– LINZESS® (linaclotide) EUTRx prescription

demand growth of 11% year-over-year –

– Plans to pursue apraglutide rolling NDA

review; expects to complete submission in the first quarter of 2025

–

– On track to deliver CNP-104 topline results

in the third quarter of 2024 –

– Revises FY 2024 financial guidance due to

continued LINZESS pricing pressure associated with

higher-than-expected Medicaid utilization trends –

Ironwood Pharmaceuticals, Inc. (Nasdaq: IRWD), a GI-focused

healthcare company, today reported its second quarter 2024 results

and recent business performance.

“We continued to make progress across our portfolio in the

second quarter,” said Tom McCourt, chief executive officer of

Ironwood Pharmaceuticals. “LINZESS prescription demand and

new-to-brand growth remain robust, increasing 11% and 15%

year-over-year in Q2, respectively. While demand is up, LINZESS

continues to experience pricing headwinds driven by

higher-than-expected Medicaid utilization trends. Even with

continued LINZESS pricing pressure, we believe we are in a

fortunate position with meaningful cash flow generation from

LINZESS and a capital structure to support the continued execution

of our strategic priorities. Beyond LINZESS, we have continued to

receive positive feedback from physicians, key opinion leaders, and

patient advocacy partners on apraglutide’s clinical profile. This

positive feedback supports our belief that, if approved,

apraglutide would be the drug of choice among physicians to treat

adult patients with short bowel syndrome who are dependent on

parenteral support, based on its demonstrated efficacy,

tolerability and once-weekly dosing convenience. In addition, we

look forward to providing an update on CNP-104 later this quarter,

which will inform a decision on our option to acquire an exclusive

license from COUR for CNP-104 in the U.S.”

Second Quarter 2024 Financial Highlights1 (in thousands,

except for per share amounts)

Q2

2024

Q2

2023

Total revenue2

$94,396

$107,382

Total costs and expenses3

69,419

1,190,521

GAAP net loss2,3

(860)

(1,089,478)

GAAP net loss attributable to Ironwood

Pharmaceuticals, Inc.2,3

(860)

(1,062,187)

GAAP net loss – per share basic2,3

(0.01)

(6.84)

GAAP net loss – per share diluted2,3

(0.01)

(6.84)

Adjusted EBITDA2,3

27,909

(1,034,182)

Non-GAAP net income (loss)2,3

1,508

(1,041,325)

Non-GAAP net income (loss) per share –

basic2,3

0.00

(6.71)

Non-GAAP net income (loss) per share –

diluted2,3

0.00

(6.71)

1 Refer to the Reconciliation of GAAP

Results to Non-GAAP Financial Measures table and to the

Reconciliation of GAAP Net Loss to Adjusted EBITDA table at the end

of this press release. Refer to Non-GAAP Financial Measures for

additional information.

2 Figures presented for the second quarter

of 2024 include a $17.0 million adjustment to collaborative

arrangements revenue, driven by a $30.0 million increase to

collaborative arrangements revenue as a result of a gross-to-net

change in estimate related to the year ended December 31, 2023,

previously recorded by Ironwood in the first quarter of 2024, which

was reflected in LINZESS U.S. net sales as reported by AbbVie in

the second quarter of 2024. This was partially offset by a $13.0

million reduction to collaborative arrangements revenue in the

second quarter of 2024, to reflect Ironwood’s estimate of LINZESS

gross-to-net reserves as of June 30, 2024.

3 Figures presented for the second quarter

of 2023 include a one‐time charge of approximately $1.1 billion

related to acquired in‐process research and development from the

acquisition of VectivBio in the second quarter of 2023.

Second Quarter 2024 Corporate Highlights

U.S. LINZESS

- Prescription Demand: Total LINZESS

prescription demand in the second quarter of 2024 was 52 million

LINZESS capsules, an 11% increase compared to the second quarter of

2023, per IQVIA.

- U.S. Brand Collaboration: LINZESS

U.S. net sales are provided to Ironwood by its U.S. partner, AbbVie

Inc. (“AbbVie”). LINZESS U.S. net sales were $211.2 million in the

second quarter of 2024, a 22% decrease compared to $269.7 million

in the second quarter of 2023. Ironwood and AbbVie share equally in

U.S. brand collaboration profits.

- LINZESS U.S. net sales as reported by AbbVie in the second

quarter of 2024 reflected the gross-to-net change in estimate

related to the year ended December 31, 2023, which Ironwood

previously accounted for in the first quarter of 2024 by recording

a $30.0 million reduction to collaborative arrangements

revenue.

- LINZESS commercial margin, including the gross-to-net change in

estimate, was 62% in the second quarter of 2024, compared to 71% in

the second quarter of 2023. See the U.S. LINZESS Full Brand

Collaboration table at the end of this press release.

- Net profit for the LINZESS U.S. brand collaboration, net of

commercial and research and development (“R&D”) expenses, and

including the gross-to-net change in estimate, was $120.5 million

in the second quarter of 2024, a decrease compared to $180.3

million in the second quarter of 2023. See the U.S. LINZESS Full

Brand Collaboration table at the end of this press release.

