#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 June 30, 2024 Investor Presentation

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Forward-Looking Statements This investor presentation contains future oral and written statements of Shore Bancshares, Inc. (the “Company” or “SHBI”) and its wholly-owned banking subsidiary, Shore United Bank, N.A. (the “Bank”), and its management, which may contain statements about future events that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by references to a future period or periods or by the use of the words "believe," "expect," "anticipate," "intend," "estimate," "assume," "will," should," "plan," and other similar terms or expressions. Forward-looking statements include but are not limited to: (i) projections and estimates of revenues, expenses, income or loss, earnings or loss per share, and other financial items, including our financial results for the second quarter of 2024, (ii) statements of plans, objectives and expectations of the Company or its management, (iii) statements of future economic performance, and (iv) statements of assumptions underlying such statements. Forward-looking statements should not be relied on because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Company and the Bank. These risks, uncertainties and other factors may cause the actual results, performance, and achievements of the Company and the Bank to be materially different from the anticipated future results, performance or achievements expressed in, or implied by, the forward- looking statements. Factors that could cause such differences include, but are not limited to, the effect of acquisitions we have made or may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such acquisitions, and/or the failure to effectively integrate an acquisition target into our operations; recent adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, liquidity, and regulatory responses to these developments; changes in general economic, political, or industry conditions; geopolitical concerns, including the ongoing wars in Ukraine and the Middle East; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Board of Governors of the Federal Reserve System; inflation/deflation, interest rate, market, and monetary fluctuations; volatility and disruptions in global capital and credit markets; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, and insurance, and the application thereof by regulatory bodies; potential changes in federal policy and at regulatory agencies as a result of the upcoming 2024 presidential election; cybersecurity threats and the cost of defending against them, including the costs of compliance with potential legislation to combat cybersecurity at a state, national, or global level; the Company's evaluation of the effect of the credit card fraud on the Company's internal controls over financial reporting and its ability to remediate the existing material weakness identified in its internal control over financial reporting; the effectiveness of the Company's internal control over financial reporting and disclosure controls and procedures; and other factors that may affect our future results. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. For more information about these factors, please see our reports filed with or furnished to the Securities and Exchange Commission (the “SEC”), including the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q on file with the SEC, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Any forward-looking statements contained in this investor presentation are made as of the date hereof, and the Company undertakes no duty, and specifically disclaims any duty, to update or revise any such statements, whether as a result of new information, future events or otherwise, except as required by applicable law. This investor presentation has been prepared by the Company solely for informational purposes based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information. This investor presentation has been prepared to assist interested parties in making their own evaluation of the Company and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of the Company and the data set forth in the investor presentation and other information provided by or on behalf of the Company. This investor presentation is not an offer to sell securities and it is not soliciting an offer to buy securities in any state where the offer or sale is not permitted. Neither the SEC nor any other regulatory body has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Non-GAAP Financials This investor presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures and the Company’s reported results prepared in accordance with GAAP. Numbers in this presentation may not sum due to rounding. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within this presentation, as necessary, of the non-GAAP financial measures to the most directly comparable GAAP financial measures. For more details on the Company's non-GAAP measures, refer to the Appendix in this presentation. 2

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Shore Bancshares, Inc. (NASDAQ: SHBI) (1) Allowance for Credit Losses ("ACL"), Nonperforming Assets (“NPAs”) includes Other Real Estate Owned ("OREO"), Loan Modifications to Borrowers Experiencing Financial Difficulty ("BEFDs") (2) Return on Average Assets ("ROAA"), Tangible Common Equity (“TCE”), Tangible Assets, Return on Average TCE (“ROATCE”), Efficiency Ratio, and Tangible Book Value (“TBV”) are non-GAAP measures - see reconciliations in Appendix 3 Balance Sheet ($ Billions) 2020 2021 2022 2023 2024 Q1 2024 Q2 Assets $ 1.93 $ 3.46 $ 3.48 $ 6.01 $ 5.83 $ 5.86 Gross Portfolio Loans 1.45 2.12 2.56 4.64 4.65 4.71 Deposits 1.70 3.03 3.01 5.39 5.18 5.15 NPAs(1) / Assets 0.32 % 0.09 % 0.11 % 0.23 % 0.28 % 0.31 % ACL / NPAs + BEFDs(1) 104.77 % 160.07 % 199.29 % 418.59 % 350.46 % 318.21 % TCE / Tangible Assets (Non-GAAP)(2) 9.18 % 8.25 % 8.67 % 6.78 % 7.11 % 7.23 % Risk-Based Capital Ratio 14.25 % 15.36 % 13.91 % 11.48 % 11.68 % 11.82 % 2020 2021 2022 2023 2024 Q1 2024 Q2 ROAA 0.92 % 0.66 % 0.90 % 0.24 % 0.57 % 0.77 % ROAA (Non-GAAP)(2) 0.94 % 0.95 % 0.99 % 0.58 % 0.94 % 0.91 % ROATCE (Non-GAAP)(2) 9.04 % 11.34 % 11.96 % 7.74 % 13.39 % 12.85 % Cost of Deposits 0.43 % 0.22 % 0.33 % 1.71 % 2.23 % 2.19 % Net Interest Margin ("NIM") 3.27 % 2.94 % 3.15 % 3.11 % 3.08 % 3.11 % Efficiency Ratio (Non-GAAP)(2) 59.56 % 61.15 % 61.18 % 61.62 % 62.37 % 61.05 % Diluted Earnings Per Share $ 1.27 $ 1.17 $ 1.57 $ 0.42 $ 0.25 $ 0.34 TBV Per Share (Non-GAAP)(2) $ 14.92 $ 14.12 $ 14.87 $ 12.06 $ 12.24 $ 12.54 2024 Insurance, Trust & Wealth Management offered Shore United / Community Financial merger Centreville National Bank of MD founded Shore United Bank rebranding Shore Bancshares acquires Talbot Bank 202320212016200420022000199618851876 Shore Bancshares, Inc. formed Shore United / Severn merger Talbot Bank of Easton founded Expansion into Delaware $5.8 billion community bank with operations in MD, DE and VA Financial Performance

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Suburban and Rural Branches Support Dominant Maryland Franchise and Growing Presence in Virginia and Delaware 4 Branch locations (41 branches) Commercial Lending Centers (4 locations) Mortgage Loan Offices (3 locations) Pennsylvania West Virginia Virginia Delaware New Jersey Maryland I-60 I-60 I-83 I-95 I-695 I-70 I-495 I-66 I-95 I-64 Fredericksburg Charlottesville Waldorf Easton Investment Services Offices (5 locations) Maryland

