false2023FY0000055529http://fasb.org/us-gaap/2022#PensionExpensehttp://fasb.org/us-gaap/2022#PensionExpensehttp://fasb.org/us-gaap/2022#PensionExpense00000555292022-05-012023-04-3000000555292022-10-31iso4217:USD00000555292023-06-26xbrli:shares00000555292021-05-012022-04-30iso4217:USDxbrli:shares0000055529us-gaap:CommonStockMember2021-04-300000055529us-gaap:AdditionalPaidInCapitalMember2021-04-300000055529us-gaap:TreasuryStockCommonMember2021-04-300000055529us-gaap:RetainedEarningsMember2021-04-300000055529us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-3000000555292021-04-300000055529us-gaap:RetainedEarningsMember2021-05-012022-04-300000055529us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-05-012022-04-300000055529us-gaap:CommonStockMember2021-05-012022-04-300000055529us-gaap:AdditionalPaidInCapitalMember2021-05-012022-04-300000055529us-gaap:CommonStockMember2022-04-300000055529us-gaap:AdditionalPaidInCapitalMember2022-04-300000055529us-gaap:TreasuryStockCommonMember2022-04-300000055529us-gaap:RetainedEarningsMember2022-04-300000055529us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-3000000555292022-04-300000055529us-gaap:RetainedEarningsMember2022-05-012023-04-300000055529us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-05-012023-04-300000055529us-gaap:CommonStockMember2022-05-012023-04-300000055529us-gaap:AdditionalPaidInCapitalMember2022-05-012023-04-300000055529us-gaap:CommonStockMember2023-04-300000055529us-gaap:AdditionalPaidInCapitalMember2023-04-300000055529us-gaap:TreasuryStockCommonMember2023-04-300000055529us-gaap:RetainedEarningsMember2023-04-300000055529us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-3000000555292023-04-300000055529kequ:KewauneeLabwayAsiaMemberkequ:KewauneeScientificCorporationMember2023-04-30xbrli:pure0000055529kequ:KewauneeScientificCorporationMemberkequ:KewauneeScientificCorporationSingaporeMember2023-04-300000055529kequ:KewauneeLabwayIndiaMemberkequ:KewauneeScientificCorporationMember2023-04-300000055529kequ:KewauneeScientificCorporationMemberkequ:KoncepoScientechInternationalMember2023-04-300000055529kequ:KequipGlobalLabSolutionsMemberkequ:KewauneeScientificCorporationSingaporeMember2023-04-300000055529srt:SubsidiariesMember2023-04-300000055529srt:SubsidiariesMember2022-04-300000055529kequ:InternationalOperationsMemberus-gaap:OperatingSegmentsMember2022-05-012023-04-300000055529kequ:InternationalOperationsMemberus-gaap:OperatingSegmentsMember2021-05-012022-04-300000055529us-gaap:LandMember2023-04-300000055529us-gaap:LandMember2022-04-300000055529us-gaap:BuildingImprovementsMember2023-04-300000055529us-gaap:BuildingImprovementsMember2022-04-300000055529us-gaap:BuildingImprovementsMembersrt:MinimumMember2021-05-012022-04-300000055529us-gaap:BuildingImprovementsMembersrt:MinimumMember2022-05-012023-04-300000055529srt:MaximumMemberus-gaap:BuildingImprovementsMember2021-05-012022-04-300000055529srt:MaximumMemberus-gaap:BuildingImprovementsMember2022-05-012023-04-300000055529us-gaap:MachineryAndEquipmentMember2023-04-300000055529us-gaap:MachineryAndEquipmentMember2022-04-300000055529us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2022-05-012023-04-300000055529us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2021-05-012022-04-300000055529srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2021-05-012022-04-300000055529srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2022-05-012023-04-300000055529us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-04-300000055529us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-04-300000055529us-gaap:OtherNoncurrentAssetsMember2023-04-300000055529us-gaap:OtherNoncurrentAssetsMember2022-04-3000000555292021-12-222021-12-220000055529kequ:TradingSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-04-300000055529kequ:TradingSecuritiesMember2023-04-300000055529us-gaap:CashSurrenderValueMemberus-gaap:FairValueInputsLevel2Member2023-04-300000055529us-gaap:CashSurrenderValueMember2023-04-300000055529us-gaap:FairValueInputsLevel1Member2023-04-300000055529us-gaap:FairValueInputsLevel2Member2023-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:NonQualifiedCompensationPlanMember2023-04-300000055529kequ:NonQualifiedCompensationPlanMember2023-04-300000055529kequ:TradingSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-04-300000055529kequ:TradingSecuritiesMember2022-04-300000055529us-gaap:CashSurrenderValueMemberus-gaap:FairValueInputsLevel2Member2022-04-300000055529us-gaap:CashSurrenderValueMember2022-04-300000055529us-gaap:FairValueInputsLevel1Member2022-04-300000055529us-gaap:FairValueInputsLevel2Member2022-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:NonQualifiedCompensationPlanMember2022-04-300000055529kequ:NonQualifiedCompensationPlanMember2022-04-30kequ:compensation_plan0000055529us-gaap:GeographicDistributionDomesticMemberus-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMember2022-05-012023-04-300000055529us-gaap:GeographicDistributionDomesticMemberus-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMember2021-05-012022-04-300000055529us-gaap:GeographicDistributionDomesticMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-05-012023-04-300000055529us-gaap:GeographicDistributionDomesticMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2021-05-012022-04-300000055529us-gaap:RestrictedStockUnitsRSUMember2022-05-012023-04-300000055529us-gaap:RestrictedStockUnitsRSUMember2021-05-012022-04-300000055529us-gaap:GeographicDistributionDomesticMemberus-gaap:TransferredOverTimeMember2022-05-012023-04-300000055529us-gaap:GeographicDistributionForeignMemberus-gaap:TransferredOverTimeMember2022-05-012023-04-300000055529us-gaap:TransferredOverTimeMember2022-05-012023-04-300000055529us-gaap:TransferredAtPointInTimeMemberus-gaap:GeographicDistributionDomesticMember2022-05-012023-04-300000055529us-gaap:TransferredAtPointInTimeMemberus-gaap:GeographicDistributionForeignMember2022-05-012023-04-300000055529us-gaap:TransferredAtPointInTimeMember2022-05-012023-04-300000055529us-gaap:GeographicDistributionDomesticMember2022-05-012023-04-300000055529us-gaap:GeographicDistributionForeignMember2022-05-012023-04-300000055529us-gaap:GeographicDistributionDomesticMemberus-gaap:TransferredOverTimeMember2021-05-012022-04-300000055529us-gaap:GeographicDistributionForeignMemberus-gaap:TransferredOverTimeMember2021-05-012022-04-300000055529us-gaap:TransferredOverTimeMember2021-05-012022-04-300000055529us-gaap:TransferredAtPointInTimeMemberus-gaap:GeographicDistributionDomesticMember2021-05-012022-04-300000055529us-gaap:TransferredAtPointInTimeMemberus-gaap:GeographicDistributionForeignMember2021-05-012022-04-300000055529us-gaap:TransferredAtPointInTimeMember2021-05-012022-04-300000055529us-gaap:GeographicDistributionDomesticMember2021-05-012022-04-300000055529us-gaap:GeographicDistributionForeignMember2021-05-012022-04-300000055529kequ:FiscalYearTwoThousandTwentyFourMember2022-05-012023-04-300000055529kequ:ForeignSubsidiariesMember2023-04-300000055529kequ:ForeignSubsidiariesMember2022-04-3000000555292013-05-0600000555292019-12-1300000555292020-02-0100000555292022-06-270000055529kequ:AdvanceAmountOneMember2022-04-300000055529kequ:AdvanceAmountTwoMember2022-04-300000055529kequ:AdvancesMember2022-04-300000055529us-gaap:BaseRateMemberus-gaap:LineOfCreditMember2021-05-012022-04-300000055529us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-05-012022-04-300000055529kequ:CreditAgreementMidCapFundingIVTrustMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-190000055529kequ:CreditAgreementMidCapFundingIVTrustMemberkequ:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-192022-12-190000055529kequ:CreditAgreementMidCapFundingIVTrustMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-04-300000055529kequ:InternationalSubsidiariesMember2023-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2023-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2023-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2023-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodFourMember2023-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2022-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2022-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2022-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodFourMember2022-04-300000055529kequ:TermLoanBMemberus-gaap:DebtInstrumentRedemptionPeriodFiveMember2022-04-300000055529us-gaap:DebtInstrumentRedemptionPeriodOneMemberkequ:BankGuaranteesMember2022-04-30kequ:renewalOption0000055529