true

--12-31

0001852973

A6

0001852973

2024-02-07

2024-02-07

0001852973

BRLS:CommonSharesMember

2024-02-07

2024-02-07

0001852973

BRLS:WarrantsMember

2024-02-07

2024-02-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): April 15, 2024 (February

7, 2024)

BOREALIS FOODS INC.

(Exact name of Registrant as Specified in its

Charter)

| Ontario |

|

001-40778 |

|

98-1638988 |

|

(State or other

jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

1540 Cornwall Rd. #104

Oakville, Ontario |

|

L6J 7W5 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(905) 278-2200

Registrant’s telephone number, including

area code

Oxus Acquisition Corp.

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a.12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| |

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Shares |

|

BRLS |

|

Nasdaq Capital Market |

| Warrants |

|

BRLSW |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Introductory Note

Overview

This Amendment No. 1 to the Current Report on

Form 8-K of Borealis Foods Inc. (“New Borealis”) originally filed by New Borealis on February 13, 2024 (such Current

Report, the “Original Current Report”) is being filed for the purpose of supplementing the historical financial statements

and pro forma combined financial information provided under Items 9.01(a) and 9.01(b) in the Original Current Report to include the audited

consolidated financial statements of each of Oxus Acquisition Corp., our predecessor company (“Oxus”), and Borealis

Foods Inc. (“Borealis”), as of December 31, 2023 and 2022 and for the years ended December 31, 2023 and 2022, and the

related Management’s Discussion and Analysis of Financial Condition and Results of Operations of Oxus and Borealis for the year

ended December 31, 2023, and the unaudited pro forma condensed combined financial information of New Borealis for the year ended December

31, 2023. This Amendment No. 1 further amends the Original Current Report in order to reflect business updates and developments at New

Borealis subsequent to the filing date of the Original Current Report.

The Business Combination

On February 7, 2024 (the “Closing Date”),

Borealis, Oxus, and 1000397116 Ontario Inc., an Ontario corporation and a wholly owned subsidiary of Oxus (“Newco”),

consummated the transactions (collectively, the “Transaction”) contemplated by the Business Combination Agreement,

dated as of February 23, 2023, by and among Borealis, Oxus, and Newco (as amended, amended and restated, supplemented, or otherwise modified

from time to time, the “Business Combination Agreement”) by means of a statutory arrangement (the “Arrangement”)

under the Canada Business Corporations Act and the Business Corporations Act (Ontario), implemented in accordance with the terms and conditions

set forth in the Business Combination Agreement and the plan of arrangement attached as Exhibit B thereto (as amended, amended and restated,

supplemented, or otherwise modified from time to time, the “Plan of Arrangement”) and which is incorporated herein

by reference, following the approval at an extraordinary general meeting of the shareholders of Oxus held on February 2, 2024 (the “Special

Meeting”).

Pursuant to the terms of the Business Combination

Agreement, among other things: (i) Oxus domesticated and continued as a corporation under the laws of Ontario, Canada (“New Oxus”);

and (ii) pursuant to the Plan of Arrangement, (a) Newco and Borealis amalgamated (the “Borealis Amalgamation”, and

the amalgamated corporation resulting therefrom, “Amalco”), with Amalco surviving the Borealis Amalgamation as a wholly-owned

subsidiary of New Oxus; and (b) following the Borealis Amalgamation, New Oxus and Amalco amalgamated (the “New Borealis Amalgamation,”

and together with the Borealis Amalgamation, the “Amalgamations,” and the corporation resulting therefrom, “New

Borealis,” as a corporation amalgamated under the Business Corporations Act (Ontario)), with New Borealis surviving the New

Borealis Amalgamation. New Borealis will continue under the name “Borealis Foods Inc.”

In connection with the Transaction, New Oxus issued

an aggregate of 21,378,890 common shares of New Oxus (“New Oxus Common Shares”), which, upon completion of the New

Borealis Amalgamation, survived and continued as common shares of New Borealis (the “New Borealis Common Shares,” and

the holders thereof upon completion of the Transaction, the “New Borealis Shareholders”).

Conversion and Exchange of Equity in the Transaction.

Upon the closing of the Transaction (the “Closing”),

the following occurred:

| ● | The common shares of Borealis (“Borealis Common

Shares”) were exchanged for shares of New Borealis Common Shares equal to the quotient of (a) $150,000,000 minus Borealis’

Closing Net Indebtedness, as agreed to by the parties, of $17,000,000, which equals $133,000,000, divided by (b) $10.00 (the “Aggregate

Transaction Consideration”). |

| ● | Each Borealis Common Share was exchanged for 0.0661 of a

New Borealis Common Share, which is equal to the quotient obtained by dividing the Aggregate Transaction Consideration by the aggregate

number of Borealis Common Shares issued and outstanding immediately prior to the Borealis Amalgamation. |

| ● | As of the Closing Date, the Aggregate Transaction Consideration

was 13,300,000 New Oxus Common Shares, and was based on 201,206,834 Borealis Common Shares issued and outstanding, with an exchange rate

of 0.0661, which the process is described in the final prospectus and definitive proxy statement, dated January 16, 2024 (the “Proxy

Statement/Prospectus”) filed by Oxus with the Securities and Exchange Commission (the “SEC”), which is incorporated

herein by reference. |

A description of the Transaction and the terms

of the Business Combination Agreement are included in the Proxy Statement/Prospectus in the section titled “The Business Combination

– The Business Combination Agreement” beginning on pages 2 and 107, respectively, of the Proxy Statement/Prospectus.

The foregoing description of the Business Combination

Agreement is a summary only, does not purport to be complete and is qualified in its entirety by the full text of the Business Combination

Agreement, which is incorporated herein by reference.

Item 1.01 Entry into a Material Definitive Agreement.

Shareholder Support Agreements

Concurrently with the execution of the Business

Combination Agreement, Borealis entered into Shareholder Support Agreements with Oxus and certain Borealis shareholders. Pursuant to the

Shareholder Support Agreements, among other things, such Borealis shareholders agreed to vote their Borealis Common Shares in favor of

the Transaction and not to sell or transfer their Borealis Common Shares.

The Shareholder Support Agreements are described

in the Proxy Statement/Prospectus in the sections entitled “Certain Agreements Related to the Business Combination– Shareholder

Support Agreements” beginning on pages 5 and 121, respectively, of the Proxy Statement/Prospectus.

The foregoing description of the Shareholder Support

Agreements does not purport to be complete and is qualified in its entirety by the full text of the form of the Shareholder Support Agreements,

which is incorporated herein by reference.

Sponsor Support Agreement

Concurrently with the execution of the Business

Combination Agreement, Borealis entered into a Sponsor Support Agreement with Oxus and Oxus Capital Pte Ltd. (the “Sponsor”),

pursuant to which, among other things, the Sponsor agreed to (A) vote its Founder Shares in favor of the Transaction and the Oxus Proposals,

(B) not redeem its Founder Shares, (C) waive certain of its anti-dilution rights, (D) convert the Sponsor Convertible Notes, and (E) forfeit

certain Sponsor Founder Shares as a part of incentive equity compensation for directors, officers and employees of Borealis.

The Sponsor Support Agreement is described in

the Proxy Statement/Prospectus in the section titled “Certain Agreements Related to the Business Combination Agreement –

Sponsor Support Agreement” beginning on pages 5 and 121, respectively, of the Proxy Statement/Prospectus.

The foregoing description of the Sponsor Support

Agreement does not purport to be complete and is qualified in its entirety by the full text of the Sponsor Support Agreement, which is

incorporated herein by reference.

Third Amended and Restated Promissory Note

On February 7, 2024, New Borealis and the Sponsor

entered into a Promissory Note (the “Sponsor Note”), which amends, replaces, and supersedes in its entirety the Second

Amended and Restated Promissory Note, dated October 2, 2023 (the “Original Sponsor Note”), pursuant to which Oxus was

granted the right to borrow up to an aggregate principal amount of $6,000,000. The Sponsor Note’s principal shall be payable on

the one-year anniversary of the Sponsor Note. The Sponsor Note was amended and restated to extend the maturity date from the Closing Date

to February 7, 2025, and to include an assumption of liabilities to constitute a drawdown of the principal.