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Investment Opportunity 2024 Q2 ▪ EPS and ROATCE of $0.34 per diluted share and 8.70%, respectively ▪ ROAA of 0.77% and 0.91% (Non-GAAP) 2024 Q1 ▪ EPS and ROATCE of $0.25 per diluted share and 6.38%, respectively ▪ ROAA of 0.57% and 0.94% (Non-GAAP) Improving Profitability Dominant Deposit Market Shares Support Dynamic Growth Markets Continued Strong Credit Performance Expense Management and Technology Will Enhance Operating Leverage ▪ 25.78% deposit market share in Maryland (1) ▪ Non-interest deposits at 30.8% of total deposits at Q2 2024 ▪ 2024 Median Household income is $97,364 in MD, $76,379 in DE, $89,172 in VA, vs. $75,874 for the US ▪ Government spending provides economic stability ▪ 0.31% Q2 2024 NPAs / Assets ▪ 0.15% 2020 to Q2 2024 Average NPAs / Assets ▪ 318.21% Q2 2024 Reserves / Nonperforming Assets ▪ 1.24% Q2 2024 Reserves / Gross Loans ▪ $1.5 million 2024 YTD Net Charge Offs ▪ $2.8 million 2020 to Q2 2024 Cumulative Net Charge-Offs ▪ Multiple initiatives are intended to improve operating leverage over time but are currently inflating expenses ▪ Total FTE's have been reduced by 72 (11%) since merger with TCFC closed on July 1, 2023 ▪ Announced closure of two branches and consolidation of two offices by Q3 2024 5 $6 billion community bank with dominant market share in Central and Southern Maryland and established presence in Delaware and Virginia (1) Per FDIC Annual Market Share Data published in July 2023 for the Maryland counties of Calvert, Charles, St. Mary's., Talbot, Queen Anne's, Caroline, Worcester and Dorchester

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Federal Agency Presence Insulates Economy in Operating Markets 6 Naval Surface Warfare – Naval Support Facility at Dahlgren Defense Intelligence Agency & Defense Intelligence Analysis Center – Joint Base Anacostia-Bolling Naval Air Station Patuxent River Air Force One – Andrews AFB US Marines – Quantico Additional major Federal Agency presence: ▪ Federal Aviation Administration (FAA) Unmanned Aerial Vehicle (UAV) Drones Program ▪ Homeland Security ▪ FBI & DEA – Quantico (Prince William County) Naval Support Facility at Indian Head National Security Agency Fort Meade Dover AFB

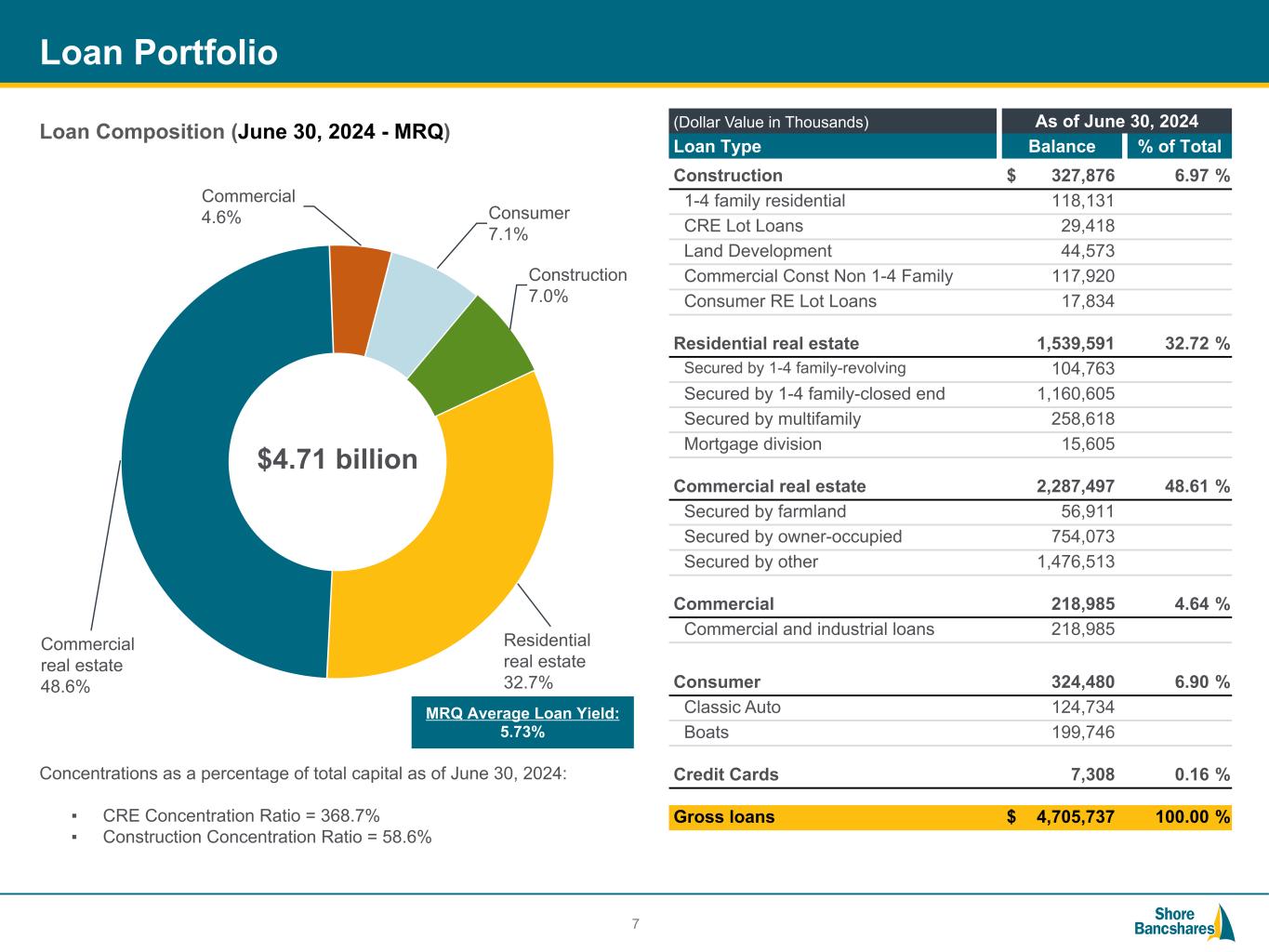

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Construction 7.0% Residential real estate 32.7% Commercial real estate 48.6% Commercial 4.6% Consumer 7.1% Loan Portfolio Loan Composition (June 30, 2024 - MRQ) 7 $4.71 billion Concentrations as a percentage of total capital as of June 30, 2024: ▪ CRE Concentration Ratio = 368.7% ▪ Construction Concentration Ratio = 58.6% (Dollar Value in Thousands) As of June 30, 2024 Loan Type Balance % of Total Construction $ 327,876 6.97 % 1-4 family residential 118,131 CRE Lot Loans 29,418 Land Development 44,573 Commercial Const Non 1-4 Family 117,920 Consumer RE Lot Loans 17,834 Residential real estate 1,539,591 32.72 % Secured by 1-4 family-revolving 104,763 Secured by 1-4 family-closed end 1,160,605 Secured by multifamily 258,618 Mortgage division 15,605 Commercial real estate 2,287,497 48.61 % Secured by farmland 56,911 Secured by owner-occupied 754,073 Secured by other 1,476,513 Commercial 218,985 4.64 % Commercial and industrial loans 218,985 Consumer 324,480 6.90 % Classic Auto 124,734 Boats 199,746 Credit Cards 7,308 0.16 % Gross loans $ 4,705,737 100.00 % MRQ Average Loan Yield: 5.73%

