false

0001015383

0001015383

2024-02-08

2024-02-08

0001015383

POWW:CommonStock0.001ParValueMember

2024-02-08

2024-02-08

0001015383

POWW:Sec8.75SeriesCumulativeRedeemablePerpetualPreferredStock0.001ParValueMember

2024-02-08

2024-02-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 8, 2024

AMMO,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-13101 |

|

83-1950534 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

7681

E. Gray Rd.

Scottsdale,

Arizona 85260

(Address

of principal executive offices)

(480)

947-0001

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

POWW |

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market) |

| 8.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, $0.001 par value |

|

POWWP |

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

February 8, 2024, Ammo, Inc. (the “Company”) reported its financial results for the fiscal quarterly period ended December

31, 2023. A copy of the press release issued by the Company in this connection is furnished herewith as Exhibit 99.1.

The

information in this Item in this Current Report on Form 8-K and Exhibit 99.1 attached hereto are being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or

the Exchange Act, regardless of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AMMO,

INC. |

| |

|

|

| Dated:

February 8, 2024 |

By: |

/s/

Robert D. Wiley |

| |

|

Robert

D. Wiley |

| |

|

Chief

Financial Officer |

Exhibit

99.1

AMMO,

Inc. Reports Third Quarter 2024 Financial Results

SCOTTSDALE,

Ariz., February 8, 2024 (GLOBE NEWSWIRE) — AMMO, Inc. (Nasdaq: POWW, POWWP) (“AMMO” or the “Company”),

the owner of GunBroker.com, the largest online marketplace serving the firearms and shooting sports industries, and a leading vertically

integrated producer of high-performance ammunition and components, today reported results for its third quarter of fiscal 2024, ended

December 31, 2024.

Third

Quarter Fiscal 2024 vs. Third Quarter Fiscal 2023

| ● |

Net

Revenues of $36.0 million |

| ● |

Gross

profit margin of approximately 30.3% compared to 32.4% |

| ● |

Adjusted

EBITDA of $5.4 million compared to $6.2 million |

| ● |

Net

loss of ($1.6) million, compared to a net loss of ($4.1) million |

| ● |

Diluted

EPS of ($0.02), compared to ($0.04) |

| ● |

Adjusted

EPS of $0.04, compared to $0.04 |

GunBroker.com

“Marketplace” Metrics – Third Quarter 2024

| ● |

Marketplace

revenue of approximately $14.0 million |

| ● |

New

user growth averaged approximately 37,000 per month |

| ● |

Average

take rate increased to 5.9% compared to 5.7% in fiscal 2023 |

Jared

Smith, AMMO’s CEO, commented “Despite the challenges we faced in calendar 2023 for our industry, Ammo Inc. continues to transition

its business to a stronger and leaner operating model. We have emerged from this time with an impeccable balance sheet and remain encouraged

about the significant opportunities we have before us here in the fourth quarter and going forward.

“We

continue to see increasing demand as the ammunition and firearms market recovers from 2022 and 2023’s post pandemic slump. As we

look at opportunities going into fiscal 2025, we will focus on the transformation of our marketplace platform. We will also continue

to transition our manufacturing model to one of pursuing higher margin, premium rifle and pistol ammunition opportunities as well as

embracing the growing OEM brass business.,” Mr. Smith concluded.

Third

Quarter 2024 Results

We

experienced an improvement in the marginality of our ammunition segment while the margins of the GunBroker.com marketplace segment remain

strong. We continue to see positive demand trends building for our ammunition product and activity continues to increase on GunBoker.com

as we enter into the final quarter of our fiscal year.

We

ended the third quarter with total revenues of approximately $36.0 million in comparison to $38.7 million in the prior year quarter.

The decrease in revenue was primarily related to a decrease in sales activity from our ammunition segment as a result of a change in

the US commercial ammunition market from the comparable prior year quarter. Our casing sales, however, which afford us higher gross margins,

increased to $4.7 million up from $3.0 million in the prior year period. Our marketplace revenue was $14.0 million for the reported quarter,

compared to $15.4 million in the prior year quarter, which decreased as a result of the current macroeconomic environment impacting our

industry as well as others.

Cost

of goods sold was approximately $25.1 million for the quarter compared to $26.2 million in the comparable prior year quarter. The decrease

in cost of goods sold was related to the decrease in sales volume.

