false

0001821175

0001821175

2024-05-17

2024-05-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 17, 2024

Motorsport

Games Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39868 |

|

86-1791356 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

5972

NE 4th Avenue

Miami,

FL |

|

33137 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (305) 507-8799

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A common stock, $0.0001 par value per share |

|

MSGM |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry Into a Material Definitive Agreement

On

May 17, 2024, Motorsport Games Inc., a Delaware corporation (the “Company”), entered into a Settlement Agreement and License

(the “Agreement”) with INDYCAR, LLC, an Indiana limited liability company (“INDYCAR”). The Agreement resolved

any and all disputes between the Company and INDYCAR with respect to the termination of (i) the License Agreement, dated July 13, 2021,

by and between INDYCAR and the Company with respect to INDYCAR SERIES racing series related gaming products (the “IndyCar Products

License”) and (ii) the License Agreement, dated July 13, 2021, by and between INDYCAR and the Company with respect to INDYCAR SERIES

racing series related esports events (the “IndyCar Events License,” together with the IndyCar Products License, the “Prior

License Agreements”). As previously disclosed by the Company on its Current Report on Form 8-K filed on November 14, 2023, the

Prior License Agreements were terminated effective as of November 8, 2023. Pursuant to the Agreement, subject to the satisfaction of

the conditions to the effectiveness of the Agreement (as described below), the Company and INDYCAR agreed that the Company’s liabilities

under the Prior License Agreements, including any and all royalties and/or any other sums or liabilities of any kind whatsoever were

forgiven by INDYCAR and discharged in their entirety in consideration of the Company’s payment to INDYCAR of $250,000 on the date

of the Agreement and $150,000 within 30 days following the date of execution of the Agreement. The Agreement becomes effective

upon satisfaction of (i) the Company’s payment to INDYCAR of $250,000 on the date of the Agreement and (ii) the Company’s

payment of $150,000 to INDYCAR within 30 days following the date of execution of the Agreement. Both $250,000 and $150,000 have been

paid to INDYCAR by the Company and the Agreement is in effect as of the date of this Current Report on Form 8-K.

Further,

as of the effective date of the Agreement, the Company granted to INDYCAR a royalty-free, perpetual, irrevocable, exclusive, transferable,

and sublicensable, right and license throughout the world (the “License”) to use the licensed intellectual property described

in the Agreement (the “Licensed Intellectual Property”) for the purpose of developing, marketing, distributing and selling

esports series and esports events related to, themed as, or containing the INDYCAR SERIES racing series and/or motorsports and/or racing

(including without limitation simulation style) video gaming products related to, themed as or containing the INDYCAR SERIES racing series,

on current and future versions of consoles, PCs, smart TVs, mobile applications, gaming subscription services, cloud gaming, cloud streaming,

handheld products and other new generation formats. In addition, the Company agreed to provide INDYCAR from the effective date of the

Agreement to December 31, 2024, upon request by INDYCAR, with up to 50 hours free-of-charge consulting services to facilitate the transition

of the INDYCAR series game development using the Licensed Intellectual Property to the software developer of INDYCAR’s choice.

The

above description of the Agreement is intended as a summary only and is qualified in its entirety by the terms and conditions set forth

therein. Copy of the Agreements is attached hereto as Exhibit 10.1 and is incorporated herein by this reference.

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As

disclosed in the Company’s Current Report on Form 8-K filed by the Company on November 22, 2023, the Nasdaq Stock Market LLC (“Nasdaq”)

notified the Company on November 17, 2023 that the Company was not in compliance with the minimum stockholders’ equity requirement

of at least $2,500,000 for continued inclusion on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(b)(1) (the “NCM

Equity Rule”). In the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, the Company reported

stockholders’ equity of $498,897, which was below the NCM Equity Rule’s stockholders’ equity threshold. Additionally,

the Company did not meet either of the alternative Nasdaq continued listing standards under the Nasdaq Listing Rules, which include (i)

a market value of listed securities of at least $35 million or (ii) net income of $500,000 from continuing operations in the most recently

completed fiscal year or in two of the three most recently completed fiscal years.

