Silvercrest Asset Management Group Inc. (NASDAQ: SAMG) (the

“Company” or “Silvercrest”) today reported the results of its

operations for the quarter ended September 30, 2024.

Business Update

Supportive markets and improving economic conditions helped

Silvercrest’s assets under management (“AUM”) growth during the

third quarter, pointing to improved top-line revenue. The firm also

saw improved business development results and will report a robust

pipeline of new business opportunities. A persistent trend of the

market’s recovery since 2022 has been the narrow leadership of

Large Cap Growth equities. We noted during our second quarter

earnings call that, despite progress in the market, Large Cap Value

and Small Cap stocks, had actually declined during that quarter. We

have been pleased to see broader company market participation

throughout the third quarter and an increase in equities across the

market cap spectrum, which benefits Silvercrest’s diversified

wealth management business as well as our exposure to the small cap

institutional business. The increases during the quarter bode well

for future revenue. We are optimistic about securing significant

organic net flows over the next two quarters.

Silvercrest’s discretionary AUM increased $1.0 billion during

the quarter to $22.6 billion, primarily due to rising markets. This

net increase in discretionary AUM – which drives revenue –

represents a 5% increase since the second quarter and a

year-over-year increase of 10% since the third quarter of 2023. New

client accounts and relationships increased during the quarter, led

by new Silvercrest Small Cap Opportunity mandates. While we report

discretionary outflows during the third quarter, the outflows were

revenue neutral to the firm. Overall, total asset flows and market

increases were a net positive for the firm and should drive an

increase in fourth-quarter revenue. Total AUM at the end of the

third quarter was $35.1 billion. Total AUM increased year-over-year

from the third quarter of 2023, up 13%. Despite these increases,

Silvercrest has been investing in the future growth of the

business, which has resulted in higher total compensation and which

we have adjusted for on a quarterly basis. As a result, while

top-line revenue has increased, most metrics of the business are

down due to these higher expenses.

Silvercrest's pipeline of new institutional business

opportunities increased during the third quarter by 20% and now

stands at $1.2 billion. Importantly, the firm’s pipeline does not

yet include potential mandates for our new Global Equity strategy

which has a high capacity for significant inflows. Over the past

two quarters, we have worked to build the infrastructure to support

the team and strategy while undertaking business development. We

are optimistic about near-term positive AUM flows and resulting

revenue increases to result from the pipeline.

I have consistently mentioned that Silvercrest has never had

more business opportunities underway. We have made and will make

investments to drive future growth in the business. We expect to

make more hires to complement our outstanding professional team and

to drive future growth. Silvercrest continues to accrue a higher

interim percentage of revenue for compensation for this purpose,

and, as mentioned, we will continue to adjust compensation levels

to match these important investments in the business and will keep

you informed of our plans and the progress of these

investments.

We continue to see substantial new opportunities globally for a

firm with our high-quality capabilities, coupled with superior

client service.

On October 30, 2024, the Company’s Board of Directors approved a

quarterly dividend of $0.20 per share of Class A common

stock. The dividend will be paid on or about December 20,

2024 to stockholders of record as of the close of business on

December 13, 2024.

Third Quarter 2024

Highlights

- Total Assets Under Management (“AUM”) of $35.1 billion,

inclusive of discretionary AUM of $22.6 billion and

non-discretionary AUM of $12.5 billion at September 30,

2024.

- Revenue of $30.4 million.

- U.S. Generally Accepted Accounting Principles (“GAAP”)

consolidated net income and net income attributable to Silvercrest

of $3.7 million and $2.3 million, respectively.

- Basic and diluted net income per share of $0.24.

- Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization (“EBITDA”)1 of $6.3 million.

- Adjusted net income1 of $3.8 million.

- Adjusted basic and diluted earnings per share1, 2 of $0.27 and

$0.26, respectively.

The table below presents a comparison of certain GAAP and

non-GAAP (“Adjusted”) financial measures and AUM.

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

(in thousands except as indicated) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