Our

gross margin for the quarter was $10.9 million or 30.3% compared to $12.5 million or 32.4% in the prior year period. The decrease in

gross profit margin was related to the shift in our sales mix.

Our

cost cutting measures are paying off, there was a 5.4% decrease in operating expenses as a percentage of sales from the prior year quarter

adjusted to exclude nonrecurring expenses.

There

were approximately $1.5 million of nonrecurring expenses related to legal and professional fees which we have included as addbacks to

Adjusted EBITDA.

For

the quarter, we recorded Adjusted EBITDA of approximately $5.4 million, compared to prior year quarter Adjusted EBITDA of $6.2 million.

This

resulted in a net loss per share of ($0.02) or adjusted net income per share of $0.04, compared to the prior year period of net loss

per share of ($0.04) or adjusted net income per share of $0.04.

Our

improvements to our marketplace, GunBroker.com, continue as our cart platform is on schedule to launch on April 1st.

We

repurchased approximately 145,000 shares of our common stock under our repurchase plan in the reported quarter bringing us to just over

1.3 million shares repurchased in total under the plan since repurchases began in December 2022.

Conference

Call

Management

will host a conference call at 5:00 PM ET on February 8, 2024, to review financial results and provide an update on corporate developments.

Following management’s formal remarks there will be a question-and-answer session.

Participants

are asked to preregister for the call at the following link: https://dpregister.com/sreg/10185867/fb6f640d8c

Please

note that registered participants will receive their dial-in number upon registration and will dial directly into the call without delay.

Those without Internet access or who are unable to pre-register may dial in by calling 1-844-481-2698 (domestic) or 1-412-317-0655 (international).

Please

join at least 5-10 minutes prior to the scheduled start and follow the operator’s instructions. When requested, please ask for

“AMMO, Inc. Third Quarter 2024 Conference Call.”

The

conference call will also be available through a live webcast at the following link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=mnSsDVht,

which is also available through the Company’s website.

About

AMMO, Inc.

With

its corporate offices headquartered in Scottsdale, Arizona, AMMO designs and manufactures products for a variety of aptitudes, including

law enforcement, military, sport shooting and self-defense. The Company was founded in 2016 with a vision to change, innovate and invigorate

the complacent munitions industry. AMMO promotes branded munitions as well as its patented STREAK™ Visual Ammunition,

/stelTH/™ subsonic munitions, and specialty rounds for military use via government programs. For more information, please

visit: www.ammo-inc.com.

About

GunBroker.com

GunBroker.com

is the largest online marketplace dedicated to firearms, hunting, shooting and related products. Aside from merchandise bearing its logo,

GunBroker.com currently sells none of the items listed on its website. Third-party sellers list items on the site and Federal and state

laws govern the sale of firearms and other restricted items. Ownership policies and regulations are followed using licensed firearms

dealers as transfer agents. Launched in 1999, GunBroker.com is an informative, secure and safe way to buy and sell firearms, ammunition,

air guns, archery equipment, knives and swords, firearms accessories and hunting/shooting gear online. GunBroker.com promotes responsible

ownership of guns and firearms. For more information, please visit: www.gunbroker.com.

Forward

Looking Statements

This

document contains certain “forward-looking statements”. All statements other than statements of historical fact are “forward-looking

statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue

or other financial items; any statements of the plans, strategies, goals and objectives of management for future operations; any statements

concerning proposed new products and services or developments thereof; any statements regarding future economic conditions or performance;

any statements or belief; and any statements of assumptions underlying any of the foregoing.

Forward

looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,”

“believe,” “expect” or “anticipate” or other similar words, or the negative thereof. These forward-looking

statements present our estimates and assumptions only as of the date of this report. Accordingly, readers are cautioned not to place

undue reliance on forward-looking statements, which speak only as of the dates on which they are made. We do not undertake to update

forward-looking statements to reflect the impact of circumstances or events that arise after the dates they are made. You should, however,

consult further disclosures and risk factors we include in Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports

filed on Form 8-K.

Investor

Contact:

CoreIR

Phone: (212) 655-0924

IR@ammo-inc.com

Source:

AMMO, Inc.

AMMO,

Inc.