The foregoing description of the Original Sponsor

Note does not purport to be complete and is qualified in its entirety by the full text of the Original Sponsor Note, which is incorporated

herein by reference. The foregoing description of the Sponsor Note does not purport to be complete and is qualified in its entirety by

the full text of the Sponsor Note, which is incorporated herein by reference, a copy of which is attached hereto as Exhibit 10.11.

Registration Rights Agreements

At Closing, the Sponsor, Oxus directors, certain

Borealis shareholders, and certain Borealis directors and officers (the “Holders”) entered into Registration Rights

Agreements, pursuant to which Oxus will be obligated to file a registration statement to register the resale of certain securities of

Oxus held by the Holders. The Registration Rights Agreement will also provide the Holders with “piggy-back” registration rights,

subject to certain requirements and customary conditions.

The terms of the Registration Rights Agreements

described in the Proxy Statement/Prospectus in the section titled “Certain Agreements Related to the Business Combination Agreement

– Registration Rights Agreements” beginning on pages 5 and 121 respectively, of the Proxy Statement/Prospectus.

The foregoing description of the Registration

Rights Agreements does not purport to be complete and is qualified in its entirety by the full text of the form of the Registration Rights

Agreements, which is incorporated herein by reference.

Lock-Up Agreements

At Closing, the Holders entered into Lock-Up Agreements,

pursuant to which (A) 50% of the New Borealis Common Shares held by either a director, officer, or 5% or greater holder party to such

agreements (the “Restricted Securities”) will be locked-up during the period commencing from Closing and ending on

the earlier to occur of (i) 12 months after the date of the Closing and (ii) the date on which the closing price of New Borealis Common

Shares equals or exceeds $12.00 per share (as adjusted to take into account any stock split, stock dividend, reverse stock split, recapitalization

or similar event) for any 20 trading days within a 30-trading day period starting after the Closing, and (B) 50% of the Restricted Securities

will be locked-up during the period commencing from Closing and ending on 12 months after the date of Closing, subject to certain specifications

and exceptions.

The terms of the Lock-Up Agreements are described

in the Proxy Statement/Prospectus in the section titled “Certain Agreements Related to the Business Combination Agreement –

Lock-Up Agreements” beginning on pages 5 and 121, respectively.

The foregoing description of the Lock-Up Agreements

does not purport to be complete and is qualified in its entirety by the full text of the form of the Lock-Up Agreements, which is incorporated

herein by reference.

New Investor Note Purchase Agreements

In accordance with the terms of the Business Combination

Agreement, Borealis executed New Investor Note Purchase Agreements with certain investors. On February 8, 2023, a New Investor Note Purchase

Agreement for an amount of $20,000,000 was executed by Belphar Ltd. (the “Belphar Note”). On March 3, 2023, a New Investor

Note Purchase Agreement for an amount of $5,000,000 was executed by Saule Algaziyeva (the “Saule Note”). On November

15, 2023, a New Investor Note Purchase Agreement for an amount of $2,000,000 was executed by Aman Murat Baikadamuly (the “Aman

Note”). On January 30, 2024, a New Investor Note Purchase Agreement for an amount of $3,000,000 was executed by GSS Overseas

LTD. (the “GSS Note,” and collectively with the Belphar Note, the Saule Note, and the Aman Note, the “New

Investor Note Purchase Agreements”). The amount of the Minimum Cash Condition set forth in the Business Combination Agreement

was reduced by any cash amounts received by Borealis prior to the Closing in connection with (A) the New Investor Convertible Note Financing,

including $30,000,000 received through January 30, 2024, or (B) any Permitted Company Financing. All New Investor Convertible Notes issued

pursuant to the New Investor Note Purchase Agreements converted into 4,163,510 New Borealis Common Shares immediately following the New

Borealis Amalgamation.

The terms of the New Investor Note Purchase Agreements

are described in the Proxy Statement/Prospectus in the section titled “Certain Agreements Related to the Business Combination–

New Investor Note Purchase Agreements” beginning on pages 5 and 121, respectively.

The foregoing description of the New Investor

Note Purchase Agreements does not purport to be complete and is qualified in its entirety by the full text of the Belphar Note and the

Saule Note, each of which is incorporated herein by reference, and the Aman Note and the GSS Note, copies of which are attached hereto

as Exhibits 10.8 and 10.9, respectively.

Belphar Ltd. Board Nomination Agreement

On February 7, 2024, a Board Nomination Agreement

was entered into by New Borealis and Belphar Ltd. (“Belphar”) effective upon Closing. Such agreement provides that,

so long as Belphar and its affiliates continue to beneficially own or control at least eight percent (8%) of the issued and outstanding

New Borealis Common Shares, Belphar has the right to designate one nominee for election to the board of directors of New Borealis (the

“New Borealis Board”). Among other things, Belphar’s nominee must: (A) meet the qualification requirements to

serve as a director under the Business Corporations Act (Ontario), applicable U.S. securities laws and/or the applicable rules

of any stock exchange on which the New Borealis Common Shares are listed; (B) be an independent director pursuant to the requirements

of the Nasdaq Capital Market ( “Nasdaq”); and (C) substantially satisfy the recommendations for director nominees in

Institutional Shareholder Services’ and Glass Lewis’ proxy voting guidelines applicable to New Borealis in effect from time

to time. Belphar’s initial nominee is Shukhrat Ibragimov.

The foregoing description of the Board Nomination

Agreement does not purport to be complete and is qualified in its entirety by the full text of the Board Nomination Agreement, which is

incorporated herein by reference.

Indemnification Agreements

On the Closing Date, New Borealis entered into

indemnification agreements with each of its directors and executive officers. These indemnification agreements provide the directors and

executive officers of New Borealis with contractual rights to indemnification and advancement of certain expenses incurred by such director

or executive officer in any action or proceeding arising out of his or her services as one of New Borealis’ directors or executive

officers.

The foregoing description of the indemnification

agreements does not purport to be complete and is qualified in its entirety by the full text of the form of indemnification agreement,

a copy of which is attached hereto as Exhibit 10.13.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the “Introductory

Note” above is incorporated by reference into this Item 2.01 of this Current Report on Form 8-K.

FORM 10 INFORMATION

Item 2.01(f) of this Current Report on Form 8-K

states that if the predecessor registrant was a shell company, as Oxus was immediately before the Transaction, then the registrant must

disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, New Borealis is providing the information below that would be included in a Form 10 if it were to file a Form 10. Please

note that the information provided below relates to the combined company after the consummation of the Transaction unless otherwise specifically

indicated or the context otherwise requires.

Forward-Looking Statements.

Certain statements in this Current Report on Form

8-K and in documents incorporated herein by reference may constitute “forward-looking statements” for purposes of the federal

securities laws. New Borealis’ forward-looking statements include, but are not limited to: statements regarding New Borealis management

team’s expectations, beliefs, intentions, projections and predictions, future plans, strategies and tactics, anticipated events

or trends and similar expressions concerning factual matters that are not historical facts. In addition, any statements that refer to

projections, forecasts or other characterizations of future events or circumstances, respective capital resources, or performance, including

any underlying assumptions, are forward-looking statements.

In some cases, you can identify forward-looking

statements by the following words: “approximately,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “seeks,”

“would” or the negative version of these words or other comparable words or phrases and similar expressions, although the

absence of these words does not mean that a statement is not forward-looking.

Forward-looking statements in the Proxy Statement/Prospectus

may include, but are not limited to, for example, statements about: changes in New Borealis’ strategy, future operations, financial

position, estimated revenues and losses, projected costs, prospects, and plans; and expansion plans and opportunities.