30,424 |

|

|

$ |

29,704 |

|

|

$ |

91,689 |

|

|

$ |

88,868 |

|

| Income before other income

(expense), net |

|

$ |

4,457 |

|

|

$ |

6,519 |

|

|

$ |

15,670 |

|

|

$ |

19,788 |

|

| Net income |

|

$ |

3,730 |

|

|

$ |

5,380 |

|

|

$ |

13,025 |

|

|

$ |

15,825 |

|

| Net income margin |

|

|

12.3 |

% |

|

|

18.1 |

% |

|

|

14.2 |

% |

|

|

17.8 |

% |

| Net income attributable to

Silvercrest |

|

$ |

2,252 |

|

|

$ |

3,216 |

|

|

$ |

7,917 |

|

|

$ |

9,505 |

|

| Net income per basic share |

|

$ |

0.24 |

|

|

$ |

0.34 |

|

|

$ |

0.83 |

|

|

$ |

1.01 |

|

| Net income per diluted share |

|

$ |

0.24 |

|

|

$ |

0.34 |

|

|

$ |

0.83 |

|

|

$ |

1.00 |

|

| Adjusted EBITDA1 |

|

$ |

6,346 |

|

|

$ |

8,000 |

|

|

$ |

21,031 |

|

|

$ |

24,297 |

|

| Adjusted EBITDA Margin1 |

|

|

20.9 |

% |

|

|

26.9 |

% |

|

|

22.9 |

% |

|

|

27.3 |

% |

| Adjusted net income1 |

|

$ |

3,801 |

|

|

$ |

5,136 |

|

|

$ |

12,921 |

|

|

$ |

15,055 |

|

| Adjusted basic earnings per

share1, 2 |

|

$ |

0.27 |

|

|

$ |

0.37 |

|

|

$ |

0.93 |

|

|

$ |

1.08 |

|

| Adjusted diluted earnings per

share1, 2 |

|

$ |

0.26 |

|

|

$ |

0.36 |

|

|

$ |

0.89 |

|

|

$ |

1.05 |

|

| Assets under management at period

end (billions) |

|

$ |

35.1 |

|

|

$ |

31.2 |

|

|

$ |

35.1 |

|

|

$ |

31.2 |

|

| Average assets under management

(billions)3 |

|

$ |

34.2 |

|

|

$ |

31.6 |

|

|

$ |

34.3 |

|

|

$ |

30.1 |

|

_________________

|

1 |

Adjusted measures are non-GAAP measures and are explained and

reconciled to the comparable GAAP measures in Exhibits 2 and

3. |

|

2 |

Adjusted basic and diluted

earnings per share measures for the three and nine months ended

September 30, 2024 are based on the number of shares of Class

A common stock and Class B common stock outstanding as of

September 30, 2024. Adjusted diluted earnings per share are

further based on the addition of unvested restricted stock units,

and non-qualified stock options to the extent dilutive at the end

of the reporting period. |

| 3 |

We have computed average AUM by

averaging AUM at the beginning of the applicable period and AUM at

the end of the applicable period. |

|

|

|

AUM at $35.1 Billion

Silvercrest’s discretionary assets under management increased by

$2.1 billion, or 10.2%, to $22.6 billion at September 30,

2024, from $20.5 billion at September 30, 2023. The increase

was attributable to market appreciation of $4.1 billion partially

offset by net client outflows of $2.0 billion. Silvercrest’s total

AUM increased by $3.9 billion, or 12.5%, to $35.1 billion at

September 30, 2024, from $31.2 billion at September 30,

2023. The increase was attributable to market appreciation of $5.7

billion partially offset by net client outflows of $1.8

billion.

Silvercrest’s discretionary assets under management increased by

$1.0 billion, or 4.6%, to $22.6 billion at September 30, 2024,

from $21.6 billion at June 30, 2024. The increase was attributable

to market appreciation of $1.3 billion and net client outflows of

$0.3 billion. Silvercrest’s total AUM increased by $1.7 billion, or

5.1%, to $35.1 billion at September 30, 2024, from $33.4

billion at June 30, 2024. The increase was attributable to market

appreciation of $1.9 billion and net client outflows of $0.2

billion.

Third Quarter 2024 vs. Third Quarter 2023

Revenue increased by $0.7 million, or 2.4%, to $30.4 million for

the three months ended September 30, 2024, from $29.7 million

for the three months ended September 30, 2023. This increase

was driven by market appreciation partially offset by net client

outflows.

Total expenses increased by $2.8 million, or 12.0%, to $26.0

million for the three months ended September 30, 2024, from

$23.2 million for the three months ended September 30, 2023.

Compensation and benefits expense increased by $1.9 million, or

11.4%, to $18.6 million for the three months ended

September 30, 2024, from $16.7 million for the three months

ended September 30, 2023. The increase was primarily

attributable to increases in the accrual for bonuses of $0.7

million, severance expense of $0.2 million, equity-based

compensation of $0.2 million and salaries and benefits of $0.8

million primarily as a result of merit-based increases.

General and administrative expenses increased by $0.9 million, or

13.4%, to $7.4 million for the three months ended

September 30, 2024, from $6.5 million for the three months

ended September 30, 2023. This was primarily attributable to

increases in occupancy and related costs of $0.1 million,

professional fees of $0.2 million, portfolio and systems expense of

$0.3 million and trade errors of $0.3 million.

Consolidated net income was $3.7 million or 12.3% of revenue for

the three months ended September 30, 2024, as compared to

consolidated net income of $5.4 million or 18.1% of revenue for the

same period in the prior year. Net income attributable to

Silvercrest was $2.3 million, or $0.24 per basic share and diluted

share for the three months ended September 30, 2024. Our

Adjusted Net Income1 was $3.8 million, or $0.27 per adjusted basic

share1, 2 and $0.26 per adjusted diluted share1, 2 for the three

months ended September 30, 2024.

Adjusted EBITDA1 was $6.3 million, or 20.9% of revenue for the

three months ended September 30, 2024, as compared to $8.0

million or 26.9% of revenue for the same period in the prior

year.

Nine Months Ended September 30, 2024 vs. Nine Months

Ended September 30, 2023

Revenue increased by $2.8 million, or 3.2%, to $91.7 million for

the nine months ended September 30, 2024, from $88.9 million

for the nine months ended September 30, 2023. This increase

was driven by market appreciation partially offset by net client

outflows.

Total expenses increased by $6.9 million, or 10.0%, to $76.0

million for the nine months ended September 30, 2024, from

$69.1 million for the nine months ended September 30, 2023.

Compensation and benefits expense increased by $4.8 million, or

9.6%, to $54.8 million for the nine months ended September 30,

2024, from $50.0 million for the nine months ended

September 30, 2023. The increase was primarily attributable to

increases in the accrual for bonuses of $3.0 million, severance

expense of $0.2 million, equity-based compensation of $0.3 million

and salaries and benefits of $1.3 million primarily as a

result of merit-based increases. General and administrative

expenses increased by $2.1 million, or 11.1%, to $21.3 million for

the nine months ended September 30, 2024, from $19.1 million

for the nine months ended September 30, 2023. This was

primarily attributable to increases in travel and entertainment

expenses of $0.2 million, occupancy and related costs of $0.2

million, professional fees of $0.6 million, portfolio and systems

expenses of $0.4 million, recruiting expenses of $0.3 million,

trade errors of $0.3 million and depreciation and amortization

expense of $0.1 million.

Consolidated net income was $13.0 million or 14.2% of revenue

for the nine months ended September 30, 2024, as compared to

consolidated net income of $15.8 million or 17.8% of revenue for

the same period in the prior year. Net income attributable to

Silvercrest was $7.9 million, or $0.83 per basic share and diluted

share for the nine months ended September 30, 2024. Our

Adjusted Net Income1 was $12.9 million, or $0.93 per adjusted basic

share1, 2 and $0.89 per adjusted diluted share1, 2 for the nine

months ended September 30, 2024.

