Filed Pursuant to Rule 424(b)(4)

Registration

No. 333-271110

Reliance

Global Group, Inc.

897,594

Shares of Common Stock Underlying Prefunded Warrants

2,105,264

Shares of Common Stock Underlying Common Warrants

155,038

Shares of Common Stock for Resale by Selling Securityholder

__________________

This

prospectus covers the sale of an aggregate of 3,157,896 shares (the “shares”) of our common stock, $0.086 par value per share

(the “common stock”) by one selling securityholder identified in this prospectus (together with any of the holder’s

transferees, pledgees, donees or successors, the “Selling Securityholder”), consisting of up to 3,157,896 shares

of common stock issuable upon the exercise of 897,594 warrants (the “Prefunded Warrants”), and up to 2,105,264 shares

of common stock are issuable upon the exercise of 2,105,264 warrants (the “Common Warrants”) and 155,038 shares of common

stock we issued to the Selling Securityholder (the “Issued Shares”). The Issued Shares, Prefunded Warrants and Common Warrants

were purchased by the selling securityholder in a private placement transaction exempt from registration under Section 4(a)(2) of the

Securities Act of 1933, as amended (the “Securities Act”), pursuant to a Securities Purchase Agreement dated March 13, 2023

(the “Purchase Agreement”). Each Prefunded Warrant will entitle the holder to purchase one share of common stock at an exercise

price of $0.001 per share and each Common Warrant will entitle the holder to purchase one share of common stock at an exercise price

of $3.55 per share. We are registering the resale of the shares of common stock covered by this prospectus as required by a Registration

Rights Agreement we entered into with the selling securityholder pursuant to the terms of the Purchase Agreement. For purposes of this

prospectus, we have exercise price under the Prefunded Warrants of $0.001 per share and an assumed exercise price under the

Common Warrants of $3.55 per share of common stock, respectively.

The

Company will not receive any proceeds from the sale by the Selling Securityholder of the shares, however, we will receive proceeds

from the exercise of the Prefunded Warrants and the Common Warrants if they are exercised for cash. We intend to use those proceeds,

if any, for general corporate purposes. We are paying the cost of registering the shares covered by this prospectus as well as various

related expenses, including with regard to compliance with state securities or “blue sky” laws. The Selling Securityholder

is responsible for all selling commissions, transfer taxes and other costs related to the offer and sale of the shares.

Sales

of the shares by the Selling Securityholder may occur at fixed prices, at market prices prevailing at the time of sale, at prices

related to prevailing market prices, or at negotiated prices. The Selling Securityholder may sell shares to or through underwriters,

broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the Selling Securityholder,

the purchasers of the shares, or both. If required, the number of shares to be sold, the public offering price of those shares, the

names of any underwriters, broker-dealers or agents and any applicable commission or discount will be included in a supplement to this

prospectus, called a prospectus supplement. Because all of the shares offered under this prospectus are being offered by the Selling

Securityholder, we cannot currently determine the price or prices at which the shares may be sold under this prospectus.

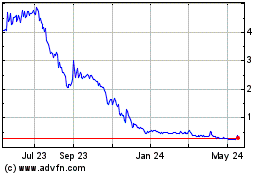

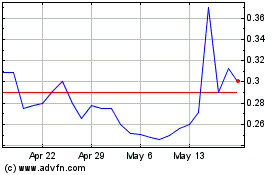

Our

common stock is currently quoted on the Nasdaq Capital Market under the symbol “RELI”. On September 6, 2023, the

last reported sale price per share of our common stock on the Nasdaq Capital Market was $2.40. You are urged to obtain

current market quotations for our common stock.

Our

principal executive offices are located at 300 Blvd. of the Americas, Suite 105, Lakewood, NJ 08701.

Investing

in our securities involves risks. You should carefully consider the Risk Factors beginning on page 5 of this prospectus before you make

an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September 13, 2023.

TABLE

OF CONTENTS

No

dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained

in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must

not be relied upon as having been authorized by us or the selling securityholder. This prospectus does not constitute an offer to sell

or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in

which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer

or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication

that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For

investors outside the United States: We have not and the selling securityholder have not done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United

States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions

relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering, and selected information contained in this prospectus. This summary is

not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock.

For a more complete understanding of the Company and this offering, we encourage you to read and consider the more detailed information

in this prospectus, including “Risk Factors” and the financial statements and related notes. Unless the context requires

otherwise, references to “Company,” “we,” “us” or “our” refer to Reliance Global Group,

Inc., a Florida corporation and its subsidiaries.

Business

Overview

Reliance

Global Group, Inc. (formerly known as Ethos Media Network, Inc.) was incorporated in Florida on August 2, 2013. In September 2018, Reliance

Global Holdings, LLC, a related party (“Reliance Holdings”), purchased a controlling interest in the Company. Ethos Media

Network, Inc. was renamed Reliance Global Group, Inc. on October 18, 2018.

We

operate as a company managing assets in the insurance markets, as well as other related sectors. Our focus is to grow the Company by

pursuing an aggressive acquisition strategy, initially and primarily focused upon wholesale and retail insurance agencies. We are led

and advised by a management team that offers over 100 years of combined business expertise in insurance, real estate and the financial

service industry.

In

the insurance sector, our management has extensive experience acquiring and managing insurance portfolios in several states, as well

as developing specialized programs targeting niche markets. Our primary strategy is to identify specific risk to reward arbitrage opportunities

and develop these on a national platform, thereby increasing revenues and returns, and then identify and acquire undervalued wholesale

and retail insurance agencies with operations in growing or underserved segments, expand and optimize their operations, and achieve asset

value appreciation while generating interim cash flows.

As

part of our growth and acquisition strategy, we are currently in negotiations with several non-affiliated parties and expect to complete

a number of material insurance asset transactions throughout the course of 2023 and beyond. As of June 30, 2023, we have acquired

nine insurance agencies, including both affiliated and unaffiliated companies. During 2022, the Company acquired multiple insurance

entities, most notably, Barra & Associates, LLC., an unaffiliated full-service insurance agency, which we rebranded to RELI Exchange

and expanded its footprint nationally.

The

Company also developed and launched 5MinuteInsure.com (“5MI”), a proprietary direct to consumer InsurTech platform which

went live during the summer of 2021. 5MI is a business to consumer website which enables consumers to compare and purchase car and home

insurance in a time efficient and effective manner. The platform is currently live in 46 states and offers coverage with up to

30 insurance carriers.

Over

the next 12 months, we plan to expand and grow our footprint and market share both through organic growth, and by expansion through additional

acquisitions in various insurance markets.

