0001861522

false

0001861522

2023-08-15

2023-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 15, 2023

Kidpik

Corp.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41032 |

|

81-3640708 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

200

Park Avenue South, 3rd Floor

New

York, New York |

|

10003 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (212) 399-2323

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

PIK |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On

August 15, 2023, Kidpik Corp. (“Kidpik” or the “Company”) issued a press release, and will hold

a live teleconference call regarding, among other things, its financial results for the 13 and 26 weeks ended July 1, 2023. A copy of

the press release, which includes information on the live teleconference call, and a summary of such financial results is furnished as

Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The

information contained in this Current Report and Exhibit 99.1 hereto shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the

liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended

or the Exchange Act, except as expressly set forth by specific reference in such a filing.

The

Company is making reference to non-GAAP financial information in the press release and the conference call. A reconciliation of these

non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

This

Current Report on Form 8-K, including the press release furnished as Exhibit 99.1 to this

Current Report on Form 8-K, contains forward-looking statements within the meaning

of the federal securities laws, including the Private Securities Litigation Reform Act of 1995,

and, as such, may involve known and unknown risks, uncertainties and assumptions. You can identify these forward-looking statements

by words such as “may,” “should,” “expect,” “anticipate,”

“believe,” “estimate,” “intend,” “plan” and other similar

expressions. These forward-looking statements relate to the Company’s current expectations

and are subject to the limitations and qualifications set forth in the press release and presentation as well as in the Company’s

other filings with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ

materially from those projected in such forward-looking statements. These statements also involve known and unknown risks, which may

cause the results of the Company, its divisions and concepts to be materially different than those expressed or implied in such statements,

including, but not limited to those referenced in the press release. Accordingly, readers should

not place undue reliance on any forward-looking statements. Forward-looking statements may include comments as to the Company’s

beliefs and expectations as to future financial performance, events and trends affecting its business and are necessarily subject to

uncertainties, many of which are outside the Company’s control. More information on potential factors that could affect the Company’s

financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, filed with the SEC

and available at www.sec.gov and in the “Investors” – “Financial Info” – “SEC

Filings” section of the Company’s website at https://investor.kidpik.com/sec-filings. Forward-looking statements

speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise that occur after that date, except as otherwise provided by law.

Item 9.01 Financial Statements and Exhibits.

*

Furnished herewith.

The

inclusion of any website address in this Form 8-K, and any exhibit thereto, is intended to be an inactive textual reference only and

not an active hyperlink. The information contained in, or that can be accessed through, such website is not part of or incorporated into

this Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

August 15, 2023

| |

Kidpik

Corp. |

| |

|

|

| |

By: |

/s/

Ezra Dabah |

| |

Name: |

Ezra

Dabah |

| |

Title: |

Chief

Executive Officer |

Exhibit 99.1

KIDPIK

Reports Second Quarter 2023 Financial Results

NEW

YORK, August 15, 2023 / PRNewswire/—Kidpik Corp. (“KIDPIK” or the “Company”), an online clothing subscription-based

e-commerce company, today reported its financial results for the second quarter ended July 1, 2023.

Second

Quarter 2023 Highlights:

| |

● |

Revenue,

net: was $3.4 million, a year over year decrease of 8.6% |

| |

● |

Gross

margin: was 60.2%, a year over year decrease of 80 basis points from 61.0% in the second quarter of 2022 |

| |

● |

Shipped

items: were 290,000 items, compared to 354,000 shipped items in the second quarter of 2022 |

| |

● |

Average

shipment keep rate: increased to 75.1%, compared to 69.2% in the second quarter of 2022 |

| |

● |

Net

Loss: was $2.0 million or $0.26 per share |

| |

● |

Adjusted

EBITDA: was a loss of $1.7 million (see “Non-GAAP Financial Measures”, below) |

“During

the 2nd quarter, we continued to execute our plan to reduce inventory levels, while maintaining our gross margin of about

60%. Our 2nd quarter earnings were, for the most part, consistent with our 1st quarter,” commented Ezra Dabah,

CEO of Kidpik.

“We

have elevated the look and feel of our brand for Back-to-School. Our creatives showcase the advancement, capturing the beauty of our

collection and the confidence children feel while wearing Kidpik outfits. We invite you to visit kidpik.com and shop.kidpik.com

to view our back-to-school collection and experience the technology that drives it,” concluded Mr. Dabah.