- Collaboration Revenue to Ironwood:

Ironwood recorded $91.4 million in collaboration revenue in the

second quarter of 2024 related to sales of LINZESS in the U.S.,

compared to $104.8 million for the second quarter of 2023. Second

quarter of 2024 collaboration revenue to Ironwood includes a $17.0

million adjustment, driven by a $30.0 million increase to

collaborative arrangements revenue as a result of a gross-to-net

change in estimate related to the year ended December 31, 2023,

previously recorded by Ironwood in the first quarter of 2024, which

was reflected in LINZESS U.S. net sales as reported by AbbVie in

the second quarter of 2024. This was partially offset by a $13.0

million reduction to collaborative arrangements revenue in the

second quarter of 2024, to reflect Ironwood’s estimate of LINZESS

gross-to-net reserves as of June 30, 2024. See the U.S. LINZESS

Commercial Collaboration table at the end of the press

release.

Pipeline Updates

Apraglutide

- Ironwood is advancing apraglutide, a next-generation, synthetic

glucagon-like peptide-2 (“GLP-2”) analog for short bowel syndrome

(“SBS”) patients dependent on parenteral support (“PS”), a severe

chronic malabsorptive condition. Ironwood believes apraglutide has

the potential to improve the standard of care for adult patients

with SBS who are dependent on PS as the first and only GLP-2 with

once-weekly administration, if approved.

- In May 2024, Ironwood presented late-breaking data during the

2024 Digestive Disease Week® (DDW) meeting from its pivotal Phase

III clinical trial, STARS, which evaluated the efficacy and safety

of once-weekly subcutaneous apraglutide in adult patients with

short bowel syndrome with intestinal failure (“SBS-IF”). These

findings build on the positive topline data that Ironwood

previously announced in February 2024. Additional details from the

late-breaking presentation can be found here.

- Ironwood is working to submit a new drug application (“NDA”) to

the U.S. Food and Drug Administration (“FDA”) and marketing

applications to other regulatory agencies for apraglutide for the

treatment of adult patients with SBS who are dependent on PS.

CNP-104

- Ironwood has a collaboration and license option agreement with

COUR Pharmaceuticals Development Company, Inc. (“COUR”). This

agreement grants Ironwood an option to acquire an exclusive license

to research, develop, manufacture and commercialize, in the U.S.,

products containing CNP-104 (“CNP-104”), a tolerizing immune

modifying nanoparticle, for the treatment of primary biliary

cholangitis (“PBC”), a rare autoimmune disease targeting the liver.

If successful, CNP-104 has the potential to be the first approved

disease modifying therapy for PBC.

- COUR is currently conducting a clinical study with CNP-104

evaluating the safety, tolerability, pharmacodynamic effects and

efficacy of CNP-104 in PBC patients. Topline data is expected in

the third quarter of 2024.

IW-3300

- Ironwood is currently advancing IW-3300, a guanylate cyclase-C

agonist being developed for the potential treatment of visceral

pain conditions, such as interstitial cystitis / bladder pain

syndrome (“IC/BPS”) and endometriosis. Ironwood is continuing the

Phase II proof of concept study in IC/BPS.

Second Quarter 2024 Financial Results

- Total Revenue. Total revenue in the second quarter of

2024 was $94.4 million, compared to $107.4 million in the second

quarter of 2023.

- As noted above, revenue was lower year-over-year, primarily due

to the decrease in collaborative arrangements revenue.

- Total revenue in the second quarter of 2024 consisted of $91.4

million associated with Ironwood’s share of the net profits from

the sales of LINZESS in the U.S., and $3.0 million in royalties and

other revenue. Total revenue in the second quarter of 2023

consisted of $104.8 million associated with Ironwood’s share of the

net profits from the sales of LINZESS in the U.S. and $2.6 million

in royalties and other revenue.

- Operating Expenses. Operating expenses in the second

quarter of 2024 were $69.4 million, compared to $1,190.5 million in

the second quarter of 2023, which included a one-time charge of

$1,090.4 million of acquired in-process research and development

(“IPR&D”) from the acquisition of VectivBio.

- Operating expenses in the second quarter of 2024 consisted of

$37.0 million in selling, general and administrative (“SG&A”)

expenses, $30.4 million in R&D expenses and $2.1 million in

restructuring expenses. Operating expenses in the second quarter of

2023 consisted of $52.5 million in SG&A expenses and $34.6

million in R&D expenses, $13.0 million in restructuring

expenses and approximately $1.1 billion in acquired IPR&D from

the acquisition of VectivBio.

- Interest Expense. Interest expense was $7.5 million in

the second quarter of 2024, primarily in connection with Ironwood’s

convertible senior notes and revolving credit facility. Interest

expense was $1.8 million in the second quarter of 2023, in

connection with Ironwood’s convertible senior notes and revolving

credit facility.

- Interest and Investment Income. Interest and investment

income was $1.4 million in the second quarter of 2024. Interest and

investment income was $8.8 million in the second quarter of

2023.