These forward-looking statements are based on

information available as of the date of this Current Report on Form 8- K, and current expectations, forecasts, and assumptions, and

involve a number of judgments, risks, and uncertainties and are not predictions of actual performance. Accordingly, forward-looking statements

should not be relied upon as representing New Borealis’ views as of any subsequent date, and New Borealis does not undertake any

obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result

of new information, future events or otherwise, except as may be required under applicable securities laws.

These forward-looking statements are not intended

to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability regarding

future performance, events, or circumstances. Many of the factors affecting actual performance, events, and circumstances are beyond the

control of New Borealis. As a result of a number of known and unknown risks and uncertainties, New Borealis’ actual results or performance

may be materially different from those expressed or implied by these forward-looking statements.

Some factors that could cause actual results to

differ include:

| ● | Borealis’ limited operating history makes it difficult to evaluate its business and prospects; |

| ● | Borealis may be unable to execute its business plan or maintain its competitive position and high-level customer satisfaction if Borealis

fails to maintain adequate operational and financial resources, particularly if Borealis continues to grow rapidly; |

| ● | a significant portion of Borealis’ revenue is concentrated with a limited number of customers; |

| ● | adverse climate conditions may have an adverse effect on Borealis’ business. Borealis may take various actions to mitigate its

business risks associated with climate change, which may require Borealis to incur substantial costs and may not be successful, due to,

among other things, the uncertainty associated with the longer-term projections associated with managing climate risks; |

| ● | Borealis’ dependence on suppliers may materially adversely affect its operating results and financial position; |

| ● | manufacturing and production forecasts are based on multiple assumptions. Borealis must adequately estimate its manufacturing capacity

and inventory supply. If Borealis overestimates its demand and overbuilds its capacity or inventory, it may have significantly underutilized

assets. Underutilization of Borealis’ manufacturing facilities can adversely affect its gross margin and other operating results; |

| ● | Borealis may experience volatility in costs for ingredients and packaging due to conditions that are difficult to predict; |

| ● | Borealis’ future success will depend, in part, on its ability to maintain its technological leadership, enhance its current

food products, develop new food products that meet changing customer needs and preferences, advertise and market its food products, and

influence and respond to emerging industry standards and other technological changes on a timely and cost-effective basis; |

| ● | Borealis’ business depends on its use of proprietary technology relying heavily on laws to protect; |

| ● | New Borealis’ management team has limited experience managing a public company; |

| ● | U.S. shareholders may not be able to obtain judgments or enforce civil liabilities against us or our executive officers or the New

Borealis Board; and |

| ● | New Borealis will incur significant increased costs as a result of operating as a public company, and its management will be required

to devote substantial time to new compliance initiatives. |

Other risks and uncertainties indicated in this

Current Report on Form 8-K, including those under “Risk Factors” herein, and other filings that have been made or will be

made with the SEC by New Borealis.

These statements are based upon information available

to New Borealis, as the case may be, as of the date of this Current Report on Form 8-K, and while New Borealis, as the case may be, believes

such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should

not be read to indicate that such party has conducted an exhaustive inquiry into, or review of, all potentially available relevant information.

These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

Please see the other risks and uncertainties set

forth in the Proxy Statement/Prospectus in the section titled “Risk Factors” beginning on page 26 of the Proxy Statement/Prospectus

and is incorporated herein by reference.

Business and Properties.

The business of New Borealis is described in the

Form 10-K of New Borealis, filed with the SEC on April [●], 2024 (the “Annual Report”) in the section titled

“Item 1. Business” beginning on page 1, which is incorporated herein by reference.

The properties of New Borealis are described in

the Annual Report in the sections titled “Item 1. Business” beginning on page 1 and in “Item 2. Properties”

beginning on page 21, which are incorporated herein by reference.

The business and properties of Oxus prior

to the Transaction are described in the Proxy Statement/Prospectus in the section titled “Information About Oxus” beginning

on page 191, and such description is incorporated herein by reference.

Risk Factors.

The risks associated with Borealis’ business

are described in the Proxy Statement/Prospectus in the section titled “Risk Factors” beginning on page 26, and are

incorporated herein by reference.

Financial Information of Borealis.

Reference

is made to the disclosure set forth in Item 9.01 of this Current Report on Form 8-K concerning the financial information of Borealis and

Oxus, which is incorporated herein by reference.

Deferred

Transaction Fees.

In connection

with the Closing, New Borealis deferred a majority of the Closing Transaction Fees (as defined in the Business Combination Agreement)

to the first anniversary of the Closing Date or an earlier date in the event of the occurrence of specified events.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations.

Reference is made to the disclosure set forth

in Item 9.01 of this Current Report on Form 8-K concerning the management’s discussion and analysis of financial condition and results

of operations of Borealis and Oxus, which is incorporated herein by reference.

Directors and Executive Officers.

New Borealis’ directors and executive officers

as of immediately after the Closing are set forth in the table below, with each person’s biography and familial relationship, if

any, described in the Proxy Statement/Prospectus in the section titled “Management of New Borealis After the Business Combination,”

beginning on page 206, which section of the Proxy Statement/Prospectus is incorporated herein by reference.

| Directors and Executive Officers |

|

Age |

|

Position/Title |

| Reza Soltanzadeh |

|

51 |

|

Director and Chief Executive Officer |

| Barthelemy Helg |

|

58 |

|

Non-executive Chairman and Directors |

| Pouneh Rahimi |

|

56 |

|

Chief Legal Officer |

| Stephen Wegrzyn |

|

59 |

|

Chief Financial Officer |

| Matt Talle |

|

62 |

|

Chief Strategy Officer |

| Henry Wong |

|

57 |

|

Chief Marketing Officer |

| Ertharin Cousin |

|

66 |

|

Director |

| Shukhrat Ibragimov |

|

37 |

|

Director |

| Kanat Mynzhanov |

|

40 |

|

Director |

| Steven Oyer |

|

68 |

|

Director |

| Shiv Vikram Khemka |

|

61 |

|

Director |

Biographical information concerning the directors

and executive officers listed above is set forth below.

Reza Soltanzadeh, M.D. is a co-founder

of Borealis and has served as its Chief Executive Officer and a member of Borealis’ board of directors since July 2019. Prior to

founding Borealis, Dr. Soltanzadeh served as the Chief Executive Officer of IIIC Investment Group, an emerging markets multibillion-dollar

food-focused buyout firm, from February 2003 to May 2016. Dr. Soltanzadeh has continued to serve as a founder and partner of Z Ventures,

Inc., an early-stage green technology investment company, since its founding in March 2008. Dr. Soltanzadeh obtained his M.D. from the

University of Manipal, India. Dr. Soltanzadeh is qualified to serve on the New Borealis Board due to his business and technical expertise,

along with his strategic insight into Borealis’ business as its current Chief Executive Officer.

Barthelemy Helg is a co-founder

of Borealis and has served as the Chairman of Borealis’ board of directors since July 2019. Mr. Helg has served as Chairman of Dara

Capital AG, a FINRA and SEC registered investment advisory and wealth management company since March 2015. Mr. Helg currently serves as

a Director of AB2 Bio Ltd, a biotech company he co-founded focused on treatment of rare autoimmune diseases since July 2010. Mr. Helg

served as Managing Partner of Lombard Odier & Co, where he was a member of the Finance Risk and Credit committees, from April 2000

to December 2006. Prior to that, he was Vice President for Mergers and Acquisitions of Nestle S.A. from January 1998 to March 2000. Mr.

Helg began his carrier as an investment banker at Goldman Sachs. Mr. Helg obtained his M.L. from the University of Geneva, Switzerland,

his L.L.M. from New York University and an MBA from Harvard Business School. He is also admitted to the New York Bar. Mr. Helg is qualified

to serve on the New Borealis Board due to his extensive experience working with entrepreneurial companies and his experience in the food

industry.

