| PROSPECTUS SUPPLEMENT |

Filed Pursuant to Rule 424(b)(5) |

| (to Prospectus dated October 18, 2023) |

Registration No. 333-275070 |

$1,100,000

Reborn Coffee, Inc.

Common Stock

We are offering $1,100,000 of our common stock,

par value $0.0001 per share (our “common stock”), by this prospectus supplement and the accompanying prospectus, directly

to EF Hutton YA Fund, LP, a Delaware limited partnership (the “Investor”), in connection with the Pre-Paid Advance Agreement

(the “PPA”) that we entered into with the Investor on February 12, 2024. In accordance with the terms of the PPA, on February

12, 2024 the Investor advanced to the Company a pre-paid advance of $1,100,000 (the “Pre-Paid Advance”). The Pre-Paid Advance

was purchased by the Investor at 90% of the face amount. If and when requested by the Investor (a “Purchase Notice”), amounts

outstanding under the Pre-Paid Advance will be correspondingly reduced upon the issuance by us of our common stock to the Investor at

a price per share equal to the lower of: (a) 100% of the volume weighted average price (as reported during regular trading hours by Bloomberg)

(the “VWAP”) of our common stock on the trading day immediately preceding the closing of the Pre-Paid Advance (the “Fixed

Price”) or (b) 87% of the lowest daily VWAP of the shares during the five trading days immediately prior to each Purchase Notice

(as applicable, the “Purchase Price”), subject to the Floor Price. The “Floor Price” is equal to $0.46. Interest

will accrue on the outstanding balance of the Pre-Paid Advance at 0%, subject to an increase to 18% upon events of default described in

the PPA. The Pre-Paid Advance matures within one year.

This prospectus supplement relates to the offering

of common stock in connection with the $1,100,000 Pre-Paid Advance pursuant to the PPA.

In addition to our issuance of common stock to

the Investor pursuant to the PPA, this prospectus supplement also covers the resale of those shares from time to time by the Investor

to the public. Although we have been advised by the Investor, and the Investor represents in the PPA, that the Investor is purchasing

the Investor shares for its own account, for investment purposes in which it takes investment risk (including, without limitation, the

risk of loss), and without any view or intention to distribute such shares in violation of the Securities Act of 1933, as amended (the

“Securities Act”), or any other applicable securities laws, the Securities and Exchange Commission (the “SEC”)

may take the position that the Investor is deemed an “underwriter” within the meaning of Section 2(a)(11) of the Securities

Act and any profits on the sales of shares of our common stock by the Investor and any discounts, commissions or concessions received

by the Investor are deemed to be underwriting discounts and commissions under the Securities Act. For additional information on the methods

of sale that may be used by the Investor, see “Plan of Distribution”.

The aggregate market value of our outstanding common stock held by

non-affiliates is $3,400,420.59 based on 2,074,507 shares of outstanding common stock, of which 1,399,820 are held by affiliates, and

a per share price of $5.04 based on the closing sale price of our common stock on December 26, 2023. Pursuant to General Instruction I.B.6

of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of our

public float in any 12-month period so long as our public float remains below $75,000,000. We have not offered any securities pursuant

to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

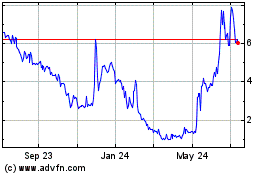

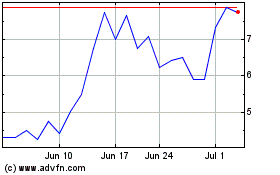

Our common stock is traded on NASDAQ under the

symbol “REBN.” On February 9, 2024, the last reported sale price on NASDAQ of our common stock was $2.32 per share.

Our principal executive office is located at 580

N. Berry Street, Brea, CA 92821, and our telephone number is (714) 784-6369.

Investing in our common stock involves significant

risks. See “Risk Factors” beginning on page [S-8] of this prospectus supplement and the risk factors that are incorporated

by reference into this prospectus supplement and the accompanying prospectus from our filings made with the SEC pursuant to the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) for a discussion of the factors you should carefully consider before

deciding to invest in our common stock.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus supplement is February

12, 2024

TABLE OF CONTENTS

PROSPECTUS

About

this Prospectus Supplement

This prospectus supplement and the accompanying

base prospectus are part of a “shelf” registration statement on Form S-3 that we filed with the U.S. Securities

and Exchange Commission (the “SEC”), using a “shelf” registration process. This prospectus supplement describes

the specific terms of this offering. The accompanying base prospectus, including the documents incorporated by reference therein, provides

general information about us, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring

to both this prospectus supplement and the accompanying base prospectus, combined.

We urge you to carefully read this prospectus

supplement, the accompanying base prospectus, the documents incorporated by reference herein and therein and the additional information

under the heading “Information Incorporated by Reference; Where You Can Find More Information” before buying any of the securities

being offered under this prospectus supplement. These documents contain information you should consider when making your investment decision.

You should rely only on the information contained

or incorporated by reference in this prospectus supplement and the accompanying base prospectus. We have not, and the underwriter has

not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you

should not rely on it. This prospectus supplement may add, update or change information contained in the accompanying base prospectus.

To the extent any information in this prospectus supplement is inconsistent with the accompanying base prospectus, you should rely on

the information in this prospectus supplement. The information in this prospectus supplement will be deemed to modify or supersede the

information in the accompanying base prospectus and the documents incorporated by reference therein, except for those documents incorporated

by reference therein which we file with the SEC after the date of this prospectus supplement.

You should not assume that the information contained

or incorporated by reference in this prospectus supplement and the accompanying base prospectus is accurate on any date subsequent to

the date set forth on the front cover of this prospectus supplement and the accompanying base prospectus or on any date subsequent to

the date of the document incorporated by reference herein or therein, as applicable. Our business, financial condition, results of operations

and prospects may have changed since those dates.

We are offering to sell, and seeking offers to

buy, the securities described in this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution

of this prospectus supplement and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside the

United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating

to, the offering of the securities and the distribution of this prospectus supplement outside the United States. This prospectus supplement

does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered

by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus

supplement or the accompanying base prospectus were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

In this prospectus supplement, unless otherwise

indicated or required by the context, the terms “Reborn,” “Reborn Coffee,” “we,” “our,”

“us,” the “Company” and the “Registrant” refer to Reborn Coffee, Inc. and its consolidated subsidiaries.

Reborn Coffee, our logo, and our other registered

and common law trade names, trademarks and service marks are the property of the Company. All other trademarks, trade names and service

marks appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names

in this prospectus may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator

that their respective owners will not assert their rights thereto.

Prospectus

Supplement Summary

This summary contains

basic information about us and this offering. This summary highlights selected information contained elsewhere in, or incorporated by

reference into, this prospectus supplement. This summary is not complete and may not contain all of the information that is important

to you and that you should consider before deciding whether or not to invest in our common stock. For a more complete understanding of

the Company and this offering, you should carefully read this prospectus supplement and the accompanying base prospectus, including any

information incorporated by reference herein and therein, in their entirety. Investing in our securities involves risks that are described

in this prospectus supplement under the heading “Risk Factors,” under the headings “Part I, Item 1A. Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31, 2022 and in our other filings with the SEC.