Adjusted EBITDA1 was $21.0 million or 22.9% of revenue for the

nine months ended September 30, 2024, as compared to $24.3

million or 27.3% of revenue for the same period in the prior

year.

Liquidity and Capital Resources

Cash and cash equivalents were $58.1 million at

September 30, 2024, compared to $70.3 million at December 31,

2023. As of September 30, 2024, there was nothing

outstanding under our term loan or under our revolving credit

facility with City National Bank.

Silvercrest’s total equity was $84.6 million at

September 30, 2024. We had 9,503,410 shares of Class A

common stock outstanding and 4,406,295 shares of Class B common

stock outstanding at September 30, 2024.

Non-GAAP Financial Measures

To provide investors with additional insight, promote

transparency and allow for a more comprehensive understanding of

the information used by management in its financial and operational

decision-making, we supplement our consolidated financial

statements presented on a basis consistent with GAAP with Adjusted

EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and Adjusted

Earnings Per Share, which are non-GAAP financial measures of

earnings. These adjustments, and the non-GAAP financial

measures that are derived from them, provide supplemental

information to analyze our operations between periods and over

time. Investors should consider our non-GAAP financial measures in

addition to, and not as a substitute for, financial measures

prepared in accordance with GAAP.

- EBITDA represents net income before provision for income taxes,

interest income, interest expense, depreciation and

amortization.

- We define Adjusted EBITDA as EBITDA without giving effect to

the Delaware franchise tax, professional fees associated with

acquisitions or financing transactions, gains on extinguishment of

debt or other obligations related to acquisitions, impairment

charges and losses on disposals or abandonment of assets and

leaseholds, client reimbursements and fund redemption costs,

severance and other similar expenses, but including partner

incentive allocations, prior to our initial public offering, as an

expense. We believe that it is important to management and

investors to supplement our consolidated financial statements

presented on a GAAP basis with Adjusted EBITDA, a non-GAAP

financial measure of earnings, as this measure provides a

perspective of recurring earnings of the Company, taking into

account earnings attributable to both Class A and Class B

stockholders.

- Adjusted EBITDA Margin is calculated by dividing Adjusted

EBITDA by total revenue. We believe that it is important to

management and investors to supplement our consolidated financial

statements presented on a GAAP basis with Adjusted EBITDA Margin, a

non-GAAP financial measure of earnings, as this measure provides a

perspective of recurring profitability of the Company, taking into

account profitability attributable to both Class A and Class B

stockholders.

- Adjusted Net Income represents recurring net income without

giving effect to professional fees associated with acquisitions or

financing transactions, losses on forgiveness of notes receivable

from our principals, gains on extinguishment of debt or other

obligations related to acquisitions, impairment charges and losses

on disposals or abandonment of assets and leaseholds, client

reimbursements and fund redemption costs, severance and other

similar expenses, but including partner incentive allocations,

prior to our initial public offering, as an expense. Furthermore,

Adjusted Net Income includes income tax expense assuming a blended

corporate rate of 26%. We believe that it is important to

management and investors to supplement our consolidated financial

statements presented on a GAAP basis with Adjusted Net Income, a

non-GAAP financial measure of earnings, as this measure provides a

perspective of recurring income of the Company, taking into account

income attributable to both Class A and Class B

stockholders.

- Adjusted Earnings Per Share represents Adjusted Net Income

divided by the actual Class A and Class B shares outstanding as of

the end of the reporting period for basic Adjusted Earnings Per

Share, and to the extent dilutive, we add unvested restricted stock

units and non-qualified stock options to the total shares

outstanding to compute diluted Adjusted Earnings Per Share. As a

result of our structure, which includes a non-controlling interest,

we believe that it is important to management and investors to

supplement our consolidated financial statements presented on a

GAAP basis with Adjusted Earnings Per Share, a non-GAAP financial

measure of earnings, as this measure provides a perspective of

recurring earnings per share of the Company as a whole as opposed

to being limited to our Class A common stock.

Conference Call

The Company will host a conference call on November 1, 2024, at

8:30 am (Eastern Time) to discuss these results. Hosting the call

will be Richard R. Hough III, Chief Executive Officer, and

President and Scott A. Gerard, Chief Financial Officer. Listeners

may access the call by dialing 1-844-836-8743 or for international

listeners the call may be accessed by dialing 1-412-317-5723.

A live, listen-only webcast will also be available via the investor

relations section of www.silvercrestgroup.com. An archived

replay of the call will be available after the completion of the

live call on the Investor Relations page of the Silvercrest website

at http://ir.silvercrestgroup.com/.

Forward-Looking Statements and Other

Disclosures

This release contains, and from time to time our management may

make, forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, each as amended. For those statements, we

claim the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995. These forward-looking statements are subject to

risks, uncertainties and assumptions. These statements are only

predictions based on our current expectations and projections about

future events. Important factors that could cause actual results,

level of activity, performance or achievements to differ materially

from those indicated by such forward-looking statements include,

but are not limited to: incurrence of net losses; fluctuations in

quarterly and annual results; adverse economic or market

conditions; our expectations with respect to future levels of

assets under management, inflows and outflows; our ability to

retain clients; our ability to maintain our fee structure; our

particular choices with regard to investment strategies employed;

our ability to hire and retain qualified investment professionals;

the cost of complying with current and future regulation coupled

with the cost of defending ourselves from related investigations or

litigation; failure of our operational safeguards against breaches

in data security, privacy, conflicts of interest or employee

misconduct; our expected tax rate; our expectations with respect to

deferred tax assets, adverse economic or market conditions;

incurrence of net losses; adverse effects of management focusing on

implementation of a growth strategy; failure to develop and

maintain the Silvercrest brand; and other factors disclosed under

“Risk Factors” in our annual report on Form 10-K for the year ended

December 31, 2023, which is accessible on the U.S. Securities and

Exchange Commission’s website at www.sec.gov. We undertake no

obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as required by law.

