UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November 2023

Commission file number: 001-39957

NLS PHARMACEUTICS LTD.

(Translation of registrant’s name into English)

The Circle 6

8058 Zurich, Switzerland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

CONTENTS

Auditor Communication

On November

10, 2023, NLS Pharmaceutics Ltd., or the Company, received a letter, or the Letter, from its independent auditor, PricewaterhouseCoopers

AG, or the Auditor. The Letter, which was issued pursuant to Art. 725 and Art. 725b par. 1 of the Swiss Code of Obligations, requested

that the Company provide a balance sheet at going concern and liquidation values as of October 31, 2023, to assess whether the Company’s

equity shows an excess of liabilities over assets, with such balance sheet required to be provided no later than November 20, 2023. The

Auditor advised it was issuing the Letter, in part, due to the fact that it has been advised that the Company will not have sufficient

cash to fund its operations through December 31, 2023. In the event that the balance sheet confirms the Auditor’s concern of the

Company’s over-indebtedness, the Company’s Board of Directors will be obligated to notify a Swiss judge, unless the Company

can otherwise show it is able to meet its financial obligations. If the Company does not provide the requested balance sheet information,

the Auditor will be legally obligated to notify a Swiss judge of the over-indebtedness pursuant to Art. 728c par. 3 of the Swiss Code

of Obligations.

Bridge Loans

On November 15, 2023,

the Company entered into a series of short term loan agreements, or the Loan Agreements, with certain existing shareholders of the Company,

including Ronald Hafner, the Company’s Chairman of the Board of Directors, Felix Grisard, Jürgen Bauer and Maria Nayvalt, or

the Lenders, providing for an unsecured loan to the Company in the aggregate amount of CHF 875,000.00 (approximately $1,000,000.00), or

the Loan. Pursuant to the Loan Agreements, the Loans bear interest at a rate of 10% per annum and mature on the earlier of June 30, 2024

or a liquidity event with a strategic partner.

The Company believes that

the proceeds of the Loan will resolve the issues raised by the Auditor in the Letter.

In addition, the Company

and Mr. Hafner agreed to extend the maturity of the previous short term loan of CHF 500,000 that

Mr. Hafner extended to the Company on September 28, 2023, such that it now expires on June 30, 2024.

The foregoing summary

of the Loan Agreements does not purport to be complete and is qualified in its entirety by reference to the Loan Agreements, a form of

which is attached as Exhibit 99.1 to this report, and is incorporated herein by reference.

Press Release

The

Company issued a press release titled: “NLS Pharmaceutics Announces Selection of Strategic Partner and Securing a Bridge

Loan.” A copy of this press release is furnished herewith as exhibit 99.2.

This Report of Foreign Private Issuer on Form 6-K

is incorporated by reference into the Company’s Registration Statements on Form F-3 (File Nos. 333-262489, 333-268690 and 333-269220),

filed with the Securities and Exchange Commission, to be a part thereof from the date on which this report is submitted, to the extent

not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

NLS Pharmaceutics Ltd. |

| |

|

|

| Date: November 16, 2023 |

By: |

/s/ Alexander Zwyer |

| |

|

Name: |

Alexander Zwyer |

| |

|

Title: |

Chief Executive Officer |

3

Exhibit 99.1

Loan Agreement

“Agreement”

of

November 15, 2023

between

NLS

Pharmaceutics AG

The

Circle 6

8058

Zürich

and

[ ]

[ ]

[ ]

(Borrower

and Lender each a “Party”

collectively

the “Parties”)

The Lender herewith grants a loan to the Borrower in

the amount of CHF 250,000.00 (“Loan”).

The Loan shall be paid out within 5 Business Days after the execution of

this Agreement.

The Loan shall be transferred to an account designated by the Borrower.

The Loan shall bear interest

at the rate of 10% per annum, calculated from (and including) the date of receipt of the Loan on the bank account designated

by the Borrower to (and including) the Maturity Date (as defined below).

Interest is calculated on the basis of the exact number of

days in relation to a year of 360 days (actual/360).

Interest shall be accrued and only becomes due and payable, together with the

principal Loan amount, at the Maturity Date (or the date of its earlier repayment and/or conversion) to the bank account indicated

by the Lender.

The Loan shall be used by

the Borrower for general financing and corporate purposes in accordance with the purpose of the Borrower.

| 4. | Term, Maturity, Repayment |

This Agreement enters into

effect on November 15, 2023. The loan will become due and payable on the earlier of (i) June 30, 2024 or (ii) a liquidity event with a

strategic partner. (“Maturity Date”).

