable products, predominantly single-use laser probe devices and other instrumentation, as well as repair, service and extended service contracts for our laser systems.

Our laser probes consist of the following product lines:

•Glaucoma – Probes used in our glaucoma product line include our patented single-use delivery devices MicroPulse P3®, G-Probe®, and G-Probe Illuminate®.

•Surgical Retina – Probes used in our surgical-retina product line include our family of single-use EndoProbe® handpieces.

Ophthalmologists typically use our laser systems in hospital operating rooms and ambulatory surgical centers, as well as their offices and clinics. In operating rooms and ambulatory surgical centers, ophthalmologists use our laser systems with either an indirect laser ophthalmoscope or a single-use consumable probe, including MicroPulse P3®, G-Probe® and G-Probe Illuminate® delivery devices, and EndoProbe handpieces. In the offices and clinics, ophthalmologists use our laser systems with either an indirect laser ophthalmoscope or a slit-lamp adapter.

Corporate Information

IRIDEX was incorporated in California in February 1989 as IRIS Medical Instruments, Inc. In January 1996, we changed our name to IRIDEX Corporation and reincorporated in Delaware. Our executive offices are located at 1212 Terra Bella Avenue, Mountain View, California 94043-1824, and our telephone number is (650) 940-4700. We can also be reached at our website at www.iridex.com. Any information on, or that can be accessed through, our website and social media channels is not part of this prospectus.

IRIDEX, the IRIDEX logo, IRIS Medical, MicroPulse, OcuLight, EndoProbe, MicroPulse P3, G-Probe, G-Probe Illuminate, TruFocus LIO Premiere, IQ 577, IQ532, Cyclo G6, and TxCell are our registered trademarks. All other trademarks or trade names appearing in this Registration Statement on Form S-3 are the property of their respective owners.

The Offering

The selling stockholder named in this prospectus may offer and sell up to 4,952,823 shares of our common stock, par value $0.01 per share. Our common stock is currently listed on The Nasdaq Capital Market under the symbol “IRIX.” Shares of our common stock that may be offered under this prospectus will be fully paid and non-assessable. We will not receive any of the proceeds of sales by the selling stockholder of any of the common stock covered by this prospectus. Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholder for offer and sale, we are referring to the shares that are being registered pursuant to the terms of the Securities Purchase Agreement (the “Purchase Agreement”), dated as of August 4, 2024, by and between us and Lind Global Asset Management IX LLC, an entity managed by The Lind Partners, LLC (“Lind”), to which we issued and sold a senior convertible promissory note in the principal amount of $4,200,000. When we refer to the selling stockholder in this prospectus, we are referring to the holder of registration rights under the Purchase Agreement and, as applicable, their permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the Registration Statement of which this prospectus is a part. See “Selling Stockholder” beginning on page 5 of this prospectus.

The securities may be sold to or through underwriters, dealers or agents or directly to purchasers or as otherwise set forth in the section titled “Plan of Distribution.” Each prospectus supplement will set forth the names of any underwriters, dealers, agents or other entities involved in the sale of securities described in that prospectus supplement and any applicable fee, commission or discount arrangements with them.

The selling stockholder may offer shares of our common stock, par value $0.01 per share. Holders of our common stock are entitled to receive dividends declared by our board of directors out of funds legally available for the payment of dividends, subject to rights, if any, of preferred stockholders. We have not paid dividends in the past and have no current plans to pay dividends. Each holder of common stock is entitled to one vote per share. The holders of common stock have no preemptive rights.

Risk Factors

An investment in our securities involves a high degree of risk. The prospectus supplement applicable to each offering of our securities will contain a discussion of the risks applicable to an investment in our securities. Prior to making a decision about investing in our securities, you should carefully consider the specific risk factors discussed in the section of the applicable prospectus supplement titled “Risk Factors,” together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under “Part I—Item 1A—Risk Factors” of our most recent Annual Report on Form 10-K for the year ended December 30, 2023 and in “Part II—Item 1A—Risk Factors” in our most recent Quarterly Report on Form 10-Q for this fiscal quarter ended June 29, 2024, all of which are incorporated herein by reference, as may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, may also become important factors that affect us. If any of the risks or uncertainties described in this prospectus or our SEC filings or any such additional risks and uncertainties actually occur, our business, financial condition or results of operations could be materially and adversely affected which could cause our actual operating results to differ materially from those indicated or suggested by forward-looking statements made in this prospectus or our SEC filings or presented elsewhere by management from time to time you could lose part or all of your investment. In that case, the trading price of our common stock could decline and you could lose all or part of your investment. Please also see “Cautionary Statement Regarding Forward-Looking Statements” on page 4 of this prospectus.

