false000178332800017833282025-03-052025-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported) |

March 5, 2025 |

|

TSCAN THERAPEUTICS, INC. (Exact name of registrant as specified in its charter) |

|

|

|

|

|

Delaware |

001-40603 |

82-5282075 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

830 Winter Street |

|

Waltham, Massachusetts |

|

02451 |

(Address of principal executive offices) |

|

(Zip Code) |

|

|

Registrant’s telephone number, including area code |

857 399-9500 |

|

Not Applicable (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Voting Common Stock, par value $0.0001 per share |

|

TCRX |

|

The Nasdaq Global Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 5, 2025, TScan Therapeutics, Inc. issued a press release announcing its financial results for the fourth quarter and fiscal year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall neither be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit relating to Item 2.02 shall be deemed to be furnished, and not filed:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TScan Therapeutics, Inc. |

|

|

|

|

Date: |

March 5, 2025 |

By: |

/s/ Gavin MacBeath |

|

|

|

Gavin MacBeath, Ph.D

Chief Executive Officer

(Principal Executive Officer) |

TScan Therapeutics Reports Fourth Quarter and Full Year 2024 Financial Results and Provides Business Update

Presented updated data from ongoing ALLOHA™ Phase 1 heme trial at the 66th ASH Annual Meeting and Exposition

IND application cleared for seventh TCR in PLEXI-T™ Phase 1 solid tumor program; TSC-202-A0201 targeting MAGE-A4 on HLA-A*02:01

Closed $30 million registered direct offering at 37% premium with long-standing, supportive shareholder

Cash, cash equivalents, and marketable securities continue to fund operations into the first quarter of 2027

WALTHAM, Mass., Mar. 5, 2025 -- TScan Therapeutics, Inc. (Nasdaq: TCRX), a clinical-stage biotechnology company focused on the development of T cell receptor (TCR)-engineered T cell (TCR-T) therapies for the treatment of patients with cancer, today reported financial results for the three months and full year ended December 31, 2024, and provided a business update.

“The progress we achieved across our pipeline in 2024 has paved the way for a transformative year ahead. We are encouraged by the ALLOHA™ heme data presented at ASH with only 2 of 26 patients having relapsed compared to 4 of 12 control-arm subjects. We look forward to presenting additional data from the Phase 1 trial by the end of the year, including two-year relapse data on the initial patients,” said Gavin MacBeath, Ph.D., Chief Executive Officer. “For the PLEXI-T™ solid tumor program, we continue to enroll patients investigating seven different TCR-Ts, including the recently added MAGE-A4 TCR-T (TSC-202-A0201). We look forward to treating our first patient with multiplex therapy in the first half of 2025 and sharing safety and response data for multiplex therapy in the second half of the year.”

Recent Corporate Highlights

•The Company recently presented updated results from the ongoing ALLOHA trial of TSC-100 and TSC-101 at the 66th American Society of Hematology (ASH) Annual Meeting and Exposition.

oInfusions with TSC-100 and TSC-101 were well-tolerated with no dose limiting toxicities and adverse events were consistent with hematopoietic cell transplantation (HCT).

oTSC-100 and TSC-101 TCR-T cells have been detected >1 year post infusion and have a clear dose-persistence relationship.

o2 of 26 (8%) treatment-arm subjects relapsed as compared to 4 of 12 (33%) control-arm subjects.

▪Median time to relapse was not evaluable in TCR-T-treated subjects vs 160 days in the control arm.

▪Event-free survival strongly favors the treatment arm (HR=0.30).

•In December 2024, the Company refinanced its previous convertible debt facility maturing in 2026 with a non-dilutive term loan for up to $52.5 million from Silicon Valley Bank (SVB), a division of First Citizens Bank, of which $32.5 million was drawn at closing. The SVB term loan allows for monthly interest-only payments through September 30, 2027, and matures on September 1, 2029.

•In December 2024, the Company completed a $30 million registered direct offering with Lynx1 Capital Management LP (Lynx1), a large existing shareholder of the Company, and an investment fund advised by Lynx1, for pre-funded warrants to purchase up to 7,500,000 shares of the Company’s voting common stock at a price of $4.00 per pre-funded warrant, representing a premium of 37% to the previous closing price of TScan Therapeutics’ common stock. Net proceeds from the offering extended the Company’s cash runway into the first quarter of 2027.