Our

competitive advantage includes the ability to:

| |

● |

Scale

to compete at a national level. |

| |

● |

Capitalize

on the consumer shift to ‘online’ with the personal touch of an agent, as the only InsurTech company with this combination. |

| |

● |

Leverage

proprietary agency software and automation to compare carrier prices, for competitive renewal pricing. |

| |

● |

Employ

an empowered and scalable insurance agency model. |

| |

● |

Leverage

technology that facilitates comparing carriers for the best prices. |

The

RELI Exchange B2B InsurTech platform and partner network for insurance agents and agencies also:

| |

● |

Boast

being the only white label insurance brokerage agency – New agents can have a multi-million dollar agency look on day 1, with

a full suite of back office support (licensing, compliance, etc). |

| |

● |

Combines

the low barriers to entry of an agency network, with state-of-the-art tech. |

| |

● |

Builds

on the artificial intelligence and data mining backbone of 5MinuteInsure.com |

| |

● |

Is

designed to provide instant and competitive insurance quotes from more than thirty insurance carriers nationwide. |

| |

● |

Reduces

back-office burden and expenses by eliminating paperwork. |

| |

● |

Provides

agents more time to focus on selling policies. |

In

addition, we have a vast mentorship program behind the scenes, to keep sales teams active. Once people are registered, we enroll them

in our mentorship program, and coach them to bring new business.

RELI

Exchange is a complete, private label system where agents have more flexibility in how they choose to brand themselves, compared to competitor

platforms that require agents to work under the platform’s brand name. In effect, agents have a greater sense of ownership on our

platform, and the feeling that comes with a well-financed agency.

Our

best-in-class product offerings include the following:

| |

1) |

An

agency partner contract |

| |

|

|

| |

2) |

An

agent / pro contract |

Our

value proposition is that we’re giving people a complete, white label business. Agents have a fast and easy website presence, get

contracts with carriers they wouldn’t normally access, and they can get paid for referrals.

Risks

Relating to Our Business

We

have been expanding our business by acquiring wholesale and retail insurance agencies in select markets in the U.S. In addition, we operate

the RELI Exchange and 5MinuteInsure.com, proprietary internet based platforms we developed as business to business

or business to consumer portals enabling agents and consumers to compare quotes from multiple carriers and sell

and purchase their auto, home and life insurance coverage in a time efficient and effective manner. Our business and

ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our common

stock. In particular, you should consider the risks discussed in detail in the section entitled “Risk Factors” including

but not limited to:

| |

● |

We

may experience significant fluctuations in our quarterly and annual results. |

| |

|

|

| |

● |

We

have limited resources and there is significant competition for business combination opportunities. Therefore, we may not be able

to acquire other assets or businesses. |

| |

|

|

| |

● |

We

may be unable to obtain additional financing, if required, to complete an acquisition, or for our operations and growth of existing

and target business, which could compel us to restructure a potential business transaction or abandon a particular business combination. |

| |

● |

Our

cash and cash equivalents that we use to meet our working capital and operating expense needs are held in deposit accounts that could

be adversely affected if the financial institution holding such funds fail. |

| |

|

|

| |

● |

Our

inability to retain or hire qualified employees, as well as the loss of any of our executive officers, could negatively impact our

ability to retain existing business and generate new business. |

| |

|

|

| |

● |

Our

growth strategy depends, in part, on the acquisition of other insurance intermediaries, which may not be available on acceptable

terms in the future or which, if consummated, may not be advantageous to us. |

| |

|

|

| |

● |

A

cybersecurity attack, or any other interruption in information technology and/or data security and/or outsourcing relationships,

could adversely affect our business, financial condition and reputation. |

| |

|

|

| |

● |

Rapid

technological change may require additional resources and time to adequately respond to dynamics, which may adversely affect our

business and operating results. |

| |

|

|

| |

● |

Changes

in data privacy and protection laws and regulations, or any failure to comply with such laws and regulations, could adversely affect

our business and financial results. |

| |

|

|

| |

● |

Because

our insurance business is highly concentrated in certain states, adverse economic conditions, natural disasters, or regulatory

changes in these states could adversely affect our financial condition. |

| |

|

|

| |

● |

If

we fail to comply with the covenants contained in certain of our agreements, our liquidity, results of operations and financial condition

may be adversely affected. |

| |

|

|

| |

● |

Certain

of our agreements contain various covenants that limit the discretion of our management in operating our business and could prevent

us from engaging in certain potentially beneficial activities. |

| |

|

|

| |

● |

We

may experience increased competition from insurance companies, technology companies and the financial services industry, as well

as the shift away from traditional insurance markets. |

| |

|

|

| |

● |

Risks

related to our lack of knowledge in distant geographic markets. |

| |

|

|

| |

● |

We

compete in a highly regulated industry, which may result in increased expenses or restrictions on our operations. |

| |

|

|

| |

● |

We

are subject to a variety of federal, state and international laws and other obligations regarding data protection. |

| |

|

|

| |

● |

Changes

in tax laws could materially affect our financial condition, results of operations and cash flows. |

| |

|

|

| |

● |

Expectations

of our company relating to environmental, social and governance factors may impose additional costs and expose us to new risks. |

Corporate

Information

We

were formed under the name Ethos Media Network, Inc. in Florida on August 2, 2013. In September 2018, Reliance Global Holdings, LLC,

a related party, purchased a controlling interest in our company. Ethos Media Network, Inc. changed its name to Reliance Global Group,

Inc. on October 18, 2018. Our principal executive offices are located at 300 Blvd. of the Americas, Suite 105, Lakewood, NJ 08701. Our

website is located at www.relianceglobalgroup.com and our telephone number is (732) 380-4600. Information found on, or accessible through,

our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of the prospectus.

THE

OFFERING

We

are registering for resale by the selling securityholder named herein the 3,157,896 shares as described below:

| Common

stock to be issued upon exercise of Prefunded Warrants |

|

897,594

shares of common stock issuable upon exercise of the Prefunded Warrants. |

| |

|

|

| Common

stock to be issued upon exercise of Common Warrants |

|

2,105,264

shares of our common stock issuable upon exercise of the Common Warrants. |

| |

|

|

| Shares

held by Selling Securityholder |

|

155,038 |

| |

|

|

| Offering

price |

|

The

selling securityholder may sell all or a portion of its shares through public or private transactions at prevailing market prices

or at privately negotiated prices. |

| |

|

|

| Common

stock outstanding prior to exercise of Prefunded Warrants and Common Warrants |

|

2,126,348

shares of common stock (1) |

| |

|

|

| Common

stock to be outstanding assuming exercise of the Prefunded Warrants and the Common Warrants |

|

5,129,206

shares of common stock. |

| |

|

|

| Terms

of the Common Warrants |

|

Prefunded

Warrants. Each Prefunded Warrant will be exercisable for one share of common stock

at an exercise price of $0.001 per share following the issue date until exercised in full.

The Prefunded Warrants may be exercised by means of a “cashless exercise” at

the holder’s option, such that the holder may use the appreciated value of the Prefunded

Warrants (the difference between the market price of the underlying shares of common stock

and the exercise price of the underlying Prefunded Warrants) to exercise the warrants without

the payment of any cash.