About Silvercrest

Silvercrest was founded in April 2002 as an independent,

employee-owned registered investment adviser. With offices in New

York, Boston, Virginia, New Jersey, California and Wisconsin,

Silvercrest provides traditional and alternative investment

advisory and family office services to wealthy families and select

institutional investors.

Silvercrest Asset Management Group

Inc.

Contact: Richard Hough

212-649-0601rhough@silvercrestgroup.com

Exhibit 1

|

Silvercrest Asset Management Group Inc. |

|

Condensed Consolidated Statements of Operations |

|

(Unaudited and in thousands, except share and per share amounts or

as noted) |

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Management and advisory fees |

$ |

29,380 |

|

|

$ |

28,425 |

|

|

$ |

88,445 |

|

|

$ |

85,445 |

|

| Family office services |

|

1,044 |

|

|

|

1,279 |

|

|

|

3,244 |

|

|

|

3,423 |

|

|

Total revenue |

|

30,424 |

|

|

|

29,704 |

|

|

|

91,689 |

|

|

|

88,868 |

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

| Compensation and benefits |

|

18,598 |

|

|

|

16,691 |

|

|

|

54,760 |

|

|

|

49,945 |

|

| General and administrative |

|

7,369 |

|

|

|

6,494 |

|

|

|

21,259 |

|

|

|

19,135 |

|

|

Total expenses |

|

25,967 |

|

|

|

23,185 |

|

|

|

76,019 |

|

|

|

69,080 |

|

| Income before other

(expense) income, net |

|

4,457 |

|

|

|

6,519 |

|

|

|

15,670 |

|

|

|

19,788 |

|

| Other (expense) income,

net |

|

|

|

|

|

|

|

|

|

|

|

| Other (expense) income, net |

|

10 |

|

|

|

(37 |

) |

|

|

25 |

|

|

|

31 |

|

| Interest income |

|

374 |

|

|

|

376 |

|

|

|

1,010 |

|

|

|

421 |

|

| Interest expense |

|

(15 |

) |

|

|

(86 |

) |

|

|

(95 |

) |

|

|

(314 |

) |

|

Total other (expense) income, net |

|

369 |

|

|

|

253 |

|

|

|

940 |

|

|

|

138 |

|

| Income before provision

for income taxes |

|

4,826 |

|

|

|

6,772 |

|

|

|

16,610 |

|

|

|

19,926 |

|

| Provision for income taxes |

|

(1,096 |

) |

|

|

(1,392 |

) |

|

|

(3,585 |

) |

|

|

(4,101 |

) |

|

Net income |

|

3,730 |

|

|

|

5,380 |

|

|

|

13,025 |

|

|

|

15,825 |

|

|

Less: net income attributable to non-controlling interests |

|

(1,478 |

) |

|

|

(2,164 |

) |

|

|

(5,108 |

) |

|

|

(6,320 |

) |

|

Net income attributable to Silvercrest |

$ |

2,252 |

|

|

$ |

3,216 |

|

|

$ |

7,917 |

|

|

$ |

9,505 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.24 |

|

|

$ |

0.34 |

|

|

$ |

0.83 |

|

|

$ |

1.01 |

|

| Diluted |

$ |

0.24 |

|

|

$ |

0.34 |

|

|

$ |

0.83 |

|

|

$ |

1.00 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

9,541,407 |

|

|

|

9,354,747 |

|

|

|

9,510,495 |

|

|

|

9,452,576 |

|

| Diluted |

|

9,579,172 |

|

|

|

9,378,479 |

|

|

|

9,547,659 |

|

|

|

9,478,090 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 2

|

Silvercrest Asset Management Group Inc. |

|

Reconciliation of GAAP to non-GAAP (“Adjusted”) Adjusted EBITDA

Measure |

|

(Unaudited and in thousands, except share and per share amounts or

as noted) |

| |

| Adjusted

EBITDA |

Three Months EndedSeptember 30, |

|

|

Nine Months EndedSeptember 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Reconciliation of

non-GAAP financial measure: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

3,730 |

|

|

$ |

5,380 |

|

|

$ |

13,025 |

|

|

$ |

15,825 |

|

| Provision for income taxes |

|

1,096 |

|

|

|

1,392 |

|

|

|

3,585 |

|

|

|

4,101 |

|

| Delaware Franchise Tax |

|

50 |

|

|

|

50 |

|

|

|

150 |

|

|

|

150 |

|

| Interest expense |

|

15 |

|

|

|

86 |

|

|

|

95 |

|

|

|

314 |

|

| Interest income |

|

(374 |

) |

|

|

(376 |

) |

|

|

(1,010 |

) |

|

|

(421 |

) |

| Depreciation and

amortization |

|

1,034 |

|

|

|

996 |

|

|

|

3,111 |

|

|

|

3,012 |

|

| Equity-based compensation |

|

535 |

|

|

|

353 |

|

|

|

1,374 |

|

|

|

1,047 |

|

| Other adjustments (A) |

|

260 |

|

|

|

119 |

|

|

|

701 |

|

|

|

269 |

|

| Adjusted

EBITDA |

$ |

6,346 |

|

|

$ |

8,000 |

|

|

$ |

21,031 |

|

|

$ |

24,297 |

|

| Adjusted EBITDA

Margin |

|

20.9 |

% |

|

|

26.9 |

% |

|

|

22.9 |

% |

|

|

27.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(A) Other adjustments consist of the following:

| |

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Acquisition costs (a) |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

