Jeffs’ Brands Ltd (“Jeffs’ Brands” or the “Company”) (Nasdaq: JFBR,

JFBRW), a data-driven e-commerce company operating on the Amazon

Marketplace, reported today its financial results for the year

ended December 31, 2023.

2023 Fiscal Year Financial

Overview:

Revenue Growth: Jeffs' Brands

reported a substantial increase in revenues, achieving $10,008

thousand in 2023, a remarkable growth of 71% from $5,859 thousand

in 2022. This growth is largely attributed to the strategic

acquisition of Fort Product Ltd. (“Fort”), in March 2023 and an

expanded product lineup, particularly in the pest control.

Gross Profit: The company

realized a gross profit of $976 thousand for the fiscal year 2023,

compared to $799 thousand in 2022, marking a 22% year-over-year

increase.

Streamlined Expenditures:

Reflecting strategic cost management initiatives, sales and

marketing expenses were optimized to $833 thousand in 2023, down

from $1,198 thousand in the preceding year.

Operating Loss: Jeffs' Brands

experienced an operating loss of $5,089 thousand in 2023, compared

to a loss of $4,512 thousand in 2022.

Liquidity: As of

December 31, 2023, the Company had approximately $535 thousand

in cash and cash equivalents. Additionally, in January 2024, Jeffs'

Brands executed a Private Investment in Public Equity (PIPE)

transaction, raising $7.275 million.

The net cash used in operating

activities amounted to $2,668 thousand in 2023, showcasing

a focused approach toward bolstering the company's operational

capabilities and market reach. Notably, net cash used in

investing activities was $4,814 thousand for the year,

reflecting the company's commitment to strategic acquisitions such

as Fort and investments in growth initiatives.

Strategic Initiatives and Corporate

Developments:

Diversified Market Entry through

Strategic Acquisitions:Jeffs' Brands has vigorously

expanded its market footprint through key acquisitions,

diversifying its portfolio into new, high-demand sectors.

Pioneering the Pest Control Sector with

Fort Acquisition: In a strategic move to dominate the pest

control market, Jeffs' Brands acquired Fort in March 2023. This

acquisition allowing the company to leverage Fort’s established

brand recognition and product efficacy to capture significant

market share.

Since the acquisition, Jeffs’ Brands has

expanded Fort's growth by entering new territories such as France,

Italy, the Netherlands and Spain, establishing a dedicated

manufacturing line in China, and introducing its pest control

products to the agricultural market.

Fort now offers over 120 different pest control

and related products, catering to both consumers and

institutions.

Innovative Financing

MechanismsJeffs' Brands has implemented innovative

financing mechanisms to bolster its financial resilience and fuel

ongoing and future expansion strategies.

- Successful PIPE

Transaction: In January 2024, Jeffs' Brands executed a

Private Investment in Public Equity (PIPE) transaction. This

strategic financial move successfully raised $7.275 million,

ensuring ample resources for continued growth and operational

scaling. The PIPE transaction emphasizes investor confidence in

Jeffs' Brands’ vision and strategic direction, enhancing its

liquidity and financial stability.

About Jeffs’ Brands Ltd

Jeffs' Brands is transforming the world of e-commerce by

creating and acquiring products and turning them into market

leaders, tapping into vast, unrealized growth potential. Through

our stellar team’s insight into the FBA Amazon business model,

we’re using both human capability and advanced technology to take

products to the next level. For more information on Jeffs’ Brands

Ltd visit https://jeffsbrands.com.

Forward-Looking Statement Disclaimer

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are intended to be covered by the “safe harbor”

created by those sections. Forward-looking statements, which are

based on certain assumptions and describe our future plans,

strategies and expectations, can generally be identified by the use

of forward-looking terms such as “believe,” “expect,” “may,”

“should,” “could,” “seek,” “intend,” “plan,” “goal,” “estimate,”

“anticipate” or other comparable terms. For example, we are using

forward-looking statements when discussing the exclusive offer and

sale by Fort of the Products on the global Amazon Marketplace and

as a wholesaler. Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on our current beliefs, expectations and

assumptions regarding the future of our business, future plans and

strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict

and many of which are outside of our control. Our actual results

and financial condition may differ materially from those indicated

in the forward-looking statements. Therefore, you should not rely

on any of these forward-looking statements. Important factors that

could cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: our ability to adapt to

significant future alterations in Amazon’s policies; our ability to

sell our existing products and grow our brands and product

offerings, including by acquiring new brands; our ability to meet

our expectations regarding the revenue growth and the demand for

e-commerce; the overall global economic environment; the impact of

competition and new e-commerce technologies; general market,

political and economic conditions in the countries in which we

operate; projected capital expenditures and liquidity; the impact

of possible changes in Amazon’s policies and terms of use; and the

other risks and uncertainties described in the Company’s Annual

Report on Form 20-F for the year ended December 31, 2023, filed

with the U.S. Securities and Exchange Commission (“SEC”), on April

1, 2024 and our other filings with the SEC. We undertake no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

