CHENGDU,

China, Nov. 8, 2023 /PRNewswire/ -- About us:

Aurora Mobile (NASDAQ: JG) established in 2011, is a leading

customer engagement and marketing technology service provider in

China. Its business includes

notification services, marketing growth, development tools, and

data products. As its sub-brand, MoonFox Data is a leading expert

in data insights and analysis services across all scenarios, aiming

to help companies gain market insights and empower precise

decision-making.

From "Discover World's Goodies" to "Mark Your Life", RED, based

on content-heavy and interaction-focused operation logic, has

developed into a "composite lifestyle community" that integrates

various dimensions of content such as great products, electronics,

store-exploring, sports, and knowledge sharing with image-text

content at its core.

In the era of short videos and traffic, why RED's image-text

system can achieve long-term growth and capture a portion of users'

attention? Is it still possible to pursue these commercial

monetization paths at RED, regardless of e-commerce or

store-exploring? Will the community lose its user stickiness?

I. 100 Million Daily Active Users (DAU) -

Favorable Condition and User Choices Shape RED:

RED's average DAU and trend from January to

October 2023:

|

Date

|

Average DAU (in

million)

|

MoM change

|

|

2023/10

|

101.7196

|

1.90 %

|

|

2023/9

|

99.8245

|

-0.32 %

|

|

2023/8

|

100.1422

|

0.28 %

|

|

2023/7

|

99.8648

|

2.56 %

|

|

2023/6

|

97.3721

|

0.85 %

|

|

2023/5

|

96.5549

|

1.76 %

|

|

2023/4

|

94.8857

|

1.41 %

|

|

2023/3

|

93.5648

|

-2.55 %

|

|

2023/2

|

96.0128

|

-7.00 %

|

|

2023/1

|

103.2426

|

5.23 %

|

Data Source: MoonFox iApp; Data Collection Period: January to

October 2023. The statistical results

only include app data and do not include traffic data from web

pages, mini-programs, or quick apps, among others, within the

WeChat ecosystem.

According to MoonFox iApp data, as of October 2023, RED's average monthly

DAU exceeded 101 million after nearly a year of

fluctuations, with its DAU stabilizing at the 100

million level, far surpassing the industry average. Unlike Douyin,

which iterates rapidly with clear strategies, and WeChat, which has

a massive and stable development, a community-based platform and

savage growth are more suitable descriptions of RED. Over the past

decade, experimentation and caution have been integral to RED's

development.

In 2013, RED was born as a platform with simple content,

positioned as a "travel guide sharing platform." Travel guides were

not new in that era. Still, RED successfully built a small platform

revolving around travel notes by using minimal text, rich visual

elements, and aesthetically pleasing page designs, combined with

the exploration and targeted promotion by travel bloggers.

In 2015, e-commerce was thriving, with Tmall's Double Eleven

sales exceeding 80 billion yuan,

surpassing the daily retail sales of consumer goods nationwide in

2014. Just before this trend, RED had already gathered a large

number of high-net-worth and high-demand users through its

note-sharing feature. Transitioning from travel guides to product

recommendations was a natural progression based on user demands.

The platform quickly created a "Benefits Group" by carefully

selecting products and determining copywriting. As an e-commerce

platform, RED began to acquire popularity among users.

In 2017, RED's e-commerce business encountered a growth

bottleneck and sought acquisition offers from top platforms, but

without success. At this time, the second wave of opportunities

arrived - the rise of variety shows, with Douyin and Pinduoduo

becoming the top players and "Extreme Challenge" becoming a popular

IP at that time. RED chose to collaborate with Idol Producer

and Produce 101, which perfectly matched its tone of sharing

goods and lifestyle. As a result, a large number of female users

flocked to the platform. RED has continuous growth thanks to

community operations and top KOL traffic control.

