false

0001831978

0001831978

2024-02-21

2024-02-21

0001831978

NBST:UnitsEachConsistingOfOneShareOfCommonStockAndOnehalfOfOneRedeemableWarrantMember

2024-02-21

2024-02-21

0001831978

NBST:CommonStockParValue0.0001PerShareMember

2024-02-21

2024-02-21

0001831978

NBST:WarrantsEachExercisableForOneShareOfCommonStockFor11.50Member

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 21, 2024

Newbury

Street Acquisition Corporation

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-40251 |

|

85-3985188 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

121

High Street, Floor 3

Boston,

MA |

|

02110 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(617)

893-3057

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on

which registered |

| Units,

each consisting of one share of Common Stock and one-half of one redeemable warrant |

|

NBSTU |

|

The

Nasdaq Stock Market LLC |

| Common

Stock, par value $0.0001 per share |

|

NBST |

|

The

Nasdaq Stock Market LLC |

| Warrants,

each exercisable for one share of Common Stock for $11.50 |

|

NBSTW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01. Regulation FD Disclosure.

As

previously disclosed, on December 12, 2022, Newbury Street Acquisition Corporation, a Delaware Corporation (the “Purchaser”),

entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among (i) the Purchaser, (ii) Infinite Reality Holdings,

Inc., a Delaware corporation and a direct wholly-owned subsidiary of the Purchaser (“Pubco”), (iii) Infinity Purchaser Merger

Sub Inc., a Delaware corporation and a direct wholly-owned subsidiary of Pubco (“Purchaser Merger Sub”), (iv) Infinity NBIR

Company Merger Sub Inc., a Delaware corporation and a direct wholly-owned subsidiary of Pubco (“Company Merger Sub” and,

together with Purchaser Merger Sub, the “Merger Subs,” and the Merger Subs collectively with the Purchaser and Pubco, the

“Purchaser Parties”), and (v) Infinite Reality, Inc., a Delaware corporation (the “Target”).

A

copy of a press release issued by the Target, dated February 21, 2024, announcing the Target’s unveiling of an innovative automotive

original equipment manufacturer (OEM) onboarding service at Mobile World Congress 2024 in Barcelona together with telecommunication giant

Vodafone , is attached hereto as Exhibit 99.1 and incorporated by reference.

The

information in this Item 7.01, including Exhibit 99.1, is being furnished and will not be deemed to be filed for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of

that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the

“Securities Act”) or the Exchange Act.

Important

Information and Where to Find It

In

connection with the proposed business combination, the Purchaser and Pubco, as applicable, plan to file relevant materials with the U.S.

Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4, which will include a preliminary

proxy statement/prospectus and other documents relating to the proposed business combination. After the registration statement is declared

effective by the SEC, the Purchaser will mail the definitive proxy statement/final prospectus to holders of shares of Purchaser common

stock of a record date to be established in connection with the Purchaser’s solicitation of proxies for vote by Purchaser shareholders

with respect to the proposed business combination and other matters as described in the proxy statement/prospectus. Purchaser shareholders

and other interested persons are urged to read the preliminary proxy statement/prospectus and the amendments thereto, the definitive

proxy statement/final prospectus, and documents incorporated by reference therein, as well as other documents filed with the SEC in connection

with the proposed business combination as these materials will contain important information about the proposed business combination.

Shareholders will be able to obtain copies of the preliminary and definitive proxy statement/prospectus and other documents containing

important information about the Purchaser, the Target and the proposed business combination filed with the SEC once such documents are

available on the website maintained by the SEC at www.sec.gov.

Participants

in the Solicitation

The

Purchaser and the Target and their respective directors, executive officers and employees may be deemed to be participants in the solicitation

of proxies from the stockholders of the Purchaser in connection with the proposed transactions under the rules of the SEC. Information

about the directors and executive officers of the Purchaser and their ownership of shares of the Purchaser’s common stock is set

forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 31, 2023, and in

subsequent documents filed with the SEC, including the joint proxy statement/prospectus to be filed with the SEC. Additional information

regarding the persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests

in the proposed transactions, by security holdings or otherwise, will also be included in the joint prospectus/proxy statement and other

relevant materials to be filed with the SEC when they become available.

No

Offer or Solicitation

This

communication is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to sell or

the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No

offering of securities in connection with the proposed business combination shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Forward

Looking Statements

This

communication contains “forward-looking statements,” within the meaning of Section 27A of the Securities Act and Section

21E of the Exchange Act. Forward-looking statements may generally be identified by terminology such as “will,” “shall,”

“may,” “should,” “expects,” “plans,” “anticipates,” “could,”

“intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,”

“predicts,” “potential” or “continue” or the negative of these terms or other similar words or expressions

that predict or indicate future events or trends that are not statements of historical matters. These statements are only predictions.

