false

0001108967

0001108967

2023-08-23

2023-08-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 23, 2023

|

Orbital Infrastructure Group, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Texas

|

0-29923

|

84-1463284

|

|

(State or other jurisdiction of

|

(Commission File Number)

|

(IRS Employer

|

|

incorporation)

|

|

Identification No.)

|

| |

|

|

|

5444 Westheimer Road,

Suite 1650

Houston, Texas

|

|

77056

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (832) 467-1420

(Former name or former address, if changed since last report)

Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

|

OIG

|

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.03.

|

Bankruptcy or Receivership.

|

Voluntary Petition for Bankruptcy

On August 23, 2023 (the “Petition Date”), Orbital Infrastructure Group, Inc. (the “Company”) and certain of its subsidiaries (collectively, the “Company Parties”) filed voluntary petitions (the “Chapter 11 Cases”) under Chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of Texas, Houston Division (the “Bankruptcy Court”). The Company Parties filed a motion with the Bankruptcy Court seeking to jointly administer the Chapter 11 Cases under the caption “In re: Orbital Infrastructure Group, Inc., et al.,” which was granted on August 24, 2023. Two of the Company’s subsidiaries, Front Line Power Construction LLC (“Front Line”) and Gibson Technical Services, Inc. (“GTS”), were not included in the Chapter 11 filing.

The Company Parties will continue to operate their business and manage their properties as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the U.S. Bankruptcy Code (the “Bankruptcy Code”) and orders of the Bankruptcy Court. To facilitate the Company Parties’ transition into Chapter 11, the Company Parties filed motions with the Bankruptcy Court seeking authority to, among other things, make payments upon, or otherwise honor, certain obligations that arose prior to the Petition Date, including obligations related to employee wages, salaries and benefits for certain employees that are essential to the Company Parties’ efforts while in Chapter 11. In addition, the Company Parties filed with the Bankruptcy Court a motion seeking approval of two superpriority senior secured debtor-in-possession (“DIP”) financing credit agreements to provide up to $15.0 million of incremental liquidity following the Petition Date.

|

Item 2.04.

|

Triggering Events that Accelerate or Increase a Direct Financial Obligation under an Off-Balance Sheet Arrangement.

|

The filing of the Chapter 11 Cases constitutes an event of default that accelerated the Company Parties’ obligations under the following debt instruments (the “Debt Instruments”):

| |

●

|

Term Loan pursuant to that certain Credit Agreement, dated as of November 17, 2021, by and among Front Line, as borrower, the Company, as parent, and certain subsidiaries, as guarantors, and Alter Domus (US) LLC, as administrative agent and collateral agent, and the various lenders from time to time party thereto, in an original principal amount of $105.0 million.

|

| |

●

|

Amended and Restated Secured Promissory Note (“Johnson Note”), dated May 26, 2023, issued by the Company in favor of Kurt A. Johnson (“Johnson”), in an original principal amount of approximately $33.9 million. The Johnson Note amended and restated those certain prior unsecured promissory notes dated November 17, 2021, issued by the Company in favor of Johnson.

|

| |

●

|

Secured Intercompany Note (“Intercompany Note”), dated as of November 7, 2022, issued by the Company to Front Line, in an original principal amount of $9.5 million. The Intercompany Note replaced that certain Unsecured Intercompany Note dated as of November 17. 2021.

|

| |

●

|

Amended and Restated Unsecured Promissory Note, dated November 17, 2021, issued by the Company to Tidal Power Group LLC, in an original principal amount of approximately $43.8 million.

|

| |

●

|

Unsecured Promissory Note, dated November 28, 2022, issued by GTS to Truist Bank, in an original principal amount of $4.0 million

|

| |

●

|

Unsecured Promissory Note (“HCT Note”) dated April 5, 2023, executed by Orbital Solar Services, LLC (“OSS”) in favor of HC Tradesman Staffing, in an original principal amount of approximately $1.9 million.

