0001828852False00018288522023-12-312023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 31, 2023

Mondee Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-39943 | | 88-3292448 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| | |

10800 Pecan Park Blvd Suite 315 Austin, Texas | | 78750 |

(Address of principal executive offices) | | (Zip Code) |

(650) 646-3320

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

Class A common stock, $0.0001 par value per share | | MOND | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e)

On December 31, 2023, Mondee Holdings, Inc., a Delaware corporation (the “Company”), allocated awards (the "Earn-Out Awards”) of shares of Class A common stock, par value $0.0001 per share (the “Common Stock”), approved by the board of directors (the “Board”) of the Company, to certain of the Company's officers, including the Company's named executive officers, that were available to be allocated in accordance with that certain Earn-Out Agreement, dated as of December 20, 2021 by and among ITHAX Acquisition Corp., and certain persons listed on Schedule A thereto (the “Earn-Out Agreement”). The Earn-Out Awards represent the final allocation of the 9,000,000 approved shares pursuant to the Earn-Out Agreement.

The Earn-Out Awards were made pursuant to the form of award agreement attached hereto as Exhibit 10.1 (the “Earn-Out Award Agreement”). Shares of the Company's Common Stock granted pursuant to the Earn-Out Award Agreements (the “Earn-Out Shares”) will vest in equal quarterly installments over a two-year period, subject to the recipient's continued employment or engagement with the Company. The Earn-Out Shares are subject to all terms and conditions of the Earn-Out Agreement, including all vesting and forfeiture terms.

Jesus Portillo, the Company's Chief Financial Officer, and Jim Dullum, the Company's Chief Operating Officer, received Earn-Out Awards of 60,000 Earn-Out Shares and 100,000 Earn-Out Shares, respectively, pursuant to their respective Earn-Out Award Agreements. Meredith Waters, the Company's General Counsel, Venkat Pasupuleti, the Company's Chief Technology Officer, and Yuvraj Datta, the Company's Chief Commercial Officer, each received Earn-Out Awards of 20,000 pursuant to their respective Earn-Out Agreements.

Orestes Fintiklis, the Company's former Chief Executive Officer and current member of the Board and Chief Corporate Strategy and Business Development Officer, received an Earn-Out Award of 133,333 Earn-Out Shares. Mr. Fintiklis' Earn-Out Shares were granted pursuant to the form Earn-Out Award Agreement, except that Mr. Fintiklis' Earn-Out Shares vest in three equal installments over three years, subject to his continued employment with the Company.

Prasad Gundumogula, the Company’s Chief Executive Officer and member of the Board, received an Earn-Out Award of 1,000,000 Earn-Out Shares. Mr. Gundumogula's Earn-Out Shares were granted pursuant to the form Earn-Out Award Agreement, except that Mr. Gundumogula's Earn-Out Shares vest immediately upon execution of his Earn-Out Award Agreement.

The foregoing description of the Earn-Out Award Agreement and the Earn-Out Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of such agreements. A copy of the form of Earn-Out Award Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and the Earn-Out Agreement was filed as Exhibit 10.5 to the Company’s Current Report on Form 8-K, filed on December 20, 2021, each of which is incorporated by reference to this Item 5.02.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1#* | | |

10.2# | | |

| 104 | | Cover Page Interactive Data File |

| * Filed herewith.

# Indicates management contract or compensatory plan or arrangement.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | MONDEE HOLDINGS, INC. |

| | |

Dated: January 8, 2023 | | | | |

| | | |

| | | | By: | | /s/ Jesus Portillo |

| | | | | | Name: Jesus Portillo Title: Chief Financial Officer |

FORM OF AWARD AGREEMENT

This Award Agreement (“Agreement”) is made and entered into by and between Mondee Holdings, Inc., a Delaware corporation (the “Company”), and [EXECUTIVE] (“Executive”) effective as of [DATE] (the “Effective Date”). Collectively, the Company and its direct and indirect subsidiaries are referred to as the “Company Group”.

