false

0001622345

0001622345

2024-07-24

2024-07-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 24, 2024

POLAR

POWER, INC.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-37960 |

|

33-0479020 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

249

E. Gardena Boulevard, Gardena, California 90248

(Address

of Principal Executive Offices) (Zip Code)

(310)

830-9153

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

POLA |

|

The

NASDAQ Stock Market, LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

As

previously disclosed, Peter Gross, a member of the Board of Directors (the “Board”) of Polar Power, Inc. (the “Company”),

resigned as a member of the Board of Directors of the Company.

The

remaining members of the Board appointed and ratified Mr. Michael G. Field, to serve as a member of the Board, effective as of July 25,

2024, and to assume the position of Mr. Gross as a member of the audit committee, chair of the compensation committee and chair of the

nominating and corporate governance committee of the Board. The Board has determined that Mr. Field qualifies as an “independent

director” as defined in the listing rules of the Nasdaq Stock Market and applicable SEC rules, and that Mr. Field meets the independent

director standard under Nasdaq listing standards and under Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”).

Mr.

Field has been the President and Chief Executive Officer of The Raymond Corporation (“Raymond”), a company providing intralogistics

solutions, since June 2014. From May 2010 to June 2014, he was Raymond’s president of operations and engineering division. From

January 2009 to April 2010, he was the executive vice president of operations and engineering. From January 2004 to December 2008, he

was the vice president of engineering. Mr. Field is also a Board member of Industrial Truck Association. Mr. Field received his bachelor

of science in mechanical engineering from Rochester Institute of Technology in 1986, his master of science in manufactured systems engineering

and his MBA in international operations management, both from Boston University in 1995.

In

connection with his appointment, the Company and Mr. Field entered into an offer letter (the “Offer Letter”) on July 24,

2024. Pursuant to the Offer Letter, Mr. Field is entitled to an annual director’s fee of $30,000 which will be paid in four quarterly

installments. Mr. Field will have the option, solely during the first year of service, to choose between receiving a cash payment in

the amount of $7,500 per quarter or receiving 18,750 shares of the Company’s common stock, $0.0001 par value, to be issued pursuant

to the Company’s 2016 Omnibus Incentive Plan.

The

foregoing description does not constitute a complete summary of the terms of the Offer Letter, and is qualified in its entirety by reference

to the complete text of the Offer Letter, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item

7.01 Regulation FD Disclosure

On

July 30, 2024, the Company issued a press release in connection with the appointment of Mr. Field as a director. A copy of the press

release is furnished as Exhibit 99.1 and is incorporated herein by reference.

The

information in this Item 7.01 is furnished pursuant to the rules and regulations of the Securities and Exchange Commission and shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

July 30, 2024

| |

POLAR

POWER, INC. |

| |

|

|

| |

By: |

/s/

Arthur D. Sams |

| |

|

Arthur

D. Sams President, Chief Executive Officer and Secretary |

Exhibit

10.1

Michael

G. Field

483

Ridge Rd.

Lansing,

NY 14882

Dear

Michael:

Thank

you for taking the time to discuss joining the Board of Directors of Polar Power, Inc. as an independent director. I hope you now have

a better understanding and share in the excitement surrounding our company.

We

have been working hard to bring seasoned and experienced professionals to our post-closing Board of Directors, and we would welcome your

knowledge and experience. We would therefore like to invite you to join the board as an independent director. We feel that you would

be a great asset to our team and contribute to our plans.

As

we have discussed, we would also like for you to serve on our Audit, Nominating and Corporate Governance and Compensation Committees,

and to take on the role as Chairperson of our Nominating and Corporate Governance and Compensation Committees. We will provide as much

advance notice to you as possible in connection with any meetings of the Board of Directors or committees of the Board of Directors that

we have.

In

consideration for your joining the Board of Directors as an independent director, and for your services on the foregoing committees,

you will receive the consideration set forth on Annex A to this letter.

If

you decide to accept this offer, please indicate your acceptance by signing below and we will get the appropriate paperwork in order.

As a public company, we are subject to ongoing reporting requirements, which include the public disclosure on a Current Report on Form

8-K, within four business days of the appointment of a new director, as well as certain related information. We will notify you promptly,

after receipt of your acceptance, of the approval by our Board of Directors of your appointment, and the effective date of your directorship.

Please

feel free to call me if you have any questions. I look forward to a successful and exciting relationship.

| Very

truly yours, |

|

|

| |

|

|

| /s/

Arthur D. Sams |

|

July

24, 2024 |

| Arthur

D. Sams |

|

Date |

| Chief

Executive Officer |

|

|

| Accepted

and agreed: |

|

|

| |

|

|

| /s/

Michael G. Field |

|

July

23, 2024 |

| Michael

G. Field |

|

Date |

249

E. GARDENA BLVD, GARDENA, CA. 90248 ● TEL: (310) 830-9153 ● FAX: (310) 719-2385

ANNEX

A

INDEPENDENT

DIRECTOR COMPENSATION

| Annual

Director’s Fee |

$30,000 |

The

Annual Director’s Fee will be paid in four quarterly installments. Mr. Field will have the option, solely during the first year

of service, to choose between receiving a cash payment in the amount of $7,500 per quarter or receiving 18,750 shares of the Company’s

common stock, $0.0001 par value (the “Common Stock”), to be issued pursuant to the Polar Power, Inc. 2016 Omnibus Incentive

Plan. The director’s fee for services provided after June 30, 2025, will solely be made by cash payment.