5 |

|

| Severance |

|

193 |

|

|

|

— |

|

|

|

253 |

|

|

|

19 |

|

| Other (b) |

|

67 |

|

|

|

119 |

|

|

|

448 |

|

|

|

245 |

|

| Total other

adjustments |

$ |

260 |

|

|

$ |

119 |

|

|

$ |

701 |

|

|

$ |

269 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

For the nine

months ended September 30, 2023, represents professional fees of $5

related to the acquisition of Cortina. |

| |

|

| (b) |

For the three months ended September30, 2024, represents an ASC

842 rent adjustment of $48 related to the amortization of property

lease incentives, data conversion costs of $14 and software

implementation costs of $5. For the nine months ended

September 30, 2024, represents a fair value adjustment to the

Neosho contingent purchase price consideration of $12, an ASC 842

rent adjustment of $144 related to the amortization of property

lease incentives, sign on bonuses paid to certain employees of

$188, professional fees of $26 related to a transfer pricing

project, legal fees of $46, data conversion costs of $14 and

software implementation costs of $18. For the three months

ended September 30, 2023, represents an adjustment to the fair

value of the tax receivable agreement of $40, an ASC 842 rent

adjustment of $48 related to the amortization of property lease

incentives, $23 related to moving costs and software implementation

costs of $8. For the nine months ended September 30, 2023,

represents an adjustment to the fair value of the tax receivable

agreement of $40, an ASC 842 rent adjustment of $144 related to the

amortization of property lease incentives, $35 related to moving

costs, software implementation costs of $28 and a fair value

adjustment to the Cortina contingent purchase price consideration

of ($2). |

Exhibit 3

|

Silvercrest Asset Management Group Inc. |

|

Reconciliation of GAAP to non-GAAP (“Adjusted”) |

|

Adjusted Net Income and Adjusted Earnings Per Share Measures |

|

(Unaudited and in thousands, except per share amounts or as

noted) |

| |

| Adjusted Net Income

and Adjusted Earnings Per Share |

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Reconciliation of

non-GAAP financial measure: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

3,730 |

|

|

$ |

5,380 |

|

|

$ |

13,025 |

|

|

$ |

15,825 |

|

| Consolidated GAAP Provision for

income taxes |

|

1,096 |

|

|

|

1,392 |

|

|

|

3,585 |

|

|

|

4,101 |

|

| Delaware Franchise Tax |

|

50 |

|

|

|

50 |

|

|

|

150 |

|

|

|

150 |

|

| Other adjustments (A) |

|

260 |

|

|

|

119 |

|

|

|

701 |

|

|

|

269 |

|

| Adjusted earnings before

provision for income taxes |

|

5,136 |

|

|

|

6,941 |

|

|

|

17,461 |

|

|

|

20,345 |

|

| Adjusted provision for income

taxes: |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted provision for income