As

disclosed in the Company’s Current Report on Form 8-K filed by the Company on February 6, 2024 (the “February 8-K”),

on February 5, 2024, Nasdaq notified the Company that, based on Nasdaq’s review of the Company and the materials submitted by the

Company to Nasdaq, Nasdaq’s staff granted to the Company an extension to regain compliance with the NCM Equity Rule until May 15,

2024, subject to the Company’s regaining and evidencing compliance with the NCM Equity Rule by such date. The February 8-K disclosed

that, in the event the Company did not regain and evidence compliance with the NCM Equity Rule by May 15, 2024, Nasdaq’s staff

would provide written notification to the Company that its securities may be subject to delisting. Further, if the Company fails to evidence

compliance upon filing its periodic report for June 30, 2024, with the SEC and Nasdaq the Company may be subject to delisting. At that

time, the Company may appeal Nasdaq’s staff’s determination to a Listing Qualifications Panel. The February 8-K disclosed,

without any assurances, that, to regain compliance with the NCM Equity Rule, the Company planned to negotiate and implement equity financing

transactions and negotiate reductions of its licensing liabilities.

To

regain compliance with the NCM Equity Rule, the Company entered into the Agreement disclosed and summarized in Item 1.01 of this Current

Report on Form 8-K. Item 1.01 of this Current Report on Form 8-K is incorporated herein by this reference. Pursuant to the Agreement,

the Company’s liability to INDYCAR, LLC in the amount of approximately $2.9 million was settled for $400,000, which resulted in

a gain of approximately $2.5 million, which in turn resulted in a $2.5 million increase to the Company’s stockholders’ equity.

Accordingly, as of the date of this Current Report on Form 8-K, the Company believes that it has regained compliance with the stockholders’

equity requirement based upon the settlement with INDYCAR that resulted in a $2.5 million increase to the Company’s stockholders’

equity, as described and disclosed in Current Report on Form 8-K.

Nasdaq

will continue to monitor the Company’s ongoing compliance with the NCM Equity Rule and, if at the time of its next periodic report

the Company does not evidence compliance, it may be subject to delisting. In addition, if the Company fails to evidence compliance upon

filing its periodic report for the June 30, 2024, the Company may be subject to delisting.

Forward-Looking

Statements

This

Current Report on Form 8-K contains forward-looking statements within the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. All statements other than those that are purely historical are forward-looking statements. Words such

as “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan,”

“project,” and similar expressions also identify forward looking statements. Forward-looking statements include, but are

not limited to statements concerning the Company’s future financial performance, whether the Company will maintain compliance with

the NCM Equity Rule and/or whether the Company will be able to evidence compliance upon filing of its quarterly periodic report for period

ending June 30, 2024. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ

materially from those expressed or implied in the forward-looking statements, many of which are generally outside of the Company’s

control and are difficult to predict. Examples of such risks and uncertainties include, but are not limited to: (i) the Company’s

ability to obtain equity financing arrangements or similar transactions; (ii) Nasdaq’s acceptance of evidence of compliance; or

(iii) the Company’s ability to otherwise maintain compliance with any other continued listing requirement of The Nasdaq Capital

Market. Additional information regarding risks and uncertainties associated with the Company’s business and a discussion of some

of the factors that may cause actual results to differ materially from the results expressed or implied by such forward-looking statements

can be found in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections

of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, its Quarterly Reports on Form 10-Q filed

with the SEC during 2024, as well as in its subsequent filings with the SEC. These forward-looking statements are based on information

as of the date hereof, and the Company assumes no obligation to publicly update or revise its forward-looking statements even if experience

or future changes make it clear that any projected results expressed or implied therein will not be realized.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

* Portions of the exhibit, marked by brackets, have been omitted because the omitted information (i) is not material and (ii) is the type that the Company treats as private or confidential.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Motorsport

Games Inc. |

| |

|

|

| Date:

May 23, 2024 |

By:

|

/s/

Stephen Hood |

| |

|

Stephen

Hood |

| |

|

Chief

Executive Officer and President |

EXHIBIT

INDEX

*

Portions of the exhibit, marked by brackets, have been omitted because the omitted information (i) is not material and (ii) is the type

that the Company treats as private or confidential.