Kidpik

Corp.

Condensed

Interim Statements of Operations

(Unaudited)

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

July

1, 2023 | | |

July

2, 2022 | | |

July

1, 2023 | | |

July

2, 2022 | |

| Revenues, net | |

$ | 3,448,919 | | |

$ | 3,774,668 | | |

$ | 7,478,397 | | |

$ | 8,100,665 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 1,372,563 | | |

| 1,473,380 | | |

| 2,991,789 | | |

| 3,207,294 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 2,076,356 | | |

| 2,301,288 | | |

| 4,486,608 | | |

| 4,893,371 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Shipping and handling | |

| 949,734 | | |

| 959,141 | | |

| 2,138,956 | | |

| 2,091,225 | |

| Payroll and related costs | |

| 1,094,135 | | |

| 1,346,744 | | |

| 2,205,236 | | |

| 2,945,980 | |

| General and administrative | |

| 2,024,871 | | |

| 1,552,890 | | |

| 4,049,435 | | |

| 3,483,783 | |

| Depreciation and amortization | |

| 12,426 | | |

| 6,654 | | |

| 23,113 | | |

| 12,319 | |

| Total operating expenses | |

| 4,081,166 | | |

| 3,865,429 | | |

| 8,416,740 | | |

| 8,533,307 | |

| Operating loss | |

| (2,004,810 | ) | |

| (1,564,141 | ) | |

| (3,930,132 | ) | |

| (3,639,936 | ) |

| Other expenses | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 24,415 | | |

| 7,925 | | |

| 49,605 | | |

| 29,600 | |

| Other (income) expense | |

| - | | |

| - | | |

| - | | |

| (286,795 | ) |

| | |

| 24,415 | | |

| 7,925 | | |

| 49,605 | | |

| (257,195 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| (2,029,225 | ) | |

| (1,572,066 | ) | |

| (3,979,737 | ) | |

| (3,382,741 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| -_ | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (2,029,225 | ) | |

$ | (1,572,066 | ) | |

$ | (3,979,737 | ) | |

$ | (3,382,741 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share attributable to common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (0.26 | ) | |

| (0.21 | ) | |

| (0.52 | ) | |

| (0.44 | ) |

| Diluted | |

| (0.26 | ) | |

| (0.21 | ) | |

| (0.52 | ) | |

| (0.44 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 7,731,195 | | |

| 7,636,493 | | |

| 7,709,695 | | |

| 7,655,359 | |

| Diluted | |

| 7,731,195 | | |

| 7,636,493 | | |

| 7,709,695 | | |

| 7,655,359 | |

Kidpik

Corp.

Condensed

Interim Balance Sheets

| | |

July 1, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 158,141 | | |

$ | 600,595 | |

| Restricted cash | |

| 4,618 | | |

| 4,618 | |

| Accounts receivable | |

| 156,396 | | |

| 336,468 | |

| Inventory | |

| 9,755,705 | | |

| 12,625,948 | |

| Prepaid expenses and other current assets | |

| 897,194 | | |

| 1,043,095 | |

| Total current assets | |

| 10,972,054 | | |

| 14,610,724 | |

| | |

| | | |

| | |

| Leasehold improvements and equipment, net | |

| 120,965 | | |

| 67,957 | |

| Operating lease right-of-use assets | |

| 1,201,105 | | |

| 1,469,665 | |

| Total assets | |

$ | 12,294,124 | | |

$ | 16,148,346 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,702,425 | | |

$ | 2,153,389 | |

| Accounts payable, related party | |

| 1,538,902 | | |

| 1,107,665 | |

| Accrued expenses and other current liabilities | |

| 419,683 | | |

| 587,112 | |

| Operating lease liabilities, current | |

| 329,654 | | |

| 438,957 | |

| Short-term debt, related party | |

| 2,050,000 | | |

| 2,050,000 | |

| Total current liabilities | |

| 6,040,664 | | |

| 6,337,123 | |

| | |

| | | |

| | |

| Operating lease liabilities, net of current portion | |

| 925,014 | | |

| 1,061,469 | |

| | |

| | | |

| | |

| Total liabilities | |

| 6,965,678 | | |

| 7,398,592 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock, par value $0.001, 25,000,000 shares authorized, of which no shares are issued and outstanding as of July 1, 2023 and December 31, 2022, respectively | |

