UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO

RULE 13d-2(a)

JEFFS’ BRANDS LTD

(Name of Issuer)

ORDINARY SHARES, NO PAR VALUE PER SHARE

(Title of Class of Securities)

M61472128

(CUSIP Number)

Viki Hakmon

7 Mezada Street, Bnei Brak, Israel, 5126112

+972-3-7713520

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

February 19, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

*The remainder of this cover

page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and

for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. M61472128 | Schedule

13D/A |

|

| 1 |

NAMES OF REPORTING PERSONS

Viki Hakmon |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

PF, OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(e) or 2(f) ☐

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Israel |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH: |

7 |

SOLE VOTING POWER

209,797*

|

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

209,797* |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

209,797 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.77%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| * |

Based on a total of 3,099,973 ordinary shares, no par value per share, outstanding as of February 19, 2024, as reported by the Issuer to the Reporting Person. |

This Amendment No. 2 to Schedule

13D amends and supplements the Schedule 13D initially filed with the Securities and Exchange Commission (the “SEC”) on October

12, 2022, as amended on November 28, 2022 (the “Schedule 13D”), by Viki Hakmon (the “Reporting Person”) with respect

to the ordinary shares, no par value per share (the “Ordinary Shares”), of Jeffs’ Brands Ltd, an Israeli company (the

“Issuer”). Except as specifically provided herein, this Amendment No. 2 does not

modify any of the information previously reported on the Schedule 13D.

Item 1. Security and Issuer.

This Statement on Schedule 13D/A relates to the ordinary shares, no

par value per share (the “Ordinary Shares”), of Jeffs’ Brands Ltd, an Israeli company (the “Issuer”).

The principal executive offices

of the Issuer are located at 7 Mezada Street, Bnei Brak, Israel, 5126112.

Item 2. Identity and Background.

Viki Hakmon (the “Reporting

Person”) is an Israeli citizen.

The Reporting Person’s

business address is 7 Mezada Street, Bnei Brak, Israel, 5126112.

The principal occupation of

the Reporting Person is serving as the Chief Executive Officer and Director of the Issuer, the business address of which is at 7 Mezada

Street, Bnei Brak, Israel, 5126112. The principal business of the Issuer is an e-commerce consumer products goods company, operating

primarily on the Amazon.com platform.

During the last five years,

the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), and he has

not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction such that, as a result of such proceeding,

he is or has been subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

“Item 3. Source and

Amount of Funds or Other Consideration” is hereby amended and restated as follows:

On May 10, 2021, pursuant

to a Stock Exchange and Plan of Restructuring Agreement, the Reporting Person contributed to the Issuer all of the equity interests he

owned in Smart Repair Pro, a California corporation, and purex Corp., a California corporation, which became wholly-owned subsidiaries

of the Issuer, in exchange for 4,997 newly-issued Ordinary Shares.

On February 17, 2022, the

Issuer effected a bonus shares issuance (equivalent to a stock dividend) of 664.0547 Ordinary Shares for each Ordinary Share issued and

outstanding as of such date, pursuant to which the Reporting Person received 3,313,284 Ordinary Shares.

On May 3, 2022, the Issuer

effected a .806-for-1 reverse split of its issued and outstanding Ordinary Shares, pursuant to which holders of Ordinary Shares received

..806 of an Ordinary Share for every one Ordinary Share held as of such date. As a result of such reverse split, the Reporting Person owned

2,674,535 Ordinary Shares.

On June 16, 2022, the Issuer effected a 1-for-1.85 reverse split of

its issued and outstanding Ordinary Shares, pursuant to which holders of Ordinary Shares received one Ordinary Share for every 1.85 Ordinary

Shares held as of such date. As a result of such reverse split, the Reporting Person owned 1,445,695 Ordinary Shares.