•The Company announced that it has been named one of the Top Places to Work in Massachusetts for the third consecutive year in the 17th annual, employee-based survey from The Boston Globe. The 2024 Top Places to Work issue can be found online at Globe.com/TopPlaces.

Upcoming Anticipated Milestones

Heme Malignancies Program: TScan’s two lead TCR-T therapy candidates, TSC-100 and TSC-101, are designed to treat residual disease and prevent relapse in patients with acute myeloid leukemia (AML), acute lymphoblastic leukemia (ALL), or myelodysplastic syndrome (MDS) undergoing allogeneic HCT (the ALLOHA trial, NCT05473910).

•Opened expansion cohorts at dose level 3 to further characterize safety and evaluate translational and efficacy endpoints.

•Plans to continue development of TSC-101 only, as TSC-101 enables treatment of ~98% of patients with HLA type A*02:01.

•Initiate a registration trial for TSC-101, pending further feedback from regulatory authorities, in the second half of 2025.

•Plans to present additional data from the Phase 1 trial by the end of the year, including two-year relapse data on the initial patients.

•Plans to file an investigational new drug (IND) application for TSC-102-A0301, a TCR-T targeting CD45 on HLA-A*03:01, in the second half of 2025.

Solid Tumor Program: TScan continues to expand the ImmunoBank, a collection of TCR-T therapy candidates that target different cancer-associated antigens presented on diverse HLA types. TScan’s strategy is to treat patients with multiple TCR-T therapy candidates to overcome tumor heterogeneity and resistance that may arise from either target or HLA loss (the PLEXI-T trial, NCT05973487).

•IND filing for TCR targeting MAGE-A4 on HLA-A*02:01 (TSC-202-A0201) recently cleared by U.S. Food and Drug Administration (FDA).

•The Company now has seven TCR-Ts cleared for clinical development in its PLEXI-T Phase 1 trial.

•Progressing through initial dose levels across the TCR-T therapy candidates.

•Plans to dose first patient with multiplex TCR-T therapy in the first half of 2025.

•Safety and response data for multiplex TCR-T therapy anticipated in the second half of 2025.

Financial Results

Revenue: Revenue for the fourth quarter of 2024 was $0.7 million, compared to $7.2 million for the fourth quarter of 2023, and $2.8 million for the full-year 2024, compared to $21.0 million for the full-year 2023. The decrease in both periods was primarily due to timing of research activities pursuant to the Company’s collaboration

agreement with Amgen which commenced in May 2023 compared to the collaboration and license agreement with Novartis which ended in March 2023.

R&D Expenses: Research and development (R&D) expenses for the fourth quarter of 2024 were $29.4 million, compared to $22.4 million for the fourth quarter of 2023, and $107.4 million for the full-year 2024, compared to $88.2 million for the full-year 2023. The period over period increases were primarily driven by an increase in clinical studies expense associated with the ongoing enrollment of our ALLOHA Phase 1 heme trial and start-up activities and initial enrollment in our PLEXI-T Phase 1 solid tumor clinical trial, as well as an increase in personnel expenses due to additional headcount in support of our expanded research and development activities. R&D expenses included non-cash stock compensation expense of $1.3 million and $0.9 million for the fourth quarter of 2024 and 2023, respectively, and $4.8 million and $2.9 million for the full-year 2024 and 2023, respectively.

G&A Expenses: General and administrative (G&A) expenses for the fourth quarter of 2024 were $8.0 million, compared to $6.2 million for the fourth quarter of 2023, and $30.3 million for the full-year 2024, compared to $26.4 million for the full-year 2023. The period over period increases were primarily driven by an increase in personnel expenses due to increased headcount to support business activities. G&A expenses included non-cash stock compensation expense of $1.4 million and $0.6 million for the fourth quarter of 2024 and 2023, respectively, and $4.7 million and $2.3 million for the full-year 2024 and 2023, respectively.

Net Loss: Net loss was $35.8 million for the fourth quarter of 2024, compared to $19.6 million for the fourth quarter of 2023, and included net interest income of $2.0 million and $1.7 million, respectively. Net loss for the full-year 2024 was $127.5 million, compared to $89.2 million for the full-year 2023, and included net interest income of $8.4 million and $4.2 million, respectively. Net loss for the fourth quarter of 2024 and full-year 2024 included a $1.1 million loss on extinguishment of debt.