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Commercial Real Estate Portfolio Details Average loan size $1.01mm Average LTV* 56.0% DSC (non-owner occupied) 1.70x % with guaranty (by $ / by #) 85% / 84% Past due 30-89 days $1.2mm / 0.04% of total CRE Nonaccrual $6.04mm / 0.21% of total CRE Special mention $23.8mm / 0.84% of total CRE Classified $6.36mm / 0.23% of total CRE *Loan to Value ("LTV") collateral values are based on the most recent appraisal, which varies from the initial loan boarding to interim credit reviews CRE Portfolio Metrics at June 30, 2024 Number of Loans by Balance <$1mm $1-5mm $5-10mm $10-20mm >$20mm 0 500 1,000 1,500 2,000 2,500 ▪ Loans secured by office properties represented 10.7% of our total loan portfolio. ▪ CRE portfolio is 26.8% owner occupied, 52.4% non-owner occupied, 11.6% construction, and 9.2% multifamily. ▪ 74% of CRE loans are below $1 million dollars. ▪ Office CRE loans compose 17.9% of total CRE loans and 10.7% of total loans. ▪ 1.0% and 2.8% of total CRE Loans are repricing in the years 2024 and 2025, respectively. 8

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Commercial Real Estate Portfolio Details CRE Portfolio Composition (As of June 30, 2024) Multifamily, 9.5% Industrial, 11.8% Office, 17.9% Retail, 18.2% Other, 34.9% Hotel/Motel, 7.6% 9 Geography (As of June 30, 2024) MD, 54.6% VA, 24.2% DE, 8.3% Other, 12.9% CRE Portfolio Composition Amount ($000) % of CRE Loans Multifamily $ 268,015 9.5 % Industrial 333,547 11.8 % Retail 512,773 18.2 % Other 983,462 34.9 % Hotel/Motel 214,410 7.6 % Office 504,869 17.9 % Grand Total $ 2,817,076 100.0 % Location Loan Count Amount ($000) % of Total Office Metropolitian(1) 14 $ 14,110 2.8 % Suburban 335 380,684 75.4 % Rural 158 110,075 21.8 % Grand Total 507 $ 504,869 100.0 % (1) Metropolitan includes major cities of Baltimore, Alexandria and Washington DC Office

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Commercial Real Estate Portfolio Details 10 $ M ill io n CRE Maturity Schedule (As of June 30, 2024) $207.4 $211.3 $217.2 $212.1 $220.1 7.4% 7.5% 7.7% 7.5% 7.8% Balance ($ Million) % of CRE Loans 2024 2025 2026 2027 2028 $— $50.0 $100.0 $150.0 $200.0 $250.0 $ M ill io n CRE Repricing Schedule (As of June 30, 2024) $27.8 $79.8 $157.8 $182.2 $365.3 1.0% 2.8% 5.6% 6.5% 13.0% Balance ($ Million) % of CRE Loans 2024 2025 2026 2027 2028 & After $— $80.0 $160.0 $240.0 $320.0 $400.0 ▪ CRE loans scheduled to mature in 2029 and after are $1.7 billion or 62.1% of the Total CRE Loans ▪ Fixed Rate CRE loans scheduled to reprice are $1.5 billion or 54.7% ▪ Floating Rate CRE loans scheduled to reprice are $461.3 million or 16.4%

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Interest Bearing, 45.6% Non-Interest Bearing, 30.8% Time Deposits, 23.6% Deposit Portfolio Deposit Composition (June 30, 2024 - MRQ) ▪ Deposit franchise positions Bank to succeed in a variety of rate environments ▪ Non-interest bearing deposits have increased to 30.8% of total deposits during Q2 2024 from 23.2% in Q1 2024 ▪ 18.4% of deposits are uninsured (Net of pledged securities 15.9%) ▪ $620.8 million of the deposits were indexed to Fed Funds at June 30, 2024 MRQ Cost of Deposits: 2.19% 11 $5.15 billion (Dollar Value in Thousands) As of June 30, 2024 Deposit Type Balance % of Total Average Rate (%) Non-interest Bearing Demand $ 1,587,252 30.8 % 0.00 Interest Bearing Demand 658,512 12.8 % 2.63 Money Market & Savings 1,689,343 32.8 % 2.45 CDs $100,000 or more 792,382 15.4 % 4.04 Other Time 421,396 8.2 % 3.91 Total Deposits $ 5,148,885 100.0 % 2.98 Total Cost of Interest Bearing Deposits 2.98 Total Cost of Funds (Including Borrowings)(1) 2.34 (1) Includes Non-interest bearing deposits

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 3.27% 2.94% 3.15% 3.11% 3.09%3.24% 2.91% 3.09% 2.89% 2.82% 3.27% 3.10% 3.37% 3.09% 3.33% 3.21% 3.46% 3.41% NIM Core-NIM Regional Peer National Peer 2020 2021 2022 2023 2024YTD 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% NIM and Core NIM1 12 1 Core NIM excludes net accretion income - see Non-GAAP reconciliations in Appendix. Q2 vs Q1 2024 ▪ Net Interest margin increased from 3.08% in Q1 2024 to 3.11% in Q2 2024 ▪ Average Loan Yields increased from 5.69% in Q1 2024 to 5.76% in Q2 2024 ▪ Cost of Deposits decreased from 2.23% in Q1 2024 to 2.19% in Q2 2024

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Balance Sheet Composition and Deposit Betas 13 1Non-maturity transaction accounts include both non-interest bearing and interest-bearing deposit accounts Non-maturity deposit1 costs have remained well below market ratesBalance Sheet Composition % of Assets 2023 2024 Q2 Cash 6.20 % 2.37 % Investments 10.38 % 10.76 % Loans, excluding PPP 76.26 % 79.25 % Other Assets 7.17 % 7.62 % NMD - Noninterest-bearing 20.93 % 27.07 % NMD - Interest-bearing 48.97 % 40.04 % CDs 19.71 % 20.70 % Total Deposits 89.61 % 87.80 % Advances 0.00 % 1.38 % Other 1.89 % 1.90 % Equity 8.50 % 8.92 % 0.33% 1.58% 3.08% 4.33% 4.83% 5.08% 5.33% 5.33% 5.33% 5.33% 0.20% 0.21% 0.47% 0.88% 1.32% 1.62% 2.05% 2.20% 2.38% 2.65% 0.13% 0.14% 0.31% 0.58% 0.89% 1.09% 1.36% 1.52% 1.68% 1.64% Fed Funds Effective NMD Interest-bearing NMD Transaction Q 1- 22 Q 2- 22 Q 3- 22 Q 4- 22 Q 1- 23 Q 2- 23 Q 3- 23 Q 4- 23 Q 1- 24 Q 2- 24 0.00% 2.00% 4.00% 6.00% ▪ Investment Portfolio effective duration = 3.8 years ▪ 4.9% of loan portfolio reprices monthly with an additional 1.3% scheduled to reprice in the next year ▪ Loan portfolio effective duration - 2.2 years (based on management estimates) ▪ Strong noninterest-bearing deposit concentration - 30.8% of total deposits at June 30, 2024. ▪ Loan betas have significantly outpaced deposit betas in first six months of 2024 ▪ The Company's ALCO model assumes a deposit beta of 40%, which is much higher than actual experience for the first six months of 2024 ▪ The Company expects NIM to remain stable or increase slightly for the remainder of 2024 based on assets repricing faster than liabilities