Investor Relations Contact:Michal EfratyAdi and Michal PR-

IRmichal@efraty.com

|

JEFFS’ BRANDS LTDCONSOLIDATED BALANCE

SHEETS(in thousand, except share and per share

data) |

| |

| |

|

|

December 31 |

|

| |

Note |

|

2023 |

|

|

2022 |

|

| ASSETS |

|

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

535 |

|

|

|

8,137 |

|

|

Restricted deposit |

|

|

|

17 |

|

|

|

- |

|

|

Trade receivables |

|

|

|

629 |

|

|

|

327 |

|

|

Other receivables |

|

|

|

597 |

|

|

|

779 |

|

|

Inventory |

|

|

|

2,386 |

|

|

|

1,791 |

|

| Total current

assets |

|

|

|

4,164 |

|

|

|

11,034 |

|

| NON-CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

|

59 |

|

|

|

41 |

|

|

Investment accounted for using the equity method |

|

|

|

1,940 |

|

|

|

- |

|

|

Investment at fair value |

|

|

|

67 |

|

|

|

- |

|

|

Intangible assets, net |

|

|

|

5,714 |

|

|

|

4,452 |

|

|

Deferred taxes |

|

|

|

168 |

|

|

|

110 |

|

|

Operating lease right-of-use assets |

|

|

|

127 |

|

|

|

138 |

|

| Total non-current

assets |

|

|

|

8,075 |

|

|

|

4,741 |

|

| TOTAL

ASSETS |

|

|

|

12,239 |

|

|

|

15,775 |

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade payables |

|

|

|

709 |

|

|

|

131 |

|

|

Other payables |

|

|

|

1,533 |

|

|

|

391 |

|

|

Related party payables |

|

|

|

66 |

|

|

|

32 |

|

|

Short-term loans |

|

|

|

- |

|

|

|

86 |

|

| Total current

liabilities |

|

|

|

2,308 |

|

|

|

640 |

|

| NON-CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

|

|

Derivative liabilities |

|

|

|

1,375 |

|

|

|

2,216 |

|

|

Operating lease liabilities |

|

|

|

45 |

|

|

|

98 |

|

| Total non-current

liabilities |

|

|

|

1,420 |

|

|

|

2,314 |

|

| TOTAL

LIABILITIES |

|

|

|

3,728 |

|

|

|

2,954 |

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS’

EQUITY: |

|

|

|

|

|

|

|

|

|

|

Ordinary shares of no par value per share – Authorized: 43,567,567

shares as of December 31, 2023, and December 31, 2022; Issued and

outstanding: 1,215,512 shares as of December 31, 2023; 1,153,461

shares as of December 31, 2022(*) |

|

|

|

- |

|

|

|

- |

|

|

Additional paid-in-capital |

|

|

|

16,787 |

|

|

|

16,499 |

|

|

Accumulated deficit |

|

|

|

(8,276 |

) |

|

|

(3,678 |

) |

| TOTAL SHAREHOLDERS’

EQUITY |

|

|

|

8,511 |

|

|

|

12,821 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

12,239 |

|

|

|

15,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

JEFFS’ BRANDS LTD CONSOLIDATED STATEMENTS

OF OPERATIONS(in thousand, except share and per

share data) |

| |

| |

Year ended December 31 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

10,008 |

|

|

|

5,859 |

|

|

|

6,509 |

|

| Cost of sales |

9,032 |

|

|

|

5,060 |

|

|

|

4,560 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

976 |

|

|

|

799 |

|

|

|

1,949 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

833 |

|

|

|

1,198 |

|

|

|

1,314 |

|

|

General and administrative |

4,262 |

|

|

|

4,113 |

|

|

|

1,480 |

|

|

Equity losses |

1,249 |

|

|

|

- |

|

|

|

- |

|

|

Impairment loss of intangible asset |

- |

|

|

|

- |

|

|

|

87 |

|

|

Other income |

(279 |

) |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss |

(5,089 |

) |

|

|

(4,512 |

) |

|

|

(932 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Financial (income) expenses,

net |

(523 |

) |

|

|

(2,305 |

) |

|

|

629 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Loss before

taxes |

(4,566 |

) |

|

|

(2,207 |

) |

|

|

(1,561 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Tax (benefit) expense |

32 |

|

|

|

(6 |

) |

|

|

(21 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Net loss |

(4,598 |

) |

|

|

(2,201 |

) |

|

|

(1,540 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss

attributable to shareholders per ordinary share |

(3.88 |

) |

|

|

(*)(3.32 |

) |

|

|

(*)(3.73 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Weighted-average ordinary

shares used in computing net loss per share, basic and diluted |

1,184,484 |

|

|

|

(*)663,411 |

|

|

|

(*)413,192 |

|

| (*) |

Share and per share data in these consolidated financial statements

have been retroactively adjusted to reflect the reverse share split

effected in November 2023. |

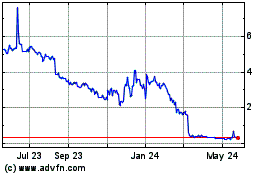

Jeffs Brands (NASDAQ:JFBR)

Historical Stock Chart

From Nov 2024 to Dec 2024

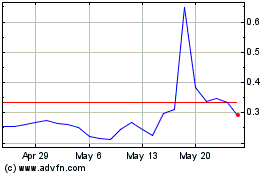

Jeffs Brands (NASDAQ:JFBR)

Historical Stock Chart

From Dec 2023 to Dec 2024