0001564708false00015647082024-09-272024-09-270001564708us-gaap:CommonClassAMember2024-09-272024-09-270001564708us-gaap:CommonClassBMember2024-09-272024-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 27, 2024

NEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-35769 | | 46-2950970 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1211 Avenue of the Americas, New York, New York 10036

(Address of principal executive offices, including zip code)

(212) 416-3400

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share | | NWSA | | The Nasdaq Global Select Market |

| Class B Common Stock, par value $0.01 per share | | NWS | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 27, 2024, News Corporation's (the “Company”) subsidiary, REA Group Ltd, issued an announcement regarding a further revised non-binding proposal relating to a possible offer for the share capital of Rightmove plc. A copy of the announcement is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| | NEWS CORPORATION

(REGISTRANT) |

| | | |

| | | |

| | By: | | /s/ Michael L. Bunder |

| | | | Michael L. Bunder |

| | | | Senior Vice President, Deputy General Counsel and Corporate Secretary |

Dated: September 27, 2024

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION.

THIS IS AN ANNOUNCEMENT OF A POSSIBLE OFFER UNDER THE CITY CODE ON TAKEOVERS AND MERGERS (THE "CODE") AND DOES NOT CONSTITUTE A FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF THE CODE. THERE CAN BE NO CERTAINTY THAT ANY FIRM OFFER WILL BE MADE.

For immediate release

27 September 2024

REA Group Ltd ("REA")

REA urges Rightmove Board to engage now

•Implied offer price of 775 pence per share based on REA latest closing share price, plus additional special dividend of 6 pence per share, together representing a 45 per cent. premium to Rightmove's 12-month VWAP

•Implied offer price of 815 pence per share based on REA undisturbed share price, plus additional special dividend of 6 pence per share, together representing a 52 per cent. premium to Rightmove's 12-month VWAP

•Mix and match facility will be made available to Rightmove shareholders

•Rightmove shareholders urged to direct their Board to engage

•REA requests extension of Monday 30 September 2024 deadline

•REA maintains a disciplined approach to M&A and capital allocation

REA announces that, on 27 September 2024, it has made a fourth non-binding indicative proposal to the Board of Directors of Rightmove plc ("Rightmove") regarding a possible cash and share offer for the entire issued and to be issued share capital of Rightmove (the "Fourth Proposal"). The Fourth Proposal follows REA's three prior possible cash and share offers made to the Board of Directors of Rightmove, all of which have been rejected.

REA reiterates its disappointment and surprise at the repeated rejections of its prior proposals by the Board of Directors of Rightmove. REA urges Rightmove shareholders to use what little time remains ahead of the upcoming deadline of 30 September 2024, under Rule 2.6(a) of the Code, to make their views known to the Board of Directors of Rightmove. REA believes it is in Rightmove shareholders' interests for the Board of Directors of Rightmove to engage in constructive discussions with REA to work towards a recommended transaction.

REA has repeatedly requested meetings with Rightmove but no meetings have taken place and as such there has been no substantive engagement beyond cursory procedural telephone calls with the Rightmove Chairman. REA is ready to engage immediately and firmly believes that engagement is now essential in order to progress the proposal and an extension to the 30 September 2024 deadline should be granted by the Board of Directors of Rightmove to permit that engagement.

Commenting on the Fourth Proposal, Owen Wilson, CEO of REA, said:

"While the Rightmove Board has refused to meet with us, we have enjoyed the opportunity to connect with Rightmove shareholders and to share our vision for the combination of the no. 1 digital property businesses in the UK and Australia. We continue to see the potential for us to strengthen Rightmove and accelerate its growth. This is a compelling opportunity to create a true global technology leader on the London market via a secondary listing, operating in two of the most attractive markets in the world."

"We have further improved our offer, and today announce that we intend to include a mix and match facility for shareholders who wish to receive a greater proportion of their consideration in REA shares to do so. We believe it is in the interests of Rightmove shareholders for the Rightmove Board to engage with us and to extend the 30 September 2024 deadline."

