Form 8-K - Current report

12 July 2024 - 8:09PM

Edgar (US Regulatory)

0000920427false00009204272024-07-122024-07-12

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

July 12, 2024

Date of Report (Date of earliest event reported)

UNITY BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

New Jersey

(State or Other Jurisdiction of Incorporation)

| |

1-12431 | 22-3282551 |

(Commission File Number) | (IRS Employer Identification No.) |

64 Old Highway 22

Clinton, NJ 08809

(Address of Principal Executive Office)

(908) 730-7630

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock | UNTY | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition

The Registrant issued a press release on July 12, 2024 announcing results for the six months ended June 30, 2024, the full text of which is incorporated by reference to this Item.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| UNITY BANCORP, INC. |

| (Registrant) |

| |

Date: July 12, 2024 | |

| By: | /s/ George Boyan |

| | George Boyan |

| | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Clinton, NJ -- Unity Bancorp, Inc. (NASDAQ: UNTY), parent company of Unity Bank, reported net income of $9.5 million, or $0.93 per diluted share, for the quarter ended June 30, 2024, compared to net income of $9.6 million, or $0.93 per diluted share for the quarter ended March 31, 2024. This represents a 1.4% decrease in net income and no change in net income per diluted share. For the six months ended June 30, 2024, Unity Bancorp reported net income of $19.0 million, or $1.86 per diluted share, compared to net income of $20.0 million, or $1.91 per diluted share, for the six months ended June 30, 2023. This represents a 4.7% decrease in net income and a 2.6% decrease in net income per diluted share.

Second Quarter Earnings Highlights

| ● | Net interest income, the primary driver of earnings, was $23.4 million for the quarter ended June 30, 2024, a decrease of $0.4 million, as compared to $23.8 million for the quarter ended March 31, 2024. Net interest margin (“NIM”) decreased 8 basis points to 4.01% for the quarter ended June 30, 2024, compared to the quarter ended March 31, 2024. The decrease was primarily due to the cost of interest-bearing liabilities increasing faster than the yield of interest-earning assets. |

| ● | The provision for credit losses on loans was $0.3 million for the quarter ended June 30, 2024, compared to $0.6 million for the quarter ended March 31, 2024. The provision in the current quarter was primarily driven by increases in the specific reserve. |

| ● | Provision for credit losses on Available For Sale (“AFS”) debt securities was $0.6 million for the quarter ended June 30, 2024, as compared to no provision for the prior quarter. The impairment was entirely attributable to the same corporate debt security for which a partial provision was taken in the fourth quarter of 2023. The Company owns $5 million in par of this position and moved the position into non-accrual status during the three months ending June 30, 2024. The net carrying value of the position was $3.1 million as of June 30, 2024. |

| ● | Noninterest income was $2.0 million for the quarter ended June 30, 2024, compared to $1.7 million for the quarter ended March 31, 2024. The $0.3 million increase was primarily due to increased BOLI income, other income and gain on sale of SBA loans. Other income is primarily comprised of interchange & wire fee revenues. The Bank sold $3.9 million of SBA loans during the quarter ended June 30, 2024, compared to $2.4 million during the quarter ended March 31, 2024. |

| ● | Noninterest expense was $12.0 million for the quarter ended June 30, 2024, compared to $12.1 million for the quarter ended March 31, 2024. The decrease was primarily driven by lower compensation and benefit expenses, partially offset by increased furniture & equipment expense. |

| ● | The effective tax rate was 24.7% for the quarter ended June 30, 2024, compared to 25.0% for the quarter ending March 31, 2024. |

Balance Sheet Highlights

| ● | Total gross loans decreased $1.5 million, or 0.1%, from December 31, 2023, primarily due to decreases in the residential construction and residential mortgage categories. These decreases were partially offset by increases in the commercial loan category. |

| ● | As of June 30, 2024, the allowance for credit losses as a percentage of gross loans was 1.20%. |

| ● | Total deposits increased $86.7 million, or 4.5%, from December 31, 2023. As of June 30, 2024, 18.3% of total deposits were uninsured or uncollateralized. The Company’s deposit composition as of June 30, 2024, consisted of 21.0% in noninterest bearing demand deposits, 15.0% in interest-bearing demand deposits, 27.5% in savings deposits, and 36.5% in time deposits. |

| ● | As of June 30, 2024, the loan to deposit ratio was 107.9%, representing a continued reduction from 112.9% as of December 31, 2023. Because the Company is in compliance with its 110% threshold, management plans to expand lending initiatives to non-owner occupied borrowers. |

| ● | As of June 30, 2024, investments comprised 5.6% of total assets. Available for sale debt securities (“AFS”) were $99.1 million or 3.8% of total assets. Held to maturity (“HTM”) debt securities were $36.2 million or 1.4% of total assets. As of June 30, 2024, pre-tax net unrealized losses on AFS and HTM were $4.7 million and $7.2 million, respectively. These pre-tax unrealized losses represent approximately 4.2% of the Company’s Tier 1 capital. Equity securities were $9.9 million or 0.4% of total assets as of June 30, 2024. |

| ● | Borrowed funds decreased $81.6 million from December 31, 2023. Borrowed funds were entirely comprised of borrowings from the FHLB. |

| ● | Shareholders’ equity was $273.4 million as of June 30, 2024, compared to $261.4 million as of December 31, 2023. The $12.0 million increase was primarily driven by 2024 earnings, partially offset by share repurchases and dividend payments. In the first half of 2024, Unity Bancorp repurchased 218,768 shares for approximately $5.9 million, or a weighted average price of $27.04 per share. For the three months ended June 30, 2024, Unity Bancorp repurchased 68,771 shares for approximately $1.8 million, or a weighted average price of $26.77 per share. |

| ● | Book value per common share was $27.41 as of June 30, 2024, compared to $25.98 as of December 31, 2023. This increase primarily reflects earnings offset by dividend payouts and share repurchases. |

| ● | Below is a summary of the Company’s regulatory capital ratios: |

| o | The Leverage Ratio increased 53 basis points to 11.67% at June 30, 2024, compared to 11.14% at December 31, 2023. |

| o | The Common Equity Tier 1 Capital Ratio increased 61 basis points to 13.31% at June 30, 2024, compared to 12.70% at December 31, 2023. |

| o | The Tier 1 Capital Ratio increased 62 basis points to 13.80% at June 30, 2024, compared to 13.18% at December 31, 2023. |

| o | The Total Capital Ratio increased 62 basis points, to 15.05% at June 30, 2024, compared to 14.43% at December 31, 2023. |

| ● | At June 30, 2024, the Company held $197.4 million of cash and cash equivalents. Further, the Company maintained approximately $610.5 million of funding available from various funding sources, including the FHLB, FRB Discount Window and other lines of credit. Additionally, the Company has the ability to pledge additional securities to further increase borrowing capacity. Total available funding plus cash on hand represented 219.3% of uninsured or uncollateralized deposits. |

| ● | As of June 30, 2024, nonperforming assets were $15.2 million, compared to $19.2 million as of December 31, 2023 and $16.9 million as of March 31, 2024. The Company diligently reviews nonperforming assets and potential problem credits, taking proactive measures to promptly address and resolve any issues. As of June 30, 2024, nonperforming assets included $3.1 million related to debt securities available for sale. There were no nonperforming debt securities available for sale as of December 31, 2023 or March 31, 2024. The ratio of nonperforming loans to total loans was 0.56% as of June 30, 2024. The ratio of nonperforming assets to total assets was 0.58% as of June 30, 2024. |

Other Highlights

| ❖ | In Q2 2024, Unity Bank actively assisted certain customers with their application to participate in the FHLBNY’s 2024 Affordable Housing Program (“AHP”). The FHLBNY AHP program awards grants to members and project sponsors who are planning to purchase, rehabilitate, or construct affordable homes or apartments. |

| ❖ | In Q2 2024, Unity Bank introduced deposit account promotions specifically tailored to business checking and savings accounts. |

| ❖ | In Q2 2024, Unity Bank’s Marketing Director, Crystal Stoneback Rose, was selected as a Lehigh Valley Business Woman of Influence. This recognition highlights Crystal’s professional experience, community involvement and commitment to mentoring others. |

Unity Bancorp, Inc. is a financial services organization headquartered in Clinton, New Jersey, with approximately $2.6 billion in assets and $2.0 billion in deposits. Unity Bank, the Company’s wholly owned subsidiary, provides financial services to retail, corporate and small business customers through its robust branch network located in Bergen, Hunterdon, Middlesex, Morris, Ocean, Somerset, Union and Warren Counties in New Jersey and Northampton County in Pennsylvania. For additional information about Unity, visit our website at www.unitybank.com , or call 800-618-BANK.