Common

Warrants. Each Common Warrant will be exercisable for one share of common stock at an exercise price of $3.55 per share six

months following the issue date and will expire five and one-half years from the issue date. In the event that there is no effective

registration statement registering the shares underlying the Common Warrants, then, under certain circumstances, the Common

Warrants may be exercised by means of a “cashless exercise” at the holder’s option, such that the holder may use

the appreciated value of the Common Warrants (the difference between the market price of the underlying shares of common stock and

the exercise price of the underlying warrants) to exercise the Common Warrants without the payment of any cash. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any of the proceeds from the sale by the selling securityholder of 155,038 shares of common stock being registered

hereby. However, we expect to receive approximately $7,474,000 in gross proceeds assuming the cash exercise of all of the

Prefunded Warrants and the Common Warrants by the selling securityholder to purchase the 897,594 shares of common stock being registered

hereby at an exercise price of $0.001 per share of common stock and 2,105,264 shares of common stock being registered hereby at an

exercise price of $3.55 per share. However, in the event the Prefunded Warrants and Common Warrants may be exercised on a

cashless basis, we would not expect to receive any gross proceeds from the cash exercise of those warrants. We intend to use any

net proceeds from the cash exercise of these warrants for working capital, non-secured debt payments and general corporate

purposes. |

| |

|

|

| Risk

factors |

|

Investing

in our securities involves a high degree of risk. See the information contained in or incorporated by reference under the heading

“Risk Factors” in this prospectus and in the documents incorporated by reference into this prospectus and any

free writing prospectus that we authorize for use. |

| |

|

|

| Dividend

policy |

|

We

have never paid dividends on our common stock and do not anticipate paying any dividends for the foreseeable future. |

| |

|

|

| Market

symbol and trading |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “RELI.” |

| (1) |

The

number of shares of common stock expected to be outstanding after this offering is based on 2,126,348 shares of common stock outstanding

as of September 7, 2023 and excludes: |

| |

● |

1,348,601 shares of common stock issuable upon the

exercise of warrants outstanding as of September 7, 2023, with a weighted average exercise price of $11.35 per share;

and |

| |

|

|

| |

● |

10,928 shares of common stock issuable upon the exercise

of options outstanding as of September 7, 2023, with a weighted average exercise price of $232.78 per share. |

RISK

FACTORS

Our

business is influenced by many factors that are difficult to predict and that involve uncertainties that may materially affect operating

results, cash flows, and financial condition. Before making an investment decision, you should carefully consider these risks, including

those set forth in the “Risk Factors” section of our most recent Annual Report on Form 10-K filed with the SEC, as revised

or supplemented by our Quarterly Reports on Form 10-Q filed with the SEC since the filing of our most recent Annual Report on Form 10-K,

all of which are incorporated by reference into this prospectus. You should also carefully consider any other information we include

or incorporate by reference in this prospectus or include in any applicable prospectus supplement. Each of the risks described in these

sections and documents could materially and adversely affect our business, financial condition, results of operations and prospects,

and could result in a partial or complete loss of your investment.

CAUTIONARY

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve risks and uncertainties. You should not place undue reliance on these forward-looking

statements. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including

the reasons described in our “Prospectus Summary,” “Use of Proceeds,” and “Risk Factors” sections.

In some cases, you can identify these forward-looking statements by terms such as “anticipate,” “believe,” “continue,”

“could,” “depends,” “estimate,” “expects,” “intend,” “may,” “ongoing,”

“plan,” “potential,” “predict,” “project,” “should,” “will,”

“would” or the negative of those terms or other similar expressions, although not all forward-looking statements contain

those words. These statements relate to future events or our future financial performance or condition and involve known and unknown

risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ

materially from those expressed or implied by these forward-looking statements.

You

should read this prospectus, including the section titled “Risk Factors,” completely and with the understanding that

our actual results may differ materially from what we expect as expressed or implied by our forward-looking statements. Furthermore,

if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in

these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that

we will achieve our objectives and plans in any specified time frame, or at all.

These

forward-looking statements represent our estimates and assumptions only as of the date of this prospectus regardless of the time of its

delivery or any sale of our common stock. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events or otherwise after the date of this prospectus. All subsequent forward-looking

statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to herein.

USE

OF PROCEEDS

We

are registering 155,038 shares of common stock for resale by the selling securityholder. We will not receive any proceeds from the sale

of the shares offered by this prospectus.

However,

we expect to receive approximately $7,474,000 in gross proceeds assuming the cash exercise of all of the Prefunded Warrants and the Common

Warrants by the selling securityholder to purchase the 897,594 shares of common stock being registered hereby by the selling securityholder

at an exercise price of $0.001 per share of common stock and 2,105,264 shares of common stock being registered hereby at an exercise

price of $3.55 per share. However, in the event the Prefunded Warrants and Common Warrants may be exercised on a cashless basis, we would

not expect to receive any gross proceeds from the cash exercise of those warrants. We intend to use any net proceeds from the cash exercise

of these warrants for working capital, non-secured debt payments and general corporate purposes.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our capital stock, and we do not currently intend to pay any cash dividends on our

common stock for the foreseeable future. We expect to retain future earnings, if any, to fund the development and growth of our business.

Any future determination to pay dividends on our common stock will be at the discretion of our board of directors and will depend upon,

among other factors, our results of operations, financial condition, capital requirements and any contractual restrictions.

SELLING

SECURITYHOLDER

We

have prepared this prospectus to allow Armistice Capital Master Fund Ltd., as selling securityholder, to offer for resale, from

time to time, up to 3,157,896 shares of our common stock, of which up to 897,594 shares are issuable upon the exercise of 897,594 Prefunded

Warrants (as defined below) held by the selling securityholder, up to 2,105,264 shares issuable upon the exercise of 2,105,264 Common

Warrants (as defined below) held by the selling securityholder and 155,038 shares of common stock we issued to the selling securityholder

(the “Issued Shares”).

On

March 13, 2023, the Company entered into a securities purchase agreement with the selling securityholder, which is an institutional accredited

investor (the “Purchase Agreement”), whereby, among other things, the Company issued and sold (i) an aggregate of 155,038

shares of common stock along with accompanying common warrants (the “Common Units”), (ii) prefunded warrants (the “Prefunded

Warrants”) that are exercisable into 897,594 shares of common stock (the “Prefunded Warrant Shares”) along with accompanying

common warrants (the “Pre-Funded Units”), and (iii) common warrants (the “Common Warrants”) to initially acquire

up to 2,105,264 shares of common stock (the “Common Warrant Shares”) (representing 200% of the Common Shares and Prefunded

Warrant Shares) in a private placement offering (the “Private Placement”).

The

aggregate purchase price for the common shares, Prefunded Warrants and the Common Warrants purchased by the investor was equal to (i)

$3.80 for each Common Unit purchased, or (ii) $3.799 for each Prefunded Unit purchased.