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

December

31, 2023 | | |

March

31, 2023 | |

| | |

| (Unaudited) | | |

| | |

| ASSETS | |

| | | |

| | |

| Current

Assets: | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 54,679,868 | | |

$ | 39,134,027 | |

| Accounts

receivable, net | |

| 21,121,450 | | |

| 29,346,380 | |

| Inventories | |

| 49,502,732 | | |

| 54,344,819 | |

| Prepaid

expenses | |

| 3,708,865 | | |

| 5,126,667 | |

| Current

portion of restricted cash | |

| - | | |

| 500,000 | |

| Total

Current Assets | |

| 129,012,915 | | |

| 128,451,893 | |

| | |

| | | |

| | |

| Equipment,

net | |

| 57,278,603 | | |

| 55,963,255 | |

| | |

| | | |

| | |

| Other

Assets: | |

| | | |

| | |

| Deposits | |

| 2,265,932 | | |

| 7,028,947 | |

| Patents,

net | |

| 4,662,656 | | |

| 5,032,754 | |

| Other

intangible assets, net | |

| 114,296,627 | | |

| 123,726,810 | |

| Goodwill | |

| 90,870,094 | | |

| 90,870,094 | |

| Right

of use assets - operating leases | |

| 2,113,943 | | |

| 1,261,634 | |

| Deferred

income tax asset | |

| 115,908 | | |

| - | |

| TOTAL

ASSETS | |

$ | 400,616,678 | | |

$ | 412,335,387 | |

| | |

| | | |

| | |

| LIABILITIES

AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current

Liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 19,146,138 | | |

$ | 18,079,397 | |

| Accrued

liabilities | |

| 6,570,668 | | |

| 4,353,354 | |

| Current

portion of operating lease liability | |

| 463,059 | | |

| 470,734 | |

| Note

payable related party | |

| - | | |

| 180,850 | |

| Current

portion of construction note payable | |

| 265,977 | | |

| 260,429 | |

| Insurance

premium note payable | |

| 173,029 | | |

| 2,118,635 | |

| Total

Current Liabilities | |

| 26,618,871 | | |

| 25,463,399 | |

| | |

| | | |

| | |

| Long-term

Liabilities: | |

| | | |

| | |

| Contingent

consideration payable | |

| 80,080 | | |

| 140,378 | |

| Construction

note payable, net of unamortized issuance costs | |

| 10,797,696 | | |

| 10,922,443 | |

| Operating

lease liability, net of current portion | |

| 1,737,615 | | |

| 903,490 | |

| Deferred

income tax liability | |

| - | | |

| 2,309,592 | |

| Total

Liabilities | |

| 39,234,262 | | |

| 39,739,302 | |

| | |

| | | |

| | |

| Shareholders’

Equity: | |

| | | |

| | |

| Series

A cumulative perpetual preferred Stock 8.75%, ($25.00 per share, $0.001 par value) 1,400,000 shares issued and outstanding as of

December 31, 2023 and March 31, 2023, respectively | |

| 1,400 | | |

| 1,400 | |

| Common

stock, $0.001 par value, 200,000,000 shares authorized 119,994,033 and 118,562,806 shares issued and 118,643,593 and 118,294,478