Pouneh Rahimi has served as Borealis’

Chief Legal Officer since July 2019. Ms. Rahimi also serves as legal counsel at Rahimi Law Office, a position she has held since September

2003. In this role, Ms. Rahimi serves as part-time general counsel to select technology companies, addressing their day-to-day legal matters

arising in connection with ongoing operations including negotiation of strategic contracts and technology licensing. Ms. Rahimi has over

25 years of experience working with companies in the high-tech industry both as a lawyer and trusted business advisor. Ms. Rahimi’s

practice has focused on general corporate and business matters including corporate governance and compliance, intellectual property development

and licensing, trademarks (in the U.S. and Canada), and private debt and equity financing. Earlier in her career, Ms. Rahimi served as

a general counsel to MRO Software, Inc. formally a publicly traded company on Nasdaq, as well as a corporate associate at Nixon Peabody

LLP. Ms. Rahimi obtained her J.D. from the New England School of Law and her B.A. from McGill University. Ms. Rahimi is licensed to practice

law in New York, Massachusetts, and Ontario.

Steve Wegrzyn has served as Borealis’

Chief Financial Officer since July 2020. Prior to joining Borealis, Mr. Wegrzyn served as the Interim Chief Financial Officer and Integration

Specialist for Shed Financial Services, a financial services company, from January 2019 to July 2020. Prior to Shed Financial Services,

Mr. Wegrzyn served as Chief Financial Officer for Diesel Laptops, an automotive software company, from January 2018 to November 2018.

Mr. Wegrzyn held several interim CFO consulting positions from January 2015 to March 2018 in various industries including computer manufacturing,

chemical manufacturing, waste transportation, trucking, and food manufacturing. Mr. Wegrzyn began his career as an accountant at Ernst

and Young. Mr. Wegrzyn obtained his B.S. in Accounting and Finance from the Darla Moore School of Business of the University of South

Carolina.

Matt Talle has served as Chief Strategy

Officer of Palmetto Food Group (a subsidiary of Borealis) since January 2020. Prior to joining Palmetto Food Group, Mr. Talle held multiple

leadership roles with increasing responsibility at Nissin Foods U.S. where he worked for 30 years. During his tenure at Nissin Foods,

Mr. Talle served as Vice President of Business Development from June 2015 to December 2019, as Executive Vice President, Board of Director

from March 2010 to June 2015, and from March 2008 to June 2010, Mr. Talle served as of Vice President of sales and Marketing. Mr. Talle

obtained his B.S., Ag-Business from California Polytechnic University.

Henry Wong has served as Chief Marketing

Officer of Palmetto Food Group (a subsidiary of Borealis) since 2021. Mr. Wong has also served as President and Creative Strategist of

Vyoo Brand + Content, a branding and marketing agency, since September 2016. His past experience also includes being Sr. VP of Global

Ad Agency Saatchi & Saatchi as well as marketing for such food brands as Maple Leaf Foods, P&G, and Hormel Foods. Mr. Wong holds

bachelor degrees from Toronto Metropolitan University and the University of Toronto in Media Studies and Film.

Ertharin Cousin became a director

of New Borealis on February 7, 2024 pursuant to the terms of the Plan of Arrangement. Since September 2019, Ms. Cousin has served as Founder,

President and Chief Executive Officer of Food Systems For The Future Institute, a non-profit organization to catalyze, enable and scale

market-driven agtech, foodtech, and food innovations, and also as Visiting Scholar, Spogli Institute for the Study of International Relations,

Center for Food and Environment at Stanford University. She has served as Distinguished Fellow of The Chicago Council on Global Affairs,

a global affairs think tank, since June 2017. Ms. Cousin previously served at Stanford University as Payne Distinguished Lecturer and

Visiting Fellow, Spogli Institute for the Study of International Relations, Center for Food and Environment from September 2017 to June

2019. From April 2012 to April 2017, Ms. Cousin served as Executive Director of the United Nations World Food Programme, the food-assistance

branch of the United Nations, and she served as Ambassador and Permanent Representative to the United Nations Food and Agriculture Agencies

on behalf of the U.S. Department of State from August 2009 to April 2012. Ms. Cousin previously served in a variety of executive roles

between 1987 and 2009, including Founding President and Chief Executive Officer of The Polk Street Group, a management services company;

Executive Vice President and Chief Operating Officer of America’s Second Harvest; Senior Vice President, Public Affairs for Albertsons

Companies; White House Liaison and Special Advisor to the Secretary for the 2016 Olympics for the U.S. Department of State; and Assistant

Attorney General for The State of Illinois. Ms. Cousin currently serves a member of the Supervisory Board of Bayer AG and the Board of

Directors of Mondelez International, Inc. Ms. Cousin earned a B.A. at the University of Illinois at Chicago and received her J.D. from

the University of Georgia School of Law.

Shukhrat Ibragimov became a director

of New Borealis on February 7, 2024 pursuant to the terms of the Plan of Arrangement. Mr. Ibragimov serves as member of the Board of Directors

of Eurasian Resources Group (ERG), a leading natural resources (ferrochrome, iron, aluminum) company with the integrated mining, processing,

energy, logistics and marketing operations based mainly in Kazakhstan and operating globally (extraction and processing of metals), since

March 2021. Prior to his appointment to the Board of Directors of ERG, Mr. Ibragimov served as ERG’s Head of Business Development

since 2015. Mr. Ibragimov currently also serves as member of the Boards of Directors of Eurasia Insurance Company JSC, Eurasian Financial

Company JSC, Eurasian Bank JSC. In 2020, Mr. Ibragimov founded Eurasian Space Ventures LLP (ESV) based in Kazakhstan, venture fund investing

in startups in aerospace industry. Through ESV, Mr. Ibragimov controls BITEEU, a cryptocurrency exchange operating globally. Mr. Ibragimov

also is a co-founder of SPRK Music, a music platform that helps musicians to be discovered via a dedicated platform. Mr. Ibragimov graduated

from the European Business School London with bachelor degree and the Beijing Language and Culture University with masters’ degree.

Kanat Mynzhanov became a director

of New Borealis on February 7, 2024 pursuant to the terms of the Plan of Arrangement. Mr. Mynzhanov has served as Oxus’ Chief Executive

Officer and director since Oxus’ inception in February 2021. Mr. Mynzhanov led and co-founded a hedge fund, Bellprescot Prime Fund,

and asset management firm Bellprescot Asset Management in September 2016. He served as the director of the investment advisory firm, Bellprescot

Ltd. from September 2016 until April 2021. He served as the chief investment officer of Bellprescot Asset Management from September 2016

to June 2020. The hedge fund’s primary focus of investments was technology driven public companies with leading and disruptive products

and service, including internet of things and cloud, autonomous driving, artificial intelligence, machine learning, semiconductors, cybersecurity

and robotics. Since 2018, Mr. Mynzhanov advised on several private equities deals in fintech (payments, remittances and alternative financing),

mobility (including EV battery metals and EV battery technology) and structured products, including tokenization and syndicated co-lending.

Prior to founding the hedge fund, Mr. Mynzhanov served as the head of investments at Kazatomprom-Damu, an investment subsidiary of NAC

Kazatomprom JSC, where he led and mentored a team of highly skilled investment managers responsible for mergers and acquisitions, joint

ventures and business development across metals & mining, rare metals and alternative energy industries. Mr. Mynzhanov joined NAC

Kazatomprom JSC in 2014 as an investment manager and during his time, he oversaw numerous projects and established strong connections

with some of the largest global firms in the industry. From March 2011 to March 2014, Mr. Mynzhanov consulted and led the business development

of a tungsten concentrate producer in CIS region. From November 2008 to March 2011, Mr. Mynzhanov led and participated in operational,

commercial and investment management of oil tankers firm in London. Over the years, Mr. Mynzhanov consulted for various firms, including

those in the metals and mining sector, on raising capital through initial public offerings, as well as restructuring and various business

developments. Mr. Mynzhanov holds a Master of Science from University of Westminster.