Each

Prefunded Warrant will be exercisable for one share of common stock at an exercise price of $0.001 per share following the issue date

until exercised in full. The Prefunded Warrants may be exercised by means of a “cashless exercise” at the holder’s

option, such that the holder may use the appreciated value of the Prefunded Warrants (the difference between the market price of the

underlying shares of common stock and the exercise price of the underlying Prefunded Warrants) to exercise the warrants without the payment

of any cash.

Each

Common Warrant will be exercisable for one share of common stock at an exercise price of $3.55 per share six months following the issue

date and will expire five and one-half years from the issue date. In the event that there is no effective registration statement registering

the shares underlying the Common Warrants, then the Common Warrants may be exercised by means of a “cashless exercise” at

the holder’s option, such that the holder may use the appreciated value of the Common Warrants (the difference between the market

price of the underlying shares of common stock and the exercise price of the underlying warrants) to exercise the Common Warrants without

the payment of any cash.

The

warrants and the shares of common stock issuable thereunder were sold and issued without registration under the Securities Act of 1933,

in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and Rule

506 promulgated under the Securities Act as sales to accredited investors.

The

selling securityholder listed in the table below may from time to time offer and sell any or all shares of our common stock set forth

below pursuant to this prospectus. When we refer to “selling securityholder” in this prospectus, we mean the person listed

in the table below, and the pledgees, donees, permitted transferees, assignees, successors and others who later come to hold any of the

selling securityholder’ interests in shares of our common stock other than through a public sale.

The

following table sets forth, as of the date of this prospectus, the name of the selling securityholder for whom we are registering shares

for resale to the public, and the number of such shares that each such selling securityholder may offer pursuant to this prospectus.

Applicable percentages are based on 2,126,348 shares of common stock outstanding on September 7, 2023.

Under the terms of the Common Warrants

and Prefunded Warrants held by the selling securityholder, the selling securityholder may not exercise any such warrants to the extent

such exercise would cause such selling securityholder, together with its affiliates and attribution parties, to beneficially own a number

of shares of common stock which would exceed 4.99% or 9.99%, as applicable, of our then outstanding common stock following such exercise,

excluding for purposes of such determination shares of common stock issuable upon exercise of such warrants which have not been exercised.

The number of shares in the table below do not reflect this limitation. The selling securityholder may sell all, some or none of their

shares in this offering. See “Plan of Distribution.”

We

cannot advise as to whether the selling securityholder will in fact sell any or all of such shares. In addition, the selling securityholder

may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time,

the shares in transactions exempt from the registration requirements of the Securities Act after the date on which they provided the

information set forth on the table below.

| | |

| | |

| | |

| | |

Shares beneficially owned after this Offering(2) | |

| Selling securityholder(1) | |

Number of Shares beneficially owned before this offering | | |

Percentage of Common Stock Owned Before this Offering | | |

Number of Shares of Common Stock Offered in this Offering | | |

Number of

Shares | | |

Percentage of total outstanding

common stock | |

| Armistice Capital

Master Fund Ltd. (3) | |

| 4,024,563 | | |

| 67.12 | % | |

| 3,157,896 | | |

| 0 | | |

| 0 | % |

| (1) |

If

required, information about other selling securityholder, except for any future transferees, pledgees, donees or successors of the

Selling Stockholder named in the table above, will be set forth in a prospectus supplement or amendment to the registration statement

of which this prospectus is a part. Additionally, post-effective amendments to the registration statement will be filed to disclose

any material changes to the plan of distribution from the description contained in the final prospectus. |

| |

|

| (2) |

Assumes

all shares offered by the selling securityholder hereby are sold and that the selling securityholder buys or sells no additional

shares of common stock prior to the completion of this offering. |

| |

|

| (3) |

The

securities are directly held by Armistice

Capital Master Fund Ltd. (the “Master Fund”), a Cayman Islands corporation, and may be deemed to be

indirectly beneficially owned by Armistice Capital, LLC (“Armistice”), as the investment manager of the Master

Fund. Steven Boyd, CIO of Armistice, has voting control and investment discretion over the securities held by Armistice Capital,

as the investment manager of the Armistice Master Fund. Armistice and Steven Boyd disclaim beneficial ownership of the reported

securities except to the extent of their respective pecuniary interest therein. The address of the Master Fund is c/o

Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. As of the date of this filing, Master Fund currently

holds (i) the Series B Warrants, subject to a 4.99% blocker, exercisable into 866,667 shares of our common stock, (ii) an aggregate

of 155,038 shares of common stock of the Company’s common stock issued pursuant to the Purchase Agreement, (iii) prefunded

warrants issued pursuant to the Purchase Agreement that are exercisable into 897,594 shares of Common Stock, and (iv) common warrants

issued pursuant to the Purchase Agreement to initially acquire up to 2,105,264 shares of Common Stock. As a result of the 4.99% blocker,

Master Fund beneficially owns 155,038 shares of our common stock. Without giving effect to the 4.99% blocker, in addition to the

155,038 shares of our common stock held directly by Master Fund, Master Fund would have the right to acquire an additional 866,667

shares of our common stock issuable upon exercise of the Series B Warrants, 897,594 shares of our common stock issuable upon exercise

of the Prefunded Warrants, and 2,105,264 shares of our common stock issuable upon exercise of the Common Warrants. |

PLAN

OF DISTRIBUTION

We are registering the shares of common

stock held by the selling securityholder and issuable upon exercise of the warrants by the selling securityholder to permit the resale

of these shares of common stock by the selling securityholder from time to time after the date of this prospectus. We will not receive

any of the proceeds from the sale by the selling securityholder of the shares of common stock, although we will receive the exercise

price of any Prefunded Warrants and Common Warrants not exercised by the selling securityholder on a cashless exercise basis. We will

bear all fees and expenses incident to our obligation to register the shares of common stock.

The selling securityholder may sell all

or a portion of the shares of common stock held by them and offered hereby from time to time directly or through one or more underwriters,

broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling

securityholder will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of

common stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale,

at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may

involve crosses or block transactions, pursuant to one or more of the following methods:

| |

● |

on

any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

| |

|

|

| |

● |

in

the over-the-counter market; |

| |

|

|

| |

● |

in

transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| |

|

|

| |

● |

through

the writing or settlement of options, whether such options are listed on an options exchange or otherwise; |

| |

|

|

| |

● |

ordinary brokerage

transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block trades

in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal

to facilitate the transaction; |

| |

|

|

| |

● |

purchases by a broker-dealer

as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an exchange distribution

in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately negotiated transactions; |

| |

|

|

| |

● |

short

sales made after the date the Registration Statement is declared effective by the SEC; |

| |

|

|

| |

● |

broker-dealers

may agree with a selling securityholder to sell a specified number of such shares at a stipulated price per share; |

| |

|

|

| |

● |

a

combination of any such methods of sale; and |

| |

|

|

| |

● |

any other method permitted

pursuant to applicable law. |

The

selling securityholder may also sell shares of common stock under Rule 144 promulgated under the Securities Act of 1933,

as amended, if available, rather than under this prospectus. In addition, the selling stockholder may transfer the shares

of common stock by other means not described in this prospectus. If the selling stockholder effect such transactions by selling

shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive

commissions in the form of discounts, concessions or commissions from the selling securityholder or commissions from purchasers

of the shares of common stock for whom they may act as agent or to whom they may sell as principal (which discounts, concessions

or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions

involved. The selling securityholder may, from time to time, pledge or grant a security interest in some or all of the warrants or

shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured

parties may offer and sell the shares of common stock from time to time pursuant to this prospectus or any amendment to

this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling

securityholder to include the pledgee, transferee or other successors in interest as selling securityholder under this prospectus. The

selling securityholder also may transfer and donate the shares of common stock in other circumstances in which case the transferees,

donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

To

the extent required by the Securities Act and the rules and regulations thereunder, the selling stockholder and any broker-dealer participating

in the distribution of the shares of common stock will be deemed to be “underwriters” within the meaning of the Securities

Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions

or discounts under the Securities Act. At the time a particular offering of the shares of common stock is made, a prospectus supplement,

if required, will be distributed, which will set forth the aggregate amount of shares of common stock being offered and the terms of

the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation

from the selling stockholder and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under

the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers

or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified

for sale in such state or an exemption from registration or qualification is available and is complied with.

There

can be no assurance that the selling securityholder will sell any or all of the shares of common stock registered pursuant to the registration

statement, of which this prospectus forms a part.

The

selling securityholder and any other person participating in such distribution will be subject to applicable provisions of the Securities

Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, to the extent applicable,

Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the selling

stockholder and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged

in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of common stock. All

of the foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making

activities with respect to the shares of common stock.

We

will pay all expenses of the registration of the shares of common stock pursuant to the registration rights agreement, estimated to be

$29,873.08 in total, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state

securities or “blue sky” laws; provided, however, a selling stockholder will pay all underwriting discounts and selling commissions,

if any. We will indemnify the selling stockholder against liabilities, including some liabilities under the Securities Act in accordance

with the registration rights agreement or the selling stockholder will be entitled to contribution. We may be indemnified by the selling

stockholder against civil liabilities, including liabilities under the Securities Act that may arise from any written information furnished

to us by the selling stockholder specifically for use in this prospectus, in accordance with the related registration rights agreements

or we may be entitled to contribution.

Once

sold under the registration statement, of which this prospectus forms a part, the shares of common stock will be freely tradable in the

hands of persons other than our affiliates.

DESCRIPTION

OF SECURITIES

Preferred

Stock

The

Company has been authorized to issue 750,000,000 shares of $0.086 par value Preferred Stock. The Board of Directors is

expressly vested with the authority to divide any or all of the Preferred Stock into series and to fix and determine the relative rights

and preferences of the shares of each series so established, within certain guidelines established in the Articles of Incorporation.

Each

share of Series A Convertible Preferred Stock shall have ten (10) votes per share and may be converted into ten (10) shares of

$0.086 par value common stock. The holders of the Series A Convertible Preferred Stock shall be entitled to receive, when, if and as

declared by the Board, out of funds legally available therefore, cumulative dividends payable in cash. The annual interest rate at

which cumulative preferred dividends will accrue on each share of Series A Convertible Preferred Stock is 0%. In the event of any

voluntary or involuntary liquidation, dissolution or winding up of the Company, before any distribution of assets of the Corporation

shall be made to or set apart for the holders of the Common Stock and subject and subordinate to the rights of secured creditors of

the Company, the holders of Series A Preferred Stock shall receive an amount per share equal to the greater of (i) one dollar

($1.00), adjusted for any recapitalization, stock combinations, stock dividends (whether paid or unpaid), stock options and the like

with respect to such shares, plus any accumulated but unpaid dividends (whether or not earned or declared) on the Series A

Convertible Preferred Stock, and (ii) the amount such holder would have received if such holder has converted its shares of Series A

Convertible Preferred Stock to common stock, subject to but immediately prior to such liquidation. As of December 31, 2021, all

Series A Convertible Preferred Stock have been converted into shares of common stock and none remain issued and

outstanding.

In

January 2022, the Company issued 9,076 shares of its newly designated Series B convertible preferred stock through the Private

Placement for the purpose of raising capital. The Series B convertible preferred stock have no voting rights and initially each share

may be converted into 16 shares of the Company’s common stock. The holders of the Series B convertible preferred stock

are not entitled to receive any dividends other than any dividends paid on account of the common stock. In the event of any voluntary

or involuntary liquidation, dissolution or winding up of the Company, the holders shall be entitled to receive out of the assets, whether

capital or surplus, of the Company the same amount that a holder of common stock would receive if the Preferred Stock were fully converted

(disregarding for such purposes any conversion limitations hereunder) to common stock which amounts shall be paid pari-passu with all

holders of common stock. During August 2022, all 9,076 Series B Convertible Preferred Stock were converted by third parties into 147,939

shares of common stock. As of December 31, 2022 and 2021, all Series B Convertible Preferred Stock have been converted and none remain

outstanding.

Common

Stock

The

Company has been authorized to issue 133,333,333 shares of common stock, $0.086 par value. Each share of issued and outstanding

common stock shall entitle the holder thereof to fully participate in all shareholder meetings, to cast one vote on each matter with

respect to which shareholders have the right to vote, and to share ratably in all dividends and other distributions declared and paid

with respect to common stock, as well as in the net assets of the corporation upon liquidation or dissolution.

In

January 2019, Reliance Global Holdings, LLC, a related party, converted 4,266 shares of Series A Convertible Preferred Stock into 42,663

shares of common stock.

In

February 2019, Reliance Global Holdings, LLC, a related party, converted 247 shares of Series A Convertible Preferred Stock into 2,474

shares of common stock.

On

May 2, 2019, the Company was to issue 2,213 shares of common stock to the members of Fortman Insurance Agency, LLC as a result of the

FIS Acquisition (see Note 4). In September 2019, Reliance Global Holdings, LLC, a related party, converted 221 shares of Series A Convertible

Preferred Stock into 2,213 shares of common stock which were immediately cancelled. The Company then issued 2,213 new shares of common

stock to the members of Fortman Insurance Agency, LLC.

On

July 22, 2019, the Company entered into a purchase agreement with The Referral Depot, LLC (TRD) to purchase a client referral software

created exclusively for the insurance industry. The total purchase price of the software is $250,000 cash and 1,555 restricted common

shares of the Company. Per the agreement the Company paid an initial payment of $50,000 at closing and the remaining $200,000 will be

paid with forty-eight equal monthly payments commencing on the first anniversary of the effective date, or July 22, 2020. As of December

31, 2019, no shares related to this acquisition have been issued. The Company has recorded 1,555 shares as common stock issuable as of

December 31, 2019.

In

September 2019, Reliance Global Holdings, LLC transferred its ownership in SWMT and FIS to the Company in exchange for 11,541 shares

of restricted common stock.