Value of Fourth Proposal

Under the terms of the Fourth Proposal, shareholders of Rightmove would receive for each Rightmove share:

346 pence in cash and 0.0417 new REA shares (the "Fourth Proposal Price") and

a special dividend of 6 pence in cash, in lieu of any final dividend for the year ending 31 December 2024 (the "Special Dividend")

Based on the closing share price of REA's shares of A$200.00 on 27 September 2024, being the last closing price on the date the Fourth Proposal was made to the Board of Directors of Rightmove, and the current A$/£ exchange rate of 1.946, the terms of the Fourth Proposal imply a total offer value of 781 pence for each Rightmove share which values Rightmove's entire issued and to be issued ordinary share capital at approximately £6.2 billion. This represents:

•an increase of 11 per cent. on the implied total value of the Initial Proposal of 705 pence per share, made to the Rightmove Board of Directors on 5 September 2024 (the "Initial Proposal"), and an increase of 15 per cent. on the cash component of the Initial Proposal;

•a 41 per cent. premium to Rightmove's undisturbed share price of 556 pence on 30 August 2024 (being the last business day prior to the date of REA's possible offer announcement on 2 September 2024);

•a 45 per cent. premium to Rightmove's 12-month and 24-month volume weighted average share price of 540 pence; and

•an enterprise value multiple of approximately 22.7x Rightmove's EBITDA for the twelve months ended 30 June 2024 of £272 million.

Based on the undisturbed share price of REA's shares of A$219.00 on 30 August 2024, being the last business day prior to the possible offer announcement on 2 September 2024, and the current A$/£ exchange rate of 1.946, the Fourth Proposal implies a total offer value of 821 pence for each Rightmove share and values Rightmove's entire issued and to be issued ordinary share capital at approximately £6.5 billion. This represents:

•a 48 per cent. premium to Rightmove's undisturbed share price of 556 pence on 30 August 2024 (being the last business day prior to the date of REA's possible offer announcement on 2 September 2024);

•a 52 per cent. premium to Rightmove's 12-month and 24-month volume weighted average share price of 540 pence; and

•an enterprise value multiple of approximately 23.9x Rightmove's EBITDA for the twelve months ended 30 June 2024 of £272 million.

Under the terms of the Fourth Proposal, Rightmove shareholders would hold approximately 20 per cent. of the combined group's issued share capital following completion of the proposed transaction.

REA continues to firmly believe that the Fourth Proposal represents a highly compelling proposition for Rightmove's shareholders at a significant premium to relevant trading metrics, providing a combination of immediate value certainty in cash and at the same time giving Rightmove shareholders the opportunity to benefit from the future value creation of the combined business.

REA has a longstanding track-record of creating value for shareholders. Over the last 10 years, REA has tripled its revenue and EBITDA. REA's share price has increased by more than 300 per cent. over the last 10 years and by over 75 per cent. in the last two years, testament to its continued strategic and financial delivery and execution track-record. In contrast, Rightmove's share price has lacked any sustained upward momentum for two years, despite being supported by its ongoing share buyback programme and revised strategy announced at last year's Capital Markets Day.

The Special Dividend would be paid by Rightmove and is expected to be paid in accordance with the ordinary course timing for the payment of Rightmove's final dividend or, if earlier, at closing of the proposed transaction. The Special Dividend will be paid without any reduction to the terms of the Fourth

Proposal Price. In addition to the Special Dividend and as previously stated, Rightmove shareholders will remain entitled to receive the 2024 interim dividend of 3.7 pence per share (the "Interim Dividend"), as announced by Rightmove on 26 July 2024, without any reduction to the Fourth Proposal Price.

Transaction structure and financing

REA will make a mix and match facility available to Rightmove shareholders in order to provide flexibility by enabling them to elect to vary the proportions in which they receive new REA shares and cash in respect of their holdings in Rightmove shares. The total number of new REA shares to be issued and the maximum aggregate amount of cash to be paid under the terms of the Fourth Proposal will not be varied as a result of elections under the mix and match facility.

REA reiterates its intention to apply for a secondary listing of all of its ordinary shares in London, which would enable trading in REA ordinary shares on both the London Stock Exchange and the Australian Securities Exchange in a fully fungible manner. This would provide the opportunity for a wider pool of investors to gain exposure to a global and diversified digital property company on the London Stock Exchange.