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Credit Quality Statistics 14 (1) FASB eliminated accounting guidance for troubled debt restructurings ("TDRs") and replaced with the new disclosure loan modifications to borrowers' experiencing financial difficulties ("BEFDs") in March 2022. (Dollar value in thousands) 2020 2021 2022 2023 2024 Q1 2024 Q2 Non-performing Assets Nonaccrual Loans $ 5,455 $ 2,004 $ 1,908 $ 12,784 $ 12,776 $ 14,837 90+ or More Days Past Due 804 508 1,841 738 1,560 414 Other Real Estate Owned — 532 197 179 2,024 3,126 Total Non-Performing Assets $ 6,259 $ 3,044 $ 3,946 $ 13,701 $ 16,360 $ 18,377 Performing BEFDs (1) $ 6,997 $ 5,667 $ 4,405 $ — $ — $ — Total NPAs + BEFDs (1) $ 13,256 $ 8,711 $ 8,351 $ 13,701 $ 16,360 $ 18,377 NPAs / Assets (%) 0.32 0.09 0.11 0.23 0.28 0.31 NPAs + BEFDs / Assets (%) 0.69 0.25 0.24 0.23 0.28 0.31 Average rate on performing BEFDs (%) 4.34 4.35 4.24 — — — Reserves Loan Loss Reserve $ 13,888 $ 13,944 $ 16,643 $ 57,351 $ 57,336 $ 58,478 Reserves / Gross Loans (%) 0.95 0.66 0.65 1.24 1.23 1.24 Reserves / Nonaccrual Loans (%) 254.59 695.81 872.27 448.62 448.78 394.14 Reserves / NPAs + BEFDs (%) 104.77 160.07 199.29 418.59 350.46 318.21 Net Charge-offs Net Charge-Offs (Recoveries) $ 519 $ (414) $ (774) $ 2,019 $ 565 $ 886

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Quarterly Capital Ratios (Bank Only) 15 9.38% 8.17% 8.33% 8.58% 8.71% 12.07% 9.85% 10.02% 10.32% 10.45% 12.07% 9.85% 10.02% 10.32% 10.45% 13.15% 11.09% 11.27% 11.56% 11.69% Total Risk-Based Capital Ratio Tier 1 Risk-Based Capital Ratio Common Equity Tier 1 Tier 1 Leverage Ratio 2023Q2 2023Q3* 2023Q4 2024Q1 2024Q2 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% *Decrease in capital ratios due to merger of equals with TCFC on July 1, 2023.

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Quarterly Capital Ratios (Holding Company) 16 *Decrease in capital ratios due to merger of equals with TCFC on July 1, 2023. 9.09% 7.55% 7.74% 7.93% 8.07% 11.04% 8.49% 8.69% 8.91% 9.06% 11.72% 9.10% 9.31% 9.53% 9.67% 13.69% 11.26% 11.48% 11.68% 11.82% Total Risk-Based Capital Ratio Tier 1 Risk-Based Capital Ratio Common Equity Tier 1 Tier 1 Leverage Ratio 2023Q2 2023Q3* 2023Q4 2024Q1 2024Q2 0.00% 2.50% 5.00% 7.50% 10.00% 12.50% 15.00%