The number of shares being registered for sale is significant in relation to the number of our outstanding shares of common stock.

We have filed a Registration Statement of which this prospectus is a part of to register the shares offered hereunder for sale into the public market by the selling stockholder. These shares represent a large number of shares of our common stock, and if sold in the market all at once or at about the same time, could depress the market price of our common stock during the period the Registration Statement remains effective and could also affect our ability to raise equity capital.

Servicing our existing and future debt, including the Note, may require a significant amount of cash, and we may not have sufficient cash flow from our business to pay our indebtedness.

On August 7, 2024, we issued the Note to Lind, which has a principal amount of $4,200,000, and we may, in the future, issue the Subsequent Note (as defined in the Purchase Agreement) to Lind which would have a principal amount of up to $1,800,000. Our ability to make scheduled payments of the principal of, to pay interest on or to refinance our indebtedness, including the Note and any Subsequent Note, depends on our future performance, which is subject to economic, financial, competitive, and other factors beyond our control. We may not generate cash flow from operations in the future sufficient to service our debt and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as selling assets, restructuring debt, or obtaining additional debt financing or equity capital on terms that may be onerous or highly dilutive. Our ability to refinance any future indebtedness will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations. In addition, the Purchase Agreement and the Note contain, and any of our future debt agreements may contain, restrictive covenants that may prohibit us from adopting any of these alternatives. Our failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of our debt.

We may not have the ability to raise the funds necessary to settle repayments of the Note in cash, and our future debt may contain limitations on our ability to make cash payments as required by the Note.

Following the occurrence of a Change of Control (as defined in the Purchase Agreement), Lind may require us to prepay, effective immediately prior to the consummation of such Change of Control, the Note in an amount equal to 105% of the outstanding principal amount of the Note as of such date. In addition, commencing 120 days from the issuance date of the Note, the Company will be required to repay the outstanding principal amount of the Note in twenty consecutive monthly installments of cash, Repayment Shares (as defined in the Purchase Agreement), or a combination of cash and Repayment Shares, at the Company’s option, provided that no portion of the outstanding principal amount may be paid in Repayment Shares unless such Repayment Shares (A) may be immediately resold pursuant to Rule 144 under the Securities Act of 1933, as amended (the “1933 Act”), by a person that is not an affiliate of the Company, or (B) are registered for resale under the 1933 Act and a registration statement is in effect and lawfully usable to effect immediate sales of such Repayment Shares. If we do not meet the conditions for repayment in Repayment Shares, we will be required to make such monthly payments in cash. However, we may not have enough available cash or be able to obtain financing at the time we are required to make such payments on the Note or at its maturity. In addition, any cash payments would reduce the amount of cash available for our operations, which could have a material and adverse effect on our business.

Our ability to make cash payments in connection with the Note may be limited by law, regulatory authority or agreements governing our future indebtedness. Our failure to make payments as required by the Note would constitute a default under the Note. A default under the Note could also lead to a default under agreements governing any of our existing or future indebtedness. Moreover, the occurrence of a Change of Control under the Note could constitute an event of default under other agreements. If the payment of the related indebtedness were to be accelerated after any applicable notice or grace periods, we may not have sufficient funds to repay the indebtedness. Any failure by us to repay indebtedness, in each case, when required to do so pursuant to the terms of the Note, could have a material adverse effect on our business, financial condition, and results of operations.

Lind has conversion rights under the Note, the exercise of which could result in the issuance of a substantial amount of our common stock at a significant discount to the trading price of our common stock.

The Note is convertible at Lind’s option into shares of our common stock at an initial conversion price of $2.44, subject to any adjustments set forth in the Note. However, upon the occurrence of a Delisting Event or an Event of Default (each as defined in the Note), the Note will become immediately due and payable, and Lind may declare an amount equal to 120% of the then outstanding principal amount of the Note due and payable, in addition to any other remedies under the Transaction Documents (as defined in the Purchase Agreement). Additionally, the occurrence of a Delisting Event, an Event of Default or an event which with the passage of time may result in an Event of Default, Lind may convert all or a portion of the outstanding principal amount of the Note at the lower of (i) the then-current conversion price and (ii) the greater of (a) eighty-percent (80%) of the average of the three (3) lowest daily VWAPs during the twenty (20) trading days prior to the delivery of the notice of conversion and (b) a floor price of $0.39, which would significantly dilute our stockholders. If we experience a Delisting Event or an Event of Default under the Note, we may experience a material adverse effect on our liquidity, financial condition, and results of operations.