This news release contains certain forward-looking statements, either expressed or implied, which are provided to assist the reader in understanding anticipated future financial performance. These statements may be identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. These statements involve certain risks, uncertainties, estimates and assumptions made by management, which are subject to factors beyond the Company’s control and could impede its ability to achieve these goals. These factors include those items included in our Annual Report on Form 10-K under the heading “Item IA-Risk Factors” as amended or supplemented by our subsequent filings with the SEC, as well as general economic conditions, trends in interest rates, the ability of our borrowers to repay their loans, our ability to manage and reduce the level of our nonperforming assets, results of regulatory exams, and the impact of COVID-19 on the Bank, its employees and customers, among other factors.

UNITY BANCORP, INC.

SUMMARY FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | June 30, 2024 vs. | |

| | | | | | | | | | | | March 31, 2024 | | June 30, 2023 | |

(In thousands, except percentages and per share amounts) | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 | | | % | | % | |

BALANCE SHEET DATA | | | | | | | | | | | | | | | |

Total assets | | $ | 2,597,707 | | $ | 2,568,088 | | $ | 2,552,301 | | | 1.2 | % | 1.8 | % |

Total deposits | | | 2,010,831 | | | 1,961,270 | | | 1,849,528 | | | 2.5 | | 8.7 | |

Total gross loans | | | 2,170,535 | | | 2,174,457 | | | 2,167,367 | | | (0.2) | | 0.1 | |

Total securities | | | 145,187 | | | 138,702 | | | 137,061 | | | 4.7 | | 5.9 | |

Total shareholders' equity | | | 273,395 | | | 266,761 | | | 244,073 | | | 2.5 | | 12.0 | |

Allowance for credit losses | | | 26,107 | | | 26,080 | | | 25,988 | | | 0.1 | | 0.5 | |

| | | | | | | | | | | | | | | |

FINANCIAL DATA - QUARTER TO DATE | | | | | | | | | | | | | | | |

Income before provision for income taxes | | $ | 12,552 | | $ | 12,784 | | $ | 13,109 | | | (1.8) | | (4.2) | |

Provision for income taxes | | | 3,098 | | | 3,198 | | | 3,409 | | | (3.1) | | (9.1) | |

Net income | | $ | 9,454 | | $ | 9,586 | | $ | 9,700 | | | (1.4) | | (2.5) | |

| | | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 0.94 | | $ | 0.95 | | $ | 0.96 | | | (1.1) | | (2.1) | |

Net income per common share - Diluted | | | 0.93 | | | 0.93 | | | 0.95 | | | - | | (2.1) | |

| | | | | | | | | | | | | | | |

PERFORMANCE RATIOS - QUARTER TO DATE (annualized) | | | | | | | | | | | | | | | |

Return on average assets | | | 1.56 | % | | 1.58 | % | | 1.60 | % | | | | | |

Return on average equity | | | 14.07 | | | 14.49 | | | 16.19 | | | | | | |

Efficiency ratio** | | | 47.10 | | | 47.57 | | | 45.87 | | | | | | |

Cost of funds | | | 2.73 | | | 2.64 | | | 2.19 | | | | | | |

Net interest margin | | | 4.01 | | | 4.09 | | | 4.04 | | | | | | |

Noninterest expense to average assets | | | 1.98 | | | 2.00 | | | 1.95 | | | | | | |

| | | | | | | | | | | | | | | |

FINANCIAL DATA - YEAR TO DATE | | | | | | | | | | | | | | | |

Income before provision for income taxes | | $ | 25,336 | | | | | $ | 26,901 | | | | | (5.8) | |

Provision for income taxes | | | 6,296 | | | | | | 6,914 | | | | | (8.9) | |

Net income | | $ | 19,040 | | | | | $ | 19,987 | | | | | (4.7) | |

| | | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 1.89 | | | | | $ | 1.94 | | | | | (2.6) | |

Net income per common share - Diluted | | | 1.86 | | | | | | 1.91 | | | | | (2.6) | |

| | | | | | | | | | | | | | | |

PERFORMANCE RATIOS - YEAR TO DATE | | | | | | | | | | | | | | | |

Return on average assets | | | 1.57 | % | | | | | 1.66 | % | | | | | |

Return on average equity | | | 14.28 | | | | | | 16.66 | | | | | | |

Efficiency ratio** | | | 47.33 | | | | | | 45.21 | | | | | | |

Cost of funds | | | 2.70 | | | | | | 2.00 | | | | | | |

Net interest margin | | | 4.05 | | | | | | 4.11 | | | | | | |

Noninterest expense to average assets | | | 1.99 | | | | | | 1.93 | | | | | | |

| | | | | | | | | | | | | | | |

SHARE INFORMATION | | | | | | | | | | | | | | | |

Market price per share | | $ | 29.57 | | $ | 27.60 | | $ | 23.59 | | | 7.1 | | 25.3 | |

Dividends paid (QTD) | | | 0.13 | | | 0.13 | | | 0.12 | | | - | | 8.3 | |

Book value per common share | | | 27.41 | | | 26.56 | | | 24.12 | | | 3.2 | | 13.6 | |

Average diluted shares outstanding (QTD) | | | 10,149 | | | 10,276 | | | 10,203 | | | (1.2) | | (0.5) | |

| | | | | | | | | | | | | | | |

CAPITAL RATIOS*** | | | | | | | | | | | | | | | |

Total equity to total assets | | | 10.52 | % | | 10.39 | % | | 9.56 | % | | 1.3 | | 10.0 | |

Leverage ratio | | | 11.67 | | | 11.39 | | | 10.49 | | | 2.5 | | 11.2 | |

Common Equity Tier 1 Capital Ratio | | | 13.31 | | | 12.90 | | | 11.74 | | | 3.2 | | 13.4 | |

Risk-based Tier 1 Capital Ratio | | | 13.80 | | | 13.38 | | | 12.21 | | | 3.1 | | 13.0 | |

Risk-based Total Capital Ratio | | | 15.05 | | | 14.63 | | | 13.45 | | | 2.9 | | 11.9 | |

| | | | | | | | | | | | | | | |

CREDIT QUALITY AND RATIOS | | | | | | | | | | | | | | | |

Nonperforming assets | | $ | 15,193 | | $ | 16,890 | | $ | 16,466 | | | (10.0) | | (7.7) | |

QTD annualized net (chargeoffs)/recoveries to QTD average loans | | | (0.04) | % | | (0.08) | % | | (0.18) | % | | | | | |

Allowance for credit losses to total loans | | | 1.20 | | | 1.20 | | | 1.20 | | | | | | |

Nonperforming loans to total loans | | | 0.56 | | | 0.78 | | | 0.76 | | | | | | |

Nonperforming assets to total assets | | | 0.58 | | | 0.66 | | | 0.65 | | | | | | |

** The efficiency ratio is a non-GAAP measure, calculated based on the noninterest expense divided by the sum of net interest income plus non interest income, excluding net gains and losses on securities. |

*** Represents Bancorp consolidated capital ratios. | | | | | | | | | | | | | | | |

UNITY BANCORP, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | June 30, 2024 vs. | |

| | | | | | | | | | | | December 31, 2023 | | June 30, 2023 | |

(In thousands, except percentages) | | June 30, 2024 | | December 31, 2023 | | June 30, 2023 | | | % | | % | |

| | | | | | | | | | | | | | | |

ASSETS | | | | | | | | | | | | | | | |

Cash and due from banks | | $ | 31,180 | | $ | 20,668 | | $ | 22,552 | | | 50.9 | % | 38.3 | % |

Interest-bearing deposits | | | 166,238 | | | 174,108 | | | 128,682 | | | (4.5) | | 29.2 | |

Cash and cash equivalents | | | 197,418 | | | 194,776 | | | 151,234 | | | 1.4 | | 30.5 | |

Securities: | | | | | | | | | | | | | | | |

Debt securities available for sale, at market value | | | 99,081 | | | 91,765 | | | 92,966 | | | 8.0 | | 6.6 | |