| - | | |

| - | |

| Common stock, par value $0.001, 75,000,000 shares authorized, of which 7,769,717 shares are issued and outstanding as of July 1, 2023 and 7,688,194 shares issued and outstanding on December 31, 2022 | |

| 7,770 | | |

| 7,688 | |

| Additional paid-in capital | |

| 50,834,858 | | |

| 50,276,511 | |

| Accumulated deficit | |

| (45,514,182 | ) | |

| (41,534,445 | ) |

| Total stockholders’ equity | |

| 5,328,446 | | |

| 8,749,754 | |

| Total liabilities and stockholders’ equity | |

$ | 12,294,124 | | |

$ | 16,148,346 | |

Kidpik

Corp.

Condensed

Interim Statements of Cash Flows

(Unaudited)

| | |

26 Weeks Ended | |

| | |

July 1, 2023 | | |

July 2, 2022 | |

| Cash flows from operating activities | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss | |

$ | (3,979,737 | ) | |

$ | (3,382,741 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 23,113 | | |

| 12,319 | |

| Amortization of debt issuance costs | |

| - | | |

| - | |

| Equity-based compensation | |

| 558,429 | | |

| 1,051,088 | |

| Bad debt expense | |

| 151,362 | | |

| 241,057 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 28,710 | | |

| (69,959 | ) |

| Inventory | |

| 2,870,243 | | |

| (1,180,833 | ) |

| Prepaid expenses and other current assets | |

| 145,901 | | |

| 57,175 | |

| Operating lease right-of-use assets and liabilities | |

| 22,802 | | |

| 5,033 | |

| Accounts payable | |

| (450,965 | ) | |

| (1,061,068 | ) |

| Accounts payable, related parties | |

| 431,238 | | |

| (129,753 | ) |

| Accrued expenses and other current liabilities | |

| (167,429 | ) | |

| (345,378 | ) |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (366,333 | ) | |

| (4,803,060 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchases of leasehold improvements and equipment | |

