false

0001347242

0001347242

2024-12-31

2024-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 31, 2024

Lipella

Pharmaceuticals Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

005-93847 |

|

20-2388040 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7800

Susquehanna St., Suite 505

Pittsburgh,

PA |

|

15208 |

| (Address

of registrant’s principal executive office) |

|

(Zip

code) |

Registrant’s

telephone number, including area code: (412) 894-1853

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.0001 per share |

|

LIPO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01 |

Entry into

a Material Definitive Agreement. |

As previously disclosed in the Current Report on Form

8-K filed by Lipella Pharmaceuticals Inc. (the “Company”) with the U.S. Securities and Exchange Commission (the “SEC”)

on December 30, 2024 (the “Initial Form 8-K”), the Company sold an aggregate of 22,295 shares of Series B non-voting convertible

preferred stock, par value $0.0001 per share, of the Company (the “Series

B Preferred Stock”) to certain investors for a purchase price of $100

per share in connection with an initial closing (the “Initial Closing”) of a best efforts private placement offering

of up to $6,000,000 (the “Maximum Amount”) of shares of Series B Preferred Stock (the “Offering”), with Spartan

Capital Securities, LLC (“Spartan”) providing placement agent and consulting services in connection therewith.

On

December 31, 2024, in connection with a second closing of the Offering (the “Second Closing”), the Company formally

entered into subscription agreements (the “Subscription Agreements”) with additional investors (the “Second

Closing Investors”), pursuant to which the Company issued and sold to the Second Closing Investors an aggregate of 3,680

shares of Series B Preferred Stock and received gross proceeds of $368,000. Such shares of Series B Preferred Stock are convertible

into 117,948 shares of common stock, par value $0.0001 per share, of the Company (the “Common Stock”) at a conversion

price of $3.12 per share, subject to customary adjustments, which is equal to the Minimum Price (as defined in Rule 5635(d)(1)(A) of

The Nasdaq Stock Market LLC) immediately prior to the execution of the Subscription Agreements. Other than the conversion price for

such shares of Series B Preferred Stock, the Subscription Agreements between the Company and each Second Closing Investor are nearly

identical to the subscription agreements that were executed in connection with the Initial Closing. The Company received net

proceeds of $305,440 in connection with the Second Closing and currently intends to use all proceeds raised in the Offering for

working capital and general corporate purposes. In connection with the Second Closing, the Company and each Second Closing Investor

also entered into a registration rights agreement (a “Registration Rights Agreement”), which is nearly identical to the

registration rights agreements executed in connection with the Initial Closing. For additional details regarding the terms of the

Subscription Agreements and Registration Rights Agreements, please see the Initial Form 8-K and the applicable exhibits filed

therewith.

At

the Second Closing and in accordance with the Spartan Agreements (as defined in the Initial Form 8-K), the Company paid Spartan an aggregate

of $62,560 in placement agent and consulting fees and issued to (i) Spartan and its designee an aggregate of 42,933 shares of the Company’s

Series C voting convertible preferred stock, par value $0.0001 per share (the “Series C Preferred Stock”), and (ii) Spartan

a placement agent warrant (the “Placement Agent Warrant”) to purchase up to 11,795 shares of Common Stock. Other than the

number of shares and expiration date, the Placement Agent Warrant is nearly identical to the placement agent warrant issued to Spartan

in connection with the Initial Closing. Also in connection with the Second Closing, pursuant to that certain irrevocable proxy and power

of attorney between Spartan and Jonathan Kaufman, Chief Executive Officer of the Company (the “Irrevocable Proxy”), Spartan

agreed to grant to Dr. Kaufman all voting power over and power of attorney with respect to all such shares of Series C Preferred Stock,

and all shares of Common Stock issuable upon conversion of such shares or exercise of the Placement Agent Warrant, issued or issuable

to Spartan or its Attribution Parties (as defined in the Irrevocable Proxy) in connection with the Second Closing. For additional details

regarding the terms of the Irrevocable Proxy, such shares of Series C Preferred Stock and the Placement Agent Warrant, please see the

Initial Form 8-K and the applicable exhibits filed therewith.