The Purchaser and the Target have based these forward-looking statements largely on their then-current expectations and projections about

future events and financial trends as well as the beliefs and assumptions of management. Forward-looking statements are subject to a

number of risks and uncertainties, many of which involve factors or circumstances that are beyond each of the Purchaser’s and the

Target’s control. Actual results could differ materially from those stated or implied in forward-looking statements due to a number

of factors, including but not limited to: (i) risks associated with the Purchaser’s ability to obtain the shareholder approval

required to consummate the proposed transactions and the timing of the closing of the proposed transaction, including the risks that

a condition to closing would not be satisfied within the expected timeframe or at all or that the closing of the proposed transactions

will not occur; (ii) the outcome of any legal proceedings that may be instituted against the parties and others related to the proposed

transactions; and (iii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination

of the proposed transactions. We refer you to the “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the Purchaser’s Annual Report on Form 10-K for the year ended

December 31, 2022, and other filings made with the SEC and that are available on the SEC’s website at www.sec.gov.

All of the forward-looking statements made in this Current Report on Form 8-K are expressly qualified by the cautionary statements contained

or referred to herein. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Neither the

Purchaser nor the Target can assure you that the events and circumstances reflected in the forward-looking statements will be achieved

or occur, and actual results could differ materially from those projected in the forward-looking statements. The forward-looking statements

made in this communication relate only to events as of the date on which the statements are made. Except as required by applicable law

or regulation, the Purchaser and the Target undertake no obligation to update any forward-looking statement to reflect events or circumstances

after the date on which the statement is made or to reflect the occurrence of an unanticipated event.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

February 21, 2024

| |

Newbury Street Acquisition Corporation |

| |

|

|

| |

By: |

/s/

Thomas Bushey |

| |

|

Thomas Bushey |

| |

|

Chief Executive Officer |

3

Exhibit 99.1

Infinite Reality and Vodafone to Unveil Revolutionary

Automotive Onboarding Service Featuring Generative AI and VR at

Mobile World Congress Barcelona 2024

A New Era in Automotive Retail: AI-Onboard is

an AI-Driven Experience Powered with

Pairpoint by Vodafone Technology

BARCELONA, SPAIN and LOS ANGELES, February 21, 2024 – Infinite

Reality (iR), a global leader in artificial intelligence innovations and immersive virtual experiences, together with telecommunication

giant Vodafone, is thrilled to announce the unveiling of an innovative automotive original equipment manufacturer (OEM) onboarding service

at Mobile World Congress 2024 in Barcelona. This pioneering product, set to redefine automotive retail and customer onboarding, will

be showcased in a state-of-the-art mixed reality experience, demonstrating the advanced capabilities of Vodafone’s Pairpoint technology.

AI-Onboard utilizes the latest in generative AI, coupled with augmented

reality (AR) and virtual reality (VR), to offer an immersive and interactive experience that showcases the future of customer engagement

and retail. This initiative serves as a powerful example of how Infinite Reality is reshaping customer engagement through cutting edge,

immersive solutions.

“We are thrilled to continue our partnership with Vodafone with

the introduction of this next-generation service offering for the automotive industry at this year’s Mobile World Congress,”

stated John Acunto, CEO of Infinite Reality. “This launch is not just about showcasing a new product but also demonstrating the immense

impact of AI immersive experiences in transforming the buying and selling of products and services. Pairpoint Technology plays a crucial

role in bringing this vision to life, offering a glimpse into the future of interactive and immersive retail. An additional and valuable

benefit is the power of the data that Vodafone will now have ownership and access to. This will drive and inform future decisions and

enhance user experiences for follow-on engagements.”

“This is a tremendous opportunity to bring immersive consumer

experiences to one of the largest markets in the world. It is a significant change in how consumers can make customized purchase decisions,

with both brands and consumers benefitting,” remarked Tom Bushey, CEO of Newbury Street Acquisition Corp (Nasdaq: NBST), SPAC partner

to Infinite Reality.