Monthly active users (MAU) and trend changes of RED from

January to December 2020

|

Date

|

MAU (in 100

million)

|

MoM change

|

|

2020/12

|

2.19

|

14.21 %

|

|

2020/11

|

1.91

|

5.88 %

|

|

2020/10

|

1.81

|

11.87 %

|

|

2020/9

|

1.62

|

-2.30 %

|

|

2020/8

|

1.65

|

12.10 %

|

|

2020/7

|

1.48

|

25.60 %

|

|

2020/6

|

1.18

|

-1.39 %

|

|

2020/5

|

1.19

|

4.50 %

|

|

2020/4

|

1.14

|

7.08 %

|

|

2020/3

|

1.07

|

3.66 %

|

|

2020/2

|

1.03

|

7.93 %

|

|

2020/1

|

0.95

|

2.12 %

|

Data Source: MoonFox iApp; Data Collection Period: January to

December 2020. The statistical

results only include app data and do not include traffic data from

web pages, mini-programs, or quick apps, among others, within the

WeChat ecosystem.

2020 marked the start of RED's period of rapid development.

According to the data from the MoonFox iAPP, as of December 2020, RED's MAU exceeded 200 million,

and DAU exceeded 50 million. At that time, online

platforms experienced growth under the influence of the COVID-19

pandemic. The lower costs of creating image-text notes on RED,

combined with the increasing user stickiness at that time, led to a

significant increase in the number of notes related to topics such

as "home cooking" and "indoor exercise." Therefore, users'

willingness to search actively increased significantly.

At the same time, RED also officially entered the view of

giants. Douyin established a special team, and WeChat launched

functional pages, both of which aimed to emulate the image-text

model. However, due to factors such as fan base and community

background, the results of such efforts were minimal. Still, more

users began to see the image-text notes on RED, making it a choice

for more users in silent environments and fragmented time.

Getting back to the present, RED formally joined the "club" of

100 million DAUs in 2023, and one of its main areas of development

attention is commercialization. Having accumulated a large

reservoir of traffic, the commercialization process is

accelerating, and RED has taken the lead in content related to

e-commerce and store-exploring.

II. Through the buyer model and traffic tilt, the e-commerce

business is officially ramping up:

The market re-evaluated RED following the successful sales

results generated by the June 18th

shopping festival.

Distribution of RED's user usage time from January to

September 2023

|

Date

|

Light users (1-3

days)

|

Regular users (4-8

days)

|

Heavy users (9 days and

above)

|

|

2023/9

|

26 %

|

10 %

|

64 %

|

|

2023/8

|

26 %

|

10 %

|

64 %

|

|

2023/7

|

27 %

|

10 %

|

64 %

|

|

2023/6

|

27 %

|

10 %

|

63 %

|

|

2023/5

|

39 %

|

10 %

|

51 %

|

|

2023/4

|

57 %

|

13 %

|

30 %

|

|

2023/3

|

53 %

|

12 %

|

34 %

|

|

2023/2

|

58 %

|

13 %

|

29 %

|

|

2023/1

|

58 %

|

13 %

|

30 %

|

Data Source: MoonFox iApp; Data Collection Period: January to

September 2023. The statistical

results only include app data and do not include traffic data from

web pages, mini-programs, or quick apps, among others, within the

WeChat ecosystem.

On one hand, a significant amount of user time is devoted to

live streaming and provides support for sales volume. According to

data from MoonFox iAPP, as of May

2023, heavy users on RED (logging in continuously for 9

days) accounted for 51.43%, showing a significant increase compared

to the previous period and reaching a high value of 62.55% in June.

Firstly, RED started to generate warm-up and seeding notes in early

May. Through the combination of topics and traffic support, some

product-related note content quickly gained attention and spread

rapidly. Secondly, by introducing features such as deposit payments

and expanding red envelope rewards, RED further attracted user

retention. Ultimately, the community made its way to the e-commerce

industry, giving consumers a greater range of options, and the

buyer model evolved into the primary strategy for retaining

customers. Users complete the conversion by clicking, browsing,

seeding content, purchasing, and spreading information.