In

September 2019, the Company issued 9,256 shares of common stock to the former sole shareholder of Altruis Benefits Consulting, Inc. as

a result of the ABC Acquisition.

In

February 2020, the Company issued 3,111 shares of common stock to a third-party individual for the purpose of raising capital to fund

the Company’s investment in NSURE, Inc. The Company received proceeds of $1,000,000 for the issuance of these common shares.

In

August 2020, the Company issued 540 shares to an employee according to an employment agreement.

In

August 2020, the Company issued 1,196 shares of common stock according to an asset purchase agreement for the acquisition of UIS Agency,

LLC for proceeds of $200,000.

In

September 2020, the Company issued 1,458 shares according to an earnout agreement regarding the acquisition of SWMT.

In

September 2020, the Company issued 2,074 shares of stock according to a stock purchase agreement and received proceeds of $200,000, subject

to certain true-up provisions.

On

January 21, 2021 pursuant to authority granted by the Board of Directors of the Company, the Company implemented a 1-for-85.71 reverse

split of the Company’s issued and outstanding common stock simultaneously with its up listing to the Nasdaq Capital Market

(the “Reverse Split-2021”). The number of authorized shares remains unchanged. All share and per share information has been

retroactively adjusted to reflect the Reverse Split-2021 for all periods presented, unless otherwise indicated.

In

February 2021, the Company issued 1,556 shares of common stock pursuant to software purchase, valued at $340,000.

In

February 2021, the Company issued 138,000 shares of common stock through a stock offering for the purpose of raising capital.

The Company received gross proceeds of $12,420,000 for the issuance of these common shares.

In

February 2021, Reliance Global Holdings, LLC, a related party, converted $3,800,000 of outstanding debt into 42,222 shares

of common stock. The conversion considered the fair market value of the stock on the day of conversion of $6.00 for total shares

issued as a result of 42,222.

In

March 2021, the Company issued 1,000 shares of the Company’s common stock to a vendor for services valued at $91,050.

In

May 2021, the Company issued 995 shares of common stock pursuant to the acquisition of the Kush Acquisition, valued at $50,000.

On

January 4, 2022, the Company issued to two institutional buyers (i) warrants (the “Series B Warrants”) to purchase an aggregate

of up to 651,997 shares of the Company’s common stock (which was increased to 1,333,333 shares in December of 2022 due to the triggering

of certain anti-dilution provisions contained in the Series B Warrants), par value $0.086 per share (the “Common Stock”),

at an initial exercise price of $61.35 per share, (ii) an aggregate of 178,060 shares of Common Stock (the “Common Shares”),

and (iii) 9,076 shares (the “Preferred Shares”) of the Company’s newly-designated Series B convertible preferred stock,

par value $0.086 per share (the “Series B Preferred”), with a stated value of $1,000 per share, initially convertible into

an aggregate of 147,939 shares of Common Stock at a conversion price of $61.35 per share in a private placement (the “Private Placement”).

The aggregate purchase price for the Common Shares, the Preferred Shares and the Warrants is approximately $20,000,000.

In

January 2022, the Company issued 40,402 shares of common stock pursuant to the Medigap Acquisition.

In

January 2022, upon agreement with Series A warrant holders, 25,000 warrants were exercised at a price of $99.00 into 25,000 shares

of the Company’s common stock.

In

March 2022, the Company issued 400 shares of the Company’s common stock due to the vesting of 400 stock awards

pursuant to an employee agreement.

In

May and June 2022, 218,462 Series C prepaid warrants were exchanged for 218,462 shares of the Company’s common

stock.

In

July 2022, 81,423 Series D prepaid warrants were exchanged for 81,423 shares of the Company’s common stock.

In

December 2022, the Company issued 14,275 shares of the Company’s common stock due to the vesting of 14,275 stock

awards pursuant to several employee agreements.

In

December 2022, upon agreement with Series B warrant holders, 1,667 warrants were exercised at a price of $7.50 into 1,667 shares

of the Company’s common stock with cash proceeds to the Company of $12,500.

In

January 2023, the Company issued 109,358 shares of the Company’s common stock to settle two earn-out liabilities.

In

March 2023, Yes Americana Group, LLC, a related party, converted $645,000 of outstanding debt into 66,743 shares of the Company’s

common stock. The conversion considered the fair market value of the stock on the day of conversion of $9.67 for the total of 66,743

shares.

On March 13, 2023, the Company entered into a securities purchase agreement

(the “SPA-2023”) with one institutional buyer for the purchase and sale of (i) an aggregate of 155,038 shares (the “Common

Shares”) of the Company’s common stock, par value $0.086 per share (the “Common Stock”) along with accompanying

common warrants (the “Common Units”), (ii) prefunded warrants (the “Prefunded Warrants” or “Series E Warrants”)

that are exercisable into 897,594 shares of Common Stock (the “Prefunded Warrant Shares”) along with accompanying common warrants

(the “Pre-Funded Units”), and (iii) common warrants (the “Common Warrants” or “Series F Warrants”)

to initially acquire up to 2,105,264 shares of Common Stock (the “Common Warrant Shares”) (representing 200% of the Common

Shares and Prefunded Warrant Shares) in a private placement offering (the “Private Placement-2023”). Additionally, the Company

agreed to issue a warrant to the Placement Agent (defined below), to initially acquire 52,632 shares of common stock (the “PA Warrant”)

and entered into a registration rights agreement with the buyer to register for resale the

common shares underlying the Series E and F Warrants.

The

aggregate purchase price for the Common Shares, Prefunded Warrants (Series E Warrants) and the Common Warrants (Series F Warrants) to

be purchased by the Buyer shall be equal to (i) $3.80 for each Common Unit purchased by such Buyer, or (ii) $3.799 for each Prefunded

Unit purchased by the Buyer, which Prefunded Warrants are exercisable into Prefunded Warrant Shares at the initial Exercise Price (as

defined in the Prefunded Warrant) of $0.001 per Prefunded Warrant Share in accordance with the Prefunded Warrant.

The

Common Warrant (Series E) has an exercise price of $3.55 per share, subject to adjustment for any stock dividend, stock split, stock

combination, reclassification or similar transaction occurring after the date of the Private

Placement-2023. The Common Warrant will be exercisable six months following the date of issuance

and will expire five and a half years from the date of issuance.

The PA Warrant has an exercise price of $3.91 per share, subject to adjustment for any stock dividend, stock split, stock combination,

reclassification or similar transaction occurring after the date of the SPA-2023. The PA Warrant will be exercisable six months following

the date of issuance and will expire five years from the date of issuance.

During

the second quarter of 2023, the Company issued 112,557 shares of the Company’s common stock in lieu of services provided.

In

May 2023, the Company issued 352,260 shares of the Company’s common stock to settle an earn-out liability.

In

May 2023, the Company issued 22,219 shares of the Company’s common stock pursuant to vested restricted stock awards earned by agents

through an equity-based compensation program at one of the Company’s subsidiaries.