OUR BUSINESS

We are focused on serving

high quality, specialty-roasted coffee at retail locations, kiosks and cafes. We are an innovative company that strives for constant improvement

in the coffee experience through exploration of new technology and premier service, guided by traditional brewing techniques. We believe

Reborn differentiates itself from other coffee roasters through its innovative techniques, including sourcing, washing, roasting, and

brewing our coffee beans with a balance of precision and craft.

Founded in 2015 by Jay

Kim, our Chief Executive Officer, Mr. Kim and his team launched Reborn Coffee with the vision of using the finest pure ingredients and

pristine water. We currently serve customers through our retail store locations in California: Brea, La Crescenta, Huntington Beach, Corona

Del Mar, Arcadia, Laguna Woods, Riverside, San Francisco, Cabazon, Manhattan Beach, two locations in Irvine, Diamond Bar and Anaheim with

one location in development.

We continue to elevate

the high-end coffee experience and we received first place traditional still in “America’s Best Cold Brew” competition

by Coffee Fest in 2017 in Portland and 2018 in Los Angeles.

The Experience, Reborn

As leading pioneers of

the emerging “Fourth Wave” movement, Reborn Coffee is redefining specialty coffee as an experience that demands much more

than premium quality. We consider ourselves leaders of the “fourth wave” coffee movement because we are constantly developing

our bean processing methods, researching design concepts, and reinventing new ways of drinking coffee. For instance, the current transition

from the K-Cup trend to the pour over drip concept allowed us to reinvent the way people consume coffee, by merging convenience and quality.

We took the pour over drip concept and made it available and affordable to the public through our Reborn Coffee Pour Over packs. Our Pour

Over Packs allow our consumers to consume our specialty coffee outdoors and on-the-go.

Our success in innovating

within the “fourth wave” coffee movement is measured by our success in B2B sales with our introduction of Reborn Coffee Pour

Over Packs to hotels. With the introduction of our Pour Over Packs to major hotels (including one hotel company with 7 locations), our

B2B sales increased as these companies recognized the convenience and functionality our Pour Over Packs serve to their customers.

Reborn Coffee’s

continuous Research and Development is essential to developing new parameters in the production of new blends. Our first place position

in “America’s Best Cold Brew” competition by Coffee Fest in 2017 in Portland and 2018 in Los Angeles is a testament

to the way we believe we lead the “fourth wave” movement by example.

Centered around its core

values of service, trust, and well-being, Reborn Coffee delivers an appreciation of coffee as both a science and an art. Developing innovative

processes such as washing green coffee beans with magnetized water, we challenge traditional preparation methods by focusing on the relationship

between water chemistry, health, and flavor profile. Reborn Coffee proactively distinguishes exceptional quality from good quality by

starting at the foundation and paying attention to the details. Our mission places an equal emphasis on humanizing the coffee experience,

delivering a fresh take on “farm-to-table” by sourcing internationally. In this way, Reborn Coffee creates opportunities to

develop transparency by paying homage to origin stories and sparking new conversations by building cross-cultural communities united by

a passion for the finest coffee.

Through a broad product

offering, Reborn Coffee provides customers with a wide variety of beverages and coffee options. As a result, we believe we can capture

market share of any experience where customers seek to consume great beverages whether in our inviting store atmospheres which are designed

for comfort, or on the go through our Pour Over Packs, or at home with our whole bean ground coffee bags. We believe that the retail coffee

market in the US is large and growing. According to IBIS, in 2021, the retail market for coffee in the United States is expected to be

$46.2 billion. This is expected to grow due to a shift in consumer preferences to premium coffee, including specialized blends, espresso-based

beverages, and cold brew options. Reborn aims to capture a growing portion of the market as we expand and increase consumer awareness

of our brand.

Plan of Operation

We have a production

and distribution center at our headquarters that we use to process and roast coffee for wholesale and retail distribution.

Currently,

we have the following fourteen retail coffee locations:

| ● | La Floresta Shopping Village in Brea, California; |

| | | |

| ● | La Crescenta, California; |

| | | |

| ● | Corona Del Mar, California; |

| | | |

| ● | Home Depot Center in Laguna Woods, California; |

| | | |

| ● | Manhattan Village at Manhattan Beach, California. |

| | | |

| ● | Huntington Beach, California; |

| | | |

| ● | Anita Westfield Mall in Arcadia, California; |

| | | |

| ● | Galleria at Tyler in Riverside, California; |

| | | |

| ● | Stonestown Galleria in San Francisco, California; |

| | | |

| ● | Intersect in Irvine, California; |

| | | |

| ● | Dupont Drive in Irvine, California; |

| | | |

| ● | Diamond Bar, California; and |

| | | |

Employees and Human

Capital Resources

Reborn Coffee has 122

full-time employees as of December 31, 2023.

Reborn Coffee believes

in mentoring and developing the next generation of premium coffee baristas. Through our in-depth training, we aim to train dedicated employees

who understand the science and art behind every cup of coffee. We also expect to form a training school specializing in creating passionate

baristas and coffee connoisseurs, by educating its students about coffee processes and preparation methods.

Recent Developments

Reverse Stock Split

On January 17, 2024 we announced our intention

to conduct the Reverse Stock Split of at a ratio of 1-for-8. Our common stock began trading on a post-Reverse Stock Split basis at the

market open on January 22, 2024. The Reverse Stock Split was part of the Company’s plan to regain compliance with the Minimum Bid

Price Requirement of $1.00 per share required to maintain continued listing on The Nasdaq Capital Market, among other benefits. As of

January 17, 2024, the Reverse Stock Split had reduced the number of shares of our issued and outstanding shares of common stock from 16,596,057

shares to 2,074,507 shares, subject to adjustment due to fractional shares. We have satisfied the

minimum price deficiency as of February 6, 2024.

NASDAQ Deficiencies & Subsequent Hearing

Panel

On April

28, 2023, we received a notification letter from the Nasdaq Listing Qualifications Staff (the “Staff”) notifying the Company

that the minimum bid price per share for its common stock has been below $1.00 for a period of 32 consecutive business days thereby violating

the minimum bid price requirements set forth in Nasdaq Listing Rule 5550(a)(2). On September 5, 2023, we received a second notification

letter stating that the Company’s amount of stockholders’ equity had fallen below the $2,500,000 required minimum for continued

listing set forth in Nasdaq Listing Rule 5550(b)(1). On January 10, 2024, we received a third notification letter regarding our failure

to hold our annual meeting of shareholders for the fiscal year ended December 31, 2023 in violation of Listing Rule 5620(a).

