0000864749false00008647492024-08-162024-08-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 16, 2024

Trimble Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-14845 | | 94-2802192 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

I.D. No.) |

10368 Westmoor Drive, Westminster, CO 80021

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (720) 887-6100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | TRMB | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As previously disclosed in a Form 12b-25 Notification of Late Filing filed by Trimble Inc. (the “Company”) on August 7, 2024 (the “Q2 Form 12b-25”), the Company is delayed in filing its Quarterly Report on Form 10-Q for the period ended June 28, 2024 (the “Q2 Form 10-Q”) with the U.S. Securities and Exchange Commission (the “SEC”).

On August 16, 2024, the Company received a notice (the “Q2 Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”), notifying the Company that, because the Company is delinquent in filing its Q2 Form 10-Q, the Company is not in compliance with Nasdaq Listing Rule 5250(c)(1) (the “Listing Rule”), which requires companies with securities listed on Nasdaq to timely file all required periodic reports with the SEC. The Company has until August 31, 2024 to submit an update to the plan of compliance previously submitted to Nasdaq, and, following receipt of such update, Nasdaq may grant an extension for the Company to regain compliance. The Q2 Notice has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Global Select Market.

As previously disclosed on a Current Report on Form 8-K filed with the SEC on May 17, 2024, the Company had received a notice from Nasdaq indicating that as a result of not having timely filed its Quarterly Report on Form 10-Q for the period ended March 29, 2024 (the “Q1 Form 10-Q”), the Company was not in compliance with the Listing Rule (the “Q1 Notice”). The Company has timely submitted a plan to regain compliance in response to the Q1 Notice. On August 16, 2024, Nasdaq granted the Company the full requested extension until November 11, 2024 to regain compliance. The Company intends to take the necessary steps to regain compliance with the Listing Rule as soon as practicable.

Item 7.01. Regulation FD Disclosure.

On August 21, 2024, the Company issued a press release disclosing the receipt of the Q2 Notice. A copy of the press release is being furnished herewith as Exhibit 99.1.

The information furnished in this Item 7.01 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

This document and the exhibits contain forward-looking statements within the meaning of Section 21E of the Exchange Act, as amended, which are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the timing and expectations regarding the Company’s and Ernst & Young LLP’s (“EY”) assessment process and the filing of the Q1 Form 10-Q and Q2 Form 10-Q, statements relating to the Company’s plan to regain compliance with Nasdaq’s listing rules, as well as all statements that are not historical facts. These forward-looking statements are subject to change, and actual results may materially differ from those set forth in this Current Report due to certain risks and uncertainties. Factors that could cause or contribute to changes in such forward-looking statements include, but are not limited to, the expected timing and results of EY’s completion of its additional audit procedures; the risk that the completion and filing of the Q1 Form 10-Q and Q2 Form 10-Q will take longer than expected; uncertainties about the timing of the Company’s submission of an update to the previously submitted compliance plan; Nasdaq’s acceptance of any such update; the duration of any extension that may be granted by Nasdaq; and the risk that the Company will be unable to meet Nasdaq’s continued listing requirements. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements set forth in reports filed with the SEC, including the Company’s current reports on Form 8-K, quarterly reports on Form 10-Q and its annual report on Form 10-K, such as statements regarding changes in economic conditions and the impact of competition. Undue reliance should not be placed on any forward-looking statement contained herein. These statements reflect the Company’s position as of the date of this Current Report. The Company expressly disclaims any undertaking to release publicly any updates or revisions to any statements to reflect any change in the Company’s expectations or any change of events, conditions, or circumstances on which any such statement is based.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | The cover page from this Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | TRIMBLE INC. |

| | a Delaware corporation |

| | | | |

| | | | |

| Date: August 21, 2024 | By: | /s/ Phillip Sawarynski | |

| | Phillip Sawarynski | |

| | | Chief Financial Officer | |

Trimble receives expected notification of deficiency from Nasdaq related to delayed filing of quarterly report on Form 10-Q

Westminster, CO, August 21, 2024 – Trimble Inc. (NASDAQ: TRMB) (the “Company”) today announced that it received an expected deficiency notification letter from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) on August 16, 2024 (the “Q2 Notice”). The Q2 Notice indicated that the Company is not in compliance with Nasdaq Listing Rule 5250(c)(1) (the “Listing Rule”) as a result of its failure to timely file its Quarterly Report on Form 10-Q for the period ended June 28, 2024 (the “Q2 Form 10-Q”), as described more fully in the Company's Form 12b-25 Notification of Late Filing (the “Q2 Form 12b-25”) filed with the Securities and Exchange Commission (the “SEC”) on August 7, 2024. The Listing Rule requires Nasdaq-listed companies to timely file all required periodic reports with the SEC.

The Company has until August 31, 2024 to submit an update to the plan of compliance previously submitted to Nasdaq, and, following receipt of such update, Nasdaq may grant an extension for the Company to regain compliance. The Q2 Notice has no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Global Select Market.

As previously disclosed on a Current Report on Form 8-K filed with the SEC on May 17, 2024, the Company had received a notice from Nasdaq indicating that as a result of not having timely filed its Quarterly Report on Form 10-Q for the period ended March 29, 2024 (the “Q1 Form 10-Q”), the Company was not in compliance with the Listing Rule (the “Q1 Notice”). The Company has timely submitted a plan to regain compliance in response to the Q1 Notice. On August 16, 2024, Nasdaq granted the Company the full requested extension until November 11, 2024 to regain compliance. The Company intends to take the necessary steps to regain compliance with the Listing Rule as soon as practicable.

Safe Harbor Statement

Certain statements made in this press release are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. These statements include statements regarding the timing and expectations regarding the Company’s and Ernst & Young LLP’s (“EY”) assessment process and the filing of the Q1 Form 10-Q and Q2 Form 10-Q, statements relating to the Company’s plan to regain compliance with Nasdaq’s listing rules, as well as all statements that are not historical facts. These forward-looking statements are subject to change, and actual results may materially differ from those set forth in this Current Report due to certain risks and uncertainties. Factors that could cause or contribute to changes in such forward-looking statements include, but are not limited to, the expected timing and results of EY’s completion of its additional audit procedures; the risk that the completion and filing of the Q1 Form 10-Q and Q2 Form 10-Q will take longer than expected; uncertainties about the timing of the Company’s submission of an update to the previously submitted compliance plan; Nasdaq’s acceptance of any such update; the duration of any extension that may be granted by Nasdaq; and the risk that the Company will be unable to meet Nasdaq’s continued listing requirements. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements set forth in reports filed with the SEC, including the Company’s current reports on Form 8-K, quarterly reports on Form 10-Q and its annual report on Form 10-K, such as statements regarding changes in economic conditions and the impact of competition. Undue reliance should not be placed on any forward-looking statement contained herein. These statements reflect the Company’s position as of the date of this Current Report. The Company expressly disclaims any undertaking to release publicly any updates or revisions to any statements to reflect any change in the Company’s expectations or any change of events, conditions, or circumstances on which any such statement is based.

About Trimble

Trimble is transforming the ways people move, build and live. Core technologies in positioning, modeling and data analytics connect the digital and physical worlds to improve our customers' productivity, quality, safety, transparency and sustainability. For more information about Trimble (NASDAQ: TRMB), visit: www.trimble.com.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

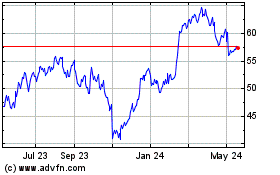

Trimble (NASDAQ:TRMB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Trimble (NASDAQ:TRMB)

Historical Stock Chart

From Nov 2023 to Nov 2024