Exhibit

10.1

[***]

Certain information in this document has been excluded pursuant to Regulation S-K, Item (601)(b)(10). Such excluded information is not

material and is the type that the Company treats as private or confidential.

SETTLEMENT

AGREEMENT AND LICENSE

This

Settlement Agreement and License (this “Agreement”) is executed as of May 17, 2024, but shall not be effective until

the date on which both of the conditions in Section 1.b have been fully satisfied (the “Effective Date”) between:

(i)

Motorsport Games Inc., a Delaware corporation located at 5972 NE 4th Avenue, Miami, Florida 33137 (the “Company”),

and

(ii)

INDYCAR, LLC, an Indiana limited liability company located at 4551 W. 16th Street, Indianapolis,

Indiana 46222 (“INDYCAR”).

The

Company and INDYCAR are sometimes collectively referred to herein as the “Parties” and individually as a “Party.”

RECITALS

A.

The Company and INDYCAR entered into a Confidentiality Agreement effective as of July 6, 2021 prior to execution of the INDYCAR License

Agreements (as defined below) and the parties have no existing obligations under such Confidentiality Agreement.

B.

The Company and INDYCAR entered into (i) the License Agreement, dated July 13, 2021, by and between INDYCAR and the Company with respect

to INDYCAR SERIES racing series related gaming products (the “IndyCar Products License”) and (ii) the License Agreement,

dated July 13, 2021, by and between INDYCAR and the Company with respect to INDYCAR SERIES racing series related esports events (the

“IndyCar Events License,” together with the IndyCar Products License, the “INDYCAR License Agreements”).

C.

Pursuant to the INDYCAR License Agreements, the Company was granted a license to use certain licensed intellectual property for esports

events and motorsports and/or racing video gaming products related to, themed as, or containing the INDYCAR SERIES racing series, on

consoles, PCs, smart TVs, mobile applications, gaming subscription services, cloud gaming, cloud streaming, handheld products and other

new generation formats.

D.

On November 8, 2023, INDYCAR delivered notice to the Company terminating the INDYCAR License Agreements effective as of November 8, 2023.

E.

In connection with the termination of the INDYCAR License Agreements, INDYCAR demanded certain payments under the INDYCAR License

Agreements.

F.

The Parties desire to reach a resolution of all issues between the Parties arising out of or in connection with the INDYCAR License Agreements

and any and all other matters on the terms and conditions set forth in this Agreement.

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing Recitals and of the mutual agreements and covenants set forth in this Agreement, and for

other good and valuable consideration, the sufficiency and adequacy of which is acknowledged, the Parties, without admitting any liabilities,

hereby agree as follows:

1.

Incorporation of Recitals and Conditions to the Agreement.

| a. | The

above and foregoing recitals are incorporated herein and made a part of this Agreement. The

Parties represent that the foregoing recitals are true and correct. |

| b. | Notwithstanding

any other provision of this Agreement, the Agreement shall not be effective until the date

on which: |

| i. | INDYCAR

receives the payment required by Section 2.b.i.; and |

| ii. | Either

(A) INDYCAR receives and approves a letter agreement from iRacing.com Motorsport Simulations,

LLC (“iRacing”) that confirms to INDYCAR’s satisfaction that iRacing is

obligated to pay $150,000 to INDYCAR on or before December 31, 2024 if INDYCAR has not received

the payment due under Section 2.b.ii from Company or (B) the Company directly pays $150,000

to INDYCAR within 30 days following the date of execution of this Agreement. |

| c. | If

both conditions set forth in Section 1.b.i-ii have not been satisfied within thirty (30)

days following the date of execution of this Agreement, INDYCAR shall have the right to rescind

the settlement contemplated by this Agreement, terminate this Agreement, and INDYCAR reserves

all rights to enforce all remedies in contract or otherwise under the INDYCAR License Agreements. |

2.