The cash component of the Fourth Proposal is expected to be fully financed through long-term third party debt and existing cash resources. Given the strong growth and high cash generation of both REA and Rightmove, REA expects the combined group will be able to rapidly delever, consistent with REA's track record of financial discipline, and receive an investment grade rating at completion. REA expects the proposed transaction will be EPSa accretive and will target a leverage ratio for the combined group of less than 3x within 18 months post-completion whilst delivering strong shareholder returns in the form of dividends.

Strategic rationale

REA's approach is driven by the strong strategic rationale that it sees for the proposed transaction and REA believes now is a natural time to be able to support and accelerate Rightmove's strategic objectives for the benefit of all stakeholders. REA's expertise will enable it to support Rightmove in retaining its number one market position given the heightened competition and increased investment in the market and de-risk the execution of its strategy.

REA continues to believe that the Fourth Proposal represents a highly compelling proposition to:

•unlock value for both Rightmove and REA shareholders by creating a global and diversified digital property company, with strong margins and significant cash generation, underpinned by number one positions in Australia and the UK;

•enhance customer and consumer value across the combined portfolio utilising REA's globally leading capabilities and expertise, including REA's top-of-funnel capabilities (e.g. content and SEO), and REA's expertise building highly engaging and personalised consumer experiences which have contributed to over 50% of adult Australians using realestate.com.au each month and 47% of realestate.com.au visits coming via REA's mobile app in FY24;

•apply REA's experience in investing in and growing adjacencies to support Rightmove in its ambition to accelerate expansion in these areas, noting REA is more advanced in executing its adjacency strategy (including building the #1 commercial property portal in Australia and operating significant financial services and property data businesses), and assist Rightmove to minimise execution risk as it invests further in adjacencies;

•benefit from knowledge transfer, leading technical capabilities as well as support from targeted investment and innovation in a competitive market;

•enhance the UK property experience for buyers, sellers and renters, positively contributing to the property market ecosystem; and

•create a highly attractive investment opportunity for both REA and Rightmove shareholders, delivering continued capital appreciation and shareholder returns.

For REA's existing shareholders, the proposed transaction presents a highly attractive opportunity for REA to become a global technology leader, benefiting from geographic diversification and further cementing the combined group's position as a leading company on the ASX.

REA is committed to its capital allocation framework and maintains a disciplined approach to mergers and acquisitions. There can be no certainty that an offer to Rightmove shareholders will be made by REA or that any transaction will proceed.

Takeover Code and other matters

The Fourth Proposal is non-binding and subject to customary conditions, including completion of due diligence to the satisfaction of REA. REA reserves the right to waive in whole or in part any of the conditions to the Fourth Proposal.

REA is exercising its right to vary the mix of consideration in the Fourth Proposal. In accordance with Rule 2.5(a) of the Code, REA continues to reserve the right to: (i) introduce other forms of consideration and I or vary the mix or composition of consideration of any offer; and (ii) to implement the transaction through or together with a subsidiary of REA or a company which will become a subsidiary of REA. REA also reserves the right to make an offer for Rightmove at a lower value and/or on less favourable terms than those described in this announcement: (i) with the agreement or recommendation of the Board of Rightmove; (ii) if a third party announces a firm intention to make an offer for Rightmove; or (iii) following the announcement by Rightmove of a Rule 9 waiver transaction pursuant to Appendix 1 of the Code or a reverse takeover (as defined in the Code). If on or after the date of this announcement Rightmove declares, makes or pays any dividend or distribution or other return of capital to its shareholders, other than the Special Dividend and the Interim Dividend, REA reserves the right to make an equivalent reduction to the Fourth Proposal Price.

REA will continue to keep the ASX informed in accordance with its obligations. REA shareholders do not need to take any action at this time.

The release of this announcement was authorised by the Disclosure Committee.

Enquiries:

| | | | | |

| REA Group Ltd Investors: | REA Group Ltd Media: |

| Alice Bennett | Angus Urquhart |

| Executive Manager Investor Relations | General Manager Corporate Affairs |

| P: +61 409 037 726 | P: + 61 437 518 713 |

| E: ir@rea-group.com | E: angus.urquhart@rea-group.com |

| | | | | |

| Deutsche Bank (Financial adviser to REA) | |

| |

| Gavin Deane | +44 (0) 207 545 8000 |

| Oliver Ives | |

| Jennifer Conway | |

| Emma-Jane Newton | |

| |

Brunswick Group (Media enquiries) | |

| |

Simon Sporborg | +44 (0) 207 404 5959 |

Nina Coad | reagroup@brunswickgroup.com |

Paul Durman | |

Jack Walker | |

Important notices

No statement in this announcement is intended to be, or should be construed as, a profit forecast or estimate for any period and no statement in this announcement should be interpreted to mean that earnings or earnings per REA share for the current or future financial years would necessarily match or be greater than or be less than the historical published earnings or earnings per REA share.