Since receiving

these letters, we have endeavored to remedy each deficiency by effecting the Reverse Stock Split,

securing additional investment to strengthen our financial position and making plans to hold our annual meeting of shareholders for the

fiscal year ended December 31, 2023 in the first quarter of 2024. We submitted a plan of compliance to the Staff and had requested a hearing

with the Nasdaq Hearings Panel. A hearing was held on January 18, 2024, during which we explained our strategy for maintaining compliance

with Nasdaq’s rules. On February 2, 2024, we received a letter from Nasdaq granting our request for an exception to the delisting

of our securities until March 29, 2024. Nasdaq’s decision to forgo the delisting of our securities were subject to several conditions.

We intend to meet each condition in our continued bid to regain and maintain compliance with Nasdaq’s listing rules. We have satisfied

the minimum price deficiency as of February 6, 2024.

Corporate Information

We were incorporated in the State of Florida in

January 2018. In July 2022, Reborn Coffee was migrated from Florida to Delaware, and filed a certificate of incorporation with the Secretary

of State of the State of Delaware having the same capitalization structure as the Florida predecessor entity. Reborn Coffee has the following

wholly owned subsidiaries:

| ● | Reborn Global Holdings, Inc. (“Reborn Holdings”),

a California Corporation incorporated in November 2014. Reborn Holdings is engaged in the operation of wholesale distribution and retail

coffee stores in California to sell a variety of coffee, tea, Reborn brand name water and other beverages along with bakery and dessert

products. |

| ● | Reborn Coffee Franchise, LLC (the “Reborn Coffee Franchise”),

a California limited liability corporation formed in December 2020, is a franchisor providing premier roaster specialty coffee to franchisees

or customers. Reborn Coffee Franchise continues to develop the Reborn Coffee system for the establishment and operation of Reborn Coffee

stores using one or more Reborn Coffee marks. Reborn Coffee Franchise does not have any franchisee as of December 31, 2022. |

In August 2022, we consummated our initial public

offering (the “IPO”) of 1,440,000 shares of our common stock at a public offering price of $5.00 per share, generating gross

proceeds of $7,200,000. Net proceeds from the IPO were approximately $6.2 million after deducting underwriting discounts and commissions

and other offering expenses of approximately $998,000.

We granted the underwriters a 45-day option to

purchase up to 216,000 additional shares (equal to 15% of the shares of common stock sold in the offering) to cover over-allotments. In

addition, we agreed to issue to the representative of the several underwriters warrants to purchase the number of shares of common stock

in the aggregate equal to five percent (5%) of the shares of common stock to be issued and sold in the IPO. The warrants are exercisable

for a price per share equal to 125% of the public offering price. No over-allotment option or representative’s warrants have been

exercised.

On August 12, 2022, our common stock began trading

on the Nasdaq Capital Market under the symbol “REBN”.

Our principal executive office is located at 580

N. Berry Street, Brea, CA 92821, and our telephone number is (714) 784-6369. Our Internet website address is www.reborncoffee.net. Any

information contained on, or that can be accessed through, our website is not incorporated by reference into, nor is it in any way part

of, this prospectus supplement and should not be relied upon in connection with making any decision with respect to an investment in our

securities. We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may

obtain any of the documents filed by us with the SEC at no cost from the SEC’s website at http://www.sec.gov.

We are a “smaller reporting company”

as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and have elected

to take advantage of certain of the scaled disclosure available for smaller reporting companies in this prospectus supplement as well

as our filings under the Exchange Act.

The

Offering

| Common stock offered by us |

Common stock having an aggregate gross sales price of $1,100,000 at

a price per share equal to the lower of: (a) 100% of the volume weighted average price (as reported during regular trading hours by Bloomberg)

(the “VWAP”) of our common stock on the trading day immediately preceding the closing of the Pre-Paid Advance (the “Fixed

Price”) or (b) 87% of the lowest daily VWAP of the shares during the five trading days immediately prior to the Purchase Notice

(as applicable, the “Purchase Price”), subject to the Floor Price. The “Floor Price” is equal to $0.46. The amount

and timing of sales of common stock offered hereby is at the sole discretion of the Investor.

|

| |

|

| Common stock outstanding before this offering |

2,074,507 shares. |

| Common stock to be outstanding immediately after this offering |

2,548,644 shares of our common stock, assuming the sale of 474,137 shares of our common stock in this offering at an offering price of $2.32 per share, which was the last reported sale price of our common stock on Nasdaq on February 9, 2024. The actual number of shares of our common stock issued will vary depending on the sale price under this offering, but will not be greater than 414,693 shares (subject to adjustments for any reorganization, recapitalization, non-cash dividend, stock split (including forward and reverse), representing 19.99% of the shares of our common stock outstanding on the date of the PPA (the “Exchange Cap”), unless, in accordance with applicable NASDAQ rules, we obtain stockholder approval of the issuance of shares of our common stock under the PPA in excess thereof. |

| Use of proceeds |

We may use some of the proceeds received by us from such sales of our common stock, if any, to repay outstanding debt. We expect to use any remaining proceeds received by us from such sales of our common stock, if any, for general corporate purposes, including working capital, strategic and other general corporate purposes. Our management will retain broad discretion over the allocation of the net proceeds from the sale of the shares of our common stock offered by this prospectus supplement. See “Use of Proceeds” beginning on page [S-12] of this prospectus supplement for additional detail. |

| The Nasdaq Capital Market symbol |

REBN. |

| Risk factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on [page S-8] of this prospectus supplement and other information included or incorporated in this prospectus supplement for a discussion of factors you should carefully consider before investing in our securities. |

PRE-PAID ADVANCE AGREEMENT

General

On February 12, 2024, we entered into a Pre-Paid Advance Agreement

(the “PPA”) with EF Hutton YA Fund, LP, a Delaware limited partnership (the “Investor”). In accordance with the

terms of the PPA, on February 12, 2024 the Investor advanced to the Company a pre-paid advance of $1,100,000 (the “Pre-Paid Advance”).

The Pre-Paid Advance was purchased by the Investor at 90% of the face amount.

If and when requested by the Investor in writing while the Pre-Paid

Advance is outstanding (a “Purchase Notice”), the Investor may require us to issue and sell shares of common stock to the

Investor (an “Advance”) and the amounts outstanding under the Pre-Paid Advance will be correspondingly reduced upon the issuance

by us of our common stock to the Investor, at a price per share equal to the lower of: (a) 100% of the volume weighted average price (as

reported during regular trading hours by Bloomberg) (the “VWAP”) of our common stock on the trading day immediately preceding

the closing of the Pre-Paid Advance (the “Fixed Price”) or (b) 87% of the lowest daily VWAP of the shares during the five

trading days immediately prior to the Purchase Notice (as applicable, the “Purchase Price”), subject to the Floor Price. The

“Floor Price” is equal to $0.46. Interest will accrue on the outstanding balance of the Pre-Paid Advance at 0%, subject to

an increase to 18% upon events of default described in the PPA. The Pre-Paid Advance matures within one year.