- Income Tax Expense. Ironwood recorded $19.7 million of

income tax expense in the second quarter of 2024, the majority of

which was non-cash, as Ironwood continues to utilize net operating

losses to offset taxable income for federal purposes and in many

states. Ironwood recorded $13.3 million of income tax expense in

the second quarter of 2023, the majority of which was non-cash, as

Ironwood continued to utilize net operating losses to offset

taxable income for federal purposes and in many states.

- GAAP Net Loss Attributable to Ironwood. GAAP net loss

attributable to Ironwood was ($0.9) million, or ($0.01) per share

(basic and diluted) in the second quarter of 2024, compared to GAAP

net loss attributable to Ironwood of ($1,062.2) million, or ($6.84)

per share (basic and diluted) in the second quarter of 2023, which

included a one-time charge of ($1,090.4) million of acquired

IPR&D from the acquisition of VectivBio.

- Non-GAAP Net Income (Loss). Non-GAAP net income was $1.5

million, or $0.00 per share (basic and diluted), in the second

quarter of 2024, compared to non-GAAP net loss of ($1,041.3)

million, or ($6.71) per share (basic and diluted), in the second

quarter of 2023, which included a one-time charge of ($1,090.4)

million of acquired IPR&D from the acquisition of VectivBio.

- Non-GAAP net income (loss) excludes the impact of

mark-to-market adjustments on the derivatives related to Ironwood’s

2022 Convertible Notes, amortization of acquired intangible assets,

restructuring expenses and acquisition-related costs, all net of

tax effect. See Non-GAAP Financial Measures below.

- Adjusted EBITDA. Adjusted EBITDA was $27.9 million in

the second quarter of 2024, compared to ($1,034.2) million in the

second quarter of 2023, which included a one-time charge of

($1,090.4) million of acquired IPR&D from the acquisition of

VectivBio.

- Adjusted EBITDA is calculated by subtracting mark-to-market

adjustments on derivatives related to Ironwood’s 2022 Convertible

Notes, restructuring expenses, net interest expense, income taxes,

depreciation and amortization, and acquisition-related costs, from

GAAP net loss. See Non-GAAP Financial Measures below.

- Cash Flow Highlights. Ironwood ended the second quarter

of 2024 with $105.5 million of cash and cash equivalents, compared

to $92.2 million of cash and cash equivalents at the end of 2023.

- In the second quarter of 2024, Ironwood repaid the aggregate

principal amount of the 2024 Convertible Notes of approximately

$200.0 million upon maturity, using $50.0 million of cash on hand

and drawing $150.0 million from its revolving credit facility. The

outstanding principal balance on the revolving credit facility was

$425.0 million as of June 30, 2024.

- Ironwood generated $33.5 million in cash from operations in the

second quarter of 2024, compared to $35.0 million in cash from

operations in the second quarter of 2023.

- Ironwood 2024 Financial Guidance. Ironwood has revised

its FY 2024 financial guidance due to continued LINZESS pricing

pressure as a result of higher-than-expected Medicaid utilization

trends for FY 2024. Ironwood now expects:

Prior 2024 Guidance (May

9, 2024)

Revised 2024 Guidance

(August 8, 2024)

U.S. LINZESS Net Sales

Mid-single digits % decline 2

$900 - $950 million

Total Revenue

$405 - $425 million

$350 - $375 million

Adjusted EBITDA1

>$120 million Excludes

potential CNP-104 option exercise

>$75 million Excludes

potential CNP-104 option exercise

1 Adjusted EBITDA is calculated by

subtracting restructuring expenses, net interest expense, income

taxes, depreciation and amortization, and acquisition-related costs

from GAAP net loss. For purposes of the 2024 guidance, Ironwood has

assumed it will not incur material expenses related to business

development activities in 2024 and excludes any costs associated

with potential CNP-104 option exercise. Ironwood does not provide

guidance on GAAP net loss or a reconciliation of expected adjusted

EBITDA to expected GAAP net loss because, without unreasonable

efforts, it is unable to predict with reasonable certainty the

non-GAAP adjustments used to calculate adjusted EBITDA. These

adjustments are uncertain, depend on various factors and could have

a material impact on GAAP net loss for the guidance period.

Management believes this non-GAAP information is useful for

investors, taken in conjunction with Ironwood’s GAAP financial

statements, because it provides greater transparency and

period-over-period comparability with respect to Ironwood’s

operating performance. These measures are also used by management

to assess the performance of the business. Investors should

consider these non-GAAP measures only as a supplement to, not as a

substitute for or as superior to, measures of financial performance

prepared in accordance with GAAP. In addition, these non-GAAP

financial measures are unlikely to be comparable with non-GAAP

information provided by other companies.

2 2024 U.S. LINZESS Net Sales guidance

presented as year-over-year change relative to 2023 U.S. LINZESS

Net Sales as reported by AbbVie of $1,073.2 million.