us-gaap:BuildingMember2022-05-012023-04-3000000555292020-03-272020-03-270000055529us-gaap:MinistryOfFinanceIndiaMember2022-05-012023-04-300000055529us-gaap:MinistryOfFinanceIndiaMember2021-05-012022-04-3000000555292017-12-222017-12-220000055529srt:MinimumMember2022-05-012023-04-300000055529srt:MaximumMember2022-05-012023-04-300000055529kequ:TwoThousandTenAndTwoThousandEightPlanMember2023-04-300000055529kequ:TwoThousandSeventeenOmnibusIncentivePlanMember2017-08-300000055529kequ:TwoThousandSeventeenOmnibusIncentivePlanMember2023-04-300000055529kequ:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-05-012023-04-300000055529kequ:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-05-012022-04-300000055529kequ:TwoThousandSeventeenOmnibusIncentivePlanMembersrt:MinimumMemberkequ:RestrictedStockUnitsRSUsServiceComponentMember2022-05-012023-04-300000055529srt:MaximumMemberkequ:TwoThousandSeventeenOmnibusIncentivePlanMemberkequ:RestrictedStockUnitsRSUsServiceComponentMember2022-05-012023-04-300000055529kequ:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-300000055529us-gaap:RestrictedStockUnitsRSUMember2022-04-300000055529us-gaap:RestrictedStockUnitsRSUMember2021-04-300000055529us-gaap:RestrictedStockUnitsRSUMember2023-04-300000055529kequ:TwoThousandAndEightPlanMember2023-04-300000055529kequ:TwoThousandAndEightPlanMember2015-08-262015-08-260000055529srt:MaximumMemberkequ:TwoThousandAndEightPlanMember2022-05-012023-04-300000055529kequ:TwoThousandAndEightPlanMember2022-05-012023-04-300000055529us-gaap:AccumulatedTranslationAdjustmentMember2021-04-300000055529us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-04-300000055529us-gaap:AccumulatedTranslationAdjustmentMember2021-05-012022-04-300000055529us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-05-012022-04-300000055529us-gaap:AccumulatedTranslationAdjustmentMember2022-04-300000055529us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-04-300000055529us-gaap:AccumulatedTranslationAdjustmentMember2022-05-012023-04-300000055529us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-05-012023-04-300000055529us-gaap:AccumulatedTranslationAdjustmentMember2023-04-300000055529us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-04-300000055529kequ:YieldCurveTechniqueMemberus-gaap:PensionPlansDefinedBenefitMember2023-04-300000055529kequ:YieldCurveTechniqueMember2021-05-012022-04-300000055529kequ:YieldCurveTechniqueMember2022-05-012023-04-300000055529srt:MaximumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-04-300000055529srt:MaximumMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-04-300000055529srt:MaximumMemberus-gaap:FixedIncomeSecuritiesMember2023-04-300000055529srt:MaximumMemberus-gaap:FixedIncomeSecuritiesMember2022-04-300000055529us-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-04-300000055529us-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-04-300000055529us-gaap:FixedIncomeSecuritiesMember2023-04-300000055529us-gaap:FixedIncomeSecuritiesMember2022-04-300000055529us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-04-300000055529us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2023-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2023-04-300000055529us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2023-04-300000055529kequ:DefinedBenefitPlanEquitySecuritiesUSSmallCapAndMidCapMemberus-gaap:FairValueInputsLevel1Member2023-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:DefinedBenefitPlanEquitySecuritiesUSSmallCapAndMidCapMember2023-04-300000055529kequ:DefinedBenefitPlanEquitySecuritiesUSSmallCapAndMidCapMemberus-gaap:FairValueInputsLevel3Member2023-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-04-300000055529us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel3Member2023-04-300000055529us-gaap:FairValueInputsLevel1Memberkequ:DefinedBenefitPlanEmergingMarketsMember2023-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:DefinedBenefitPlanEmergingMarketsMember2023-04-300000055529kequ:DefinedBenefitPlanEmergingMarketsMemberus-gaap:FairValueInputsLevel3Member2023-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2023-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMember2023-04-300000055529us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-04-300000055529us-gaap:FairValueInputsLevel1Memberkequ:DefinedBenefitPlanLiquidAlternativesMember2023-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:DefinedBenefitPlanLiquidAlternativesMember2023-04-300000055529kequ:DefinedBenefitPlanLiquidAlternativesMemberus-gaap:FairValueInputsLevel3Member2023-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-04-300000055529us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2023-04-300000055529us-gaap:FairValueInputsLevel3Member2023-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2022-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2022-04-300000055529us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanEquitySecuritiesUsLargeCapMember2022-04-300000055529kequ:DefinedBenefitPlanEquitySecuritiesUSSmallCapAndMidCapMemberus-gaap:FairValueInputsLevel1Member2022-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:DefinedBenefitPlanEquitySecuritiesUSSmallCapAndMidCapMember2022-04-300000055529kequ:DefinedBenefitPlanEquitySecuritiesUSSmallCapAndMidCapMemberus-gaap:FairValueInputsLevel3Member2022-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2022-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2022-04-300000055529us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel3Member2022-04-300000055529us-gaap:FairValueInputsLevel1Memberkequ:DefinedBenefitPlanEmergingMarketsMember2022-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:DefinedBenefitPlanEmergingMarketsMember2022-04-300000055529kequ:DefinedBenefitPlanEmergingMarketsMemberus-gaap:FairValueInputsLevel3Member2022-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2022-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMember2022-04-300000055529us-gaap:FixedIncomeSecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-04-300000055529us-gaap:FairValueInputsLevel1Memberkequ:DefinedBenefitPlanLiquidAlternativesMember2022-04-300000055529us-gaap:FairValueInputsLevel2Memberkequ:DefinedBenefitPlanLiquidAlternativesMember2022-04-300000055529kequ:DefinedBenefitPlanLiquidAlternativesMemberus-gaap:FairValueInputsLevel3Member2022-04-300000055529us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-04-300000055529us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-04-300000055529us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2022-04-300000055529us-gaap:FairValueInputsLevel3Member2022-04-30kequ:segment0000055529kequ:DomesticOperationsMemberus-gaap:OperatingSegmentsMember2022-05-012023-04-300000055529kequ:DomesticOperationsMemberus-gaap:IntersegmentEliminationMember2022-05-012023-04-300000055529kequ:InternationalOperationsMemberus-gaap:IntersegmentEliminationMember2022-05-012023-04-300000055529us-gaap:IntersegmentEliminationMember2022-05-012023-04-300000055529us-gaap:CorporateNonSegmentMember2022-05-012023-04-300000055529kequ:DomesticOperationsMemberus-gaap:OperatingSegmentsMember2023-04-300000055529kequ:InternationalOperationsMemberus-gaap:OperatingSegmentsMember2023-04-300000055529us-gaap:NonUsMemberkequ:DomesticOperationsMemberus-gaap:OperatingSegmentsMember2022-05-012023-04-300000055529kequ:InternationalOperationsMemberus-gaap:NonUsMemberus-gaap:OperatingSegmentsMember2022-05-012023-04-300000055529us-gaap:NonUsMember2022-05-012023-04-300000055529kequ:DomesticOperationsMemberus-gaap:OperatingSegmentsMember2021-05-012022-04-300000055529kequ:DomesticOperationsMemberus-gaap:IntersegmentEliminationMember2021-05-012022-04-300000055529kequ:InternationalOperationsMemberus-gaap:IntersegmentEliminationMember2021-05-012022-04-300000055529us-gaap:IntersegmentEliminationMember2021-05-012022-04-300000055529us-gaap:CorporateNonSegmentMember2021-05-012022-04-300000055529kequ:DomesticOperationsMemberus-gaap:OperatingSegmentsMember2022-04-300000055529kequ:InternationalOperationsMemberus-gaap:OperatingSegmentsMember2022-04-300000055529us-gaap:NonUsMemberkequ:DomesticOperationsMemberus-gaap:OperatingSegmentsMember2021-05-012022-04-300000055529kequ:InternationalOperationsMemberus-gaap:NonUsMemberus-gaap:OperatingSegmentsMember2021-05-012022-04-300000055529us-gaap:NonUsMember2021-05-012022-04-300000055529us-gaap:FacilityClosingMember2022-05-012023-04-300000055529us-gaap:FacilityClosingMember2021-05-012022-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 10-K