On May 23, 2019, Smart Repair

Pro Inc (“Smart Repair Pro”), a now subsidiary of the Issuer, entered into loan agreements with the Reporting Person and a

third party. During July and August 2019 and April and May 2020, Smart Repair Pro entered into additional loan agreements with the

Reporting Person and certain other parties. On May 3, 2022, the Issuer entered into Assignments of Loan Agreements (the “Assignment

Agreements”), with Smart Repair Pro, the Reporting Person and such other parties, including L.I.A. Pure Capital Ltd. (“Pure

Capital”), pursuant to which the Issuer assumed Smart Repair Pro’s obligations under the outstanding loans and the Issuer

agreed that unless earlier repaid pursuant to the terms of the respective loan agreements with such parties, upon the consummation of

the Issuer’s initial public offering (the “IPO”), all outstanding principal due to each such party shall be automatically

converted into a number of Ordinary Shares equal to the quotient obtained by dividing the outstanding principal amount due to such party,

by the per Ordinary Share price of $3.46 per share, obtained by dividing $10,000,000 by the issued and outstanding Ordinary Shares immediately

prior to the closing of the IPO. The Issuer completed the IPO on August 30, 2022. As of such date, Smart Repair Pro had outstanding loans

to the Reporting Person of $940,000. In accordance with the Reporting Person’s assignment agreement, on August 30, 2022, the outstanding

principal amount of the loans due to the Reporting Person automatically converted into 271,951 Ordinary Shares and the Issuer issued 15,383

Ordinary Shares to the Reporting Person and the remaining 256,568 Ordinary Shares to Pure Capital at the Reporting Person’s instruction

pursuant to that certain Call Option Agreement, dated November 14, 2021, between the Reporting Person and Pure Capital.

On

November 1, 2022, the Reporting Person purchased 7,500 Ordinary Shares in the open market through a broker, at a price per share of $1.28,

with cash on hand.

On November 3, 2023, the Issuer effected a 1-for-7 reverse split of

its issued and outstanding Ordinary Shares, pursuant to which holders of Ordinary Shares received one Ordinary Share for every 7 Ordinary

Shares held as of such date. As a result of such reverse split, the Reporting Person owned 209,797 Ordinary Shares.

On July 25, 2023, the Issuer entered into an amendment to the Assignment

Agreement with Smart Repair Pro and the Reporting Person, pursuant to which, among others, the outstanding debt between the Issuer and

Smart Repair Pro was converted into and paid in capital of Smart Repair Pro.

Item 4. Purpose of Transaction.

All of the Issuer’s

securities owned by the Reporting Person were acquired for investment purposes only.

The Reporting Person may from

time to time engage in discussions with the Issuer, its directors and officers, other shareholders of the Issuer and other persons on

matters that relate to the management, operations, business, assets, capitalization, financial condition, strategic plans, governance

and the future of the Issuer and/or its subsidiaries. Although the Reporting Person has no present intention to do so, he may purchase

of Ordinary Shares or other securities of the Issuer from time to time, in the open market or in private transactions depending on his

analysis of the Issuer’s business, prospects and financial condition, the market for such securities, other investment and business opportunities

available to him, general economic and stock market conditions, proposals from time to time sought by or presented to him and other factors.

The Reporting Person intends to monitor his investments closely and may take advantage of opportunities offered to him from time to time.

The Reporting Person may also formulate plans or proposals regarding the Issuer, including possible future plans or proposals concerning

events or transactions of the kind described in paragraphs (a) through (j) of Item 4 of Schedule 13D. Depending upon the Reporting Person’s

continuing review of his investments and various other factors, including those mentioned above, the Reporting Person may (subject to

any applicable securities laws and lock-up arrangements) decide to sell all or any part of the Ordinary Shares or other securities owned

by him from time to time. However, he has no current plans to do so. Except as set forth above, the Reporting Person has no present plans

or proposals that relate to or would result in any of the actions required to be described in subsections (a) through (j) of Item 4 of

Schedule 13D. However, the Reporting Person specifically reserves the right to adopt and pursue one or more such plans, and to make such

proposals, at any time and from time to time in the future.

Item 5. Interest in Securities of the Issuer.

“Item 5. Interest in Securities of the Issuer”

of the Schedule 13D is hereby amended and restated as follows:

The information provided herein

is based upon 3,099,973 Ordinary Shares issued and outstanding as of February 19, 2024, as reported by the Issuer to the Reporting Person.