outstanding at December 31, 2023 and March 31, 2023, respectively | |

| 118,644 | | |

| 118,294 | |

| Additional

paid-in capital | |

| 395,449,082 | | |

| 391,940,374 | |

| Accumulated

deficit | |

| (31,513,554 | ) | |

| (18,941,825 | ) |

| Treasury

Stock | |

| (2,673,156 | ) | |

| (522,158 | ) |

| Total

Shareholders’ Equity | |

| 361,382,416 | | |

| 372,596,085 | |

| TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 400,616,678 | | |

$ | 412,335,387 | |

AMMO,

Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

For

the Three Months Ended

December 31, | | |

For

the Nine Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net

Revenues | |

| | | |

| | | |

| | | |

| | |

| Ammunition

sales(1) | |

$ | 17,322,967 | | |

$ | 20,250,965 | | |

$ | 46,945,585 | | |

$ | 90,607,817 | |

| Marketplace

revenue | |

| 13,985,034 | | |

| 15,419,202 | | |

| 40,371,952 | | |

| 46,486,842 | |

| Casing

sales | |

| 4,698,463 | | |

| 3,041,327 | | |

| 17,315,888 | | |

| 10,661,420 | |

| | |

| 36,006,464 | | |

| 38,711,494 | | |

| 104,633,425 | | |

| 147,756,079 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost

of Revenues | |

| 25,096,088 | | |

| 26,184,315 | | |

| 71,410,243 | | |

| 104,257,529 | |

| Gross

Profit | |

| 10,910,376 | | |

| 12,527,179 | | |

| 33,223,182 | | |

| 43,498,550 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

Expenses | |

| | | |

| | | |

| | | |

| | |

| Selling

and marketing | |

| 236,565 | | |

| 1,010,543 | | |

| 822,098 | | |

| 3,987,214 | |

| Corporate

general and administrative | |

| 5,803,255 | | |

| 7,835,201 | | |

| 21,606,442 | | |

| 17,920,197 | |

| Employee

salaries and related expenses | |

| 3,390,153 | | |

| 4,705,636 | | |

| 13,096,468 | | |

| 11,414,434 | |

| Depreciation

and amortization expense | |

| 3,401,156 | | |

| 3,309,074 | | |

| 10,117,001 | | |

| 9,950,752 | |

| Total

operating expenses | |

| 12,831,129 | | |

| 16,860,454 | | |

| 45,642,009 | | |

| 43,272,597 | |

| Income/(Loss)

from Operations | |

| (1,920,753 | ) | |

| (4,333,275 | ) | |

| (12,418,827 | ) | |

| 225,953 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other

Expenses | |

| | | |

| | | |

| | | |

| | |

| Other

income/(loss) | |

| 4,576 | | |

| (170,403 | ) | |

| 376,186 | | |

| 28,193 | |

| Interest

expense | |

| (193,046 | ) | |

| (320,439 | ) | |

| (609,561 | ) | |

| (538,191 | ) |

| Total

other expense, net | |

| (188,470 | ) | |

| (490,842 | ) | |

| (233,375 | ) | |

| (509,998 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

before Income Taxes | |

| (2,109,223 | ) | |

| (4,824,117 | ) | |

| (12,652,202 | ) | |

| (284,045 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision

for Income Taxes | |

| (465,234 | ) | |

| (721,125 | ) | |

| (2,419,883 | ) | |

| 1,369,427 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

Loss | |

| (1,643,989 | ) | |

| (4,102,992 | ) | |

| (10,232,319 | ) | |

| (1,653,472 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Preferred

Stock Dividend | |

| (782,639 | ) | |

| (782,639 | ) | |

| (2,339,410 | ) | |

| (2,339,409 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

Loss Attributable to Common Stock Shareholders | |

$ | (2,426,628 | ) | |

$ | (4,885,631 | ) | |

$ | (12,571,729 | ) | |

$ | (3,992,881 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net

Loss per share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.02 | ) | |

$ | (0.04 | ) | |

$ | (0.11 | ) | |

$ | (0.03 | ) |

| Diluted | |

$ | (0.02 | ) | |

$ | (0.04 | ) | |

$ | (0.11 | ) | |

$ | (0.03 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

average number of shares outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 118,447,154 | | |

| 117,348,511 | | |

| 118,110,943 | | |

| 116,950,013 | |

| Diluted | |

| 118,447,154 | | |

| 117,348,511 | | |

| 118,110,943 | | |

| 116,950,013 | |

| (1) |

Included

in revenue for the three months ended December 31, 2023 and 2022 are excise taxes of $1,498,429 and $1,669,206, respectively. Included

in revenue for the nine months ended December 31, 2023 and 2022 are excise taxes of $3,958,391 and $7,816,598, respectively. |