Cash Position: Cash, cash equivalents, and marketable securities as of December 31, 2024 were $290.1 million, excluding $5.0 million of restricted cash. The Company believes that its existing cash resources will be sufficient to fund its current operating plan into the first quarter of 2027.

Share Count: As of December 31, 2024, the Company had issued and outstanding shares of 56,590,627, which consists of 52,314,039 shares of voting common stock and 4,276,588 shares of non-voting common stock, and outstanding pre-funded warrants to purchase 73,087,945 shares of voting common stock at an exercise price of $0.0001 per share.

About TScan Therapeutics, Inc.

TScan is a clinical-stage biotechnology company focused on the development of T cell receptor (TCR)-engineered T cell (TCR-T) therapies for the treatment of patients with cancer. The Company’s lead TCR-T therapy candidates are in development for the treatment of patients with hematologic malignancies to prevent relapse following allogeneic hematopoietic cell transplantation (the ALLOHA™ Phase 1 heme trial). The Company has developed and continues to expand its ImmunoBank, the Company’s repository of therapeutic TCRs that recognize diverse targets and are associated with multiple HLA types, to provide customized multiplex TCR-T therapies for patients with a variety of cancers (the PLEXI-T™ Phase 1 solid tumor trial). The Company is currently enrolling patients into both clinical programs.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, express or implied statements regarding the Company’s plans, progress, expectations, and timing relating to the Company’s hematologic malignancies program, including clinical updates of the ALLOHA Phase 1 heme trial, presentation of data, opening of expansion cohorts, filing of an IND for TSC-102-A0301, and initiation of registrational trials; the Company’s plans, progress, expectations, and timing relating to the Company’s solid tumor program, including clinical updates of the PLEXI-T Phase 1 solid tumor trial,

enrolling and dosing patients, and presentation of data; the progress of the hematologic malignancies and solid tumor programs being indicative or predictive of the success of each program; the Company’s current and future research and development plans or expectations; the structure, timing and success of the Company’s planned preclinical development, submission of INDs, and clinical trials; the potential benefits of any of the Company’s proprietary platforms, multiplexing, or current or future product candidates in treating patients; the Company’s ability to fund its operating plan into the first quarter of 2027 with its existing cash, cash equivalents, and marketable securities; and the Company’s goals, strategy and anticipated financial performance. TScan intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terms such as, but not limited to, “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “target,” “design,” “estimate,” “predict,” “potential,” “plan,” “on track,” or similar expressions or the negative of those terms. Such forward-looking statements are based upon current expectations that involve risks, changes in circumstances, assumptions, and uncertainties. The express or implied forward-looking statements included in this release are only predictions and are subject to a number of risks, uncertainties and assumptions, including, without limitation: the beneficial characteristics, safety, efficacy, therapeutic effects and potential advantages of TScan’s TCR-T therapy product candidates; TScan’s expectations regarding its preclinical studies being predictive of clinical trial results; TScan’s approved INDs being indicative or predictive of bringing TScan closer to its goal of providing customized TCR-T therapies to treat patients with cancer; the timing of the launch, initiation, progress, expected results and announcements of TScan’s preclinical studies, clinical trials and its research and development programs; TScan’s ability to enroll patients for its clinical trials within its expected timeline; TScan’s plans relating to developing and commercializing its TCR-T therapy product candidates, if approved, including sales strategy; estimates of the size of the addressable market for TScan’s TCR-T therapy product candidates; TScan’s manufacturing capabilities and the scalable nature of its manufacturing process; TScan’s estimates regarding expenses, future milestone payments and revenue, capital requirements and needs for additional financing; TScan’s expectations regarding competition; TScan’s anticipated growth strategies; TScan’s ability to attract or retain key personnel; TScan’s ability to establish and maintain development partnerships and collaborations; TScan’s expectations regarding federal, state and foreign regulatory requirements; TScan’s ability to obtain and maintain intellectual property protection for its proprietary platform technology and our product candidates; the sufficiency of TScan’s existing capital resources to fund its future operating expenses and capital expenditure requirements; and other factors that are described in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of TScan’s most recent Annual Report on Form 10-K and any other filings that TScan has made or may make with the SEC in the future. Any forward-looking statements contained in this release represent TScan’s views only as of the date hereof and should not be relied upon as representing its views as of any subsequent date. Except as required by law, TScan explicitly disclaims any obligation to update any forward-looking statements.