Settlement Terms. Subject to full execution of this Agreement by all Parties:

| a. | Subject

to the terms of this Agreement, INDYCAR hereby agrees to accept the terms of this Agreement,

including without limitation the Settlement Payment (as described below) and the Company’s

grant to INDYCAR a License (as defined below), in satisfaction of Company’s liabilities

under the INDYCAR License Agreements and that any and all royalties and/or any other sums

or liabilities of any kind whatsoever are hereby forgiven by INDYCAR and are deemed discharged

in their entirety except as provided in this Agreement. |

| i. | Company

shall pay $250,000 immediately upon execution of this Agreement; and |

| ii. | iRacing

shall pay to INDYCAR $150,000 on or before December 31, 2024, if the Company has not paid

such sum prior to that date. |

| c. | License.

Effective as of the Effective Date, the Company hereby grants to INDYCAR a royalty-free,

perpetual, irrevocable, exclusive, transferable, and sublicensable, right and license throughout

the world (the “License”) to use the licensed intellectual property listed

in Schedule A attached hereto and the results of the transition services specified

in Section 2.d (the “Licensed Intellectual Property”), in whole or in

part, for the purpose of developing, marketing, distributing and selling (1) esports series

and esports events related to, themed as, or containing the INDYCAR SERIES racing series

and/or (2) motorsports and/or racing (including without limitation simulation style) video

gaming products related to, themed as or containing the INDYCAR SERIES racing series, on

current and future versions of consoles, PCs, smart TVs, mobile applications, gaming subscription

services, cloud gaming, cloud streaming, handheld products and other new generation formats

(collectively, the “Purpose”). INDYCAR and the Company acknowledge and

agree that the rights and license granted under the License includes rights to modify, edit,

combine with other materials and/or create derivative works of the Licensed Intellectual

Property in whole or in part solely for the Purpose. For the avoidance of doubt, the Parties

acknowledge and agree that: (i) no licenses are currently held with any track owner and such

licenses have to be negotiated by INDYCAR with the track owners prior to release of any product,

(ii) the Licensed Intellectual Property does not include, and no license nor any other right

are granted with respect to KartKraft platform and project acquired by the Company from Black

Delta (including for use of Unreal Engine); INDYCAR acknowledges and agrees that a license

for the use of Unreal Engine has to be obtained prior to release of any product, and (iii)

the Company shall own and retain all right, title, and interest in and to the Licensed Intellectual

Property with respect to any use other than the Purpose. For clarity, the Parties agree that

INDYCAR shall not be obligated to use the License or obtain any third-party licenses for

any purpose including release of any esports events or any video gaming products. The License,

including the transition services and the results therefrom, is and shall be deemed to be,

for purposes of Section 365(n) of the United States Bankruptcy Code, a license to rights

to “intellectual property” as defined therein. INDYCAR and its successors and

assigns, as licensee of such rights, shall have the rights and elections with respect thereto

as specified in the United States Bankruptcy Code. |

| d. | Free-of-Charge

Transition Service. Within the period from the Effective Date and December 31, 2024,

the Company shall provide INDYCAR upon request by INDYCAR with up to 50 hours free-of-charge

consulting services to facilitate the transition of the INDYCAR series game development using

the Licensed Intellectual Property to the software developer of INDYCAR’s choice. |

| e. | Representations

and Warranties of the Company. Company hereby represents and warrants that as of the

Effective Date: |

| i. | The

Company has full right, authority and ability to license the Licensed Intellectual Property

to INDYCAR and perform its obligations under this Agreement. |

| ii. | The

Company owns the Licensed Intellectual Property, free and clear of all encumbrances, claims,

and rights of third parties. The Company has not and shall not in the future pledge its rights

to the Licensed Intellectual Property as security for any of the Company’s debts or

for any other purpose. |

| iii. | Except

with respect to track licenses which are not in place and will need to be attained by INDYCAR

or the publisher prior to release of any game containing any of the tracks represented in

the INDYCAR project from the Company, the Licensed Intellectual Property is licensable to

INDYCAR in accordance with this Agreement and the Company may perform this Agreement without

any third party consent or approval. All required consents and approvals have been obtained

by the Company (including the Company’s board approval). |

| iv. | Performance

of this Agreement does not violate any of the Company’s governing documents, laws or

regulations, contracts, or other obligations. |

| v. | There

are no restrictions that prohibit the License of any Licensed Intellectual Property as set

forth in this Agreement. |

| vi. | Upon

the Effective Date, INDYCAR and its successors, assigns, tranferees and sublicensees will

have the exclusive right, which is non-terminable and not subject to expiration or revocation,

to develop, license, control, regulate the use of and otherwise exploit the Licensed Intellectual