|

| |

●

|

Secured Promissory Note, dated December 9, 2022, issued by the Company to Streeterville Capital LLC (“Streeterville”), in an original principal amount of approximately $42.1 million.

|

| |

●

|

Secured Promissory Note, dated February 24, 2023, issued by the Company to Streeterville, in an original principal amount of approximately $14.9 million.

|

| |

●

|

Amended and Restated Secured Promissory Note, dated March 6, 2023, issued by the Company to Streeterville, in an original principal amount of approximately $20.9 million.

|

| |

●

|

Promissory Note issued by the Company and OSS in connection with a settlement to Jingoli Power, LLC in April 2023 in the amount of $34 million.

|

The Debt Instruments provide that, as of the filing of the Chapter 11 Cases, the unpaid principal and interest due thereunder shall be immediately due and payable. Any efforts to enforce such payment obligations under the Debt Instruments are automatically stayed upon the filing of the Chapter 11 Cases, and the creditors’ rights of enforcement prescribed in the Debt Instruments are subject to the applicable provisions of the Bankruptcy Code.

Item 7.01 Regulation FD Disclosure.

Press Release

On August 23, 2023, the Company issued a press release in connection with the filing of the Chapter 11 Cases. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Nasdaq Delisting Notice

The Company expects to receive a notice from The Nasdaq Stock Market (“Nasdaq”) that the Common Stock, $0.001 par value per share, of the Company (the “Common Stock”) no longer meets the eligibility requirements necessary for listing pursuant to Nasdaq Listing Rule 5110(b) as a result of the Chapter 11 Cases. If the Company receives such notice, the Company does not intend to appeal Nasdaq’s determination and, therefore, it is expected that its Common Stock will be delisted. The delisting of the Common Stock would not affect the Company’s post-petition status and does not presently change its reporting requirements under the rules of the Securities and Exchange Commission.

Additional Information on the Chapter 11 Cases

Court filings and information about the Chapter 11 Cases can be found at a website maintained by the Company Parties’ claim agent, Donlin, Recano & Company, Inc. (“DRC”), at https://www.donlinrecano.com/Clients/oig/Index or by contacting DRC at 1-866-853-1834 (Toll Free), +1-212-771-1128 (International) or by e-mail at oiginfo@drc.equiniti.com. The documents and other information available via such website or elsewhere are not part of this Current Report on Form 8-K and shall not be deemed incorporated herein.

The information furnished in this Item 7.01 of this Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Safe Harbor for Forward-Looking Statements

This Form 8-K and the related exhibits contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally use forward-looking words, such as “may,” “will,” “could,” “should,” “would,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast” and other words that convey the uncertainty of future events or outcomes. These forward- looking statements are not guarantees of the Company’s future performance and involve risks, uncertainties, estimates and assumptions that are difficult to predict and may be outside of the Company’s control. Therefore, the Company’s actual outcomes and results may differ materially from those expressed in or contemplated by the forward-looking statements. Factors and uncertainties that may cause the Company’s actual outcomes and results to differ from those expressed in or contemplated by forward-looking statements include, but are not limited to: risks attendant to the Chapter 11 bankruptcy process, including the Company’s ability to obtain court approval from the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 process; the Company’s plans to sell certain assets pursuant to Chapter 11 of the U.S. Bankruptcy Code, the outcome and timing of such sale, and the Company’s ability to satisfy closing and other conditions to such sale; the effects of Chapter 11, including increased legal and other professional costs necessary to execute the Company’s wind down, on the Company’s liquidity and results of operations (including the availability of operating capital during the pendency of Chapter 11); the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of Chapter 11; the Company’s ability to continue funding operations through the Chapter 11 bankruptcy process, and the possibility that it may be unable to obtain any additional funding as needed; the Company’s ability to meet its financial obligations during the Chapter 11 process and to maintain contracts that are critical to its operations; the Company’s ability to comply with the restrictions imposed by the terms and conditions of the DIP credit agreements and other financing arrangements; objections to the Company’s wind down process, the DIP credit agreements, or other pleadings filed that could protract Chapter 11; the effects of Chapter 11 on the interests of various constituents and financial stakeholders; the effect of the Chapter 11 filings and any potential asset sale on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Chapter 11 process or the potential asset sale and risks associated with third-party motions in Chapter 11; the timing or amount of any distributions, if any, to the Company’s stakeholders; expectations regarding future performance of assets expected to be sold in the bankruptcy process; employee attrition and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties; the impact and timing of any cost-savings measures and related local law requirements in various jurisdictions; the impact of litigation and regulatory proceedings; expectations regarding financial performance, strategic and operational plans, and other related matters; and other factors discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” section of the Annual Report on Form 10-K for its 2022 fiscal year. Any forward-looking statement speaks only as of the date of this Form 8-K. Except as may be required by applicable law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and you are cautioned not to rely upon them unduly.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