taxes (26% assumed tax rate) |

|

(1,335 |

) |

|

|

(1,805 |

) |

|

|

(4,540 |

) |

|

|

(5,290 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net

income |

$ |

3,801 |

|

|

$ |

5,136 |

|

|

$ |

12,921 |

|

|

$ |

15,055 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income per share

(B): |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.24 |

|

|

$ |

0.34 |

|

|

$ |

0.83 |

|

|

$ |

1.01 |

|

| Diluted |

$ |

0.24 |

|

|

$ |

0.34 |

|

|

$ |

0.83 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted earnings per

share/unit (B): |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.27 |

|

|

$ |

0.37 |

|

|

$ |

0.93 |

|

|

$ |

1.08 |

|

| Diluted |

$ |

0.26 |

|

|

$ |

0.36 |

|

|

$ |

0.89 |

|

|

$ |

1.05 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Shares/units

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

| Basic Class A shares

outstanding |

|

9,503 |

|

|

|

9,342 |

|

|

|

9,503 |

|

|

|

9,342 |

|

| Basic Class B shares/units

outstanding |

|

4,406 |

|

|

|

4,545 |

|

|

|

4,406 |

|

|

|

4,545 |

|

| Total basic shares/units

outstanding |

|

13,909 |

|

|

|

13,887 |

|

|

|

13,909 |

|

|

|

13,887 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted Class A shares

outstanding (C) |

|

9,541 |

|

|

|

9,366 |

|

|

|

9,541 |

|

|

|

9,366 |

|

| Diluted Class B shares/units

outstanding (D) |

|

5,001 |

|

|

|

4,956 |

|

|

|

5,001 |

|

|

|

4,956 |

|

| Total diluted shares/units

outstanding |

|

14,542 |

|

|

|

14,322 |

|

|

|

14,542 |

|

|

|

14,322 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (A) |

See A in

Exhibit 2. |

| |

|

| (B) |

GAAP earnings per share is strictly attributable to Class A

stockholders. Adjusted earnings per share takes into account

earnings attributable to both Class A and Class B

stockholders. |

| |

|

| (C) |

Includes 37,109 and 23,732 unvested restricted stock units at

September 30, 2024 and 2023, respectively. |

| |

|

| (D) |

Includes 228,117 and 264,037 unvested restricted stock units at

September 30, 2024 and 2023, respectively, and 366,293 and

147,506 unvested non-qualified options at September 30, 2024

and 2023, respectively. |

Exhibit 4

|

Silvercrest Asset Management Group Inc. |

|

Condensed Consolidated Statements of Financial Condition |

|

(Unaudited and in thousands) |

|

|

|

|

|

|

September 30,2024 |

|

|

December 31,2023 |

|

| Assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

58,103 |

|

|

$ |

70,301 |

|

| Investments |

|

219 |

|

|

|

219 |

|

| Receivables, net |

|

12,833 |

|

|

|

9,526 |

|

| Due from Silvercrest Funds |

|

860 |

|

|

|

558 |

|

| Furniture, equipment and

leasehold improvements, net |

|

7,458 |

|

|

|

7,422 |

|

| Goodwill |

|

63,675 |

|

|

|

63,675 |

|

| Operating lease assets |

|

16,290 |

|

|

|

19,612 |

|

| Finance lease assets |

|

237 |

|

|

|

330 |

|

| Intangible assets, net |

|

17,216 |

|

|

|

18,933 |

|

| Deferred tax asset—tax receivable

agreement |

|

3,749 |

|

|

|

5,034 |

|

| Prepaid expenses and other

assets |

|

3,530 |

|

|

|

3,964 |

|

| Total

assets |

$ |

184,170 |

|

|

$ |

199,574 |

|

| Liabilities and

Equity |

|

|

|

|

|

| Accounts payable and accrued

expenses |

$ |

1,718 |

|

|

$ |

1,990 |

|

| Accrued compensation |

|

27,238 |

|

|

|

37,371 |

|

| Borrowings under credit

facility |

|

— |

|

|

|

2,719 |

|

| Operating lease liabilities |

|

22,668 |

|

|

|

26,277 |

|

| Finance lease liabilities |

|

245 |

|

|

|

336 |

|

| Deferred tax and other

liabilities |

|

9,423 |

|

|

|

9,071 |

|

| Total

liabilities |

|

61,292 |

|

|

|

77,764 |

|

| Commitments and

Contingencies |

|

|

|

|

|

| Equity |

|

|

|

|

|

| Preferred Stock, par value $0.01,

10,000,000 shares authorized; none issued and outstanding |

|

— |

|

|

|

— |

|

| Class A Common Stock, par value

$0.01, 50,000,000 shares authorized; 10,394,542 and 9,503,410

issued and outstanding, respectively, as of September 30, 2024;

10,287,452 and 9,478,997 issued and outstanding, respectively, as

of December 31, 2023 |

|

104 |

|

|

|

103 |

|

| Class B Common Stock, par value

$0.01, 25,000,000 shares authorized; 4,406,295 and 4,431,105 issued

and outstanding as of September 30, 2024 and December 31, 2023,

respectively |

|

43 |

|

|

|

43 |

|

| Additional Paid-In Capital |

|

56,643 |

|

|

|

55,809 |

|

| Treasury Stock, at cost,

891,132 shares as of September 30, 2024 and 808,455 as of December

31, 2023 |

|

(16,421 |

) |

|

|

(15,057 |

) |

| Accumulated other comprehensive

income (loss) |

|

(19 |

) |

|

|

(12 |

) |

| Retained earnings |

|

44,227 |

|

|

|

41,851 |

|

| Total Silvercrest Asset

Management Group Inc.’s equity |

|

84,577 |

|

|

|

82,737 |

|

| Non-controlling interests |

|

38,301 |

|

|

|

39,073 |

|

| Total

equity |

|

122,878 |

|

|

|

121,810 |

|

| Total liabilities and

equity |

$ |

184,170 |

|

|

$ |

199,574 |

|

| |

|

|

|

|

|

|

|

Exhibit 5

|

Silvercrest Asset Management Group Inc. |

|

Total Assets Under Management |

|

(Unaudited and in billions) |

| |

| Total

Assets Under Management: |

| |

| |

Three Months Ended September 30, |

|

|

% Change from September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2023 |

|

|

Beginning assets under management |

$ |

33.4 |

|

|

$ |

31.9 |

|

|

|

4.7 |

% |

| |

|

|

|

|

|

|

|

|

| Gross client inflows |

|

1.1 |

|

|

|

0.6 |

|

|

|

83.3 |

% |

| Gross client outflows |

|

(1.3 |

) |

|

|

(0.8 |

) |

|

|

62.5 |

% |

| Net client flows |

|

(0.2 |

) |

|

|

(0.2 |

) |

|

|

0.0 |

% |

| |

|

|

|

|

|

|

|

|

| Market

appreciation/(depreciation) |

|

1.9 |

|

|

|

(0.5 |

) |

|

NM |

|

| Ending assets under

management |

$ |

35.1 |

|

|

$ |

31.2 |

|

|

|

12.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months Ended September 30, |

|

|

% Change from September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2023 |

|

|

Beginning assets under management |

$ |

33.3 |

|

|

$ |

28.9 |

|

|

|

15.2 |

% |

| |

|

|

|

|

|

|

|

|

| Gross client inflows |

|

2.9 |

|

|

|

4.5 |

|

|

|

-35.6 |

% |

| Gross client outflows |

|

(4.4 |

) |

|

|

(3.5 |

) |

|

|

25.7 |

% |

| Net client flows |

|

(1.5 |

) |

|

|

1.0 |

|

|

|

-250.0 |

% |

| |

|

|

|

|

|

|

|

|

| Market appreciation |

|

3.3 |

|

|

|

1.3 |

|

|

|

153.8 |

% |

| Ending assets under

management |

$ |

35.1 |

|

|

$ |

31.2 |

|

|

|

12.5 |

% |

| |

NM = Not Meaningful

Exhibit 6

|

Silvercrest Asset Management Group Inc. |

|

Discretionary Assets Under Management |

|

(Unaudited and in billions) |

| |

|

Discretionary Assets Under Management: |

| |

| |

Three Months Ended September 30, |

|

|

% Change from September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2023 |

|

|

Beginning assets under management |

$ |

21.6 |

|

|

$ |

21.5 |

|

|

|

0.5 |

% |

| |

|

|

|

|

|

|

|

|

| Gross client inflows |

|

0.8 |

|

|

|

0.4 |

|

|

|

100.0 |

% |

| Gross client outflows |

|

(1.1 |

) |

|

|

(0.6 |

) |

|

|

83.3 |

% |

| Net client flows |

|

(0.3 |

) |

|

|

(0.2 |

) |

|

|

50.0 |

% |

| |

|

|

|

|

|

|

|

|

| Market

appreciation/(depreciation) |

|

1.3 |

|

|

|

(0.8 |

) |

|

|

-262.5 |

% |

| Ending assets under

management |

$ |

22.6 |

|

|

$ |

20.5 |

|

|

|

10.2 |

% |

| |

| |

Nine Months Ended September 30, |

|

|

% Change from September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2023 |