__________________________

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 30, 2023

or

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 0-5286

KEWAUNEE SCIENTIFIC CORPORATION

(Exact name of registrant as specified in its charter)

__________________________

| | | | | | | | |

| Delaware | | 38-0715562 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

| | |

2700 West Front Street Statesville, North Carolina | | 28677-2927 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (704) 873-7202

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Exchange on which registered |

| Common Stock $2.50 par value | KEQU | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

__________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of shares of voting stock held by non-affiliates of the registrant was approximately $37,907,714 based on the last reported sale price of the registrant's Common Stock on October 31, 2022, the last business day of the registrant's most recently completed second fiscal quarter. Only shares beneficially owned by directors of the registrant (excluding shares subject to options) and each person owning more than 10% of the outstanding Common Stock of the registrant were excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. As of June 26, 2023, the registrant had outstanding 2,879,785 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE: Those portions of the Company's proxy statement for use in connection with Kewaunee Scientific Corporation's annual meeting of stockholders to be held on August 23, 2023, indicated in this report are incorporated by reference into Part III hereof.

| | | | | | | | |

| Table of Contents | | Page or

Reference |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| |

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this document constitute "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the "Reform Act"). All statements other than statements of historical fact included in this Annual Report, including statements regarding the Company's future financial condition, results of operations, business operations and business prospects, are forward-looking statements. Words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "predict," "believe" and similar words, expressions and variations of these words and expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions, and other important factors that could significantly impact results or achievements expressed or implied by such forward-looking statements. Such factors, risks, uncertainties and assumptions include, but are not limited to: competitive and general economic conditions, including disruptions from government mandates, both domestically and internationally, as well as supplier constraints and other supply disruptions; changes in customer demands; technological changes in our operations or in our industry; dependence on customers’ required delivery schedules; risks related to fluctuations in the Company’s operating results from quarter to quarter; risks related to international operations, including foreign currency fluctuations; changes in the legal and regulatory environment; changes in raw materials and commodity costs; acts of terrorism, war, governmental action, natural disasters and other Force Majeure events. The cautionary statements made pursuant to the Reform Act herein and elsewhere by us should not be construed as exhaustive. We cannot always predict what factors would cause actual results to differ materially from those indicated by the forward-looking statements. Over time, our actual results, performance, or achievements will likely differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, and such difference might be significant and harmful to our stockholders' interest. Many important factors that could cause such a difference are described under the caption "Risk Factors," in Item 1A of this Annual Report, which you should review carefully. These forward-looking statements speak only as of the date of this document. The Company assumes no obligation, and expressly disclaims any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Item 1. Business

GENERAL

Kewaunee Scientific Corporation (the "Company") was founded in 1906, incorporated in Michigan in 1941, became publicly-held in 1968, and was reincorporated in Delaware in 1970. Our principal business is the design, manufacture, and installation of laboratory, healthcare, and technical furniture and infrastructure products. Our products include steel and wood casework, fume hoods, adaptable modular systems, moveable workstations, stand-alone benches, biological safety cabinets, and epoxy resin work surfaces and sinks.

Our products are sold primarily through purchase orders and contracts submitted by customers through our dealers, our subsidiaries in Singapore and India, and a national distributor. Products are sold principally to pharmaceutical, biotechnology, industrial, chemical and commercial research laboratories, educational institutions, healthcare institutions, governmental entities, and manufacturing facilities. We consider the markets in which we compete to be highly competitive, with a significant amount of the business involving competitive public bidding.

It is common in the laboratory and healthcare furniture industries for customer orders to require delivery at extended future dates, as products are frequently installed in buildings yet to be constructed. Changes or delays in building construction may cause delays in delivery of the orders and our recognition of the sale. Since prices are normally quoted on a firm basis in the industry, we bear the burden of possible increases in labor and material costs between quotation of an order and delivery of the product. The impact of such possible increases is considered when determining the sales price. The primary raw materials and products manufactured by others and used by us in our products are cold-rolled carbon and stainless steel, hardwood lumber and plywood, paint, chemicals, resins, hardware, plumbing and electrical fittings. Such materials and products are purchased from multiple suppliers and are typically readily available.

Our need for working capital and our credit practices are comparable to those of other companies manufacturing, selling and installing similar products in similar markets. Since our products are used in building construction projects, in many cases payments for our products are received over longer periods of time than payments for many other types of manufactured products, thus requiring increased working capital. In addition, payment terms associated with certain projects provide for a retention amount until final completion of the project, thus also increasing required working capital. On average, payments for our products are received during the quarter following shipment, with the exception of the retention amounts which are collected at the final completion of the project.