1.Earn-Out Shares. The Company shall issue to Executive [X] shares of the Company’s common stock, par value $0.0001 per share (the “Earn-Out Shares”), pursuant and subject to that certain Earn-Out Agreement, dated as of December 20, 2021 by and among ITHAX Acquisition Corp., and certain persons listed on Schedule A thereto (the “Earn-Out Agreement”). The Earn-Out Shares are subject to all terms and conditions of the Earn-Out Agreement, including the vesting and forfeiture terms thereof, which Executive acknowledges receipt of, and agrees to become bound by and a party thereto. Executive agrees to sign such documents and take such actions as may be reasonably requested by the Company (such as but not limited to executing a joinder agreement) in relation to the Earn-Out Agreement. In addition to being subject to those vesting and forfeiture terms in the Earn-Out Agreement, the Earn-Out Shares, will be granted to Executive as follows:

(i)On the three-month anniversary of the Effective Date, and each three-month anniversary for two (2) years thereafter, if this Agreement has not been terminated due to (A) Executive’s voluntary termination of this Agreement, or (B) termination by the Company for Cause (as defined herein), then the Company shall grant to Executive [X] Earn-Out Shares; and

(ii)For clarity, if this Agreement is terminated (A) by the Company without Cause, (B) by Executive for Good Reason or (C) due to Executive’s death or disability, the Company shall grant the Earn-Out Shares to Executive (or his heirs or designees) in accordance with Section 1; provided, however, that in any such case, the Earn-Out Shares remain subject to all vesting, forfeiture, and other terms and conditions of the Earn-Out Agreement. If this Agreement is terminated by the Company for Cause or Executive terminates the Agreement for convenience, Executive shall only be entitled to the Earn-Out Shares vested as of the termination date of the Agreement.

2.Arbitration.

(a)Subject to Section 2(b), any dispute, controversy or claim between Executive and any member of the Company Group arising out of or relating to this Agreement or Executive’s employment or engagement with any member of the Company Group (“Disputes”) will be finally settled by confidential arbitration in the State of Texas in accordance with the then-existing American Arbitration Association (“AAA”) Employment Arbitration Rules. The arbitration award shall be final and binding on both parties. Any arbitration conducted under this Section 12 shall be private, shall be heard by a single arbitrator (the “Arbitrator”) selected in accordance with the then-applicable rules of the AAA and shall be conducted in accordance with the Federal Arbitration Act. The Arbitrator shall expeditiously hear and decide all matters concerning the Dispute. Except as expressly provided to the contrary in this Agreement, the Arbitrator shall have the power to (i) gather such materials, information, testimony and evidence as the Arbitrator deems relevant to the Dispute before him or her (and each party will provide such materials, information, testimony and evidence requested by the Arbitrator), and (ii) grant injunctive relief and enforce specific performance. All Disputes shall be arbitrated on an individual basis, and each party hereto hereby foregoes and waives any right to

arbitrate any Dispute as a class action or collective action or on a consolidated basis or in a representative capacity on behalf of other persons or entities who are claimed to be similarly situated, or to participate as a class member in such a proceeding. The decision of the Arbitrator shall be reasoned, rendered in writing, be final and binding upon the disputing parties and the parties agree that judgment upon the award may be entered by any court of competent jurisdiction. The parties acknowledge and agree that in connection with any such arbitration and regardless of outcome, except as provided under this Section 12, each party will pay all of its own costs and expenses, including its own legal fees and expenses, and the arbitration costs will be shared equally by the Company and Executive.

(b)By entering into this Agreement and entering into the arbitration provisions of this Section 2, THE PARTIES EXPRESSLY ACKNOWLEDGE AND AGREE THAT THEY ARE KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVING THEIR RIGHTS TO A JURY TRIAL.

(c)Nothing in this Section 2 shall prohibit a party to this Agreement from (i) instituting litigation to enforce any arbitration award, or (ii) joining the other party to this Agreement in a litigation initiated by a person or entity that is not a party to this Agreement. Further, nothing in this Section 2 precludes Executive from filing a charge or complaint with a federal, state or other governmental administrative agency.

3.Withholdings; Deductions. The Company is authorized to withhold and deduct from any benefits, amounts, or payments related to this Agreement or Executive’s employment (a) all federal, state, local and other taxes and (b) any applicable deductions or withholdings.

