Safe & Green Holdings Announces Equity Line of Credit with Alumni Capital to Accelerate Growth through Shareholder-Friendly Funding Mechanism

28 January 2025 - 12:30AM

Safe & Green Holdings Corp. (NASDAQ: SGBX) (“Safe &

Green Holdings” or the “Company”), a leading developer,

designer, and fabricator of modular structures, today announced it

has entered into a Securities Purchase Agreement with Alumni

Capital LP, establishing an equity line of credit (ELOC). This

agreement provides the Company with a flexible funding mechanism to

support its strategic growth initiatives while minimizing dilution

to existing shareholders.

The funding aligns with Safe & Green's

commitment to utilizing capital in a prudent manner, with a focus

on highly accretive projects that drive long-term shareholder

value. The structure of the ELOC ensures that the Company retains

full control over the timing and amount of any equity sales,

thereby providing financial stability and strategic

flexibility.

Michael McLaren, Chief Executive Officer of Safe

& Green Holdings, commented, “This agreement with Alumni

Capital represents a key milestone in our growth strategy. It is

designed with the best interests of our shareholders in mind,

offering us the ability to access capital efficiently while

mitigating dilution. We are grateful for the strong support and

confidence from Alumni Capital following their extensive due

diligence. This funding positions us to accelerate the execution of

our strategic initiatives and deliver meaningful value to our

shareholders.”

Tricia Kaelin, Chief Financial Officer of Safe

& Green Holdings, stated, “We plan to leverage the proceeds

from the ELOC to advance our growth agenda, including expansion

into new markets, development of high-impact projects, and

enhancement of operational efficiencies. Moreover, we remain

committed to maintaining a balance between growth, financial

discipline, and shareholder interests.”

Ashkan Mapar, Portfolio Manager and General

Partner at Alumni Capital, added, “We are pleased to partner with

Safe & Green Holdings as they continue to innovate and grow.

This agreement reflects our confidence in the Company's vision and

management team, and we look forward to supporting their efforts to

drive sustainable value creation.”

The flexibility provided by this ELOC allows the

Company to align its capital needs with market conditions and

operational priorities. Through a disciplined approach, Safe &

Green Holdings seeks to deploy capital in areas that maximize

returns and strengthen the Company’s market position.

Additional details about the transaction are

available in the Company’s Form 8-K that has been filed with the

Securities and Exchange Commission.

About Safe & Green Holdings Corp.

Safe & Green Holdings Corp., a leading

modular solutions company, operates under core capabilities which

include the development, design, and fabrication of modular

structures, meeting the demand for safe and green solutions across

various industries. The firm supports third-party and in-house

developers, architects, builders, and owners in achieving faster

execution, greener construction, and buildings of higher value. For

more information, visit https://www.safeandgreenholdings.com/ and

follow us at @SGHcorp on Twitter.

Safe Harbor Statement

Certain statements in this press release

constitute "forward-looking statements" within the meaning of the

federal securities laws. Words such as "may," "might," "will,"

"should," "believe," "expect," "anticipate," "estimate,"

"continue," "predict," "forecast," "project," "plan," "intend" or

similar expressions, or statements regarding intent, belief, or

current expectations, are forward-looking statements. These

forward-looking statements are based upon current estimates and

assumptions. These forward-looking statements are subject to

various risks and uncertainties, many of which are difficult to

predict that could cause actual results to differ materially from

current expectations and assumptions from those set forth or

implied by any forward-looking statements. Important factors that

could cause actual results to differ materially from current

expectations include, among others, the Company’s ability to

successfully satisfy all of the conditions in the Securities

Purchase Agreement, the Company’s ability to successfully file a

registration statement to register the resale of shares to be

purchased by Alumni Capital LP via the Securities Purchase

Agreement, the Company’s ability to successfully execute its

business plans, the effect of government regulation, the Company’s

ability to maintain compliance with the NASDAQ listing

requirements, and the other factors discussed in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023 and

its subsequent filings with the SEC, including subsequent periodic

reports on Forms 10-Q and 8-K. The information in this release is

provided only as of the date of this release, and we undertake no

obligation to update any forward-looking statements contained in

this release on account of new information, future events, or

otherwise, except as required by law.

Investor Relations:

Crescendo Communications, LLC(212)

671-1020sgbx@crescendo-ir.com

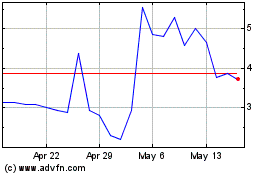

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Jan 2024 to Jan 2025