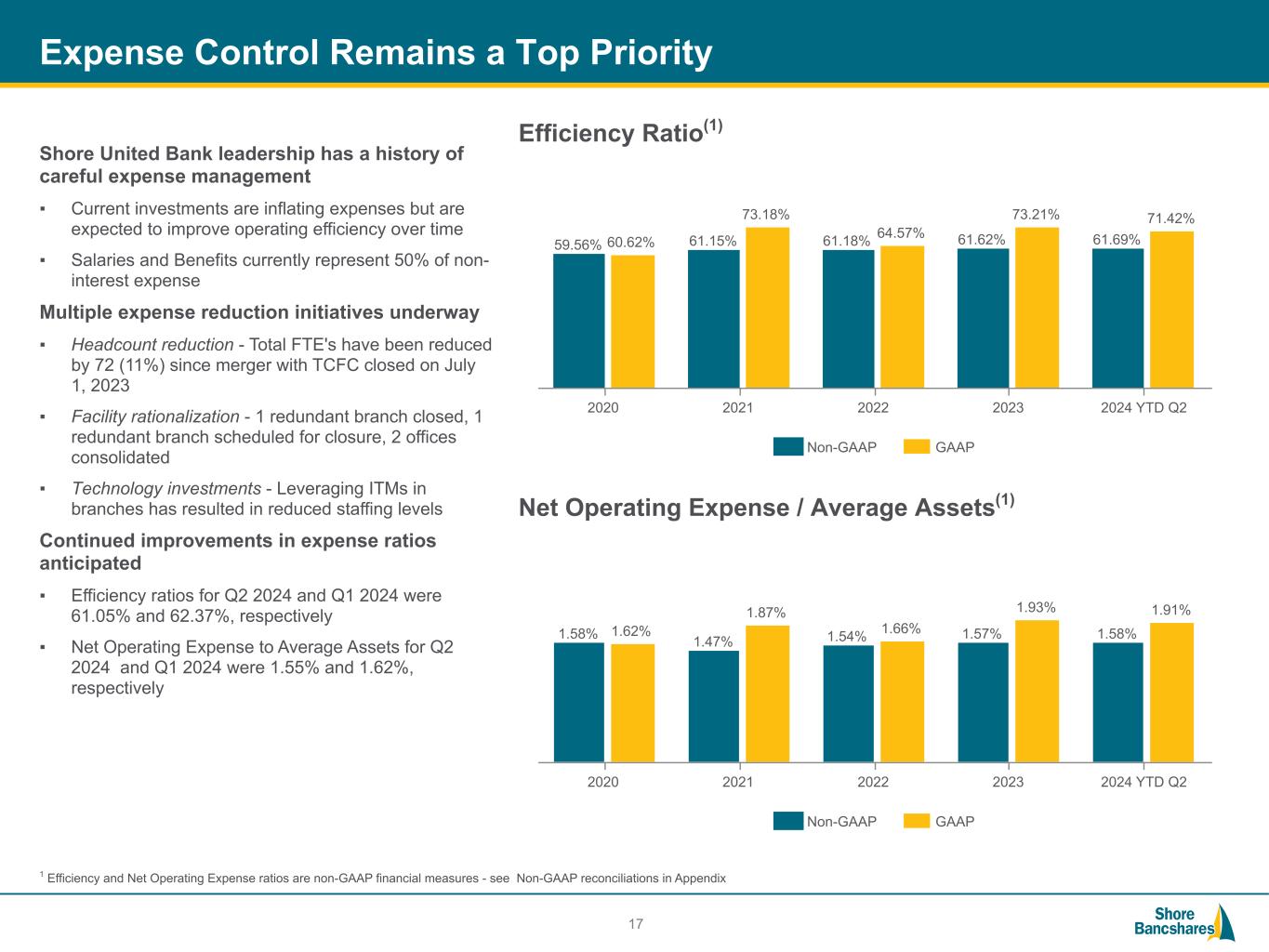

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Expense Control Remains a Top Priority Shore United Bank leadership has a history of careful expense management ▪ Current investments are inflating expenses but are expected to improve operating efficiency over time ▪ Salaries and Benefits currently represent 50% of non- interest expense Multiple expense reduction initiatives underway ▪ Headcount reduction - Total FTE's have been reduced by 72 (11%) since merger with TCFC closed on July 1, 2023 ▪ Facility rationalization - 1 redundant branch closed, 1 redundant branch scheduled for closure, 2 offices consolidated ▪ Technology investments - Leveraging ITMs in branches has resulted in reduced staffing levels Continued improvements in expense ratios anticipated ▪ Efficiency ratios for Q2 2024 and Q1 2024 were 61.05% and 62.37%, respectively ▪ Net Operating Expense to Average Assets for Q2 2024 and Q1 2024 were 1.55% and 1.62%, respectively 1 Efficiency and Net Operating Expense ratios are non-GAAP financial measures - see Non-GAAP reconciliations in Appendix 17 Efficiency Ratio(1) Net Operating Expense / Average Assets(1) 59.56% 61.15% 61.18% 61.62% 61.69%60.62% 73.18% 64.57% 73.21% 71.42% Non-GAAP GAAP 2020 2021 2022 2023 2024 YTD Q2 1.58% 1.47% 1.54% 1.57% 1.58%1.62% 1.87% 1.66% 1.93% 1.91% Non-GAAP GAAP 2020 2021 2022 2023 2024 YTD Q2

Appendix

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Financial Highlights 19 1 Gross portfolio loans and US SBA loans are inclusive of net deferred costs and fees. 2 Non-GAAP financial measures. Refer to Appendix to this presentation for a reconciliation. 3 NPLs include nonaccrual loans and BEFDs. NPAs include NPLs and OREO. Balance Sheet (dollars in thousands, except share data) For the Years Ended Three Months Ended Six Months Ended 2022 2023 6/30/2023 06/30/2024 6/30/2023 06/30/2024 Total Assets $ 3,477,276 $ 6,010,918 $ 3,641,631 $ 5,864,017 $ 3,641,631 $ 5,864,017 Gross Portfolio Loans (GPLs)1 2,556,107 4,641,010 2,753,223 4,705,737 2,753,223 4,705,737 Deposits 3,009,784 5,386,120 2,937,526 5,148,885 2,937,526 5,148,885 Tangible Common Equity2 364,285 511,135 363,140 522,783 363,140 522,783 Consolidated Capital (%) Tangible Common Equity / Tangible Assets2 8.67 % 6.78 % 8.26 % 7.23 % 8.26 % 7.23 % Tier 1 Leverage Ratio 9.52 % 7.74 % 9.09 % 8.07 % 9.09 % 8.07 % Tier 2 Risk-Based Ratio 13.91 % 11.48 % 13.69 % 11.82 % 13.69 % 11.82 % TBV Per Share2 $ 14.87 $ 12.06 $ 14.83 $ 12.54 $ 14.83 $ 12.54 Asset Quality NPAs / Assets3 0.11 % 0.23 % 0.13 % 0.31 % 0.17 % 0.31 % NCOs / Average Portfolio Loans (0.03) % 0.06 % 0.00 % 0.02 % 0.00 % 0.03 % NPLs3 + OREO / GPLs + OREO 0.15 % 0.30 % 0.17 % 0.39 % 0.17 % 0.39 % ACL / NPLs3 443.9 % 424.1 % 833.5 % 394.1 % 833.5 % 394.1 % Profitability Net Income $ 31,177 $ 11,228 $ 4,018 $ 11,234 $ 10,475 $ 19,418 ROAA 0.90 % 0.24 % 0.45 % 0.77 % 0.59 % 0.67 % ROAA (Non-GAAP)2 0.99 % 0.58 % 0.58 % 0.91 % 0.71 % 0.92 % Pre-tax Pre-provision (“PTPP”) ROAA2 1.28 % 0.97 % 0.69 % 1.18 % 0.92 % 0.97 % ROACE 8.76 % 2.54 % 4.49 % 8.70 % 5.83 % 7.54 % ROACE (Non-GAAP)2 11.96 % 7.74 % 7.08 % 12.85 % 8.57 % 13.08 % ROATCE2 11.45 % 4.50 % 7.16 % 12.85 % 8.57 % 13.08 % Net Interest Margin 3.15 % 3.11 % 2.68 % 3.11 % 2.93 % 3.09 % Core Net Interest Margin2 3.09 % 2.89 % 2.64 % 2.83 % 2.88 % 2.82 % Efficiency Ratio 64.57 % 73.21 % 77.76 % 66.23 % 72.30 % 71.42 % Efficiency Ratio (Non-GAAP)2 61.18 % 61.62 % 71.76 % 61.05 % 67.49 % 61.69 % Net Operating Expenses / Average Assets2 1.54 % 1.57 % 1.64 % 1.55 % 1.65 % 1.58 % Diluted EPS $ 1.57 $ 0.42 $ 0.20 $ 0.34 $ 0.53 $ 0.58 Diluted EPS (Non-GAAP)2 $ 1.72 $ 1.02 $ 0.26 $ 0.40 $ 0.63 $ 0.80