4.Title and Headings; Construction. Titles and headings to Sections hereof are for the purpose of reference only and shall in no way limit, define or otherwise affect the provisions hereof. Any and all Exhibits or Attachments referred to in this Agreement are, by such reference, incorporated herein and made a part hereof for all purposes. Unless the context requires otherwise, all references to laws, regulations, contracts, documents, agreements and instruments refer to such laws, regulations, contracts, documents, agreements and instruments as they may be amended, restated or otherwise modified from time to time, and references to particular provisions of laws or regulations include a reference to the corresponding provisions of any succeeding law or regulation. All references to “dollars” or “$” in this Agreement refer to United States dollars. The words “herein”, “hereof”, “hereunder” and other compounds of the word “here” shall refer to the entire Agreement, including all Exhibits attached hereto, and not to any particular provision hereof. Unless the context requires otherwise, the word “or” is not exclusive. Wherever the context so requires, the masculine gender includes the feminine or neuter, and the singular number includes the plural and conversely. All references to “including” shall be construed as meaning “including without limitation.” Neither this Agreement nor any uncertainty or ambiguity herein shall be construed or resolved against any party hereto, whether under any rule of construction or otherwise. On the contrary, this Agreement has been reviewed by each of the parties hereto and shall be construed and interpreted according to the ordinary meaning of the words used so as to fairly accomplish the purposes and intentions of the parties hereto.

5.Applicable Law; Submission to Jurisdiction. This Agreement shall in all respects be construed according to the laws of the State of Texas without regard to its conflict of laws principles that would result in the application of the laws of another jurisdiction. With respect to any claim or dispute related to or arising under this Agreement, the parties

hereby consent to the arbitration provisions of Section 12 and recognize and agree that should any resort to a court be necessary and permitted under this Agreement, then they consent to the exclusive jurisdiction, forum and venue of the state and federal courts (as applicable) located in Texas.

6.Entire Agreement and Amendment. This Agreement contains the entire agreement of the parties with respect to the matters covered herein and supersede all prior and contemporaneous agreements and understandings, oral or written, between the parties hereto concerning the subject matter hereof; provided, however, that the provisions of this Agreement are in addition to and complement (and do not replace or supersede) any other written agreement(s) or parts thereof between Executive and any member of the Company Group that create restrictions on Executive with respect to confidentiality, non-disclosure, non-competition, non-solicitation or non-disparagement. Without limiting the scope of the preceding sentence, except as otherwise expressly provided in this Section 17, all understandings and agreements preceding the Effective Date and relating to the subject matter hereof are hereby null and void and of no further force or effect, and this Agreement shall supersede all other agreements, written or oral, that purport to govern the terms of Executive’s employment (including Executive’s compensation) with any member of the Company Group. This Agreement may be amended only by a written instrument executed by both parties hereto.

7.Waiver of Breach. Any waiver of this Agreement must be executed by the party to be bound by such waiver. No waiver by either party hereto of a breach of any provision of this Agreement by the other party, or of compliance with any condition or provision of this Agreement to be performed by such other party, will operate or be construed as a waiver of any subsequent breach by such other party or any similar or dissimilar provision or condition at the same or any subsequent time. The failure of either party hereto to take any action by reason of any breach will not deprive such party of the right to take action at any time.

8.Assignment. This Agreement is personal to Executive, and neither this Agreement nor any rights or obligations hereunder shall be assignable or otherwise transferred by Executive. The Company may assign this Agreement without Executive’s consent, including to any member of the Company Group and to any successor to or acquirer of (whether by merger, purchase or otherwise) all or substantially all of the equity, assets or businesses of the Company.

9.Notices. Notices provided for in this Agreement shall be in writing and shall be deemed to have been duly received (a) when delivered in person, (b) when sent by facsimile transmission (with confirmation of transmission) or email on a business day to the number or email address set forth below, if applicable; provided, however, that if a notice is sent by facsimile transmission or email after normal business hours of the recipient or on a non-business day, then it shall be deemed to have been received on the next business day after it is sent, (c) on the first business day after such notice is sent by express overnight courier service, or (d) on the second business day following deposit with an internationally-recognized second-day courier service with proof of receipt maintained, in each case, to the following address, as applicable:

If to the Company, addressed to:

Mondee Holdings, Inc.

10800 Pecan Park Blvd., Suite 315

Austin, TX 78750

With copies (which shall not itself constitute notice) to:

Reed Smith LLP

2850 N. Harwood Street, Suite 1500

Dallas, TX 75201

If to Executive, to the address most recently on file in the payroll records of the Company.

10.Counterparts. This Agreement may be executed in any number of counterparts, including by electronic mail or facsimile, each of which when so executed and delivered shall be an original, but all such counterparts shall together constitute one and the same instrument. Each counterpart may consist of a copy hereof containing multiple signature pages, each signed by one party, but together signed by both parties hereto. Electronic copies shall have the same force and effect as the originals.