CAUTIONARY STATEMENTS REGARDING Forward‑Looking Statements

This prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement contain certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “potentially,” “likely,” and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of identifying such statements. Those statements appear in this prospectus, any accompanying prospectus supplement and the documents incorporated herein and therein by reference, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and include statements regarding the intent, belief or current expectations of our management that are subject to known and unknown risks, uncertainties and assumptions. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this prospectus, whether as a result of any new information, future events or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

This prospectus and the documents incorporated by reference in this prospectus may contain market data that we obtain from industry sources. These sources do not guarantee the accuracy or completeness of the information. Although we believe that our industry sources are reliable, we do not independently verify the information. The market data may include projections that are based on a number of other projections. While we believe these assumptions to be reasonable and sound as of the date of this prospectus, actual results may differ from the projections.

Use of Proceeds

All shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholder and we will not receive any proceeds from the sale of these shares by the selling stockholder.

We have agreed to pay all costs, expenses and fees relating to registering the shares of our common stock referenced in this prospectus. The selling stockholder will pay any brokerage commissions and/or similar charges incurred in connection with the sale or other disposition by them of the shares covered hereby.

See “Selling Stockholder” and “Plan of Distribution” described below.

Selling stockholder

Unless the context otherwise requires, as used in this prospectus, “selling stockholder” refers to the selling stockholder named in this prospectus, or certain transferees, assignees or other successors-in-interest that may receive our securities from the selling stockholder.

We have prepared this prospectus to allow the selling stockholder to sell or otherwise dispose of, from time to time, up to 4,952,823 shares of our common stock, which are comprised of (i) 4,825,855 Note Shares, the maximum number of shares of common stock issuable under the Note, and (ii) 126,968 Incentive Shares. See “Summary – The Offering” on page 2 of this prospectus for a description of the private transaction in which we issued the Note and Incentive Shares. Except for the beneficial ownership of securities of the Company, neither the selling stockholder nor any persons who have control over the selling stockholder have had any material relationship with us within the past three years.

The table below lists the selling stockholder and other information regarding the ownership of our shares of common stock by the selling stockholder.

The second column lists the number of shares of common stock owned by the selling stockholder, based on its ownership of the shares of common stock and securities convertible or exercisable into shares of common stock, as of September 3, 2024, assuming exercise or conversion, as applicable, of the securities exercisable or convertible into shares of common stock held by the selling stockholder on that date, if applicable, without regard to any limitations on conversions or exercises. In addition, the Note initially contains provisions preventing the number of shares of common stock issuable upon conversion of the Note, if such conversion would result in the holder obtaining greater than 19.99% of the Company’s voting securities. We intend to seek stockholder approval for conversion of the Note in excess of 19.99% of our voting securities at a special of meeting of stockholders in 2024 and these blocking provisions will terminate if such approval is obtained.

The third column lists the shares of common stock being offered pursuant to this prospectus by the selling stockholder. Because the selling stockholder may sell some or all of the shares of common stock beneficially owned by them and covered by this prospectus, no estimate can be given as to the amount or percentage of common stock that will be held by the selling stockholder after any sales made pursuant to this prospectus. The following table assumes that the selling stockholder will sell all of the shares of common stock listed in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned

Prior to Offering (1) |

|

Maximum

Number of Shares

to be Offered by

the Prospectus |

|

Shares Beneficially Owned

After Offering (2) |

Name of Selling Stockholder |

|

Number |

Percentage |

|

|

|

Number |

Percentage |

|

Lind Global Asset Management IX LLC (3) |

|

4,952,823 |

29.77% |

|

4,952,823 |

|

* |

* |

|

_____________________________________

(1) Percentages are based on 16,636,380 shares of common stock outstanding as of September 3, 2024. Lind may not convert any portion of the Note, to the extent such conversion would cause Lind, together with its affiliates, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding common stock (or 9.99% of our then outstanding common stock to the extent Lind, together with its affiliates, beneficially owns in excess of 4.99% of shares of our then outstanding common stock at the time of such exercise or conversion).