Non-GAAP Financial Measures

Ironwood presents non-GAAP net income (loss) and non-GAAP net

income (loss) per share to exclude the impact, net of tax effects,

of net gains and losses on derivatives related to Ironwood’s 2022

Convertible Notes that are required to be marked-to-market,

amortization of acquired intangible assets, restructuring expenses,

and acquisition-related costs. Non-GAAP adjustments are further

detailed below:

- The gains and losses on the derivatives related to Ironwood’s

2022 Convertible Notes were highly variable, difficult to predict

and of a size that could have a substantial impact on the company’s

reported results of operations in any given period.

- Amortization of acquired intangible assets are non-cash

expenses arising in connection with the acquisition of VectivBio

and are considered to be non-recurring.

- Restructuring expenses are considered to be a non-recurring

event as they are associated with distinct operational decisions.

Restructuring expenses include costs associated with exit and

disposal activities.

- Acquisition-related costs in connection with the acquisition of

VectivBio are considered to be non-recurring and include direct and

incremental costs associated with the acquisition and integration

of VectivBio to the extent such costs were not classified as

capitalizable transaction costs attributed to the cost of net

assets acquired through acquisition accounting.

Ironwood also presents adjusted EBITDA, a non-GAAP measure, as

well as guidance on adjusted EBITDA. Adjusted EBITDA is calculated

by subtracting mark-to-market adjustments on derivatives related to

Ironwood’s 2022 Convertible Notes, restructuring expenses, net

interest expense, income taxes, depreciation and amortization, and

acquisition-related costs from GAAP net loss. The adjustments are

made on a similar basis as described above related to non-GAAP net

income (loss), as applicable.

Management believes this non-GAAP information is useful for

investors, taken in conjunction with Ironwood’s GAAP financial

statements, because it provides greater transparency and

period-over-period comparability with respect to Ironwood’s

operating performance. These measures are also used by management

to assess the performance of the business. Investors should

consider these non-GAAP measures only as a supplement to, not as a

substitute for or as superior to, measures of financial performance

prepared in accordance with GAAP. In addition, these non-GAAP

financial measures are unlikely to be comparable with non-GAAP

information provided by other companies. For a reconciliation of

non-GAAP net income (loss) and non-GAAP net income (loss) per share

to GAAP net loss and GAAP net loss per share, respectively, and for

a reconciliation of adjusted EBITDA to GAAP net loss, please refer

to the tables at the end of this press release.

Ironwood does not provide guidance on GAAP net loss or a

reconciliation of expected adjusted EBITDA to expected GAAP net

loss because, without unreasonable efforts, it is unable to predict

with reasonable certainty the non-GAAP adjustments used to

calculate adjusted EBITDA. These adjustments are uncertain, depend

on various factors and could have a material impact on GAAP net

loss for the guidance period.

Conference Call Information

Ironwood will host a conference call and webcast at 8:30 a.m.

Eastern Time on Thursday, August 8, 2024 to discuss its second

quarter 2024 results and recent business activities. Individuals

interested in participating in the call should dial (888) 596-4144

(U.S. and Canada) or (646) 968-2525 (international) using

conference ID number and event passcode 2530602. To access the

webcast, please visit the Investors section of Ironwood’s website

at www.ironwoodpharma.com. The call will be available for replay

via telephone starting at approximately 11:30 a.m. Eastern Time on

August 8, 2024, running through 11:59 p.m. Eastern Time on August

22, 2024. To listen to the replay, dial (800) 770-2030 (U.S. and

Canada) or (609) 800-9909 (international) using conference ID

number 2530602. The archived webcast will be available on

Ironwood’s website for 1 year beginning approximately one hour

after the call has completed.

About Ironwood Pharmaceuticals

Ironwood Pharmaceuticals (Nasdaq: IRWD), an S&P SmallCap

600® company, is a leading gastrointestinal (GI) healthcare company

on a mission to advance the treatment of GI diseases and redefine

the standard of care for GI patients. We are pioneers in the

development of LINZESS® (linaclotide), the U.S. branded

prescription market leader for adults with irritable bowel syndrome

with constipation (IBS-C) or chronic idiopathic constipation (CIC).

LINZESS is also approved for the treatment of functional

constipation in pediatric patients ages 6-17 years-old. Ironwood is

also advancing apraglutide, a next-generation, long-acting

synthetic GLP-2 analog being developed for rare gastrointestinal

diseases, including short bowel syndrome with intestinal failure

(SBS-IF) as well as several earlier stage assets. Building upon our

history of GI innovation, we keep patients at the heart of our

R&D and commercialization efforts to reduce the burden of GI

diseases and address significant unmet needs.

Founded in 1998, Ironwood Pharmaceuticals is headquartered in

Boston, Massachusetts, with a site in Basel, Switzerland.

We routinely post information that may be important to investors

on our website at www.ironwoodpharma.com. In addition, follow us on

X and on LinkedIn.