The entire Loan including

accrued and unpaid interest shall become due for repayment on the Maturity Date.

The Loan shall not be secured.

The existence as well as

the terms and conditions of the Agreement, and any information exchanged among the Parties in connection with the Agreement (all such

information collectively “Confidential Information”), shall be kept strictly confidential by each Party. The Parties

shall neither use in any form nor disclose to any third party any Confidential Information unless explicitly authorized by this Agreement.

The Parties shall ensure that their employees, directors and any other representatives as well as the advisors of each Party to whom any

such Confidential Information is entrusted comply with these restrictions.

The term Confidential Information

shall not include any information: (i) which as of the time of its disclosure by a Party was already lawfully in the possession of the

receiving Party as evidenced by written records, or (ii) which at the time of the disclosure was in the public domain, or (iii) the disclosure

of which was previously explicitly authorized by the respective Party.

The non-disclosure obligation

shall not apply to any disclosure of Confidential Information required by law or regulations. In the event a disclosure of Confidential

Information is required by law or regulations (including, without limitation, for tax, audit or regulatory purposes), the disclosing Party

shall use all reasonable efforts to arrange for the confidential treatment of the materials and information so disclosed.

Each Party may use any Confidential

Information in accordance with this Agreement.

Any communication to be made

under or in connection with this Agreement shall be made in writing and made by letter or e-mail.

Each Party may change or

amend the addresses given on the cover page or designate additional addresses for the purposes of this Section 6.2

by giving the other Parties written notice of the new address in the manner set forth in this Section 6.2.

The Agreement constitutes the

entire agreement among the Parties and supersede any prior understandings, agreements or representations by or among the Parties, or any

of them, written or oral, with respect to the subject matter of this Agreement.

If at any time any provision

of the Agreement or any part thereof is or becomes invalid or unenforceable, then neither the validity nor the enforceability of the remaining

provisions or the remaining part of the provision shall in any way be affected or impaired thereby.

The Parties agree to replace

the invalid or unenforceable provision or part thereof by a valid or enforceable provision which shall best reflect the Parties’ original

intention and shall to the extent possible achieve the same economic result.

No waiver by a Party of

a failure of any other Party to perform any provision of this Agreement shall operate or be construed as a waiver in respect of any other

or further failure whether of a similar or different character.

The Agreement may be executed

in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of the Agreement.

| 7. | Governing law and Jurisdiction |

This Agreement shall in all

respects be governed by and construed in accordance with the substantive laws of Swiss law.

All disputes arising out

of or in connection with this Agreement, including disputes regarding its conclusion, validity, binding effect, amendment, breach, termination

or rescission shall be subject to the exclusive jurisdiction of the ordinary courts of Zurich, canton of Zurich, Switzerland, venue being

Zurich 1.

IN WITNESS WHEREOF, the Parties have signed this

Agreement on the date first written above

| NLS Pharmaceutics AG |

|

|

|

| |

|

|

|

|

|

|

| Name: |

Alex Zwyer |

|

Name: |

|

| Function: |

CEO |

|

Function: |

|

Exhibit 99.2

NLS Pharmaceutics Announces

Selection of Strategic

Partner and Securing a Bridge Loan

| ● | NLS has executed a non-binding term sheet for licensing

of NLS intellectual property |

| ● | NLS has secured an additional bridge loan through insiders

to extend cash runway |

| ● | NLS has implemented significant internal cost reductions |

Zürich, Switzerland,

November 16, 2023 – NLS Pharmaceutics Ltd. (Nasdaq: NLSP, NLSPW) (“NLS” or the “Company”), a

Swiss clinical-stage biopharmaceutical company focused on the discovery and development of innovative therapies for patients with rare

and complex central nervous system disorders, today announced that it is conducting an ongoing process to explore strategic alternatives

to maximize shareholder value.

In response to the ever-evolving

biotech and pharmaceutical landscape and driven by a commitment to innovation, NLS has initiated a comprehensive exploration of new opportunities

that align with its core values and strengths. This strategic move aims to diversify NLS revenue streams, mitigate risks, and create lasting

value for our stakeholders. As part of this process, the Company plans to consider a wide range of options with a focus on maximizing

shareholder value, including strategic partnerships, outlicensing assets of the Company, and other future strategic actions.