Property solely for the Purpose without any claim by, or payment or other obligation owing

to, or required consent or approval from any person or entity. |

| vii. | This

Agreement including the License of the Licensed Intellectual Property does not cause INDYCAR

to become responsible for any tax or other liability. Without limiting the foregoing, the

License does not require INDYCAR to pay any amount to any person or entity for any reason. |

| viii. | To

the Company’s knowledge, the Licensed Intellectual Property does not and the use of

the Licensed Intellectual Property by INDYCAR and/or its successors and assigns for the Purpose

will not infringe, misappropriate, or otherwise make any unlawful or unauthorized use of

any of the intellectual property or other proprietary rights of any person or entity. Without

limiting the foregoing, to the Company’s knowledge, the Company did not infringe or

misappropriate or otherwise make any unlawful or unauthorized use of the intellectual property

or other proprietary rights of any person or entity in the creation and development of the

Licensed Intellectual Property. |

| ix. | The

Company has not received any communications claiming infringement, misappropriation or other

unlawful or unauthorized use of the Licensed Intellectual Property and, (i) no person or

entity has threatened to make any claims for infringement, misappropriation or other unlawful

or unauthorized use of the Licensed Intellectual Property and (ii) to the Company’s

knowledge, there is no basis for any claims for infringement, misappropriation or other unlawful

or unauthorized use of the Licensed Intellectual Property. |

| x. | To

the Company’s knowledge, no person or entity is infringing upon any of the Company’s

rights in any of the Licensed Intellectual Property. |

| xi. | Except

as set forth in Section 2.c with respect to KartKraft platform and project acquired by the

Company from Black Delta (including the Unreal Engine and its use as the chassis), the Company

has developed the Licensed Intellectual Property as its original work and entirely through

its own efforts. No Licensed Intellectual Property have been created by any independent contractors

or other third parties for the Company who have not by contract or by operation of law assigned

to the Company their respective intellectual property rights (if any) for the Licensed Intellectual

Property. All employees of the Company involved in the development of the Licensed Intellectual

Property have by contract or by operation of law assigned all their rights (if any) to the

Licensed Intellectual Property to the Company. |

| xii. | Except

as disclosed in the Company’s filings with the U.S. Securities and Exchange Commission

(the “SEC”), including relating the Company’s deficiency with respect

to the Nasdaq listing standards, the Company is not in a material violation of or default

with respect to any law, regulation, contracts, or other obligations applicable to its business

or the Licensed Intellectual Property. |

| xiii. | Except

as disclosed in the Company’s filings with the SEC, including relating the Company’s

deficiency with respect to the Nasdaq listing standards, the Company has not been notified

about any investigations, audits, lawsuits, or other proceedings pending or threatened against

or affecting the Company or any of the Licensed Intellectual Property. |

| xiv. | There

are no unsatisfied judgments against the Company or any of the Licensed Intellectual Property. |

| xv. | The

Company is not subject to any judgment or order of any court or government authority with

respect to or affecting the Licensed Intellectual Property. |

| xvi. | Both

before and following License of the Licensed Intellectual Property and fulfillment of this

Agreement, the Company remains capable of fulfilling its obligations under this Agreement. |

f.

Survival of Certain Obligations of Company. The obligations of Company set forth in Sections 9.5 (insurance) and 12.1 and 12.2

and 12.3 (confidentiality) of the IndyCar Products License and Section 9.4 (insurance) and 12.1 and 12.2 and 12.3 (confidentiality) of

the IndyCar Events License shall continue in force and effect following execution of this Agreement.

g.

Indemnification. The Company shall indemnify, defend, and hold harmless each and every of the INDYCAR Released Parties (as defined

below) from any against any and all actions, claims, demands, liabilities, losses, and damages whatsoever (including without limitation

court costs and attorneys’ fees) (collectively, “Claims”) resulting from, arising out of, or in any manner related

to the Company’s material and uncured breach of any of its representations and warranties and/or other obligations set forth in

this Agreement (including without limitation any Claims of wrongdoing or negligence of any of the INDYCAR Released Parties). Defense

shall be by counsel reasonably acceptable to INDYCAR.