|

|

Beginning assets under management |

$ |

21.9 |

|

|

$ |

20.9 |

|

|

|

4.8 |

% |

| |

|

|

|

|

|

|

|

|

| Gross client inflows |

|

2.1 |

|

|

|

2.3 |

|

|

|

-8.7 |

% |

| Gross client outflows |

|

(3.7 |

) |

|

|

(3.0 |

) |

|

|

23.3 |

% |

| Net client flows |

|

(1.6 |

) |

|

|

(0.7 |

) |

|

|

128.6 |

% |

| |

|

|

|

|

|

|

|

|

| Market appreciation |

|

2.3 |

|

|

|

0.3 |

|

|

NM |

|

| Ending assets under

management |

$ |

22.6 |

|

|

$ |

20.5 |

|

|

|

10.2 |

% |

| |

NM = Not Meaningful

Exhibit 7

|

Silvercrest Asset Management Group Inc. |

|

Non-Discretionary Assets Under Management |

|

(Unaudited and in billions) |

| |

|

Non-Discretionary Assets Under Management: |

| |

| |

Three Months Ended September 30, |

|

|

% Change from September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2023 |

|

|

Beginning assets under management |

$ |

11.8 |

|

|

$ |

10.4 |

|

|

|

13.5 |

% |

| |

|

|

|

|

|

|

|

|

| Gross client inflows |

|

0.3 |

|

|

|

0.2 |

|

|

|

50.0 |

% |

| Gross client outflows |

|

(0.2 |

) |

|

|

(0.2 |

) |

|

|

0.0 |

% |

| Net client flows |

|

0.1 |

|

|

|

— |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Market appreciation |

|

0.6 |

|

|

|

0.3 |

|

|

|

100.0 |

% |

| Ending assets under

management |

$ |

12.5 |

|

|

$ |

10.7 |

|

|

|

16.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Nine Months EndedSeptember 30, |

|

|

% Change from September 30, |

|

| |

2024 |

|

|

2023 |

|

|

2023 |

|

|

Beginning assets under management |

$ |

11.4 |

|

|

$ |

8.0 |

|

|

|

42.5 |

% |

| |

|

|

|

|

|

|

|

|

| Gross client inflows |

|

0.8 |

|

|

|

2.2 |

|

|

|

-63.6 |

% |

| Gross client outflows |

|

(0.7 |

) |

|

|

(0.5 |

) |

|

|

40.0 |

% |

| Net client flows |

|

0.1 |

|

|

|

1.7 |

|

|

|

-94.1 |

% |

| |

|

|

|

|

|

|

|

|

| Market appreciation |

|

1.0 |

|

|

|

1.0 |

|

|

|

0.0 |

% |

| Ending assets under

management |

$ |

12.5 |

|

|

$ |

10.7 |

|

|

|

16.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Exhibit 8

|

Silvercrest Asset Management Group Inc. |

|

Assets Under Management |

|

(Unaudited and in billions) |

| |

| |

Three Months Ended September 30, |

|

| |

2024 |

|

|

2023 |

|

|

Total AUM as of June 30, |

$ |

33.430 |

|

|

$ |

31.924 |

|

| Discretionary AUM: |

|

|

|

|

|

| Total Discretionary AUM as of

June 30, |

$ |

21.646 |

|

|

$ |

21.500 |

|

| New client accounts/assets

(1) |

|

0.076 |

|

|

|

0.054 |

|

| Closed accounts (2) |

|

(0.042 |

) |

|

|

(0.015 |

) |

| Net cash inflow/(outflow)