About LINZESS (Linaclotide)

LINZESS® is the #1 prescribed brand in the U.S. for the

treatment of adult patients with irritable bowel syndrome with

constipation (“IBS-C”) or chronic idiopathic constipation (“CIC”),

based on IQVIA data. LINZESS is a once-daily capsule that helps

relieve the abdominal pain, constipation, and overall abdominal

symptoms of bloating, discomfort and pain associated with IBS-C, as

well as the constipation, infrequent stools, hard stools,

straining, and incomplete evacuation associated with CIC. LINZESS

relieves constipation in children and adolescents aged 6 to 17

years with functional constipation. The recommended dose is 290 mcg

for IBS-C patients and 145 mcg for CIC patients, with a 72 mcg dose

approved for use in CIC depending on individual patient

presentation or tolerability. In children with functional

constipation aged 6 to 17 years, the recommended dose is 72

mcg.

LINZESS is not a laxative; it is the first medicine approved by

the FDA in a class called GC-C agonists. LINZESS contains a peptide

called linaclotide that activates the GC-C receptor in the

intestine. Activation of GC-C is thought to result in increased

intestinal fluid secretion and accelerated transit and a decrease

in the activity of pain-sensing nerves in the intestine. The

clinical relevance of the effect on pain fibers, which is based on

nonclinical studies, has not been established.

In the United States, Ironwood and AbbVie co-develop and

co-commercialize LINZESS for the treatment of adults with IBS-C or

CIC. In Europe, AbbVie markets linaclotide under the brand name

CONSTELLA® for the treatment of adults with moderate to severe

IBS-C. In Japan, Ironwood's partner, Astellas, markets linaclotide

under the brand name LINZESS for the treatment of adults with IBS-C

or CIC. Ironwood also has partnered with AstraZeneca for

development and commercialization of LINZESS in China, and with

AbbVie for development and commercialization of linaclotide in all

other territories worldwide.

LINZESS Important Safety Information

INDICATIONS AND USAGE

LINZESS® (linaclotide) is indicated for the treatment of both

irritable bowel syndrome with constipation (IBS-C) and chronic

idiopathic constipation (CIC) in adults and functional constipation

(FC) in children and adolescents 6 to 17 years of age. It is not

known if LINZESS is safe and effective in children with FC less

than 6 years of age or in children with IBS-C less than 18 years of

age.

IMPORTANT SAFETY INFORMATION

WARNING: RISK OF SERIOUS DEHYDRATION IN

PEDIATRIC PATIENTS LESS THAN 2 YEARS OF AGE

LINZESS is contraindicated in patients

less than 2 years of age. In nonclinical studies in neonatal mice,

administration of a single, clinically relevant adult oral dose of

linaclotide caused deaths due to dehydration.

Contraindications

- LINZESS is contraindicated in patients less than 2 years of age

due to the risk of serious dehydration.

- LINZESS is contraindicated in patients with known or suspected

mechanical gastrointestinal obstruction.

Warnings and Precautions

- LINZESS is contraindicated in patients less than 2 years of

age. In neonatal mice, linaclotide increased fluid secretion as a

consequence of age-dependent elevated guanylate cyclase (GC-C)

agonism, which was associated with increased mortality within the

first 24 hours due to dehydration. There was no age dependent trend

in GC-C intestinal expression in a clinical study of children 2 to

less than 18 years of age; however, there are insufficient data

available on GC-C intestinal expression in children less than 2

years of age to assess the risk of developing diarrhea and its

potentially serious consequences in these patients.

Diarrhea

- In adults, diarrhea was the most common adverse reaction in

LINZESS-treated patients in the pooled IBS-C and CIC double-blind

placebo-controlled trials. The incidence of diarrhea was similar in

the IBS-C and CIC populations. Severe diarrhea was reported in 2%

of 145 mcg and 290 mcg LINZESS-treated patients and in <1% of 72

mcg LINZESS-treated CIC patients.

- In children and adolescents 6 to 17 years of age, diarrhea was

the most common adverse reaction in 72 mcg LINZESS-treated patients

in the FC double-blind placebo-controlled trial. Severe diarrhea

was reported in <1% of 72 mcg LINZESS treated patients. If

severe diarrhea occurs, dosing should be suspended and the patient

rehydrated.

Common Adverse Reactions (incidence ≥2% and greater than

placebo)

- In IBS-C or CIC adult patients: diarrhea, abdominal pain,

flatulence, and abdominal distension.

- In FC pediatric patients: diarrhea.

Please see full Prescribing Information including Boxed Warning:

https://www.rxabbvie.com/pdf/linzess_pi.pdf

LINZESS® and CONSTELLA® are registered trademarks of Ironwood

Pharmaceuticals, Inc. Any other trademarks referred to in this

press release are the property of their respective owners. All

rights reserved.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Investors are cautioned not to place undue reliance on these

forward-looking statements, including statements about Ironwood’s

ability to execute on its mission; Ironwood’s strategy, business,

financial position and operations; Ironwood’s ability to drive

growth and profitability; the commercial potential of LINZESS; our

financial performance and results, and guidance and expectations

related thereto; LINZESS prescription demand growth, LINZESS U.S.

