UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported)

March 2, 2015

PCTEL, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-27115 |

|

77-0364943 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

471 Brighton Drive

Bloomingdale, Illinois 60108

(Address of Principal Executive Offices, including Zip Code)

(630) 372-6800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition |

The following information is intended to be furnished

under Item 2.02 of Form 8-K, “Results of Operations and Financial Condition.” This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

On March 2, 2015, PCTEL, Inc. issued a press release regarding its financial results for its fourth fiscal quarter ended December 31, 2014. The full

text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| 99.1 |

|

Press release, dated March 2, 2015, of PCTEL, Inc. announcing its financial results for its fourth fiscal quarter ended December 31, 2014. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

Date: March 2, 2015

|

|

|

|

|

PCTEL, INC. |

|

|

| By: |

|

/s/ John W. Schoen |

|

|

John W. Schoen, Chief Financial Officer |

EXHIBIT INDEX

|

|

|

Exhibit

Number |

|

Description |

|

|

| Exhibit 99.1 |

|

Press release, dated March 2, 2015, of PCTEL, Inc. announcing its financial results for its fourth fiscal quarter ended December 31, 2014. |

Exhibit 99.1

PCTEL Achieves $29.4 Million in Fourth Quarter Revenue

$107.2 Million in 2014 Revenue

BLOOMINGDALE, IL. – March 2, 2015 — PCTEL, Inc. (NASDAQ:PCTI), a leader in Performance Critical Telecom solutions,

announced its 2014 fourth quarter and annual results.

Fourth Quarter and Annual Highlights

$29.4 million in revenue for the quarter, an increase of 13 percent from the same period last year. $107.2 million in revenue for the

year, an increase of three percent over 2013.

Gross profit margin of 40 percent in the quarter, compared to 42 percent for the same

period last year. Gross profit margin of 41 percent for the year, compared to 40 percent in 2013.

GAAP operating margin from continuing

operations of six percent for the quarter, compared to operating margin of two percent for the same period last year. Operating margin for the year of four percent as compared to break even in 2013.

GAAP net income from continuing operations of $2.0 million for the quarter, or $0.11 per diluted share, compared to net income of

$453,000, or $0.02 per diluted share for the same period last year. $4.6 million of net income from continuing operations for the year, or $0.25 per diluted share, as compared to net income of $3.3 million, or $0.18 per diluted share in 2013.

Non-GAAP operating profit and net income are measures the company uses to reflect the results of its core earnings. The Company’s

reporting of Non-GAAP net income excludes expenses for restructuring, gain or loss on sale of assets, stock based compensation, amortization and impairment of intangible assets and goodwill related to the Company’s acquisitions, and non-cash

related income tax expense.

Non-GAAP operating margin from continuing operations of 12 percent in the quarter, compared to 10

percent in the same period last year. Non-GAAP operating margin for the year was 10 percent as compared to nine percent in 2013.

Non-GAAP net income from continuing operations of $3.0 million or $0.16 per diluted share in the quarter, as compared to $2.1 million or

$0.12 per diluted share in the same period last year. Non-GAAP net income from continuing operations of $8.8 million or $0.48 per diluted share for the year, as compared to $7.6 million or $0.42 per diluted share in 2013. The 2014 Non-GAAP earnings

represent a 4X increase over the last five years.

$60.0 million of cash and short-term investments at December 31, 2014, an

increase of approximately $1.1 million from the preceding quarter. This quarterly change includes approximately $2.6 million of cash flow from operations and approximately $700,000 of capital expenditures.

“Continued demand for in-building and small cell solutions drove our revenue growth, generating demand for

our engineering services, scanning receivers, in-building antenna solutions, and our site solutions,” said Marty Singer, PCTEL’s Chairman and CEO. “We believe that we are off to a good start to 2015 with our recent announcement of an

industry-leading five year warranty and our innovative VenU™ product line. We are preparing for the release of additional products during the Mobile World Congress this week,” added Singer.

CONFERENCE CALL / WEBCAST

PCTEL’s management team

will discuss the Company’s results today at 8:30 AM ET. The call can be accessed by dialing (877) 734-5369 (U.S. / Canada) or (706) 679-6397 (International), conference ID: 13775109. The call will also be webcast at

http://investor.pctel.com/events.cfm.