Debt securities held to maturity, at book value | | | 36,157 | | | 36,122 | | | 35,890 | | | 0.1 | | 0.7 | |

Equity securities, at market value | | | 9,949 | | | 7,802 | | | 8,205 | | | 27.5 | | 21.3 | |

Total securities | | | 145,187 | | | 135,689 | | | 137,061 | | | 7.0 | | 5.9 | |

Loans: | | | | | | | | | | | | | | | |

SBA loans held for sale | | | 15,159 | | | 18,242 | | | 20,074 | | | (16.9) | | (24.5) | |

SBA loans held for investment | | | 38,017 | | | 38,584 | | | 39,878 | | | (1.5) | | (4.7) | |

SBA PPP loans | | | 1,734 | | | 2,318 | | | 2,555 | | | (25.2) | | (32.1) | |

Commercial loans | | | 1,318,208 | | | 1,277,460 | | | 1,256,032 | | | 3.2 | | 5.0 | |

Residential mortgage loans | | | 624,949 | | | 631,506 | | | 633,414 | | | (1.0) | | (1.3) | |

Consumer loans | | | 69,280 | | | 72,676 | | | 75,990 | | | (4.7) | | (8.8) | |

Residential construction loans | | | 103,188 | | | 131,277 | | | 139,424 | | | (21.4) | | (26.0) | |

Total loans | | | 2,170,535 | | | 2,172,063 | | | 2,167,367 | | | (0.1) | | 0.1 | |

Allowance for credit losses | | | (26,107) | | | (25,854) | | | (25,988) | | | 1.0 | | 0.5 | |

Net loans | | | 2,144,428 | | | 2,146,209 | | | 2,141,379 | | | (0.1) | | 0.1 | |

Premises and equipment, net | | | 19,073 | | | 19,567 | | | 19,923 | | | (2.5) | | (4.3) | |

Bank owned life insurance ("BOLI") | | | 25,483 | | | 25,230 | | | 26,940 | | | 1.0 | | (5.4) | |

Deferred tax assets | | | 13,294 | | | 12,552 | | | 12,891 | | | 5.9 | | 3.1 | |

Federal Home Loan Bank ("FHLB") stock | | | 14,957 | | | 18,435 | | | 21,430 | | | (18.9) | | (30.2) | |

Accrued interest receivable | | | 13,257 | | | 13,582 | | | 14,858 | | | (2.4) | | (10.8) | |

Goodwill | | | 1,516 | | | 1,516 | | | 1,516 | | | - | | - | |

Prepaid expenses and other assets | | | 23,094 | | | 10,951 | | | 25,069 | | | 110.9 | | (7.9) | |

Total assets | | $ | 2,597,707 | | $ | 2,578,507 | | $ | 2,552,301 | | | 0.7 | % | 1.8 | % |

| | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | |

Deposits: | | | | | | | | | | | | | | | |

Noninterest-bearing demand | | $ | 422,001 | | $ | 419,636 | | $ | 439,220 | | | 0.6 | % | (3.9) | % |

Interest-bearing demand | | | 301,480 | | | 312,208 | | | 299,290 | | | (3.4) | | 0.7 | |

Savings | | | 505,586 | | | 497,491 | | | 503,122 | | | 1.6 | | 0.5 | |

Brokered deposits | | | 221,990 | | | 268,408 | | | 236,457 | | | (17.3) | | (6.1) | |

Time deposits | | | 559,774 | | | 426,397 | | | 371,439 | | | 31.3 | | 50.7 | |

Total deposits | | | 2,010,831 | | | 1,924,140 | | | 1,849,528 | | | 4.5 | | 8.7 | |

Borrowed funds | | | 274,798 | | | 356,438 | | | 423,000 | | | (22.9) | | (35.0) | |

Subordinated debentures | | | 10,310 | | | 10,310 | | | 10,310 | | | - | | - | |

Accrued interest payable | | | 1,657 | | | 1,924 | | | 715 | | | (13.9) | | 131.7 | |

Accrued expenses and other liabilities | | | 26,716 | | | 24,265 | | | 24,675 | | | 10.1 | | 8.3 | |

Total liabilities | | | 2,324,312 | | | 2,317,077 | | | 2,308,228 | | | 0.3 | | 0.7 | |

Shareholders' equity: | | | | | | | | | | | | | | | |

Common stock | | | 102,226 | | | 100,426 | | | 98,910 | | | 1.8 | | 3.4 | |

Retained earnings | | | 207,534 | | | 191,108 | | | 173,823 | | | 8.6 | | 19.4 | |

Treasury stock, at cost | | | (33,285) | | | (27,367) | | | (25,037) | | | 21.6 | | 32.9 | |

Accumulated other comprehensive loss | | | (3,080) | | | (2,737) | | | (3,623) | | | 12.5 | | (15.0) | |

Total shareholders' equity | | | 273,395 | | | 261,430 | | | 244,073 | | | 4.6 | | 12.0 | |

Total liabilities and shareholders' equity | | $ | 2,597,707 | | $ | 2,578,507 | | $ | 2,552,301 | | | 0.7 | % | 1.8 | % |

| | | | | | | | | | | | | | | |

Shares issued | | | 11,555 | | | 11,424 | | | 11,387 | | | | | | |

Shares outstanding | | | 9,975 | | | 10,063 | | | 10,119 | | | | | | |

Treasury shares | | | 1,580 | | | 1,361 | | | 1,268 | | | | | | |

| | | | | | | | | | | | | | | |

*NM=Not meaningful | | | | | | | | | | | | | | | |

UNITY BANCORP, INC.

QTD CONSOLIDATED STATEMENTS OF INCOME

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | June 30, 2024 vs. | |

| | For the three months ended | | | March 31, 2024 | | June 30, 2023 | |

(In thousands, except percentages and per share amounts) | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 | | | $ | | % | | $ | | % | |

INTEREST INCOME | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 435 | | $ | 420 | | $ | 441 | | | $ | 15 | | | 3.6 | % | $ | (6) | | | (1.4) | % |

FHLB stock | | | 180 | | | 280 | | | 343 | | | | (100) | | | (35.7) | | | (163) | | | (47.5) | |

Securities: | | | | | | | | | | | | | | | | | | | | | | | |

Taxable | | | 1,749 | | | 1,849 | | | 1,798 | | | | (100) | | | (5.4) | | | (49) | | | (2.7) | |

Tax-exempt | | | 17 | | | 18 | | | 19 | | | | (1) | | | (5.6) | | | (2) | | | (10.5) | |

Total securities | | | 1,766 | | | 1,867 | | | 1,817 | | | | (101) | | | (5.4) | | | (51) | | | (2.8) | |

Loans: | | | | | | | | | | | | | | | | | | | | | | | |

SBA loans | | | 1,276 | | | 1,333 | | | 1,403 | | | | (57) | | | (4.3) | | | (127) | | | (9.1) | |

SBA PPP loans | | | 11 | | | 8 | | | 27 | | | | 3 | | | 37.5 | | | (16) | | | (59.3) | |

Commercial loans | | | 21,160 | | | 20,830 | | | 18,621 | | | | 330 | | | 1.6 | | | 2,539 | | | 13.6 | |

Residential mortgage loans | | | 9,316 | | | 9,219 | | | 8,532 | | | | 97 | | | 1.1 | | | 784 | | | 9.2 | |

Consumer loans | | | 1,390 | | | 1,402 | | | 1,471 | | | | (12) | | | (0.9) | | | (81) | | | (5.5) | |

Residential construction loans | | | 2,453 | | | 2,578 | | | 2,737 | | | | (125) | | | (4.8) | | | (284) | | | (10.4) | |

Total loans | | | 35,606 | | | 35,370 | | | 32,791 | | | | 236 | | | 0.7 | | | 2,815 | | | 8.6 | |

Total interest income | | | 37,987 | | | 37,937 | | | 35,392 | | | | 50 | | | 0.1 | | | 2,595 | | | 7.3 | |

INTEREST EXPENSE | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing demand deposits | | | 2,010 | | | 1,710 | | | 1,331 | | | | 300 | | | 17.5 | | | 679 | | | 51.0 | |

Savings deposits | | | 3,349 | | | 3,144 | | | 1,993 | | | | 205 | | | 6.5 | | | 1,356 | | | 68.0 | |