On the other hand, guidelines and reward measures are

implemented to help firms gain users' mindset. At the guideline

level, RED launched the "Good Products to Win the June 18 Battle" practical guide activity in late

April. By assisting businesses in understanding user search habits,

consumption motivations, and segmented scenario demands through its

research team, it helps businesses determine promotional materials

and styles. On the incentive level, various measures, such as new

customer incentives and incentives for returning customers, have

been introduced. Meanwhile, RED has officially opened the "Product

Collaboration" feature, allowing brands to collaborate with

influencers through pure commission-based partnerships. Businesses

receive assistance to better align their advertising materials with

the community's tone, which will increase the amount of time users

spend online and the regularity with which they utilize the

platform.

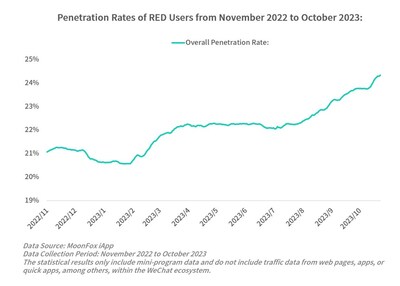

According to data from MoonFox iApp, as of October 2023, RED's overall penetration rate has

exceeded 24%, while the penetration rate in the mobile shopping

industry has surpassed 28%, showing steady growth throughout the

year. After the trial during the June

18 shopping festival, RED has become more determined in its

e-commerce path of combining buyer-selected products with live

streaming. Based on the community's tone and user demographics, RED

tends to refer to live-streaming influencers as "brand curators"

and introduces more personal and niche brands. Through professional

content explanations, it stimulates users' desire to buy products,

enabling even small live-streaming rooms with only a few thousand

viewers to quickly and frequently achieve conversions.

RED's e-commerce business has taken shape, and the closure of

its self-operated business lines "Small Oasis" and "Benefits Group"

confirms RED's commitment to serving third-party sellers and

connecting buyers with consumers. Currently, Zhang Xiaohui's live stream sales have exceeded

100 million yuan in a single session

on RED. With the combination of the buyer model and high average

order value, breakthroughs are expected in RED's live streaming

rooms during the Double 11 shopping festival.

III. Focusing on Local Lifestyles, the Commercialization of

Store-Exploring Is Accelerating:

September 2023: Distribution of

active and new users' attributes on RED

|

Attributes

|

Active users

|

New users

|

|

Male

|

39.25 %

|

44.30 %

|

|

Female

|

60.75 %

|

55.70 %

|

|

15 years old and

below

|

5.47 %

|

4.40 %

|

|

16-25 years

old

|

27.73 %

|

28.19 %

|

|

26-35 years

old

|

32.49 %

|

35.40 %

|

|

36-45 years

old

|

21.01 %

|

22.16 %

|

|

46 years old and

above

|

13.30 %

|

9.85 %

|

Data Source: MoonFox iApp; Data Collection Period:

September 2023. The statistical

results only include app data and do not include traffic data from

web pages, mini-programs, or quick apps, among others, within the

WeChat ecosystem.

The attributes of users give brands their tone, and RED's

community tone aligns well with the direction of store-exploring.

According to data from MoonFox iApp, as of September 2023, female users accounted for 60.75%

of the total user base on RED, with the majority of them falling

into the age range of 26-35. This group of users typically

possesses a certain level of aesthetic and judgment ability, as

well as an increase in their consumption level and disposable

income. They have a strong desire to share their experiences and

generally have a higher level of writing skills. In addition to

popular travel guides and experience-sharing notes, there has been

a growing trend of more diverse and high-demand notes related to

store-exploring. Focusing on these kinds of notes is becoming more

and more common among bloggers.

Formal data indicates that in 2022, there were more than tens of

millions of notes on RED pertaining to "food-exploring." "What to

eat" has become one of the core search scenarios for users on RED,

and there has been an emergence of explosive notes with hundreds of

thousands of views and tens of thousands of favorites. These

explosive notes are undoubtedly attractive to merchants. However,

the majority of merchants choose to interact through private

messages due to the scarcity of available communication channels,

which results in low efficiency. Additionally, because they cannot

select suitable bloggers, their promotional efforts also yield

minimal results.