REPLAY: A replay will be available for two weeks after the call on either the website listed above or by

calling (855) 859-2056 (U.S./Canada), or International (404) 537-3406, conference ID: 13775109.

About PCTEL

PCTEL delivers Performance Critical Telecom solutions. Engineers rely upon PCTEL’s products and services to visualize, benchmark, and

optimize wireless networks worldwide. PCTEL’s antennas and site solutions are vital elements for SCADA, oil and gas, utilities, fleet management, health care, public safety, education, small cell, and network timing.

PCTEL’s RF Solutions products and services improve the performance of wireless networks globally. PCTEL’s performance critical

products include its MXflex™, IBflex™, and EXflex® SeeGull® scanning receivers and related SeeHawk® and SeeWave™ tools. PCTEL’s sophisticated engineering services utilize these products as well as the Meridian™ network analytics tool.

PCTEL Connected Solutions™ designs and delivers performance critical antennas and site solutions for wireless networks globally.

PCTEL’s performance critical MAXRAD® and Bluewave™ antenna solutions include high rejection and high performance GPS and GNSS products, the industry leading Yagi portfolio, mobile

and indoor LTE, broadband, and LMR antennas and PIM-rated antennas for transit, in-building, and small cell applications. We provide performance critical mobile towers for demanding emergency and oil and gas network applications and leverage our

design, logistics, and support capabilities to deliver performance critical site solutions into carrier, railroad, and utility applications.

PCTEL’s

products are sold worldwide through direct and indirect channels. For more information, please visit the company’s web sites: www.pctel.com, www.antenna.com, or www.rfsolutions.pctel.com.

PCTEL Safe Harbor Statement

This press release contains

“forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Specifically, the statements regarding the demand for in-building and small cell solutions generating growth in PCTEL’s in-building

engineering services and scanning receiver sales, the impact of the five-year warranty, and the anticipated success of the Company’s new VenU™ and other products, are forward-looking statements within the meaning of the safe harbor. These

statements are based on management’s current expectations and actual results may

differ materially from those projected as a result of certain risks and uncertainties, including the customer demand for in-building and small cell solutions, PCTEL’s ability to successfully

grow the wireless products business and its ability to implement new technologies and obtain protection for the related intellectual property. These and other risks and uncertainties are detailed in PCTEL’s Securities and Exchange Commission

filings. These forward-looking statements are made only as of the date hereof, and PCTEL disclaims any obligation to update or revise the information contained in any forward-looking statement, whether as a result of new information, future events

or otherwise.

For further information contact:

|

|

|

|

|

|

|

| John Schoen CFO

PCTEL, Inc.

(630) 372-6800 |

|

Jack Seller Public Relations

PCTEL, Inc. (630)372-6800

Jack.seller@pctel.com |

|

|

|

|

PCTEL, INC.

CONSOLIDATED BALANCE SHEETS (unaudited)

(in thousands, except share data)

|

|

|

|

|

|

|

|

|

| |

|

December 31,

2014 |

|

|

December 31,

2013 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

20,432 |

|

|

$ |

21,790 |

|

| Short-term investment securities |

|

|

39,577 |

|

|

|

36,105 |

|

| Accounts receivable, net of allowance for doubtful accounts of $121 and $130 at December 31, 2014 and December 31, 2013,

respectively |

|

|

23,874 |

|

|

|

18,603 |

|

| Inventories, net |

|

|

16,358 |

|

|

|

14,535 |

|

| Deferred tax assets, net |

|

|

2,281 |

|

|

|

1,629 |

|

| Prepaid expenses and other assets |

|

|

1,757 |

|

|

|

3,166 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

104,279 |

|

|

|

95,828 |

|

|

|

|

| Property and equipment, net |

|

|

14,842 |

|

|

|

14,971 |

|

| Goodwill |

|

|

161 |

|

|

|

161 |

|

| Intangible assets, net |

|

|

2,637 |

|

|

|

4,604 |

|

| Deferred tax assets, net |

|

|

9,710 |

|

|

|

11,827 |

|

| Other noncurrent assets |

|

|

40 |

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

$ |

131,669 |

|

|

$ |

127,432 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

5,495 |

|

|

$ |

4,440 |

|

| Accrued liabilities |

|

|

10,211 |

|

|

|

7,803 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

15,706 |

|

|

|

12,243 |

|

|

|

|

| Other long-term liabilities |

|

|

448 |

|

|

|

3,137 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

16,154 |

|

|

|

15,380 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par value, 100,000,000 shares authorized, 18,571,419 and 18,566,119 shares issued and outstanding at