At

the Second Closing, such shares of Series B Preferred Stock were offered and sold to the Second Closing Investors, and such Placement

Agent Warrant and shares of Series C Preferred Stock were issued to Spartan and its designee, as applicable, pursuant to an exemption

from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided in Section

4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder. In

connection with the offer, sale and/or issuance of such securities, the Company relied on the Second Closing Investors’, Spartan’s

and its designee’s written representations, as applicable, that they were each an “accredited investor” as defined

in Rule 501(a) of Regulation D. In addition, neither the Company nor anyone acting on its behalf offered or sold such securities by any

form of general solicitation or general advertising.

The

foregoing descriptions of the Irrevocable Proxy, and each of the forms of Subscription Agreement, Registration Rights Agreement and Placement

Agent Warrant do not purport to be complete and are qualified in their entirety by reference to the full text of such agreements. The

forms of Subscription Agreement, Registration Rights Agreement and Placement Agent Warrant were filed as Exhibits 10.2, 10.3, and 4.1,

respectively, to the Initial Form 8-K and are incorporated herein by reference. The Irrevocable Proxy reflecting the additional securities

issued in connection with the Second Closing is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Form 8-K”)

and is also incorporated herein by reference.

This Form

8-K contains forward-looking statements. Forward-looking statements include, but are not limited to, statements that express the Company’s

intentions, beliefs, expectations, strategies, predictions or any other statements related to the Company’s future activities, or

future events or conditions, including without limitation, the Company’s intended use of the proceeds raised from the Offering,

the Company’s ability to file the applicable Registration Statements (as defined in the Registration Rights Agreements) and have

them declared effective by the SEC, or the Company’s and/or Spartan’s ability to continue the Offering or raise the Maximum

Amount. These statements are based on current expectations, estimates and projections about the Company’s business based, in part,

on assumptions made by its management. These statements are not guarantees of future performances and involve risks, uncertainties and

assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted

in the forward-looking statements due to numerous factors, including those risks discussed in the Company’s Annual Report on Form

10-K and other reports and documents that the Company files from time to time with the SEC. Any forward-looking statements speak only

as of the date on which they are made, and the Company undertakes no obligation to update any forward-looking statement to reflect events

or circumstances after the date of this Form 8-K, except as required by law.

| Item 3.02 |

Unregistered

Sales of Equity Securities. |

The

applicable disclosure contained in Item 1.01 of this Form 8-K is incorporated by reference in this Item 3.02.

| Item 9.01 |

Financial Statements and Exhibits.

|

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: January 6, 2025 |

Lipella Pharmaceuticals Inc. |

|

| |

|

|

|

| |

By: |

/s/ Jonathan

Kaufman |

|

| |

|

Name:

Jonathan Kaufman

Title:

Chief Executive Officer |

|

Exhibit

10.1

Irrevocable

Proxy and Power of Attorney

Pursuant

to that certain (i) consulting agreement and advisory agreement, by and between Lipella Pharmaceuticals Inc., a Delaware corporation

(the “Corporation”), and Spartan Capital Securities, LLC, including any designee thereof (“Spartan”), dated as

of December 5, 2024, as amended by that certain Amendment to Consulting Agreement and Placement Agent Agreement (the “Amendment”),

dated December 10, 2024 (the “Consulting Agreement”), the Corporation is obligated to issue to Spartan up to 1,050,000 shares

(“Consultant Shares”) of Series C Convertible Preferred Stock, par value $0.0001 per share, of the Corporation (the “Series

C Preferred Stock”), convertible into up to 1,050,000 shares (“Conversion Shares”) of common stock, par value $0.0001

per share, of the Corporation (the “Common Stock”) in consideration for advisory and consultant services that have been and

will be rendered by Spartan and (ii) placement agent agreement, dated December 5, 2024, as amended the Amendment, by and between the