(2) Assumes the selling stockholder has sold all of the shares of common stock beneficially owned by the selling stockholder, which may or may not occur.

(3) Beneficial ownership includes 4,825,855 Note Shares, the maximum number of shares of common stock issuable under the Note, and 126,968 Incentive Shares. The securities are directly owned by Lind. Jeff Easton is the Managing Member of The Lind Partners, LLC, which is the Investment Manager of Lind, and in such capacity has the right to vote and dispose of the securities held by such entities. Mr. Easton disclaims beneficial ownership over the securities listed except to the extent of his pecuniary interest therein. The address for Lind is 444 Madison Avenue, 41st Floor, New York, NY 10022.

Description of Capital Stock

The description of our capital stock is incorporated by reference to Exhibit 4.3 to our Annual Report on Form 10‑K for the fiscal year ended December 30, 2023, filed with the SEC on March 29, 2024.

The following description of the capital stock of IRIDEX (“us,” “our,” “we,” or the “Company”) is a summary. We have adopted an amended and restated certificate of incorporation and amended and restated bylaws, and this description summarizes the provisions that are included in such documents. Because it is only a summary, it does not contain all the information that may be important to you. For a complete description of the matters set forth, you should refer to our amended and restated certificate of incorporation and our amended and restated bylaws, each previously filed with the SEC and incorporated by reference as an exhibit to the Annual Report on Form 10-K, filed with the SEC on March 29, 2024, and to the applicable provisions of Delaware law.

General

Our authorized capital stock consists of 30,000,000 shares of common stock, $0.01 par value per share, and 2,000,000 shares of undesignated preferred stock, $0.01 par value per share.

In August 2007, we filed a Certificate of Designation (the “Certificate of Designation”) authorizing us to issue up to 500,000 shares of preferred stock as shares of Series A Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), and we issued 500,000 shares of Series A Preferred Stock, convertible into 1,000,000 shares of common stock, and warrants to purchase an aggregate of 600,000 shares of common stock at an exercise price of $0.01 per share.

On June 11, 2013, all outstanding shares of our Series A Preferred Stock automatically converted into 1,000,000 shares of common stock. Pursuant to the Certificate of Designation, upon conversion into shares of common stock, the 500,000 shares of Series A Preferred Stock were cancelled and shall not be reissuable. The warrants were to expire on December 31, 2007 but were exercised prior to that date.

Common Stock

We are authorized to issue up to 30,000,000 shares with a par value of $0.01 per share.

Holders of shares of common stock are entitled to one vote per share on all matters to be voted upon by the stockholders generally. Stockholders are entitled to receive such dividends as may be declared from time to time by the board of directors out of funds legally available therefore.

Dividend Rights

Subject to preferences that may be applicable to any then outstanding preferred stock, holders of our common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Voting Rights

There are 30,000,000 shares of common stock authorized for issuance. Pursuant to our amended and restated certificate of incorporation, each holder of our common stock is entitled to one vote for each share on all matters submitted to a vote of stockholders; provided, however, that, except as otherwise required by law, holders of our common stock, as such, shall not be entitled to vote on any amendment to our amended and restated certificate of incorporation that relates solely to the terms of one or more outstanding series of preferred stock if the holders of such affected series are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to our amended and restated certificate of incorporation. Pursuant to our amended and restated certificate of incorporation and amended and restated bylaws, corporate actions can generally be taken by a majority of our board of directors and/or stockholders holding a majority of our outstanding shares, except as otherwise indicated in the section entitled “Anti-takeover Effects of Delaware Law and Our Certificate of Incorporation and Bylaws.” Additionally, our stockholders do not have cumulative voting rights in the election of directors. Accordingly, holders of a plurality of the votes cast at a meeting of stockholders will be able to elect all of the directors then standing for election.

Right to Receive Liquidation Distributions

In the event of our liquidation, dissolution or winding up, holders of our common stock are entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Right and Preferences

Holders of our common stock have no preemptive, conversion, subscription or other rights, and there are no redemption or sinking fund provisions applicable to our common stock. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of our preferred stock that we may designate in the future.

Our common stock is listed on The Nasdaq Capital Market under the symbol “IRIX”. The transfer agent and registrar for the common stock is Computershare Trust Company, N.A. Its address is 150 Royall Street, Canton, MA 02021.