Brokered deposits | | | 2,181 | | | 2,295 | | | 1,857 | | | | (114) | | | (5.0) | | | 324 | | | 17.4 | |

Time deposits | | | 5,832 | | | 4,699 | | | 2,564 | | | | 1,133 | | | 24.1 | | | 3,268 | | | 127.5 | |

Borrowed funds and subordinated debentures | | | 1,191 | | | 2,248 | | | 4,125 | | | | (1,057) | | | (47.0) | | | (2,934) | | | (71.1) | |

Total interest expense | | | 14,563 | | | 14,096 | | | 11,870 | | | | 467 | | | 3.3 | | | 2,693 | | | 22.7 | |

Net interest income | | | 23,424 | | | 23,841 | | | 23,522 | | | | (417) | | | (1.7) | | | (98) | | | (0.4) | |

Provision for credit losses, loans | | | 266 | | | 641 | | | 777 | | | | (375) | | | (58.5) | | | (511) | | | (65.8) | |

Provision for credit losses, off-balance sheet | | | 13 | | | 2 | | | (84) | | | | 11 | | | 550.0 | | | 97 | | | 115.5 | |

Provision for credit losses, AFS securities | | | 646 | | | - | | | - | | | | 646 | | | *NM | | | 646 | | | *NM | |

Net interest income after provision for credit losses | | | 22,499 | | | 23,198 | | | 22,829 | | | | (699) | | | (3.0) | | | (330) | | | (1.4) | |

NONINTEREST INCOME | | | | | | | | | | | | | | | | | | | | | | | |

Branch fee income | | | 266 | | | 243 | | | 228 | | | | 23 | | | 9.5 | | | 38 | | | 16.7 | |

Service and loan fee income | | | 467 | | | 457 | | | 491 | | | | 10 | | | 2.2 | | | (24) | | | (4.9) | |

Gain on sale of SBA loans held for sale, net | | | 305 | | | 238 | | | 586 | | | | 67 | | | 28.2 | | | (281) | | | (48.0) | |

Gain on sale of mortgage loans, net | | | 266 | | | 320 | | | 463 | | | | (54) | | | (16.9) | | | (197) | | | (42.5) | |

BOLI income | | | 189 | | | 65 | | | 84 | | | | 124 | | | 190.8 | | | 105 | | | 125.0 | |

Net securities gains (losses) | | | 20 | | | 54 | | | (164) | | | | (34) | | | (63.0) | | | 184 | | | 112.2 | |

Other income | | | 520 | | | 341 | | | 427 | | | | 179 | | | 52.5 | | | 93 | | | 21.8 | |

Total noninterest income | | | 2,033 | | | 1,718 | | | 2,115 | | | | 315 | | | 18.3 | | | (82) | | | (3.9) | |

NONINTEREST EXPENSE | | | | | | | | | | | | | | | | | | | | | | | |

Compensation and benefits | | | 7,121 | | | 7,357 | | | 7,271 | | | | (236) | | | (3.2) | | | (150) | | | (2.1) | |

Processing and communications | | | 840 | | | 906 | | | 663 | | | | (66) | | | (7.3) | | | 177 | | | 26.7 | |

Occupancy | | | 815 | | | 798 | | | 779 | | | | 17 | | | 2.1 | | | 36 | | | 4.6 | |

Furniture and equipment | | | 819 | | | 684 | | | 690 | | | | 135 | | | 19.7 | | | 129 | | | 18.7 | |

Professional services | | | 405 | | | 436 | | | 296 | | | | (31) | | | (7.1) | | | 109 | | | 36.8 | |

Advertising | | | 397 | | | 400 | | | 443 | | | | (3) | | | (0.8) | | | (46) | | | (10.4) | |

Loan related expenses | | | 351 | | | 384 | | | 130 | | | | (33) | | | (8.6) | | | 221 | | | 170.0 | |

Deposit insurance | | | 321 | | | 339 | | | 617 | | | | (18) | | | (5.3) | | | (296) | | | (48.0) | |

Director fees | | | 231 | | | 247 | | | 203 | | | | (16) | | | (6.5) | | | 28 | | | 13.8 | |

Other expenses | | | 680 | | | 581 | | | 743 | | | | 99 | | | 17.0 | | | (63) | | | (8.5) | |

Total noninterest expense | | | 11,980 | | | 12,132 | | | 11,835 | | | | (152) | | | (1.3) | | | 145 | | | 1.2 | |

Income before provision for income taxes | | | 12,552 | | | 12,784 | | | 13,109 | | | | (232) | | | (1.8) | | | (557) | | | (4.2) | |

Provision for income taxes | | | 3,098 | | | 3,198 | | | 3,409 | | | | (100) | | | (3.1) | | | (311) | | | (9.1) | |

Net income | | $ | 9,454 | | $ | 9,586 | | $ | 9,700 | | | $ | (132) | | | (1.4) | % | $ | (246) | | | (2.5) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Effective tax rate | | | 24.7 | % | | 25.0 | % | | 26.0 | % | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 0.94 | | $ | 0.95 | | $ | 0.96 | | | | | | | | | | | | | | |

Net income per common share - Diluted | | | 0.93 | | | 0.93 | | | 0.95 | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Weighted average common shares outstanding - Basic | | | 10,016 | | | 10,127 | | | 10,103 | | | | | | | | | | | | | | |

Weighted average common shares outstanding - Diluted | | | 10,149 | | | 10,276 | | | 10,203 | | | | | | | | | | | | | | |

*NM=Not meaningful | | | | | | | | | | | | | | | | | | | | | | | |

UNITY BANCORP, INC.

YTD CONSOLIDATED STATEMENTS OF INCOME

| | | | | | | | | | | | | | |

| | | | | | | | | | |

| | For the six months ended June 30, | | | Current YTD vs. Prior YTD | |

(In thousands, except percentages and per share amounts) | | 2024 | | 2023 | | | $ | | % | |

INTEREST INCOME | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 855 | | $ | 775 | | | $ | 80 | | | 10.3 | % |

FHLB stock | | | 460 | | | 674 | | | | (214) | | | (31.8) | |

Securities: | | | | | | | | | | | | | | |

Taxable | | | 3,598 | | | 3,537 | | | | 61 | | | 1.7 | |

Tax-exempt | | | 35 | | | 38 | | | | (3) | | | (7.9) | |

Total securities | | | 3,633 | | | 3,575 | | | | 58 | | | 1.6 | |

Loans: | | | | | | | | | | | | | | |

SBA loans | | | 2,609 | | | 2,807 | | | | (198) | | | (7.1) | |

SBA PPP loans | | | 19 | | | 104 | | | | (85) | | | (81.7) | |

Commercial loans | | | 41,990 | | | 36,022 | | | | 5,968 | | | 16.6 | |

Residential mortgage loans | | | 18,535 | | | 16,641 | | | | 1,894 | | | 11.4 | |

Consumer loans | | | 2,792 | | | 2,825 | | | | (33) | | | (1.2) | |

Residential construction loans | | | 5,031 | | | 5,323 | | | | (292) | | | (5.5) | |

Total loans | | | 70,976 | | | 63,722 | | | | 7,254 | | | 11.4 | |

Total interest income | | | 75,924 | | | 68,746 | | | | 7,178 | | | 10.4 | |

INTEREST EXPENSE | | | | | | | | | | | | | | |

Interest-bearing demand deposits | | | 3,720 | | | 2,296 | | | | 1,424 | | | 62.0 | |

Savings deposits | | | 6,493 | | | 3,548 | | | | 2,945 | | | 83.0 | |

Brokered deposits | | | 4,476 | | | 3,419 | | | | 1,057 | | | 30.9 | |

Time deposits | | | 10,531 | | | 4,126 | | | | 6,405 | | | 155.2 | |

Borrowed funds and subordinated debentures | | | 3,439 | | | 7,924 | | | | (4,485) | | | (56.6) | |

Total interest expense | | | 28,659 | | | 21,313 | | | | 7,346 | | | 34.5 | |

Net interest income | | | 47,265 | | | 47,433 | | | | (168) | | | (0.4) | |

Provision for credit losses, loans | | | 907 | | | 885 | | | | 22 | | | 2.5 | |

Provision for credit losses, off-balance sheet | | | 15 | | | (84) | | | | 99 | | | *NM | |

Provision for credit losses, AFS securities | | | 646 | | | - | | | | 646 | | | *NM | |

Net interest income after provision for credit losses | | | 45,697 | | | 46,632 | | | | (935) | | | (2.0) | |

NONINTEREST INCOME | | | | | | | | | | | | | | |

Branch fee income | | | 509 | | | 463 | | | | 46 | | | 9.9 | |

Service and loan fee income | | | 924 | | | 993 | | | | (69) | | | (6.9) | |

Gain on sale of SBA loans held for sale, net | | | 543 | | | 896 | | | | (353) | | | (39.4) | |

Gain on sale of mortgage loans, net | | | 586 | | | 707 | | | | (121) | | | (17.1) | |

BOLI income | | | 254 | | | 164 | | | | 90 | | | 54.9 | |

Other income | | | 861 | | | 796 | | | | 65 | | | 8.2 | |

Total noninterest income | | | 3,751 | | | 3,532 | | | | 219 | | | 6.2 | |

NONINTEREST EXPENSE | | | | | | | | | | | | | | |

Compensation and benefits | | | 14,478 | | | 14,361 | | | | 117 | | | 0.8 | |

Processing and communications | | | 1,746 | | | 1,467 | | | | 279 | | | 19.0 | |

Occupancy | | | 1,613 | | | 1,549 | | | | 64 | | | 4.1 | |

Furniture and equipment | | | 1,503 | | | 1,379 | | | | 124 | | | 9.0 | |

Professional services | | | 841 | | | 723 | | | | 118 | | | 16.3 | |

Advertising | | | 797 | | | 703 | | | | 94 | | | 13.4 | |

Loan related expenses | | | 735 | | | 305 | | | | 430 | | | 141.0 | |

Deposit insurance | | | 660 | | | 965 | | | | (305) | | | (31.6) | |

Director fees | | | 478 | | | 420 | | | | 58 | | | 13.8 | |

Other expenses | | | 1,261 | | | 1,391 | | | | (130) | | | (9.3) | |

Total noninterest expense | | | 24,112 | | | 23,263 | | | | 849 | | | 3.6 | |

Income before provision for income taxes | | | 25,336 | | | 26,901 | | | | (1,565) | | | (5.8) | |

Provision for income taxes | | | 6,296 | | | 6,914 | | | | (618) | | | (8.9) | |

Net income | | $ | 19,040 | | $ | 19,987 | | | $ | (947) | | | (4.7) | % |

| | | | | | | | | | | | | | |

Effective tax rate | | | 24.9 | % | | 25.7 | % | | | | | | | |

| | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 1.89 | | $ | 1.94 | | | | | | | | |

Net income per common share - Diluted | | | 1.86 | | | 1.91 | | | | | | | | |

| | | | | | | | | | | | | | |

Weighted average common shares outstanding - Basic | | | 10,072 | | | 10,319 | | | | | | | | |

Weighted average common shares outstanding - Diluted | | | 10,212 | | | 10,444 | | | | | | | | |

*NM=Not meaningful | | | | | | | | | | | | | | |

UNITY BANCORP, INC.

QUARTER TO DATE NET INTEREST MARGIN

| | | | | | | | | | | | | | | | | | | |

| | For the three months ended | |

(Dollar amounts in thousands, interest amounts and | | June 30, 2024 | | June 30, 2023 | |

interest rates/yields on a fully tax-equivalent basis) | | Average Balance | | Interest | | Rate/Yield | | Average Balance | | Interest | | Rate/Yield | |

ASSETS | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 32,237 | | $ | 435 | | | 5.43 | % | $ | 34,808 | | $ | 441 | | | 5.09 | % |

FHLB stock | | | 7,951 | | | 180 | | | 9.12 | | | 17,252 | | | 343 | | | 7.97 | |

Securities: | | | | | | | | | | | | | | | | | | | |

Taxable | | | 140,501 | | | 1,749 | | | 4.98 | | | 135,943 | | | 1,798 | | | 5.29 | |

Tax-exempt | | | 1,571 | | | 18 | | | 4.55 | | | 1,766 | | | 20 | | | 4.59 | |

Total securities (A) | | | 142,072 | | | 1,767 | | | 4.97 | | | 137,709 | | | 1,818 | | | 5.28 | |

Loans: | | | | | | | | | | | | | | | | | | | |

SBA loans | | | 55,922 | | | 1,276 | | | 9.13 | | | 61,744 | | | 1,403 | | | 9.09 | |

SBA PPP loans | | | 1,782 | | | 11 | | | 2.49 | | | 2,561 | | | 27 | | | 4.20 | |

Commercial loans | | | 1,300,754 | | | 21,160 | | | 6.44 | | | 1,225,761 | | | 18,621 | | | 6.01 | |

Residential mortgage loans | | | 625,086 | | | 9,316 | | | 5.96 | | | 622,283 | | | 8,532 | | | 5.48 | |

Consumer loans | | | 69,943 | | | 1,390 | | | 7.86 | | | 76,741 | | | 1,471 | | | 7.59 | |

Residential construction loans | | | 112,272 | | | 2,453 | | | 8.64 | | | 158,165 | | | 2,737 | | | 6.85 | |

Total loans (B) | | | 2,165,759 | | | 35,606 | | | 6.50 | | | 2,147,255 | | | 32,791 | | | 6.04 | |

Total interest-earning assets | | $ | 2,348,019 | | $ | 37,988 | | | 6.51 | % | $ | 2,337,024 | | $ | 35,393 | | | 6.07 | % |

| | | | | | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | | 23,547 | | | | | | | | | 21,967 | | | | | | | |

Allowance for credit losses | | | (26,202) | | | | | | | | | (26,270) | | | | | | | |

Other assets | | | 90,971 | | | | | | | | | 103,234 | | | | | | | |

Total noninterest-earning assets | | | 88,316 | | | | | | | | | 98,931 | | | | | | | |

Total assets | | $ | 2,436,335 | | | | | | | | $ | 2,435,955 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Interest-bearing demand deposits | | $ | 337,629 | | $ | 2,010 | | | 2.39 | % | $ | 310,717 | | $ | 1,331 | | | 1.74 | % |

Savings deposits | | | 504,685 | | | 3,349 | | | 2.67 | | | 503,979 | | | 1,993 | | | 1.60 | |

Brokered deposits | | | 228,276 | | | 2,181 | | | 3.84 | | | 229,872 | | | 1,857 | | | 3.28 | |

Time deposits | | | 535,444 | | | 5,832 | | | 4.38 | | | 344,883 | | | 2,564 | | | 3.02 | |

Total interest-bearing deposits | | | 1,606,034 | | | 13,372 | | | 3.35 | | | 1,389,451 | | | 7,745 | | | 2.24 | |

Borrowed funds and subordinated debentures | | | 129,763 | | | 1,191 | | | 3.63 | | | 339,599 | | | 4,125 | | | 4.81 | |

Total interest-bearing liabilities | | $ | 1,735,797 | | $ | 14,563 | | | 3.37 | % | $ | 1,729,050 | | $ | 11,870 | | | 2.75 | % |

| | | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing demand deposits | | | 401,146 | | | | | | | | | 440,289 | | | | | | | |

Other liabilities | | | 29,139 | | | | | | | | | 26,275 | | | | | | | |

Total noninterest-bearing liabilities | | | 430,285 | | | | | | | | | 466,564 | | | | | | | |

Total shareholders' equity | | | 270,253 | | | | | | | | | 240,341 | | | | | | | |

Total liabilities and shareholders' equity | | $ | 2,436,335 | | | | | | | | $ | 2,435,955 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | $ | 23,425 | | | 3.13 | % | | | | $ | 23,523 | | | 3.32 | % |

Tax-equivalent basis adjustment | | | | | | (1) | | | | | | | | | (1) | | | | |

Net interest income | | | | | $ | 23,424 | | | | | | | | $ | 23,522 | | | | |

Net interest margin | | | | | | | | | 4.01 | % | | | | | | | | 4.04 | % |

| | | | | | | | | | | | | | | | | | | |

| (A) | Yields related to securities exempt from federal and state income taxes are stated on a fully tax-equivalent basis. They are reduced by the nondeductible portion of interest expense, assuming a federal tax rate of 21 percent and applicable state rates. |

| (B) | The loan averages are stated net of unearned income, and the averages include loans on which the accrual of interest has been discontinued. |

UNITY BANCORP, INC.

QUARTER TO DATE NET INTEREST MARGIN

| | | | | | | | | | | | | | | | | | | |

| | For the three months ended | |

(Dollar amounts in thousands, interest amounts and | | June 30, 2024 | | March 31, 2024 | |

interest rates/yields on a fully tax-equivalent basis) | | Average Balance | | Interest | | Rate/Yield | | Average Balance | | Interest | | Rate/Yield | |

ASSETS | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 32,237 | | $ | 435 | | | 5.43 | % | $ | 30,685 | | $ | 420 | | | 5.50 | % |

FHLB stock | | | 7,951 | | | 180 | | | 9.12 | | | 11,000 | | | 280 | | | 10.23 | |

Securities: | | | | | | | | | | | | | | | | | | | |

Taxable | | | 140,501 | | | 1,749 | | | 4.98 | | | 134,874 | | | 1,849 | | | 5.48 | |

Tax-exempt | | | 1,571 | | | 18 | | | 4.55 | | | 1,658 | | | 18 | | | 4.47 | |

Total securities (A) | | | 142,072 | | | 1,767 | | | 4.97 | | | 136,532 | | | 1,867 | | | 5.47 | |

Loans: | | | | | | | | | | | | | | | | | | | |

SBA loans | | | 55,922 | | | 1,276 | | | 9.13 | | | 58,120 | | | 1,333 | | | 9.17 | |

SBA PPP loans | | | 1,782 | | | 11 | | | 2.49 | | | 2,215 | | | 8 | | | 1.38 | |

Commercial loans | | | 1,300,754 | | | 21,160 | | | 6.44 | | | 1,281,600 | | | 20,830 | | | 6.43 | |

Residential mortgage loans | | | 625,086 | | | 9,316 | | | 5.96 | | | 625,451 | | | 9,219 | | | 5.90 | |

Consumer loans | | | 69,943 | | | 1,390 | | | 7.86 | | | 70,250 | | | 1,402 | | | 7.90 | |

Residential construction loans | | | 112,272 | | | 2,453 | | | 8.64 | | | 129,720 | | | 2,578 | | | 7.86 | |

Total loans (B) | | | 2,165,759 | | | 35,606 | | | 6.50 | | | 2,167,356 | | | 35,370 | | | 6.46 | |

Total interest-earning assets | | $ | 2,348,019 | | $ | 37,988 | | | 6.51 | % | $ | 2,345,573 | | $ | 37,937 | | | 6.51 | % |

| | | | | | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | | 23,547 | | | | | | | | | 23,220 | | | | | | | |

Allowance for credit losses | | | (26,202) | | | | | | | | | (26,059) | | | | | | | |

Other assets | | | 90,971 | | | | | | | | | 94,001 | | | | | | | |

Total noninterest-earning assets | | | 88,316 | | | | | | | | | 91,162 | | | | | | | |

Total assets | | $ | 2,436,335 | | | | | | | | $ | 2,436,735 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Interest-bearing demand deposits | | $ | 337,629 | | $ | 2,010 | | | 2.39 | % | $ | 324,829 | | $ | 1,710 | | | 2.12 | % |

Savings deposits | | | 504,685 | | | 3,349 | | | 2.67 | | | 503,071 | | | 3,144 | | | 2.51 | |

Brokered deposits | | | 228,276 | | | 2,181 | | | 3.84 | | | 243,592 | | | 2,295 | | | 3.79 | |

Time deposits | | | 535,444 | | | 5,832 | | | 4.38 | | | 465,166 | | | 4,699 | | | 4.06 | |

Total interest-bearing deposits | | | 1,606,034 | | | 13,372 | | | 3.35 | | | 1,536,658 | | | 11,848 | | | 3.10 | |

Borrowed funds and subordinated debentures | | | 129,763 | | | 1,191 | | | 3.63 | | | 201,335 | | | 2,248 | | | 4.41 | |

Total interest-bearing liabilities | | $ | 1,735,797 | | $ | 14,563 | | | 3.37 | % | $ | 1,737,993 | | $ | 14,096 | | | 3.26 | % |

| | | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing demand deposits | | | 401,146 | | | | | | | | | 403,847 | | | | | | | |

Other liabilities | | | 29,139 | | | | | | | | | 28,747 | | | | | | | |

Total noninterest-bearing liabilities | | | 430,285 | | | | | | | | | 432,594 | | | | | | | |

Total shareholders' equity | | | 270,253 | | | | | | | | | 266,148 | | | | | | | |

Total liabilities and shareholders' equity | | $ | 2,436,335 | | | | | | | | $ | 2,436,735 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | $ | 23,425 | | | 3.13 | % | | | | $ | 23,841 | | | 3.25 | % |

Tax-equivalent basis adjustment | | | | | | (1) | | | | | | | | | - | | | | |

Net interest income | | | | | $ | 23,424 | | | | | | | | $ | 23,841 | | | | |

Net interest margin | | | | | | | | | 4.01 | % | | | | | | | | 4.09 | % |

| | | | | | | | | | | | | | | | | | | |

| (A) | Yields related to securities exempt from federal and state income taxes are stated on a fully tax-equivalent basis. They are reduced by the nondeductible portion of interest expense, assuming a federal tax rate of 21 percent and applicable state rates. |

| (B) | The loan averages are stated net of unearned income, and the averages include loans on which the accrual of interest has been discontinued. |

UNITY BANCORP, INC.

YTD NET INTEREST MARGIN

| | | | | | | | | | | | | | | | | | | |

| | For the six months ended | |

(Dollar amounts in thousands, interest amounts and | | June 30, 2024 | | June 30, 2023 | |

interest rates/yields on a fully tax-equivalent basis) | | Average Balance | | Interest | | Rate/Yield | | Average Balance | | Interest | | Rate/Yield | |

ASSETS | | | | | | | | | | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | | | | | | | | | | |

Interest-bearing deposits | | $ | 31,461 | | $ | 855 | | | 5.46 | % | $ | 33,798 | | $ | 775 | | | 4.62 | % |

FHLB stock | | | 9,476 | | | 460 | | | 9.76 | | | 17,016 | | | 674 | | | 7.98 | |

Securities: | | | | | | | | | | | | | | | | | | | |

Taxable | | | 137,688 | | | 3,598 | | | 5.23 | | | 137,154 | | | 3,537 | | | 5.16 | |

Tax-exempt | | | 1,615 | | | 36 | | | 4.51 | | | 1,760 | | | 40 | | | 4.54 | |

Total securities (A) | | | 139,303 | | | 3,634 | | | 5.22 | | | 138,914 | | | 3,577 | | | 5.15 | |

Loans: | | | | | | | | | | | | | | | | | | | |

SBA loans | | | 57,021 | | | 2,609 | | | 9.15 | | | 64,171 | | | 2,807 | | | 8.75 | |

SBA PPP loans | | | 1,999 | | | 19 | | | 1.87 | | | 3,397 | | | 104 | | | 6.12 | |

Commercial loans | | | 1,291,176 | | | 41,990 | | | 6.43 | | | 1,212,741 | | | 36,022 | | | 5.91 | |

Residential mortgage loans | | | 625,269 | | | 18,535 | | | 5.93 | | | 618,630 | | | 16,641 | | | 5.38 | |

Consumer loans | | | 70,096 | | | 2,792 | | | 7.88 | | | 76,930 | | | 2,825 | | | 7.30 | |

Residential construction loans | | | 120,996 | | | 5,031 | | | 8.22 | | | 160,978 | | | 5,323 | | | 6.58 | |

Total loans (B) | | | 2,166,557 | | | 70,976 | | | 6.48 | | | 2,136,847 | | | 63,722 | | | 5.93 | |

Total interest-earning assets | | $ | 2,346,797 | | $ | 75,925 | | | 6.51 | % | $ | 2,326,575 | | $ | 68,748 | | | 5.96 | % |

| | | | | | | | | | | | | | | | | | | |

Noninterest-earning assets: | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | | 23,383 | | | | | | | | | 22,350 | | | | | | | |

Allowance for credit losses | | | (26,130) | | | | | | | | | (26,025) | | | | | | | |

Other assets | | | 92,486 | | | | | | | | | 107,147 | | | | | | | |

Total noninterest-earning assets | | | 89,739 | | | | | | | | | 103,472 | | | | | | | |