Corporation and Spartan (the “Placement Agent Agreement”), the Corporation has agreed to issue Spartan common stock purchase

warrants exercisable for a number of shares of Common Stock (collectively, the “Warrant Shares”) equal to 10% of the number

of shares of Series B non-voting convertible preferred stock of the Corporation, par value $0.0001 per share, sold in a private placement

by the Corporation (the “Offering”) for which Spartan is serving as placement agent. Spartan is executing this Irrevocable

Proxy and Power of Attorney (this “Irrevocable Proxy”) as a material inducement for the Corporation’s entering into

the Consulting Agreement and the Placement Agent Agreement.

Upon

the issuance of any and all Consultant Shares, Conversion Shares and/or Warrant Shares (as applicable), Spartan (x) will be the record

holder of the Consultant Shares, Conversion Shares and/or Warrant Shares (as applicable) and (y) will have good and valid title to such

Consultant Shares, Conversion Shares and/or Warrant Shares (as applicable), free and clear of any liens or restrictions on transfer except

as provided herein and in the Consulting Agreement and Placement Agent Agreement. Upon the issuance by the Corporation of a number of

Consultant Shares, Conversion Shares and/or Warrant Shares (as applicable) to Spartan and/or its Affiliates (as defined under Rule 405

of the Securities Act of 1933, as amended) or any other person or entity acting as a group together with Spartan and such Affiliates

(such persons, “Attribution Parties”), Spartan (and such other Attribution Parties, if any) hereby irrevocably appoints Dr.

Jonathan Kaufman, Chief Executive Officer of the Corporation (the “Principal Stockholder”), and any designee of the Principal

Stockholder as the proxy and attorney-in-fact, with full power of substitution and resubstitution, to represent and vote the aggregate

number of Consultant Shares, Conversion Shares and/or Warrant Shares (as applicable), held by Spartan (and such Attribution Party, if

any) (such shares collectively, the “Proxied Shares”), whether at a meeting of the shareholders of the Corporation or by

any consent to any action taken by such shareholders without a meeting, with respect to any and all matters presented to the shareholders

of the Corporation for vote or for action without a meeting. Such irrevocable appointment to the Principal Stockholder of the aforementioned

rights to the Proxied Shares shall be evidenced by the signature of each of Spartan, such Attribution Party (if any) and the Principal

Stockholder on the row of Schedule I attached hereto corresponding to such Proxied Shares. This proxy and power of attorney granted

by Spartan (and any other Attribution Party, if any) shall be irrevocable during its term and shall be deemed to be coupled with an interest

sufficient in law to support an irrevocable proxy. Spartan authorizes the Principal Stockholder to file this Irrevocable Proxy and any

substitution or revocation with the Corporation so that the existence of this Irrevocable Proxy is noted on the books and records of

the Corporation. The power of attorney granted by Spartan herein is a durable power of attorney and shall survive the dissolution, bankruptcy,

death or incapacity of Spartan.

During

the effectiveness of this Irrevocable Proxy, the Principal Stockholder shall have all the voting power and all power to grant consent

that Spartan (or an Attribution Party, if any) would possess by virtue of being the holder of the Consultant Shares, Conversion Shares

and/or Warrant Shares (as applicable). Upon each signature by Spartan (and any other Attribution Party) on Schedule I with respect

to Proxied Shares, Spartan and such Attribution Party hereby ratifies and confirms all acts that the Principal Stockholder will do or

cause to be done with respect to such Proxied Shares by virtue of and within the limitations set forth in this Irrevocable Proxy.

This

Irrevocable Proxy is binding on Spartan’s heirs, estate, executors, personal representatives, successors, and assigns (including

any transferee of any of the Consultant Shares, Conversion Shares and/or Warrant Shares (as applicable)) to the fullest extent permitted

under applicable law.