Preferred Stock

Our board of directors has the authority, without further action by our stockholders, to issue up to 1,500,000 shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions thereof. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of common stock. The issuance of preferred stock by us could adversely affect the voting power of holders of common stock and the likelihood that such holders will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change of control of our Company or other corporate action. No shares of preferred stock are outstanding, and we have no present plan to issue any shares of preferred stock.

Anti-Takeover Effects of Delaware Law and Our Certificate of Incorporation and Bylaws

The provisions of Delaware law, our amended and restated certificate of incorporation and our amended and restated bylaws may have the effect of delaying, deferring or discouraging another person from acquiring control of our Company. These provisions, which are summarized below, may have the effect of discouraging takeover bids. They are also designed, in part, to encourage persons seeking to acquire control of us to negotiate first with our board of directors. We believe that the benefits of increased protection of our potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us because negotiation of these proposals could result in an improvement of their terms.

Delaware Law

We are governed by the provisions of Section 203 of the Delaware General Corporation Law (the “DGCL”). In general, Section 203 prohibits a public Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business combination is approved in a prescribed manner. A “business combination” includes mergers, asset sales or other transactions resulting in a financial benefit to the stockholder. An “interested stockholder” is a person who, alone or together with affiliates and associates, owns, or within three years of the date on which it is sought to be determined whether such person is an “interested stockholder,” did own, 15% or more of the corporation’s outstanding voting stock. These provisions may have the effect of delaying, deferring or preventing a change in our control.

Amended and Restated Certificate of Incorporation and Amended and Restated Bylaw Provisions

Our amended and restated certificate of incorporation and our amended and restated bylaws include a number of provisions that could deter hostile takeovers or delay or prevent changes in control of our management team, including the following:

•Board of directors vacancies. Our amended and restated bylaws authorize only our board of directors to fill vacant directorships, including newly created seats. In addition, the number of directors constituting our board of directors is permitted to be set only by a resolution adopted by our board of directors. These provisions prevent a stockholder from increasing the size of our board of directors and then gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change the composition of our board of directors but promotes continuity of management.

•Special meeting of stockholders. Our amended and restated bylaws provide that special meetings of our stockholders may be called only by our board of directors or by a committee of our board of directors, thus prohibiting a stockholder from calling a special meeting. These provisions might delay the ability of our stockholders to force consideration of a proposal or for stockholders controlling a majority of our capital stock to take any action, including the removal of directors.

•Advance notice requirements for stockholder proposals and director nominations. Our amended and restated bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders or to nominate candidates for election as directors at our annual meeting of stockholders. Our amended and restated bylaws also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions might preclude our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our Company.

•No cumulative voting. The DGCL provides that stockholders are not entitled to the right to cumulate votes in the election of directors unless a corporation’s certificate of incorporation provides otherwise. Our amended and restated certificate of incorporation does not provide for cumulative voting.

•Issuance of undesignated preferred stock. Our board of directors has the authority, without further action by the stockholders, to issue up to 1,500,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by our board of directors. The existence of authorized but unissued shares of preferred stock would enable our board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or other means.

Plan of Distribution

We are registering the shares of common stock issued to the selling stockholder to permit the sale and resale of these shares of common stock by the selling stockholder from time to time after the date of this prospectus.

The selling stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. Sales of the common stock to be registered hereunder could be made at prevailing market prices at the time of the sale, at fixed prices, at negotiated prices, or at varying prices determined at the time of sale. As a result, we cannot know the price at which any of our common stock to be registered hereunder may ultimately be sold by the holders thereof. A selling stockholder may use any one or more of the following methods when selling securities:

•ordinary brokerage transactions and transactions in which the broker dealer solicits purchasers;

•block trades in which the broker dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker dealer as principal and resale by the broker dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales;

•in transactions through broker dealers that agree with the selling stockholder to sell a specified number of such securities at a stipulated price per security;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•a combination of any such methods of sale; or

•any other method permitted pursuant to applicable law.

The selling stockholder may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the

pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders may also sell securities under Rule 144 under the Securities Act , if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

The aggregate proceeds to the selling stockholder from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. The selling stockholder reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from the sale by the selling stockholder of the shares of common stock.