Initial steps taken:

| ● | NLS Pharmaceutics has selected a strategic partner and executed

a non-binding term sheet for the outlicensing of its intellectual property, including its key asset Mazindol. The financial terms of

the term sheet have not yet been finalized. The Company intends to close this transaction in the first quarter of 2024. |

| ● | NLS has secured additional bridge financing in the amount

of approximately $1 million USD to extend the Company’s cash runway until the second quarter of 2024. The bridge financing has

been provided by company insiders, including Ronald Hafner, the Company’s Chairman, Felix Grisard, Jürgen Bauer and Maria

Nayvalt. Such bridge loans will mature upon the earlier of June 30, 2024 or a liquidity event with a strategic partner. NLS previously

received a bridge loan of 500,000 CFH from Mr. Hafner , which has also been extended to to mature at the same time as the second loan,

or until June 30, 2024. |

| ● | In conjunction with the ongoing strategic process, NLS has

implemented a workforce reduction of approximately 50%. This includes a pause on consulting agreements, reduction in non-clinical staff,

reduction in non-esstential operating expenses. |

Alex Zwyer, CEO and

Co-Founder of NLS Pharmaceutics notes, “We invite stakeholders, customers and partners to follow our journey as we explore new

opportunities now and in the coming months. Regular updates and progress reports will be shared to keep everyone informed about the

exciting developments stemming from this strategic exploration.”

NLS remains committed to maintaining the highest standards of

quality and integrity throughout this exploration process. The Company’s leadership is confident that these strategic initiatives

will not only contribute to sustainable growth but also fortify our position as an emerging leader in innovative therapies for

patients with rare and complex central nervous system disorders.

About NLS Pharmaceutics Ltd.

NLS Pharmaceutics Ltd. (Nasdaq:

NLSP) is a global development-stage biopharmaceutical company, working with a network of world-class partners and internationally recognized

scientists, focused on the discovery and development of innovative therapies for patients with rare and complex central nervous system

disorders who have unmet medical needs. Headquartered in Switzerland and founded in 2015, NLS is led by an experienced management team

with a track record of developing and commercializing product candidates. For more information, please visit www.nlspharma.com.

Safe Harbor Statement

This press release contains expressed

or implied forward-looking statements pursuant to U.S. Federal securities laws. For example, NLS is using forward-looking statements when

it discusses the potential for the licensing transaction pursuant to the non-binding term sheet, the expected closing of the licensing

transaction, its expected cash runway and that its leadership is confident that these strategic initiatives will not only contribute to

sustainable growth but also fortify its position as an emerging leader in innovative therapies for patients with rare and complex central

nervous system disorders. These forward-looking statements and their implications are based on the current expectations of the management

of NLS only and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described

in the forward-looking statements. The following factors, among others, could cause actual results to differ materially from those described

in the forward-looking statements: changes in technology and market requirements; NLS may encounter delays or obstacles in launching and/or

successfully completing its clinical trials; NLS’ products may not be approved by regulatory agencies, NLS’ technology may not be validated

as it progresses further and its methods may not be accepted by the scientific community; NLS may be unable to retain or attract key employees

whose knowledge is essential to the development of its products; unforeseen scientific difficulties may develop with NLS’ process; NLS’

products may wind up being more expensive than it anticipates; results in the laboratory may not translate to equally good results in

real clinical settings; results of preclinical studies may not correlate with the results of human clinical trials; NLS’ patents may not

be sufficient; NLS’ products may harm recipients; changes in legislation may adversely impact NLS; inability to timely develop and introduce

new technologies, products and applications; and loss of market share and pressure on pricing resulting from competition, which could

cause the actual results or performance of NLS to differ materially from those contemplated in such forward-looking statements. Except

as otherwise required by law, NLS undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect

events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. More detailed information about the

risks and uncertainties affecting NLS is contained under the heading “Risk Factors” in NLS’ annual report on Form 20-F for the

year ended December 31, 2022 filed with the Securities and Exchange Commission (SEC), which is available on the SEC’s website, www.sec.gov,

and in subsequent filings made by NLS with the SEC.

For additional information:

Marianne Lambertson (investors & media)

NLS Pharmaceutics Ltd.

ml@nls-pharma.com

www.nls-pharma.com

###

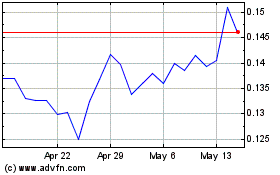

NLS Pharmaceutics (NASDAQ:NLSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

NLS Pharmaceutics (NASDAQ:NLSP)

Historical Stock Chart

From Apr 2023 to Apr 2024