Steven Oyer became a director of

New Borealis on February 7, 2024 pursuant to the terms of the Plan of Arrangement. Mr. Oyer is a seasoned finance executive with over

40 years of business and investment experience. Since January 2023, Mr. Oyer served as the Managing Partner of Sustainable Finance Partnerships

(SFP) where he advises companies in capital transactions and business development. Prior to that, Mr. Oyer served as Chief Executive Officer

of i(x) Net Zero, a publicly traded holding company focused on energy transition and sustainability. From September 2015 to February 2018,

Mr. Oyer served as Senior Vice President at Lazard Asset Management where he led their Global Family Office Advisory Group. Mr. Oyer’s

experience includes a senior position at the Private Funds Group of Brookfield Asset Management focused on Real Assets and Renewable Investments.

Additionally, Mr. Oyer served as interim Chief Executive Officer and led the restructuring of Saflink Corporation, a NASDAQ listed biometric

software company. Mr. Oyer served as a board member and audit chair of Salton, Inc., a designer, marketer, manufacturer, and distributor

of a broad range of branded small appliances. Mr. Oyer was the founder of Quake Capital, an accelerator that fosters early-stage ventures

led by student and faculty entrepreneurs from university ecosystems and still serves in an advisory capacity. Mr. Oyer is currently a

board member of The Truth Initiative, a nonprofit public health organization committed to tobacco use prevention and nicotine addiction.

He also has served as a member of the investment committee for the Florida Atlantic University’s Foundation. Mr. Oyer attended the

University of Massachusetts.

Shiv Vikram Khemka became a director

of New Borealis on February 7, 2024 pursuant to the terms of the Plan of Arrangement. Mr. Khemka has served as one of Oxus’ independent

directors commencing since September 2021. Mr. Khemka is a vice-chairman of SUN Group, a 120-year-old family enterprise comprised of both

operating and investment companies. He has served as a vice-chairman of SUN Group since 1990. SUN Group is active in asset management,

natural resources, green infrastructure and high technology. SUN has partnered to establish SUN Mobility, an energy tech company focused

on becoming a leader in EV energy. SUN is also a significant investor in a leading EV solid state battery manufacturer. The group has

been active in various regions around the world, including India, the Middle East, Central and South-East Asia. Mr. Khemka is the chairman

of the Entrepreneurship Sports Generation, also executive chairman of the Global Education and Leadership Foundation. He is currently

a member of the board of governors at Junior Achievement Worldwide and is a member of the Leadership Council at the Brooking Centre for

Universal Education. The World Economic Forum elected Mr. Khemka a “Global Leader for Tomorrow” and he was also a member of

the organization’s Global Agenda Council on Education. He has served on both the Brown University and Yale University’s President’s

Councils. Mr. Khemka has also served as a board member on the Stanford Philanthropy and Civic Society (PACS) centre. He is currently a

founding member of V20, a global community of values experts and practitioners that engage with G20, and is the chairman of Aikido Aikikai

Foundation of India. He was awarded the Dr. Jean Mayer Global Citizenship Award from Tufts University, the Outstanding Contribution to

Education Prize and the India Alumni Award from the Wharton School of Business. Mr. Khemka studied at Eton College, earned a BA in economics

from Brown (1985), an MBA/MA with distinction from the Wharton School of Business and the Lauder Institute at the University of Pennsylvania

(1990).

Belphar Board Nomination Agreement

The information set forth in the Item 1.01 above

with respect to the Belphar Board Nomination Agreement is incorporated by reference into this Item 2.01 of this Current Report on Form

8-K.

Director and Executive Compensation

Information with respect to the compensation of

New Borealis’ executive officers is described in the Proxy Statement/Prospectus in the section titled “Executive and Director

Compensation” beginning on page 212, which is incorporated herein by reference.

New Borealis will determine the annual compensation

to be paid to the members of the New Borealis Board.

Security Ownership of Certain Beneficial Owners

and Management.

The following table sets forth information regarding

the actual beneficial ownership of New Borealis as of February 7, 2024 by:

| ● | each person who is the beneficial owner of more than 5% of

the issued and outstanding New Borealis Common Shares; and |

| ● | each of New Borealis’ named executive officers and

directors. |

Beneficial ownership is determined according to

the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she, or it possesses sole or

shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within

60 days of February 7, 2024.

The beneficial ownership of New Borealis is based

on 21,378,890 New Borealis Common Shares issued and outstanding as of February 7, 2024, immediately following the Closing of the Transaction.

Unless otherwise indicated, New Borealis believes

that all persons named in the table below have sole voting and investment power with respect to all Borealis Common Shares beneficially

owned by them. To our knowledge, no New Borealis Common Shares beneficially owned by any executive officer or director have been pledged

as security.

The following table illustrates varying ownership

levels in New Borealis with the percentage of outstanding shares based on New Borealis Common Shares:

| Name and Address of Beneficial Owner | |

Number of

shares | | |

% of Total

Voting

Power | |

| Directors and Named Executive Officers of New Borealis(1) | |

| | |

| |

| Reza Soltanzadeh(2) | |

| 3,660,452 | | |

| 17.121 | % |

| Barthelemy Helg(3) | |

| 3,205,556 | | |

| 14.994 | % |

| Stephen Wegrzyn(4) | |

| 33,046 | | |

| * | |

| Pouneh Rahimi(5) | |

| — | | |

| * | |

| Matt Talle(6) | |

| 80,962 | | |

| * | |

| Henry Wong(7) | |

| 14,334 | | |

| * | |

| Kanat Mynzhanov(8) | |

| 200,000 | | |

| * | |

| Shiv Vikram Khemka(9) | |

| 50,000 | | |

| * | |

| Shukhrat Ibragimov(10) | |

| 3,224,880 | | |

| 15.084 | % |

| Steven Oyer | |

| — | | |

| — | |

| Ertharin Cousin | |

| — | | |

| — | |

| All directors and executive officers as a group (11 individuals) | |

| 10,469,230 | | |

| 49.87 | % |

| Five or more Percent Holders | |

| | | |

| | |

| Reza Soltanzadeh(2) | |

| 3,660,452 | | |

| 17.121 | % |

| Leila Rasoulian(13) | |

| 3,660,452 | | |

| 17.121 | % |

| Oxus Capital Pte.(11) | |

| 5,352,477 | | |

| 25.036 | % |

| Belphar Ltd.(12) | |

| 2,848,955 | | |

| 13.326 | % |

| Barthelemy Helg(3) | |

| 3,205,556 | | |

| 14.994 | % |

| (1) | Unless otherwise noted, the business address of each of the

following entities or individuals is c/o Borealis Foods Inc., 1540 Cornwall Road, Suite 104, Oakville, Ontario L6J 7W5. |

| (2) | Consists of (i) 3,532,505 Common Shares held by Zagros Alpine

Capital ULC and (ii) 127,947 Common Shares held by Z Ventures Inc. Reza Soltanzadeh is the President of Zagros Alpine Capital ULC and

Z Ventures Inc. Leila Rasoulian is the spouse of Mr. Soltanzadeh. Mr. Soltanzadeh and Ms. Rasoulian may be deemed to share beneficial

ownership of all the Common Shares held by Zagros Alpine Capital ULC and Z Ventures Inc. Mr. Soltanzadeh and Ms. Rasoulian may be deemed

to have joint voting and dispositive power over the shares held by Zagros Alpine Capital ULC and Z Ventures Inc. |

(3) | Consists of 3,205,556 Common Shares. |

| (4) | Consists of 33,046 Common Shares. |

| (5) | Does not include of 192,368 Common Shares held by Zagros

Alpine Capital ULC. Ms. Rahimi does not have voting or dispositive power over the shares held by Zagros Alpine Capital ULC. |

| (6) | Consists of 80,962 Common Shares. Does not include 133,703

Common Shares held by Zagros Alpine Capital ULC. Mr. Talle does not have voting or dispositive power over the shares held by Zagros Alpine

Capital ULC. |

| (7) | Consists of 14,334 Common Shares. |

| (8) | Consists of 200,000 Common Shares. |

| (9) | Consists of 50,000 Common Shares. |

| (10) | Consists of (i) 2,848,955 Common Shares held by Belphar Ltd.

and (ii) 375,925 Common Shares held by GSS Overseas LTD. Mr. Ibragimov is the sole shareholder of Belphar Ltd. and GSS Overseas LTD.

and has sole voting and dispositive power over the shares of Belphar Ltd. and GSS Overseas LTD. |

| (11) | Consists of 5,352,477 Common Shares. Kenges Rakishev is the

controlling shareholder. |

| (12) | Consists of 2,848,955 Common Shares. Mr. Ibragimov is the

controlling shareholder. |

| (13) | Consists of (i) 3,532,505 Common Shares held by Zagros Alpine

Capital ULC and (ii) 127,947 Common Shares held by Z Ventures Inc. Reza Soltanzadeh is the spouse of Ms. Rasoulian. Ms. Rasoulian and

Mr. Soltanzadeh may be deemed to share beneficial ownership of all the Common Shares held by Zagros Alpine Capital ULC and Z Ventures

Inc. Ms. Rasoulian and Mr. Soltanzadeh may be deemed to have joint voting and dispositive power over the shares held by Zagros Alpine

Capital ULC and Z Ventures Inc. |

Certain Relationships and Related Party Transactions,

and Director Independence.