| (76,121 | ) | |

| (31,317 | ) |

| Net cash used in investing activities | |

| (76,121 | ) | |

| (31,317 | ) |

| Cash flows from financing activities | |

| | | |

| | |

| Cash used to settle net share equity awards | |

| - | | |

| (33,692 | ) |

| Net proceeds from line of credit | |

| - | | |

| - | |

| Net proceeds (repayments) from advance payable | |

| - | | |

| (932,155 | ) |

| Net proceeds (repayments) from loan payable | |

| - | | |

| (150,000 | ) |

| Net cash provided by (used in) financing activities | |

| - | | |

| (1,115,847 | ) |

| Net (decrease)/increase in cash and restricted cash | |

| (442,454 | ) | |

| (5,950,224 | ) |

| | |

| | | |

| | |

| Cash and restricted cash, beginning of period | |

| 605,213 | | |

| 8,420,500 | |

| Cash and restricted cash, end of period | |

$ | 162,759 | | |

$ | 2,470,276 | |

| | |

| | | |

| | |

| Reconciliation of cash and restricted cash: | |

| | | |

| | |

| Cash | |

$ | 158,141 | | |

$ | 2,465,831 | |

| Restricted cash | |

| 4,618 | | |

| 4,445 | |

| | |

$ | 162,759 | | |

$ | 2,470,276 | |

| Supplemental disclosure of cash flow data: | |

| | | |

| | |

| Interest paid | |

$ | - | | |

$ | 20,577 | |

| Taxes paid | |

$ | - | | |

$ | - | |

| Supplemental disclosure of non-cash flow data: | |

| | | |

| | |

| Record right-of use asset and operating lease liabilities | |

$ | - | | |

| 1,857,925 | |

Revenue

by Channel

| | |

13 weeks ended July 1, 2023 | | |

13 weeks ended July 2, 2022 | | |

Change ($) | | |

Change (%) | |

| Revenue by channel | |

| | | |

| | | |

| | | |

| | |

| Subscription boxes | |

$ | 2,607,543 | | |

$ | 2,974,550 | | |

$ | (367,007 | ) | |

| (12.3 | )% |

| 3rd party websites | |

| 426,914 | | |

| 559,077 | | |

| (132,163 | ) | |

| (23.6 | )% |

| Online website sales | |

| 414,462 | | |

| 241,041 | | |

| 173,421 | | |

| 71.9 | % |

| Total revenue | |

$ | 3,448,919 | | |

$ | 3,774,668 | | |

$ | (325,749 | ) | |

| (8.6 | )% |

| | |

26 weeks ended July 1, 2023 | | |

26 weeks ended July 2, 2022 | | |

Change ($) | | |

Change (%) | |

| Revenue by channel | |

| | | |

| | | |

| | | |

| | |

| Subscription boxes | |

$ | 5,579,110 | | |

$ | 6,458,401 | | |

$ | (879,291 | ) | |

| (13.6 | )% |

| 3rd party websites | |

| 863,212 | | |

| 1,108,577 | | |

| (245,365 | ) | |

| (22.1 | )% |

| Online website sales | |

| 1,036,075 | | |

| 533,687 | | |

| 502,388 | | |

| 94.1 | % |

| Total revenue | |

$ | 7,478,397 | | |

$ | 8,100,665 | | |

$ | (622,268 | ) | |

| (7.7 | )% |

Subscription

Boxes Revenue

| | |

13 weeks ended July 1, 2023 | | |

13 weeks ended July 2, 2022 | | |

Change ($) | | |

Change (%) | |

| Subscription boxes revenue from | |

| | | |

| | | |

| | | |

| | |

| Active subscriptions – recurring boxes | |

$ | 2,177,298 | | |

$ | 2,650,324 | | |

$ | (473,026 | ) | |

| (17.8 | )% |

| New subscriptions - first box | |

| 430,245 | | |

| 324,226 | | |

| 106,019 | | |

| 32.7 | % |

| Total subscription boxes revenue | |

$ | 2,607,543 | | |

$ | 2,974,550 | | |

$ | (367,007 | ) | |

| (12.3 | )% |

| | |

26 weeks ended July 1, 2023 | | |

26 weeks ended July 2, 2022 | | |

Change ($) | | |

Change (%) | |

| Subscription boxes revenue from | |

| | | |

| | | |

| | | |

| | |

| Active subscriptions – recurring boxes | |

$ | 4,578,324 | | |

$ | 5,786,892 | | |

$ | (1,208,568 | ) | |

| (20.9 | )% |

| New subscriptions - first box | |

| 1,000,786 | | |

| 671,509 | | |

| 329,277 | | |

| 49.0 | % |

| Total subscription boxes revenue | |

$ | 5,579,110 | | |

$ | 6,458,401 | | |

$ | (879,291 | ) | |

| (13.6 | )% |

Revenue

by Product Line

| | |

13 weeks ended July 1, 2023 | | |

13 weeks ended July 2, 2022 | | |

Change ($) | | |

Change (%) | |

| Revenue by product line | |

| | | |

| | | |

| | | |

| | |

| Girls’ apparel | |

$ | 2,636,965 | | |

$ | 2,762,669 | | |

$ | (125,704 | ) | |

| (4.6 | )% |

| Boys’ apparel | |

| 640,937 | | |

| 821,650 | | |

| (180,713 | ) | |

| (22.0 | )% |

| Toddlers’ apparel | |

| 171,017 | | |

| 190,349 | | |

| (19,332 | ) | |

| (10.5 | )% |

| Total revenue | |

$ | 3,448,919 | | |

$ | 3,774,668 | | |

$ | (325,749 | ) | |

| (8.6 | )% |

| | |

26 weeks ended July 1, 2023 | | |

26 weeks ended July 2, 2022 | | |

Change ($) | | |

Change (%) | |

| Revenue by product line | |

| | | |

| | | |

| | | |

| | |

| Girls’ apparel | |

$ | 5,684,721 | | |

$ | 6,019,561 | | |

$ | (334,840 | ) | |

| (5.6 | )% |

| Boys’ apparel | |

| 1,428,096 | | |

| 1,689,445 | | |

| (261,349 | ) | |

| (15.5 | )% |

| Toddlers’ apparel | |

| 365,580 | | |

| 391,659 | | |

| (26,079 | ) | |

| (6.7 | )% |

| Total revenue | |

$ | 7,478,397 | | |

$ | 8,100,665 | | |

$ | (622,268 | ) | |

| (7.7 | )% |

Balance

Sheet and Cash Flow

| |

● |

Cash

at the end of the second quarter of 2023 totaled $0.2 million compared to $0.6 million as of December 31, 2022. |