net sales growth, total revenue and adjusted EBITDA in 2024; our

plan to pursue apraglutide rolling NDA review and the expected

timing to complete submission; our belief that our cash flow

position supports the continued execution of strategic priorities;

our belief that if apraglutide is approved, it would be the drug of

choice among physicians to treat adult patients with SBS who are

dependent on PS, based on its demonstrated efficacy, tolerability

and once-weekly dosing convenience; our plan to submit an NDA and

marketing applications to other regulatory agencies for

apraglutide; apraglutide's potential, if approved, to be the first

and only once-weekly GLP-2 analog for adult SBS patients who are

dependent on PS; the timing of topline data for CNP-104, which will

inform a decision on our option to acquire an exclusive license

from COUR, and that, if successful, CNP-104 has the potential to be

the first approved disease modifying therapy for PBC. These

forward-looking statements speak only as of the date of this press

release, and Ironwood undertakes no obligation to update these

forward-looking statements. Each forward-looking statement is

subject to risks and uncertainties that could cause actual results

to differ materially from those expressed or implied in such

statement. Applicable risks and uncertainties include those related

to the effectiveness of development and commercialization efforts

by us and our partners; preclinical and clinical development,

manufacturing and formulation development of linaclotide,

apraglutide, CNP-104, IW-3300, and our other product candidates;

the risk of uncertainty relating to pricing and reimbursement

policies in the U.S., which, if not favorable for our products,

could hinder or prevent our products’ commercial success; the risk

that clinical programs and studies, including for linaclotide

pediatric programs, apraglutide, CNP-104 and IW-3300, may not

progress or develop as anticipated, including that studies are

delayed or discontinued for any reason, such as safety,

tolerability, enrollment, manufacturing, economic or other reasons;

the risk that findings from our completed nonclinical studies and

clinical trials may not be replicated in later trials and

earlier-stage clinical trials may not be predictive of the results

we may obtain in later-stage clinical trials or of the likelihood

of regulatory approval; the risk that apraglutide will not be

approved by the FDA or other regulatory agencies; the risk of

competition or that new products may emerge that provide different

or better alternatives for treatment of the conditions that our

products are approved to treat; the risk that we are unable to

execute on our strategy to in-license externally developed products

or product candidates; the risk that we are unable to successfully

partner with other companies to develop and commercialize products

or product candidates; the risk that healthcare reform and other

governmental and private payor initiatives may have an adverse

effect upon or prevent our products’ or product candidates’

commercial success; the efficacy, safety and tolerability of

linaclotide and our product candidates; the risk that the

commercial and therapeutic opportunities for LINZESS, apraglutide

or our other product candidates are not as we expect; decisions by

regulatory and judicial authorities; the risk we may never get

additional patent protection for linaclotide, apraglutide and other

product candidates, that patents for linaclotide, apraglutide or

other products may not provide adequate protection from

competition, or that we are not able to successfully protect such

patents; the risk that we are unable to manage our expenses or cash

use, or are unable to commercialize our products as expected; the

risk that the development of any of our linaclotide pediatric

programs, apraglutide, CNP-104 and/or IW-3300 is not successful or

that any of our product candidates does not receive regulatory

approval or is not successfully commercialized; outcomes in legal

proceedings to protect or enforce the patents relating to our

products and product candidates, including abbreviated new drug

application litigation; the risk that financial and operating

results may differ from our projections; developments in the

intellectual property landscape; challenges from and rights of

competitors or potential competitors; the risk that our planned

investments do not have the anticipated effect on our company

revenues; developments in accounting guidance or practice;

Ironwood’s or AbbVie’s accounting practices, including reporting

and settlement practices as between Ironwood and AbbVie; the risk

that our indebtedness could adversely affect our financial

condition or restrict our future operations; and the risks listed

under the heading “Risk Factors” and elsewhere in our Annual Report

on Form 10-K for the year ended December 31, 2023, and in our

subsequent Securities and Exchange Commission filings.

Condensed Consolidated Balance

Sheets

(In thousands)

(unaudited)

June 30, 2024

December 31, 2023

Assets

Cash and cash equivalents

$

105,524

$

92,154

Accounts receivable, net

58,108

129,122

Prepaid expenses and other current

assets

14,548

12,012

Total current assets

178,180

233,288

Property and equipment, net

5,068

5,585

Operating lease right-of-use assets

11,823

12,586

Intangible assets, net

3,273

3,682

Deferred tax assets

193,019

212,324

Other assets

4,257

3,608

Total assets

$

395,620

$

471,073

Liabilities and stockholders’

equity

Accounts payable

$

3,227

$

7,830

Accrued research and development costs

6,720

21,331

Accrued expenses and other current

liabilities

32,406

44,254

Current portion of operating lease

liabilities

3,157

3,126

Current portion on convertible senior

notes

-

199,560

Total current liabilities

45,510

276,101

Operating lease liabilities, net of

current portion

13,452

14,543

Convertible senior notes, net of current

portion

198,647

198,309

Revolving credit facility

425,000

300,000

Other liabilities

34,738

28,415

Total stockholders’ deficit

(321,727)

(346,295)

Total liabilities and stockholders’

deficit

$

395,620

$

471,073

Condensed Consolidated

Statements of Income (Loss)

(In thousands, except per

share amounts)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Total revenues1