We hold various patents and patent rights, but do not consider that our success or growth is dependent upon our patents or patent rights. Our business is not dependent upon licenses, franchises, concessions, trademarks, royalty agreements, or labor contracts.

Our business is not generally cyclical, although domestic sales are sometimes lower during our third quarter because of slower construction activity in certain areas of the country during the winter months. Sales for two of the Company's domestic dealers and our national stocking distributor represented, in the aggregate, approximately 35% and 38% of the Company's sales in fiscal years 2023 and 2022, respectively. Loss of all or part of our sales to a large customer would have a material effect on our financial operations.

Our order backlog at April 30, 2023 was $147.9 million, as compared to $173.9 million at April 30, 2022. Based on scheduled shipment dates and past experience, we estimate that not less than 91% of our order backlog at April 30, 2023 will be shipped during fiscal year 2024. However, it may be expected that delays in shipments will occur because of customer rescheduling or delay in completion of projects which involve the installation of our products.

SEGMENT INFORMATION

See Note 11, Segment Information, of the Notes to Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K for information concerning our Domestic and International business segments. COMPETITION

We consider the industries in which we participate to be highly competitive and believe that the principal deciding factors are price, product performance, and customer service. A significant portion of our business is based upon competitive public bidding.

RESEARCH AND EXPERIMENTATION EXPENDITURES

The amount spent and expensed by us during the fiscal year ended April 30, 2023 on research and experimentation expenditures activities related to new or redesigned products was $1,012,000. The amount spent for similar purposes in the fiscal year ended April 30, 2022 was $990,000.

ENVIRONMENTAL COMPLIANCE

In the last two fiscal years, compliance with federal, state, or local provisions enacted or adopted regulating the discharge of materials into the environment has had no material effect on us and such regulation is not expected to have a material effect on our earnings or competitive position in the future.

CULTURE AND WORKFORCE

We are a company of passionate, talented, and motivated people. We embrace collaboration and creativity, and encourage the iteration of ideas to address complex challenges in technology and society.

At April 30, 2023, the Company had 603 Domestic employees and 379 International employees. Our people are critical for our continued success, so we work hard to create an environment where employees can have fulfilling careers, and be happy, healthy, and productive. We offer competitive benefits and programs to take care of the diverse needs of our employees and their families, including opportunities for career growth and development, resources to support their financial health, and access to excellent healthcare choices and resources, including access to an onsite medical clinic and separate gym facility and regular access to onsite specialists. Our competitive compensation programs help us to attract and retain top candidates, and we will continue to invest in recruiting talented people to technical and non-technical roles, and rewarding them well.

The Company believes that open and honest communication among team members, managers, and leaders helps create a collaborative work environment where everyone can contribute, grow, and succeed. Team members are encouraged to come to their managers with questions, feedback, or concerns, and the Company conducts surveys that gauge employee engagement.

When necessary, we contract with businesses around the world to provide specialized services where we do not have appropriate in-house expertise or resources. We also contract with temporary staffing agencies when we need to cover short-term leaves, when we have spikes in business needs, or when we need to quickly incubate special projects. We choose our partners and staffing agencies carefully and continually make improvements to promote a respectful and positive working environment for everyone - employees, vendors, and temporary staff alike.

OTHER INFORMATION

Our Internet address is www.kewaunee.com. We make available, free of charge through this website, our annual report to stockholders. Our Form 10-K and 10-Q financial reports may be obtained by stockholders by writing the Secretary of the

Company, Kewaunee Scientific Corporation, P.O. Box 1842, Statesville, NC 28687-1842. The public may also obtain information on our reports, proxy, and information statements at the Securities and Exchange Commission ("SEC") Internet site www.sec.gov. The reference to our website does not constitute incorporation by reference of any information contained at that site.

EXECUTIVE OFFICERS OF THE REGISTRANT

Included in Part III, Item 10(b), Directors, Executive Officers and Corporate Governance, of this Annual Report on Form 10-K. Item 1A. Risk Factors

You should carefully consider the following risks before you decide to buy shares of our common stock. If any of the following risks actually occur, our business, results of operations, or financial condition would likely suffer. In such case, the trading price of our common stock would decline, and you may lose all or part of the money you paid to buy our stock.

This and other public reports may contain forward-looking statements based on current expectations, assumptions, estimates and projections about us and our industry. These forward-looking statements involve risks and uncertainties. Our actual results could differ materially from those forward-looking statements as a result of many factors, including those more fully described below and elsewhere in our public reports. We do not undertake to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

Risks Specific to our Company

If we lose a large customer, our sales and profits would decline.

We have substantial sales to three of our domestic channel partners. The combined sales to two dealers and our national stocking distributor accounted for approximately 35% of our sales in fiscal year 2023. Loss of all or a part of our sales to a large channel partner would have a material effect on our revenues and profits until an alternative channel partner could be developed.

We rely on the talents and efforts of key management and our Associates. If we are unable to retain or motivate key personnel, hire qualified personnel, or maintain and continue to adapt our corporate culture, we may not be able to grow or operate effectively.

Our performance largely depends on the talents and efforts of our Associates. Our ability to compete effectively and our future success depends on our continuing to identify, hire, develop, motivate, and retain key management and highly skilled personnel for all areas of our organization. In addition, our total compensation program may not always be successful in attracting new employees and retaining and motivating our existing employees. Restrictive immigration policy and regulatory changes may also affect our ability to hire, mobilize, or retain some of our global talent.

In addition, we believe that our corporate culture fosters innovation, creativity, and teamwork. As our organization grows and evolves, we may need to implement more complex organizational management structures or adapt our corporate culture and work environments to ever-changing circumstances, such as during times of a natural disaster or pandemic, and these changes could affect our ability to compete effectively or have an adverse effect on our corporate culture. With the constant evolution of workforce dynamics, if we do not manage these changes effectively, it could materially adversely affect our culture, reputation, and operational flexibility.

We are subject to other risks that might also cause our actual results to vary materially from our forecasts, targets, or projections, including:

•Failing to anticipate the need for and appropriately invest in information technology and logistical resources necessary to support our business, including managing the costs associated with such resources;

•Failing to generate sufficient future positive operating cash flows and, if necessary, secure and maintain adequate external financing to fund our operations and any future growth; and

•Interruptions in service by common carriers that ship goods within our distribution channels.

Our business and reputation are impacted by information technology system failures and network disruptions.

We, and our global supply chain, are exposed to information technology system failures or network disruptions caused by natural disasters, accidents, power disruptions, telecommunications failures, acts of terrorism or war, computer viruses, physical or electronic break-ins, ransomware or other cybersecurity incidents, or other events or disruptions. System redundancy and other continuity measures may be ineffective or inadequate, and our, or our vendors', business continuity and disaster recovery planning may not be sufficient for all eventualities. Such failures or disruptions can adversely impact our business by, among other things,

preventing access to our cloud-based systems, interfering with customer transactions or impeding the manufacturing and shipping of our products. These events could materially adversely affect our business, reputation, results of operations and financial condition.