AMMO,

Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

| | |

For

the Nine Months Ended

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash

flows from operating activities: | |

| | | |

| | |

| Net

Loss | |

$ | (10,232,319 | ) | |

$ | (1,653,472 | ) |

| Adjustments

to reconcile Net Loss to Net Cash provided by operations: | |

| | | |

| | |

| Depreciation

and amortization | |

| 14,047,216 | | |

| 12,950,972 | |

| Debt

discount amortization | |

| 62,440 | | |

| 62,440 | |

| Employee

stock awards | |

| 2,977,845 | | |

| 4,457,973 | |

| Stock

grants | |

| 152,250 | | |

| 135,344 | |

| Common

stock purchase options | |

| 380,045 | | |

| - | |

| Warrants

Issued for Services | |

| - | | |

| 106,909 | |

| Contingent

consideration payable fair value | |

| (60,298 | ) | |

| (45,572 | ) |

| Allowance

for doubtful accounts | |

| 1,117,565 | | |

| 1,327,419 | |

| Reduction

in right of use asset | |

| 362,402 | | |

| 512,063 | |

| Deferred

income taxes | |

| (2,425,500 | ) | |

| 1,283,481 | |

| Changes

in Current Assets and Liabilities | |

| | | |

| | |

| Accounts

receivable | |

| 7,107,365 | | |

| 12,208,054 | |

| Due

from related parties | |

| - | | |

| 15,000 | |

| Inventories | |

| 4,842,087 | | |

| (8,129,249 | ) |

| Prepaid

expenses | |

| 2,474,001 | | |

| 1,941,206 | |

| Deposits | |

| 4,763,015 | | |

| 1,678,415 | |

| Accounts

payable | |

| 1,066,741 | | |

| (5,852,397 | ) |

| Accrued

liabilities | |

| 2,072,696 | | |

| (2,044,248 | ) |

| Operating

lease liability | |

| (388,261 | ) | |

| (522,917 | ) |

| Net

cash provided by operating activities | |

| 28,319,290 | | |

| 18,431,421 | |

| | |

| | | |

| | |

| Cash

flows from investing activities: | |

| | | |

| | |

| Purchase

of equipment | |

| (5,562,283 | ) | |

| (10,566,182 | ) |

| Net

cash used in investing activities | |

| (5,562,283 | ) | |

| (10,566,182 | ) |

| | |

| | | |

| | |

| Cash

flow from financing activities: | |

| | | |

| | |

| Proceeds

from factoring liability | |

| 37,252,869 | | |

| 57,300,000 | |

| Payments

on factoring liability | |

| (37,252,869 | ) | |

| (56,107,221 | ) |

| Payments

on inventory facility, net | |

| - | | |

| (825,675 | ) |

| Payments

on note payable - related party | |

| (180,850 | ) | |

| (507,508 | ) |

| Payments

on insurance premium note payment | |

| (3,001,805 | ) | |

| (1,916,070 | ) |

| Proceeds

from construction note payable | |

| - | | |

| 1,000,000 | |

| Payments

on construction note payable | |

| (181,639 | ) | |

| (66,586 | ) |

| Preferred

stock dividends paid | |

| (2,194,792 | ) | |

| (2,195,075 | ) |

| Common

stock repurchase plan | |

| (2,152,080 | ) | |

| (291,011 | ) |

| Common

stock issued for exercised warrants | |

| - | | |

| 56,046 | |

| Net

cash used in financing activities | |

| (7,711,166 | ) | |

| (3,553,100 | ) |

| | |

| | | |

| | |

| Net

increase in cash | |

| 15,045,841 | | |

| 4,312,139 | |

| Restricted

cash, beginning of period | |

| 500,000 | | |

| - | |

| Cash,

beginning of period | |

| 39,134,027 | | |

| 23,281,475 | |

| Cash

and restricted cash, end of period | |

$ | 54,679,868 | | |

$ | 27,593,614 | |

| Restricted

cash, end of period | |

$ | - | | |

$ | 500,000 | |

| Cash,

end of period | |

$ | 54,679,868 | | |

$ | 27,093,614 | |

(Continued)

AMMO,

Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

| | |

For

the Nine Months Ended

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Supplemental

cash flow disclosures: | |

| | | |

| | |

| Cash

paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 548,118 | | |

$ | 433,761 | |

| Income

taxes | |

$ | - | | |

$ | 1,302,811 | |

| | |

| | | |

| | |

| Non-cash

investing and financing activities: | |

| | | |

| | |

| Operating

lease liability | |

$ | 1,214,711 | | |

$ | 901,076 | |

| Insurance

premium note payment | |

$ | 1,056,199 | | |

$ | 2,035,519 | |

| Dividends

accumulated on preferred stock | |

$ | 144,618 | | |

$ | 144,334 | |

| Construction

note payable | |

$ | - | | |

$ | 10,237,032 | |

| Warrants

issued for services | |

$ | - | | |

$ | 427,639 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

Non-GAAP

Financial Measures

We

analyze operational and financial data to evaluate our business, allocate our resources, and assess our performance. In addition to total

net sales, net loss, and other results under accounting principles generally accepted in the United States (“GAAP”), the

following information includes key operating metrics and non-GAAP financial measures we use to evaluate our business. We believe these

measures are useful for period-to-period comparisons of the Company. We have included these non-GAAP financial measures in this Current