$

94,396

$

107,382

$

169,273

$

211,443

Collaborative arrangements revenue1

94,396

107,382

169,273

211,443

Costs and expenses:

Research and development

30,388

34,577

56,203

47,424

Selling, general and administrative

36,964

52,484

74,569

83,601

Restructuring

2,067

13,011

2,504

13,011

Acquired in-process research and

development

-

1,090,449

-

1,090,449

Total costs and expenses2

69,419

1,190,521

133,276

1,234,485

Income (loss) from operations

24,977

(1,083,139)

35,997

(1,023,042)

Other income (expense):

Interest expense and other financing

costs

(7,470)

(1,840)

(14,701)

(3,367)

Interest and investment income

1,369

8,757

2,538

16,029

Gain on derivatives

-

-

-

19

Other income (expense), net

(6,101)

6,917

(12,163)

12,681

Income (loss) before income taxes

18,876

(1,076,222)

23,834

(1,010,361)

Income tax expense

(19,736)

(13,256)

(28,856)

(33,403)

GAAP net loss1,2

(860)

(1,089,478)

(5,022)

(1,043,764)

Less: GAAP net loss attributable

to noncontrolling interests

-

(27,291)

-

(27,291)

GAAP net loss attributable to Ironwood

Pharmaceuticals, Inc.

$

(860)

$

(1,062,187)

$

(5,022)

$

(1,016,473)

GAAP net loss per share—basic

$

(0.01)

$

(6.84)

$

(0.03)

$

(6.56)

GAAP net loss per share—diluted

$

(0.01)

$

(6.84)

$

(0.03)

$

(6.56)

_________________

1 Figures presented for the three

and six months ended June 30, 2024 include a $17.0 million increase

and $13.0 million reduction to collaborative arrangement revenues,

respectively, as a result of an adjustment recorded for Ironwood’s

estimate of LINZESS gross-to-net reserves as of June 30, 2024.

2 Figures presented for the three

and six months ended June 30, 2023 include a one-time charge of

approximately $1.1 billion related to acquired IPR&D from the

acquisition of VectivBio in the second quarter of 2023.

Reconciliation of GAAP Results to Non-GAAP Financial

Measures

(In thousands, except per

share amounts) (unaudited)

A reconciliation between net income (loss)

on a GAAP basis and on a non-GAAP basis is as follows:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP net loss1,2

$

(860)

$

(1,089,478)

$

(5,022)

$

(1,043,764)

Adjustments:

Mark-to-market adjustments on the

derivatives related to convertible notes, net

-

-

-

(19)

Amortization of acquired intangible

assets

204

4

409

4

Restructuring expenses

2,067

13,011

2,504

13,011

Acquisition-related costs

359

35,681

1,146

35,681

Tax effect of adjustments

(262)

(543)

(461)

(543)

Non-GAAP net income (loss)1,2

$

1,508

$

(1,041,325)

$

(1,424)

$

(995,630)

A reconciliation between basic and diluted net income (loss) per

share on a GAAP basis and on a non-GAAP basis is as follows:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP net loss attributable to Ironwood

Pharmaceuticals, Inc. per share – basic and diluted

$

(0.01)

$

(6.84)

$

(0.03)

$

(6.56)

Plus: Net income (loss) per share

attributable to noncontrolling interests

-

(0.18)

-

(0.18)

Adjustments to GAAP net income (loss) per

share (as detailed above)

0.01

0.31

0.02

0.31

Non-GAAP net income (loss) per share–

basic and diluted

$

0.00

$

(6.71)

$

(0.01)

$

(6.43)

Weighted average number of common shares

used to calculate net loss per share — basic and diluted

159,014

155,367

158,357

154,912

_________________

1 Figures presented for the three and six

months ended June 30, 2024 include a $17.0 million increase and

$13.0 million reduction to collaborative arrangement revenues,

respectively, as a result of an adjustment recorded for Ironwood’s

estimate of LINZESS gross-to-net reserves as of June 30, 2024.

2 Figures presented for the three and six

months ended June 30, 2023, include a one-time charge of

approximately $1.1 billion related to acquired IPR&D from the

acquisition of VectivBio in the second quarter of 2023.

Reconciliation of GAAP Net

Loss to Adjusted EBITDA

(In thousands)

(unaudited)

A reconciliation of GAAP net loss to

adjusted EBITDA:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP net loss1,2

$

(860)

$

(1,089,478)

$

(5,022)

$

(1,043,764)

Adjustments:

Mark-to-market adjustments on the

derivatives related to convertible notes, net

-

-

-

(19)

Restructuring expenses

2,067

13,011

2,504

13,011

Interest expense

7,470

1,840

14,701

3,367

Interest and investment income

(1,369)

(8,757)

(2,538)

(16,029)

Income tax expense

19,736

13,256

28,856

33,403

Depreciation and amortization

506

265

1,019

551

Acquisition-related costs

359

35,681

1,146

35,681

Adjusted EBITDA1,2

$

27,909

$

(1,034,182)

$

40,666

$

(973,799)

_________________

1 Figures presented for the three and six

months ended June 30, 2024 include a $17.0 million increase and

$13.0 million reduction to collaborative arrangement revenues,

respectively, as a result of an adjustment recorded for Ironwood’s

estimate of LINZESS gross-to-net reserves as of June 30, 2024.