In connection with the sale of the securities or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholder may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. A selling stockholder who is an “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities of, including but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act. The selling stockholder has informed us that it is not a registered broker-dealer or an affiliate of a registered broker-dealer, and it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

Because the selling stockholder may be deemed to be an “underwriter” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. The selling stockholder has advised us that there is no underwriter or coordinating broker acting in connection with the proposed sale of the resale securities by the selling stockholder.

We are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act, and the selling stockholder may be entitled to contribution. We may be indemnified by the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act that may arise from any written information furnished to us by the selling stockholder specifically for use in this prospectus, or we may be entitled to contribution.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the selling stockholder without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

There can be no assurance that any selling stockholder will sell any or all of the shares of common stock we registered on behalf of the selling stockholder pursuant to the Registration Statement of which this prospectus forms a part.

Once sold under the Registration Statement of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

Legal Matters

The validity of the securities offered hereby will be passed upon for us by Wilson Sonsini Goodrich & Rosati, Professional Corporation, Palo Alto, California. Additional legal matters may be passed on for us, or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

Experts

The consolidated financial statements of IRIDEX Corporation as of December 30, 2023 and December 31, 2022 and for each of the two years in the period ended December 30, 2023 incorporated in this Registration Statement on Form S-3 by reference to the Annual Report on Form 10-K for the year ended December 30, 2023, have been so incorporated in reliance on the report of BPM LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.iridex.com. Information accessible on or through our website is not a part of this prospectus. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, including any amendments to those reports, and other information that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act can also be accessed free of charge through the Internet. These filings will be available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

This prospectus and any prospectus supplement is part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. You should review the information and exhibits in the registration statement for further information on us and our consolidated subsidiaries and the securities that we are offering. Forms of any documents establishing the terms of the offered securities are filed as exhibits to the registration statement of which this prospectus forms a part or under cover of a Current Report on Form 8-K and incorporated in this prospectus by reference. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should read the actual documents for a more complete description of the relevant matters.

Incorporation by Reference

The SEC allows us to incorporate by reference much of the information that we file with the SEC, which means that we can disclose important information to you by referring you to those publicly available documents. The information that we incorporate by reference in this prospectus is considered to be part of this prospectus. Because we are incorporating by reference future filings with the SEC, this prospectus is continually updated and those future filings may modify or supersede some of the information included or incorporated by reference in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or in any document previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case, other than those documents or the portions of those documents furnished pursuant to Items 2.02 or 7.01 of any Current Report on Form 8-K and, except as may be noted in any such Form 8-K, exhibits filed on such form that are related to such information), until the offering of the securities under the registration statement of which this prospectus forms a part is terminated or completed:

•our Annual Report on Form 10-K for the year ended December 30, 2023, filed with the SEC on March 29, 2024;

•the information incorporated by reference into our Annual Report on Form 10-K for the year ended December 30, 2023 from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 29, 2024;

•our Quarterly Reports on Form 10-Q for the quarters ended March 30, 2024 and June 29, 2024, filed with the SEC on May 14, 2024 and August 8, 2024, respectively;

•The description of the Registrant’s capital stock contained in Exhibit 4.3 of the Registrant’s Annual Report on Form 10-K for the year ended December 30, 2023, filed with the SEC on March 29, 2024, including any amendment or report filed for the purpose of updating such description.

We will provide to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no cost to the requester, a copy of any and all of the information that is incorporated by reference in this prospectus.

IRIDEX Corporation

1212 Terra Bella Avenue

Mountain View, California 94043

Attn: Investor Relations

(650) 940-4700

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth fees and expenses to be paid by us in connection with the issuance and distribution of the securities being registered, other than discounts and commissions to be paid to agents or underwriters. All amounts are estimates except the SEC registration fee.

|

|

|

|

Amount

to be Paid |

SEC registration fee for securities offered by the selling stockholder identified in the prospectus |

$ |

1,396.29 |

Accounting fees and expenses |

|

* |

Legal fees and expenses |

|

* |

Miscellaneous expenses |

|

* |

Total |

$ |

* |

* These fees and expenses are calculated based on the securities offered and the number of issuances and, accordingly, cannot be estimated at this time.

Item 15. Indemnification of Directors and Officers

Section 145 of the DGCL authorizes a corporation’s board of directors to grant, and authorizes a court to award, indemnity to officers, directors and other corporate agents.