Total assets | | $ | 2,436,536 | | | | | | | | $ | 2,430,047 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Total interest-bearing demand deposits | | $ | 331,229 | | $ | 3,720 | | | 2.26 | % | $ | 298,511 | | $ | 2,296 | | | 3.09 | % |

Total savings deposits | | | 503,878 | | | 6,493 | | | 2.59 | | | 519,922 | | | 3,548 | | | 2.74 | |

| | | 235,934 | | | 4,476 | | | 3.82 | | | 233,270 | | | 3,419 | | | 5.88 | |

Total time deposits | | | 500,305 | | | 10,531 | | | 4.23 | | | 315,780 | | | 4,126 | | | 5.24 | |

Total interest-bearing deposits | | | 1,571,346 | | | 25,220 | | | 3.23 | | | 1,367,483 | | | 13,389 | | | 1.97 | |

Borrowed funds and subordinated debentures | | | 165,550 | | | 3,439 | | | 4.11 | | | 340,991 | | | 7,924 | | | 4.62 | |

Total interest-bearing liabilities | | $ | 1,736,896 | | $ | 28,659 | | | 3.32 | % | $ | 1,708,474 | | $ | 21,313 | | | 2.52 | % |

| | | | | | | | | | | | | | | | | | | |

Noninterest-bearing liabilities: | | | | | | | | | | | | | | | | | | | |

Noninterest-bearing demand deposits | | | 402,497 | | | | | | | | | 454,270 | | | | | | | |

Other liabilities | | | 28,943 | | | | | | | | | 25,413 | | | | | | | |

Total noninterest-bearing liabilities | | | 431,440 | | | | | | | | | 479,683 | | | | | | | |

Total shareholders' equity | | | 268,200 | | | | | | | | | 241,890 | | | | | | | |

Total liabilities and shareholders' equity | | $ | 2,436,536 | | | | | | | | $ | 2,430,047 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | $ | 47,266 | | | 3.19 | % | | | | $ | 47,435 | | | 3.44 | % |

Tax-equivalent basis adjustment | | | | | | (1) | | | | | | | | | (2) | | | | |

Net interest income | | | | | $ | 47,265 | | | | | | | | $ | 47,433 | | | | |

Net interest margin | | | | | | | | | 4.05 | % | | | | | | | | 4.11 | % |

| | | | | | | | | | | | | | | | | | | |

UNITY BANCORP, INC.

QUARTERLY ALLOWANCE FOR CREDIT LOSSES AND ASSET QUALITY SCHEDULES

| | | | | | | | | | | | | | | |

Amounts in thousands, except percentages | | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | March 31, 2023 |

ALLOWANCE FOR CREDIT LOSSES: | | | | | | | | | | | | | | | |

Balance, beginning of period | | $ | 26,080 | | $ | 25,854 | | $ | 25,918 | | $ | 25,988 | | $ | 26,201 |

Impact of the adoption of ASU 2016-13 ("CECL") | | | - | | | - | | | - | | | - | | | - |

Provision for credit losses on loans charged to expense | | | 266 | | | 641 | | | 413 | | | 534 | | | 777 |

| | | 26,346 | | | 26,495 | | | 26,331 | | | 26,522 | | | 26,978 |

Less: Chargeoffs | | | | | | | | | | | | | | | |

SBA loans | | | - | | | - | | | - | | | 100 | | | - |

Commercial loans | | | 138 | | | 98 | | | 252 | | | 500 | | | - |

Residential mortgage loans | | | - | | | - | | | - | | | - | | | - |

Consumer loans | | | 130 | | | 70 | | | 274 | | | 52 | | | 225 |

Residential construction loans | | | - | | | 277 | | | 100 | | | - | | | 900 |

Total chargeoffs | | | 268 | | | 445 | | | 626 | | | 652 | | | 1,125 |

Add: Recoveries | | | | | | | | | | | | | | | |

SBA loans | | | 6 | | | 8 | | | - | | | 1 | | | 15 |

Commercial loans | | | 12 | | | 12 | | | 23 | | | 10 | | | 96 |

Residential mortgage loans | | | - | | | - | | | 4 | | | - | | | - |

Consumer loans | | | 11 | | | 10 | | | 11 | | | 37 | | | 24 |

Residential construction loans | | | - | | | - | | | 111 | | | - | | | - |

Total recoveries | | | 29 | | | 30 | | | 149 | | | 48 | | | 135 |

Net (chargeoffs)/recoveries | | | (239) | | | (415) | | | (477) | | | (604) | | | (990) |

Balance, end of period | | $ | 26,107 | | $ | 26,080 | | $ | 25,854 | | $ | 25,918 | | $ | 25,988 |

| | | | | | | | | | | | | | | |

ASSET QUALITY INFORMATION: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Nonperforming loans: | | | | | | | | | | | | | | | |

SBA loans | | $ | 3,813 | | $ | 3,542 | | $ | 3,444 | | $ | 3,445 | | $ | 3,591 |

Commercial loans | | | 2,321 | | | 2,415 | | | 1,948 | | | 750 | | | 835 |

Residential mortgage loans | | | 5,336 | | | 7,440 | | | 11,272 | | | 10,530 | | | 8,607 |

Consumer loans | | | 105 | | | 366 | | | 381 | | | 130 | | | - |

Residential construction loans | | | 547 | | | 3,127 | | | 2,141 | | | 3,201 | | | 3,182 |

Total nonperforming loans | | | 12,122 | | | 16,890 | | | 19,186 | | | 18,056 | | | 16,215 |

Debt securities available for sale | | | 3,071 | | | - | | | - | | | - | | | - |

OREO | | | - | | | - | | | - | | | 251 | | | 251 |

Nonperforming assets | | | 15,193 | | | 16,890 | | | 19,186 | | | 18,307 | | | 16,466 |

| | | | | | | | | | | | | | | |

Loans 90 days past due & still accruing | | $ | 373 | | $ | 138 | | $ | 946 | | $ | 265 | | $ | - |

| | | | | | | | | | | | | | | |

Nonperforming loans to total loans | | | 0.56 | % | | 0.78 | % | | 0.88 | % | | 0.84 | | | 0.76 |

Nonperforming assets to total assets | | | 0.58 | | | 0.66 | | | 0.74 | | | 0.71 | | | 0.65 |

| | | | | | | | | | | | | | | |

Allowance for credit losses to: | | | | | | | | | | | | | | | |

Total loans at quarter end | | | 1.20 | % | | 1.20 | % | | 1.19 | % | | 1.19 | % | | 1.20 |

Total nonperforming loans | | | 215.37 | | | 154.41 | | | 134.75 | | | 143.54 | | | 160.27 |

UNITY BANCORP, INC.

QUARTERLY FINANCIAL DATA

| | | | | | | | | | | | | | | | |

(In thousands, except %'s, employee, office and per share amounts) | | June 30, 2024 | | December 31, 2023 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | |

SUMMARY OF INCOME: | | | | | | | | | | | | | | | | |

Total interest income | | $ | 37,987 | | $ | 37,937 | | $ | 37,758 | | $ | 36,990 | | $ | 35,392 | |

Total interest expense | | | 14,563 | | | 14,096 | | | 13,727 | | | 13,457 | | | 11,870 | |

Net interest income | | | 23,424 | | | 23,841 | | | 24,031 | | | 23,533 | | | 23,522 | |

Provision for credit losses | | | 925 | | | 643 | | | 1,811 | | | 556 | | | 693 | |

Net interest income after provision for credit losses | | | 22,499 | | | 23,198 | | | 22,220 | | | 22,977 | | | 22,829 | |

Total noninterest income | | | 2,033 | | | 1,718 | | | 2,568 | | | 2,043 | | | 2,115 | |

Total noninterest expense | | | 11,980 | | | 12,132 | | | 11,740 | | | 11,973 | | | 11,835 | |

Income before provision for income taxes | | | 12,552 | | | 12,784 | | | 13,048 | | | 13,047 | | | 13,109 | |

Provision for income taxes | | | 3,098 | | | 3,198 | | | 3,278 | | | 3,097 | | | 3,409 | |

Net income | | $ | 9,454 | | $ | 9,586 | | $ | 9,770 | | $ | 9,950 | | $ | 9,700 | |

| | | | | | | | | | | | | | | | |

Net income per common share - Basic | | $ | 0.94 | | $ | 0.95 | | $ | 0.97 | | $ | 0.98 | | $ | 0.96 | |