This announcement is not intended to, and does not, constitute or form part of any offer, invitation or solicitation of any offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities or the solicitation of any vote or approval in any jurisdiction, whether pursuant to this announcement or otherwise.

The release, distribution or publication of this announcement in jurisdictions outside the United Kingdom and Australia may be restricted by laws of the relevant jurisdictions and therefore persons into whose possession this announcement comes should inform themselves about, and observe, any such restrictions. Any failure to comply with the restrictions may constitute a violation of the securities law of any such jurisdiction.

Sources of information and bases of calculation

i.Any references to the issued and to be issued share capital of Rightmove are based on:

•788,750,604 basic ordinary shares as at 2 September 2024, based on Rightmove's Rule 2.9 disclosure;

•plus 4,130,729 shares reflecting the dilutive impact of Rightmove share options and awards outlined in Rightmove's FY23 Annual Report based on the treasury stock method.

ii.The enterprise value multiples are based on:

•an enterprise value calculated as Rightmove's fully diluted equity value based on the Fourth Proposal Price adjusted for net cash and lease liabilities of £21 million as at 30 June 2024 plus the value of the Special Dividend;

•an EBITDA of £272 million for the 12 months to 30 June 2024. EBITDA defined as Rightmove's underlying operating profit plus depreciation and amortisation.

iii.The implied total offer value of the Fourth Proposal per Rightmove share has been calculated by reference to a A$/£ exchange rate of 1.946 on 27 September 2024 and either i) a closing price of A$200.00 per REA share (being the last closing price on 27 September 2024, the last trading day prior to the date of the Fourth Proposal), or ii) an undisturbed price of A$219.00 per REA share (as of 30 August 2024, being the last business day prior to the possible offer announcement on 2 September 2024) plus the Special Dividend.

iv.VWAPs are calculated with reference to the period ending 30 August 2024, being the last business day prior to the possible offer announcement on 2 September 2024

v.REA EBITDA performance based on A$225 million for the 12 months to 30 June 2014 and A$825 million for the 12 months to 30 June 2024, based on REA reporting, implying 3.7x (14 per cent. CAGR over a 10 year period).

vi.REA revenue performance based on A$438 million for the 12 months to 30 June 2014 and A$1,453 million for the 12 month period to 30 June 2024, based on REA reporting, implying 3.3x (13 per cent. CAGR over a 10 year period).

vii.REA 10 year share price performance based on A$47.92 on 30 August 2014 and A$219.00 on 30 August 2024, being the last business day prior to the possible offer announcement on 2 September 2024, implying an increase of 357 per cent.

viii.REA two year share price performance based on A$124.20 on 30 August 2022 and A$219.00 on 30 August 2024, being the last business day prior to the possible offer announcement on 2 September 2024, implying an increase of 76 per cent.

ix.The reference to the leverage ratio of the combined group in this announcement assumes completion occurs in Q2 calendar year 2025.

x.Certain figures included in this announcement have been subject to rounding adjustments.

Notice to US Rightmove shareholders

In accordance with normal UK practice and pursuant to Rule 14e-5(b) of the US Exchange Act, REA or its nominees, or its brokers (acting as agents), may from time to time make certain purchases of, or arrangements to purchase, Rightmove shares outside the United States, other than pursuant to an offer, before or during the period in which an offer, if made, remains open for acceptance. Also, in accordance with Rule 14e-5(b) of the US Exchange Act, Deutsche Bank will continue to act as an exempt principal trader in Rightmove shares on the London Stock Exchange. These purchases may occur either in the open market at prevailing prices or in private transactions at negotiated prices. Any information about such purchases will be disclosed as required in the United Kingdom, will be reported to a Regulatory Information Service and will be available on the London Stock Exchange website, www.londonstockexchange.com.