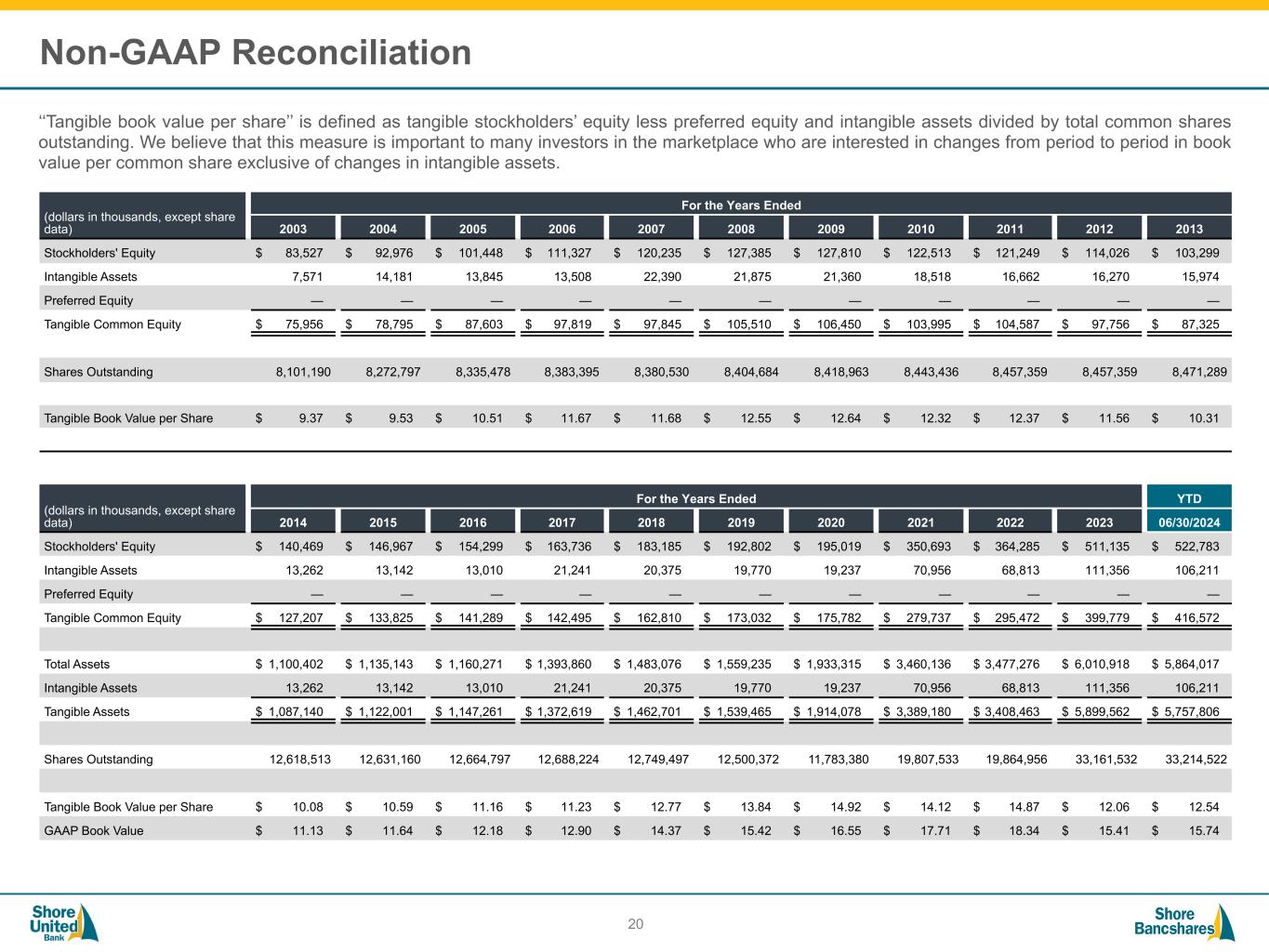

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation ‘‘Tangible book value per share’’ is defined as tangible stockholders’ equity less preferred equity and intangible assets divided by total common shares outstanding. We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in book value per common share exclusive of changes in intangible assets. 20 (dollars in thousands, except share data) For the Years Ended 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Stockholders' Equity $ 83,527 $ 92,976 $ 101,448 $ 111,327 $ 120,235 $ 127,385 $ 127,810 $ 122,513 $ 121,249 $ 114,026 $ 103,299 Intangible Assets 7,571 14,181 13,845 13,508 22,390 21,875 21,360 18,518 16,662 16,270 15,974 Preferred Equity — — — — — — — — — — — Tangible Common Equity $ 75,956 $ 78,795 $ 87,603 $ 97,819 $ 97,845 $ 105,510 $ 106,450 $ 103,995 $ 104,587 $ 97,756 $ 87,325 Shares Outstanding 8,101,190 8,272,797 8,335,478 8,383,395 8,380,530 8,404,684 8,418,963 8,443,436 8,457,359 8,457,359 8,471,289 Tangible Book Value per Share $ 9.37 $ 9.53 $ 10.51 $ 11.67 $ 11.68 $ 12.55 $ 12.64 $ 12.32 $ 12.37 $ 11.56 $ 10.31 (dollars in thousands, except share data) For the Years Ended YTD 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 06/30/2024 Stockholders' Equity $ 140,469 $ 146,967 $ 154,299 $ 163,736 $ 183,185 $ 192,802 $ 195,019 $ 350,693 $ 364,285 $ 511,135 $ 522,783 Intangible Assets 13,262 13,142 13,010 21,241 20,375 19,770 19,237 70,956 68,813 111,356 106,211 Preferred Equity — — — — — — — — — — — Tangible Common Equity $ 127,207 $ 133,825 $ 141,289 $ 142,495 $ 162,810 $ 173,032 $ 175,782 $ 279,737 $ 295,472 $ 399,779 $ 416,572 Total Assets $ 1,100,402 $ 1,135,143 $ 1,160,271 $ 1,393,860 $ 1,483,076 $ 1,559,235 $ 1,933,315 $ 3,460,136 $ 3,477,276 $ 6,010,918 $ 5,864,017 Intangible Assets 13,262 13,142 13,010 21,241 20,375 19,770 19,237 70,956 68,813 111,356 106,211 Tangible Assets $ 1,087,140 $ 1,122,001 $ 1,147,261 $ 1,372,619 $ 1,462,701 $ 1,539,465 $ 1,914,078 $ 3,389,180 $ 3,408,463 $ 5,899,562 $ 5,757,806 Shares Outstanding 12,618,513 12,631,160 12,664,797 12,688,224 12,749,497 12,500,372 11,783,380 19,807,533 19,864,956 33,161,532 33,214,522 Tangible Book Value per Share $ 10.08 $ 10.59 $ 11.16 $ 11.23 $ 12.77 $ 13.84 $ 14.92 $ 14.12 $ 14.87 $ 12.06 $ 12.54 GAAP Book Value $ 11.13 $ 11.64 $ 12.18 $ 12.90 $ 14.37 $ 15.42 $ 16.55 $ 17.71 $ 18.34 $ 15.41 $ 15.74

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation ‘‘Efficiency ratio” is defined as recurring non-interest expense less foreclosed real estate (OREO) expenses and valuation allowances, less merger and acquisition costs, less amortization of intangible assets divided by operating revenue. Operating revenue is equal to net interest income plus non-interest income excluding gains and losses on securities, foreclosed real estate and sales of impaired loans. In our judgment, the adjustments made to non- interest expense and operating revenue allow investors and analysts to better assess our operating expenses in relation to our core operating revenue by removing the volatility that is associated with certain one-time items and other discrete items that are unrelated to our core business. “Efficiency ratio as reported” is defined as non-interest expense divided by operating revenue. This is the ratio that appears in the Company’s SEC filings. 21 (dollars in thousands, except share data) For the Years Ended Three Months Ended Six Months Ended 2020 2021 2022 2023 6/30/2023 06/30/2024 6/30/2023 06/30/2024 Non-Interest Expense $ 38,399 $ 56,806 $ 80,322 $ 123,329 $ 21,608 $ 33,499 $ 42,501 $ 70,197 OREO Valuation Allowance & Expenses (56) (2) (44) 2 — — 1 — Amortization of Intangible Assets (533) (734) (1,988) (6,105) (435) (2,569) (876) (5,145) Merger Expenses — (8,530) (2,098) (17,356) (1,197) — (1,888) — Credit Card Fraud Losses1 — — — — — — — (4,323) Adjusted Non-Interest Expense (Numerator) $ 37,810 $ 47,540 $ 76,192 $ 99,870 $ 19,976 $ 30,930 $ 39,738 $ 60,729 Net Interest Income $ 52,597 $ 64,130 $ 101,302 $ 135,307 $ 22,494 $ 42,140 $ 48,158 $ 83,275 Taxable-equivalent adjustment 141 121 155 253 51 82 92 161 Taxable-equivalent net interest income $ 52,738 $ 64,251 $ 101,457 $ 135,560 $ 22,545 $ 42,222 $ 48,250 $ 83,436 Non-Interest Income $ 10,749 $ 13,498 $ 23,086 $ 33,159 $ 5,294 $ 8,440 $ 10,628 $ 15,007 Investment securities losses (gains) — — — 2,166 — — — — Bargain purchase gain — — — (8,816) — — — — Adjusted noninterest income $ 10,749 $ 13,498 $ 23,086 $ 26,509 $ 5,294 $ 8,440 $ 10,628 $ 15,007 Operating Revenue (Denominator) $ 63,487 $ 77,749 $ 124,543 $ 162,069 $ 27,839 $ 50,662 $ 58,878 $ 98,443 Average Assets $ 1,709,997 $ 2,317,597 $ 3,444,981 $ 4,663,539 $ 3,596,311 $ 5,839,328 $ 3,551,573 $ 5,807,076 Reported Efficiency Ratio 60.6 % 73.2 % 64.6 % 73.2 % 77.8 % 66.2 % 72.3 % 71.4 % Efficiency Ratio 59.6 % 61.2 % 61.2 % 61.6 % 71.8 % 61.1 % 67.5 % 61.7 % Reported Non-interest Expense/Average Assets 2.25 % 2.45 % 2.33 % 2.64 % 2.41 % 2.31 % 2.41 % 2.43 % Operating Non-interest Expense/Average Assets 2.21 % 2.05 % 2.21 % 2.14 % 2.23 % 2.13 % 2.26 % 2.10 % Reported Net Operating Expense/Average Assets2 1.62 % 1.87 % 1.66 % 1.93 % 1.82 % 1.73 % 1.81 % 1.91 % Operating Net Operating Expense/Average Assets2 1.58 % 1.47 % 1.54 % 1.57 % 1.64 % 1.55 % 1.65 % 1.58 % 1Noninterest expense in the first six months of 2024 included a $4.3 million related to an isolated credit card fraud incident. Our investigation determined that no information systems of the Bank were compromised, and no employee fraud was involved. 2 Net operating expense is non-interest expense offset by non-interest income.