Limitations

The Investor will not be entitled to an Advance

if the issuance of shares of common stock (i) would result in the Investor (and its affiliates) beneficially owning more than 4.99% of

the outstanding shares of the company (the “Beneficial Ownership Limitation”) or (ii) when combined with all other Advances

would exceed the Exchange Cap of 414,693 shares of our common stock, unless we obtain stockholder approval to do so.

No Short-Selling or Hedging by the Investor

The Investor has agreed that, while the Pre-Paid Advance is outstanding,

neither the Investor nor any of its affiliates will engage in any short sales or hedging transactions with respect to our common stock.

Amortization Event

An “Amortization Event” occurs if (1) the daily VWAP of

our common stock (as reported by Bloomberg) is lower than the Floor Price for any five of seven consecutive trading days, (2) we have

issued in excess of 99% of all of the shares available under the Exchange Cap, or (3) the Investor is unable to use the registration statement

that includes this prospectus (and any one or more additional registration statements filed with the SEC that include the shares of our

common stock that may be issued and sold by us to the Investor under the PPA) for period of ten consecutive trading days. Within ten trading

days of an Amortization Event, we must make a cash repayment to the Investor of an amount outstanding under the Pre-Paid Advance (the

“Cash Payment”) equal to $500,000, plus any accrued and unpaid interest (if any), and a 10% redemption premium.

Redemption

We may, in our sole discretion, redeem an outstanding

Pre-Paid Advance in cash by providing the Investor with advance written notice at least ten trading days prior to such prepayment if the

VWAP of our common stock is, at the time of such written notice, lower than the Fixed Price. The prepayment shall include a prepayment

premium (a “Prepayment Premium”) equal to 10%.

Fees

As consideration for the Investor’s entry

into the PPA, we agreed to pay to the Investor a non-refundable due diligence fee of $15,000, which will be deducted from proceeds at

closing.

Prohibition of Certain Variable Rate Transactions

Pursuant to the PPA, as long as the Pre-Paid Advance remains outstanding,

we may not enter into any Variable Rate Transactions (as defined in the PPA) other than with the Investor, including equity line of credit”

or other continuous offering or similar offering of shares of common stock or common stock equivalents.

Effect of Sales of our Common Stock under the PPA on our Stockholders

All shares of our common stock that may be issued

or sold by us to the Investor under the PPA that are being registered under the Securities Act covering the sale of common stock to the

Investor pursuant to the PPA and the resale by the Investor of the shares of our common stock purchased from us by in this prospectus

are expected to be freely tradable. The request for Advances by the Investor, and the resale by the Investor of a significant amount of

shares registered in this offering at any given time, or the perception that these sales may occur, could cause the market price of our

common stock to decline and to be highly volatile.

If and when the Investor elects to request Advances

pursuant to the PPA, after the Investor has acquired such shares, the Investor may resell all, some or none of such shares at any time

or from time to time in its discretion and at different prices. As a result, investors who purchase shares of our common stock from the

Investor in this offering at different times will likely pay different prices for those shares of common stock, and so may experience

different levels of dilution and in some cases substantial dilution and different outcomes in their investment results. Investors may

experience a decline in the value of the shares of our common stock they purchase from the Investor in this offering as a result of future

issuances made by us to the Investor at prices lower than the prices such investors paid for their shares in this offering. In addition,

if we issue a substantial number of shares to the Investor under the PPA, or if investors expect that we will do so, the actual sales

of shares or the mere existence of the PPA may make it more difficult for us to sell equity or equity-related securities in the future

at a time and at a price that we might otherwise wish to effect such sales.

Because the Purchase Price at which shares of

common stock may be issued to the Investor will fluctuate based on the market prices of our common stock, if any, as of the date of this

prospectus it is not possible for us to predict the number of shares of our common stock that we will issue to the Investor under the

PPA or the actual purchase price at which we will issue shares to the Investor for those shares.

The issuance of shares of our common stock to

the Investor pursuant to the PPA will not affect the rights or privileges of our existing stockholders, except that the economic and voting

interests of each of our existing stockholders will be diluted. Although the number of shares of common stock that our existing stockholders

own will not decrease, the shares of common stock owned by our existing stockholders will represent a smaller percentage of our total

outstanding shares of common stock after any such issuance.

Dilutive Effect of Performance of the PPA on

our Stockholders

All of our shares of common stock registered in

this offering, which may be issued or sold by us to the Investor under the PPA, are expected to be freely tradable. The sale by the Investor

of a significant amount of our common stock registered in this offering at any given time could cause the market price of our common stock

to decline and to be highly volatile.

Issuances of our common stock in this offering

will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests of each of our existing

stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing stockholders

own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of our total outstanding shares

after any such issuance to the Investor. If and when we do issue our common stock to the Investor under the PPA, after the Investor has

acquired those shares, the Investor may resell all, some or none of such shares at any time or from time to time in its discretion. Therefore,

issuances the Investor by us under the PPA may result in substantial dilution to the interests of other holders of our common stock. In

addition, if we issue a substantial number of our shares of common stock to the Investor under the PPA, or if investors expect that we

will do so, the actual sales of our common stock or the mere existence of our arrangement with the Investor may make it more difficult

for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect such

sales.

The following table sets forth the amount of gross

proceeds we would receive from the Investor from our issuance of shares of common stock to the Investor under the PPA registered hereunder

at varying purchase prices:

Assumed Average

Purchase Price

Per Share | | |

Number

of Registered

Shares to be Issued if

entire Amount of Pre-Paid

Advance is Settled in Shares of Common Stock(1) | | |

Percentage of

Outstanding

Shares After Giving

Effect to

Issuance to the Investor (2) | | |

Gross

Proceeds

from the Sale of

Shares to the Investor

Under the PPA | |

| $ | 1.75 | | |

| 571,429 | | |

| 21.60 | % | |

$ | 1,000,000 | |

| $ | 2.00 | | |

| 500,000 | | |

| 19.42 | % | |

$ | 1,000,000 | |

| $ | 2.32 | (3) | |

| 431,034 | | |

| 17.20 | % | |

$ | 1,000,000 | |

| $ | 2.50 | | |

| 400,000 | | |

| 16.16 | % | |

$ | 1,000,000 | |

| $ | 3.00 | | |

| 333,333 | | |

| 13.84 | % | |

$ | 1,000,000 | |

| $ | 3.50 | | |

| 285,714 | | |

| 12.11 | % | |

$ | 1,000,000 | |

| $ | 4.00 | | |

| 250,000 | | |

| 10.75 | % | |

$ | 1,000,000 | |

| (1) | We will not issue more than an aggregate of 414,693 shares of

our common stock (equal to the Exchange Cap) unless we obtain stockholder approval to do so. The number of registered shares to be issued

as set forth in this column does not take into effect the (i) the Beneficial Ownership Limitation and (ii) the Exchange Cap. |

| (2) | The denominator is based on 2,074,507 shares outstanding as

of February 9, 2024, adjusted to include the issuance of the number of shares set forth in the adjacent column that we would have issued

to the Investor pursuant to future Advances, assuming the average purchase price in the first column for all shares issued. The numerator

is based on the number of shares issuable pursuant to future Advances under the PPA (that are the subject of this offering) at the corresponding

assumed average purchase price set forth in the first column. |

| (3) | The closing sale price of our common stock on February 9, 2024. |

This summary of the material provisions of the

PPA does not purport to be a complete statement of its terms and conditions. A copy of the PPA is filed as an exhibit to a current report

on Form 8-K filed under the Exchange Act, and incorporated by reference in this prospectus supplement.