This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States. Any securities referenced in this announcement have not been registered under the US Securities Act and may not be offered or sold in the United States absent registration under the US Securities Act, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Any offer would be subject to disclosure and other procedural requirements, including with respect to withdrawal rights, offer timetable, settlement procedures and timing of payments, that are different from those applicable under US domestic tender offer procedures and law.

Disclaimer

Deutsche Bank AG is a stock corporation (Aktiengesellschaft) incorporated under the laws of the Federal Republic of Germany with its principal office in Frankfurt am Main. It is registered with the local district court (Amtsgericht) in Frankfurt am Main under No HRB 30000 and licensed to carry on banking business and to provide financial services. The London branch of Deutsche Bank AG is registered as a branch office in the register of companies for England and Wales at Companies House (branch registration number BR000005) with its registered branch office address and principal place of business at 21 Moorfields, London EC2Y 9DB. Deutsche Bank AG is subject to supervision by the European Central Bank (ECB), Sonnemannstrasse 22, 60314 Frankfurt am Main, Germany, and the German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht or BaFin), Graurheindorfer Strasse 108, 53117 Bonn and Marie-Curie-Strasse 24-28, 60439 Frankfurt am Main, Germany. With respect to activities undertaken in the United Kingdom, Deutsche Bank AG is authorised by the Prudential Regulation Authority. It is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of Deutsche Bank AG's authorisation and regulation by the Prudential Regulation Authority are available from Deutsche Bank AG on request.

Deutsche Bank AG, acting through its London branch ("Deutsche Bank") is acting as financial adviser to REA and no-one else in connection with the matters described in this announcement and will not be responsible to anyone other than REA for providing the protections afforded to clients of Deutsche Bank, nor for providing advice in connection with the subject matter of this announcement or any other matter referred to in this announcement.

Publication on website

In accordance with Rule 26.1 of the Code, a copy of this announcement will be available, subject to certain restrictions relating to persons resident in restricted jurisdictions, on REA's website at www.rea-group.com by no later than 12 noon (London time) on the business day following the date of this announcement. The content of the website referred to in this announcement is not incorporated into, and does not form part of, this announcement.

About REA Group Ltd (www.rea-group.com)

REA Group Ltd ACN 068 349 066 (ASX:REA) ("REA Group") is a multinational digital advertising business specialising in property. REA Group operates Australia's leading residential and commercial property websites - realestate.com.au and realcommercial.com.au - as well as the leading website dedicated to share property, Flatmates.com.au and property research website, property.com.au. REA Group owns Mortgage Choice Pty Ltd, an Australian mortgage broking franchise group, PropTrack Pty Ltd, a leading provider of property data services, Campaign Agent Pty Ltd, Australia's leading provider in vendor paid advertising and home preparation finance solutions for the Australian real estate market and Realtair Pty Ltd, a digital platform providing end-to-end technology solutions for the real estate transaction process. In Australia, REA Group holds strategic investments in Simpology Pty Ltd, a leading provider of mortgage application and e-lodgement solutions for the broking and lending industries and Arealytics, a provider of commercial real estate information and technology in Australia. Internationally, REA Group holds a controlling interest in REA India Pte. Ltd. operator of established brands Housing.com and PropTiger.com. REA Group also holds a significant minority shareholding in Move, Inc., operator of realtor.com in the US, the PropertyGuru Group, operator of leading property sites in Malaysia, Singapore, Thailand and Vietnam and Easiloan, a technology platform for end-to-end digital processing of home loans in India.

For further information in relation to REA, please refer to the REA Group overview on the microsite: https://www.rea-qroup.com/investor-centre/possible-offer-for-rightmove/

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

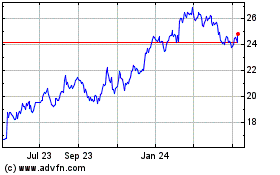

News (NASDAQ:NWSA)

Historical Stock Chart

From Oct 2024 to Nov 2024

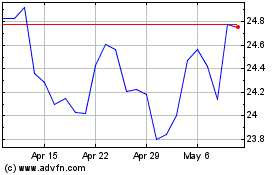

News (NASDAQ:NWSA)

Historical Stock Chart

From Nov 2023 to Nov 2024