3.

Mutual Releases.

a.

INDYCAR’s Releases. Except as to the obligations created by this Agreement, INDYCAR, on behalf of itself and its agents,

heirs, representatives, shareholders, members, affiliates, parents, subsidiaries, partners, officers, directors, principals, predecessors,

successors in interest (in whole or in part), and assigns, does hereby fully and forever release and discharge the Company, and each

of its respective agents, partners, members, directors, officers, employees, affiliates, principals, predecessors, successors in interest

(in whole or in part), heirs, representatives, and assigns (collectively, the “Company Released Parties”), from any

and all claims, actions, causes of action, suits at law or in equity, demands, damages (actual, compensatory, special, presumed, punitive,

or statutory), costs, judgments, expenses, liabilities, attorneys’ fees and legal costs or any compensation whatsoever, whether

based upon alleged tort or alleged contract, vicarious liability, strict liability or any other legal or equitable theory of recovery,

matured or unmatured, current or future, known or unknown of any kind or nature that any of the INDYCAR Released Parties (as defined

below) have, or ever had against the Company Released Parties.

b.

Company’ Releases. Except as to the obligations created by this Agreement, the Company, on behalf of itself and its agents,

heirs, companies, representatives, shareholders, members, affiliates, parents, subsidiaries, partners, officers, directors, principals,

predecessors, successors in interest (in whole or in part), and assigns does hereby fully and forever release and discharge INDYCAR,

Indianapolis Motor Speedway, LLC, Brickyard Trademarks, Inc., and each of their respective affiliates, agents, partners, members, managers,

shareholders, owners, directors, officers, employees, affiliates, principals, predecessors, successors in interest (in whole or in part),

heirs, representatives, and assigns (collectively, the “INDYCAR Released Parties”), from any and all claims, actions,

causes of action, suits at law or in equity, demands, damages (actual, compensatory, special, presumed, punitive, or statutory), costs,

judgments, expenses, liabilities, attorneys’ fees and legal costs or any compensation whatsoever, whether based upon alleged tort

or alleged contract, vicarious liability, strict liability or any other legal or equitable theory of recovery, matured or unmatured,

current or future, known or unknown of any kind or nature that the Company Released Parties have, or ever had against the INDYCAR Released

Parties.

c.

Covenant Not to Sue or Initiate Proceedings. Each of the Parties agrees not to sue or initiate any civil proceeding, criminal

proceeding, or regulatory proceeding against the other Party or in any way assist any other person or entity in doing so with respect

to the claims released herein. This release provisions as set forth in this Section 3 may be pleaded as a full and complete defense to,

and may be used as the basis for an injunction against, any action, suit, or other proceeding which may be instituted, prosecuted, or

attempted in breach of the release contained herein.

4.

Cooperation to Facilitate Agreement. The Parties agree to cooperate, and cause their representatives to cooperate, in taking

any further action(s) reasonably necessary to implement the letter and purpose of this Agreement. Without limiting the foregoing, the

Company agrees to promptly deliver all information and materials (including without limitation source code and copies and/or assignment

of agreements related to track content and the 2023 INDYCAR vehicle model).

5.

Miscellaneous Terms.

a.

Entire Agreement. This Agreement contains the entire agreement and understanding between the Parties with respect to the subject

matter of this Agreement, and supersedes all other agreements between the Parties. The terms of this Agreement can be modified only by

a writing signed by all of the Parties who are affected by such modification at the time of the modification. This Agreement cannot be

orally modified.

b.

Severability. Any provision of this Agreement which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction

only, be unenforceable without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction

shall not invalidate or render unenforceable such provision in any other jurisdiction. Notwithstanding the foregoing, the Parties agree

that if any provision of this Agreement is determined by a court to be void, invalid, or unenforceable, and, as a result the Party for

whose benefit such void, invalid, or unenforceable provision exists is denied any or all of the material benefits provided to such Party

pursuant to this Agreement (as determined by a court of competent jurisdiction), then this Agreement may be rescinded by such Party.

c.