Risk

Factors

Our Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated by reference into this prospectus supplement, as well as our other filings

with the SEC, include material risk factors relating to our business. Those risks and uncertainties and the risks and uncertainties described

below are not the only risks and uncertainties that we face. Additional risks and uncertainties that are not presently known to us or

that we currently deem immaterial or that are not specific to us, such as general economic conditions, may also materially and adversely

affect our business and operations. If any of those risks and uncertainties or the risks and uncertainties described below actually occurs,

our business, financial condition or results of operations could be harmed substantially. In such a case, you may lose all or part of

your investment. You should carefully consider the risks and uncertainties described below and those risks and uncertainties incorporated

by reference into this prospectus supplement, as well as the other information included in this prospectus supplement, before making an

investment decision with respect to our common stock.

Risks Related to this Offering and the PPA

Substantial blocks of our common stock may

be sold into the market as a result of the Pre-Paid Advance Agreement.

The price of our common stock could decline if

there are substantial sales of shares of our common stock, if there is a large number of shares of our common stock available for sale,

or if there is the perception that these sales could occur.

On February 12, 2024, we entered into the PPA with the Investor. Pursuant

to the PPA, on February 12, 2024 the Investor advanced to the Company a pre-paid advance of $1,100,000 (the “Pre-Paid Advance”).

The Pre-Paid Advance was purchased by the Investor at 90% of the face amount. At the request and sole discretion of the Investor, the

Pre-Paid Advance will be correspondingly reduced upon the issuance of our common stock to the Investor at a Purchase Price equal to the

lower of: (a) the Fixed Price or (b) 87% of the lowest daily VWAP of the shares during the five trading days immediately prior to each

request (as applicable, the “Purchase Price”), subject to the Floor Price.

Any issuances of shares of our common stock pursuant to the PPA to

offset the Pre-Paid Advance will dilute the percentage ownership of stockholders and may dilute the per share projected earnings

(if any) or book value of our common stock. Sales of a substantial number of shares of our common stock in the public market or other

issuances of shares of our common stock, or the perception that these sales or issuances could occur, could cause the market price of

our common stock to decline and may make it more difficult for you to sell your shares at a time and price that you deem appropriate.

You may experience immediate and substantial

dilution in the net tangible book value per share of our C common stock you purchase.

The offering price per share of our common stock

in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that

an aggregate of 474,137 shares of our common stock are sold pursuant to this prospectus supplement at a price of $2.32 per share,

which was the last reported sale price of our common stock on NASDAQ on February 9, 2024, for aggregate gross proceeds of $1,100,000,

after deducting estimated aggregate offering expenses payable by us, you would experience immediate dilution of $1.10 per share, representing

the difference between our as adjusted net tangible book value per share after giving effect to this offering and the assumed offering

price.

Once we receive the Pre-Paid Advance, we do not have the right to control

the timing and amount of the issuance of our shares of common stock to the Investor under the PPA and, accordingly, it is not possible

to predict the actual number of shares we will issue pursuant to the PPA at any one time or in total.

Once we receive the Pre-Paid Advance, we do not

have the right to control the timing and amount of any issuances of our shares of common stock to the Investor under the PPA. Sales of

our common stock, if any, to the Investor under the PPA will depend upon market conditions and other factors, and the discretion of the

Investor. We may ultimately decide to sell to Investor all, some or none of the shares of our common stock that may be available for us

to sell to the Investor pursuant to the PPA. The Pre-Paid Advance matures within one year.

Because the purchase price per share to be paid

by the Investor for the shares of common stock that we may elect to sell to the Investor under the PPA, if any, will fluctuate based on

the market prices of our common stock, if any, it is not possible for us to predict, as of the date of this prospectus supplement and

prior to any such sales, the number of shares of common stock that we will sell to the Investor under the PPA, the purchase price per

share that the Investor will pay for shares purchased from us under the PPA, or the aggregate gross proceeds that we will receive from

those purchases by Investor under the PPA, if any.

In addition, unless we obtain stockholder approval,

we will not be able to issue shares of our common stock in excess the Exchange Cap of 414,693 under the PPA (or any other transaction

that is integrated with the PPA) in accordance with applicable NASDAQ rules. Depending on the market prices of our common stock in the

future, this could be a significant limitation on the amount of funds we are able to raise pursuant to the PPA.

Further, the resale by the Investor of a significant

amount of shares registered in this offering at any given time, or the perception that these sales may occur, could cause the market price

of our common stock to decline and to be highly volatile.

Upon an Amortization Event, we may be required

to make payments that could cause financial hardship to the company.

An “Amortization Event” occurs if

(1) the daily VWAP of our common stock (as reported by Bloomberg) is lower than the Floor Price for any five of seven consecutive trading

days, (2) we have issued in excess of 99% of all of the shares available under the Exchange Cap, or (3) the Investor is unable to use

the registration statement that includes this prospectus (and any one or more additional registration statements filed with the SEC that

include the shares of our common stock that may be issued and sold by us to the Investor under the PPA) for period of ten consecutive

trading days. Within ten trading days of an Amortization Event, we must pay the Investor the Cash Payment equal to $500,000, plus any

accrued and unpaid interest (if any), and a 10% redemption premium.

This financial obligation may cause an undue and

unsustainable burden on us and cause a material adverse effect on our operations and financial condition.

Our current business plans require a significant

amount of capital. If we are unable to obtain sufficient funding or do not have access to capital, we may not be able to execute our business

plans and our prospects, financial condition and results of operations could be materially adversely affected.

In addition to the amount of funds we ultimately

raise under the PPA, we expect to continue to seek other sources of funding, including by offering additional equity, and/or equity-linked

securities, through one or more credit facilities and potentially by offering debt securities, to finance a portion of our future expenditures.

We have experienced operating losses, and we expect

to continue to incur operating losses as we implement our business plans. We expect our capital expenditures to continue to be significant

in the foreseeable future as we expand our business. We expect to expend capital with significant outlays directed towards expanding current

programs and service offerings. As a result, our capital requirements are uncertain and actual capital requirements may be different from

those we currently anticipate. In addition, new opportunities for growth in future product lines and markets may arise and may require

additional capital.

As of September 30, 2023, our principal source of liquidity is from

our line of credit and the loan from financial institutions. We entered into the PPA whereby we requested the Pre-Paid Advance of $1,100,000.

Any debt we incur from the Investor or other parties could make us more vulnerable to a downturn in our operating results or a downturn

in economic conditions. If our cash flow from operations and our then-existing liquidity is insufficient to meet any debt service requirements,

we could be required to refinance our obligations, or dispose of assets in order to meet debt service requirements.