On

July 14, 2023, the Company issued 73,264 shares of Common Stock to Hudson Bay Master Fund Ltd. pursuant to a cashless exercise of 165,000

of the Series B warrants.

Reverse

Stock Split

On

February 23, 2023, pursuant to authority granted by the Board of Directors of the Company, the Company implemented a 1-for-15 reverse

split of the Company’s authorized and issued and outstanding common stock (the “Reverse Split-2023”). The par value

remains unchanged. All share and per share information as well as common stock and additional paid-in capital have been retroactively

adjusted to reflect the Reverse Split-2023 for all periods presented, unless otherwise indicated. The split resulted in a rounding addition

of approximately 15,300 shares valued at par, totaling $1,300.

Stock

Options

During

the year ended December 31, 2019, the Company adopted the Reliance Global Group, Inc. 2019 Equity Incentive Plan (the “Plan”)

under which various forms of equity awards can be granted to employees, directors, consultants, and service providers. Awards include

but are not limited to, restricted stock, restricted stock units, performance shares and stock options. A total of 46,667 shares

of common stock were reserved for issuance under the Plan, and as of December 31, 2022, 32,391 shares remain available for

issuance. With regards to options, the Company issues new shares of common stock from the shares reserved under the Plan upon exercise

of options.

The

Plan is administered by the Board of Directors (the “Board”). The Board is authorized to select from among eligible employees,

directors, and service providers those individuals to whom shares and options are to be granted and to determine the number of shares

to be subject to, and the terms and conditions of the options. The Board is also authorized to prescribe, amend, and rescind terms relating

to options granted under the Plan. Generally, the interpretation and construction of any provision of the Plan or any shares and options

granted hereunder is within the discretion of the Board.

Stock

Options:

The

Plan provides that options may or may not be Incentive Stock Options (ISOs) within the meaning of Section 422 of the Internal Revenue

Code. Only employees of the Company are eligible to receive ISOs, while employees, non-employee directors, consultants, and service providers

are eligible to receive options which are not ISOs, i.e. “Non-Statutory Stock Options.” The options granted by the Board

in connection with its adoption of the Plan were Non-Statutory Stock Options.

The

fair value of each option granted is estimated on the grant date using the Black-Scholes option pricing model or the value of the services

provided, whichever is more readily determinable. The Black-Scholes option pricing model takes into account, as of the grant date, the

exercise price and expected life of the option, the current price of the underlying stock and its expected volatility, expected dividends

on the stock and the risk-free interest rate for the term of the option.

The

following is a summary of the stock options granted, forfeited or expired, and exercised under the Plan for the years ended December

31, 2022 and 2021 respectively:

| | |

Options | | |

Weighted Average Exercise Price

Per Share | | |

Weighted Average Remaining Contractual

Life (Years) | | |

Aggregate Intrinsic Value | |

| Outstanding at December 31, 2021 | |

| 10,928 | | |

$ | 232.78 | | |

| 2.61 | | |

$ | - | |

| Granted | |

| - | | |

| - | | |

| - | | |

| - | |

| Forfeited or expired | |

| - | | |

| - | | |

| - | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | | |

| - | |

| Outstanding at December 31, 2022 | |

| 10,928 | | |

$ | 232.78 | | |

| 1.61 | | |

| - | |

| | |

Options | | |

Weighted Average Exercise Price

Per Share | | |

Weighted Average Remaining Contractual

Life (Years) | | |

Aggregate Intrinsic Value | |

| Outstanding at December 31, 2020 | |

| 15,594 | | |

$ | 231.45 | | |

| 3.63 | | |

$ | - | |

| Granted | |

| | | |

| - | | |

| - | | |

| - | |

| Forfeited or expired | |

| (4,667 | ) | |

$ | 218.56 | | |

| 2.68 | | |

| - | |

| Exercised | |

| - | | |

| - | | |

| - | | |

| - | |

| Outstanding at December 31, 2021 | |

| 10,928 | | |

$ | 232.78 | | |

| 2.61 | | |

| - | |

The

following is a summary of the Company’s non-vested stock options as of December 31, 2022 and 2021 respectively:

| | |

Options | | |

Weighted Average Exercise Price

Per Share | | |

Weighted Average Remaining Contractual

Life (Years) | |

| Non-vested at December 31, 2021 | |

| 3,587 | | |

$ | 227.78 | | |

| 0.90 | |

| Granted | |

| - | | |

| - | | |

| - | |

| Vested | |

| (3,315 | ) | |

| 14.89 | | |

| 1.71 | |

| Forfeited or expired | |

| - | | |

| - | | |

| - | |

| Non-vested at December 31, 2022 | |

| 271 | | |

$ | 18.25 | | |

| 2.27 | |

| | |

Options | | |

Weighted Average Exercise Price

Per Share | | |

Weighted Average Remaining Contractual

Life (Years) | |

| Non-vested at December 31, 2020 | |

| 10,636 | | |

$ | 200.85 | | |

| 2.53 | |

| Granted | |

| - | | |

| - | | |

| - | |

| Vested | |

| (3,315 | ) | |

| 206.40 | | |

| 0.82 | |

| Forfeited or expired | |

| (3,734 | ) | |

| 218.55 | | |

| 2.68 | |

| Non-vested at December 31, 2021 | |

| 3,587 | | |

$ | 227.78 | | |

| 0.90 | |

For

the years ended December 31, 2022 and 2021, the Board did not approve any options to be issued

pursuant to the Plan.

During

the years ended December 31, 2022 and 2021, various employee terminations occurred resulting in option forfeitures of $0 and $70,004 respectively.

As

of December 31, 2022, the Company determined that the options granted and outstanding had a total fair value of $2,421,960, which will

be amortized in future periods through February 2024. During the year ended December 31, 2022, the Company recognized $178,579 of

compensation expense relating to the stock options granted to employees, directors, and consultants. As of December 31, 2022, unrecognized

compensation expense totaled $17,166 which will be recognized on a straight-line basis over the vesting period or requisite service

period through February 2024.

The

intrinsic value is calculated as the difference between the market value and the exercise price of the shares on December 31, 2022. The

market value as of December 31, 2022 was $8.55 based on the closing bid price for December 31, 2022.

As

of December 31, 2021, the Company determined that the options granted and outstanding had a total fair value of $2,421,960, which will

be amortized in future periods through February 2024. During the year ended December 31, 2021, the Company recognized $576,160 of

compensation expense relating to the stock options granted to employees, directors, and consultants. As of December 31, 2021, unrecognized

compensation expense totaled $195,746 which will be recognized on a straight-line basis over the vesting period or requisite service

period through February 2024.

The

intrinsic value is calculated as the difference between the market value and the exercise price of the shares on December 31, 2021. The

market value as of December 31, 2021 was $96.60 based on the closing bid price for December 31, 2021.