Construction. Headings are used herein for convenience only and shall have no force or effect in the interpretation or construction

of this Agreement. All references in this Agreement to the singular shall be deemed to include the plural if the context so requires

and vice versa. References in the collective or conjunctive shall also include the disjunctive unless the context otherwise clearly requires

a different interpretation.

d.

Governing Law; Waiver of Jury Trial. This Agreement shall be governed by the laws of the State of Indiana, without giving effect

to its choice of law principles. EACH PARTY HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO

A TRIAL BY JURY IN RESPECT TO ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT. EACH

PARTY (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER

PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES

HERETO HAVE BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 5.d.

e.

Representation. The Parties acknowledge and represent that they have been given adequate opportunity to consult with legal counsel

before entering into this settlement and executing this Agreement. The language of this Agreement shall be construed as representing

the Parties’ mutual understanding and as having been drafted and approved by the Parties and counsel for all Parties. Each individual

signing this Agreement represents and warrants that he or she has the full right, power and authority to execute this Agreement on behalf

of the Party for which or whom he or she signs. Each Party covenants and agrees to execute such further documents and perform such further

acts as may be reasonable and necessary to effectuate the purposes of this Agreement.

f.

Attorneys’ Fees and Costs. The Parties shall each bear their own respective attorneys’ fees and costs incurred in

connection with the matters resolved by this Agreement, as well as the negotiation and documentation of the compromise represented by

this Agreement. However, in the event of any proceedings to enforce this Agreement, the prevailing party shall be entitled to recover

its legal expenses, including attorneys’ fees and costs, incurred in connection therewith. The parties further agree that this

Agreement may be introduced into evidence in any subsequent proceeding to enforce its terms.

g.

Successors and Assigns. This Settlement Agreement is binding upon, and shall inure to the benefit of, the Parties, their current,

past and future officers, directors, supervisors, employees, agents, representatives, subsidiaries, affiliates, associates, and their

heirs, beneficiaries, trustees, administrators, estates, predecessors, successors and assigns.

h.

Counterparts. This Agreement may be executed in any number of counterparts each of which shall be deemed an original and all of

which shall constitute one and the same agreement, with the same effect as if all Parties had signed the same signature page. Any signature

page of this Agreement may be detached from any counterpart of this Agreement and reattached to any other counterpart of this Agreement

identical in form hereto but having attached to it one or more additional signature pages. This Agreement shall only become effective

on its execution by all Parties.

[Signatures

are on next page.]

IN

WITNESS WHEREOF, the Parties execute this Agreement as of the date set forth below.

| MOTORSPORT

GAMES INC. |

|

| |

|

|

| By:

|

/s/

Stephen Hood |

|

| Name:

|

Stephen

Hood |

|

| Title:

|

Chief

Executive Officer and President |

|

| |

|

|

| INDYCAR,

LLC |

|

| |

|

|

| By:

|

/s/

Mark D. Miles |

|

| Name:

|

Mark

D. Miles |

|

| Title:

|

President

and CEO – Penske Entertainment Corp. |

|

Schedule

A

Licensed

Intellectual Property

1.

The Company’s intellectual property rights related to the Company’s latest (i.e., as of the date of the Company’s IndyCar

project termination) IndyCar development project for PC, PlayStation and Xbox formats, including the software source code, tools and

applications necessary for a professional development team to resume development and production of the IndyCar game project on the aforementioned

formats.

2.

The Company’s intellectual property rights related to 2023 IndyCar vehicle model, including components necessary to feature the

car in-game, in a drivable state complete with associated audio and effects.

3.

[***]

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

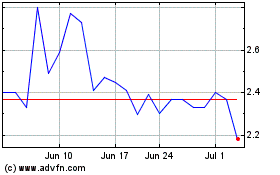

Motorsport Games (NASDAQ:MSGM)

Historical Stock Chart

From May 2024 to Jun 2024

Motorsport Games (NASDAQ:MSGM)

Historical Stock Chart

From Jun 2023 to Jun 2024