On the other hand, bloggers are also facing challenges, such as

difficulty in monetizing their notes and connecting with merchants.

In response to this, some merchants choose to build or collaborate

with professional PR teams to connect with bloggers. In contrast,

bloggers themselves share merchant resources through group chats

and other means. However, due to the lack of official guidance,

there are widespread issues in the industry, such as violation of

regulations due to excessive promotion or breaches of contracts

either by businesses or bloggers, resulting in damages to both

parties' interests. It is critical that these flaws be addressed

and rectified immediately.

Based on this, in April 2023, the

official launched the "Food Power Store" plan, which first

introduced the "offline store" feature on the account home page to

drive traffic for merchants. At the same time, the "Spotlight Plan"

was introduced, starting with pilot cities such as Beijing, Shanghai, Guangzhou, and Shenzhen, providing users with a platform to

accept orders. Merchants can provide transportation expenses or

offer goods in exchange to bloggers, who can then publish their

notes without worrying about violations or traffic

restrictions.

In June of the same year, RED launched themed store-exploring

activities such as "Cafe Tour," where users can purchase themed

group-buying packages on the RED platform and gain official traffic

boost by publishing notes. In July, RED officially launched the

"Exploring 100 Stores" plan and simultaneously launched the

Store-Exploring Cooperation Center, further facilitating

cooperation between stores and influential bloggers. For every

order, bloggers are able to view estimated commission income and

sharing amount.

With multiple activities and traffic support, many bloggers

began to notice the importance and standardization of RED's

store-exploring business. Businesses also started to choose

official channels for influencer collaborations. In the future, we

believe that as the store-exploring model in major cities becomes

successful, RED will gradually incorporate local lifestyle services

into the platform. After completing the search and browsing seeding

content, users will no longer need to exit RED and open other

platforms to check prices. Group-buying packages and official

accounts will be completely incorporated into the flow of RED

notes. The standardized store-exploring business will attract more

businesses to join and generate revenue through profit-sharing.

IV. Under the Acceleration of Commercialization, Can the

Community Maintain Its Unique Character?

We believe that regardless of e-commerce or store-exploring, the

acceleration of commercialization in RED will inevitably impact its

community attributes and user experience. In this perspective, we

believe that the following two points should be highlighted:

Firstly, optimizing algorithms to control the proportion of

marketing content and improve the viewing experience. Under the

development of e-commerce, the proportion of live-streaming content

will increase, and the proportion of live-streaming interfaces

within the image-text content will directly affect the perceived

experience of highly engaged users. The UI design and exit methods

should be clear and smooth. In the offline store-exploring

business, the division of store categories and targeted promotion

needs to be considered to avoid mismatching users and note content,

which can lead to a negative impact on user experience.

Secondly, protecting creators and providing traffic support.

Based on the "PUGC + controlling traffic of top accounts", RED's

rapid development in the early stage relied on image-text content

as the main rival against short videos. Daily sharing can garner a

certain amount of likes or even followers, which is the core

driving force for middle-tier and micro-influencers to write notes

in the initial stage. As the commercialization of store-exploring

deepens, RED must connect more middle-tier and even long-tail

influencers with businesses. This is key to maintaining the

community's unique character and ensuring the stable and

sustainable development of store-exploring content.

In summary, the commercialization of RED, which has experienced

rapid growth, is an important battle that cannot be avoided. We are

excited about RED's future growth and anticipate more

surprises.

Website: https://www.moonfox.cn/

Contact number: 400-888-0936

View original content to download

multimedia:https://www.prnewswire.com/news-releases/moonfox-data-image-text-content-hot-items-and-seeding-drive-the-rapid-growth-of-red-community-301981573.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/moonfox-data-image-text-content-hot-items-and-seeding-drive-the-rapid-growth-of-red-community-301981573.html

SOURCE Aurora