We expect that we will need to raise additional

capital in order to continue to execute our business plans in the future, and we plan to use the PPA, if the conditions for its use are

satisfied and seek additional equity and/or debt financing, including by offering additional equity, and/or equity-linked securities,

through one or more credit facilities and potentially by offering debt securities, to finance a portion of our future expenditures.

The sale of additional equity or equity-linked

securities could dilute our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could

result in operating and financing covenants that would restrict our operations or our ability to pay dividends to our stockholders. Our

ability to obtain the necessary additional financing to carry out our business plans or to refinance, if necessary, any outstanding debt

when due is subject to a number of factors, including general market conditions and investor acceptance of our business model. These factors

may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient

funds on favorable terms, we may have to significantly reduce our spending, delay or cancel our planned activities or substantially change

our corporate structure. We might not be able to obtain any such funding or we might not have sufficient resources to conduct our business

as projected, both of which could mean that we would be forced to curtail or discontinue our operations and our prospects, financial consolidated

results of operations could be materially adversely affected, in which case our investors could lose some or all of their investment.

Our management team will have broad discretion

over the use of the net proceeds from the PPA, if any, and you may not agree with how we use the proceeds and the proceeds may not be

invested successfully.

Our management will have broad discretion over

the use of proceeds from this offering, and we could spend the proceeds from this offering in ways our stockholders may not agree with

or that do not yield a favorable return, if at all. We may use some of the proceeds received by us from such sales of our common stock,

if any, to repay outstanding debt. We expect to use any remaining proceeds received by us from such sales of our common stock, if any,

for general corporate purposes, including working capital, strategic and other general corporate purposes. See “Use of Proceeds”

beginning on [page S-12] of this prospectus supplement for additional detail. However, our use of these proceeds may differ substantially

from our current plans. If we do not invest or apply the proceeds from this offering in ways that improve our operating results, we may

fail to achieve expected financial results, which could cause our stock price to decline.

We are not in compliance with the Nasdaq

continued listing requirements. If we are unable to comply with the continued listing requirements of The Nasdaq Capital Market, our common

stock could be delisted, which could affect our common stock’s market price and liquidity and reduce our ability to raise capital.

On November 1, 2024 we

requested a hearing by the Nasdaq Hearings Panel (the “Panel”) of The Nasdaq Stock Market LLC to appeal delisting determinations

made by the Listing Qualifications Department of Nasdaq: (i) on April 28, 2023 for failure to comply with the bid price requirement of

Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”), (ii) on September 5, 2023 for failure to comply with the minimum stockholders

equity required for continued listing on Nasdaq, or any of the alternative requirement to Nasdaq Listing Rule 5550(b) (the “Equity

Rule”), and (iii) on January 4, 2024 for failure to hold an annual meeting of stockholders for the fiscal year ended December 31,

2023 as required by Nasdaq Listing Rule 5620(a) (the “Meeting Rule”). At the Panel hearing, which occurred on January 18,

2024, we, represented by members of senior management and outside counsel, advised that we intended to regain compliance with the Bid

Price Rule by effecting the Reverse Stock Split, which we have effected – our common stock

has since had a closing bid price greater than $1.00 for ten consecutive trading days. We also informed the Panel that we

intend to regain compliance with the Equity Rule by completing one or more equity financings. Finally, we informed the Panel that we intend

to regain compliance with the Meeting Rule by holding an annual meeting of stockholders in the first quarter of 2024. As such, we proposed

to the Panel a compliance plan that included a tentative schedule to complete the reverse stock split (which has now been completed),

the equity financings, and the annual meeting and requested an extension of time to fully comply with Nasdaq listing requirements so that

we could demonstrate to the Panel that it should not be delisted from Nasdaq.

On February 2, 2024,

we received a letter (the “Letter”) from Nasdaq notifying us that the Panel had granted the Company’s request to continue

its listing on Nasdaq until March 29, 2024, subject to certain conditions.

We intend to comply with

the conditions set forth by the Panel, as stated in the Letter. There can be no assurance that the Panel will afford us more time to complete

the compliance plan it articulated in the hearing, or that we will be able to remain in compliance with the applicable Nasdaq listing

requirements on an ongoing basis.

If our common stock is delisted, it could be more

difficult to buy or sell our common stock and to obtain accurate quotations, and the price of our common stock could suffer a material

decline. Delisting could also impair the liquidity of our common stock and could harm our ability to raise capital through alternative

financing sources on terms acceptable to us, or at all, and may result in potential loss of confidence by investors, employees, and fewer

business development opportunities.

Cautionary

Note Regarding Forward-Looking Statements

This prospectus supplement and the documents incorporated

herein by reference contain “forward-looking statements” by us within the meaning of Section 27A of the Securities Act,

and Section 21E of the Exchange Act, including, without limitation, statements as to expectations, beliefs and strategies regarding

the future. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the

forward-looking statements. These forward-looking statements rely on a number of assumptions concerning future events and include, but

are not limited to, statements relating to:

| |

● |

our ability to continue as a going concern; |

| |

|

|

| |

● |

our reliance on third party vendors; |

| |

|

|

| |

● |

our dependence on our executive officers; |

| |

|

|

| |

● |

our financial performance guidance; |

| |

|

|

| |

● |

material weaknesses in our internal control over financial reporting; |

| |

|

|

| |

● |

regulatory developments in the United States and foreign countries; |

| |

|

|

| |

● |

the impact of laws, regulations, accounting standards, regulatory requirements, judicial decisions and guidance issued by authoritative bodies; |

| |

|

|

| |

● |

our estimates regarding expenses, future revenue and cash flow, capital requirements and needs for additional financing; |

| |

|

|

| |

● |

our financial performance; and |

| |

|

|

| |

● |

the ability to recognize the anticipated benefits of our business combination and/or divestiture |

Any forward-looking statements should be considered

in light of these factors. Words such as “anticipates,” “believes,” “forecasts,” “potential,”

“goal,” “contemplates,” “expects,” “intends,” “plans,” “projects,”

“hopes,” “seeks,” “estimates,” “strategy,” “continues,” “ongoing,”

“opportunity,” “could,” “would,” “should,” “likely,” “will,” “may,”

“can,” “designed to,” “future,” “foreseeable future” and similar expressions and variations,

and negatives of these words, identify forward-looking statements. These forward-looking statements are based on the expectations, estimates,

projections, beliefs and assumptions of our management based on information currently available to management, all of which are subject

to change. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that could

cause actual results to differ materially from the results contemplated by the forward-looking statements. Many of the important factors

that will determine these results and values are beyond our ability to control or predict. You are cautioned not to put undue reliance

on any forward-looking statements. Except as otherwise required by law, we do not assume any obligation to update any forward-looking

statements.

In evaluating an investment in our securities,

you should carefully consider the discussion of risks and uncertainties described under the heading “Risk Factors” contained

in this prospectus supplement, and under similar headings in other documents, including in our Annual Report on Form 10-K for the year ended December 31, 2022 and in other filings with the SEC, that are incorporated by reference in this prospectus supplement.