(a) The

Reporting Person beneficially owns 209,797 Ordinary Shares, representing approximately 6.77%

of the outstanding Ordinary Shares.

(b)

The Reporting Person may be deemed to hold sole voting and dispositive power over 209,797 Ordinary Shares of the Issuer.

(c) The Reporting Person has not effected any transactions in the Ordinary

Shares in the past 60 days, except as set forth in Item 3, which is incorporated by reference herein.

(d) No other person is known

to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities beneficially

owned by the Reporting Person.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

“Item 6. Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer” of the Schedule 13D/A is hereby amended

and restated as follows:

See Item 4 above, which is

incorporated by reference herein.

Except as set forth below,

there are no present contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting Person, and any

other person with respect to the securities of the Issuer, including, but not limited to, transfer or voting of any of the securities,

finder’s fees, joint ventures, loan or option arrangement, puts or calls, guarantees of profits, division of profits or loss, or

the giving or withholding of proxies:

Call Option Agreement

On November 14, 2021, the Reporting Person entered into a Call Option

Agreement with Pure Capital pursuant to which the Reporting Person granted to Pure Capital the right to purchase up to 122,689 Ordinary

Shares (as adjusted post the reverse split on November 3, 2023) of the Issuer held or acquired or to be acquired by the Reporting Person

for an aggregate purchase price of $10,000 (the “Call Option”). Pure Capital may exercise the Call Option at any time until

the earlier of: (i) such time where Pure Capital provides a waiver of its rights under the Call Option; and (ii) when Pure Capital has

exercised the Call Option in its entirety. On August 30, 2022, Pure Capital exercised its Call Option with respect to 36,653 Ordinary

Shares (as adjusted post the reverse split on November 3, 2023). On February 19, 2024, the Reporting Person and Pure Capital entered into

an amendment to the Call Option Agreement (the “Amendment”), effective as of January 29, 2024. Pursuant to the Amendment,

Pure Capital shall not have the right to exercise any portion of the Call Option, to the extent that after giving effect to such issuance

after exercise, Pure Capital, would beneficially own in excess of 4.99% of the number of Ordinary Shares of the Issuer outstanding immediately

after giving effect to the issuance of Ordinary Shares issuable upon exercise of the Call Option.

IPO Lock-Up Agreement

On August 25, 2022, in connection

with the IPO, the Reporting Person entered into a standard form of Lock-up Agreement with the underwriter of the IPO which closed on August

30, 2022 (the “Lock-up Agreement”), pursuant to which the Reporting Person agreed that for a period of 180 days from August

26, 2022, subject to certain exceptions, he will not (i) offer, pledge, sell, contract to sell, grant, lend, or otherwise transfer or

dispose of, directly or indirectly any Ordinary Shares or any securities convertible into or exercisable or exchangeable for Ordinary

Shares, (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences

of ownership of the Ordinary Shares, (iii) make any demand for or exercise any right with respect to the registration of any Ordinary

Shares, or (iv) publicly disclose the intention to make any offer, sale, pledge, disposition, or enter into any swap or other agreement

that transfers, in whole or in part, any of the economic consequences of ownership of the Ordinary Shares or any such other securities.

January 2024 PIPE Lock-Up

Agreement

On January 25, 2024, in connection

with the previously reported private placement transaction of the Issuer (the “January 2024 PIPE”), the Reporting Person entered

into a standard form of lock-up agreement (the “2024 Lock-up Agreement”), pursuant to which the Reporting Person agreed, subject

to certain exceptions, that he will not (i) offer, pledge, sell, contract to sell, grant, lend, or otherwise transfer or dispose of, directly

or indirectly any Ordinary Shares or any securities convertible into or exercisable or exchangeable for Ordinary Shares, (ii) enter into

any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Ordinary

Shares, (iii) make any demand for or exercise any right with respect to the registration of any Ordinary Shares, or (iv) publicly disclose

the intention to make any offer, sale, pledge, disposition, or enter into any swap or other agreement that transfers, in whole or in part,

any of the economic consequences of ownership of the Ordinary Shares or any such other securities. Pursuant to the 2024 Lock-Up Agreement,

such restrictions shall remain in effect until the date that is sixty calendar days after the earlier

of the date that is: (i) such time as a registration statement is declared effective and available for the re-sale of all of the registrable

securities issued in the January 2024 PIPE and remains effective for a period of at least thirty (30) consecutive trading days and (ii)

such time all of the registrable securities may be sold without restriction or limitation pursuant to Rule 144 for a period of at least

thirty (30) consecutive trading days.