December 31, 2014 and December 31, 2013, respectively |

|

|

19 |

|

|

|

19 |

|

| Additional paid-in capital |

|

|

145,462 |

|

|

|

143,572 |

|

| Accumulated deficit |

|

|

(30,101 |

) |

|

|

(31,748 |

) |

| Accumulated other comprehensive income |

|

|

135 |

|

|

|

209 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

115,515 |

|

|

|

112,052 |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND EQUITY |

|

$ |

131,669 |

|

|

$ |

127,432 |

|

|

|

|

|

|

|

|

|

|

PCTEL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| REVENUES |

|

$ |

29,395 |

|

|

$ |

25,963 |

|

|

$ |

107,164 |

|

|

$ |

104,253 |

|

| COST OF REVENUES |

|

|

17,634 |

|

|

|

15,120 |

|

|

|

63,577 |

|

|

|

62,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

11,761 |

|

|

|

10,843 |

|

|

|

43,587 |

|

|

|

41,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

2,766 |

|

|

|

3,102 |

|

|

|

11,736 |

|

|

|

11,064 |

|

| Sales and marketing |

|

|

3,649 |

|

|

|

3,134 |

|

|

|

12,961 |

|

|

|

12,121 |

|

| General and administrative |

|

|

2,997 |

|

|

|

3,589 |

|

|

|

12,819 |

|

|

|

15,623 |

|

| Amortization of intangible assets |

|

|

464 |

|

|

|

596 |

|

|

|

1,967 |

|

|

|

2,400 |

|

| Restructuring charges |

|

|

0 |

|

|

|

2 |

|

|

|

0 |

|

|

|

256 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

9,876 |

|

|

|

10,423 |

|

|

|

39,483 |

|

|

|

41,464 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

1,885 |

|

|

|

420 |

|

|

|

4,104 |

|

|

|

296 |

|

| Other income, net |

|

|

927 |

|

|

|

600 |

|

|

|

1,666 |

|

|

|

5,378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

|

2,812 |

|

|

|

1,020 |

|

|

|

5,770 |

|

|

|

5,674 |

|

| Expense for income taxes |

|

|

817 |

|

|

|

567 |

|

|

|

1,158 |

|

|

|

2,332 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME FROM CONTINUING OPERATIONS |

|

|

1,995 |

|

|

|

453 |

|

|

|

4,612 |

|

|

|

3,342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) FROM DISCONTINUED OPERATIONS, NET OF TAX EXPENSE (BENEFIT) |

|

|

0 |

|

|

|

17 |

|

|

|

0 |

|

|

|

(91 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

1,995 |

|

|

$ |

470 |

|

|

$ |

4,612 |

|

|

$ |

3,251 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per Share from Continuing Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.11 |

|

|

$ |

0.03 |

|

|

$ |

0.25 |

|

|

$ |

0.19 |

|

| Diluted |

|

$ |

0.11 |

|

|

$ |

0.03 |

|

|

$ |

0.25 |

|

|

$ |

0.18 |

|

|

|

|

|

|

| Earnings (Loss) per Share from Discontinued Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

($ |

0.01 |

) |

| Diluted |

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.00 |

|

|

|

|

|

|

| Earnings per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.11 |

|

|

$ |

0.03 |

|

|

$ |

0.25 |

|

|

$ |

0.18 |

|

| Diluted |

|

$ |

0.11 |

|

|

$ |

0.03 |

|

|

$ |

0.25 |

|

|

$ |

0.18 |

|

|

|

|

|

|

| Weighed Average Shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

18,154 |

|

|

|

17,916 |

|

|

|

18,159 |

|

|

|

17,797 |

|

| Diluted |

|

|

18,412 |

|

|

|

18,508 |

|

|

|

18,389 |

|

|

|

18,184 |

|

|

|

|

|

|

| Cash dividend per share |

|

$ |

0.040 |

|

|

$ |

0.035 |

|

|

$ |

0.160 |

|

|

$ |

0.140 |

|

PCTEL, INC.