| |

● |

Net

cash used in operating activities was $0.4 million for the 26 weeks ended July 1, 2023, compared to $4.8 million of cash used in

operating activities for the 26 weeks ended July 2, 2022. |

| |

● |

As

of July 1, 2023, we had $11.0 million in total current assets, $6.0 million in total current liabilities and working capital of $4.9

million. |

RESULTS

OF OPERATIONS

The

Company’s revenue, net, is disaggregated based on the following categories:

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

July

1, 2023 | | |

July

2, 2022 | | |

July

1, 2023 | | |

July

2, 2022 | |

| Subscription boxes | |

$ | 2,607,543 | | |

$ | 2,974,550 | | |

$ | 5,579,110 | | |

$ | 6,458,401 | |

| 3rd party websites | |

| 426,914 | | |

| 559,077 | | |

| 863,212 | | |

| 1,108,577 | |

| Online website sales | |

| 414,462 | | |

| 241,041 | | |

| 1,036,075 | | |

| 533,687 | |

| Total revenue | |

$ | 3,448,919 | | |

$ | 3,774,668 | | |

$ | 7,478,397 | | |

$ | 8,100,665 | |

Gross

Margin

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

July 1, 2023 | | |

July 2, 2022 | | |

July 1, 2023 | | |

July 2, 2022 | |

| | |

| | |

| | |

| | |

| |

| Gross margin | |

| 60.2 | % | |

| 61.0 | % | |

| 60.0 | % | |

| 60.4 | % |

Gross

profit is equal to our net sales less cost of goods sold. Gross profit as a percentage of our net sales is referred to as gross margin.

Cost of sales consists of the purchase price of merchandise sold to customers and includes import duties and other taxes, freight in,

returns from customers, inventory write-offs, and other miscellaneous shrinkage.

Shipped

Items

We

define shipped items as the total number of items shipped in a given period to our customers through our active subscription, Amazon

and online website sales.

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

(in thousands) | | |

(in thousands) | |

| | |

July 1, 2023 | | |

July 2, 2022 | | |

July 1, 2023 | | |

July 2, 2022 | |

| | |

| | |

| | |

| | |

| |

| Shipped Items | |

| 290 | | |

| 354 | | |

| 630 | | |

| 725 | |

Average

Shipment Keep Rate

Average

shipment keep rate is calculated as the total number of items kept by our customers divided by total number of shipped items in a given

period.

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

July 1, 2023 | | |

July 2, 2022 | | |

July 1, 2023 | | |

July 2, 2022 | |

| | |

| | | |

| | | |

| | | |

| | |

| Average Shipment Keep Rate | |

| 75.1 | % | |

| 69.2 | % | |

| 71.3 | % | |

| 69.8 | % |

Non-GAAP

Financial Measures

We

report our financial results in accordance with generally accepted accounting principles in the United States (“GAAP”). However,

management believes that certain non-GAAP financial measures provide users of our financial information with additional useful information

in evaluating our performance. We believe that adjusted EBITDA is frequently used by investors and securities analysts in their evaluations

of companies, and that this supplemental measure facilitates comparisons between companies. This non-GAAP financial measure may be different

than similarly titled measures used by other companies.

Our

non-GAAP financial measures should not be considered in isolation from, or as substitutes for, financial information prepared in accordance

with GAAP. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for

analysis of our results as reported under GAAP. Some of these limitations are:

| |

● |

Although

depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future,

and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| |

● |

Adjusted

EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| |

● |

Adjusted

EBITDA does not consider the potentially dilutive impact of equity-based compensation; |

| |

● |

Adjusted

EBITDA does not reflect tax payments that may represent a reduction in cash available to us; |

| |

● |

Adjusted

EBITDA does not reflect certain non-routine items that may represent a reduction in cash available to us; and |

| |

● |

Other

companies, including companies in our industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative

measure. |

We

compensate for these limitations by providing a reconciliation of this non-GAAP measure to the most comparable GAAP measure. We encourage

investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single

financial measure, and to view this non-GAAP measure in conjunction with the most directly comparable GAAP financial measure. For more

information on these non-GAAP financial measure, please see the section titled “Unaudited Reconciliation of Net Loss to Adjusted

Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA)”, included below.