Item 7. Material to Be Filed as Exhibits.

| Exhibit

1 |

|

Form

of Lock-Up Agreement with the underwriter named therein (filed as Exhibit 10.16 to the Issuer’s Registration Statement on Form

F-1/A filed with the SEC on May 5, 2022 and incorporated herein by reference). |

| |

|

|

| Exhibit

2 |

|

Stock

Exchange and Plan of Restructuring Agreement, dated May 10, 2021, by and between Jeffs’ Brands Ltd, on one hand, and Viki Hakmon

and Medigus Ltd., on the other hand. (filed as Exhibit 10.4 to the Issuer’s Registration Statement on Form F-1 filed with the

SEC on February 18, 2022 and incorporated herein by reference). |

| |

|

|

| Exhibit

3 |

|

Common

Stock Purchase Agreement, dated October 8, 2020, by and between Smart Repair Pro, Purex Corp., the stockholders of Smart Repair Pro

and Purex Corp., Viki Hakmon, and Medigus Ltd. (filed as Exhibit 10.2 to the Issuer’s Registration Statement on Form F-1 filed

with the SEC on February 18, 2022 and incorporated herein by reference). |

| |

|

|

| Exhibit

4 |

|

Amendment

No. 1 to Common Stock Purchase Agreement, dated June 22, 2021, by and between Smart Repair Pro, Purex Corp., the stockholders of

Smart Repair Pro and Purex Corp., Viki Hakmon, and Medigus Ltd. (filed as Exhibit 10.3 to the Issuer’s Registration Statement

on Form F-1 filed with the SEC on February 18, 2022 and incorporated herein by reference). |

| |

|

|

| Exhibit

5 |

|

Form

of Assignment and Assumption Agreement, dated May 3, 2022, by and between Smart Repair Pro and Jeffs’ Brands Ltd (form of Assignment

and Assumption Agreement filed as Exhibit 10.15 to the Issuer’s Registration Statement on Form F-1/A filed with the SEC on

May 5, 2022 and incorporated herein by reference). |

| |

|

|

| Exhibit

6 |

|

Call

Option Agreement, dated November 14, 2021, by and between Viki Hakmon and L. I. A. Pure Capital Ltd. (filed as Exhibit 6 to the Reporting

Person’s Schedule 13D filed with the SEC on October 12, 2022 and incorporated herein by reference). |

| |

|

|

| Exhibit

7 |

|

Amendment

No, 1 to the Call Option Agreement, dated February 19, 2024, by and between Viki Hakmon and L. I. A. Pure Capital Ltd. |

| |

|

|

| Exhibit

8 |

|

Form

of Lock-Up Agreement |

| |

|

|

| Exhibit

9 |

|

Amendment

to the Assignment Agreement, dated July 25, 2023, by and between Smart Repair Pro Inc and Jeffs’ Brands Ltd. |

SIGNATURE

After a reasonable inquiry

and to the best knowledge and belief of the undersigned, the undersigned hereby certifies that the information set forth in this statement

is true, complete and correct.

Dated: February 26, 2024

| |

/s/ Viki Hakmon |

| |

Viki Hakmon |

Exhibit 7

Amendment

to Call Option Agreement

This Amendment to the Call

Option Agreement (the “Amendment”) is made and entered into as of January 29, 2024 (the “Effective Date”),

by and among Mr. Viki Hackmon, Israeli ID#033847799 (“Hakmon”), and L.I.A. Pure Capital Ltd., a company organized and

existing under the laws of the State of Israel (“Pure”). Each of Pure and Hakmon are referred to collectively herein

as the “Parties” and each separately as a “Party”.