Future cybersecurity incidents could expose us to liability and damage our reputation and our business.

We collect, process, store, and transmit large amounts of data, and it is critical to our business strategy that our facilities and infrastructure remain secure and are perceived by the marketplace to be secure. Our information technology systems are essential to our efforts to manufacture our products, process customer sales transactions, manage inventory levels, conduct business with our suppliers and other business partners, and record, summarize and analyze the results of our operations. These systems contain, among other things, material operational, financial and administrative information related to our business. As with most companies, there will always be some risk of physical or electronic break-ins, computer viruses, or similar disruptions.

In addition, we, like all entities, are the target of cybercriminals who attempt to compromise our systems. From time to time, we experience threats and intrusions that may require remediation to protect sensitive information, including our intellectual property and personal information, and our overall business. Any physical or electronic break-in, computer virus, cybersecurity attack or other security breach or compromise of the information handled by us or our service providers may jeopardize the security or integrity of information in our computer systems and networks or those of our customers and cause significant interruptions in our and our customers' operations.

Any systems and processes that we have developed that are designed to protect customer, associate and vendor information, and intellectual property, and to prevent data loss and other security attacks, cannot provide absolute security. In addition, we may not successfully implement remediation plans to address all potential exposures. It is possible that we may have to expend additional financial and other resources to address these problems. Failure to prevent or mitigate data loss or other security incidents could expose us or our customers, associates and vendors to a risk of loss or misuse of such information, cause customers to lose confidence in our data protection measures, damage our reputation, adversely affect our operating results or result in litigation or potential liability for us.

Additionally, we expect to continue to make investments in our information technology infrastructure. The implementation of these investments may be more costly or take longer than we anticipate, or could otherwise adversely affect our business operations, which could negatively impact our financial position, results of operations or cash flows.

Internal controls over financial reporting may not be effective at preventing or detecting material misstatements.

Because of its inherent limitations, internal controls over financial reporting may not prevent or detect material misstatements in the Company's consolidated financial statements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Risks Related to Operations

Sales to customers outside the United States or with international operations expose us to risks inherent in international sales.

During fiscal year 2023, 34% of our revenues were derived from sales outside of the United States. A key element of our growth strategy is to expand our worldwide customer base and our international operations. Operating in international markets requires significant resources and management attention and subjects us to regulatory, economic and political risks that are different from those in the United States. We cannot assure you that our expansion efforts into other international markets will be successful. Our experience in the United States and other international markets in which we already have a presence may not be relevant to our ability to expand in other emerging markets. Our international expansion efforts may not be successful in creating further demand for our products outside of the United States or in effectively selling our products in the international markets we enter.

If we fail to compete effectively, our revenue and profit margins could decline.

We face a variety of competition in all of the markets in which we participate. Competitive pricing, including price competition or the introduction of new products, could have material adverse effects on our revenues and profit margins.

Our ability to compete effectively depends to a significant extent on the specification or approval of our products by architects, engineers, and customers. If a significant segment of those communities were to decide that the design, materials, manufacturing, testing, or quality control of our products is inferior to that of any of our competitors, our sales and profits would be materially and adversely affected.

An increase in the price of raw materials could negatively affect our sales and profits.

It is common in the laboratory and healthcare furniture industries for customers to require delivery at extended future dates, as products are frequently installed in buildings yet to be constructed. Since prices are normally quoted on a firm basis in the industry, we bear the burden of possible increases in labor and material costs between the quotation of an order and the delivery of the products. Our principal raw materials are steel, including stainless steel, wood and epoxy resin. Numerous factors beyond our control, such as general economic conditions, competition, worldwide demand, labor costs, energy costs, and import duties and other trade restrictions, influence prices for our raw materials. We have not always been able, and in the future we might not be able, to increase our product prices in amounts that correspond to increases in costs of raw materials. Where we are not able to increase our prices, increases in our raw material costs will adversely affect our profitability.

Events outside our control may affect our operating results.

We have little control over the timing of shipping customer orders, as customers' required delivery dates are subject to change by the customer. Construction delays and customer changes to product designs are among the factors that may delay the start of manufacturing. Weather conditions, such as unseasonably warm, cold, or wet weather, can also affect and sometimes delay projects. Political and economic events can also affect our revenues. When sales do not meet our expectations, our operating results will be reduced for the relevant quarters.

Our principal markets are in the laboratory and healthcare building construction industry. This industry is subject to significant volatility due to various factors, none of which is within our control. Declines in construction activity or demand for our products could materially and adversely affect our business and financial condition.

We face numerous manufacturing and supply chain risks. In addition, our reliance upon sole or limited sources of supply for certain materials, components, and services could cause production interruptions, delays and inefficiencies.

We purchase materials, components, and equipment from third parties for use in our manufacturing operations. Our results of operations could be adversely impacted if we are unable to adjust our purchases to reflect changes in customer demand and market fluctuations. Suppliers may extend lead times, limit supplies, or increase prices. If we cannot purchase sufficient products at competitive prices and of sufficient quality on a timely enough basis to meet increasing demand, we may not be able to satisfy market demand, product shipments may be delayed, our costs may increase, or we may breach out contractual commitments and incur liabilities.

In addition, some of our businesses purchase certain required products from sole or limited source suppliers for reasons of quality assurance, regulatory requirements, cost effectiveness, availability or uniqueness of design. If these or other suppliers encounter financial, operating, or other difficulties, or if our relationship with them changes, we might not be able to quickly establish or qualify replacement sources of supply. The supply chains for our businesses were impacted in fiscal year 2023 from factors outside our control and could also be disrupted in the future for such reasons as supplier capacity constraints, supplier bankruptcy or exiting of the business for other reasons, decreased availability of key raw materials or commodities and external events such as natural disasters, pandemics or other public health problems, war, terrorist actions, governmental actions and legislative or regulatory changes. Any of these factors could result in production interruptions, delays, extended lead times and inefficiencies.

Our revenues and other operating results depend in large part on our ability to manufacture our products in sufficient quantities and in a timely manner. Any interruptions we experience in the manufacture of our products or changes to the way we manufacture products could delay our ability to recognize revenues in a particular period. In addition, we must maintain sufficient production capacity in order to meet anticipated customer demand, which carries fixed costs that we may not be able to offset because we cannot always immediately adapt our production capacity and related cost structures to changing market conditions, which would adversely affect our operating margins. If we are unable to manufacture our products consistently, in sufficient quantities, and on a timely basis, our revenues, gross margins, and our other operating results will be materially and adversely affected.

Disruptions in the financial markets have historically created, and may continue to create, uncertainty in economic conditions that may adversely affect our customers and our business.

The financial markets in the United States, Europe and Asia have in the past been, and may in the future be, volatile. The tightening of credit in financial markets, worsening of economic conditions, a prolonged global, national or regional economic recession or other similar events could have a material adverse effect on the demand for our products and on our sales, pricing and profitability. We are unable to predict the likely occurrence or duration of these adverse economic conditions and the impact these events may have on our operations and the end users who purchase our products.

Our future growth may depend on our ability to penetrate new international markets.