Article VIII of our amended and restated certificate of incorporation contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by the DGCL. Consequently, our directors will not be personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for the following:

•any breach of their duty of loyalty to us or our stockholders;

•any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

•unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the DGCL; or

•any transaction from which they derived an improper personal benefit.

Any amendment, repeal or elimination of these provisions will not eliminate or reduce the effect of these provisions in respect of any act, omission or claim that occurred or arose prior to that amendment, repeal or elimination. If the DGCL is amended to provide for further limitations on the personal liability of directors of corporations, then the personal liability of our directors will be further limited to the greatest extent permitted by the DGCL.

In addition, Article VI of our amended and restated bylaws provide that we will indemnify our directors and officers, and we may indemnify our employees, agents and any other persons, to the fullest extent permitted by the DGCL. Our amended and restated bylaws also provide that we must advance expenses incurred by or on behalf of a director or officer in advance of the final disposition of any action or proceeding, subject to limited exceptions.

Further, we have entered into indemnification agreements with each of our directors and executive officers that may be broader than the specific indemnification provisions contained in the DGCL. These indemnification agreements require us to, among other things, indemnify our directors and executive officers against liabilities that may arise by reason of their status or service. These indemnification agreements also generally require us to advance all expenses reasonably and actually incurred by our directors and executive officers in investigating or defending any such action, suit or proceeding. We believe that these agreements are necessary to attract and retain qualified individuals to serve as directors and executive officers.

The limitation of liability and indemnification provisions in our amended and restated certificate of incorporation, amended and restated bylaws and indemnification agreements may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and other stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement and damage awards against our directors and officers as required by these indemnification provisions.

We have obtained insurance policies under which, subject to the limitations of the policies, coverage is provided to our directors and officers against loss arising from claims made by reason of breach of fiduciary duty or other wrongful acts as a director or officer, including claims relating to public securities matters, and to us with respect to payments that may be made by us to our directors and officers pursuant to our indemnification obligations or otherwise as a matter of law.

Item 16. Exhibits

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) to file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the

maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” or “Calculation of Registration Fee” table, as applicable, in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) that, for the purpose of determining liability under the Securities Act to any purchaser:

(i) each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) that, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) the portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6) that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual

report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(b) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S‑3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Mountain View, State of California, on September 5, 2024.

|

|

IRIDEX Corporation |

|

By: |

/s/ David I. Bruce |

|

David I. Bruce |

|

Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints David I. Bruce and Fuad Ahmad, and each of them, as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments to this registration statement, including post-effective amendments, and registration statements filed pursuant to Rule 462 under the Securities Act, and to file the same, with all exhibits thereto, and all other documents in connection therewith, with the SEC, granting unto said attorney-in-fact and agent and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith and about the premises, as fully for all intents and purposes as they, he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or any of them, or their, his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated:

|

|

|

|

|

Signature |

|

Title |

|

Date |

|

|

|

|

|

/s/ David I. Bruce |

|

Chief Executive Officer and Director |

|

September 5, 2024 |

David I. Bruce |

|

(Principal Executive Officer) |

|

|

|

|

|

|

|

/s/ Fuad Ahmad |

|

Interim Chief Financial Officer |

|

September 5, 2024 |

Fuad Ahmad |

|

(Principal Financial and Accounting Officer) |

|

|

|

|

|

|

|

/s/ Scott Shuda |

|

Chairperson of the Board of Directors |

|

September 5, 2024 |

Scott Shuda |

|

|

|

|

|

|

|

|

|

/s/ Beverly A. Huss |

|

Director |

|

September 5, 2024 |

Beverly A. Huss |

|

|

|

|

|

|

|

|

|

/s/ Kenneth E. Ludlum |

|

Director |

|

September 5, 2024 |

Kenneth E. Ludlum |

|

|

|

|

|

|

|

|

|

/s/ Robert Grove, Ph.D. |

|

Director |

|

September 5, 2024 |

Robert Grove, Ph.D. |

|

|

|

|

|

|

|

Wilson Sonsini Goodrich & Rosati

Professional Corporation 650 Page Mill Road

Palo Alto, California 94304-1050 o: 650.493.9300

f: 650.493.6811 |

Exhibit 5.1

September 5, 2024

IRIDEX Corporation

1212 Terra Bella Avenue

Mountain View, California 94043

Re: Registration Statement on Form S-3

Ladies and Gentlemen: