false

0000831641

0000831641

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 31, 2024

TETRA TECH, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

0-19655 |

|

95-4148514 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

3475 East Foothill Boulevard, Pasadena,

California 91107

(Address of principal executive office,

including zip code)

(626) 351-4664

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.01 par value |

|

TTEK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

| Item 2.02. | Results of Operations and Financial Condition. |

On January 31, 2024,

Tetra Tech, Inc. (“Tetra Tech”) reported its financial results for the first fiscal quarter ended December 31, 2023.

A copy of the press release is attached to this report as Exhibit 99.1.

Exhibit 99.1 attached

hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor

shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

On January 31, 2024,

Tetra Tech announced that its Board of Directors has declared a $0.26 per share quarterly cash dividend. The dividend is payable on February 27,

2024 to stockholders of record as of the close of business on February 14, 2024.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, Tetra Tech has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

TETRA TECH, INC. |

| |

|

| |

|

| Date: January 31, 2024 |

By: |

/s/

DAN L. BATRACK |

| |

|

Dan L. Batrack |

| |

|

Chairman and Chief Executive Officer |

Exhibit 99.1

|

NEWS

RELEASE

January 31,

2024 |

Tetra Tech Reports Strong First Quarter Results

and

Raises Full Fiscal Year Guidance

| |

· |

Revenue $1.23 billion, up 37%

Y/Y |

| |

|

|

| |

· |

Net revenue $1.02 billion, up 38% Y/Y |

| |

|

|

| |

· |

EBITDA $131 million, up 32% Y/Y |

| |

|

|

| |

· |

Backlog of $4.74 billion, up 24% Y/Y |

| |

|

|

| |

· |

Increasing Fiscal Year 2024 net revenue and EPS

full year guidance |

Pasadena,

California. Tetra Tech, Inc. (NASDAQ: TTEK), today announced results for the first quarter ended December 31, 2023.

As

the pure play global leader in water and environmental consulting and engineering, Tetra Tech produces higher margins, organic growth

rates and cash flows than the industry. For fiscal 2024, Tetra Tech is raising guidance for increased EPS growth of 20% with

a 20% IFRS EBITDA1 margin.

In the past 90 days, the Company was awarded

more than 1,000 individual high-end consulting projects addressing the entire water cycle. During the first quarter of fiscal 2024, Tetra

Tech announced the award of a $5 billion water framework contract for the Republic of Ireland; an $800 million U.S. Army Corps of Engineers

PFAS remediation contract; and a $450 million Great Lakes environmental restoration contract.

First Quarter Highlights

| · | Revenue

increased 37% to $1.23 billion with double-digit organic growth |

| · | EBITDA

increased 32% to $131 million; on pace to reach $575 million in FY24, doubling in the past

3 years |

| · | Record

first quarter EPS of $1.40 |

| · | Largest

first quarter backlog ever, up 24% year-over-year |

| · | Industry

leading DSO of 55 days |

| · | RPS

Group integration exceeding expectations: |

| – | RPS

EBITDA margin exceeded 10%, up more than 600 basis points in less than one year |

| – | RPS

revenue synergies with more than $100 million in new contracts won |

1Non-GAAP financial measures which the Company believes

provide valuable perspectives on its business results. Refer to tables in the Regulation G Information for reconciliations to the comparable

GAAP metrics.

Executive Management Comments

Dan Batrack, Chairman and CEO, commented, “Tetra

Tech began fiscal 2024 with a strong first quarter as revenue was up in all of our key end markets, building on our record performance

of the prior year. Based on the strength of our end markets, our strong results in the first quarter, and the increasing realization

of revenue synergies with RPS, we have raised our full year guidance for both net revenue and EPS, with a forecasted 20% growth in EPS

for fiscal 2024.”

Steve Burdick, Chief Financial Officer, said,

“In addition to our record first quarter revenue and earnings, we continue to generate strong positive operating cash flow with

$353 million over the trailing twelve months, which is 152% of net income for the same period. This annual cash generation continues

our track record of cash flow exceeding net income every year for the last two decades.”

Jill Hudkins, President, stated, “These

results demonstrate the value of Tetra Tech’s pure play focus on the water cycle that continues to drive increasing demand

for our high-end services. Tetra Tech’s key differentiator is our Leading with Science® approach to the water

cycle; from client-funded research and development, watershed management, water supply and treatment, to flood protection and marine

navigation.”

Leslie Shoemaker, PhD., Chief Sustainability

Officer, added, “Tetra Tech is changing lives through science, technology, and innovation. Our goal is to improve the lives of

one billion people around the world by 2030, providing sustainable solutions across our water and environment markets by optimizing water

management, preserving biodiversity, and mitigating climate change.”

Recent Key Wins

| |

· | $5

billion Republic of Ireland water framework contract, improving water quality and enhancing

watershed protection for 4 million people |

| |

· | $800

million U.S. Army Corps of Engineers PFAS remediation contract, preventing future environmental

contamination and protecting lives at more than 500 military bases |

| |

· | $450

million Great Lakes environmental restoration contract, providing environmental restoration

of the world’s largest freshwater watershed and improving the lives of 34 million people |

| |

· | $125

million United Utilities Better Rivers AMP 8 program, reducing wastewater overflows and enhancing

watershed quality for 7 million people in North West England |

| |

· | $34

million USAID Land and Resource Governance contract, protecting land, water, and resources

for more than 100 million vulnerable households in developing countries |

| |

· | $24

Million USAID Biodiversity and Ecosystem Conservation contract, preserving ecosystems

and enhancing community livelihoods for 16 million people in Cambodia |

Quarterly Dividend and Share Repurchase Program

On January 29, 2024, Tetra Tech’s

Board of Directors approved the Company’s 39th consecutive quarterly dividend at an amount of $0.26 per share, a 13%

increase year-over-year, payable on February 27, 2024, to stockholders of record as of February 14, 2024. Tetra Tech has $348 million remaining under its $400 million share repurchase program.

Business Outlook

The following statements are based on current

expectations. These statements are forward-looking, and the actual results could differ materially. These statements do not include the

potential impact of transactions that may be completed or developments that become evident after the date of this release. The Business

Outlook section should be read in conjunction with the information on forward-looking statements at the end of this release.

Tetra Tech expects EPS for the second

quarter of fiscal 2024 to range from $1.25 to $1.35 and net revenue to range from $990 million to $1.04 billion. For fiscal 2024,

Tetra Tech is raising EPS guidance to range from $5.90 to $6.20 and is raising net revenue guidance to range from $4.15 billion

to $4.30 billion2.

Webcast

Investors will have the opportunity to access

a live audio-visual webcast and supplemental financial information concerning the first quarter of fiscal 2024 results through a link

posted on the Company’s website at tetratech.com on February 1, 2024, at 8:00 a.m. (PT).

About Tetra Tech

Tetra

Tech is the leader in water, environment and sustainable infrastructure, providing high-end consulting and engineering services for projects

worldwide. With 27,000 employees working together, Tetra Tech provides clear solutions to complex problems by Leading with Science®

to address the entire water cycle, protect and restore the environment, design sustainable and resilient infrastructure, and

support the clean energy transition. For more information about Tetra Tech, please visit tetratech.com or follow us on

LinkedIn and Facebook.

CONTACTS:

Jim Wu, Investor Relations

Charlie MacPherson, Media & Public Relations

(626) 470-2844

2Reconciliation of the net revenue guidance to the most

directly comparable GAAP measure is not available without unreasonable efforts because the Company cannot predict the magnitude and timing

of all the components required to provide such reconciliation with sufficient precision.

Forward-Looking Statements

This release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as "anticipate," "expect,"

"could," "may," "intend," "plan" and "believe," among others, generally identify forward-looking

statements. These forward-looking statements are based on currently available operating, financial, economic and other information, and

are subject to a number of risks and uncertainties. Readers are cautioned that these forward-looking statements are only predictions

and may differ materially from actual future events or results. A variety of factors, many of which are beyond our control, could cause

actual future results or events to differ materially from those projected in the forward-looking statements in this release, including

but not limited to: continuing worldwide political and economic uncertainties; the U.S. Administration’s potential changes to fiscal

policies; the cyclicality in demand for our overall services; the fluctuation in demand for oil and gas, and mining services; risks related

to international operations; concentration of revenues from U.S. government agencies and potential funding disruptions by these agencies;

dependence on winning or renewing U.S. government contracts; the delay or unavailability of public funding on U.S. government contracts;

the U.S. government’s right to modify, delay, curtail or terminate contracts at its convenience; compliance with government procurement

laws and regulations; the impact of global pandemics like COVID-19; credit risks associated with certain clients in certain geographic

areas or industries; acquisition strategy and integration risks; goodwill or other intangible asset impairment; the failure to comply

with worldwide anti-bribery laws; the failure to comply with domestic and international export laws; the failure to properly manage projects;

the loss of key personnel or the inability to attract and retain qualified personnel; the ability of our employees to obtain government

granted eligibility; the use of estimates and assumptions in the preparation of financial statements; the ability to maintain adequate

workforce utilization; the use of the percentage-of-completion method of accounting; the inability to accurately estimate and control

contract costs; the failure to adequately recover on our claims for additional contract costs; the failure to win or renew contracts

with private and public sector clients; growth strategy management; backlog cancellation and adjustments; risks relating to cyber security

breaches; the failure of partners to perform on joint projects; the failure of subcontractors to satisfy their obligations; requirements

to pay liquidated damages based on contract performance; the adoption of new legal requirements; changes in resource management, environmental

or infrastructure industry laws, regulations or programs; changes in bank and capital markets and the access to capital; credit agreement

covenants; industry competition; liability related to legal proceedings, investigations, and disputes; the availability of third-party

insurance coverage; the ability to obtain adequate bonding; employee, agent, or partner misconduct; employee risks related to international

travel; safety programs; conflict of interest issues; liabilities relating to reports and opinions; liabilities relating to environmental

laws and regulations; force majeure events; protection of intellectual property rights; stock price volatility; the ability to impede

a business combination based on Delaware law and charter documents; and other risks and uncertainties as may be described in Tetra Tech’s

periodic filings with the Securities and Exchange Commission, including those described in the “Risk Factors” section of

Tetra Tech’s Annual Report on Form 10-K for the fiscal year ended October 1, 2023. Readers should not place undue reliance

on forward-looking statements since such information speaks only as of the date of this release. Tetra Tech does not intend to update

forward-looking statements and expressly disclaims any obligation to do so.

Non-GAAP Financial Measures

To supplement the financial results presented

in accordance with generally accepted accounting principles in the United States (“GAAP”), we present certain non-GAAP financial

measures within the meaning of Regulation G under the Securities Exchange Act of 1934, as amended. We provide these non-GAAP financial

measures because we believe they provide a valuable perspective on our financial results. However, non-GAAP measures have limitations

as analytical tools and should not be considered in isolation and are not in accordance with, or a substitute for, GAAP measures. In

addition, other companies may define non-GAAP measures differently which limits the ability of investors to compare non-GAAP measures

of Tetra Tech to those used by our peer companies. A reconciliation of these non-GAAP financial measures to the most directly comparable

GAAP financial measures is included in this release.

| Tetra Tech, Inc |

| Balance Sheet - Unaudited |

| (unaudited - in thousands, except par value) |

| | |

| | |

| |

| | |

December 31, | | |

October 1, | |

| | |

2023 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

| 198,689 | | |

| 168,831 | |

| Accounts receivable, net | |

| 1,040,510 | | |

| 974,535 | |

| Contract assets | |

| 89,073 | | |

| 113,939 | |

| Prepaid expenses and other current assets | |

| 125,769 | | |

| 98,719 | |

| Total current assets | |

| 1,454,041 | | |

| 1,356,024 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 74,971 | | |

| 74,832 | |

| Right-of-use assets, operating leases | |

| 179,513 | | |

| 175,932 | |

| Goodwill | |

| 1,923,146 | | |

| 1,880,244 | |

| Intangible assets, net | |

| 168,134 | | |

| 173,936 | |

| Deferred tax assets | |

| 76,210 | | |

| 89,002 | |

| Other non-current assets | |

| 74,808 | | |

| 70,507 | |

| Total assets | |

| 3,950,823 | | |

| 3,820,477 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 207,062 | | |

| 173,271 | |

| Accrued compensation | |

| 222,686 | | |

| 302,755 | |

| Contract liabilities | |

| 382,862 | | |

| 335,044 | |

| Short-term lease liabilities, operating leases | |

| 68,091 | | |

| 65,005 | |

| Current contingent earn-out liabilities | |

| 37,556 | | |

| 51,108 | |

| Other current liabilities | |

| 242,738 | | |

| 280,959 | |

| Total current liabilities | |

| 1,160,995 | | |

| 1,208,142 | |

| | |

| | | |

| | |

| Deferred tax liabilities | |

| 11,620 | | |

| 14,256 | |

| Long-term lease liabilities, operating leases | |

| 139,537 | | |

| 144,685 | |

| Long-term debt | |

| 945,319 | | |

| 879,529 | |

| Non-current contingent earn-out liabilities | |

| 18,048 | | |

| 22,314 | |

| Other non-current liabilities | |

| 137,617 | | |

| 148,045 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Preferred stock - authorized, 2,000 shares of $0.01 par value; no shares issued and outstanding at December 31, 2023 and October 1, 2023 | |

| - | | |

| - | |

| Common stock - authorized, 150,000 shares of $0.01 par value;

issued and outstanding, 53,466 and 53,248 shares at December 31, 2023 and October 1, 2023, respectively | |

| 534 | | |

| 532 | |

| Additional paid-in capital | |

| 9,979 | | |

| - | |

| Accumulated other comprehensive loss | |

| (132,202 | ) | |

| (195,295 | ) |

| Retained earnings | |

| 1,659,295 | | |

| 1,598,196 | |

| Tetra Tech stockholders' equity | |

| 1,537,606 | | |

| 1,403,433 | |

| Noncontrolling interests | |

| 81 | | |

| 73 | |

| Total stockholders' equity | |

| 1,537,687 | | |

| 1,403,506 | |

| Total liabilities and stockholders' equity | |

| 3,950,823 | | |

| 3,820,477 | |

| Tetra Tech, Inc |

| Consolidated Statements of Income |

| (unaudited - in thousands, except per share data) |

| | |

| | |

| |

| | |

Three Months Ended | |

| | |

December 31, | | |

January 1, | |

| | |

2023 | | |

2023 | |

| Revenue | |

| 1,228,267 | | |

| 894,766 | |

| Subcontractor costs | |

| (213,098 | ) | |

| (158,204 | ) |

| Other costs of revenue | |

| (824,671 | ) | |

| (583,316 | ) |

| Gross profit | |

| 190,498 | | |

| 153,246 | |

| Selling, general and administrative expenses | |

| (79,417 | ) | |

| (56,502 | ) |

| Contingent consideration - fair value adjustments | |

| - | | |

| (933 | ) |

| Acquisition and Integration | |

| - | | |

| (3,761 | ) |

| Income from operations | |

| 111,081 | | |

| 92,050 | |

| Interest expense, net | |

| (9,577 | ) | |

| (5,372 | ) |

| Other non-operating income | |

| - | | |

| 67,995 | |

| Income before income tax expense | |

| 101,504 | | |

| 154,673 | |

| Income tax expense | |

| (26,524 | ) | |

| (37,958 | ) |

| Net income | |

| 74,980 | | |

| 116,715 | |

| Net income attributable to noncontrolling interests | |

| (8 | ) | |

| (9 | ) |

| Net income attributable to Tetra Tech | |

| 74,972 | | |

| 116,706 | |

| | |

| | | |

| | |

| Earnings per share attributable to Tetra Tech: | |

| | | |

| | |

| Basic | |

| 1.41 | | |

| 2.20 | |

| Diluted | |

| 1.40 | | |

| 2.18 | |

| | |

| | | |

| | |

| Weighted-average common shares outstanding: | |

| | | |

| | |

| Basic | |

| 53,317 | | |

| 53,069 | |

| Diluted | |

| 53,738 | | |

| 53,529 | |

| Tetra Tech, Inc. |

| Consolidated Statements of Cash Flows |

| (unaudited, in thousands) |

| | |

| | |

| |

| | |

Three Months Ended | |

| | |

December 31, | | |

January 1, | |

| | |

2023 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 74,980 | | |

$ | 116,715 | |

| | |

| | | |

| | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 19,484 | | |

| 6,616 | |

| Amortization of stock-based awards | |

| 7,641 | | |

| 7,184 | |

| Deferred income taxes | |

| (1,624 | ) | |

| 15,935 | |

| Fair value adjustments to foreign currency forward contract | |

| - | | |

| (67,995 | ) |

| Other non-cash items | |

| 123 | | |

| 601 | |

| Changes in operating assets and liabilities, net of effects of business acquisitions: | |

| | | |

| - | |

| Accounts receivable and contract assets | |

| (22,288 | ) | |

| (16,175 | ) |

| Prepaid expenses and other assets | |

| (28,615 | ) | |

| 5,967 | |

| Accounts payable | |

| 33,790 | | |

| 3,820 | |

| Accrued compensation | |

| (80,069 | ) | |

| (53,201 | ) |

| Contract liabilities | |

| 41,862 | | |

| 27,769 | |

| Income taxes receivable/payable | |

| (15,941 | ) | |

| 4,387 | |

| Other liabilities | |

| (20,097 | ) | |

| (26,432 | ) |

| Net cash provided by operating activities | |

| 9,246 | | |

| 25,191 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Capital expenditures | |

| (3,456 | ) | |

| (4,996 | ) |

| Proceeds from sale of assets | |

| 22 | | |

| 51 | |

| Net cash used in investing activities | |

| (3,434 | ) | |

| (4,945 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from borrowings | |

| 125,000 | | |

| 60,889 | |

| Repayments on long-term debt | |

| (60,000 | ) | |

| (73,125 | ) |

| Taxes paid on vested restricted stock | |

| (12,670 | ) | |

| (16,586 | ) |

| Payments of contingent earn-out liabilities | |

| (18,862 | ) | |

| - | |

| Stock options exercised | |

| 335 | | |

| 57 | |

| Dividends paid | |

| (13,873 | ) | |

| (12,186 | ) |

| Principal payments on finance leases | |

| (1,539 | ) | |

| (1,316 | ) |

| Net cash provided by (used in) financing activities | |

| 18,391 | | |

| (42,267 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| 5,655 | | |

| 8,695 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | |

| 29,858 | | |

| (13,326 | ) |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 168,831 | | |

| 185,491 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 198,689 | | |

$ | 172,165 | |

| | |

| | | |

| | |

| Supplemental information: | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 9,768 | | |

$ | 3,433 | |

| Income taxes, net of refunds received of $0.9 million and $0.1 million | |

$ | 43,297 | | |

$ | 14,540 | |

| | |

| | | |

| | |

| Reconciliation of cash, cash equivalents and restricted cash: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 198,689 | | |

$ | 164,397 | |

| Restricted cash included in other current assets | |

| - | | |

| 7,768 | |

| Total cash, cash equivalents and restricted cash | |

$ | 198,689 | | |

$ | 172,165 | |

Tetra Tech, Inc.

Regulation

G Information

December 31, 2023

Reconciliation of Revenue to Revenue, Net of Subcontractor Costs ("Net Revenue")

(in

millions)

| | |

| | |

| | |

2023 | | |

2024 | |

| | |

2021 | | |

2022 | | |

1st Qtr | | |

2nd Qtr | | |

6 Mos | | |

3rd Qtr | | |

9 Mos | | |

4th Qtr | | |

Total | | |

1st Qtr | |

| Consolidated | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 3,213.5 | | |

| 3,504.0 | | |

| 894.8 | | |

| 1,158.2 | | |

| 2,053.0 | | |

| 1,208.9 | | |

| 3,261.9 | | |

| 1,260.6 | | |

| 4,522.6 | | |

| 1,228.3 | |

| Subcontractor Costs | |

| (661.3 | ) | |

| (668.5 | ) | |

| (158.2 | ) | |

| (188.7 | ) | |

| (346.9 | ) | |

| (221.4 | ) | |

| (568.3 | ) | |

| (203.2 | ) | |

| (771.5 | ) | |

| (213.1 | ) |

| Net Revenue | |

| 2,551.6 | | |

| 2,835.5 | | |

| 736.6 | | |

| 969.5 | | |

| 1,706.1 | | |

| 987.5 | | |

| 2,693.6 | | |

| 1,057.4 | | |

| 3,751.1 | | |

| 1,015.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| GSG Segment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 1,772.9 | | |

| 1,820.9 | | |

| 471.1 | | |

| 563.3 | | |

| 1,034.3 | | |

| 531.0 | | |

| 1,565.4 | | |

| 593.5 | | |

| 2,158.9 | | |

| 575.0 | |

| Subcontractor Costs | |

| (507.1 | ) | |

| (484.4 | ) | |

| (118.0 | ) | |

| (127.7 | ) | |

| (245.7 | ) | |

| (140.8 | ) | |

| (386.6 | ) | |

| (136.9 | ) | |

| (523.4 | ) | |

| (132.3 | ) |

| Net Revenue | |

| 1,265.8 | | |

| 1,336.5 | | |

| 353.1 | | |

| 435.6 | | |

| 788.6 | | |

| 390.2 | | |

| 1,178.8 | | |

| 456.6 | | |

| 1,635.5 | | |

| 442.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| CIG Segment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 1,500.1 | | |

| 1,738.4 | | |

| 439.6 | | |

| 610.4 | | |

| 1,049.9 | | |

| 691.4 | | |

| 1,741.3 | | |

| 683.3 | | |

| 2,424.6 | | |

| 669.1 | |

| Subcontractor Costs | |

| (214.3 | ) | |

| (239.3 | ) | |

| (56.0 | ) | |

| (76.4 | ) | |

| (132.4 | ) | |

| (94.0 | ) | |

| (226.4 | ) | |

| (82.6 | ) | |

| (309.0 | ) | |

| (96.6 | ) |

| Net Revenue | |

| 1,285.8 | | |

| 1,499.1 | | |

| 383.6 | | |

| 534.0 | | |

| 917.5 | | |

| 597.4 | | |

| 1,514.9 | | |

| 600.7 | | |

| 2,115.6 | | |

| 572.5 | |

Reconciliation of Net Income Attributable to Tetra Tech to Adjusted EBITDA

(in thousands)

| | |

| | |

| | |

2023 | | |

2024 | |

| | |

2021 | | |

2022 | | |

1st Qtr | | |

2nd Qtr | | |

6 Mos | | |

3rd Qtr | | |

9 Mos | | |

4th Qtr | | |

Total | | |

1st Qtr | |

| Net Income Attributable to Tetra Tech | |

| 232,810 | | |

| 263,125 | | |

| 116,706 | | |

| 42,830 | | |

| 159,536 | | |

| 60,235 | | |

| 219,771 | | |

| 53,649 | | |

| 273,420 | | |

| 74,972 | |

| Income Tax Expense | |

| 34,039 | | |

| 85,602 | | |

| 37,958 | | |

| 26,254 | | |

| 64,212 | | |

| 22,568 | | |

| 86,780 | | |

| 40,745 | | |

| 127,526 | | |

| 26,524 | |

| Interest Expense1 | |

| 11,831 | | |

| 11,584 | | |

| 5,372 | | |

| 13,323 | | |

| 18,695 | | |

| 14,869 | | |

| 33,564 | | |

| 12,973 | | |

| 46,537 | | |

| 9,577 | |

| Depreciation | |

| 12,337 | | |

| 13,859 | | |

| 3,178 | | |

| 4,849 | | |

| 8,027 | | |

| 5,624 | | |

| 13,651 | | |

| 6,330 | | |

| 19,980 | | |

| 6,951 | |

| Amortization | |

| 11,468 | | |

| 13,174 | | |

| 3,438 | | |

| 12,072 | | |

| 15,510 | | |

| 14,060 | | |

| 29,570 | | |

| 11,656 | | |

| 41,226 | | |

| 12,533 | |

| FX Hedge Gain | |

| - | | |

| (19,904 | ) | |

| (67,995 | ) | |

| (21,407 | ) | |

| (89,402 | ) | |

| - | | |

| (89,402 | ) | |

| - | | |

| (89,402 | ) | |

| - | |

| EBITDA | |

| 302,485 | | |

| 367,440 | | |

| 98,657 | | |

| 77,921 | | |

| 176,578 | | |

| 117,356 | | |

| 293,934 | | |

| 125,353 | | |

| 419,287 | | |

| 130,557 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contingent Consideration | |

| (3,273 | ) | |

| - | | |

| 933 | | |

| 7,544 | | |

| 8,477 | | |

| - | | |

| 8,477 | | |

| 3,778 | | |

| 12,255 | | |

| - | |

| Acquisition & Integration Expenses2 | |

| - | | |

| - | | |

| 3,761 | | |

| 19,944 | | |

| 23,705 | | |

| 2,107 | | |

| 25,812 | | |

| 23,742 | | |

| 49,554 | | |

| - | |

| COVID-19 Credits | |

| - | | |

| (6,486 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Adjusted EBITDA | |

| 299,212 | | |

| 360,954 | | |

| 103,351 | | |

| 105,409 | | |

| 208,760 | | |

| 119,463 | | |

| 328,223 | | |

| 152,873 | | |

| 481,096 | | |

| 130,557 | |

1 Includes write-off

of deferred debt origination fees of $2.7M in Q1-23 and $1.1M in Q2-23

2 Includes lease

impairment charge of $16.4M in Q4-23

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

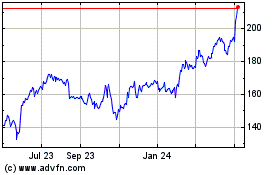

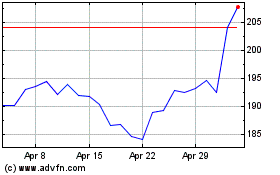

Tetra Tech (NASDAQ:TTEK)

Historical Stock Chart

From Apr 2024 to May 2024

Tetra Tech (NASDAQ:TTEK)

Historical Stock Chart

From May 2023 to May 2024