P&L INFORMATION BY SEGMENT (unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2014 |

|

|

Year Ended December 31, 2014 |

|

| |

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

| REVENUES |

|

$ |

19,924 |

|

|

$ |

9,535 |

|

|

($ |

64 |

) |

|

$ |

29,395 |

|

|

$ |

72,333 |

|

|

$ |

35,113 |

|

|

($ |

282 |

) |

|

$ |

107,164 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

6,183 |

|

|

|

5,572 |

|

|

|

6 |

|

|

|

11,761 |

|

|

|

22,818 |

|

|

|

20,743 |

|

|

|

26 |

|

|

|

43,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME (LOSS) |

|

$ |

2,078 |

|

|

$ |

2,184 |

|

|

($ |

2,377 |

) |

|

$ |

1,885 |

|

|

$ |

7,357 |

|

|

$ |

7,333 |

|

|

($ |

10,586 |

) |

|

$ |

4,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2013 |

|

|

Year Ended December 30, 2013 |

|

| |

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

| REVENUES |

|

$ |

17,349 |

|

|

$ |

8,693 |

|

|

($ |

79 |

) |

|

$ |

25,963 |

|

|

$ |

74,223 |

|

|

$ |

30,310 |

|

|

($ |

280 |

) |

|

$ |

104,253 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

5,368 |

|

|

|

5,471 |

|

|

|

4 |

|

|

|

10,843 |

|

|

|

22,720 |

|

|

|

19,018 |

|

|

|

22 |

|

|

|

41,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING INCOME (LOSS) |

|

$ |

1,140 |

|

|

$ |

2,109 |

|

|

($ |

2,829 |

) |

|

$ |

420 |

|

|

$ |

6,012 |

|

|

$ |

7,248 |

|

|

($ |

12,964 |

) |

|

$ |

296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation GAAP To non-GAAP Results Of Continuing Operations (unaudited)

(in thousands except per share information)

Reconciliation of GAAP operating income to non-GAAP operating income (a) from Continuing Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

|

Operating Income |

|

$ |

1,885 |

|

|

$ |

420 |

|

|

$ |

4,104 |

|

|

$ |

296 |

|

| (a) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of intangible assets |

|

|

464 |

|

|

|

596 |

|

|

|

1,967 |

|

|

|

2,400 |

|

|

|

TelWorx restructuring: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-Restructuring charges |

|

|

0 |

|

|

|

2 |

|

|

|

0 |

|

|

|

256 |

|

|

|

-Cost of Goods Sold |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

284 |

|

|

|

TelWorx investigation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-General & Administrative |

|

|

580 |

|

|

|

747 |

|

|

|

1,266 |

|

|

|

2,626 |

|

|

|

Legal settlement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-General & Administrative |

|

|

0 |

|

|

|

0 |

|

|

|

75 |

|

|

|

0 |

|

|

|

Stock Compensation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-Cost of Goods Sold |

|

|

111 |

|

|

|

95 |

|

|

|

426 |

|

|

|

390 |

|

|

|

-Engineering |

|

|

150 |

|

|

|

185 |

|

|

|

658 |

|

|

|

689 |

|

|

|

-Sales & Marketing |

|

|

170 |

|

|

|

140 |

|

|

|

661 |

|

|

|

575 |

|

|

|

-General & Administrative |

|

|

267 |

|

|

|

402 |

|

|

|

1,530 |

|

|

|

1,786 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,742 |

|

|

|

2,167 |

|

|

|

6,583 |

|

|

|

9,006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Operating Income |

|

$ |

3,627 |

|

|

$ |

2,587 |

|

|

$ |

10,687 |

|

|

$ |

9,302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% of revenue |

|

|

12.3 |

% |

|

|

10.0 |

% |

|

|

10.0 |

% |

|

|

8.9 |

% |

Reconciliation of GAAP net income to

non-GAAP net income (b) from Continuing Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