WHEREAS, the Parties

have entered into that certain Call Option Agreement dated November 14, 2021 (the “Call Option Agreement”); and

WHEREAS, the Call

Option Agreement includes certain provisions which the Parties mutually wish to amend, effectively as of the Effective Date, as set forth

herein.

NOW, THEREFORE, the

Parties agree to amend the Call Option Agreement as follows:

| 1.1. | As of the Effective Date, the following shall be added as

Section 1.4: |

“Notwithstanding anything

to the contrary contained herein, no exercise of any portion of this Call Option shall be effected and any such exercise shall be null

and void and treated as if never made, to the extent that after giving effect to such exercise, Pure would beneficially own in excess

of 4.99% of the number of issued and outstanding Ordinary Shares of the Company immediately after giving effect to such exercise.”

| 2.1. | This Amendment shall be deemed for all intents and purposes as an integral part

of the Call Option Agreement and/or any amendment thereof. All capitalized terms used in this Amendment and not defined hereto, shall

have the meanings attributed to them in the Call Option Agreement. In the event of any inconsistency between the provisions of this Amendment

and the provisions of the Call Option Agreement and/or any amendment thereof, this Amendment shall prevail. Except as provided explicitly

hereto, all other provisions of the Call Option Agreement shall continue to be in full force and effect, mutatis mutandis. |

| 2.2. | This Amendment supersedes all prior agreements, written or oral, between the Parties

relating to the subject matter of this Amendment. |

| 2.3. | Any provision of this Amendment may be amended, waived or modified only upon the written consent of both

Parties. |

[Signature Page Follows]

In

Witness Whereof, the Parties have executed this Amendment as of the date written below.

| Viki Hackmon |

|

L.I.A. Pure Capital Ltd. |

| |

|

|

|

|

| |

/s/ Viki Hackmon |

|

By: |

/s/ Kfir Zilberman |

| |

|

|

Name: |

Kfir Zilberman |

| |

|

|

Title: |

Chief Executive Officer |

| Date: |

February 19, 2024 |

|

Date: |

February 19, 2024 |

[Signature Page to Amendment to Call Option

Agreement]

Exhibit 8

Jeffs’

Brands Ltd - Lock-up Agreement

January 25, 2024

Jeffs’ Brands Ltd

7 Mezada Street

Bnei Brak, Israel 5126112

Ladies and Gentlemen:

The undersigned understands

that Jeffs’ Brands Ltd, an Israeli company (the “Company”), proposes to enter into a Securities Purchase Agreement

(the “SPA”) on January 25, 2024 with each purchaser (each, an “Investor”, and collectively

“Investors”) identified on the signature page of the SPA, providing for the placement (the “Transaction”)

of ordinary shares, no par value per share, of the Company (“Shares”), Series A Warrants and Series B Warrants

to purchase Shares and Pre-Funded Warrants to purchase Shares. Capitalized terms used herein and not otherwise defined shall have the

respective meanings set forth in the SPA.

To induce the Company to continue

its efforts in connection with the Transaction, the undersigned hereby irrevocably enters into this Lock-Up Agreement (this “Agreement”)

and agrees that the undersigned will not, during the period commencing on the date hereof and ending sixty (60) calendar days after the

earlier of the date that (i) such time one or more Registration Statement(s) covering the resale of all Registrable Securities has been

effective and available for the re-sale of all such Registrable Securities for a period of at least thirty (30) consecutive Trading Daysand

(ii) such time as all of the Registrable Securities may be sold without restriction or limitation pursuant to Rule 144 for a period of

at least thirty (30) consecutive Trading Days(the “Lock-Up Period”), (1) offer, pledge, sell, contract to sell,

grant, lend, or otherwise transfer or dispose of, directly or indirectly, any Shares or any securities convertible into or exercisable

or exchangeable for Shares, whether now owned or hereafter acquired by the undersigned (or any Affiliate of the undersigned) or with respect

to which the undersigned (or any Affiliate of the undersigned) has or hereafter acquires the power of disposition (collectively, the “Lock-Up

Securities”); (2) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic

consequences of ownership of the Lock-Up Securities, whether any such transaction described in clause (1) or (2) above is to be settled

by delivery of Lock-Up Securities, in cash or otherwise; (3) make any demand for or exercise any right with respect to the registration

of any Lock-Up Securities; or (4) publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into any

transaction, swap, hedge or other arrangement relating to any Lock-Up Securities.