Contacts

Heather Savelle

TScan Therapeutics, Inc.

VP, Investor Relations

857-399-9840

hsavelle@tscan.com

Maghan Meyers

Argot Partners

212-600-1902

TScan@argotpartners.com

|

|

|

|

|

|

|

|

|

TScan Therapeutics, Inc. |

|

Condensed Consolidated Balance Sheet Data |

|

(unaudited, in thousands, except share amount) |

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

178,689 |

|

|

$ |

133,359 |

|

Other assets |

|

|

192,429 |

|

|

|

138,790 |

|

Total assets |

|

$ |

371,118 |

|

|

$ |

272,149 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Total liabilities |

|

$ |

130,148 |

|

|

$ |

121,282 |

|

Total stockholders' equity |

|

|

240,970 |

|

|

|

150,867 |

|

Total liabilities and stockholders' deficit |

|

$ |

371,118 |

|

|

$ |

272,149 |

|

Common stock and pre-funded warrants outstanding (1) |

|

|

129,678,572 |

|

|

|

94,840,055 |

|

|

|

|

|

|

|

|

(1) Includes at December 31, 2024 and 2023, respectively, 73,087,945 and 47,010,526 issued and outstanding pre-funded warrants to purchase shares of voting common stock at an exercise price of $0.0001 per share. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TScan Therapeutics, Inc. |

|

Condensed Consolidated Statements of Operations |

|

(unaudited, in thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration and license revenue |

|

$ |

665 |

|

|

$ |

7,211 |

|

|

$ |

2,816 |

|

|

$ |

21,049 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

29,354 |

|

|

|

22,407 |

|

|

|

107,350 |

|

|

|

88,153 |

|

General and administrative |

|

|

8,023 |

|

|

|

6,161 |

|

|

|

30,287 |

|

|

|

26,354 |

|

Total operating expenses |

|

|

37,377 |

|

|

|

28,568 |

|

|

|

137,637 |

|

|

|

114,507 |

|

Loss from operations |

|

|

(36,712 |

) |

|

|

(21,357 |

) |

|

|

(134,821 |

) |

|

|

(93,458 |

) |

Interest and other income, net |

|

|

2,777 |

|

|

|

2,596 |

|

|

|

12,065 |

|

|

|

7,999 |

|

Interest expense |

|

|

(784 |

) |

|

|

(852 |

) |

|

|

(3,653 |

) |

|

|

(3,759 |

) |

Loss on extinguishment of debt |

|

|

(1,090 |

) |

|

|

- |

|

|

|

(1,090 |

) |

|

|

- |

|

Net loss |

|

$ |

(35,809 |

) |

|

$ |

(19,613 |

) |

|

$ |

(127,499 |

) |

|

$ |

(89,218 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.30 |

) |

|

$ |

(0.21 |

) |

|

$ |

(1.14 |

) |

|

$ |

(1.36 |

) |

Weighted average common shares outstanding—basic and diluted (2) |

|

|

120,789,625 |

|

|

|

94,835,735 |

|

|

|

111,990,417 |

|

|

|

65,599,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) The calculation of weighted average common shares outstanding-basic and diluted includes 73,087,945 shares of the Company's voting common stock issuable upon exercise of pre-funded warrants for the three and twelve months ended December 31, 2024, and includes 47,010,526 shares of the Company's voting common stock issuable upon exercise of pre-funded warrants for the three and twelve months ended December 31, 2023. |

|

|

|

|

|

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

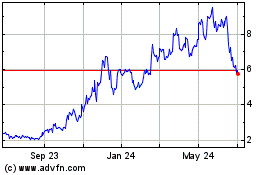

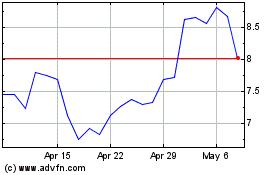

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Mar 2024 to Mar 2025