Unaudited

Reconciliation of Net Loss to Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA)

We

define adjusted EBITDA as net loss excluding interest income, other (income) expense, net, provision for income taxes, depreciation and

amortization, and equity-based compensation expense. The following table presents a reconciliation of net loss, the most comparable GAAP

financial measure, to adjusted EBITDA for each of the periods presented:

| | |

For the 13 weeks ended | | |

For the 26 weeks ended | |

| | |

July 1, 2023 | | |

July

2, 2022 | | |

July 1, 2023 | | |

July 2, 2022 | |

| Net loss | |

$ | (2,029,225 | ) | |

$ | (1,572,066 | ) | |

$ | (3,979,737 | ) | |

$ | (3,382,741 | ) |

| Add (deduct) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| 24,415 | | |

| 7,925 | | |

| 49,605 | | |

| 29,600 | |

| Other (income)/expense, net | |

| - | | |

| - | | |

| - | | |

| (286,795 | ) |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| Depreciation and amortization | |

| 12,426 | | |

| 6,654 | | |

| 23,113 | | |

| 12,319 | |

| Equity-based compensation | |

| 290,953 | | |

| 433,924 | | |

| 558,429 | | |

| 1,051,088 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | (1,701,431 | ) | |

$ | (1,123,563 | ) | |

$ | (3,348,590 | ) | |

$ | (2,576,529 | ) |

Earnings

Call Information:

Today

at 4:30pm ET, the Company will host a live teleconference call that is accessible over the internet at the company’s website, https://investor.kidpik.com

and additionally by dialing at 1-877-407-9039 or at 1-201-689-8470 for international callers.

A

replay of the conference call will be available approximately two hours after the conclusion of the call on the investor relations section

of the KIDPIK website at https://investor.kidpik.com or by dialing 1-844-512-2921, or 1-412-317-6671, internationally, with the Replay

Pin Number: 13738787. The replay will be available until August 25, 2023.

About

Kidpik Corp.

Founded

in 2016, KIDPIK (NASDAQ:PIK) is an online clothing subscription box for kids, offering mix & match, expertly styled outfits that

are curated based on each member’s style preferences. KIDPIK delivers a surprise box monthly or seasonally, providing an effortless

shopping experience for parents and a fun discovery for kids. Each seasonal collection is designed in-house by a team with decades of

experience designing childrenswear. KIDPIK combines the expertise of fashion stylists with proprietary data and technology to translate

kids’ unique style preferences into surprise boxes of curated outfits. We also sell our branded clothing and footwear through our

e-commerce website, shop.kidpik.com. For more information, visit www.kidpik.com.

Forward-Looking

Statements

This

press release may contain statements that constitute “forward-looking statements” within the federal securities laws, including

The Private Securities Litigation Reform Act of 1995, which provide a safe-harbor for forward-looking statements. In particular, when

used in the preceding discussion, the words “may,” “could,” “expect,” “intend,” “plan,”

“seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “likely,” “will,” “would” and variations of these terms and similar expressions,

or the negative of these terms or similar expressions are intended to identify forward-looking statements within the meaning of such

laws, and are subject to the safe harbor created by such applicable laws. Any statements made in this news release other than those of

historical fact, about an action, event or development, are forward-looking statements. These statements involve known and unknown risks,

uncertainties and other factors, which may cause the results of KIDPIK to be materially different than those expressed or implied in

such statements. The forward-looking statements may include projections and estimates of KIDPIK’s corporate strategies, future

operations and plans, including the costs thereof. We have based these forward-looking statements on our current expectations and assumptions

and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments,

as well as other factors we believe are appropriate under the circumstances. However, whether actual results and developments will conform

with our expectations and predictions is subject to a number of risks and uncertainties, including our ability to obtain additional funding,

the terms of such funding and potential dilution caused thereby; the continuing effect of rising interest rates and inflation on our

operations, sales, and market for our products; deterioration of the global economic environment; rising interest rates and inflation

and our ability to control our costs, including employee wages and benefits and other operating expenses; our history of losses; our

ability to achieve profitability; our ability to execute our growth strategy and scale our operations and risks associated with such