Notwithstanding the foregoing,

and subject to the conditions below, the undersigned may transfer Lock-Up Securities in connection with

| 1. | transfers of Lock-Up Securities as a bona fide gift, by will or intestacy or to a family member

or trust for the benefit of the undersigned (for purposes of this Agreement, “family member” means any relationship by blood,

marriage or adoption, not more remote than first cousin) provided that the transferee agrees to sign and deliver a lock-up agreement

substantially in the form of this Agreement for the balance of the Lock-Up Period; |

| 2. | transfers of Lock-Up Securities to a charity or educational institution; |

| 3. | if the undersigned is a corporation, partnership, limited liability company or other business entity,

(i) any transfers of Lock-Up Securities to another corporation, partnership or other business entity that controls, is controlled by or

is under common control with the undersigned or (ii) distributions of Lock-Up Securities to members, partners, shareholders, subsidiaries

or affiliates (as defined in Rule 405 promulgated under the Securities Act of 1933, as amended) of the undersigned as of the date of this

Agreement, provided that the transferee agrees to sign and deliver a lock-up agreement substantially in the form of this Agreement

for the balance of the Lock-Up Period; |

| 4. | if the undersigned is a trust, to a trustee or beneficiary of the trust, provided that in the case

of any transfer pursuant to this clause (4) and the foregoing clauses (1), (2) or (3), (i) any such transfer shall not involve a disposition

for value, (ii) each transferee shall sign and deliver to the Company a lock-up agreement substantially in the form of this Agreement

and (iii) no filing under Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

or other public announcement shall be required or shall be voluntarily made during the Lock-Up Period; |

| 5. | the receipt by the undersigned from the Company of Shares upon the vesting of restricted share awards

or share units or upon the exercise of options to purchase the Shares issued under an equity incentive plan of the Company or an employment

arrangement (the “Plan Shares”) or the transfer or withholding of Shares or any securities convertible

into Shares to the Company upon a vesting event of the Company’s securities or upon the exercise of options to purchase the Company’s

securities, in each case on a “cashless” or “net exercise” basis or to cover tax obligations of the undersigned

in connection with such vesting or exercise, provided that if the undersigned is required to file a report under Section 13 of

the Exchange Act reporting a reduction in beneficial ownership of Shares during the Lock-Up Period, the undersigned shall include a statement

in such schedule or report to the effect that the purpose of such transfer was to cover tax withholding obligations of the undersigned

in connection with such vesting or exercise and, provided further that the Plan Shares shall be subject to the terms of this Agreement; |

| 6. | the establishment or the continued use of a trading plan pursuant to Rule 10b5-1 under the Exchange Act

for the transfer of Lock-Up Securities, provided that (i) such plan does not provide for the transfer of Lock-Up Securities during

the Lock-Up Period and (ii) during the Lock-Up Period, no public announcement or filing under the Exchange Act is required of, or voluntarily

made by or on behalf of, the undersigned or the Company regarding the establishment of such plan; |

| 7. | the transfer of Lock-Up Securities that occurs by operation of law, such as pursuant to a qualified domestic

order or in connection with a divorce settlement, provided that the transferee agrees to sign and deliver a lock-up agreement substantially

in the form of this Agreement for the balance of the Lock-Up Period, and provided further that any filing under Section 13 of the