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation We believe core net interest margin, which reflects our net interest margin before the impact of U.S. SBA PPP loan interest and average balances, accretion interest on acquired loans and prepayment penalties of long-term debt, allows investors to better assess our net interest margin in relation to our core net interest margin by removing the volatility associated with volatility and temporary interest income and interest expense for comparable institutions. We also believe that during a crisis such as the COVID-19 pandemic, this information is useful as the impact of the pandemic on net interest income of various institutions will likely vary based on the geography of the communities served by a particular institution. 22 Net Interest Margin ("NIM") and Core NIM1 (dollars in thousands) For the Years Ended Three Months Ended Six Months Ended 2020 2021 2022 2023 06/30/2023 06/30/2024 06/30/2023 06/30/2024 Average Interest-Earning Assets ("IEAs") $ 1,611,004 $ 2,185,123 $ 3,220,672 $ 4,356,855 $ 3,369,183 $ 5,459,961 $ 3,324,682 $ 5,423,871 Adjusted Average IEAs $ 1,611,004 $ 2,185,123 $ 3,220,672 $ 4,356,855 $ 3,369,183 $ 5,459,961 $ 3,324,682 $ 5,423,871 Net Interest Income $ 52,597 $ 64,130 $ 101,302 $ 135,307 $ 22,549 $ 42,222 $ 48,250 $ 83,436 Less: Accretion Interest (330) (440) (1,902) (9,392) (342) (3,803) (736) (7,410) Adjusted Net Interest Income $ 52,267 $ 63,690 $ 99,400 $ 125,915 $ 22,207 $ 38,419 $ 47,514 $ 76,026 NIM 3.27 % 2.94 % 3.15 % 3.11 % 2.68 % 3.11 % 2.93 % 3.09 % Core NIM 3.24 % 2.91 % 3.09 % 2.89 % 2.64 % 2.83 % 2.88 % 2.82 % 1 Core NIM excludes net accretion income.

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation We believe core net interest margin, which reflects our net interest margin before the impact of U.S. SBA PPP loan interest and average balances, accretion interest on acquired loans and prepayment penalties of long-term debt, allows investors to better assess our net interest margin in relation to our core net interest margin by removing the volatility associated with volatility and temporary interest income and interest expense for comparable institutions. We also believe that during a crisis such as the COVID-19 pandemic, this information is useful as the impact of the pandemic on net interest income of various institutions will likely vary based on the geography of the communities served by a particular institution. 23 Net Interest Margin ("NIM") and Core NIM1 (dollars in thousands) For the Quarters Ended 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 Average Interest-Earning Assets ("IEAs") $ 3,210,233 $ 3,206,591 $ 3,279,686 $ 3,369,183 $ 5,404,572 $ 5,339,833 $ 5,387,782 $ 5,459,961 Less: Average SBA PPP Loans — — — — — — — — Adjusted Average IEAs $ 3,210,233 $ 3,206,591 $ 3,279,686 $ 3,369,183 $ 5,404,572 $ 5,339,833 $ 5,387,782 $ 5,459,961 Net Interest Income $ 27,351 $ 26,943 $ 25,705 $ 22,494 $ 45,622 $ 41,525 $ 41,135 $ 42,140 Less: Accretion Interest (454) (666) (683) (53) (4,447) (2,751) (3,607) (3,803) Adjusted Net Interest Income $ 26,897 $ 26,277 $ 25,022 $ 22,441 $ 41,175 $ 38,774 $ 37,528 $ 38,337 NIM 3.38 % 3.35 % 3.18 % 2.68 % 3.35 % 3.09 % 3.08 % 3.11 % Core NIM 3.32 % 3.25 % 3.09 % 2.67 % 3.02 % 2.88 % 2.80 % 2.82 % 1 Core NIM excludes net accretion income.

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation During 2023, our operating results were impacted by one-time expenses related to the merger equal with The Community Financial Corporation ("TCFC"). We believe that investors would benefit from analyzing our profitability and expense metrics excluding this one-time item. 24 (dollars in thousands, except share data) For the Years Ended Three Months Ended Six Months Ended 2020 2021 2022 2023 6/30/2023 06/30/2024 6/30/2023 06/30/2024 Net Income (as reported) $ 15,730 $ 15,368 $ 31,177 $ 11,228 $ 4,018 $ 11,234 $ 10,475 $ 19,418 Amortization of Intangible Assets, net of tax 398 533 1,471 4,254 317 1,924 637 3,903 Merger Expenses, net of tax — 6,189 1,552 11,637 872 — 1,373 — Credit Card Fraud Losses, net of tax — — — — — — — 3,279 Non-GAAP Operating Net Income $ 16,128 $ 22,090 $ 34,200 $ 27,119 $ 5,207 $ 13,158 $ 12,485 $ 26,600 Reported Return on Average Assets 0.92 % 0.66 % 0.90 % 0.24 % 0.45 % 0.77 % 0.59 % 0.67 % Operating Return on Average Assets 0.94 % 0.95 % 0.99 % 0.58 % 0.58 % 0.91 % 0.71 % 0.92 % Reported Return on Average Common Equity 7.95 % 6.86 % 8.76 % 2.54 % 4.44 % 8.70 % 5.83 % 7.54 % Operating Return on Average Common Equity 9.04 % 11.24 % 11.96 % 7.74 % 7.08 % 12.85 % 8.57 % 13.08 % Reported Diluted Earnings Per Share $ 1.27 $ 1.17 $ 1.57 $ 0.42 $ 0.20 $ 0.34 $ 0.53 $ 0.58 Operating Diluted Earnings Per Share $ 1.30 $ 1.68 $ 1.72 $ 1.02 $ 0.26 $ 0.40 $ 0.63 $ 0.80 Average Assets $ 1,709,997 $ 2,317,597 $ 3,444,981 $ 4,663,539 $ 3,596,311 $ 5,839,328 $ 3,551,573 $ 5,807,076 Average Equity $ 197,969 $ 224,055 $ 355,850 $ 441,790 $ 363,225 $ 519,478 $ 362,205 $ 517,727 Average Goodwill and Core Deposit Intangible (19,498) (27,535) (69,845) (91,471) (68,172) (107,594) (68,388) (108,881) Average Tangible Equity $ 178,471 $ 196,520 $ 286,005 $ 350,319 $ 295,053 $ 411,884 $ 293,817 $ 408,846 Weighted Average Common Shares Outstanding 12,380,000 13,119,000 19,847,000 26,572,000 19,903,000 33,215,000 19,895,000 33,337,000