growth; our ability to maintain current members and customers and grow our members and customers; risks associated with the effect of

global pandemics, and governmental responses thereto on our operations, those of our vendors, our customers and members and the economy

in general; risks associated with our supply chain and third-party service providers, interruptions in the supply of raw materials and

merchandise; increased costs of raw materials, products and shipping costs due to inflation; disruptions at our warehouse facility and/or

of our data or information services; issues affecting our shipping providers; disruptions to the internet; risks that effect our ability

to successfully market our products to key demographics; the effect of data security breaches, malicious code and/or hackers; increased

competition and our ability to maintain and strengthen our brand name; changes in consumer tastes and preferences and changing fashion

trends; material changes and/or terminations of our relationships with key vendors; significant product returns from customers, excess

inventory and our ability to manage our inventory; the effect of trade restrictions and tariffs, increased costs associated therewith

and/or decreased availability of products; our ability to innovate, expand our offerings and compete against competitors which may have

greater resources; certain anti-dilutive, drag-along and tag-along rights which may be deemed to be held by a former minority stockholder;

our significant reliance on related party transactions and loans; the fact that our Chief Executive Officer has majority voting control

over the Company; if the use of “cookie” tracking technologies is further restricted, regulated, or blocked, or if changes

in technology cause cookies to become less reliable or acceptable as a means of tracking consumer behavior; our ability to comply with

the covenants of future loan and lending agreements and covenants; our ability to prevent credit card and payment fraud; the risk of

unauthorized access to confidential information; our ability to protect our intellectual property and trade secrets, claims from third-parties

that we have violated their intellectual property or trade secrets and potential lawsuits in connection therewith; our ability to comply

with changing regulations and laws, penalties associated with any non-compliance (inadvertent or otherwise), the effect of new laws or

regulations, and our ability to comply with such new laws or regulations; changes in tax rates; our reliance and retention of our current

management; the outcome of future lawsuits, litigation, regulatory matters or claims; the fact that we have a limited operating history;

the effect of future acquisitions on our operations and expenses; our significant indebtedness; and others that are included from time

to time in filings made by KIDPIK with the Securities and Exchange Commission, many of which are beyond our control, including, but not

limited to, in the “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” sections in its

Form 10-Ks and Form 10-Qs and in its Form 8-Ks, which it has filed, and files from time to time, with the U.S. Securities and Exchange

Commission, including, but not limited to its Annual Report on Form 10-K for the year ended December 31, 2022 and its Quarterly Report

on Form 10-Q for the quarter ended July 1, 2023. These reports are available at www.sec.gov and on our website at https://investor.kidpik.com/sec-filings.

The Company cautions that the foregoing list of important factors is not complete. All subsequent written and oral forward-looking statements

attributable to the Company or any person acting on behalf of the Company are expressly qualified in their entirety by the cautionary

statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on KIDPIK’s future

results and/or could cause our actual results and financial condition to differ materially from those indicated in the forward-looking

statements. The forward-looking statements included in this press release are made only as of the date hereof. KIDPIK cannot guarantee

future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking

statements. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information

or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required

by applicable laws and take no obligation to update or correct information prepared by third parties that is not paid for by the Company.

If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to

those or other forward-looking statements.

Contacts

Investor

Relations Contact:

ir@kidpik.com

Media:

press@kidpik.com

v3.23.2

Cover

|

Aug. 15, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 15, 2023

|

| Entity File Number |

001-41032

|

| Entity Registrant Name |

Kidpik

Corp.

|

| Entity Central Index Key |

0001861522

|

| Entity Tax Identification Number |

81-3640708

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

200

Park Avenue South

|

| Entity Address, Address Line Two |

3rd Floor

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10003

|

| City Area Code |

(212)

|

| Local Phone Number |

399-2323

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

PIK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

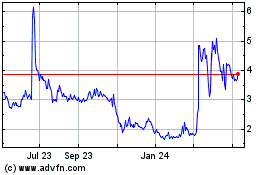

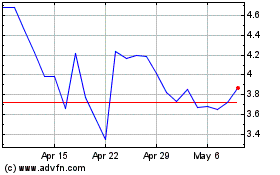

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From Apr 2024 to May 2024

Kidpik (NASDAQ:PIK)

Historical Stock Chart

From May 2023 to May 2024