11.Certain Excise Taxes. Notwithstanding anything to the contrary in this Agreement, if Executive is a “disqualified individual” (as defined in Section 280G(c) of the Code), and the payments and benefits provided for in this Agreement, together with any other payments and benefits which Executive has the right to receive from the Company or any of its affiliates, would constitute a “parachute payment” (as defined in Section 280G(b)(2) of the Code), then the payments and benefits provided for in this Agreement shall be reduced (but not below zero) so that the present value of such total amounts and benefits received by Executive from the Company or any of its affiliates shall be one dollar ($1.00) less than three times Executive’s “base amount” (as defined in Section 280G(b)(3) of the Code) and so that no portion of such amounts and benefits received by Executive shall be subject to the excise tax imposed by Section 4999 of the Code. The reduction of payments and benefits hereunder shall be made by reducing, first, payments or benefits to be paid in cash hereunder in the order in which such payment or benefit would be paid or provided (beginning with such payment or benefit that would be made last in time and continuing, to the extent necessary, through to such payment or benefit that would be made first in time) and, then, reducing any benefit to be provided in-kind hereunder in a similar order. The determination as to whether any such reduction in the amount of the payments and benefits provided hereunder is necessary shall be made by the Company in good faith. If a reduced payment or benefit is made or provided and through error or otherwise that payment or benefit, when aggregated with other payments and benefits from the Company or any of its affiliates used in determining if a “parachute payment” exists, exceeds one dollar ($1.00) less than three times Executive’s base amount, then Executive shall immediately repay such excess to the Company upon notification that an overpayment has been made. Nothing in this Section 24 shall require any member of the Company Group to be responsible for, or have any liability or obligation with respect to, Executive’s excise tax liabilities under Section 4999 of the Code.

12.Clawback. To the extent required by applicable law or any applicable securities exchange listing standards, or as otherwise determined by the Board (or a committee thereof), amounts paid or payable under this Agreement shall be subject to the provisions of any applicable clawback policies or procedures adopted by any member of the Company Group, which clawback policies or procedures may provide for forfeiture and/or recoupment of amounts paid or payable under this Agreement. Notwithstanding any provision of this Agreement to the contrary, each member of the Company Group reserves the right, without the consent of Executive, to adopt any such clawback policies

and procedures, including such policies and procedures applicable to this Agreement with retroactive effect.

13.Effect of Termination. The provisions of Sections 2, 11 and 12 and those provisions necessary to interpret and enforce them, shall survive any termination of this Agreement and any termination of the employment relationship between Executive and the Company.

14.Third-Party Beneficiaries. Each member of the Company Group that is not a signatory to this Agreement shall be a third-party beneficiary of Executive’s obligations under Section 2 and shall be entitled to enforce such obligations as if a party hereto.

15.Severability. If an arbitrator or court of competent jurisdiction determines that any provision of this Agreement (or portion thereof) is invalid or unenforceable, then the invalidity or unenforceability of that provision (or portion thereof) shall not affect the validity or enforceability of any other provision of this Agreement, and all other provisions shall remain in full force and effect. It is the intention of the parties that any such invalid or unenforceable provision be reformed and enforced to the fullest extent permitted by law.

[Remainder of Page Intentionally Blank; Signature Page Follows]

IN WITNESS WHEREOF, Executive and the Company each have caused this Agreement to be executed and effective as of the Effective Date.

EXECUTIVE

[EXECUTIVE]

MONDEE HOLDINGS, INC.

By:

Signature Page to

Award Agreement

Cover

|

Dec. 31, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 31, 2023

|

| Entity Registrant Name |

Mondee Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39943

|

| Entity Tax Identification Number |

88-3292448

|

| Entity Address, Address Line One |

10800 Pecan Park Blvd

|

| Entity Address, Address Line Two |

Suite 315

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| City Area Code |

650

|

| Local Phone Number |

646-3320

|

| Entity Address, Postal Zip Code |

78750

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

MOND

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0001828852

|

| Amendment Flag |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

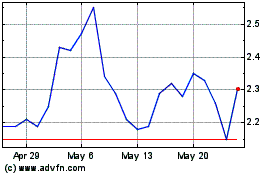

Mondee (NASDAQ:MOND)

Historical Stock Chart

From Apr 2024 to May 2024

Mondee (NASDAQ:MOND)

Historical Stock Chart

From May 2023 to May 2024