“The in-car payment market is forecast to be a $580 billion opportunity

by 2030 and the sales and onboarding touch points will be key for automotive manufacturers to build a relationship with the customer through

the lifecycle of car ownership. AI promises to be a key factor in placing the car at the center of retail experiences, as well as powering

retail engagement where the car pays on behalf of the customer. The VR and AI solutions create an environment where customers can experience

the vehicle and optional extras, as well as select and pay for them before they physically collect the car from the showroom. The Pairpoint

platform builds on Vodafone’s 40m SIM footprint in connected cars by providing a vehicle digital identity passport and wallet that

is set up during car onboarding and can be used for retail pay by car services,” commented David Palmer, Chief

Product Officer, Pairpoint by Vodafone.

This extension of Infinite Reality and Vodafone’s partnership,

highlights their collective commitment to innovation and bringing forward customer-centric solutions. Building from their collaborative

success at the 2023 London Tech Week, the Mobile World Congress 2024 showcase promises to be a landmark event, illustrating the transformative

impact of advanced AI-driven immersive experiences with Pairpoint Technology in the retail sector.

For more information about AI-Onboard and future collaborations between

Infinite Reality and Vodafone, visit the websites of Infinite Reality and Vodafone.

About Infinite Reality, Inc.

Infinite Reality (iR) helps clients with audiences develop immersive

experiences that convert those audiences into users. An iR powered virtual experience enables brands and creators to fully control the

ways in which they commercialize their creations, distribute content, and communicate with their communities. With deep expertise in Hollywood

production, iR develops world-class products and experiences that upend traditional, passive one-way viewership of events and static online

retail transactions while shaping the future of audience engagement, brand loyalty, and fan commitment. The Services and Advisory teams

manage, design, and oversee custom builds, leveraging the Technology team’s platform development expertise. Infinite Reality’s

products are hardware agnostic, do not require any special equipment, and can be viewed and experienced on laptop, desktop, mobile phone,

tablet, and Smart TV. iR Studios, one of the largest independent production studios in the country, works collaboratively with iR’s

expert Innovation team to develop proprietary technology for Metaverse creation and immersive experiences, including live event virtualization

and remote collaboration tools, from their 150,000 sq. ft. state-of-the-art facility. Visit theinfinitereality.com.

About Vodafone

Vodafone is the largest pan-European and African

telecoms company. Our purpose is to connect for a better future by using technology to improve lives, digitalise critical sectors and

enable inclusive and sustainable digital societies.

We provide mobile and fixed services to over

300 million customers in 17 countries, partner with mobile networks in 46 more and are also a world leader in the Internet of Things (IoT),

connecting over 167 million devices and platforms. With Vodacom Financial Services and M-Pesa, we have the largest financial technology

platform in Africa, serving more than 71 million people across seven countries.

We are committed to reducing our environmental

impact to reach net zero emissions by 2040, while helping our customers reduce their own carbon emissions by 350 million tonnes by 2030. We

are driving action to reduce device waste and achieve our target to reuse, resell or recycle 100% of our network waste by 2025.

For more information, please visit www.vodafone.com,

follow us on Twitter at @VodafoneGroup or connect with us on LinkedIn at www.linkedin.com/company/vodafone.

Investor & Media Contacts:

Ashley DeSimone, ICR

Ashley.DeSimone@icrinc.com

Brett Milotte, ICR

Brett.Milotte@icrinc.com

Company

press@theinfinitereality.com

v3.24.0.1

Cover

|

Feb. 21, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity File Number |

001-40251

|

| Entity Registrant Name |

Newbury

Street Acquisition Corporation

|

| Entity Central Index Key |

0001831978

|

| Entity Tax Identification Number |

85-3985188

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

121

High Street

|

| Entity Address, Address Line Two |

Floor 3

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02110

|

| City Area Code |

(617)

|

| Local Phone Number |

893-3057

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Common Stock and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one share of Common Stock and one-half of one redeemable warrant

|

| Trading Symbol |

NBSTU

|

| Security Exchange Name |

NASDAQ

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

NBST

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock for $11.50 |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Common Stock for $11.50

|

| Trading Symbol |

NBSTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NBST_UnitsEachConsistingOfOneShareOfCommonStockAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NBST_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NBST_WarrantsEachExercisableForOneShareOfCommonStockFor11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

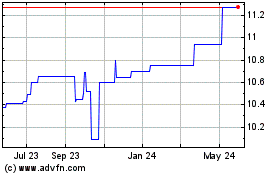

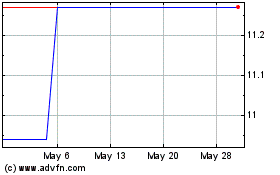

Newbury Street Acquisition (NASDAQ:NBSTU)

Historical Stock Chart

From Apr 2024 to May 2024

Newbury Street Acquisition (NASDAQ:NBSTU)

Historical Stock Chart

From May 2023 to May 2024