(3) |

|

(0.308 |

) |

|

|

(0.286 |

) |

| Non-discretionary to

Discretionary AUM (4) |

|

(0.004 |

) |

|

|

0.008 |

|

| Market

(depreciation)/appreciation |

|

1.271 |

|

|

|

(0.799 |

) |

| Change to Discretionary

AUM |

|

0.993 |

|

|

|

(1.038 |

) |

| Total Discretionary AUM at

September 30, |

|

22.639 |

|

|

|

20.462 |

|

| Change to Non-Discretionary AUM

(5) |

|

0.665 |

|

|

|

0.301 |

|

| Total AUM as of September

30, |

$ |

35.088 |

|

|

$ |

31.187 |

|

| |

|

|

|

|

|

|

|

| |

Nine Months EndedSeptember 30, |

|

| |

2024 |

|

|

2023 |

|

|

Total AUM as of January 1, |

$ |

33.281 |

|

|

$ |

28.905 |

|

| Discretionary AUM: |

|

|

|

|

|

| Total Discretionary AUM as of

January 1, |

$ |

21.885 |

|

|

$ |

20.851 |

|

| New client

accounts/assets (1) |

|

0.179 |

|

|

|

0.151 |

|

| Closed accounts (2) |

|

(0.516 |

) |

|

|

(0.100 |

) |

| Net cash

inflow/(outflow) (3) |

|

(1.256 |

) |

|

|

(0.793 |

) |

| Non-discretionary to

Discretionary AUM (4) |

|

(0.006 |

) |

|

|

(0.030 |

) |

| Market appreciation |

|

2.353 |

|

|

|

0.383 |

|

| Change to Discretionary

AUM |

|

0.754 |

|

|

|

(0.389 |

) |

| Total Discretionary AUM at

September 30, |

|

22.639 |

|

|

|

20.462 |

|

| Change to Non-Discretionary

AUM (5) |

|

1.053 |

|

|

|

2.671 |

|

| Total AUM as of September

30, |

$ |

35.088 |

|

|

$ |

31.187 |

|

| |

|

|

|

|

|

|

|

| (1) |

Represents new

account flows from both new and existing client relationships. |

| (2) |

Represents closed accounts of existing client relationships and

those that terminated. |

| (3) |

Represents periodic cash flows related to existing

accounts. |

| (4) |

Represents client assets that converted to Discretionary AUM

from Non-Discretionary AUM. |

| (5) |

Represents the net change to Non-Discretionary AUM. |

Exhibit 9

|

Silvercrest Asset Management Group Inc. |

|

Equity Investment Strategy Composite Performance 1, 2 |

|

As of September 30, 2024 |

|

(Unaudited) |

| |

| PROPRIETARY EQUITY

PERFORMANCE 1, 2 |

ANNUALIZED PERFORMANCE |

|

|

INCEPTION |

|

1-YEAR |

|

3-YEAR |

|

5-YEAR |

|

7-YEAR |

|

INCEPTION |

| Large Cap Value

Composite |

4/1/02 |

|

31.1 |

|

9.6 |

|

12.5 |

|

12.0 |

|

9.9 |

| Russell 1000 Value Index |

|

|

27.8 |

|

9.0 |

|

10.7 |

|

9.5 |

|

8.1 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Small Cap Value

Composite |

4/1/02 |

|

26.7 |

|

7.3 |

|

10.6 |

|

7.8 |

|

10.5 |

| Russell 2000 Value Index |

|

|

25.9 |

|

3.8 |

|

9.3 |

|

6.6 |

|

8.0 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Smid Cap Value

Composite |

10/1/05 |

|

27.9 |

|

5.1 |

|

9.1 |

|

7.5 |

|

9.6 |

| Russell 2500 Value Index |

|

|

26.6 |

|

6.1 |

|

10.0 |

|

7.8 |

|

7.9 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Multi Cap Value

Composite |

7/1/02 |

|

27.6 |

|

5.7 |

|

10.2 |

|

9.2 |

|

9.7 |

| Russell 3000 Value Index |

|

|

27.6 |

|

8.7 |

|

10.6 |

|

9.3 |

|

8.6 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Equity Income

Composite |

12/1/03 |

|

24.8 |

|

7.4 |

|

8.5 |

|

8.8 |

|

11.0 |

| Russell 3000 Value Index |

|

|

27.6 |

|

8.7 |

|

10.6 |

|

9.3 |

|

8.7 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Focused Value

Composite |

9/1/04 |

|

23.6 |

|

1.9 |

|

6.4 |

|

6.1 |

|

9.4 |

| Russell 3000 Value Index |

|

|

27.6 |

|

8.7 |

|

10.6 |

|

9.3 |

|

8.5 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Small Cap Opportunity

Composite |

7/1/04 |

|

25.9 |

|

4.7 |

|

12.0 |

|

10.8 |

|

11.1 |

| Russell 2000 Index |

|

|

26.8 |

|

1.8 |

|

9.4 |

|

7.4 |

|

8.2 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Small Cap Growth

Composite |

7/1/04 |

|

18.9 |

|

-5.2 |

|

12.0 |

|

10.9 |

|

10.4 |

| Russell 2000 Growth Index |

|

|

27.7 |

|

-0.4 |

|

8.8 |

|

7.6 |

|

8.5 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Smid Cap Growth

Composite |

1/1/06 |

|

24.3 |

|

-5.8 |

|

13.0 |

|

12.9 |

|

10.7 |

| Russell 2500 Growth Index |

|

|

25.2 |

|

-0.7 |

|

9.7 |

|

9.4 |

|

9.5 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Returns are based upon a time weighted rate of return of various

fully discretionary equity portfolios with similar investment

objectives, strategies and policies and other relevant criteria

managed by Silvercrest Asset Management Group LLC (“SAMG LLC”), a

subsidiary of Silvercrest. Performance results are gross of fees

and net of commission charges. An investor’s actual return will be

reduced by the advisory fees and any other expenses it may incur in

the management of the investment advisory account. SAMG LLC’s

standard advisory fees are described in Part 2 of its Form ADV.

Actual fees and expenses will vary depending on a variety of

factors, including the size of a particular account. Returns

greater than one year are shown as annualized compounded returns

and include gains and accrued income and reinvestment of

distributions. Past performance is no guarantee of future results.

This piece contains no recommendations to buy or sell securities or

a solicitation of an offer to buy or sell securities or investment

services or adopt any investment position. This piece is not

intended to constitute investment advice and is based upon

conditions in place during the period noted. Market and economic

views are subject to change without notice and may be untimely when

presented here. Readers are advised not to infer or assume that any

securities, sectors or markets described were or will be

profitable. SAMG LLC is an independent investment advisory and

financial services firm created to meet the investment and

administrative needs of individuals with substantial assets and

select institutional investors. SAMG LLC claims compliance with the

Global Investment Performance Standards (GIPS®). |

|

|

|

|

2 |

The market indices used to

compare to the performance of Silvercrest’s strategies are as

follows: |

| |

|

| |

The Russell 1000 Index is a

capitalization-weighted, unmanaged index that measures the 1000

largest companies in the Russell 3000. The Russell 1000 Value Index

is a capitalization-weighted, unmanaged index that includes those

Russell 1000 Index companies with lower price-to-book ratios and

lower expected growth values. |

| |

|

| |

The Russell 2000 Index is a

capitalization-weighted, unmanaged index that measures the 2000

smallest companies in the Russell 3000. The Russell 2000 Value

Index is a capitalization-weighted, unmanaged index that includes

those Russell 2000 Index companies with lower price-to-book ratios

and lower expected growth values. |

| |

|

| |

The Russell 2500 Index is a

capitalization-weighted, unmanaged index that measures the 2500

smallest companies in the Russell 3000. The Russell 2500 Value

Index is a capitalization-weighted, unmanaged index that includes

those Russell 2000 Index companies with lower price-to-book ratios

and lower expected growth values. |

| |

|

| |

The Russell 3000 Value Index is a

capitalization-weighted, unmanaged index that measures those

Russell 3000 Index companies with lower price-to-book ratios and

lower forecasted growth. |

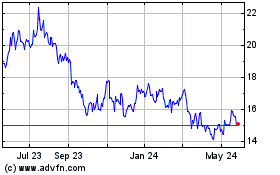

Silvercrest Asset Manage... (NASDAQ:SAMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

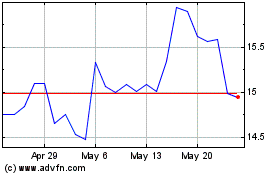

Silvercrest Asset Manage... (NASDAQ:SAMG)

Historical Stock Chart

From Dec 2023 to Dec 2024