Certain relationships and related party transactions

are described in the Proxy Statement/Prospectus in the sections titled “Certain Borealis Relationships and Related Person Transactions”

and “Certain Oxus Relationships and Related Person Transactions” beginning on pages 216 and 218, respectively, of the

Proxy Statement/Prospectus, which are incorporated herein by reference.

Reference is made to the disclosure regarding

director independence in the section of the Proxy Statement/Prospectus titled “Management of New Borealis After the Business

Combination – Independence of Directors” beginning on page 206 of the Proxy Statement/Prospectus, which is incorporated

herein by reference.

The information set forth under “Item

1.01 Entry into a Material Definitive Agreement,” “Shareholder Support Agreement,” “Sponsor Support

Agreement,” “Registration Rights Agreements and Lock-Up Agreements,” “New Investor Note Purchase

Agreement,” “Board Nomination Agreement,” and “Item 5.02 Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers” of this Current Report on Form 8-K is incorporated into this Item 2.01

by reference.

Legal Proceedings.

There is no material litigation, arbitration,

or governmental proceeding currently pending against New Borealis or any members of its management team.

Market Price of and Dividends on the Registrant’s

Common Equity and Related Stockholder Matters.

Market Information and Holders

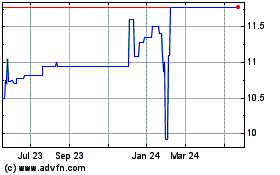

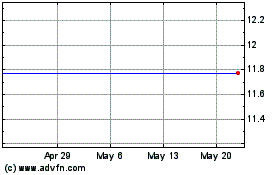

Oxus’ units, common stock and warrants were

historically quoted on the Nasdaq under the symbols “OXUS,” “OXUSU” and “OXUSW,” respectively. The

New Borealis Common Shares and the New Borealis Warrants began trading on Nasdaq under the new trading symbols “BRLS” and

“BRLSW,” respectively, on February 8, 2024.

As of the Closing Date and following the completion

of the Transaction, New Borealis had 21,378,890 New Borealis Common Shares issued and outstanding held of record by 79 holders and 9,300,000

New Borealis Warrants outstanding held of record by 4 holders.

Dividends

New Borealis has not paid any dividends to its

shareholders. The New Borealis Board will consider whether or not to institute a dividend policy in the future. The determination to pay

dividends will depend on many factors, including, among others, New Borealis’ financial condition, current, and anticipated cash

requirements, contractual restrictions and financing agreement covenants, solvency and other tests imposed by applicable corporate law

and other factors that the New Borealis Board may deem relevant.

Recent Sales of Unregistered Securities.

Reference is made to the disclosure set forth

under Item 3.02 of this Current Report on Form 8-K concerning recent sales of unregistered securities, which is incorporated herein by

reference.

Description of Registrant’s Securities.

New Borealis’ Common Shares

A description of New Borealis Common Shares is

included in the Proxy Statement/Prospectus in the section titled “Description of New Borealis Securities” beginning

on page 221 and is incorporated herein by reference.

New Borealis Warrants

A description of New Borealis Warrants is included

in the Proxy Statement/Prospectus in the sections titled “New Borealis Warrants” and “Exercise of New Borealis

Warrants” beginning on pages 226 and 132, respectively, and is incorporated herein by reference.

Indemnification of Directors and Officers.

In connection with the Transaction, New Borealis

entered into indemnification agreements with each of its directors and officers. These indemnification agreements provide such directors

and executive officers with contractual rights to indemnification and expense advancement.

The foregoing summary does not purport to be complete

and is qualified in its entirety by reference to the text of the form of indemnification agreements, a copy of which is attached hereto

as Exhibit 10.13 and is incorporated herein by reference.

Financial Statements and Supplementary Data.

The information set forth in Item 9.01 of this

Current Report on Form 8-K is incorporated herein by reference.

Changes in Accountants on Accounting and Financial

Disclosure.

The information set forth under Item 4.01 of this

Current Report on Form 8-K is incorporated herein by reference.

Financial Statements and Exhibits.

Reference is made to the disclosure set forth

under Item 9.01 of this Current Report on form 8-K concerning the financial information of New Borealis.

Item 2.02 Results of Operations and Financial Condition.

Reference is made to the disclosure set forth

under Item 9.01 of this Current Report on Form 8-K concerning the financial statements of Borealis and the disclosure contained in Management’s

Discussion and Analysis of Financial Condition and Results of Operations of Borealis, is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities

Following the Closing, the New Investor Convertible

Notes, each of which was issued pursuant to a New Investor Note Purchase Agreement, converted into 4,163,510 New Borealis Common Shares.

The New Borealis Common Shares issued pursuant to the New Investor Convertible Notes have not been registered under the Securities Act

of 1933, as amended (the “Securities Act”), or were issued in reliance upon the exemption provided under Section 4(a)(2)

of the Securities Act and Regulation S promulgated thereunder. Further information regarding the New Investor Convertible Notes is made

under the subheading “New Investor Note Purchase Agreements” in Item 1.01 of this Current Report on Form 8-K, which

is incorporated in this Item 3.02 by reference.

None of the foregoing transactions involved any

underwriters, underwriting discounts or commissions, or any public offering. Each of these transactions was exempt from registration under

the Securities Act in reliance on Section 4(a)(2) of the Securities Act (or Regulation S as promulgated thereunder) as transactions by

an issuer not involving any public offering. The recipients of the securities in each of these transactions represented their intention

to acquire the securities for investment only and not with a view to or for sale in connection with any distribution thereof, and appropriate

legends were placed on the note certificates issued in these transactions. All recipients had adequate access, through their relationships

with us, to information about us. The sales of these securities were made without any general solicitation or general advertising.

Further, the issuance of New Borealis Common Shares

upon the conversion of the New Investor Convertible Notes is exempt from registration under Section 3(a)(10) of the Securities Act as

the examination and approval by the court or governmental entity (either U.S. or foreign) of the fairness of the business combination

or exchange offer is deemed to be an adequate substitute for the protection afforded to investors.

Item 3.03 Material Modification to Rights of Security Holders.

Pursuant to the Plan of Arrangement: (a) Articles

of Amalgamation were filed for New Borealis (the “Articles”) with the Ministry of Public and Business Service Delivery

of Ontario; and (b) New Borealis adopted amended and restated bylaws substantially in the form included in Annex J to the Proxy Statement/Prospectus

(the “Bylaws,” and together with the Articles, the “Governing Documents”), in each case effective

as of February 7, 2024. Following the Arrangement, existing Oxus shareholders became holders of New Borealis Common Shares and, as such,

their rights are governed by the Governing Documents and applicable law.

The material terms of the Governing Documents

and the general effect upon the rights of the New Borealis Shareholders are described in the Proxy Statement/Prospectus beginning at page

156 thereof, which is incorporated by reference herein. The foregoing description of the Governing Documents is a summary only and is

qualified in its entirety by reference to the complete text of the Articles and the Bylaws, respectively, each of which is incorporated

herein by reference.