The

Company estimated the fair value of each stock option on the grant date using a Black-Scholes option-pricing model. Black-Scholes option-pricing

models require the Company to make predictive assumptions regarding future stock price volatility, recipient exercise behavior, and dividend

yield. The Company estimated the future stock price volatility using the historical volatility over the expected term of the option.

The expected term of the options was computed by taking the mid-point between the vesting date and expiration date. The following assumptions

were used in the Black-Scholes option-pricing model, not accounting for the reverse splits:

| |

|

Year

Ended

December 31, 2022 |

|

|

Year

Ended

December 31, 2021 |

|

| Exercise

price |

|

$ |

0.16

- $0.26 |

|

|

$ |

0.16

- $0.26 |

|

| Expected

term |

|

|

3.25

to 3.75 years |

|

|

|

3.25

to 3.75 years |

|

| Risk-free

interest rate |

|

|

0.38%

- 2.43 |

% |

|

|

0.38%

- 2.43 |

% |

| Estimated

volatility |

|

|

293.07%

- 517.13 |

% |

|

|

293.07%

- 517.13 |

% |

| Expected

dividend |

|

|

- |

|

|

|

- |

|

Series

A Warrants

In

conjunction with the Company’s initial public offering, the Company issued 138,000 Series A Warrants which were classified

as equity warrants because of provisions, pursuant to the warrant agreement, that permit the holder obtain a fixed number of shares for

a fixed monetary amount. The warrants are standalone equity securities that are transferable without the Company’s consent or knowledge.

The warrants were recorded at a value per the offering of $0.15. The warrants may be exercised at any point from the effective date until

the 5-year anniversary of issuance and are not subject to standard antidilution provisions. After taking into account warrant exercises,

there were 113,000 Series A warrants outstanding as of June 30, 2023 and December 31, 2022.

Series

B Warrants

The

Series B Warrants are exercisable commencing on the date of issuance and expire five years from the date of issuance. Pursuant to the

terms of the SPA, during the quarter ended June 30, 2023, the Series B Warrants’ effective exercise price reset to $2.50,

subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based adjustment

in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for, Common Stock, at a price below

the then-applicable exercise price (subject to certain exceptions). If a registration statement registering the issuance of the shares

of Common Stock underlying the warrants under the Securities Act is not effective or available and an exemption from registration under

the Securities Act is not available for the issuance of such shares, the holder may, in its sole discretion, elect to exercise the warrant

through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of Common Stock determined

according to the formula set forth in the warrant. As of June 30, 2023, there remain 1,331,667 Series B Warrants outstanding.

For

the three and six months ended June 30, 2023, net fair value gains and losses recognized for the Series B Warrants were a loss of $1,584,684 and

a gain of $2,642,267, respectively. For the three and six months ended June 30, 2022, net fair value gains and losses recognized for

the Series B Warrants were gains of $12,322,737 and $24,748,163, respectively, presented in the recognition and change in fair value

of warrant liabilities account in the consolidated statements of operations. The Series B Warrant liability outstanding as of June 30,

2023 and December 31, 2022 was $3,741,984 and $6,384,250 respectively, presented in the warrant liability account on the consolidated

balance sheets.

Series

C and D Warrants

In

January 2022, as a result of the Private Placement and the Medigap Acquisition, the Company received a deficiency notification from Nasdaq

indicating violation of Listing Rule 5365(a). As part of its remediation plan, in March 2022, the Company entered into Exchange Agreements

with the holders of common stock issued in January 2022. Pursuant to the Exchange Agreements, the Company issued 218,462 Series

C prepaid warrants in exchange for 218,462 shares of the Company’s common stock. Additionally, as compensation for entering

into the Exchange Agreements, the Company issued 81,500 Series D prepaid warrants to the Private Placement investors for no

additional consideration.

The

Series C and D Warrants are equity classified pursuant to the warrant agreement provisions that permit holders to obtain a fixed number

of shares for a fixed monetary amount. The warrants are standalone equity securities that are transferable without the Company’s

consent or knowledge. The warrants expire on the fifth anniversary of the respective issuance dates and are exercisable at a per share

exercise price equal to $0.015.

In

May and June 2022, the 218,462 Series C prepaid warrants were converted for 218,462 shares of the Company’s

common stock for a conversion price of $0.015. Through December 31, 2022, the Company has received payments of $1,336 for these

issuances.

In

July 2022, the 81,500 Series D prepaid warrants were converted into 81,472 shares of the Company’s common stock

for a conversion price of $0.015 through both cash and cashless exercises. Proceeds of $795 were received in conjunction with

the cash exercise.

Common

Stock

The

material terms and provisions of our common stock and each other class of our securities which qualifies or limits our common stock are

described above in this section of this prospectus.

Transfer

Agent

The

transfer agent and registrar for our common stock is VStock Transfer. The transfer agent’s address is 18 Lafayette Place, Woodmere,

New York 11598 and its telephone number is (212) 828-8436.

Listing

Our

common stock is quoted on the NASDAQ under the symbol “RELI” and our Series A Warrants under the symbol “RELIW”.

LEGAL

MATTERS

The

validity of the securities offered by this prospectus will be passed upon for us by Anthony L.G., PLLC, 1700 Palm Beach Lakes Blvd.,

Suite 820, West Palm Beach, Florida 33401.

EXPERTS

The consolidated financial

statements appearing in the Reliance Global Group, Inc.’s Annual Report on Form 10-K/A filed for the year ended December

31, 2022, have been audited by Mazars USA LLP, an independent registered public accounting firm, as set forth in their report thereon,

included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in

reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

have filed with the SEC the registration statement on Form S-1 under the Securities Act for the securities offered by this prospectus.

This prospectus, which is a part of the registration statement, does not contain all of the information in the registration statement

and the exhibits filed with it, portions of which have been omitted as permitted by SEC rules and regulations. For further information

concerning us and the securities offered by this prospectus, we refer to the registration statement and to the exhibits filed with it.

Statements contained in this prospectus as to the content of any contract or other document referred to are not necessarily complete.

In each instance, we refer you to the copy of the contracts and/or other documents filed as exhibits to the registration statement.

We

are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other

information with the SEC. You can read our SEC filings, including the registration statement, over the Internet at the SEC’s website

at http://www.sec.gov. We also maintain a website at http:/www.relianceglobalgroup.com, at which you may access these materials

free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information

contained in, or that can be accessed through, our website is not part of this prospectus.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to “incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose

important information to you by referring you to those other documents. The information incorporated by reference is an important part

of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We filed

a registration statement on Form S-1 under the Securities Act with the SEC with respect to the securities being offered pursuant to this

prospectus. This prospectus omits certain information contained in the registration statement, as permitted by the SEC. You should refer

to the registration statement, including the exhibits, for further information about us and the securities being offered pursuant to

this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or incorporated by reference

in, the registration statement are not necessarily complete and each statement is qualified in all respects by that reference. Copies

of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, may be obtained

upon payment of the prescribed rates at the offices of the SEC listed above in “Where You Can Find More Information”. We