Spartan

shall not dispose of, pledge, sell, convey, assign, hypothecate, or otherwise transfer (each, a “Transfer”) number of Consultant

Shares, Conversion Shares and/or Warrant Shares (as applicable) without the express prior consent of the Corporation and shall provide

the Corporation with at least five (5) Business Days’ prior notice of its intention to effect a Transfer to a non-Attribution Party.

“Business Day” shall mean any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United

States or any day on which the Federal Reserve Bank of New York is closed and/or The Nasdaq Stock Market LLC is not open for at least

five (5) hours of trading. Spartan shall inform the Corporation of any pledge of Proxied Shares made prior to the date of this Irrevocable

Proxy. Except pursuant to this Irrevocable Proxy, as of the date hereof, no person or entity other than Spartan or an Attribution Party

has any contractual or other right or obligation to purchase or otherwise acquire any of the Consultant Shares, Conversion Shares and/or

Warrant Shares (as applicable). Upon the registration of the reoffer and resale of the Conversion Shares and Warrant Shares (as applicable)

listed on Schedule I, the appointment of voting power granted to the Principal Stockholder shall immediately terminate with respect

to such respective Conversion Shares and the corresponding Consultant Shares, and Warrant Shares (as applicable) and all restrictions

on, and consents required for, Transfers of the Consultant Shares, Conversion Shares and Warrant Shares shall terminate, provided,

that Spartan hereby agrees that neither Spartan, the other Attribution Parties nor their respective designees, successors or assigns,

shall Transfer any Consultant Shares, Conversion Shares or Warrant Shares to a non-Attribution Party (other than to the Corporation or

the Principal Stockholder) (i) whose business is directly or indirectly competitive with the business of the Corporation as it is being

conducted or planned to be conducted at the time of such proposed disposition, or (ii) who intends to or has taken action, directly or

indirectly, in one or more related transactions, towards obtaining an ownership interest in the Corporation for purposes of effecting

(x) a change of “control” of the Corporation (as such term is defined under Section 203 of the General Corporation Law of

the State of Delaware), (y) a sale or all or substantially all of the assets of the Corporation or (z) a change to the board of directors

or management of the Corporation at the time of such proposed disposition, (iii) if such disposition will, to Spartan’s knowledge,

result in such third party (together with all of such third party’s “affiliates” (as defined in Rule 405 of the Securities

Act of 1933, as amended) and any other persons acting as a group together with such third party) being deemed a “beneficial owner”

(as defined under Rule 13d-3) of more than 4.99% of the outstanding shares of Common Stock immediately after giving effect to such disposition.

In addition, this Irrevocable Proxy shall terminate with respect to Consultant Shares, Conversion Shares and Warrant Shares (as applicable)

upon each disposition of Consultant Shares, Conversion Shares and Warrant Shares (as applicable) by an Attribution Party to a non-Attribution

Party. Notwithstanding the foregoing, a Transfer of Consultant Shares, Conversion Shares or Warrant Shares by Spartan (or any other Attribution

Party) to an Attribution Party shall only become effective upon such transferee’s delivery of a completed and executed Joinder

Agreement, substantially in the form attached hereto as Schedule II. The Company undertakes to include the maximum possible number

of Conversion Shares and Warrant Shares in the initial registration statement filed in connection with the Offering and in each subsequent

registration statement, as needed, and agrees to lift all Transfer and notice restrictions six months after any issuance if such Conversion

Shares and Warrant Shares are not then registered for resale.

This

Irrevocable Proxy may be amended or supplemented, and any obligation of an Attribution Party may be waived, only with the prior written

consent of the Corporation. No waivers of any breach of this Irrevocable Proxy extended by the Corporation to any Attribution Party shall

be construed as a waiver of any rights or remedies of the Corporation or with respect to any subsequent breach.

This

Irrevocable Proxy shall be governed by, and construed under, the laws of the State of Delaware, without regard to principles of conflict

of laws. In case any provision of this Irrevocable Proxy shall be invalid, illegal or unenforceable, it shall to the extent practicable,

be modified so as to make it valid, legal and enforceable and to retain as nearly as practicable the intent of the Corporation and Spartan

(and any other Attribution Party, if any) represented by such invalidated term, and the validity, legality and enforceability of the

remaining provisions shall not in any way be affected or impaired thereby.

In

the event that any signature hereto is delivered by facsimile transmission or by an e-mail which contains a portable document format

(.pdf) file of an executed signature page, such signature page shall create a valid and binding obligation of the party executing (or

on whose behalf such signature is executed) with the same force and effect as if such signature page were an original thereof.

[signature

page follows]

Spartan,

hereby revoking any and all prior proxies granted by Spartan with respect to the Consultant Shares, Conversion Shares and Warrant Shares

(as applicable), has executed this Irrevocable Proxy on the date set forth below to be deemed effective as of December 20, 2024.

| |

|

SPARTAN

CAPITAL SECURITIES, LLC |

| |

|

|

| |

By: |

/s/ Kim Monchik |

| |

|

Name:

Kim Monchik |

| |

|

Title: Chief

Administrative Officer |

| |

|

|

| |

|

|

| |

Date: |

12/20/2024 |

| |

|

|

| ACKNOWLEDGED AND AGREED TO BY: |

| |

|

|

| |

|

|

| /s/ Jonathan Kaufman |

|

| Name: Jonathan Kaufman |

|

| |

|

|

| Date: |

December 20, 2024 |

|

| |

|

|

Schedule

I

| Date |

Number

of Conversion Shares as of such date |

Number

of Warrant Shares as of such date |

Signature

of Authorized Signatory of Spartan (and/or Attribution Party, if any) |

Acknowledgement

and Acceptance of Principal Stockholder |

| 12/23/2024 |

182,076 |

85,421 |

Signature:

/s/ Kim Monchik |

Signature:

/s/ Jonathan Kaufman |

| 12/23/2024 |

78,032 |

0 |

Signature:

/s/ Eric Meyer |

| 12/31/2024 |

30,053 |

11,795 |

Signature:

/s/ Kim Monchik |

Signature:

/s/ Jonathan Kaufman |

| 12/31/2024 |

12,880 |

0 |

Signature:

/s/ Eric Meyer |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

Schedule

II

Joinder

Agreement

In

connection with the Transfer from [Spartan/other Attribution Party] to the undersigned of [Consultant

Shares/Conversion Shares/Warrant Shares], the undersigned is executing and delivering this Joinder Agreement to the Irrevocable Proxy

and Power of Attorney, dated as of December 20, 2024 (the “Irrevocable Proxy”). Terms used but not defined herein shall have

the same meanings ascribed to them as in the Irrevocable Proxy.

By

executing and delivering this Joinder Agreement to the Corporation and [Spartan/ other Attribution Party],

the undersigned hereby agrees to become a party to, to be bound by, and to comply with the provisions of the Irrevocable Proxy in the

same manner as if the undersigned were an original signatory to the Irrevocable Proxy. This Joinder Agreement shall become an integral

part of, and undersigned shall become a party to and be bound by the Irrevocable Proxy upon execution and delivery of this Joinder Agreement

by the undersigned.

Accordingly,

the undersigned has executed and delivered this Joinder Agreement as of , .

________________________

Address

for notices:

Email:

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

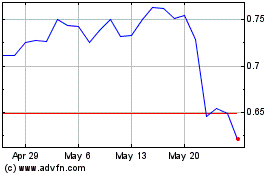

Lipella Pharmaceuticals (NASDAQ:LIPO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lipella Pharmaceuticals (NASDAQ:LIPO)

Historical Stock Chart

From Jan 2024 to Jan 2025