Item 4.01 Change in Registrant’s Certifying Accountants.

On February 7, 2024, the New Borealis Board approved

the appointment of Berkowitz Pollack Brant, Advisors + CPAs (“BPB”) as New Borealis’ independent registered public

accounting firm to audit Borealis’ consolidated financial statements for the year ended December 31, 2024. BPB served as the independent

registered public accounting firm of Borealis prior to the Transaction. Accordingly, Marcum LLP (“Marcum”), Oxus’

independent registered public accounting firm prior to the Transaction, was informed on February 7, 2024 that it will be dismissed as

New Borealis’ independent registered public accounting firm, effective immediately upon the filing of the December 31, 2023 Form

10-K for Oxus, pre-business combination SPAC.

The report of Marcum on Oxus’ balance

sheet as of December 31, 2023 and December 31, 2022 and the related statements of operations, changes in shareholders’

(deficit) equity and cash flows for the year ended December 31, 2022 and for the period from February 3, 2021 (inception) through

December 31, 2021, did not contain an adverse opinion or disclaimer of opinion, and were not qualified or modified as to

uncertainties, audit scope or accounting principles, except for an explanatory paragraph in such report regarding the substantial

doubt about Oxus’ ability to continue as a going concern.

During the period from February 3, 2021

(inception) through December 31, 2023 and the subsequent interim period through the date of Marcum’s dismissal, there were no

“disagreements” (as defined in Item 304(a)(1)(iv) of Regulation S-K under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”)) between Oxus and Marcum on any matter of accounting principles or practices,

financial disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Marcum, would have

caused it to make reference to the subject matter of the disagreements in its reports on Oxus’ financial statements for such

periods.

During the period from February 3, 2021

(inception) through December 31, 2023 and the subsequent interim period through the date of Marcum’s dismissal, there were no

“reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act), except that for the

years ended December 31, 2023 and December 31, 2022, based upon an evaluation of the effectiveness of the design and operation of

its disclosure controls and procedures, the Chief Executive Officer and the Chief Financial Officer of Oxus concluded that its

disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) were not effective due to

its accounting for complex financial instruments and prepaid expenses, as well as the chief executive officer having administrative

access to the Company’s financial reporting. Based on the foregoing, it was determined that Oxus had

material weaknesses as of December 31, 2023 relating to its internal controls over financial reporting.

During the period from February 3, 2021 (inception)

through December 31, 2022 and the subsequent interim period through the date of Marcum’s dismissal, Oxus and Borealis did not consult

with BPB regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed; or the

type of audit opinion that might be rendered on the financial statements of Oxus or Borealis, and no written report or oral advice was

provided that BPB concluded was an important factor considered by us in reaching a decision as to the accounting, auditing, or financial

reporting issue; or (ii) any matter that was either the subject of a “disagreement” (as defined in Item 304(a)(1)(iv) of Regulation

S-K under the Exchange Act) or a “reportable event” (as defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange

Act).

New Borealis has provided Marcum with a copy of

the foregoing disclosures and has requested that Marcum furnish New Borealis with a letter addressed to the SEC stating whether it agrees

with the statements made by New Borealis set forth above. A copy of Marcum’s letter, dated February 13, 2024, is filed as Exhibit

16.1 to this Current Report on Form 8-K.

Item 5.01 Changes in Control of Registrant.

Reference is made to the section of the Proxy

Statement/Prospectus entitled “Oxus Shareholder Proposal No. 4 — The Share Issuance Proposal” beginning on page

162 of Proxy Statement/Prospectus, which is incorporated herein by reference. Further reference is made to disclosure in the section titled

“Introductory Note” in Item 2.01 of this Current Report on Form 8-K, which is incorporated herein by reference.

Item 5.02 Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

The information set forth in the sections titled

“Director and Executive Officers” and “Certain Relationships and Related Transactions” in Item 2.01

of this Current Report on Form 8-K and in the section titled “Executive and Director Compensation” beginning on page

212 of the Proxy Statement/Prospectus is incorporated herein by reference.

The New Borealis Board consists of seven (7) members.

On February 7, 2024, each of Reza Soltanzadeh, Barthelemy Helg, Kanat Mynzhanov, Shiv Vikram Khemka, Shukhrat Ibragimov, Steven Oyer,

and Ertharin Cousin became directors of New Borealis pursuant to the terms of the Plan of Arrangement. Such individuals will serve as

directors of New Borealis until the first annual meeting of New Borealis Shareholders following the Transaction or their earlier resignation.

Biographical information for these individuals is set forth in Item 2.01 of this Current Report on Form 8-K.

The Committees of the Board of Directors

The New Borealis Board appointed Shiv Vikram Khemka,

Kanat Mynzhanov, and Steven Oyer to serve on the Audit Committee, with Mr. Oyer serving as its Chairman. The New Borealis Board appointed

Kanat Mynzhanov, Shiv Vikram Khemka, and Steven Oyer to serve on the Nominating and Corporate Governance Committee, with Mr. Oyer serving

as its Chairman. The New Borealis Board appointed Kanat Mynzhanov, Shiv Vikram Khemka, and Steven Oyer to serve on the Compensation Committee,

with Mr. Khemka serving as the Chairman. Information with respect to Borealis’ Audit Committee, Nominating and Corporate Governance

Committee, and Compensation Committee is set forth in the Proxy Statement/Prospectus in the section entitled “Management of New

Borealis After the Business Combination – Corporate Governance” beginning on page 209 of the Proxy Statement/Prospectus,

which is incorporated herein by reference.

In connection with the consummation of the Transaction,

effective upon completion of the Closing, on February 7, 2024: Reza Soltanzadeh was appointed to serve as the Chief Executive Officer;

Stephen Wegrzyn was appointed to serve as the Chief Financial Officer, Pouneh Rahimi was appointed to serve as Chief Legal Officer: Matt

Talle was appointed to serve as Chief Strategy Officer; and Henry Wong was appointed to serve as Chief Marketing Officer. The biographical

information set forth in Item 2.01 of this Current Report on Form 8-K, is incorporated in this section by reference.

New Borealis’ executive compensation program

is designed to align with compensation rules applicable to “smaller reporting companies,” as defined in the Exchange Act.

In connection with the Closing, on February 7,

2024, each executive officer and director of New Oxus immediately prior to the Closing resigned from his or her respective positions with

the post-combination company, other than any individual that became a director of New Borealis pursuant to the terms of the Plan of Arrangement.

Equity Incentive Plan.

At a special

meeting of the Oxus shareholders held on February 2, 2024, the Oxus shareholders considered and approved the Equity Incentive Plan

(the “Incentive Plan”). The Incentive Plan was previously approved, subject to shareholder approval, by Oxus’

board of directors on February 2, 2024, and subsequently approved and ratified by the New Borealis Board upon the Closing of the Transaction.

The Incentive Plan became effective immediately upon the consummation of the Transaction. The Incentive Plan initially makes available

a maximum number of 1,125,869 Borealis Common Shares. The aggregate number of Borealis Common Shares that is (i) issued to an officer,

director, 10% stockholder and anyone who possesses material non-public information because of his or her relationship with the company

or with an officer, director or principal stockholder of the company (“Insiders”) under the Incentive Plan or any other

proposed or established share compensation arrangement within any one-year period will not exceed 10% of the total issued and outstanding

Borealis Common Shares subject to the Incentive Plan from time to time and (ii) issuable to a non-employee director under the Incentive

Plan during any fiscal year of Borealis may not have a “fair value” as of the date of grant, as determined in accordance with

ASC Topic 718 (or any other applicable accounting guidance), that exceeds $300,000 in the aggregate.

A summary of the terms of the Equity Incentive

Plan is set forth in the Proxy Statement/Prospectus in the section titled “Oxus Shareholder Proposal No. 5 – The Incentive

Plan Proposal” beginning on page 163 of the Proxy Statement/Prospectus and is incorporated herein by reference. Such summary

and the foregoing description does not purport to be complete and is qualified in its entirety by reference to the text of the Equity

Incentive Plan, which is incorporated herein by reference as Exhibit 10.4 of the Proxy Statement/Prospectus.