International laws and regulations, construction customs, standards, techniques and methods differ from those in the United States. Significant challenges of conducting business in foreign countries include, among other factors, geopolitical tensions, local

acceptance of our products, political instability, currency controls, changes in import and export regulations, changes in tariff and freight rates and fluctuations in foreign exchange rates.

The effects of geopolitical instability, including as a result of Russia's invasion of Ukraine, may adversely affect us and heighten significant risks and uncertainties for our business, with the ultimate impact dependent on future developments, which are highly uncertain and unpredictable.

Ongoing geopolitical instability could negatively impact the global and U.S. economies in the future, including by causing supply chain disruptions, rising energy costs, volatility in capital markets and foreign currency exchange rates, rising interest rates, and heightened cybersecurity risks. The extent to which such geopolitical instability adversely affects our business, financial condition, and results of operations, as well as our liquidity and capital profile, is highly uncertain and unpredictable. If geopolitical instability adversely affects us, it may also have the effect of heightening other risks related to our business.

In response to the military conflict between Russia and Ukraine that began in February 2022, the United States and other North Atlantic Treaty Organization member states, as well as non-member states, announced targeted economic sanctions on Russia. The long-term impact on our business resulting from the disruption of trade in the region caused by the conflict and associated sanctions and boycotts is uncertain at this time due to the fluid nature of the ongoing military conflict and response. The potential impacts include supply chain and logistics disruptions, financial impacts including volatility in foreign exchange and interest rates, increased inflationary pressure on raw materials and energy, and other risks, including an elevated risk of cybersecurity threats and the potential for further sanctions.

Legal and Regulatory Compliance Risks

Changes in U.S. trade policy, including the imposition of tariffs and the resulting consequences, may have a material adverse impact on our business and results of operations.

We cannot predict the extent to which the U.S. or other countries will impose quotas, duties, tariffs, taxes or other similar restrictions upon the import or export of our products or raw materials in the future, nor can we predict future trade policy or the terms of any renegotiated trade agreements and their impact on our business. Changes in U.S. trade policy could result in one or more foreign governments adopting responsive trade policies making it more difficult or costly for us to import our products or raw materials from those countries. This, together with tariffs already imposed, or that may be imposed in the future, by the U.S., could require us to increase prices to our customers which may reduce demand, or, if we are unable to increase prices, result in lowering our margin on products sold. The adoption and expansion of trade restrictions, the occurrence of a trade war, or other governmental action related to tariffs or trade agreements or policies has the potential to adversely impact demand for our products, our costs, our customers, our suppliers, and the U.S. economy, which in turn could have a material adverse effect on our business, financial condition and results of operations.

Expectations related to environmental, social, and governance ("ESG") considerations could expose us to potential liabilities, increased costs, and reputational harm.

We are subject to laws, regulations, and other measures that govern a wide range of topics, including those related to matters beyond our core products and services. For instance, new laws, regulations, policies, and international accords relating to ESG matters, including sustainability, climate change, human capital, and diversity, are being developed and formalized in Europe, the U.S., and elsewhere, which may entail specific, target-driven frameworks and/or disclosure requirements. The implementation of these may require considerable investments. Any failure, or perceived failure, by us to adhere to any public statements or initiatives, comply with federal, state or international environmental social and governance laws and regulations, or meet evolving and varied stakeholder expectations and standards could result in legal and regulatory proceedings against us and could materially adversely affect the Company's business reputation, results of operations, financial condition, and stock price.

General Risks

Our stock price is likely to be volatile and could drop.

The trading price of our Common Stock could be subject to wide fluctuations in response to quarter-to-quarter variation in operating results, announcement of technological innovations or new products by us or our competitors, general conditions in the construction and construction materials industries, relatively low trading volume in our common stock and other events or factors. In addition, in recent years, the stock market has experienced extreme price fluctuations. This volatility has had a substantial effect on the market prices of securities issued by many companies for reasons unrelated to the operating performance of those companies. Securities market fluctuations may adversely affect the market price of our common stock.

We currently, and may in the future, have assets held at financial institutions that may exceed the insurance coverage offered by the Federal Deposit Insurance Corporation ("FDIC"), the loss of which would have a severe negative effect on our operations and liquidity.

We may maintain our cash assets at financial institutions in the U.S. in amounts that may be in excess of the FDIC insurance limit of $250,000. Actual events involving limited liquidity, defaults, non-performance or other adverse developments that affect financial institutions, transactional counterparties or other companies in the financial services industry of the financial services industry generally, or concerns or rumors about any events of these kinds or other similar risks, have in the past and may in the future lead to market-wide liquidity problems. In the event of a failure or liquidity issues of or at any of the financial institutions where we maintain our deposits or other assets, we may incur a loss to the extent such loss exceeds the FDIC insurance limitation, which could have a material adverse effect upon our liquidity, financial condition, and our results of operations.

Similarly, if our customers or partners experience liquidity issues as a result of financial institution defaults or non-performance where they hold cash assets, their ability to pay us may become impaired and could have a material adverse effect on our results of operations, including the collection of accounts receivable and cash flows.

The impact of investor concerns on U.S. or international financial systems could impact our ability to obtain favorable financing terms in the future.

Investor concerns regarding the U.S. or international financial systems could result in less favorable commercial financing terms, including higher interest rates or costs and tighter financial and operating covenants, or systemic limitations on access to credit and liquidity sources, thereby making it more difficult for us to acquire financing on terms favorable to us, or at all, and could have material adverse impacts on our liquidity, our business, financial condition or results of operations, and our prospects.

The impact of future pandemics could adversely affect our business, results of operations, financial condition, and liquidity.

While we believe we successfully navigated the risks associated with the recent COVID-19 pandemic and were able to successfully maintain our business operations, the extent of the impact of future COVID-19 variations or other pandemics on our business and financial results is, by nature of this type of event, highly uncertain. The sweeping nature of pandemics makes it extremely difficult to predict how and to what extent our business and operations could be affected in the long run. Our workforce, and the workforce of our vendors, service providers, and counterparties, could be affected by a pandemic, which could result in an adverse impact on our ability to conduct business. No assurance can be given that the actions we take to protect our Associates and our operations will be sufficient, nor can we predict the level of disruption that could occur to our employees' ability to provide customer support and service. New processes, procedures, and controls may be required to respond to any changes in our business environment. Further, should any key employees become ill during the course of a future health event and be unable to work, our ability to operate our internal controls may be adversely impacted.

Additional factors related to major public health issues that could have material and adverse effects on our ability to successfully operate include, but are not limited to, the following:

•The effectiveness of any governmental and non-governmental organizations in combating the spread and severity, including any legal and regulatory responses;

•A general decline in business activity, especially as it relates to our customers' expansion or consolidation activities;

•The destabilization of the financial markets, which could negatively impact our customer growth and access to capital, along with our customers' ability to make payments for their purchase orders; and

•Severe disruptions to and instability in the global financial markets, and deterioration in credit and financing conditions, which could affect our access to capital necessary to fund business operations or current investment and growth strategies.

Item 1B. Unresolved Staff Comments

Not Applicable.