Exchange Act that is required to be made during the Lock-Up Period as a result of such transfer shall include a statement that such transfer

has occurred by operation of law; and provided further that competent legal counsel for the Company shall have first advised that

such transfer is a mandatory and not voluntary transfer; and |

| 8. | the transfer of Lock-Up Securities pursuant to a bona fide third party tender offer, merger, consolidation

or other similar transaction made to all holders of the Shares involving a change of control (as defined below) of the Company after the

closing of the Transaction and approved by the Company’s board of directors; provided that in the event that the tender offer,

merger, consolidation or other such transaction is not completed, the Lock-Up Securities owned by the undersigned shall remain subject

to the restrictions contained in this Agreement. For purposes of clause (i) above, “change of control” shall mean the consummation

of any bona fide third party tender offer, merger, amalgamation, consolidation or other similar transaction the result of which is that

any “person” (as defined in Section 13(d)(3) of the Exchange Act), or group of persons, becomes the beneficial owner (as defined

in Rules 13d-3 and 13d-5 of the Exchange Act) of a majority of total voting power of the voting shares of the Company. |

The undersigned also agrees

and consents to the entry of stop transfer instructions with the Company’s transfer agent and registrar against the transfer of

the undersigned’s Lock-Up Securities except in compliance with this Agreement.

This Agreement may not be

amended or otherwise modified in any respect without the written consent of each of the Company and the undersigned. This Agreement shall

be governed by and construed in accordance with the law of the State of New York. The undersigned hereby irrevocably submits to the exclusive

jurisdiction of the United States District Court sitting in the Southern District of New York and the courts of the State of New York

located in the City and County of New York, for the purposes of any suit, action or proceeding arising out of or relating to this Agreement,

and hereby waives, and agrees not to assert in any such suit, action or proceeding, any claim that (i) it is not personally subject to

the jurisdiction of such court, (ii) the suit, action or proceeding is brought in an inconvenient forum, or (iii) the venue of the suit,

action or proceeding is improper. The undersigned hereby irrevocably waives personal service of process and consents to process being

served in any such suit, action or proceeding by receiving a copy thereof sent to the Company at the address in effect for notices to

it under the SPA and agrees that such service shall constitute good and sufficient service of process and notice thereof. The undersigned

hereby waives any right to a trial by jury. Nothing contained herein shall be deemed to limit in any way any right to serve process in

any manner permitted by law. The undersigned agrees and understands that this Agreement does not intend to create any relationship between

the undersigned and any Purchaser and that no Purchaser is entitled to cast any votes on the matters herein contemplated and that no issuance

or sale of the Securities is created or intended by virtue of this Agreement.

The undersigned understands

that the Company is relying upon this Agreement in proceeding toward consummation of the Transaction. The undersigned further understands

that this Agreement is irrevocable and shall be binding upon the undersigned’s heirs, legal representative, successors and assigns.

This Letter Agreement is intended for the benefit of the undersigned and the Company and their respective successors and permitted assigns

and is not for the benefit of, nor may any provisions hereof be enforced by, any of other person or entity.

The undersigned understands

that, if the SPA is not executed by February 13, 2024 or if the SPA (other than the provisions thereof which survive termination) shall

terminate or be terminated prior to payment for and delivery of all the securities to be sold thereunder, then this Agreement shall be

void and of no further force or effect.

Whether or not the Transaction

actually occurs depends on a number of factors, including market conditions. Any Transaction will only be made pursuant to the SPA.

[JFBR Lock-Up Agreement Signature Page Follows]

[JFBR Lock-Up Agreement Signature Page]

The undersigned has read and

agrees to be bound by the terms of this Agreement dated as of January __, 2024.

| |

Very truly yours, |

| |

|

|

| |

|

|

| |

(Signature) |

| |

Name: |

|

| |

|

|

| |

Address: |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Email: |

|

Exhibit 9

First Amendment to Assignment Agreement

This First Amendment to the Assignment Agreement

(the “Amendment”) is made and entered into on July 25, 2023 by and between:

| (i) | Smart Repair Pro Inc, with its principal place of business

at Hanechoshet 3, Tel Aviv (“Assignor”); |

| (ii) | Jeffs’ Brands Ltd., with its principal place of business

at Mezada 7, Bnei Brak (“Assignee”). |

Acknowledged by Julia Gerasimova

and Vick Hakmon (together, the “Lender”), as party under the Loan Agreements.