You should carefully read this prospectus supplement together with the information incorporated by reference in this prospectus supplement

as described under the heading “Information Incorporated by Reference; Where You Can Find More Information,” completely and

with the understanding that our actual future results may be materially different from what we expect.

All subsequent written and oral forward-looking

statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by our cautionary statements.

The forward-looking statements included or incorporated by reference herein are made only as of the date of this prospectus supplement

(or as of the date of any such document incorporated by reference). We do not intend, and undertake no obligation, to update these forward-looking

statements, except as required by law.

Market

and Industry Data

Unless otherwise indicated, we have based the

information concerning our industry contained in this prospectus supplement and incorporated by reference herein on our general knowledge

of and expectations concerning the industry, which involve risks and uncertainties and are subject to change based on various factors,

including those discussed in the “Risk Factors” section of this prospectus supplement and in the other information contained

or incorporated by reference in this prospectus supplement. These and other factors could cause the information concerning our industry

to differ materially from those expressed in this prospectus supplement and incorporated by reference herein.

Use

of Proceeds

We will receive aggregate net proceeds from this

offering of approximately $950,000 before deducting the estimated offering expenses payable by us.

We may use some of the proceeds received by us

from such sales of our common stock, if any, to repay outstanding debt. We expect to use any remaining proceeds received by us from such

sales of our common stock, if any, for general corporate purposes, including working capital, strategic and other general corporate purposes.

However, our use of these proceeds may differ substantially from our current plans.

Our expected use of the net proceeds from this

offering represents our current intentions based upon our present plans and business condition. The precise amount and timing of the application

of these proceeds will depend upon a number of factors, such as the timing and progress of store openings, our funding requirements and

the availability and costs of other funds. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular

uses for the net proceeds to us from this offering. Accordingly, our management will have broad discretion in the timing and application

of these proceeds.

Capitalization

The following table sets forth our consolidated

cash and cash equivalents, equity and total capitalization as of September 30, 2023, as

retrospectively adjusted to reflect our Reverse Stock Split:

| ● | on an as adjusted basis to give effect to our issuance and sale of common stock in the aggregate amount

of $1,100,000 in this offering at an assumed offering price of $2.32 per share, which was the last reported sale price of our common stock

on NASDAQ on February 9, 2024, and after deducting estimated offering expenses payable by us. |

You should read the data set forth in the table

below in conjunction with the section of this prospectus supplement under the caption “Use of Proceeds” as well as

our “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated

financial statements and other financial information included or incorporated by reference in this prospectus supplement.

| | |

As of September 30, 2023 (unaudited) | |

| | |

Actual | | |

As Adjusted | |

| Cash and cash equivalents | |

$ | 363,951 | | |

$ | 1,353,951 | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.0001 par value; 1,000,000 shares authorized; no shares issued or outstanding, actual and as adjusted | |

| — | | |

| — | |

| Common stock, $0.0001 par value; 40,000,000 shares authorized, and 1,657,840 shares issued and outstanding, actual; and 2,084,564 shares issued and outstanding, as adjusted | |

| 166 | | |

| 208 | |

| Additional paid-in capital | |

| 16,602,004 | | |

| 17,591,796 | |

| Accumulated deficit | |

| (15,037,349 | ) | |

| (15,038,509 | ) |

| Total stockholders’ equity | |

| 1,564,821 | | |

| 2,553,495 | |

| Total capitalization | |

$ | 1,564,821 | | |

$ | 2,553,495 | |

The as adjusted

information discussed above is illustrative only.

The above table is based on 1,657,840 shares of

common stock as of September 30, 2023.

Dilution

Purchasers of securities in this offering will

experience immediate dilution to the extent of the difference between the public offering price per share of common stock and the net

tangible book value per share of common stock immediately after this offering.

Our net tangible book value as of September 30,

2023 was approximately $1,564,821, or $0.94 per share of common stock, as

retrospectively adjusted to reflect our Reverse Stock Split. Net tangible book value per share is determined by dividing the net

of total tangible assets less total liabilities, by the aggregate number of shares of common stock outstanding as of September 30, 2023,

as retrospectively adjusted to reflect our Reverse Stock

Split.

After giving effect to the sale by us of our common

stock in the aggregate amount of $1,100,000 in this offering at an assumed offering price of $2.32 per share, which was the last reported

sale price of our common stock on NASDAQ on February 9, 2024, and after deducting estimated offering expenses payable by us, our pro forma

as adjusted net tangible book value as of September 30, 2023 would have been approximately $2,553,495, or $1.22 per share of common

stock, as retrospectively adjusted to reflect our Reverse

Stock Split. This represents an immediate increase in pro forma net tangible book value of $0.28 per share to our existing

stockholders and an immediate dilution of $1.10 per share of common stock issued in this offering.

The following table illustrates this per share

dilution:

| Assumed offering price per share of common stock | |

| | | |

$ | 2.32 | |

| Net tangible book value per share as of September 30, 2023 | |

$ | 0.94 | | |

| | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 0.28 | | |

| | |

| As adjusted net tangible book value per share after this offering | |

| | | |

$ | 1.22 | |

| Dilution per share to the Investor | |

| | | |

$ | 1.10 | |

The above table is based on 1,657,840 shares

of common stock as of September 30, 2023.

To the extent that options or warrants are exercised,

new options or other equity awards are issued under our equity incentive plans, or we issue additional shares of common stock or other

equity or convertible debt securities in the future, there may be further dilution to the Investor. Moreover, we may choose to raise additional

capital because of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or

future operating plans. If we raise additional capital through the sale of equity or convertible debt securities, the issuance of these

securities could result in further dilution to our stockholders.

DIVIDEND POLICY

We currently intend to

retain all available funds and future earnings, if any, to fund the development and expansion of our business, and we do not anticipate

paying any cash dividends in the foreseeable future. Any decision to declare and pay dividends in the future will be made at the discretion

of our board of directors and will depend on then-existing conditions, including, among other things, our results of operations, financial

condition, cash requirements, contractual restrictions, business prospects and other factors that our board of directors may deem relevant.

PLAN OF DISTRIBUTION

On February 12, 2024, we entered into the PPA with the Investor. On

February 12, 2024, the Investor advanced to the Company the Pre-Paid Advance of $1,100,000,, and the Pre-Paid Advance will be offset upon

the issuance of our common stock to the Investor at a Purchase Price equal to the lower of: (a) the Fixed Price or (b) 87% of the lowest

daily VWAP of the shares during the five trading days immediately prior to each Purchase Notice (as applicable, the “Purchase Price”),

subject to the Floor Price,

In addition to our issuance of common stock to

the Investor pursuant to the PPA, this prospectus supplement also covers the resale of those shares from time to time by the Investor

to the public. Though we have been advised by the Investor, and the Investor represents in the PPA, that the Investor is purchasing the

shares for its own account, for investment purposes in which it takes investment risk (including, without limitation, the risk of loss),

and without any view or intention to distribute such shares in violation of the Securities Act or any other applicable securities laws,

the SEC may take the position that the Investor may be deemed an “underwriter” within the meaning of Section 2(a)(11) of the

Securities Act. We have agreed in the PPA to provide customary indemnification to the Investor.