Share Issuance Proposal.

At the Special Meeting, the Oxus shareholders

considered and approved the Share Issuance Proposal (the “Issuance Proposal”). The Issuance Proposal was previously

approved, subject to shareholder approval, by Oxus’ board of directors on February 2, 2024. The Issuance Proposal became effective

upon the consummation of the Transaction. Existing holders of Oxus’ Class A Shares and Class B Shares received an aggregate of 6,561,968

Borealis Common Shares. New Oxus issued 13,300,000 New Oxus Common Shares to Borealis shareholders, which survived and continued as New

Borealis Common Shares.

A summary of the terms of the Share Issuance Proposal

is set forth in the Proxy Statement/Prospectus in the section titled “Oxus Shareholder Proposal No. 4 – The Share Issuance

Proposal” beginning on page 162 of the Proxy Statement/Prospectus and is incorporated herein by reference. Such summary and

the foregoing description do not purport to be complete and are qualified in their entirety by reference to the text of the Share Issuance

Proposal, which is incorporated herein by reference.

Item 5.03 Amendments to Articles of

Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in Item 3.03 of this

Current Report on Form 8-K is incorporated by reference into this Item 5.03.

Item 5.05 Amendments to

Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

In connection with the Closing of the Transaction,

on February 7, 2024 and effective as of such date, the New Borealis Board adopted a new code of business conduct and ethics (the “Code

of Ethics”) applicable to directors, officers, and employees of New Borealis and its subsidiaries. New Borealis intends to post

any amendments to or any waivers from a provision of the Code of Ethics on its website. The full text of the Code of Ethics is included

as Exhibit 14.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.06 Change in Shell Company Status.

As a result of the Transaction, on February 7,

2024, Oxus ceased being a shell company. Reference is made to the disclosure in the Proxy Statement/Prospectus in the section titled “Oxus

Shareholder Proposal 1 – The Business Combination Proposal” beginning on page 137 of the Proxy Statement/Prospectus, and

such disclosure is incorporated herein by reference. Further reference is made to the information contained in Item 2.01 of this Current

Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On February 7, 2024, New Borealis issued a press

release announcing the Closing. A copy of the press release is furnished pursuant to Exhibit 99.1 attached hereto to this Current Report

on Form 8-K and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit

99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to

liabilities under that section, and shall not be deemed to be incorporated by reference into filings of the registrant under the Securities

Act, or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be

deemed an admission as to the materiality of any information contained in this Item 7.01, including Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

| (a) | Financial Statements of Business Acquired. |

The audited consolidated financial

statements of Borealis Foods Inc. as of and for the years ended December 31, 2023 and December 31, 2022 and the related notes are included

as Exhibits 99.2 to this Current Report and are incorporated herein by reference.

The audited consolidated financial

statements of Oxus Acquisition Corp. as of and for the years ended December 31, 2023 and December 31, 2022 and the related notes are included

as Exhibit 99.3 to this Current Report and are incorporated herein by reference.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations of Borealis Foods Inc. for the year ended December 31, 2023 are included as Exhibit 99.4

to this Current Report and is incorporated herein by reference.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations of Oxus Acquisition Corp. for the year ended December 31, 2023 are included as Exhibit

99.5 to this Current Report and is incorporated herein by reference.

| (b) | Pro Forma Financial Information. |

The unaudited pro forma condensed

combined financial information of the New Borealis for the year ended December 31, 2023, is attached as Exhibit 99.6 and is incorporated

herein by reference.

Exhibit

Number |

|

Description |

| 2.1*+ |

|

Business Combination Agreement, dated as of February 23, 2023, by and among Oxus Acquisition Corp., 1000397116 Ontario Inc., and Borealis Foods Inc. (incorporated by reference to Exhibit 2.1 to Oxus Acquisition Corp.’s Registration Statement on S-4, filed with the SEC on August 14, 2023). |

| 2.2*+ |

|

Amendment No. 1 to the Business Combination Agreement, dated as of August 11, 2023, by and among Oxus Acquisition Corp., 1000397116 Ontario Inc., and Borealis Foods Inc. (incorporated by reference to Exhibit 2.2 to Oxus Acquisition Corp.’s Registration Statement on S-4/A, filed with the SEC on October 24, 2023). |

| 2.3*+ |

|

Amendment No. 2 to the Business Combination Agreement, dated as of January 11, 2024, by and among Oxus Acquisition Corp., 1000397116 Ontario Inc., and Borealis Foods Inc. (incorporated by reference to Exhibit 2.3 to Oxus Acquisition Corp.’s Registration Statement on S-4/A, filed with the SEC on January 12, 2024). |

| 2.4*+ |

|

Plan of Arrangement (Amended) (incorporated by reference on Exhibit 10.4 to Oxus Acquisition Corp.’s Registration Statement on S-4/A, filed with the SEC on October 24, 2023). |

| 3.1* |

|

Form of New Borealis By-Laws (incorporated by reference to Exhibit 10.9 to Oxus Acquisition Corp.’s Registration Statement on S-4, filed with the SEC on August 14, 2023). |

| 3.2* |

|

Form of Borealis Articles of Continuance (incorporated by reference to Exhibit 10.8 to Oxus Acquisition Corp.’s Registration Statement on S-4, filed with the SEC on August 14, 2023). |

| 10.1*+ |

|

Form of Shareholder Support Agreement, dated as of February 23, 2023, by and among Oxus Acquisition Corp. and certain shareholders of Borealis Foods Inc. (incorporated by reference to Exhibit 10.4 to Oxus Acquisition Corp.’s Registration Statement on S-4, filed with the SEC on August 14, 2023). |

| 10.2*+ |

|

Sponsor Support Agreement, dated as of February 23, 2023, by and among Oxus Acquisition Corp., Oxus Capital Pte. Ltd and Borealis Foods Inc. (incorporated by reference to Exhibit 10.11 to Oxus Acquisition Corp.’s Registration Statement on S-4, filed with the SEC on August 14, 2023). |

| 10.3*+ |

|

Form of Registration Rights Agreement (incorporated by reference to Exhibit 10.5 to Oxus Acquisition Corp.’s Registration Statement on S-4, filed with the SEC on August 14, 2023). |

| 10.4*+ |

|

Form of Lock-up Agreement (incorporated by reference to Exhibit 10.6 to Oxus Acquisition Corp.’s Registration Statement on S-4, filed with the SEC on August 14, 2023). |

| 10.5* |

|

Note Purchase Agreement, dated February 28, 2023, by and between Borealis Foods Inc. and Saule Algaziyeva (incorporated by reference to Exhibit 10.37 to Oxus Acquisition Corp.’s Registration Statement on S-4/A, filed with the SEC on October 24, 2023). |

| 10.6* |

|

Note Purchase Agreement, dated February 8, 2023, by and between Borealis Foods Inc. and Belphar Ltd. (incorporated by reference to Exhibit 10.38 to Oxus Acquisition Corp.’s Registration Statement on S-4/A, filed with the SEC on October 24, 2023). |

| 10.7* |

|

First Amendment to the Note Purchase Agreement, dated July 23, 2023 (incorporated by reference to Exhibit 10.41 to Oxus Acquisition Corp.’s Registration Statement on S-4/A, filed with the SEC on November 13, 2023). |

| 10.8# |

|

Note Purchase Agreement, dated November 15, 2023, by and between Borealis Foods Inc. and Aman Murat Baikdamuly |

| 10.9 |

|

Note Purchase Agreement, dated January 30, 2024, by and between Borealis Foods Inc. and GSS Overseas LTD. |

| 10.10* |

|

Second Amended and Restated Promissory Note, dated October 2, 2023 (incorporated by reference to Exhibit 10.40 to Oxus Acquisition Corp.’s Registration Statement on S-4/A, filed with the SEC on October 24, 2023). |

| 10.11* |

|