Net income per common share - Diluted | | | 0.93 | | | 0.93 | | | 0.96 | | | 0.97 | | | 0.95 | |

| | | | | | | | | | | | | | | | |

COMMON SHARE DATA: | | | | | | | | | | | | | | | | |

Market price per share | | $ | 29.57 | | $ | 27.60 | | $ | 29.59 | | $ | 23.43 | | $ | 23.59 | |

Dividends paid | | | 0.13 | | | 0.13 | | | 0.12 | | | 0.12 | | | 0.12 | |

Book value per common share | | | 27.41 | | | 26.56 | | | 25.98 | | | 24.95 | | | 24.12 | |

| | | | | | | | | | | | | | | | |

Weighted average common shares outstanding - Basic | | | 10,016 | | | 10,127 | | | 10,066 | | | 10,128 | | | 10,103 | |

Weighted average common shares outstanding - Diluted | | | 10,149 | | | 10,276 | | | 10,209 | | | 10,258 | | | 10,203 | |

Issued common shares | | | 11,555 | | | 11,555 | | | 11,424 | | | 11,411 | | | 11,387 | |

Outstanding common shares | | | 9,975 | | | 10,044 | | | 10,063 | | | 10,115 | | | 10,119 | |

Treasury shares | | | 1,580 | | | 1,511 | | | 1,361 | | | 1,296 | | | 1,268 | |

| | | | | | | | | | | | | | | | |

PERFORMANCE RATIOS (Annualized): | | | | | | | | | | | | | | | | |

Return on average assets | | | 1.56 | % | | 1.58 | % | | 1.59 | % | | 1.61 | % | | 1.60 | % |

Return on average equity | | | 14.07 | | | 14.49 | | | 15.12 | | | 15.84 | | | 16.19 | |

Efficiency ratio** | | | 47.10 | | | 47.57 | | | 43.06 | | | 46.59 | | | 45.54 | |

| | | | | | | | | | | | | | | | |

BALANCE SHEET DATA: | | | | | | | | | | | | | | | | |

Total assets | | $ | 2,597,707 | | $ | 2,568,088 | | $ | 2,578,507 | | $ | 2,563,006 | | $ | 2,552,301 | |

Total securities | | | 145,187 | | | 138,702 | | | 135,689 | | | 136,091 | | | 137,061 | |

Total loans | | | 2,170,535 | | | 2,174,457 | | | 2,172,063 | | | 2,173,190 | | | 2,167,367 | |

Allowance for credit losses | | | 26,107 | | | 26,080 | | | 25,854 | | | 25,918 | | | 25,988 | |

Total deposits | | | 2,010,831 | | | 1,961,270 | | | 1,924,140 | | | 1,884,910 | | | 1,849,528 | |

Total shareholders' equity | | | 273,395 | | | 266,761 | | | 261,430 | | | 252,384 | | | 244,073 | |

| | | | | | | | | | | | | | | | |

TAX EQUIVALENT YIELDS AND RATES: | | | | | | | | | | | | | | | | |

Interest-earning assets | | | 6.51 | % | | 6.51 | % | | 6.38 | % | | 6.22 | % | | 6.07 | % |

Interest-bearing liabilities | | | 3.37 | | | 3.26 | | | 3.14 | | | 3.05 | | | 2.75 | |

Net interest spread | | | 3.13 | | | 3.25 | | | 3.24 | | | 3.17 | | | 3.32 | |

Net interest margin | | | 4.01 | | | 4.09 | | | 4.06 | | | 3.96 | | | 4.04 | |

| | | | | | | | | | | | | | | | |

CREDIT QUALITY: | | | | | | | | | | | | | | | | |

Nonperforming assets | | $ | 15,193 | | $ | 16,890 | | $ | 19,186 | | $ | 18,307 | | $ | 16,466 | |

QTD annualized net (chargeoffs)/recoveries to QTD average loans | | | (0.04) | % | | (0.08) | % | | (0.09) | % | | (0.11) | % | | (0.18) | % |

Allowance for credit losses to total loans | | | 1.20 | | | 1.20 | | | 1.19 | | | 1.19 | | | 1.20 | |

Nonperforming loans to total loans | | | 0.56 | | | 0.78 | | | 0.88 | | | 0.84 | | | 0.76 | |

Nonperforming assets to total assets | | | 0.58 | | | 0.66 | | | 0.74 | | | 0.71 | | | 0.65 | |

| | | | | | | | | | | | | | | | |

CAPITAL RATIOS*** AND OTHER: | | | | | | | | | | | | | | | | |

Total equity to total assets | | | 10.52 | % | | 10.39 | % | | 10.14 | % | | 9.85 | % | | 9.56 | % |

Leverage ratio | | | 11.67 | | | 11.39 | | | 11.14 | | | 10.76 | | | 10.49 | |

Common Equity Tier 1 Capital Ratio | | | 13.31 | | | 12.90 | | | 12.70 | | | 12.16 | | | 11.74 | |

Risk-based Tier 1 Capital Ratio | | | 13.80 | | | 13.38 | | | 13.18 | | | 12.64 | | | 12.21 | |

Risk-based Total Capital Ratio | | | 15.05 | | | 14.63 | | | 14.43 | | | 13.88 | | | 13.45 | |

| | | | | | | | | | | | | | | | |

Number of banking offices | | | 21 | | | 21 | | | 21 | | | 21 | | | 20 | |

Employee Full-Time Equivalent | | | 217 | | | 217 | | | 232 | | | 232 | | | 230 | |

** The efficiency ratio is a non-GAAP measure, calculated based on the noninterest expense divided by the sum of net interest income plus non interest income, excluding net gains and losses on securities. | |

'*** Represents Bancorp consolidated capital ratios. | | | | | | | | | | | | | | | | |

Unity Bancorp, Inc

Loan Portfolio Composition

| | | | | | | | | | |

In thousands, except percentages | | June 30, 2024 | | % | | December 31, 2023 | | % |

SBA Loans: | | | | | | | | | | |

SBA loans held for sale | | $ | 15,159 | | 0.6% | | $ | 18,242 | | 0.8% |

SBA loans held for investment | | | 38,017 | | 1.8% | | | 38,584 | | 1.8% |

SBA PPP | | | 1,734 | | 0.1% | | | 2,318 | | 0.1% |

Total SBA Loans | | | 54,910 | | 2.5% | | | 59,144 | | 2.7% |

Commercial Loans | | | | | | | | | | |

Commercial construction | | | 125,749 | | 5.8% | | | 129,159 | | 6.0% |

SBA 504 | | | 39,195 | | 1.8% | | | 33,669 | | 1.7% |

Commercial & Industrial | | | 147,172 | | 6.8% | | | 128,402 | | 5.9% |

Commercial Mortgage - Owner Occupied | | | 527,498 | | 24.3% | | | 502,397 | | 23.1% |

Commercial Mortgage - Nonowner Occupied | | | 411,455 | | 19.0% | | | 424,490 | | 19.5% |

Other | | | 67,139 | | 3.0% | | | 59,343 | | 2.7% |

Total Commercial Loans | | | 1,318,208 | | 60.7% | | | 1,277,460 | | 58.9% |

| | | | | | | | | | |

Residential Mortgage loans | | | 624,949 | | 28.8% | | | 631,506 | | 29.1% |

Consumer Loans | | | | | | | | | | |

Home equity | | | 65,065 | | 3.0% | | | 67,037 | | 3.0% |

Consumer other | | | 4,215 | | 0.2% | | | 5,639 | | 0.3% |

Total Consumer Loans | | | 69,280 | | 3.2% | | | 72,676 | | 3.3% |

| | | | | | | | | | |

Residential Construction | | | 103,188 | | 4.8% | | | 131,277 | | 6.0% |

| | | | | | | | | | |

Total Gross Loans | | $ | 2,170,535 | | 100.0% | | $ | 2,172,063 | | 100.0% |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

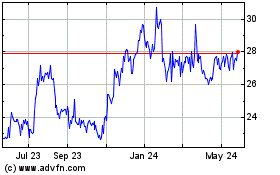

Unity Bancorp (NASDAQ:UNTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

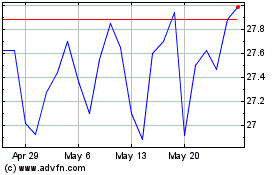

Unity Bancorp (NASDAQ:UNTY)

Historical Stock Chart

From Jan 2024 to Jan 2025