Each of the aforementioned may be referred

to herein as a “Party” and together as the “Parties”.

WHEREAS, the Parties

have signed and entered into that certain Assignment Agreement dated May 3, 2022 and attached hereto as Exhibit A (the “Agreement”);

and

WHEREAS, the Parties

wish to correct several author mistakes made in the Agreement effective as of the date of the Agreement.

Now therefore the parties

hereto have agreed as follows:

The Amendment

| 1. | Through the entire agreement the word “Borrower”

will be replaced by the word “Lender”. |

| 2. | Sub-Article 2.1 of the main body of the Agreement shall be

deleted in its entirety and replaced by the following: |

“2.1 In connection with the

assignment of the Assigned Rights, upon the effectiveness of the assignment prescribed in Section 1.1 above, the Lender shall be issued

with (i) such amount of ordinary shares of the Assignee, equal to all outstanding principal amount specified under the Loan Agreement,

divided by a price per share calculated based on a pre-money company valuation of US$10,000,000, on an issued and outstanding basis immediately

prior to the IPO (as such term is defined below), and (ii) all outstanding interest amounts, as defined under the Loan Agreement, shall

be paid by the Assignee to the Lender and (iii) all amounts stated in Sub-Article 2.1 (i) and (ii) as debt between the Assignor and Assignee

shall be converted into and paid in capital of the Assignor.”

Miscellaneous

| 3. | Each party hereby acknowledges that it is and shall be responsible

for payment of all its respective tax implications, duties, compulsory payments and any fees resulting from or relating to this Amendment

imposed upon it by law, if any. |

| 4. | Each of the parties hereto shall perform such further acts

and execute such further documents as may reasonably be necessary to carry out and give full effect to the provisions of this Amendment

and the intentions of the parties as reflected thereby. |

| 5. | If any provision of this Amendment is determined by a court

of competent jurisdiction to be invalid, inoperative or unenforceable for any reason, the parties shall negotiate in good faith to modify

this Amendment so as to effect the original intent of the parties as closely as possible in an acceptable manner in order that the transactions

contemplated hereby be consummated as originally contemplated to the fullest extent possible. The invalidity, inoperability or unenforceability

of any term of the Amendment will not adversely affect the validity, operability or enforceability of the remaining terms. |

| 6. | Any provision of this Amendment may be amended, waived or

modified only upon the written consent of both Parties. |

| 7. | Each Party shall bear its own fees and expenses in connection

with this Amendment. |

IN WITNESS WHEREOF, the Parties

have caused this Amendment to be executed by their duly authorized representatives as of the date first mentioned above.

| Assignor |

|

Assignee |

| |

|

|

| Smart Repair Pro Inc. |

|

Jeffs’ Brands Ltd |

| |

|

|

|

|

| By: |

/s/ Ronen Zalayet |

|

By: |

/s/ Oz Adler |

| Name: |

Ronen Zalayet |

|

Name: |

Oz Adler |

| Title: |

Director |

|

Title: |

Chairman of the Board |

| Acknowledged by: |

|

|

|

| Lender |

|

|

|

|

| |

|

|

|

|

| Julia Gerasimova and Vick Hakmon |

|

|

|

| |

|

|

|

| /s/ Julia Gerasimova /s/ Vick Hakmon |

|

|

|

| |

|

|

|

[Signature Page to Amendment to Assignment Agreement,

Vick Hakmon]

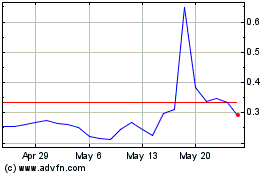

Jeffs Brands (NASDAQ:JFBR)

Historical Stock Chart

From Apr 2024 to May 2024

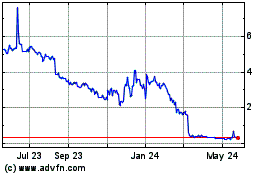

Jeffs Brands (NASDAQ:JFBR)

Historical Stock Chart

From May 2023 to May 2024