|

Net Income from Continuing Operations |

|

$ |

1,995 |

|

|

$ |

453 |

|

|

$ |

4,612 |

|

|

$ |

3,342 |

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

Non-GAAP adjustment to operating income |

|

|

1,742 |

|

|

|

2,167 |

|

|

|

6,583 |

|

|

|

9,006 |

|

|

|

Other income related to the TelWorx settlement and

TelWorx SEC investigation |

|

|

(908 |

) |

|

|

(586 |

) |

|

|

(1,568 |

) |

|

|

(5,353 |

) |

|

|

Other legal settlements |

|

|

0 |

|

|

|

0 |

|

|

|

(75 |

) |

|

|

0 |

|

| (b) |

|

Income Taxes |

|

|

161 |

|

|

|

99 |

|

|

|

(770 |

) |

|

|

653 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

995 |

|

|

|

1,680 |

|

|

|

4,170 |

|

|

|

4,306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Income from Continuing Operations |

|

$ |

2,990 |

|

|

$ |

2,133 |

|

|

$ |

8,782 |

|

|

$ |

7,648 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Earning per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.16 |

|

|

$ |

0.12 |

|

|

$ |

0.48 |

|

|

$ |

0.43 |

|

|

|

Diluted |

|

$ |

0.16 |

|

|

$ |

0.12 |

|

|

$ |

0.48 |

|

|

$ |

0.42 |

|

|

|

|

|

|

|

|

|

Weighed Average Shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

18,154 |

|

|

|

17,916 |

|

|

|

18,159 |

|

|

|

17,797 |

|

|

|

Diluted |

|

|

18,412 |

|

|

|

18,508 |

|

|

|

18,389 |

|

|

|

18,184 |

|

This schedule reconciles the Company’s GAAP

operating income and GAAP net income to its non-GAAP operating income and non-GAAP net income. The Company believes that presentation of this schedule provides meaningful supplemental information to both management and investors that is indicative

of the Company’s core operating results and facilitates comparison of operating results across reporting periods. The Company uses these non-GAAP measures when evaluating its financial results as well as for internal planning and forecasting

purposes. These non-GAAP measures should not be viewed as a substitute for the Company’s GAAP results.

(a) These adjustments reflect stock based

compensation expense, amortization of intangible assets, restructuring charges, and general and administrative expenses associated with the TelWorx investigation.

(b) These adjustments include the items described in footnote (a) as well as other income for the TelWorx legal settlement and insurance claims related

to the TelWorx investigation, and non-cash income tax expense.

Reconciliation GAAP To non-GAAP SEGMENT INFORMATION (unaudited) (a) - Continuing Operations

(in thousands except per share information)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2014 |

|

|

Year Ended December 31, 2014 |

|

| |

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

| Operating Income (Loss) |

|

$ |

2,078 |

|

|

$ |

2,184 |

|

|

($ |

2,377 |

) |

|

$ |

1,885 |

|

|

$ |

7,357 |

|

|

$ |

7,333 |

|

|

($ |

10,586 |

) |

|

$ |

4,104 |

|

|

|

|

|

|

|

|

|

|

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

|

260 |

|

|

|

204 |

|

|

|

0 |

|

|

|

464 |

|

|

|

1,151 |

|

|

|

816 |

|

|

|

0 |

|

|

|

1,967 |

|

| TelWorx restructuring: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -Restructuring charges |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

| -Cost of Goods Sold |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

| TelWorx investigation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -General & Administrative |

|

|

0 |

|

|

|

0 |

|

|

|

580 |

|

|

|

580 |

|

|

|

0 |

|

|

|

0 |

|

|

|

1,266 |

|

|

|

1,266 |

|

| Legal settlement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -General & Administrative |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

75 |

|

|

|

75 |

|

| Stock Compensation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -Cost of Goods Sold |