Item 2. Properties

We lease and operate three adjacent manufacturing facilities in Statesville, North Carolina. These facilities also house our corporate offices, as well as sales and marketing, administration, engineering and drafting personnel. These facilities together comprise 414,000 square feet and are located on 20 acres of land. On March 24, 2022, we entered into a Sale-Leaseback Arrangement (defined below), pursuant to which we sold, and now lease, our manufacturing and office facilities in Statesville, North Carolina. See Note 5, Sale-Leaseback Financing Transaction, of the Notes to Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K for information concerning the Sale-Leaseback Arrangement. In addition, we lease our primary distribution facility and other warehouse facilities totaling 365,000 square feet in Statesville, North Carolina. We also lease an office facility in Charlotte, North Carolina. In Bangalore, India, we lease and operate a manufacturing facility comprising

119,000 square feet. Our international sales and administrative offices are located in Singapore, India, and Saudi Arabia. We believe our facilities are suitable for their respective uses and are adequate for our current needs.

Item 3. Legal Proceedings

From time to time, we are involved in disputes and litigation relating to claims arising out of our operations in the ordinary course of business. Further, we are periodically subject to government audits and inspections. We believe that any such matters presently pending will not, individually or in the aggregate, have a material adverse effect on our results of operations or financial condition.

Item 4. Mine Safety Disclosures

Not Applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

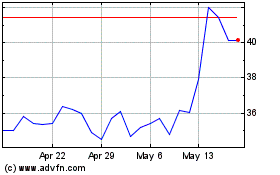

Our common stock is traded on the NASDAQ Global Market, under the symbol KEQU.

As of June 26, 2023, there were 111 stockholders of record. The declaration and payment of any future dividends is at the discretion of the Board of Directors and will depend upon many factors, including the Company's earnings, capital requirements, investment and growth strategies, financial conditions, the terms of the Company's indebtedness, which contains provisions that could limit the payment of dividends in certain circumstances, and other factors that the Board of Directors may deem to be relevant.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

See Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters, in this Form 10-K for a discussion of securities authorized for issuance under our equity compensation plans.

Item 6. Reserved

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

INTRODUCTION

Kewaunee Scientific Corporation is a recognized leader in the design, manufacture and installation of laboratory, healthcare and technical furniture products. The Company's corporate headquarters are located in Statesville, North Carolina. Sales offices are located in the United States, India, Saudi Arabia, and Singapore. Three manufacturing facilities are located in Statesville serving the domestic and international markets, and one manufacturing facility is located in Bangalore, India serving the local, Asian, and African markets. Kewaunee Scientific Corporation's website is located at www.kewaunee.com. The reference to our website does not constitute incorporation by reference of any information contained at that site.

Our products are sold primarily through purchase orders and contracts submitted by customers through our dealers, our subsidiaries in Singapore and India, and a national distributor. Products are sold principally to pharmaceutical, biotechnology, industrial, chemical and commercial research laboratories, educational institutions, healthcare institutions, governmental entities, manufacturing facilities and users of networking furniture. We consider the markets in which we compete to be highly competitive, with a significant amount of the market requiring competitive public bidding.

It is common in the laboratory and healthcare furniture industries for customer orders to require delivery at extended future dates, as products are frequently to be installed in buildings yet to be constructed. Changes or delays in building construction may cause delays in delivery of the orders and our recognition of the sale. Since prices are normally quoted on a firm basis in the industry, we bear the burden of possible increases in labor and material costs between quotation of an order and delivery of the product. The impact of such possible increases is considered when determining the sales price. The principal raw materials and products manufactured by others used in our products are cold-rolled carbon and stainless steel, hardwood lumbers and plywood, paint, chemicals, resins, hardware, plumbing and electrical fittings. Such materials and products are purchased from multiple suppliers and are typically readily available.

CRITICAL ACCOUNTING ESTIMATES

In the ordinary course of business, we have made estimates and assumptions relating to the reporting of results of operations and financial position in the preparation of our consolidated financial statements in conformity with generally accepted accounting principles in the United States of America. Actual results could differ significantly from those estimates. We believe that the following discussion addresses our most critical accounting estimates, which are those that are most important to the portrayal of our financial condition and results of operations, and require management's most difficult, subjective and complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain.

Allowance for Doubtful Accounts

Evaluation of the allowance for doubtful accounts involves management judgments and estimates. We evaluate the collectability of our trade accounts receivable based on a number of factors. In circumstances where management is aware of a customer's inability to meet its financial obligations to us, or a project dispute makes it unlikely that the outstanding amount owed by a customer will be collected, a specific reserve for bad debts is estimated and recorded to reduce the recognized receivable to the estimated amount we believe will ultimately be collected. In addition to specific customer identification of potential bad debts, a reserve for bad debts is estimated and recorded based on our recent past loss history and an overall assessment of past due trade accounts receivable amounts outstanding.

Pension Benefits

We sponsor pension plans covering all employees who met eligibility requirements as of April 30, 2005. These pension plans were amended as of April 30, 2005, no further benefits have been, or will be, earned under the plans subsequent to the amendment date, and no additional participants have been, or will be, added to the plans. Several statistical and other factors, which attempt to anticipate future events, are used in calculating the expense and liability related to the pension plans. These factors include actuarial assumptions about the discount rate used to calculate and determine benefit obligations and the expected return on plan assets within certain guidelines. The actuarial assumptions used by us may differ materially from actual results due to changing market and economic conditions, higher or lower withdrawal rates, or longer or shorter life spans of participants. These differences may significantly affect the amount of pension income or expense recorded by us in future periods.

Self-Insurance Reserves

The Company's domestic operations are self-insured for employee health care costs. The Company has purchased specific stop-loss insurance policies to limit claims above a certain amount. Estimated medical costs were accrued for claims incurred but not reported using assumptions based upon historical loss experiences. The Company's exposure reflected in the self-insurance reserves varies depending upon market conditions in the insurance industry, availability of cost-effective insurance coverage, and actual claims versus estimated future claims.

Income Taxes

We are subject to income taxes in the U.S. (federal and state) and numerous foreign jurisdictions. Tax laws, regulations, administrative practices, and interpretations in various jurisdictions may be subject to significant change, with or without notice, due to economic, political, and other conditions, and significant judgment is required in evaluating and estimating our provision and accruals for these taxes. There are many transactions that occur during the ordinary course of business for which the ultimate tax determination is uncertain. In addition, our actual and forecasted earnings are subject to change due to economic, political, and other conditions.

Our effective tax rates could be affected by numerous factors, such as changes in our business operations, acquisitions, investments, entry into new businesses and geographies, intercompany transactions, the relative amount of our foreign earnings, including earnings being lower than anticipated in jurisdictions where we have lower statutory rates and higher than anticipated in jurisdictions where we have higher statutory rates, losses incurred in jurisdictions for which we are not able to realize related tax benefits, the applicability of special tax regimes, changes in foreign currency exchange rates, changes to our forecasts of income and loss and the mix of jurisdictions to which they relate, changes in our deferred tax assets and liabilities and their valuation, and interpretations related to tax laws and accounting rules in various jurisdictions.