| |

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date:

|

August 24, 2023

|

|

|

| |

|

|

|

| |

|

Orbital Infrastructure Group, Inc.

|

| |

|

|

|

| |

|

By:

|

/s/ James F. O’Neil

|

| |

|

|

Name: James F. O’Neil

|

| |

|

|

Title: Chief Executive Officer

|

Exhibit 99.1

Orbital Infrastructure Group Inc. Intends to Enter into Purchase Agreements for the Sale of Front Line Power Construction and Gibson Technical Services and Files for Chapter 11 Protection

Receives Commitment from Existing Secured Lenders for $15.0 Million in Debtor-in-Possession Financing

HOUSTON, TX – Orbital Infrastructure Group Inc. (NASDAQ: OIG) (the “Company”), announced today that it and certain of its subsidiaries (Orbital Solar Services, L.L.C., Orbital Power, Inc., Orbital Gas Systems, North America, and Eclipse Foundation Group, Inc.) have filed voluntary Chapter 11 petitions in the U.S. Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”). The filing specifically excludes Front Line Power Construction (“FLP”) and Gibson Technical Services (“GTS”), which are being sold separately as described below.

The Sale Transactions

The Company and the FLP secured lenders (the “FLP Lenders”) intend to enter into a purchase agreement pursuant to which the FLP Lenders will designate an entity to acquire the equity interests in FLP. The Company and the GTS secured lender (the “GTS Lender”) intend to enter into a purchase agreement pursuant to which the GTS Lender will designate an entity to acquire the equity interests in GTS.

Jim O’Neil, Vice-Chairman and CEO of the Company, stated: “Having carefully reviewed all available options, our comprehensive strategic alternatives process has concluded. The Chapter 11 filing is not the outcome we would have wanted for our stockholders or the stakeholders, but this difficult decision was necessary to sell the primary and profitable parts of the Company as going concerns.”

The transactions with the FLP Lenders and the GTS Lender are part of a sale process under Section 363 of the Bankruptcy Code in which the Lenders are the “stalking horse” bidders. The purchase agreements between the Company and the FLP Lenders, and between the Company the GTS Lender, contain the terms against which competing offers will be solicited and evaluated during a Chapter 11 auction process. The Company is seeking Bankruptcy Court approval of bidding procedures allowing for the submission of highest and best purchase offers. Any sale will be subject to Bankruptcy Court approval. The Company will manage the bidding process and evaluate any bids received, in consultation with its advisors and otherwise in accordance with the bidding procedures and oversight by the Bankruptcy Court.

Under the purchase agreements, successful purchasers will not acquire the Company’s other subsidiaries (Orbital Infrastructure Group, Inc., Orbital Solar Services, L.L.C., Orbital Power, Inc., Orbital Gas Systems, North America, Eclipse Foundation Group, Inc.).

DIP Financing

To provide necessary funding during the Chapter 11 proceeding, the Company has received commitments for two debtor-in-possession ("DIP") financing credit agreements with the FLP Lenders and the GTS Lender. Upon approval by the Bankruptcy Court, the DIP financing agreements are expected to provide the Company with the necessary liquidity to permit the Company to operate in the ordinary course of business throughout the Chapter 11 proceedings and close the sale transactions. The DIP financing will provide $15.0 million of incremental liquidity following the petition filing.