|

|

58 |

|

|

|

53 |

|

|

|

0 |

|

|

|

111 |

|

|

|

215 |

|

|

|

211 |

|

|

|

0 |

|

|

|

426 |

|

| -Engineering |

|

|

64 |

|

|

|

86 |

|

|

|

0 |

|

|

|

150 |

|

|

|

292 |

|

|

|

366 |

|

|

|

0 |

|

|

|

658 |

|

| -Sales & Marketing |

|

|

133 |

|

|

|

37 |

|

|

|

0 |

|

|

|

170 |

|

|

|

534 |

|

|

|

127 |

|

|

|

0 |

|

|

|

661 |

|

| -General & Administrative |

|

|

54 |

|

|

|

31 |

|

|

|

182 |

|

|

|

267 |

|

|

|

256 |

|

|

|

129 |

|

|

|

1,145 |

|

|

|

1,530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

569 |

|

|

|

411 |

|

|

|

762 |

|

|

|

1,742 |

|

|

|

2,448 |

|

|

|

1,649 |

|

|

|

2,486 |

|

|

|

6,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Operating Income (Loss) |

|

$ |

2,647 |

|

|

$ |

2,595 |

|

|

($ |

1,615 |

) |

|

$ |

3,627 |

|

|

$ |

9,805 |

|

|

$ |

8,982 |

|

|

($ |

8,100 |

) |

|

$ |

10,687 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2013 |

|

|

Year Ended December 30, 2013 |

|

| |

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

|

Connected

Solutions |

|

|

RF Solutions |

|

|

Corporate |

|

|

Total |

|

| Operating Income (Loss) |

|

$ |

1,140 |

|

|

$ |

2,109 |

|

|

($ |

2,829 |

) |

|

$ |

420 |

|

|

$ |

6,012 |

|

|

$ |

7,248 |

|

|

($ |

12,964 |

) |

|

$ |

296 |

|

|

|

|

|

|

|

|

|

|

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of intangible assets |

|

|

392 |

|

|

|

204 |

|

|

|

0 |

|

|

|

596 |

|

|

|

1,573 |

|

|

|

827 |

|

|

|

0 |

|

|

|

2,400 |

|

| TelWorx restructuring: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -Restructuring charges |

|

|

2 |

|

|

|

0 |

|

|

|

0 |

|

|

|

2 |

|

|

|

256 |

|

|

|

0 |

|

|

|

0 |

|

|

|

256 |

|

| -Cost of Goods Sold |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

284 |

|

|

|

0 |

|

|

|

0 |

|

|

|

284 |

|

| TelWorx investigation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -General & Administrative |

|

|

0 |

|

|

|

0 |

|

|

|

747 |

|

|

|

747 |

|

|

|

0 |

|

|

|

0 |

|

|

|

2,626 |

|

|

|

2,626 |

|

| Stock Compensation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -Cost of Goods Sold |

|

|

44 |

|

|

|

51 |

|

|

|

0 |

|

|

|

95 |

|

|

|

153 |

|

|

|

237 |

|

|

|

0 |

|

|

|

390 |

|

| -Engineering |

|

|

78 |

|

|

|

107 |

|

|

|

0 |

|

|

|

185 |

|

|

|

285 |

|

|

|

404 |

|

|

|

0 |

|

|

|

689 |

|

| -Sales & Marketing |

|

|

122 |

|

|

|

18 |

|

|

|

0 |

|

|

|

140 |

|

|

|

450 |

|

|

|

125 |

|

|

|

0 |

|

|

|

575 |

|

| -General & Administrative |

|

|

91 |

|

|

|

33 |

|

|

|

278 |

|

|

|

402 |

|

|

|

341 |

|

|

|

109 |

|

|

|

1,336 |

|

|

|

1,786 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

729 |

|

|

|

413 |

|

|

|

1,025 |

|

|

|

2,167 |

|

|

|

3,342 |

|

|

|

1,702 |

|

|

|

3,962 |

|

|

|

9,006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Operating Income (Loss) |

|

$ |

1,869 |

|

|

$ |

2,522 |

|

|

($ |

1,804 |

) |

|

$ |

2,587 |

|

|

$ |

9,354 |

|

|

$ |

8,950 |

|

|

($ |

9,002 |

) |

|

$ |

9,302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This schedule reconciles the Company’s GAAP operating income by segment to its non-GAAP operating income and non-GAAP net

income. The Company believes that presentation of this schedule provides meaningful supplemental information to both management and investors that is indicative of the Company’s core operating results and facilitates comparison of operating

results across reporting periods. The Company uses these non-GAAP measures when evaluating its financial results as well as for internal planning and forecasting purposes. These non-GAAP measures should not be viewed as a substitute for the

Company’s GAAP results.

(a) These adjustments reflect stock based compensation expense, amortization of intangible assets, restructuring charges,

and general and administrative expenses associated with the TelWorx investigation.

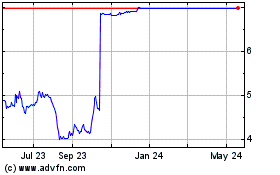

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From Mar 2024 to May 2024

PCTEL (NASDAQ:PCTI)

Historical Stock Chart

From May 2023 to May 2024