Report on Form 8-K because they are key measures we use to evaluate our operational performance, produce future strategies for our operations,

and make strategic decisions, including those relating to operating expenses and the allocation of our resources. Accordingly, we believe

these measures provide useful information to investors and others in understanding and evaluating our operating results in the same manner

as our management and board of directors.

Reconciliation

of GAAP net income to Adjusted EBITDA

Adjusted

EBITDA

| | |

For

the Three Months Ended | | |

For

the Nine Months Ended | |

| | |

31-Dec-23 | | |

31-Dec-22 | | |

31-Dec-23 | | |

31-Dec-22 | |

| | |

| | |

| | |

| | |

| |

| Reconciliation

of GAAP net income to Adjusted EBITDA | |

| | | |

| | | |

| | | |

| | |

| Net

Loss | |

$ | (1,643,989 | ) | |

$ | (4,102,992 | ) | |

$ | (10,232,319 | ) | |

$ | (1,653,472 | ) |

| Provision

for Income Taxes | |

| (465,234 | ) | |

| (721,125 | ) | |

| (2,419,883 | ) | |

| 1,369,427 | |

| Depreciation

and amortization | |

| 4,753,650 | | |

| 4,356,004 | | |

| 14,047,216 | | |

| 12,950,972 | |

| Interest

expense, net | |

| 193,046 | | |

| 320,439 | | |

| 609,561 | | |

| 538,191 | |

| Employee

stock awards | |

| 687,099 | | |

| 2,106,535 | | |

| 2,977,845 | | |

| 4,457,973 | |

| Stock

grants | |

| 50,750 | | |

| 43,750 | | |

| 152,250 | | |

| 135,344 | |

| Common

stock purchase options | |

| 380,045 | | |

| - | | |

| 380,045 | | |

| - | |

| Warrant

Issuance | |

| - | | |

| 106,909 | | |

| - | | |

| 106,909 | |

| Other

(income) expense, net | |

| (4,576 | ) | |

| 170,403 | | |

| (376,186 | ) | |

| (28,193 | ) |

| Contingent

consideration fair value | |

| (39,274 | ) | |

| (20,326 | ) | |

| (60,298 | ) | |

| (45,572 | ) |

| Other

nonrecurring expenses(1) | |

| 1,498,684 | | |

| 3,983,254 | | |

| 8,126,102 | | |

| 4,724,385 | |

| Adjusted

EBITDA | |

$ | 5,410,201 | | |

$ | 6,242,851 | | |

$ | 13,204,333 | | |

$ | 22,555,964 | |

| |

1) |

For

the three and nine months ended December 31, 2023, other nonrecurring expenses consist of professional and legal fees that are nonrecurring

in nature. For the three and nine months ended December 31, 2022, other nonrecurring expenses consist of proxy contest fees. |