About Orbital

Orbital Infrastructure Group, Inc. [NASDAQ: OIG] is a diversified infrastructure services platform, providing engineering, design, construction, and maintenance services to customers in three operating segments; electric power, telecommunications, and renewables.

For more information please visit: http://www.orbitalenergygroup.com

Forward-looking Statement Disclaimer

This press release contains “forward-looking statements” within the meaning of the term set forth in the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally use forward-looking words, such as “may,” “will,” “could,” “should,” “would,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast” and other words that convey the uncertainty of future events or outcomes. These forward- looking statements are not guarantees of the Company’s future performance and involve risks, uncertainties, estimates and assumptions that are difficult to predict and may be outside of the Company’s control. Therefore, the Company’s actual outcomes and results may differ materially from those expressed in or contemplated by the forward-looking statements. Factors and uncertainties that may cause the Company’s actual outcomes and results to differ from those expressed in or contemplated by forward-looking statements include, but are not limited to: risks attendant to the Chapter 11 bankruptcy process, including the Company’s ability to obtain court approval from the Bankruptcy Court with respect to motions or other requests made to the Bankruptcy Court throughout the course of the Chapter 11 process, including with respect to the sale of FLP and GTS and the DIP credit agreements; the Company’s plans to sell certain assets pursuant to Chapter 11 of the U.S. Bankruptcy Code, the outcome and timing of such sale, and the Company’s ability to satisfy closing and other conditions to such sale; the effects of Chapter 11, including increased legal and other professional costs necessary to execute the Company’s wind down, on the Company’s liquidity and results of operations (including the availability of operating capital during the pendency of Chapter 11); the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of Chapter 11; the Company’s ability to continue funding operations through the Chapter 11 bankruptcy process, and the possibility that it may be unable to obtain any additional funding as needed; the Company’s ability to meet its financial obligations during the Chapter 11 process and to maintain contracts that are critical to its operations; the Company’s ability to comply with the restrictions imposed by the terms and conditions of the DIP credit agreements and other financing arrangements; objections to the Company’s wind down process, the DIP credit agreements, or other pleadings filed that could protract Chapter 11; the effects of Chapter 11 on the interests of various constituents and financial stakeholders; the effect of the Chapter 11 filings and any potential asset sale on the Company’s relationships with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in connection with the Chapter 11 process or the potential asset sale and risks associated with third-party motions in Chapter 11; the timing or amount of any distributions, if any, to the Company’s stakeholders; expectations regarding future performance of assets expected to be sold in the bankruptcy process; employee attrition and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties; the impact and timing of any cost-savings measures and related local law requirements in various jurisdictions; the impact of litigation and regulatory proceedings; expectations regarding financial performance, strategic and operational plans, and other related matters; and other factors discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” section of the Annual Report on Form 10-K for its 2022 fiscal year. Any forward-looking statement speaks only as of the date of this press release. Except as may be required by applicable law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and you are cautioned not to rely upon them unduly.

v3.23.2

Document And Entity Information

|

Aug. 23, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Orbital Infrastructure Group, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 23, 2023

|

| Entity, Incorporation, State or Country Code |

TX

|

| Entity, File Number |

0-29923

|

| Entity, Tax Identification Number |

84-1463284

|

| Entity, Address, Address Line One |

5444 Westheimer Road

|

| Entity, Address, Address Line Two |

Suite 1650

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77056

|

| City Area Code |

832

|

| Local Phone Number |

467-1420

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

OIG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001108967

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

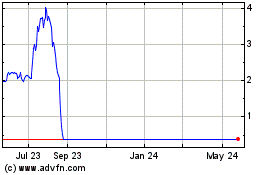

Orbital Infrastructure (NASDAQ:OIG)

Historical Stock Chart

From Apr 2024 to May 2024

Orbital Infrastructure (NASDAQ:OIG)

Historical Stock Chart

From May 2023 to May 2024