It is possible that our shares may be sold by

the Investor in one or more of the following manners:

| ● | ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| ● | a block trade in which the broker or dealer so engaged will attempt to sell the shares as agent, but may

position and resell a portion of the block as principal to facilitate the transaction; |

| ● | to a broker-dealer as principal and resale by the broker-dealer for its account; or |

| ● | a combination of any such methods of sale. |

We have advised the Investor that it is required

to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation M precludes the Investor, any affiliated

purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to

induce any person to bid for or purchase, any security that is the subject of the distribution until the entire distribution is complete.

Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution

of that security.

These restrictions may affect the marketability

of the shares of our common stock by the Investor and any unaffiliated broker-dealer.

We have paid the expenses incident to the registration

under the Securities Act of the offer and sale of the shares of our common stock covered by this prospectus supplement and the accompanying

prospectus. We also agreed to pay a $15,000 structuring and due diligence fee to an affiliate of the Investor in connection with entry

into the PPA, which will be deducted from proceeds at closing.

DESCRIPTION OF COMMON STOCK

Authorized Capitalization

The total amount of our authorized share capital

consists of 40,000,000 shares of common stock, par value $0.0001 per share, and 1,000,000 shares of preferred stock, par value $0.0001

per share.

Common Stock Rights

Holders of shares of our common stock are entitled

to one vote for each share held of record on all matters on which stockholders are entitled to vote generally, including the election

or removal of directors. The holders of our common stock do not have cumulative voting rights in the election of directors.

Holders of shares of our common stock are entitled

to receive dividends at the same rate when, as and if declared by our board of directors out of funds legally available therefor, subject

to any statutory or contractual restrictions on the payment of dividends and to the rights of the holders of one or more outstanding series

of our preferred stock.

Upon our liquidation, dissolution or winding up,

and after payment in full of all amounts required to be paid to creditors, the holders of shares of our common will be entitled to receive

pro rata our remaining assets available for distribution.

All shares of our common stock that will be outstanding

at the time of the completion of the offering will be fully paid and non-assessable. The common stock will not be subject to further calls

or assessments by us. Holders of shares of our common stock do not have preemptive, subscription, redemption or conversion rights. There

will be no redemption or sinking fund provisions applicable to the common stock. The rights, powers, preferences and privileges of holders

of our common stock will be subject to those of the holders of any shares of our preferred stock or any other series or class of stock

we may authorize and issue in the future.

No shares of common stock will be subject to redemption

or have preemptive rights to purchase additional shares of common stock. Holders of shares of our common stock do not have subscription,

redemption or conversion rights. There will be no redemption or sinking fund provisions applicable to the common stock. Upon consummation

of this offering, all the outstanding shares of common stock will be validly issued, fully paid and non-assessable.

Anti-Takeover Provisions

Because our stockholders do not have cumulative

voting rights, stockholders holding a majority of the voting power of our shares of common stock will be able to elect all our directors.

A special meeting of stockholders may be called by a majority of our board of directors, the chair of our board of directors, or our chief

executive officer. Our bylaws establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of

our stockholders, including proposed nominations of persons for election to our board of directors.

This will make it more difficult for another party

to obtain control of us by replacing our board of directors. Since our board of directors has the power to retain and discharge our officers,

these provisions could also make it more difficult for existing stockholders or another party to effect a change in management. This is

intended to preserve our existing control structure following this offering, facilitate our continued product innovation and the risk-taking

that it requires, permit us to continue to prioritize our long-term goals rather than short-term results, enhance the likelihood of continued

stability in the composition of our board of directors and its policies and to discourage certain types of transactions that may involve

an actual or threatened acquisition of us. These provisions are also designed to reduce our vulnerability to an unsolicited acquisition

proposal and to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect of discouraging

others from making tender offers for our shares and may have the effect of deterring hostile takeovers or delaying changes in our control

or management. As a consequence, these provisions may also inhibit fluctuations in the market price of our stock that could result from

actual or rumored takeover attempts.

Delaware Anti-Takeover Law

We are subject to Section 203 of the DGCL, or

Section 203. Section 203 generally prohibits a public Delaware corporation from engaging in a “business combination” with

an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested

stockholder, unless:

| |

● |

prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; |

| |

|

|

| |

● |

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding upon consummation of the transaction, excluding for purposes of determining the number of shares outstanding (a) shares owned by persons who are directors and also officers and (b) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

|

|

| |

● |

on or subsequent to the consummation of the transaction, the business combination is approved by the board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder. |

Section 203 defines a business combination to

include:

| |

● |

any merger or consolidation involving the corporation and the interested stockholder; |

| |

|

|

| |

● |

any sale, transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation; |

| |

● |

subject to exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; |

| |

|

|

| |

● |

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; and |

| |

|

|

| |

● |

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation. |

In general, Section 203 defines an interested

stockholder as any entity or person beneficially owning 15% or more of the outstanding voting stock of the corporation and any entity

or person affiliated with or controlling or controlled by the entity or person.

Undesignated Preferred Stock

The ability to authorize undesignated preferred stock will

make it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the

success of any attempt to change control of the company. These and other provisions may have the effect of deterring hostile takeovers

or delaying changes in control or management of the company.

Exclusive Forum

Our bylaws contain an exclusive forum provision

providing that the Court of Chancery of the State of Delaware will be the sole and exclusive forum for: (1) any derivative action or proceeding

brought on our behalf, (2) any action asserting a claim of breach of a fiduciary duty owed by, or other wrongdoing by, any of our directors,

officers, employees, agents or stockholders, (3) any action asserting a claim arising pursuant to any provision of the Delaware General

Corporation Law, our certificate of incorporation or our bylaws, or (4) any action asserting a claim that is governed by the internal

affairs doctrine. However, the exclusive forum provision states that it shall not apply to actions arising under the Securities Act of

1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934 (the “Exchange Act”).

In addition, Section 22 of the Securities Act

creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities

Act or the rules and regulations thereunder. As a result, the exclusive forum provision will not apply to suits brought to enforce any

duty or liability created by the Securities Act or any other claim for which the federal and state courts have concurrent jurisdiction,

and our stockholders will not be deemed to have waived our compliance with the federal securities laws and the rules and regulations thereunder.

Any person purchasing or otherwise acquiring any

interest in any shares of our capital stock shall be deemed to have notice of and to have consented to this provision included in our

bylaws. The exclusive forum provision, if enforced, may limit a stockholder’s ability to bring a claim in a judicial forum that

it finds favorable for disputes with us or our directors, officers or other employees, which may discourage such lawsuits. Alternatively,

if a court were to find the exclusive forum provision to be inapplicable or unenforceable in an action, we may incur additional costs