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation ‘‘Tangible common equity (or “TCE”)” is defined as stockholders’ equity less preferred equity and intangible assets. “Tangible assets (or “TA”)” are defined as total assets less intangible assets. We believe that the TCE/TA and the Return on Average Tangible Equity (“ROATCE”) ratios are important to many investors in the marketplace who are interested in changes from period to period exclusive of changes in preferred equity and intangible assets. Our calculation of ROATCE excludes the amortization of core deposits and merger costs. 25 Common Equity to Assets and TCE to TA Return on Average Common Equity ("ROACE") and Return on Average Tangible Common Equity ("ROATCE") (dollars in thousands, except share data) For the Years Ended Year to Date 2020 2021 2022 2023 6/30/2023 06/30/2024 Stockholders' Equity $ 195,019 $ 350,693 $ 364,285 $ 511,135 $ 363,140 $ 522,783 Intangible Assets (19,237) (70,956) (68,813) (111,356) (67,937) (106,211) Tangible Common Equity $ 175,782 $ 279,737 $ 295,472 $ 399,779 $ 295,203 $ 416,572 Total Assets $ 1,933,315 $ 3,460,136 $ 3,477,276 $ 6,010,918 $ 3,641,631 $ 5,864,017 Intangible Assets (19,237) (70,956) (68,813) (111,356) (67,937) (106,211) Tangible Assets $ 1,914,078 $ 3,389,180 $ 3,408,463 $ 5,899,562 $ 3,573,694 $ 5,757,806 Shares Outstanding 11,783,380 19,807,533 19,864,956 33,161,532 19,907,000 33,214,522 Common Equity to Assets 10.09 % 10.14 % 10.48 % 8.50 % 9.97 % 8.92 % Tangible Common Equity/Tangible Assets 9.18 % 8.25 % 8.67 % 6.78 % 8.26 % 7.23 % (dollars in thousands, except share data) For the Years Ended Three Months Ended Six Months Ended 2020 2021 2022 2023 6/30/2023 06/30/2024 6/30/2023 06/30/2024 Net Income (as reported) $ 15,730 $ 15,368 $ 31,177 $ 11,228 $ 4,018 $ 11,234 $ 10,475 $ 19,418 Amortization of Intangible Assets, net of tax 398 548 1,471 4,254 317 1,924 637 3,903 Merger Expenses, net of tax — 6,363 1,552 11,637 872 — 1,373 — Credit Card Fraud Losses, net of tax — — — — — — — 3,279 Non-GAAP Operating Net Income $ 16,128 $ 22,279 $ 34,200 $ 27,119 $ 5,207 $ 13,158 $ 12,485 $ 26,600 ROACE 7.95 % 6.86 % 8.76 % 2.54 % 4.44 % 8.70 % 5.83 % 7.54 % ROATCE 9.04 % 11.34 % 11.96 % 7.74 % 7.08 % 12.85 % 8.57 % 13.08 % Average Common Equity $ 197,969 $ 224,055 $ 355,850 $ 441,790 $ 363,225 $ 519,478 $ 362,205 $ 517,727 Average Tangible Common Equity $ 178,474 $ 196,520 $ 286,005 $ 350,319 $ 295,053 $ 411,884 $ 293,817 $ 408,846

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Non-GAAP Reconciliation We believe that pre-tax pre-provision income, which reflects our profitability before income taxes and loan loss provisions, allows investors to better assess our operating income and expenses in relation to our core operating revenue by removing the volatility that is associated with credit provisions and different state income tax rates for comparable institutions. We also believe that during a crisis such as the COVID-19 pandemic, this information is useful as the impact of the pandemic on the loan loss provisions of various institutions will likely vary based on the geography of the communities served by a particular institution. 26 Pre-Tax Pre-Provision ROAA, ROAE and ROATCE (dollars in thousands) For the Years Ended Three Months Ended Six Months Ended 2020 2021 2022 2023 6/30/2023 06/30/2024 6/30/2023 06/30/2024 Net Income (as reported) $ 15,730 $ 15,368 $ 31,177 $ 11,228 $ 4,018 $ 11,234 $ 10,475 $ 19,418 Provision for Credit Losses and Unfunded Commitments 3,900 (358) 1,925 30,953 667 2,081 1,880 2,488 Income Taxes 5,317 5,812 10,964 2,956 1,495 3,766 3,930 6,179 Non-GAAP PTPP Income $ 24,947 $ 20,822 $ 44,066 $ 45,137 $ 6,180 $ 17,081 $ 16,285 $ 28,085 PTPP ROAA 1.46 % 0.90 % 1.28 % 0.97 % 0.69 % 1.18 % 0.92 % 0.97 % PTPP ROACE 12.60 % 9.29 % 12.38 % 10.22 % 6.82 % 13.22 % 9.07 % 10.91 % PTPP ROATCE 13.98 % 10.60 % 15.41 % 12.88 % 8.40 % 16.68 % 11.18 % 13.81 % Average Assets $ 1,709,997 $ 2,317,597 $ 3,444,981 $ 4,663,539 $ 3,596,311 $ 5,839,328 $ 3,551,573 $ 5,807,076 Average Equity $ 197,969 $ 224,055 $ 355,850 $ 441,790 $ 363,225 $ 519,478 $ 362,205 $ 517,727 Average Tangible Common Equity $ 178,474 $ 196,520 $ 286,005 $ 350,319 $ 295,053 $ 411,884 $ 293,817 $ 408,846

#006881 #ACC0C6 #83AFB4 #FEBE10 #5F574F #4D4F53 #C75B12 #5B8F22 #593160 Investor Presentation Second Quarter 2024 NASDAQ: SHBI Parent of: Shore Bancshares, Inc. is the largest independent financial holding company headquartered on the Eastern Shore of Maryland. It is the parent company of Shore United Bank, N.A. The Bank operates 30 full-service branches in Baltimore County, Howard County, Kent County, Queen Anne’s County, Caroline County, Talbot County, Dorchester County, Anne Arundel County and Worcester County in Maryland, Kent County and Sussex County in Delaware and in Accomack County, Virginia. The Company engages in trust and wealth management services through Wye Financial Partners, a division of Shore United Bank, N.A. The Company also engages in title work for real estate transactions through Mid-Maryland Title Company, Inc. (“Title Company”). As a result of the acquisition of TCFC, which was effective July 1, 2023, the Bank now operates 41 full-service branches in the above locations as well as Calvert County, St Mary’s County, and Charles County in Maryland and Fredericksburg City and Spotsylvania County in Virginia. © 2024 Shore Bancshares, Inc.