OHA is Administrative Agent & Lead Left Arranger of Private Unitranche Financing Supporting Carlyle’s Acquisition of Worldpac

10 September 2024 - 6:14AM

Oak Hill Advisors (“OHA”) served as Administrative Agent and Lead

Left Arranger of a private unitranche facility to support Carlyle’s

acquisition of Worldpac, Inc. (“Worldpac”), a formerly fully owned

subsidiary of Advance Auto Parts, Inc. Worldpac is a national

distributor of original equipment and quality aftermarket

replacement automotive parts, primarily to independent service

professionals. OHA provided the entire unitranche financing

facility, while its private credit joint venture partner BMO

Capital Markets served as Administrative Agent on the company’s

asset-based lending (“ABL”) facility. OHA’s

comprehensive understanding of the automotive aftermarket industry

positioned it to provide constructive feedback to the sponsor and

lead and structure this tailored financing solution.

“We are pleased to extend our long-standing

partnership with Carlyle by lending in scale to support this

transaction,” said Eric Muller, Partner and Portfolio Manager at

OHA. “Operating in a recession-resistant and growing end market,

Worldpac has maintained strong competitive positioning and a

diversified business model, and we look forward to the future

growth that we believe the company is well-positioned to

achieve.”

###

About OHA: Oak Hill Advisors (OHA) is a

leading global credit-focused alternative asset manager with over

30 years of investment experience. OHA works with institutions and

individuals and seeks to deliver a consistent track record of

attractive risk-adjusted returns. The firm manages approximately

$65 billion of capital across credit strategies, including private

credit, high yield bonds, leveraged loans, stressed and distressed

debt and collateralized loan obligations as of June 30, 2024. OHA’s

emphasis on long-term partnerships with companies, sponsors and

other partners provides access to a proprietary opportunity set,

allowing for customized credit solutions across market cycles.

With over 400 experienced professionals across

six global offices, OHA brings a collaborative approach to offering

investors a single platform to meet their diverse credit needs. OHA

is the private markets platform of T. Rowe Price Group, Inc.

(NASDAQ – GS: TROW). For more information, please visit

oakhilladvisors.com.

About Worldpac: Worldpac is a leading

North American distributor of aftermarket automotive parts. The

Company offers a wide assortment of products covering 40+ import

and domestic carlines and operates through an extensive network of

branch and distribution center locations across the U.S. and

Canada. Worldpac was founded in 1995 and acquired by Advance Auto

Parts in 2013 as a part of the acquisition of General Parts

International. The Company reported $2.25 billion in revenues for

2023.

Natalie Harvard, Head of Investor Relations & Partner

Oak Hill Advisors, L.P.

212-326-1505

nharvard@oakhilladvisors.com

Kristin Celestino, Public Relations

Oak Hill Advisors, L.P.

817-215-2934

kcelestino@oakhilladvisors.com

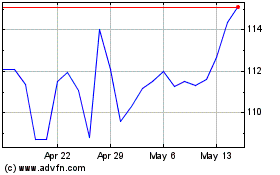

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Oct 2024 to Nov 2024

T Rowe Price (NASDAQ:TROW)

Historical Stock Chart

From Nov 2023 to Nov 2024