Cash

payments will be paid within 45 days after the end of each reporting quarter unless Mr. Field provides written notice, during the first

year of service, to the Company’s CFO at lzavala@polarpowerinc.com by the 15th calendar day after the end of

a reporting quarter electing to receive shares in lieu of cash payment.

If

elected, the Company shall issue to Mr. Field 18,750 shares of the Common Stock, after receiving Mr. Field’s written notice electing

compensation by Common Stock.

For

the avoidance of doubt, the option to receive compensation by Common Stock is only available during the first four reporting quarters

within the first year of service. Compensation is prorated during a quarter if service does not start at the beginning of a reporting

quarter or ends prior to the end of a reporting quarter.

Reporting

quarters are as follows:

First

Quarter: January 1 to March 31 of each year

Second

Quarter: April 1 to June 30 of each year

Third

Quarter: July 1 to September 30 of each year

Fourth

Quarter: October 1 to and December 31 of each year

Exhibit

99.1

Polar

Power Appoints Michael Field as Independent Director and Compensation Committee Chair

New

Board Member Provides Four Decades of Industrial Global Manufacturing and Team Building Leadership

GARDENA,

CA – July 30, 2024 – Polar Power, Inc. (“Polar Power” or the “Company”) (NASDAQ: POLA), a global

provider of prime, backup, and solar hybrid power solutions, today announces that Michael Field has been appointed a director of the

Company and compensation committee chair.

Mr.

Field joins the Polar Board with four decades of experience in global manufacturing and equipment spanning engineering and technology

development, lean manufacturing, factory and systems integration, product management and channel development. He has held key operating

and managerial roles and positions both at the divisional and executive levels at UTC Carrier Corporation, PRI Automation and Brooks

Automation, and is currently the President and CEO of The Raymond Corporation, which is in the materials handling market.

He

holds a BS in Mechanical Engineering from Rochester Institute of Technology (RIT), an MS in Manufacturing Engineering and MBA with a

concentration in International Operations from Boston University.

Arthur

Sams, Polar Power’s CEO, commented, “We welcome Mike to the Board of Directors and the opportunity to leverage his vast experience

for the benefit of Polar Power and our shareholders. His outstanding credentials as a leader from within the heavy equipment industry,

besides from the manufacturing side, include an expertise in distribution and channel management along with talent acquisition and development,

both very high priorities to us. We expect that he will be a great resource and addition to the board.”

Mr.

Field added, “I look forward to joining the team and augmenting Polar Power’s ability to achieve global operational excellence,

through a commitment to continuous improvement, from the shop floor to distribution management and customer experience. I believe my

extensive background and experience will provide a great source of support to the board and enhance the Polar Power team’s ability

to execute on a set of very exciting and environmentally-friendly growth initiatives.”

The

appointment fills a vacant board seat and brings the number of independent directors to three.

About

Polar Power, Inc.

Polar

Power (NASDAQ: POLA), an innovative provider of DC advanced power and cooling systems across diverse industrial applications, is pioneering

technological changes that radically change the production, consumption, and environmental impact of power generation. Our product portfolio,

known for innovation, durability, and efficiency, presently includes standard products for telecom, military, renewable energy, marine,

automotive, residential, commercial, oil field and mining applications. Polar Power’s systems can be configured to operate on any

energy source including photovoltaics, diesel, LPG (propane and butane), and renewable fuels.

Our

telecom power solutions offer significant cost savings with installation, permitting, site leases, and operation. Our military solutions

provide compact, lightweight, fuel efficient, reliable power solutions for robotics, drone, communications, hybrid propulsion, and other

applications.

Our

mobile rapid battery charging technology enables on-demand roadside charging for electric vehicles. Our combined heat and power (CHP)

residential systems offer innovative vehicle charging and integrated home power systems via natural gas or propane feedstocks, optimizing

performance and system costs.

Our

micro / nano grid solutions provide lower cost energy in “bad-grid or no-grid” environments. Our commitment to technological

advancement extends to hybrid propulsion systems for marine and specialty vehicles, ensuring efficiency, comfort, reliability, and cost

savings.

For

more information, please visit www.polarpower.com or follow us on www.linkedin.com/company/polar-power-inc/.

Investor

Relations Contact:

At

CORE IR

Peter

Seltzberg, SVP Investor Relations and Corporate Advisory

516-419-9915

peters@coreir.com

At

Polar Power Inc.

IR@PolarPowerinc.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

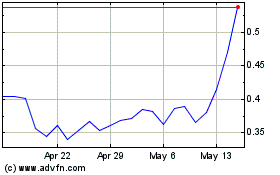

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Jul 2024 to Aug 2024

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Aug 2023 to Aug 2024