RESULTS OF OPERATIONS

Sales for fiscal year 2023 were $219.5 million, an increase compared to fiscal year 2022 sales of $168.9 million. Domestic Segment sales for fiscal year 2023 were $146.7 million, an increase of 15.7% compared to fiscal year 2022 sales of $126.8 million. The increase in Domestic Segment sales is primarily driven by the pricing of new orders in response to higher raw material input costs. International Segment sales for fiscal year 2023 were $72.8 million, an increase of 73.2% from fiscal year 2022 sales of $42.0 million. The increase in International Segment sales in fiscal year 2023 is due to the delivery of several large projects in India, Asia, and Africa that were awarded over the course of the past eighteen months.

Our order backlog was $147.9 million at April 30, 2023, as compared to $173.9 million at April 30, 2022. The decrease in backlog is primarily attributable to the substantial completion of the previously announced Dangote Oil project in Nigeria during the fiscal year and a reduction in new orders within the ASEAN marketplace. The Company's backlog for the United States and Indian markets on April 30, 2023 is similar to prior fiscal year levels as order rates in these markets remain strong.

Gross profit represented 16.2% and 14.3% of sales in fiscal years 2023 and 2022, respectively. The increase in gross profit margin percentage for fiscal year 2023 is driven by the significant increase in International Segment sales, which has a higher gross profit rate than the Domestic Segment, coupled with an increase in Domestic Segment sales that had improved pricing as noted above.

Operating expenses were $30.2 million and $26.8 million in fiscal years 2023 and 2022, respectively, and 13.8% and 15.9% of sales, respectively. The increase in operating expense in fiscal year 2023 as compared to fiscal year 2022 was primarily due to increases in consulting and professional fees of $552,000, corporate governance expenses of $113,000, and increases in International Segment operating expenses of $2,286,000 as a result of the significant sales growth experienced. These increases were partially offset by reductions in administrative wages, benefits, and stock-based compensation of $142,000, and marketing expense of $223,000. The increase in operating expenses for fiscal year 2023 also included a one-time charge related to the write-down of a prior year insurance claim in the amount of $260,000. The increase in international operating expenses for fiscal year 2023 is related to the continued sales growth in the International operating segment.

Pension expense was $71,000 in fiscal year 2023, compared to pension income of $355,000 in fiscal year 2022. The increase in pension expense was primarily due to the lower expected return on plan assets driven by a decrease in plan assets in the prior fiscal year.

Other income, net was $939,000 and $400,000 in fiscal years 2023 and 2022, respectively. The increase in other income in fiscal year 2023 was primarily due to interest income earned on the cash balances held by the Company's international subsidiaries and the increased interest earned on the Note Receivable related to the Sale-Leaseback financing transaction when compared to the prior fiscal year. See Note 5, Sale-Leaseback Financing Transaction for additional information on this transaction. Interest expense was $1,734,000 and $632,000 in fiscal years 2023 and 2022, respectively. The increase in interest expense for fiscal year 2023 was primarily due to the Sale-Leaseback financing transaction noted above, partially offset by a decrease in interest expense related to the Company's revolving credit facility.

Income tax expense was $3.1 million and $3.5 million for fiscal years 2023 and 2022, respectively, or 69.8% and 141.6% of pretax earnings (loss), respectively. The effective rate for fiscal year 2023 was unfavorably impacted by the increase in the valuation allowance attributable to changes to Internal Revenue Code Section 174 Research and Experimental Expenditures, which became effective in the current fiscal year. The primary impact of this change is the amortization of current year expenditures over a five year period, as compared to prior fiscal years where research expenditures were deductible in the year incurred. The effective rate change for fiscal year 2022 was also unfavorably impacted due to changes in the valuation allowance

attributable to the net increase in deferred tax assets of $4,170,000 before valuation allowance as a result of the book to tax differences primarily related to the Company's execution of a Sale-Leaseback transaction for owned real property, which was treated as a taxable sale transaction for tax purposes and a financing transaction for financial statement reporting purposes.

Net earnings attributable to the non-controlling interest related to our subsidiaries that are not 100% owned by the Company were $621,000 and $123,000 for fiscal years 2023 and 2022, respectively. The changes in the net earnings attributable to the non-controlling interest for each year were due to changes in the levels of net income of the subsidiaries.

Net earnings were $738,000, or $0.25 per diluted share, as compared to net loss of $6,126,000, or $2.20 per diluted share, for fiscal years ended April 30, 2023 and April 30, 2022, respectively. The increase in net earnings was attributable to the factors discussed above.

LIQUIDITY AND CAPITAL RESOURCES

Our principal sources of liquidity have historically been funds generated from operating activities, supplemented as needed by borrowings under our revolving credit facility. Additionally, certain machinery and equipment are financed by non-cancelable operating and financing leases. We believe that these sources of funds will be sufficient to support ongoing business requirements, including capital expenditures, through fiscal year 2024.

At April 30, 2023, we had $3,548,000 outstanding under our $15.0 million revolving credit facility. See Note 4, Long-term Debt and Other Credit Arrangements, of the Notes to Consolidated Financial Statements included in Item 8 of this Annual Report for additional information concerning our credit facility. In fiscal year 2022, we executed a Sale-Leaseback financing transaction with respect to our manufacturing and corporate facilities in Statesville, North Carolina to provide additional liquidity. See Note 5, Sale-Leaseback Financing Transaction for more information. We did not have any off balance sheet arrangements at April 30, 2023 or 2022. The following table summarizes the cash payment obligations for our lease and financing arrangements as of April 30, 2023:

PAYMENTS DUE BY PERIOD

($ in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Contractual Cash Obligations | Total | | 1 Year | | 2-3 Years | | 4-5 Years | | After 5 years |

| Operating Leases | $ | 10,636 | | | $ | 2,373 | | | $ | 4,095 | | | $ | 2,788 | | | $ | 1,380 | |

| Financing Lease Obligations | 254 | | | 91 | | | 163 | | | — | | | — | |

| Sale-Leaseback Financing Transaction | 43,917 | | | 1,931 | | | 3,979 | | | 4,140 | | | 33,867 | |

| Total Contractual Cash Obligations | $ | 54,807 | | | $ | 4,395 | | | $ | 8,237 | | | $ | 6,928 | | | $ | 35,247 | |

The Company's operating activities used cash of $3,790,000 in fiscal year 2023, primarily for increases in receivables of $4,947,000 and decreases in accounts payable and accrued expenses of $5,558,000, partially offset by cash from operations, decreases in inventories of $1,907,000, and increases in deferred revenue of $568,000. Operating activities used cash of $7,885,000 in fiscal year 2022, primarily for operations, increases in inventories of $7,279,000 and receivables of $8,464,000, partially offset by increases in accounts payable and accrued expenses of $11,886,000 and a decrease in income tax receivable of $955,000.

The Company's financing activities provided cash of $14,931,000 during fiscal year 2023 as a result of the collection of $13,629,000 in final proceeds from the Sale-Leaseback transaction executed in the prior fiscal year and proceeds from the net increase in short-term borrowings of $1,998,000, partially offset by repayment of long-term debt of $121,000. The Company's financing activities provided cash of $11,031,000 during fiscal year 2022 from proceeds of $15,893,000 from the Sale-Leaseback transaction, including redemption of preferred shares from the buyer, net of debt issuance costs, partially offset by payments of $5,239,000 for short-term borrowings.