Reconciliation

of GAAP net income to Fully Diluted EPS

| | |

For

the Three Months Ended | |

| | |

31-Dec-23 | | |

31-Dec-22 | |

| Reconciliation

of GAAP net income to Fully Diluted EPS | |

| | | |

| | | |

| | | |

| | |

| Net

Loss | |

$ | (1,643,989 | ) | |

$ | (0.01 | ) | |

$ | (4,102,992 | ) | |

$ | (0.03 | ) |

| Depreciation

and amortization | |

| 4,753,650 | | |

| 0.04 | | |

| 4,356,004 | | |

| 0.04 | |

| Interest

expense, net | |

| 193,046 | | |

| - | | |

| 320,439 | | |

| - | |

| Employee

stock awards | |

| 687,099 | | |

| 0.01 | | |

| 2,106,535 | | |

| 0.02 | |

| Stock

grants | |

| 50,750 | | |

| - | | |

| 43,750 | | |

| - | |

| Common

stock purchase options | |

| 380,045 | | |

| - | | |

| - | | |

| - | |

| Warrant

issuance | |

| - | | |

| - | | |

| 106,909 | | |

| - | |

| Contingent

consideration fair value | |

| (39,274 | ) | |

| - | | |

| (20,326 | ) | |

| - | |

| Nonrecurring

expenses | |

| 1,498,684 | | |

| 0.01 | | |

| 3,983,254 | | |

| 0.03 | |

| Tax

effect(1) | |

| (1,708,026 | ) | |

| (0.01 | ) | |

| (2,294,820 | ) | |

| (0.02 | ) |

| Adjusted

Net Income | |

$ | 4,171,985 | | |

$ | 0.04 | | |

$ | 4,498,753 | | |

$ | 0.04 | |

| | |

For

the Nine Months Ended | |

| | |

31-Dec-23 | | |

31-Dec-22 | |

| Reconciliation

of GAAP net income to Fully Diluted EPS | |

| | | |

| | | |

| | | |

| | |

| Net

Loss | |

$ | (10,232,319 | ) | |

$ | (0.09 | ) | |

$ | (1,653,472 | ) | |

$ | (0.01 | ) |

| Depreciation

and amortization | |

| 14,047,216 | | |

| 0.12 | | |

| 12,950,972 | | |

| 0.11 | |

| Interest

expense, net | |

| 609,561 | | |

| - | | |

| 538,191 | | |

| - | |

| Employee

stock awards | |

| 2,977,845 | | |

| 0.03 | | |

| 4,457,973 | | |

| 0.04 | |

| Stock

grants | |

| 152,250 | | |

| - | | |

| 135,344 | | |

| - | |

| Common

stock purchase options | |

| 380,045 | | |

| | | |

| - | | |

| - | |

| Warrant

issuance | |

| - | | |

| | | |

| 106,909 | | |

| - | |

| Contingent

consideration fair value | |

| (60,298 | ) | |

| - | | |

| (45,572 | ) | |

| - | |

| Nonrecurring

expenses | |

| 8,126,102 | | |

| 0.07 | | |

| 4,724,385 | | |

| 0.04 | |

| Tax

effect(1) | |

| (6,037,463 | ) | |

| (0.05 | ) | |

| (4,826,590 | ) | |

| (0.04 | ) |

| Adjusted

Net Income | |

$ | 9,962,939 | | |

$ | 0.08 | | |

$ | 16,388,140 | | |

$ | 0.14 | |

| |

(1) |

Tax

effects are estimated by applying the statutory rate to each applicable Non-GAAP adjustment. |

| | |

For

the Three Months Ended

December 31, | | |

For

the Nine Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

Weighted

average number

of shares outstanding | |

| | |

| | |

| | |

| |

| Basic | |

| 118,447,154 | | |

| 117,348,511 | | |

| 118,110,943 | | |

| 116,950,013 | |

| Diluted | |

| 118,447,154 | | |

| 117,348,511 | | |

| 118,110,943 | | |

| 116,950,013 | |

v3.24.0.1

Cover

|

Feb. 08, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 08, 2024

|

| Entity File Number |

001-13101

|

| Entity Registrant Name |

AMMO,

INC.

|

| Entity Central Index Key |

0001015383

|

| Entity Tax Identification Number |

83-1950534

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7681

E. Gray Rd.

|

| Entity Address, City or Town |

Scottsdale

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85260

|

| City Area Code |

(480)

|

| Local Phone Number |

947-0001

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 par value |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

POWW

|

| Security Exchange Name |

NASDAQ

|

| 8.75% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.001 par value |

|

| Title of 12(b) Security |

8.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, $0.001 par value

|

| Trading Symbol |

POWWP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POWW_CommonStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POWW_Sec8.75SeriesCumulativeRedeemablePerpetualPreferredStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

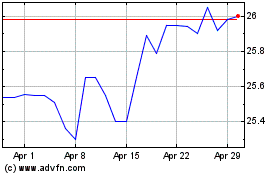

AMMO (NASDAQ:POWWP)

Historical Stock Chart

From Apr 2024 to May 2024

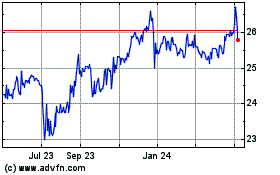

AMMO (NASDAQ:POWWP)

Historical Stock Chart

From May 2023 to May 2024