2 Figures presented for the three and six months ended June 30,

2023, include a one-time charge of approximately $1.1 billion

related to acquired IPR&D from the acquisition of VectivBio in

the second quarter of 2023.

U.S. LINZESS Commercial

Collaboration1

Revenue/Expense

Calculation

(In thousands)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

LINZESS U.S. net sales as reported by

AbbVie2

$

211,183

$

269,686

$

467,783

$

519,900

AbbVie & Ironwood commercial costs,

expenses and other discounts3

80,950

78,998

154,312

145,406

Commercial profit on sales of LINZESS

$

130,233

$

190,688

$

313,471

$

374,494

Commercial Margin4

62%

71%

67%

72%

Ironwood’s share of net profit

65,117

95,344

156,736

187,247

Reimbursement for Ironwood’s commercial

expenses

9,298

9,407

19,394

19,135

Adjustment for Ironwood’s estimate of

LINZESS gross-to-net reserves

17,000

-

(13,000)

-

Ironwood’s U.S. collaborative arrangements

revenue5

$

91,415

$

104,751

$

163,130

$

206,382

_________________

1 Ironwood collaborates with AbbVie on the

development and commercialization of linaclotide in North America.

Under the terms of the collaboration agreement, Ironwood receives

50% of the net profits and bears 50% of the net losses from the

commercial sale of LINZESS in the U.S. The purpose of this table is

to present calculations of Ironwood’s share of net profit (loss)

generated from the sales of LINZESS in the U.S. and Ironwood’s

collaboration revenue/expense; however, the table does not present

the research and development expenses related to LINZESS in the

U.S. that are shared equally between the parties under the

collaboration agreement. Please refer to the table at the end of

this press release for net profit for the U.S. LINZESS brand

collaboration with AbbVie.

2 LINZESS net sales are recognized using

AbbVie’s revenue recognition accounting policies and reporting

conventions. As a result, certain rebates and discounts are

classified as LINZESS U.S. commercial costs, expenses and other

discounts within Ironwood’s calculation of collaborative

arrangements revenue.

3 Includes certain discounts recognized

and cost of goods sold incurred by AbbVie; also includes commercial

costs incurred by AbbVie and Ironwood that are attributable to the

cost-sharing arrangement between the parties.

4 Commercial margin is defined as

commercial profit on sales of LINZESS as a percent of total LINZESS

U.S. net sales.

5 Figures presented for the three and six

months ended June 30, 2024 include a $17.0 million increase and

$13.0 million reduction to collaborative arrangement revenues,

respectively, as a result of an adjustment recorded for Ironwood’s

estimate of LINZESS gross-to-net reserves as of June 30, 2024.

US LINZESS Full Brand

Collaboration1

Revenue/Expense

Calculation

(In thousands)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

LINZESS U.S. net sales as reported by

AbbVie2

$

211,183

$

269,686

$

467,783

$

519,900

AbbVie & Ironwood commercial costs,

expenses and other discounts3

80,950

78,998

154,312

145,406

AbbVie & Ironwood R&D

Expenses4

9,736

10,356

17,372

19,006

Total net profit on sales of LINZESS

$

120,497

$

180,332

$

296,099

$

355,488

_________________

1 Ironwood collaborates with AbbVie on the

development and commercialization of linaclotide in North America.

Under the terms of the collaboration agreement, Ironwood receives

50% of the net profits and bears 50% of the net losses from the

commercial sale of LINZESS in the U.S. The purpose of this table is

to present calculations of the total net profit (loss) generated

from the sales of LINZESS in the U.S., including the commercial

costs and expenses and the research and development expenses

related to LINZESS in the U.S. that are shared equally between the

parties under the collaboration agreement.

2 LINZESS net sales are recognized using

AbbVie’s revenue recognition accounting policies and reporting

conventions. As a result, certain rebates and discounts are

classified as LINZESS U.S. commercial costs, expenses and other

discounts within Ironwood’s calculation of collaborative

arrangements revenue.

3 Includes certain discounts recognized

and cost of goods sold incurred by AbbVie; also includes commercial

costs incurred by AbbVie and Ironwood that are attributable to the

cost-sharing arrangement between the parties.

4 Expenses related to LINZESS in the U.S. are shared equally

between Ironwood and AbbVie under the collaboration agreement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808744786/en/

Investors: Greg Martini, 617-374-5230

gmartini@ironwoodpharma.com

Matt Roache, 617-621-8395 mroache@ironwoodpharma.com

Media: Beth Calitri, 978-417-2031

bcalitri@ironwoodpharma.com

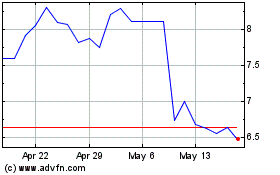

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Historical Stock Chart

From Dec 2023 to Dec 2024